Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. An earlier version appeared in The Hill.

Monthly Archives: May 2018

What Will Policy Uncertainty Be Tomorrow?

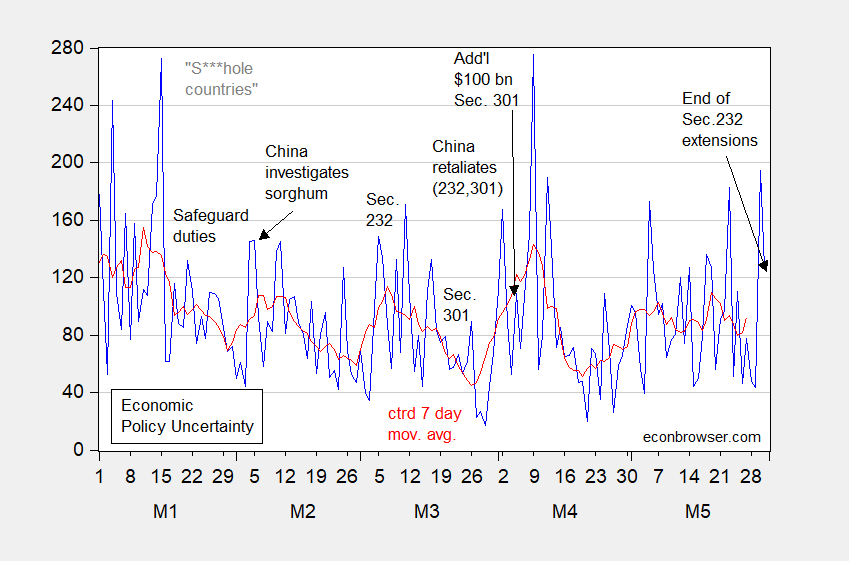

Below is reported Economic Policy Uncertainty through 5/31/2018, reflecting newspaper accounts through 5/30.

Figure 1: US Economic Policy Uncertainty index (blue) and centered 7-day moving average (bold red). Source: policyuncertainty.com accessed 31 May 2018, and author’s calculations.

As of 2PM EST, Dow down 1%, VIX up 6.69%.

Measurement and Forecasts of the Puerto Rico Economy

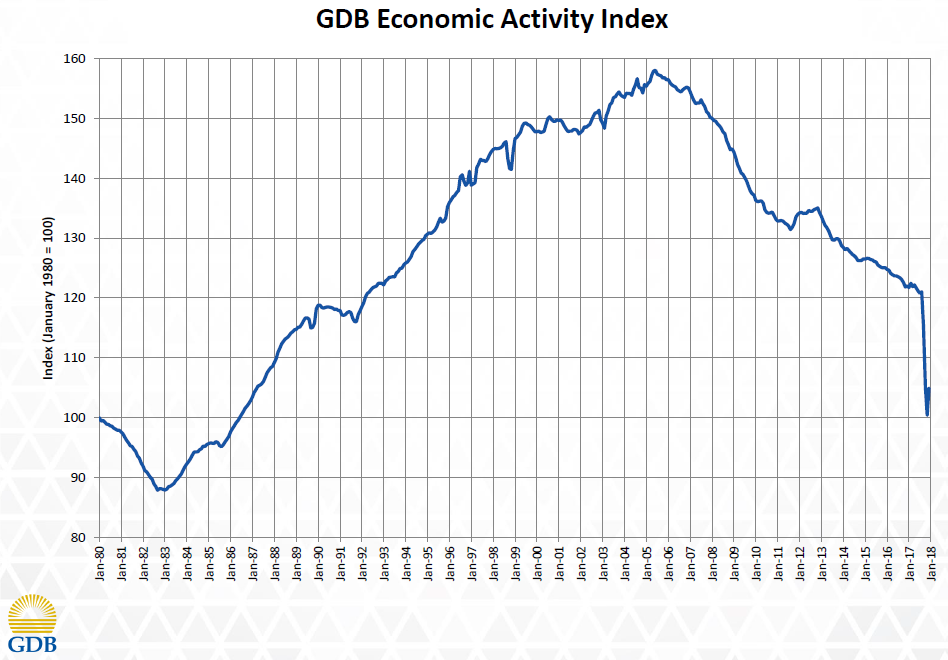

As one of the largest social and humanitarian disasters in the American homeland, remarkably little coverage has been devoted to evaluating the economic consequences of Hurrican Maria. Here is a high frequency index, the GDB-EAI (Government Development Bank-Economic Activity Indicator):

Source: Government Development Bank for Puerto Rico.

Continue reading

All that is old is new again

Tonight:

In Nashville tonight, @realDonaldTrump insists not only is Mexico going to pay for the wall… "they’re going to enjoy it"

— Cecilia Vega (@CeciliaVega) May 30, 2018

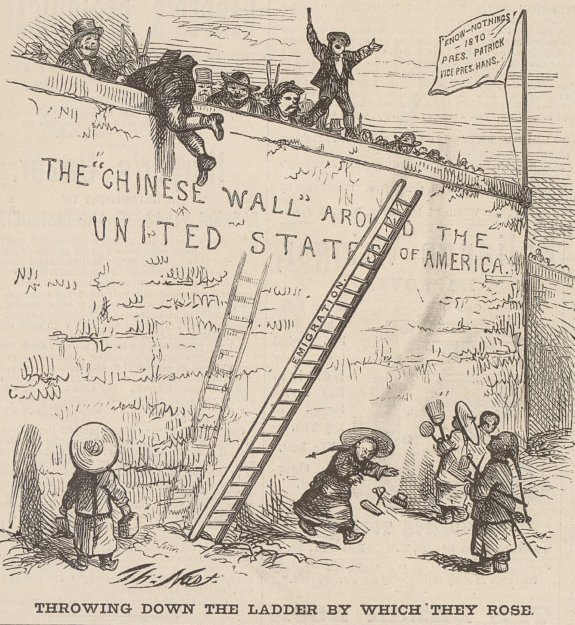

Nearly century and a half ago, political cartoonist Tomas Nast presents a “harsh commentary on the hypocrisy of these new Americans and their willingness to oppress others who are in the same circumstances in which they found themselves 30 years earlier. The once oppressed have now become the oppressors.”:

“Throwing Down the Ladder by Which They Rose,” by Thomas Nast, 23 July 1870. Source

For more, see this.

Heckuva Job, Donny! Puerto Rico Edition

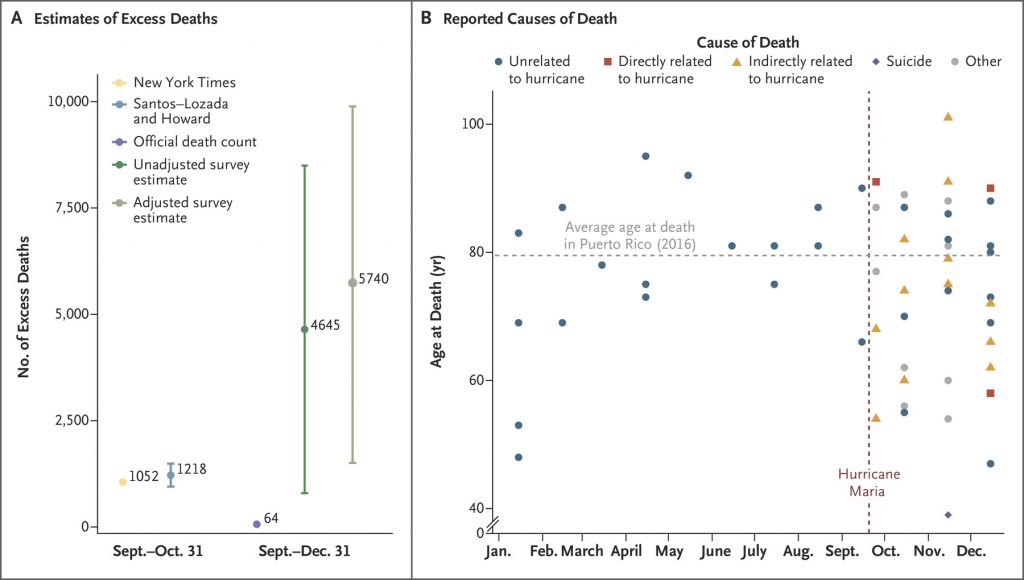

From New England Journal of Medicine, results of a study led by researchers at Harvard T.H. Chan School of Public Health and Beth Israel Deaconess Medical Center:

Figure 4. Estimates of Excess Deaths and Reported Causes of Death.

Panel A shows a comparison of estimates of excess deaths from official reports, press (New York Times)8 and academic (Santos–Lozada and Howard)9 reports, and from our survey. Panel B shows deaths according to the month of death and the age at death as reported in our survey, categorized according to the cause of death reported by the household member. Two persons who died of similar causes at the same age are represented by dots that are superimposed in December; thus, the 37 points shown represent 38 deaths after the hurricane.

Continue reading

Iowa under Consolidated Republican Control

Since January of 2017, Republicans have controlled both houses of Iowa legislature and the governorship. This month, the legislature passed tax cut legislation sharing elements of the Kansas tax cuts. Are we seeing another Kansas disaster in the making?

Recession 2020?

Goldman Sachs (Hatzius et al., May 24):

Ongoing rate hikes are likely to tighten financial conditions, at least gradually, and we expect growth to slow to a trend pace through 2019 even with fiscal stimulus still helping. From 2020, when the fiscal impulse ends, the risk of recession looks set to rise, but the lack of cyclical excesses in borrowing and spending suggest that an outright contraction is far from a foregone conclusion—so long as Fed officials manage to prevent a big overheating.

Guest Contribution: “An Economic Platform for the Democrats”

Today, we present a guest post written by Jeffrey Frankel, Harpel Professor at Harvard’s Kennedy School of Government, and formerly a member of the White House Council of Economic Advisers. An earlier version appeared in Project Syndicate.

Inclusion: What’s It Good For?

(Once again, apologies to Seinfeld). PBS presents a documentary on “The Chinese Exclusion Act”,” the 1882 law that made it illegal for Chinese workers to come to America and for Chinese nationals already here ever to become U.S. citizens. The first in a long line of acts targeting the Chinese for exclusion, it remained in force for more than 60 years.” Some will say it should be a template for our times.

Long Horizon Uncovered Interest Parity, Updated

About twenty years ago, while visiting the Research Department of the IMF, Guy Meredith poked his head in my office and wondered aloud whether interest differentials could reliably predict (in the right direction) subsequent exchange rate changes at horizons of three to five years. The resulting paper led in turn to production of this graph:

Figure 1: Panel beta coefficients at different horizons. Notes: up to 12 months, panel estimates for 6 currencies against US$, euro deposit rates, 1980Q1-2000Q4; 3-year results are zero-coupon yields, 1976Q1-1999Q2; 5 and 10 years, constant yields to maturity, 1980Q1-2000Q4 and 1983Q1-2000Q4 (last observation corresponds to exchange rate data). Source: Chinn (2006).