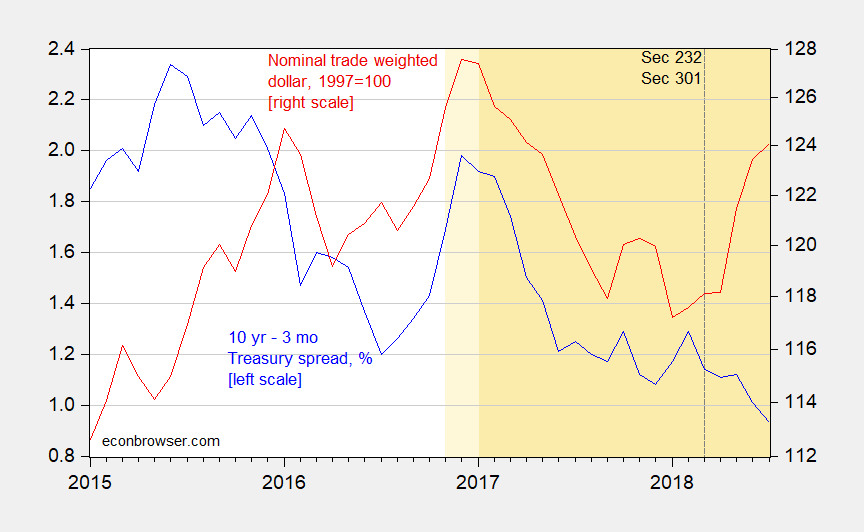

With the election, and anticipation of a large fiscal impulse (tax cut, infrastructure spending), the dollar rose and the term spread increased. As expectations of the latter disippated, both the dollar and spread shrank. But recently, the comovement has broken down.

Figure 1: Ten year minus three month Treasury spread, % (blue, left scale), nominal trade weighted dollar against broad basket of currencies (red, right log scale). Orange shading denotes Trump administration, light orange is post election period. Source: Federal Reserve Board via FRED.

Notice that the beginning of the declaration of trade sanctions coincides with appreciation of the US dollar; to the extent that the RMB has depreciated, it’s part of the story (see EconoFact). And perhaps larger than the share implied by accounting, as other East Asian currencies quasi-peg to the RMB.

The other major portion is due to the weakening of emerging market currencies as the Fed looks set to raise rates. The shrinking term spread is signalling a slowdown, partly due to tariffs, partly due to dollar appreciation, and partly due to the crash from the sugar high induced by massive tax cuts.

Normally, and certainly in years past, I would have gotten exceedingly angry about RMB devaluation. I like to pretend or kid myself that I am wiser than I once was, certainly 20 years ago. If Orange Excrement wants to, I forgot the word I’m looking for, but we’ll say “randomly” put on tariffs that benefit no one— China can devalue all they see fit—more power to them, drive it into the ground up past 10RMB per USD for all I care. What is Orange Excrement going to do then?? Offer more free-market punishments for the US farmer and MORE welfare payments from the US taxpayer to the US farmer, so Orange Excrement can convince himself his D*ck is bigger than Xi’s?? Have at it man, whatever gets you through the night. We’re all here for your convenience Orange Excrement.

In separate news, I have decided to download the /R package to try some of these OLS regressions and other intellectual pursuits Menzie is kind enough to share with us. I imagine lots of migraines looking at a monitor, fumbling through R commands and Unix commands on top of the Econometrics math. But in maybe 18 months, I hope to have “got the hang of it” or DIE TRYING. Commence Vegas betting on my Econometrics and “R” endeavors now.

I don’t plan on wallowing in my own ignorance my entire life like some commenters on this blog do. The Vegas spread WILL narrow over time, so place your wager at the Casino now.

Some of this stuff on R is pretty damned cool, they even have a specific function command for “Newey-West”. Now how ’bout them apples?

A quantile regression command. Some of the more abstract or less heard of gunk, and most of it is in here. Of course I haven’t taken the car out of the garage yet, as my Econometrics knowledge just isn’t there yet—but you can bet I will be spinning a couple of these around the block for a test drive with some textbook examples.

Moses Herzog There’s something of learning curve with R and it’s a bit clunky for routine econometric tasks. I use R for some of the more obscure features, such as discreet event simulation (package “simmer”) or the DSGE package written by the Polish Chancellery or anything to avoid using MATLAB. If you’re looking for a free, good and relatively intuitive econometrics package then I would recommend GRETL http://gretl.sourceforge.net/. It’s very similar to EViews and allows for either point-and-click or command input. It also interacts with R. GRETL has been approved by Econometrica as well. Also, over at Dave Giles’ “Econometrics Beat” blog (https://davegiles.blogspot.com/) he works a lot of examples in both R and GRETL.

@ 2slugbaits

Appreciate it.

Yeah, I was looking at Gretl. My only deal with that was I was afraid I would have to learn C language, and between C and learning nothing or between C and learning Unix, I chose Unix (I don’t think I’ll need much Unix, but you know what I mean). Are you saying there’s not a whole lot of learning C language on the Gretl?? It also seemed to be a more “community” feel over on “R”. These are just my first impressions after looking at it only 48 hours, so I’m honestly asking here. Obviously you think Gretl is slightly better?

Appreciate the Dave Giles link, as you can imagine I have been hunting for Giles type links heavily in the last 16 hours or so. I need those examples whatever I go with, because something as easy as putting up data sets I can imagine wasting hours on just because I missed one letter or couldn’t find a specific command code for the set-up.

Moses Herzog No, you don’t need to know UNIX or C. On the left side of the homepage look for the link for Windows download, then run the GRETL executable and it will autoload. Most of the GRETL tools are in a pull down menu. There are also several very good user manuals.

@ 2slugbaits

I’m really riding on the fence on this, as they both look like great programs. Certainly either is going to be better than “OpenOffice” which has now been discontinued. Also another reason I’m tempted to use Gretl is because I think it is much more similar to Menzie’s Eviews than R is. My deal is, I’m going to be “teaching myself” all on the net. So if I get stuck or hit a “snag”, I need to have people out there who can say “hey dumdum, have you tried this??” or “hey dumdum, you don’t do it like that, you do it….” And if the Gretl community is smaller those people I need to tell me in what way I am being a dumdum, are harder to find.

“or anything to avoid using MATLAB. ”

2slugs, you are a coward! matlab rules!

“arbitrarily” was the word I couldn’t pull from my brain

It’s interesting to note, Peter Brimelow was a senior editor at Forbes magazine (once upon a time the Bible of finance and economics in much the same way Bloomberg is now on the internet) as recently as 2002, and also an editor at National Review (which has been connected to white supremacy on more than one occasion). He was also a Senate aide for Orrin Hatch. There’s a pic online somewhere (I’m too lazy to hunt it down) where Brimelow and Pat Buchanan are at an anti-immigrant/”pro-English only” event, and in the photo they are both underneath a very large banner espousing that English should be the only language spoken in America—where on the banner, a very elementary English word is misspelled.

https://www.washingtonpost.com/politics/trump-speechwriter-fired-amid-scrutiny-of-appearance-with-white-nationalists/2018/08/19/f5051b52-a3eb-11e8-a656-943eefab5daf_story.html

This is the banner I mentioned earlier with the misspelled English—at a conference where Pat Buchanan and Brimelow were lecturing others on the importance of English. There used to be much bigger images of this picture online, but I’ll be damned if I can find them now.

https://thinkprogress.org/under-misspelled-banner-buchanan-and-white-nationalist-brimelow-argue-for-english-only-initiatives-538ecb8b3f1a/

Now, don’t quote me on this, because I may be wrong, (call it my “Giuliani moment”) but here also is a still image of Brimelow from when he was doing a screen test for the part of George Taylor in “Planet of the Apes”.

https://goo.gl/images/rJYjRv

“the sugar high induced by massive tax cuts”. Why does this remind me of Treas. Sec. Geithner. “Sugar, sugar”!

https://www.youtube.com/watch?v=h9nE2spOw_o

I was thinking more “Tab” soda pop for Geithner. Or maybe fruitcake. Non-caffiene coffee?? How about just anything served in a grade school cafeteria?? You know, because “children are our future”—so we stuff them with bad tasting cheap carbs—“because we love them”. Kids should actually pray for “Take Your Daughters/Sons to Work Day” to be a bi-weekly thing just so they can get some good food. Unless you’re the snob kids at age 16 with cars that drive off campus for lunch. Then F**K the other kids, this is America damn it!!!

The E.U. economy is slowing and has become even weaker than the U.S. economy, resulting in a stronger dollar.

The 10-year Treasury yield moves with mortgage rates, which remain low and are positive for U.S. growth.

The U.S. economy is in a relatively strong position, including with China, to use leverage for concessions towards free trade and open markets, along with reducing the taking and stealing of IP.

“The E.U. economy is slowing and has become even weaker than the U.S. economy, resulting in a stronger dollar.”

Can you make a more incomplete and stoooopid comment? You left out the fact that the ECB has been aggressively lowering Euro interest rates well below even the low but rising US interest rates. Which everyone who knows anything about international finance realizes why the Euro has devalued. Of course a dropout like you likely never learned the Dornbusch overshooting model.

Pgl, so, you disagree with reality again.

Talk about stupid.

And, have you ever heard of “foreign exchange markets?”

Everyone with an IQ above the teens would disagree with your latest. Which BTW is one of your least stooopid rants. Try learning remedial economics along with the other village idiot – CoRev.

BTW – we were disagreeing with the facts but at least I offered an explanation as in the Dornbusch overshooting model.

My apologies – you have no clue what we mean by the Dornbusch overshooting model!

Of course, since Trump was elected, the swamp has reared its ugly head for all to see.

Instead of trying to solve some very important problems, they’ve worsened.

Wow – you got one almost right. Of course you left out that it is the swamp that Trump brought to DC that is behind all of this!

You’ve been watching too much CNN.

Get some “fair and balanced news.”

Fox and Friends! Yes – you watch their intellectual garbage with your boss (King Trump).

Swamp clearing. With Mnuchin and his wife—Marie Antoinette Mnuchin—leading the drainage. (“Stevie, move. They need to see more of me behind all that money.”)

This what makes exchange rate forecasting so challenging.

Most of the time interest rate spreads explain exchange rates–

but you still have to correctly forecast two interest rates, not an easy task.

But every once in a while this relationship breaks down and markets decide

to dance to the tune of a different player.

Not much you can do about it and it happens just often enough to drive you up the wall.

Please share with the class. Would love a horrific FX trading story, especially if there’s blood spurting everywhere and multiple characters in pure agony like a scene from a Tarantino film. We need the “heavy fuel”

https://www.youtube.com/watch?v=LKboo0p4YFI

Trump *is* the swamp.

Also, wouldn’t the cause and effect be mortgage rates following the 10 year not the 10 year following mortgage rates?

The swamp existed well before Trump.

Trump is a victim of the swamp.

And, don’t you know about causality?

Dan Rather was one of my favorite swamp creatures.

He was so clever.

However, there are many to choose from in the Eastern Establishment.

Some victim. He and Wilbur Ross are making a killing on all their insider trader.

what are you saying peak, that mortgage rates drive the 10 year note?

I said nothing about causality.

Maybe, someday you’ll learn the difference between co-movements and causality.

Some day you will learn not to type words you have no clue what they mean.

peak, you believe the ten year note and mortgages are unrelated?

Actually 30-year mortgages tend to follow 30-year government bond rates. OK you have to add a 1% credit spread. Of course things like the term structure and credit spreads come across to PeakStupidity as Communist plots!

The data series are fairly short, but “eyeballing” them seems like a fairly weak correlation. There are periods where they seem to move in concert and others where they diverge. Perhaps a longer timeframe would shed more light.

Nominal exchange rates are driven by two monetary factors as well as relative price factors. There is a well known tension between long-run effects of monetary shocks (classical neutrality v. Keynesian aka Dornbusch modeling). But it does seem that real or relative price effects strongly drive exchange rates. We could explain this to PeakStupidity but he dropped out or CoRev but he struggles with basic demand = supply.

Apparently my Google searching skills aren’t good enough to find a graph that separates the 4-5 major currencies, color codes them and puts them overlapped on the USD—-I suppose this says the same thing:

https://fred.stlouisfed.org/series/DTWEXM

Unless China’s weight on the other Asian currencies is that heavy, this seems to imply it’s mostly on the USA side of things—i.e. not all a factor of China’s devaluation.

Continuing my thought, which actually I was mimicking Menzie more than I thought I was (he obviously used the mixed currencies on his graph). How does the appreciation in the US dollar affect the trade deficit numbers?? (rhetorical question) I’m thinking the next time the “data dump” comes on that one the folks at the White house aren’t going to get the number they’ve been selling to the MAGA illiterates. Has Hassett rehearsed his 100% bullsh*t talking points on this one??

BTW, I’ve been told by many people I’m a “sexist” or a “misogynist” because I strongly dislike Hillary Clinton and wouldn’t vote for her if she ran for county dog catcher (I’m a Democrat). Give me a female candidate who doesn’t LIE every time she exhales carbon dioxide and I’ll vote for her. Zephyr Teachout qualifies. But watch rural American women trash Teachout if she ever runs on a Presidential ticket. They’ll tear her to shreds before she arrives at the podium for her official announcement. Women apparently much prefer a woman who lies to them every 5 minutes in self-righteous, angry, and indignant tones, than someone who respects them enough to speak truthfully and SANELY. Or even prefer liars over someone (think Wisconsin and Michigan here) who can be bothered to “bless them with their presence” by entering their state’s borders on the campaign trail.

@Moses Herzog – I share your antipathy to Ms. Clinton and held my nose when I voted in 2016. I really wish that Amy Kloubachar (D-MN) had a higher profile as she would be a credible candidate. She is also incredibly funny:

And then Klobuchar — who told Politico that she wrote half of her own jokes — stepped up, and things got unexpectedly funny.

Slideshow

Washington Press Club Foundation’s Dinner (2009)

“I’d like to make this as short as Bill Richardson’s tenure as commerce secretary,” she opened. “I raised $17,000 from ex-boyfriends — true story! I know that is the record in the Senate, but in the House it’s held by Barney Frank.” Roars of laughter, even from Frank.

Then she turned to the “great reporters? in this room — all of whom got scooped on the John Edwards story by the National Enquirer.” She promised not to be too rough with them, though, since “I’m all about protecting endangered species.”

@ Goldhammer

Quite good. I like Kloubachar’s style of humor, a little bit of a punch to it, but not mean-spirited. I like Barney Frank (and I wager she does also), but even Frank has to admit she hit the nail on the head on that one. Sorry I missed that presser. She’s got a sharp mind, and I would also gladly consider her on a Presidential ticket. Maybe not at the head of the ticket, but would make a solid VP candidate, and someone who could fill in capably as President in a jam I think.

It is kind of strange Kloubachar doesn’t have more of a national presence than she does, considering how long she has served and when you look at how a know-nothing like Michele Bachmann grabbed attention so easily. Guess she doesn’t have the Bachmann crazy eyes.

https://goo.gl/images/ujpSuz

https://www.theguardian.com/commentisfree/2016/mar/28/hillary-clinton-honest-transparency-jill-abramson

Not sure when Menzie’s next soybean post will be. Saw this, and thought it had some interesting numbers to share, including timing of soybean sales that have been argued about on here:

From an article by Caitlin Dewey of WaPo:

In a poll of 7,000 farmers, FBN found that nearly half of this year’s soybean crop is forward-contracted, which means it isn’t subject to falling prices. Those who have not already sold their crop will wait until harvest or later. “We’ve had a $2-per-bushel slide since June,” McNew said. “If prices don’t revert, farmers who didn’t sell anything before will face a much lower soybean price than ones who were actively selling ahead.”

More from the same article by Dewey:

Traders are optimistic, however, that soybean prices will rebound. Global demand is strong, said Arlan Suderman, chief commodities economist at the advisory firm INTL FCStone, and the United States is the world’s largest soybean producer. Brazil, the second-biggest producer, is expected to exhaust its supply of exportable soybeans at the end of September. That, together with a recent USDA crop report that forecast this year’s U.S. harvests will be smaller than expected, has already begun boosting prices.

And this last part, again, from Caitlin Dewey of WaPo, seems to imply that although farmers will exit out of 2018 largely unscathed, things could get pretty rough around winter 2019.

“Those two programs have been spending a ton of money as commodity prices have fallen, even before the tariff wars,” he said. “They have kicked out literally billions of dollars in the last two years.” But there is a hidden sting for farmers if the trade war continues, Cox said. Farm price supports adjust to lower average prices over time — pushing producers further below the point of breaking even. Crop insurance is pegged to average market prices, which means the revenue it guarantees farmers will shrink. Next year’s forward contracts may also be less favorable if soybean futures prices continue to sink.

I think “the takeaway” here is that lower average crop prices will lower BOTH crop insurance and federal government subsidies/welfare over time—which would imply a lag impact on this that impacts farmers late 2019 and into 2020 if trump’s tyrannical tariffs trudge on to terrorize tolerant taxpayers.

Wait for it – CoRev is going to take credit for all of this! He does say so many contradictory things, he can take credit for anything!

Pgl, this sounds like the same WaPo article we’ve talked about for days. you didn’t understand it then nor later.

Watching the Karen Carpenter special on the PBS money grab. PBS always knows the notes to hit when asking people for money. I get really temporarily depressed when I watch these things on Karen Carpenter. Just an AMAZING AMAZING talent—similar to JImi Hendrix, and just let life go for nothing. So much talent and just let life go. Not one person that cared about her could get her to a hospital or some clinic?? It’s best not to think about it. Anyone see this woman playing the drums like Buddy Rich and singing like some angel from Heaven at the same time??? Unbelievable. That’s how you know society and human beings are a “strange lot”—when women like this are wandering around wondering when the hell anyone is going to offer her a record contract—from record company to record company and playing gigs where nobody “got” it. Who hears that voice (let alone the drums simultaneously) and doesn’t cut her a check for a record on the spot?? And we have what now??—not even going to mention the names of these contemporary music losers. The biggest talent is jello injections in the rear. It’s enough to make you think you got placed in the wrong species or something.

https://www.newyorker.com/news/news-desk/zephyr-teachouts-loss-and-the-fight-against-dark-money

She opposed corporate monopolies and free-trade agreements like nafta and the proposed Trans-Pacific Partnership. She wanted protections for local manufacturing instead. “One in five people should be making or growing something here,” she told me. She opposed hydraulic fracturing as well as the construction of new natural-gas pipelines. (Teachout first got to know the region while pushing for a statewide fracking ban during her gubernatorial run.) In short, her appeal looked broad.

Perhaps her economics approach needed a tune-up. She seems to conflate “large” with “corrupt”. She is a protectionist (like Trump?). She opposes energy production (likes high prices for workers?). I’m not so sure her appeal is “broad”.

@ Bruce Hall

You can be against something and not walk out on already signed agreements. When you walk out on already signed deals you make the USA’s word look like it signifies nothing (which in fact, in 2018 the USA’s promise does mean nothing). I also suspect (though do not know) that Teachout would have taken a similar stance on ZTE that Menzie has proposed was the correct way to handle it. Bruce, we know you like dumb*ass when dumb*ass has trump’s name on it. The rest of us do in fact have a broader (pun very much intended) view of the world.

Moses, You can be against something and not walk out on already signed agreements. Agreed.

The same argument can be used by those who support Kavanaugh in saying he can be against abortion without walking out on previous SCOTUS rulings. But, really, if you are in or running for a public office and have made specific statements about specific issues, you have to expect to be held to the notion that you will act on your positions if given the opportunity and authority. That said, it is reasonable to expect that Teachout would act on her positions regarding protectionism (generally aligned with Trump) which are deemed harmful by the majority of commenters to this blog. I’m not sure if the majority of commenters would agree or disagree with her position on domestic energy production/distribution. I view her socialist/pseudo-socialist positions are not necessarily “working-class” friendly.

The problem, as I see it, with current progressivism is that it is no longer a debate about right or wrong or better or worse, it is about mandatory thinking. So if a self-styled progressive wants protectionism, it is a good thing; if Trump wants protectionism, it is a bad thing. Accepting that some of what Trump has done is beneficial is forbidden; accepting everything that progressives propose is compulsory.

As author T. H. White once wrote about ant colonies: “Everything which is not forbidden is compulsory.”

@Moses Herzog – You really need to watch the short film by Todd Haynes, “Superstar: The Karen Carpenter Story.” https://en.wikipedia.org/wiki/Superstar:_The_Karen_Carpenter_Story Totally original!

@ Anon Thanks for the recommendation. I’ll be looking to see if my public library has it, and if they don’t will request them to get a copy. Much appreciated,

Is anyone else having problems with their RSS reader lately?? I’m pretty sure it’s on my end or the reader itself, because I’m having the same problems both with this site and Mark Thoma’s site. Menzie’s feed only updates up to July 23, and Thoma’s only updates to July 30. I also have the most up-to-date version of Vienna RSS reader, 3.4.2. If anyone else uses Vienna or has thoughts on this, please advise. Thanks.

Lots of RSS readers out there. I use Protopage because it allows me to organize/customize the way I want. No problem with Econbrowser feed.

I appreciate the response. I just opened “Shrook” which is kind of my “back up” RSS reader for occasions such as these when the “Vienna” reader acts up. It seems to be working fine for both Menzie’s and Thoma’s most recent postings. So I am sure the problem is the “Vienna” RSS now. What has me perplexed now is, the Vienna reader still has a “semi-active” community, with a Github site where they run version updates. But Shrook is no longer maintained or does software package updates—so wouldn’t a person think that Shrook is the one that would be messing up at this stage?? Weird. I will keep them both running for awhile and look at your “Prototype”. Always interested in “word-of-mouth” type recommendations, or would this be a “word-of-keyboard” recommendation??

Moses,

It’s Protopage

https://www.protopage.com/

CNN’s title is a bit misleading:

Russians targeted Senate and conservative think tanks, Microsoft says

https://www.cnn.com/2018/08/21/politics/microsoft-russia-american-politicians/index.html

The Russians are not hacking Kudlow and his ilk or Team Trump. They have been trying to act the Hudson Institute. which has criticized the Russian and their “collusion” with Team Trump.

No wonder we have heard so little from PeakTraitor and CoRev – they have been busy doing this!

Just in case anyone is having trouble keeping up, here is the latest tally:

Trump personal lawyer/RNC Deputy Chairman – GUILTY

Trump Campaign Manager – GUILTY

Trump Deputy Campaign Manager – GUILTY

Trump Senior Campaign Advisor – GUILTY

Trump National Security Advisor – GUILTY

Boy, Trump sure seems to surround himself with a lot of shady people. And Mueller hasn’t even started yet.

Also worth noting that Trump’s personal lawyer today in his guilty plea said that Trump personally directed him in commission of campaign finance crimes related to hush money paid to two of his mistresses.

There are lots of “shady people” involved in politics.

More special prosecutors will prove that.

As in everyone on Team Trump. What’s the matter Peaky – has Wilbur stopped giving you insider information?

Some inside information: http://fromthetrenchesworldreport.com/connecting-some-dots/231693

I can neither confirm nor deny.

Bruce Hall Wow! That’s some kinda JBH approved craziness. I really liked the part where Clinton gets the QAnon “17” connection attached to her. I wonder what kind of person regularly follows those kinds of bloggers.

2slugs asks: “I wonder what kind of person regularly follows those kinds of bloggers.”

The answer is very simple, a person with the opposite beliefs of those who follow CNN, MSNBC, ABC, CBS, NBC, NPR, Daily KOS, BuzzFeed, Economist, Politico, WaPo, BBC, NYT and Guardian etc. “News”, and denigrates FNS. IOW conservatives.

<b<CoRev I agree. Exactly that kind of person.

Just the icicle point on the tip of the iceberg, Bruce. Your task is to do the intellectual work to confirm it. Which will then lead to much, much more.

I writing a new book – The Truth According to RUDY!

Should be a short book, which ought to help sales among the short attention span Fox News viewers.

@ joseph

Next you’ll be saying Joel Osteen is the type of guy who tells flood victims in his own native city they can go “suck it”. Not on my watch pal:

https://www.youtube.com/watch?v=7y1xJAVZxXg

“…the sugar high induced by massive tax cuts.”

The Trump Administration is also smart spurring economic growth before the 2018 and 2020 elections.

Of course, the sugar high of very accommodative monetary policy is wearing off.

However, we need a larger and permanent tax cut, to raise GDP growth, and reduce federal spending to 18% of GDP.

Aha! You admit that Trump is doing the Nordhaus political theory of the business cycle. Of course the only real world example until now was NIXON. PeakyBoo just admitted Trump is as corrupt as NIXON.

Sad to tell you Peaky – this means KellyAnne has to fire you. So now you are 100% dependent on government dole!

Pgl says: “Of course the only real world example until now was NIXON.”

You really are ignorant.

And, if politicians could influence monetary policy, they’d do that too.

Hey – what a rebuttal. You just said absolutely nothing. Which is more than you usually do!

PeakTrader a.k.a., “The King of Contradictions”

Do you see any connection between Trump’s deficits and the trade weighted dollar shown in Menzie’s graph?

Do you understand the difference between T and dT? If so, then perhaps you could explain how a permanent tax cut would permanently raise GDP growth.

If tax cuts stimulate nominal aggregate demand, what do reductions in federal spending do to nominal aggregate demand?

If the economy is at full employment and inflation is at the upper end of the Fed’s target, are you surprised that the days of an accommodative monetary policy are over?

And are you serious about the tax cuts helping Trump in the 2020 election? And you can forget about tax cuts in 2019 if there’s a blue wave. Look for Trump to resign in exchange for a Nixon style pardon from President Pence.

2slugbaits, you see contradictions, because you’re ignorant of economics.

You need a lot more than a partial equilibrium model.

Of course, a stronger economy, including with greater budget deficits, compared to our trading partners, tends to cause greater trade deficits.

Nonetheless, true free trade and open markets will increase U.S. exports and increase the volume of international trade.

PeakTrader You need a lot more than a partial equilibrium model.

You’ve said this many times before, but I don’t think you actually understand the difference between a partial and a general equilibrium. Do you understand what it means for a system to be in equilibrium?

true free trade and open markets will increase U.S. exports and increase the volume of international trade.

So you therefore support Trump’s tariffs??? Like I said, King of Contradictions.

Peak things get things partly right deserves a Ph.D. Hey just yesterday he finally figured out that 2 + 2 = 4! Give me a Nobel Prize!

2slugbaits, ignoring the interrelationships and interactions of economic variables in n-space is why you see contradictions where they don’t exist.

Obviously, the macroeconomy has been functioning at a suboptimal rate. I’ve made suggestions how it can move towards an optimal rate and you see contradictions where they don’t exist.

Achieving actual free trade and open markets will benefit the U.S. and global economy. It seems, you want to give up any attempt and just accept more failure.

PeakTrader ignoring the interrelationships and interactions of economic variables in n-space is why you see contradictions where they don’t exist.

Please spare us. No one here believes you have anything like the intellectual chops or macro knowledge to understand “the interrelationships and interactions” of economic variables in any space. You’re just making stuff up and everyone knows it. You use macroeconomic complexity as a way to just fuzz things over in order to conclude anything that you want to conclude. In the real world it’s very often the case that all you need to know is the first order effect to get the direction right, and much of the time just getting the sign right is good enough.

I’ve made suggestions how it can move towards an optimal rate

Sure you have. And we all appreciate the way you carefully worked through the Bellman equations to show us the way.

Achieving actual free trade and open markets will benefit the U.S. and global economy

And therefore we should increase tariffs??? And if you want to go west, then I suppose you turn to the east. If you want to lose weight, then eat more donuts. If you want to be more informed, then watch Fox News. If you want to drain the swamp, then vote for Trump. Up is down. Hot is cold. Slavery is freedom. Truth isn’t truth.

2slugbaits, you and your fellow liberal/socialist commentators cannot directly respond to my statements, which suggests a very limited understanding of economics.

There’s really no debate, just changing the subject and name calling.

A permanent tax cut with appropriate changes in federal spending will finally close the output gap, with better than 2.2% real growth, on average, over the past nine years.

Ever heard of the Barro-Ricardian Equivalence proposition? Didn’t think so!

2slugbaits says: “Look for Trump to resign.”

So far, it’s been Trump haters kicked out of government.

You mean “Trump haters” like Sean Spicer? Or Michael Flynn? Or Scott Pruitt? Or Rex Tillerson? Or David Shulkin? Or the boatload of various advisers and subcabinet officers appointed by Trump who have since left? Or the half dozen nominated secretaries of the Army and Navy who couldn’t get through the confirmation process because they were so corrupt that even Mitch McConnell had to hold his nose? You mean all of those “Trump haters”?

“If so, then perhaps you could explain how a permanent tax cut would permanently raise GDP growth.”

Kudlow and company have this theory that if we permanently cut taxes – people will consume more which means less national investment. Of course the Solow growth model – and all economic evidence – notes that this raises real interest rates crowding investment. When presented with theory and evidence such as these – Kudlow and company revert to “but we won so it is our turn”.

Of course Kudlow is an idiot. And even his rant is an improvement over Peak’s reply which is nothing more than gibberish.

Pgl, you continue to prove you’re the “idiot.”

You want wasteful government spending – called investment – and low interest rates with weak growth.

We need to raise GDP = Consumption + Savings.

Also, an increase in disposable income is needed after low interest rates reduced saving and increased borrowing, till real wages take up the slack. The output gap hasn’t closed.

BS ALERT! BS ALERT! BS ALERT!

I feel it’s my civic duty to alert naïve and unschooled readers on the sheer nonsense of PeakTrader’s comments. No one should take this man’s views seriously. He’s a joke. And if you’re a parent with a son or daughter thinking about college, you should do everything in your power to steer your child away from the University of Colorado’s econ department if PeakTrader is evidence of a typical UC graduate.

In all of your babbling incoherence we see this mistake:

GDP = Consumption + Savings.

You cannot even complete the definition – can you? It is GDP = C + S + T. Of course you are stupid enough to think T means taxes. No babbling fool. Taxes net of transfers. Of course most people write that as C + I + G + NX. Of course you have no idea what that identity even means. And yet all of this is definition. Theory? No – you’d never get that either. Hey Peaky – babble on!

Pgl, there are many ways to rewrite output = income.

You totally miss the point of what I’ve been saying regarding saving and dissaving.

You have no idea what others and even yourself are talking about!:

https://ssag.sk/studovna/files/RELATIONSHIP-BETWEEN-GDP.pdf

pgl It’s bad enough that PeakTrader got the identity wrong, but here’s the real howler. Just a few comments earlier he blathered on about the need for a dynamic general equilibrium approach. So in PeakTrader’s world a static identity satisfies as a dynamic general equilibrium. Utterly clueless. How did this guy ever pass a freshman macro 101 course? Maybe he didn’t. Or maybe he did a very long time ago but now he’s so old that all he can do now is misremember things. A case of an old brain losing its analytical edge and just reflexively responding to econ sounding buzzwords.

2slugbaits, that’s complete nonsense.

You need at least an Econ 101 class.

See link I just posted to start.

It should be noted, the low interest rates during the Obama Depression induced consumption by reducing saving and increasing borrowing.

Isn’t that exactly what the Fed is supposed to do when the economy slips into recession?

First of all it was the Bush Depression and secondly it was driven a lot by a decline in real wealth which lowered consumption demand. C’mon Peaky – even a college freshman gets wealth effects. No wonder Colorado kicked you out of the Ph.D. program!

Just checked with http://www.bea.gov

Table 1.1.6. Real Gross Domestic Product, Chained Dollars

Consumption in real terms was $10,672.8 billion as 2007QIV but fell to $10,417.3 billion by 2009QII. Yea it did return to late 2007 levels by the end of 2010. Anyone who thinks we had too much consumption back then is beyond stooopid.

Of course Peakstupidity never provides actual data. I doubt he even knows how to check the data given his incessant fact free rants.

In other news, it was revealed today that economic adviser Larry Kudlow hosted at his birthday party last week the publisher of the white nationalist web site vdare.com, Peter Brimelow.

Larry said in his defense that “he had know him forever.”

Larry, I don’t think you are helping your case here.

Interesting how Trump and his administration seem to be filled with people of — how do I put this — rather peculiar proclivities.

What’s so “peculiar” of politics?

You play politics all the time.

And you follow Herr Trump’s marching orders without question!

Paul Craig Roberts wrote for these racists and was also a supply-sider. I once debated this clown. Easiest take down ever.

And on the same day we have Republican Duncan Hunter indicted for “malversion” in which he illegally charged over $250,000 in person expenses to his campaign fund under the pretext, among other things, of it being for “wounded veterans.”

And last week we had Republican Chris Collins indicted for insider trading along with his son, his son’s fiancee, his son’s fiancee’s father, his son’s fiancee’s mother and his son’s finacee’s father’s best friends.

Is this what Trump means by draining the swamp?

Next up is little Donny Jr. who everyone, even in the White House, refers to as idiot Fredo from the Godfather movie.

NOT a fan of “Economist” magazine. Possibly the most over-rated periodical on planet Earth. I am however, a fan of giving respect to bloggers, who take a lot of guff off of MSM, often in topics the MSM has zero knowledge of.

https://www.economist.com/finance-and-economics/2018/08/11/why-is-macroeconomics-so-hard-to-teach

NIck Lowe was/is one of the co-hosts of the blog “Worthwhile Canadian Initiative”. And I should apologize for being so late to notice this.

Pretty amazing times. And I think it’s STILL not registering with 75%+ of the American public. And I’m not old enough to remember how America “digested” or “metabolized” Watergate. But these are special times, and maybe people will only recognize it looking back. The following 2 links are long, the first is 40 minutes of audio–the second is 24 minutes of video. It is MUST WATCH if you have ANY pride as an American. and I mean ANY pride to call yourself American.

https://itunes.apple.com/us/podcast/breaking-cohen-happy-to-tell-mueller-what-he-knows-attorney/id294055449?i=1000418264572&mt=2

https://www.youtube.com/watch?v=UV7-ZdDGijY

MORE

https://www.youtube.com/watch?v=-2ptSZcRpxQ

I was curious when the next US trade deficit numbers would come out. It looks like September 5. So kinda similar to the non-farm jobs report, roughly one week inside each new month. One place is predicting $37.3 billion. It’s hard for me to imagine it won’t be higher than that. But I’m not willing to argue that as I’m not the one crunching the numbers.

Professor Chinn,

Any thoughts to share about the WSJ opinion piece on 8/22/2018, “The Myth of the All-Powerful Federal Reserve”? The author, David Ranson discusses short rates, long rates, yield spread and the speed of rate increases.

Should say 8/21/2018

Sorry,thinking about another opinion piece about “free tuition” that appeared yesterday. 8/22/2018 is correct for the David Ranson opinion.

WSJ had a major exodus of journalists that went to NYT and other major outlets about a year ago. Ask yourself why and then act accordingly.

Some might also wonder why trump calls up WSJ every time he needs a cheerleader to sit down and transcribe his lies. I’m sure it’s because they’re hardworking folks.

https://www.youtube.com/watch?v=Ih22WUKyCaM

AS: Call this subject Fed policy operating on the real economy through interest rates, money, and credit to generate the business cycle including recessions. Take all peer-reviewed articles in the literature on this subject, this WSJ article, and in addition the 21 comments. On a scale of 0% to 100%, 90 and up an A, 80 and up a B, and so on, the Ranson article is good but not perfect. I give it a low A-. Of all peer-reviewed articles on this subject, perhaps only 10% are worthy of that same A-. Not a one has it quite right. 98% don’t even have the germane segment of the yield curve correct. What’s truly surprising is that, as a whole, the 21 comments roughly also rate a low A-. This latter is extraordinary!

My recommendation is to copy Ranson’s article and the comments, and with the raw data in hand pour over it time and again until a clear picture emerges. This may take you months. The flaw in Ranson’s otherwise excellent work is that short-rate increases ahead of recessions have not disappeared since 1987. And that both the increase and the level are important, not just the former. Cycle to cycle piecewise analysis is imperative, as one thing Ranson is quite right about is the evolving nature of the economy. The comments that bring regulation and deregulation into the discussion are quite apropos to this evolution.

JBH,

Thanks for the comments.

I am now the King of RSS Readers. I shutdown Vienna because I got angry it wasn’t working. Re-downloaded Vienna AGAIN thinking it might start working on a re-download. “Vienna” STILL only shows all the feeds to July 31 (and strangely Menzie’s feed only to about July 23). I’m not deleting it because it has all the blogs I like listed and I’m too lazy right now to re-list them all (like 60 feeds??). Re-opened “Shrook” which I hadn’t used since like 6 months ago because they no longer support software updates. And I have now downloaded a 3rd RSS Reader which appears it was created by Russians. So if like a few weeks later from now, if I start repeating Kremlin bullet points for public propaganda or start sounding like Trump, and I send a last ditch blog comment that the Feds have come to take me away—you’ll know it all started from the innocent download of a Russian authored RSS Reader.

This was all AFTER DL’ing a feed that worked from a “console” or “terminal” format, which I didn’t realize until AFTER I DL’ed it, and AFTER I DL’ed another RSS reader I decided not to use because I don’t trust Java software. So there you go. I have one accomplishment in my life now, I’m now King of bad working RSS Readers.

We finally have seen PeakStupidity’s macroeconomic textbook!

https://ssag.sk/studovna/files/RELATIONSHIP-BETWEEN-GDP.pdf

In its entirety, it is 3 pages long. All it does is go to over the most basic Keynesian multiplier and nothing more. It pretends there is no exports or imports aka a closed economy and it pretends we have no government spending or taxes.

As bad as that is – it ignores financial markets, the supply side, basic neoclassical growth theory. In other words, incredibly naïve. Which explains the usual rants from our pretend economist PeakStupidity!

More nonsense from Pgl.

That link I posted contradicts your ridiculous statements above.

When Pgl earns $1, he not only spends $0.80 and saves $0.20, he magically discovers another $0.20 left by the tooth fairy!

Peak, not the tooth fairy, but his opportunity cost savings.

Now that is funny but not in the way you think. It is the Laffer supply side types who believe in the tooth fairy. As in the myth that one can consume and save the same dollar.

So PeakStupidity once again mocks his own team. Shooting fish in the barrel? No – try shooting oneself in the foot!

OMG. You have mastered the marginal propensity to consume! Let us know when you learn to tie your shoe laces.

Look Peaky – no need to try so hard as we all know you are beyond stooopid.

PeakTrader OMG!!! Is that your understanding of the Keynesian multiplier???

Well, PeakTrader did get the link from a formerly Soviet Bloc country (Slovakia). You’d think that the Internet Research Agency in St Petersburg could do a better job of disguising PeakTrader’s true identity.

I totally missed that the author of Peaky’s 3 page graduate economics text was Michaela Podmanicka. OK – no Nobel Prize winner but catch this of him dancing!

https://www.youtube.com/watch?v=1LBmSyPMa5U

Thanks for the Youtube. We do Western Swing dancing and that couple made me tired just watching. Old age slows one down.

Actually, I believe Michaela Podmanicka is the woman dancing in the video.

Hey, pgl, hows that re-calc of my model going? To satisfy my curiosity could you list the bills you’ve now paid from your your opportunity cost savings? Have you yet figured out that economics is not the answer to all things economic? Farmers worry about their bank accounts balances and that, although economic, is not measured by an economic model in the real world. If you want to (which you will not) the same question my model answers show us your model. If you have forgotten that question, it was: “have soybean farmers yet lost money”? You can get extra credit if you show how much.

CoRev Just a few days ago you agreed that over the long run a farmer had to earn more than just cover operating costs in order to stay in business. So apparently you also agree that opportunity costs have to be covered over the long run.

2slugs opportunity costs? No! More profit. Maybe you can explain how opportunity costs add to the farmer’s bank account.

Pgl, so you can not list any billl, re-calculate my model, nor answer whether farmers have yet lost money in this years soybean crop. I’m shocked another of my predictions re: your abilities and actions has come true so soon.

No extra credit not even for another failed attempt for you.

CoRev Opportunity costs do not “add to the farmer’s bank account.” Costs subtract from the farmer’s bank account. Opportunity costs are real costs and have to be recovered over the long run. That’s why econ textbooks and fully accredited business schools teach the importance of opportunity costs. Of course, if you got your degree from Trump University, then you probably didn’t cover that topic.

2slugs & Menzie, “Opportunity costs are real costs and have to be recovered over the long run.” maybe in Econ, but not in REAL LIFE. In reality they “… are not treated as an actual cost in any financial statement.” They may be treated as a measure of efficiency and may be counted as lost opportunities to gain efficiency, but are seldom used to pay bills. Most often they are used to measure management. Could they have done better? In the soybean farmer example, they can and should be considered near the top in efficiency and foretelling their market.

corev: yeesh. Why then do you bother coming to a blog called Econbrowser? Inquiring minds want to know.

CoRev They may be treated as a measure of efficiency and may be counted as lost opportunities to gain efficiency

Sorry, but that’s just wrong. And FYI, that’s certainly not how economists measure efficiency. Efficiency studies typically use either stochastic frontier analysis (SFA) parametric approaches or data envelopment analysis (DEA) non-parametric approaches. There’s been a lot of SFA and DEA work done on agriculture and fishing…especially rice farming.

Menzie, if Econbrowser was simply an econ blog and only economics articles were provided without political and other content, then I probably would not comment on many of the articles. Indeed, I do not comment on many of the articles. Economics is one of those subjects that crosses so many disciplines there is often something for everyone. Just look at the diversity of comments. My interests are fulfilled by many of your less technical and/or political articles.

2slugs, clearly I was talking about: “In reality they “… are not treated as an actual cost in any financial statement.” They may be treated as a measure of efficiency and may be counted as lost opportunities to gain efficiency, but are seldom used to pay bills. ” You’ve mis-represented my comments twice now in the thread. I’ve used Real Life and reality to center my comment., and not pure economics.

CoRev: So you’ll dismiss the main component of the main component of the blog in your comments? (Opportunity cost is central to economics, at least as I learned it. Might be different where you did your studies…)

CoRev They may be treated as a measure of efficiency and may be counted as lost opportunities to gain efficiency, but are seldom used to pay bills. ” You’ve mis-represented my comments twice now in the thread.

Economists do not use opportunity costs to measure relative efficiencies. As I said before, the use SFA or DEA models. If you don’t understand those models, then Google them. Those are the standard ways to measure the relative efficiency of a firm. There are plenty of dedicated econometric software packages for SFA and DEA models. No one is misrepresenting your comment, simply correcting your misunderstanding of how economists measure the relative efficiency of a firm.

Menzie, “CoRev: So you’ll dismiss the main component of the main component of the blog in your comments? (Opportunity cost is central to economics, at least as I learned it. Might be different where you did your studies…)”. Yes, when talking about business or accounting practices, where opportunity costs “… are not treated as an actual cost in any financial statement.”

It’s about the context of the comment(s), and not the purity of an economics blog.

CoRev: OK. My next twenty posts will be about cooking, without concern about prices.

Menzie, 😉

Corev this *is* Econbrowser.

🙂 “Why is opportunity cost important?

For example, if an asset such as capital is used for one purpose, the opportunity cost is the value of the …next best purpose the asset could have been used for. Opportunity cost analysis is an important part of a company’s decision-making processes,but is not treated as an actual cost in any financial statement.” Nor is it treated as an actual PROFIT.

My point has been although opportunity cost may be important in economics, it doesn’t necessarily make it important in the REAL World. This discussion started with you and 2slugs insisted that opportunity cost should be considered as part of the Farmer’s budget, but ignored its use in his decision-making processes. Which no one had argued for or against. BUT, opportunity costs were used in context of farmers losses.

“USDA apparently does not see a recovery trend in prices. Average price is $935 for the nearly ended market year, and is now forecasted to range from $7.65-$10.15 in 2018/19, down from the July range of $8.00-$10.50.

For context, one estimate of breakeven for an Indiana farm on high productivity soil is $10.05/bushel.” is just one of the latest examples of farmers’ plight which was challenged. Your series of soybean articles started AFTER farmers key decision making processes had ended; therefore, its use in either enterprise budgets or cash flow reports inappropriate this late in the harvest cycle.

Fascinatingly, farmers made good business decisions regarding when to contract their crops’ sale to maintain prices for a large portion of their soybean crop. Do they yet have an actual loss? It’s too early to tell.

CoRev So now you’re telling us that farmers are not rational actors??? How else are we to interpret your claim that farmers choose to continually invest in operations that yield a lower expected return than alternative investments? If you’re a banker, would you loan money to a farmer that ignored opportunity costs? You better not because then you as the banker would be loaning money to that farmer when you could have earned a higher return loaning it somewhere else. The point is that opportunity costs eventually show up as capital losses.

BTW, yesterday’s Iowa interior markets for soybeans average $7.61 and the statewide average for the Sep CBOT was down $0.80.

Also, I’m not sure if you can say farmers made “good business decisions” or just lucky business decisions. As this analysis by an Iowa State University farm management specialist makes clear, there’s a lot of year-to-year variability as to which marketing strategy works best, with storing and then selling July futures being the historically worst strategy. Unpriced on farm storage had the best expected return over the last three years, but maybe not the best approach this year.

https://www.wallacesfarmer.com/farm-operations/does-storing-unpriced-corn-and-soybeans-really-pay

2slougs, which of my comments did you deliberately miss-represent?

Are you now saying farmers did not make a good decision in forward contracting their 2018/19 soybean after all of Menzies articles?

Trump today: “If I ever got impeached, I think the market would crash. I think everybody would be very poor.”

This could be a golden opportunity for one of those rare natural economic experiments that economists are always talking about.

Yep! OK – I make two predictions. Stock market and economy would flourish but those DC trial attorneys would all quickly be out of work.

Now we know the drill. The winners could always compensate the losers. Which of course the high priced politicians and lawyers make sure never happens when the losers are average working people.

But wouldn’t it be sweet to see these overpriced lawyers all begging for government dole!

We don’t need impeachment to tank the stock market. All we need is for Trump to open his mouth about tariffs. The event studies provide a pretty good natural experiment.

@ 2slugbaits

I believe this is one of TWO things that could potentially bring down trump in 2020—-Democrats winning majority in the House of Reps—which at least brings on impeachment proceedings (even though impeachment would likely fail—still brings things up to the surface), and the lag effect (when will it hit??? hopefully Menzie will help us to decipher the timing) of the tariffs. Those are the two things that get the VSG at this point—and even loss of the House doesn’t necessarily cost him 2020–but it raises the odds significantly. It goes from 25% he loses 2020, up to a good 45% he loses 2020 re-election with loss of the House of Reps.

https://www.politico.com/newsletters/playbook-pm/2018/08/23/sessions-responds-to-trump-300539

https://www.bloomberg.com/news/articles/2018-08-23/graham-says-he-expects-trump-to-oust-sessions-after-elections

Moses Herzog I don’t think it’s likely that Trump wins reelection in 2020. In 2016 he lost the popular vote by a wide margin and only won the Electoral College because of a quirk in a few precincts (with a little help from Putin) that’s unlikely to be repeated again. Trump’s popularity is stuck at 40% and would only go down if the economy takes a turn for the worse. Also, there will be fewer angry, old white conservatives in 2020 than in 2016…that’s just a biological fact. I think it’s far more likely that Trump pulls a Nixon in 2019 and arranges a Pence pardon in exchange for resigning. That’s also the GOP’s best path for keeping the WH in 2020. The GOP Senate map is going to be tough enough in 2020 even without an unpopular President at the top of the ticket. If Trump runs in 2020 and loses, then he and his family will be exposed to significant legal jeopardy without the possibility of a pardon. Trump might not spend any jail time himself, but it’s a foregone conclusion that the Trump Organization will be wiped out. BTW, I don’t believe Manafort is keeping silent because he’s hoping for a pardon. A more likely explanation is that he’s seen what happens to people who cross Russian and Ukrainian oligarchs. His life expectancy is greater in a federal prison than it is as a free man.

2slugsbaits: Methodologically speaking, according to the original 13 Keys which correctly predicted the winner of each presidential election since 1984, Trump is a shoo-in in 2020. Yours is just a story you tell yourself. Moreover, long before 2020 the unparalleled hidden mass corruption of higher-ups in all walks of life is going to be global front page headlines for months on end. A near-infinite line of lemmings are going to be indicted and some substantial fraction put behind bars. Starting on if not before February 2019.

JBH: 13 Keys misses the role of the Illuminati being on the side of incumbent. I am surprised you omitted it.

FWIW, here’s the list:

Party Mandate: After the midterm elections, the incumbent party holds more seats in the U.S. House of Representatives than after the previous midterm elections.

Contest: There is no serious contest for the incumbent party nomination.

Incumbency: The incumbent party candidate is the sitting president.

Third party: There is no significant third party or independent campaign.

Short term economy: The economy is not in recession during the election campaign.

Long term economy: Real per capita economic growth during the term equals or exceeds mean growth during the previous two terms.

Policy change: The incumbent administration effects major changes in national policy.

Social unrest: There is no sustained social unrest during the term.

Scandal: The incumbent administration is untainted by major scandal.

Foreign/military failure: The incumbent administration suffers no major failure in foreign or military affairs.

Foreign/military success: The incumbent administration achieves a major success in foreign or military affairs.

Incumbent charisma: The incumbent party candidate is charismatic or a national hero.

Challenger charisma: The challenging party candidate is not charismatic or a national hero.

I’d say 1, 4, 9 are at question — unless Trump conspiracy with foreign adversaries is a virtue, not a scandal, in your book.

PeakTrader Just to clear things up, when you note that Y = C + S, just how is this supposed to increase income? Are you claiming that increasing C increases Y, therefore we must increase C. Or increasing S increases Y, therefore we should increase interest rates in order to increase S? Is that what you’re claiming? That seems to be what you’re arguing, but I can’t tell for sure. I realize that it’s pure nonsense, but I cannot see any other reason why you would post that kind of identity. This is your opportunity to provide an actual argument instead of just your usual drive-by “thus spake PeakTrader” kind of announcement.

Peak is waiting to here back from Kudlow on how to reply to your question.

2slugbaits, basically, you want to raise Y through tax cuts to raise C and S. Real wage growth, or increases in the minimum wage, is too slow. Given higher or rising interest rates (from very low levels), we need demand to increase. Also, wasteful government spending can be cut in a way that shifts, and attracts, idle or underemployed labor into the workforce (which I explained before). When the output gap closes, or real wage growth increases, then taxes can be raised to slow the economy to a sustainable rate. Of course, this is a very unusual “recovery.” It’s a slow and long L-shaped expansion, actually moving away from trend growth, from a severe recession.

PeakTrader You cannot “raise Y through tax cuts to raise C and S.” If that’s your understanding of the Keynesian fiscal multiplier, then you are hopelessly confused. Your first clue that something is wrong with your approach is that you referred to tax cuts but did not account for government spending in your Y = C + S equation. Where’s G? So at a minimum you need Y = C + S + G. And S does not add to GDP unless it is converted to investment (I), so it should be Y = C + I + G. Of course, there is no guarantee that I = S. A tax cut does not just mechanically raise C and S. In fact, a tax cut works by reducing S and having the government absorb the excess saving and recycling that excess saving as greater disposable income, thereby raising consumption. (In a simple Keynesian model recessions are all about the disequilibrium condition when “I” does not equal “S”. Hey, that’s why the Hicks formulation calls it the “IS” curve!) If you raise C, then you lower S. You cannot raise both at the same time using the same fiscal tool. You can use a fiscal tool to raise C or you can use a fiscal tool to raise S, but you cannot use a fiscal tool to do both. If you raise one, then you lower the other. That’s why your own link shows the share of GDP for C and S as constrained to 1.00 (see the equation at the top of page 2). And we haven’t even touched on an open economy world in which tax cuts are funded not by domestic “S” buy by borrowing from abroad.

You’re also confused about the purpose of the Keynesian model. It’s a business cycle model, not a long run growth model. If you want to increase the long run growth rate, then you leave the simple Keynesian business cycle model and move to some version of a neoclassical Solow style model. And in that world changes in per capita growth rates are driven by changes in technology and human capital.

2slugbaits, you completely missed the point, including in my comments above, and changed the subject with false assumptions and half-ass economics. What a mess to respond to!

PeakTrader What false assumption? You’re the one who went down this Y = C + S path and then botched the math by talking about raising both. You’re the one who talked about tax cuts and then left out “G” in the GDP identity. You’re the one who doesn’t seem to understand the difference between a Keynesian business cycle model and a long run growth model. You had the opportunity to explain how your Y = C + S formulation was supposed to increase GDP, but instead you wandered off into your usual blather about wasteful government spending, L-shaped recovery, the need for increasing aggregate demand, blah, blah, blah. You do this all the time. You recite what you perceive to be the current set of problems (viz., weak aggregate demand and sluggish growth below trend) and then having announced the problem you think you’ve also solved it! This is just magical thinking. Your approach is to solve the problem by assuming it away. Weak aggregate demand? Then increase it! Voila! Problem solved. And you wonder why no one takes you seriously???

“you want to raise Y through tax cuts to raise C and S.”

This is the new winner for the dumbest statement EVER. Your pathetic little multiplier paper did not have taxes or government spending in it. OK in the real world we do which is why your identity was so incredibly laughable.

Now do this the right way. Please call you preK teacher as this will quickly go over your head but she will get it. If we cut taxes and people consume say 80% of that privately saving the rest of their increase in after-tax income, national savings falls by the rise in consumption. Which drives up real interest rates crowding out investment.

It is really THAT simple. But yea PeakIncrediblyStupid cannot follow basic economics so he babbles his incoherent gibberish instead.

Where’s my Menzie Chinn “Fix” man?? I need an OLS regression that I won’t be able to figure out for the next two years.

https://www.youtube.com/watch?v=ycH9dGXq13w

BTW, eating dumplings at Grandma Chinn’s house in Fuzhou Fujian is not a valid excuse.

Trump this morning: ““Department of Justice will not be improperly influenced by political considerations.” Jeff, this is GREAT, what everyone wants, so look into all of the corruption on the “other side” including deleted Emails, Comey lies & leaks, Mueller conflicts, McCabe, Strzok, Page, Ohr, FISA abuse, Christopher Steele & his phony and corrupt Dossier, the Clinton Foundation, illegal surveillance of Trump Campaign, Russian collusion by Dems – and so much more. Open up the papers & documents without redaction? Come on Jeff, you can do it, the country is waiting!”

A crazy man is babbling away incoherently in the White House. Can you imagine any other president in history behaving this way.

And Republicans just sit on their hands, terrified of defying their leader. They will have a lot to answer for if the country survives. This is like Germany in 1933.

Trump:

“White House Councel [sic] Don McGahn is not a John Dean type ‘RAT”

“I feel very badly for Paul Manafort and his wonderful family … ‘Justice’ took a 12 year old tax case, among other things, applied tremendous pressure on him and, unlike Michael Cohen, he refused to ‘break’.

“Flipping is dishonorable, and is so unfair it “almost ought to be outlawed.”

Jeff Sessions … The only reason I gave him the job I felt loyalty from him.”

This isn’t the way a president speaks. This is the way a Mafia mobster speaks

Omertà is a Mafia code of honor that places importance on silence, non-cooperation with authorities, and non-interference in the illegal actions of others.

https://en.wikipedia.org/wiki/Omerta

And Republicans remain silent, cowering before their leader.

Fascinating that at the same time Atlanta Fed’s GDP Nowcast is going up, NYFRB’s Nowcast is now below 2%. I know we have discussed this before, and maybe the idea is to take the average of these two or maybe throw a couple more into the soup mix and take the average. But honestly, does anyone believe these numbers are worth a crap when you’ve got a 2% gap in numbers that are updated every 7 days??? Sure, and right now the skies in Denton Texas are sunny and the skies in Mount Vernon Indiana are cloudy. Well, “we’re looking at two different pictures of the sky”. Great, that’s genius guys. How many more Economics research grants you envision you can suck out of the American taxpayer on THAT one?? Shall we have a Fed Reserve Office in Anchorage Alaska that gives is a GDP Nowcast of 9% just to assure us Atlanta FRB isn’t living in fantasyland??—->> ‘cuz I got a feeling someone up in Alaska needs a useless F’ing job right now.

USD has to stay strong, for all the economic forces and constraints.

Another thing not in picture yet is Bitcoin. USD has to beat Bitcoin so that the stock market performance stays “legitimate”.

Trump’s latest speech (full-text on NPR) is worth a read. I personally think Politics is bigger than Economics. If US cannot materially increase the real long rate, the hegemony will break. At least someone should attempt at the issue head-on, and may fail.

Silly humor, but still got me to laugh:

https://twitter.com/freedom_moates/status/1033022545275092993

Apparently, 2slugbaits and Pgl cannot understand that Y = C + S. The summation of every individual in a country has income, which they either spend or save. Taxes reduce income and government spending raises income. However, the tax multiplier can be greater than the spending multiplier to raise output = income, under some economic conditions. For example, you can reduce some taxes by $100 billion and reduce some government spending by $100 billion, basically shrink government, to increase GDP by much more than $100 billion. Under certain economic conditions, which I explained above, would benefit the economy. Of course, faster GDP growth means we can afford more government services.

Regarding productivity, increases in disposable income, real wages, or the minimum wage can increase productivity, which is disinflationary. However, productivity gains don’t necessarily raise real wages.

“2slugbaits and Pgl cannot understand that Y = C + S.”

You are still grinding on this incomplete and incorrect GDP accounting definition? Sorry Peaky but everyone should ignore your comments until they achieve basic coherence.

PeakTrader you can reduce some taxes by $100 billion and reduce some government spending by $100 billion, basically shrink government, to increase GDP by much more than $100 billion

Sorry, but this is simply wrong. This is called the balanced budget multiplier and once again you’ve botched the math.

increases in disposable income, real wages, or the minimum wage can increase productivity,

I believe you’re trying to appeal to the efficient wage theorem, but once again you’ve managed to mangle it almost beyond recognition.

productivity gains don’t necessarily raise real wages.

That’s true in a degenerate labor market. The solution is to fix the labor market by reducing monopsony and wage theft opportunities for capital, but I don’t think those kinds of policies are like to get the GOP/Koch Brothers/Trump seal of approval.

2slugbaits, the balanced budget multiplier reflects GDP increases when all of a tax hike is spent, because the marginal propensity to consume is less than 1. I’ve stated above some saving is needed, given the dissaving, and some government spending needs to be reduced to spur employment, which will increase output and therefore tax revenue. An increase in disposable income, real wages, or the minimum wage will attract idle and underemployed workers, increase productivity, and raise tax revenue. If increases in taxes and spending worked so well, E.U. countries would have higher GDP’s than the U.S..

“the balanced budget multiplier reflects GDP increases when all of a tax hike is spent, because the marginal propensity to consume is less than 1.”

This is transparently false. If MPC = 1 then all of the tax change (generally tax cut) is “spent”. When MPC is less than one the change in spending is less than the change in taxes. Even 2 year olds get the simple arithmetic.

But based on your comment here – it is entirely clear you have no clue with the balanced budget multiplier even is.

Please stop as this gibberish is wasting everyone’s time.

A very thorough and patient discussion of the simple concept known as the Balanced Budget Multiplier:

http://www.amosweb.com/cgi-bin/awb_nav.pl?s=wpd&c=dsp&k=balanced-budget+multiplier

Note Peaky has this all backwards. Of course if he thinks GDP = private consumption + private savings as if G and T do not even exist, no wonder he will never understand this very simple concept.

I’m done. Talking to a dead tree is a waste of space.

Menzie: I have to give you credit for knowing about the 13 Keys. I came across them in the Chicago Trib in 1981. However, you cite the bastardized amended version. Why would the American author want to have gone and done that? Perhaps because he parted ways with his Russian co-author? The original 13 Keys have predicted to perfection. The tried and true aphorism is “If it ain’t broke don’t fix it.” Lichtman got his head handed to him last time around touting his amended version.

In the original, mandate is popular vote. Of course, Trump loses this key. As for #4, where is a Third Party challenge coming from? Unless it be from the splintered Democratic party fast turning into a rump socialist party with a new party cobbled together from the leftover remnants. The last two Third Party challenges arose out of anguish with the economy. That surely won’t be the case in 2020. I too count what is going on as scandal in the eyes of the public, so Trump will likely lose key #9. You left off the 13th which is challenger charisma. Conservatively I count this a lost key for Trump, though for the life of me I have yet to see who the charismatic Dem might be. Maybe Representative Joe Kennedy? Or Oprah? Or might young what’s her name out in California cut the mustard?

My count is at most 4 against Trump. In the original methodology, 5 was a tossup. Hence at this juncture it looks like Trump will be victorious. The hope for a toss-up rides on a Third Party springing out of nowhere, and someone charismatic like JFK, Ronald Reagan, Bill Clinton, Barrack Obama, or Donald Trump getting the Dem nomination.

Regarding the Illuminati, you have it upside down. Exposing and rooting out the illuminati is what brought Trump to Washington. Drain the swamp in his words. With no political favoritism to the swamp creatures. Look at all the Reps not up for reelection. Why is this? You seem to think that a man with no blood on his hands is somehow on the side of darkness. You’ve got it upside down, Menzie. The Greatest Light Show On Earth is about to begin, no matter how you might denigrate and ridicule my bringing it to the attention of readers. No matter how far you bury your head in denial. What for God’s sake do you think those 45 thousand sealed indictments the Attorney General has put together are all about, anyway?

JBH: I think those sealed 45,000 indictmenst are CLEARLY about the child trafficking ring being run out of the pizza shop basement, and the doughnut chain in a Pacific NW city.

Is the “Greatest Light Show on Earth” gonna be the Rapture? Inquiring minds want to know.

JBH Only 13 keys? Wouldn’t 17 keys be a better fit? BTW, if you knew anything about the federal government, then you would know that the Attorney General does not put together sealed indictments. That’s not how the bureaucracy over at the DOJ works.