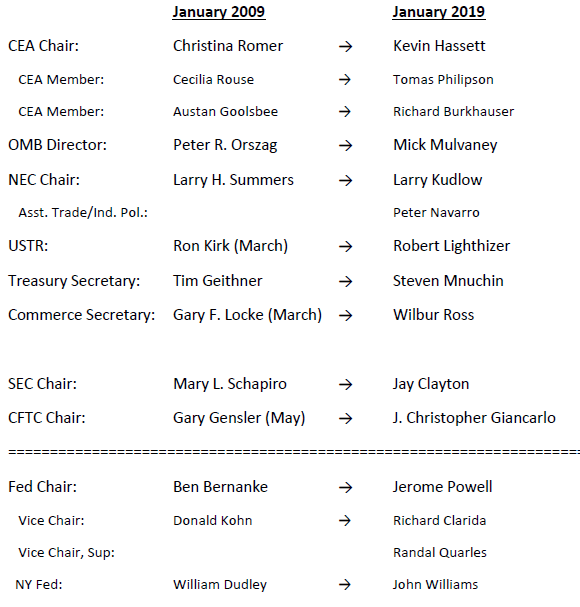

In the wake of the pre-holiday meltdown in the financial markets, I thought for a few minutes about who would be doing crisis management, especially after SecTreas Mnuchin’s ham-fisted attempt to calm the markets. My musings did not calm my nerves. Consider the January 2009 team and the (likely, barring further dismissals) January 2019 team, and you’ll see what I mean.

Surprisingly, I’m not worried by the people who have been appointed to the Fed by Trump. Jerome Powell has, despite the hue and cry from Trump, pursued a relatively sensible process of tightening (even if slightly tighter than I think warranted). Rich Clarida is eminently qualified. So too is the NY Fed President John Williams.

No, my worries are focused on some of Trump’s political appointees. Consider:

Christina Romer had published important work on economic macrohistory and monetary policy. Kevin Hassett wrote, among others, “Dow 36,000”.

Peter Orszag had been director of CBO, after stints at Brookings and CEA staff. Mick Mulvaney on the other hand wanted to ignore the CBO.

Larry Summers at the time had been professor of economics at Harvard, and formerly Treasury Secretary. Larry Kudlow, well, is Larry Kudlow.

Tim Geithner had been President of the NY Fed. Steven Mnuchin had worked at Goldman Sachs and financed movies.

And overarching all these points, Mr. Trump seems to accord heaviest weight to the last person he has spoken too. This means we should worry more about “informal” advisers like Stephen Moore lurking about.

Surprisingly, I’m not worried by the people who have been appointed to the Fed by Trump.

I had a similar reaction when I learned that Bush 43 had selected Ben Bernanke to succeed Greenspan. I would have bet the farm that Bush 43 was going to nominate some inept political hack. I was never so glad to be wrong, wrong, wrong. I do think that Bush 43 eventually grew into the job. He was godawful the first six years in office; but by the end of this second term he graduated to somewhere between mediocre and “not too bad.” There’s no hope that Trump grows into the job…we’re still waiting for him to grow-up from his toddler stage.

I did not know Richard Burkhauser was on the CEA. A very impressive resume:

https://cfadmin.human.cornell.edu/FAR/uploads/webcv/rvb1_webcv.pdf

Of course one has to wonder why is on the Trump CEA. I can guarantee you that no one else in this White House has a clue about the topics that Burkhauser has written on.

I guess poor Kevin will never live down “DOW 36,000.” But he is no dummy.

Books are being closed for the year now, and I wonder if the current stock meltdown is partly the response to discovering that the effects of TCJA on after-tax corporate earnings are not as great as previously thought. For one thing, many of the biggest corporations earning super-normal profits from intellectual property rights may not have seen much improvement in the effective tax rate on these profits, as they had already gotten their tax rate rate down far below the statutory rate by artificially shifting profits to offshore tax havens.

don: Should he be able to live down Dow 36,000? We still haven’t hit that target (and we seem to be getting farther away from it each month). But there are plenty of other reasons to look askance at Dr. Hassett’s analytics — e.g., here.

Two key factors led to the 36000 conclusion. One was their assumption that the appropriate discount rate should be the risk-free rate as if there should be no compensation for bearing systematic risk.

If that was not bad enough, they equated cash flows with operating profits even in a growing economy. Of course part of profits have to be dedicated to investments in new tangible assets for the growing firm.

The 2nd clear and incredibly incompetent error should give the authors of that book an F in freshman finance.

Hassett leaves a lot to be desired but let’s be fair. He is better at analysis than Stephen Moore!

Yeah. And his stuff about the effect of the corporate tax cuts on wages is pretty bad, too.

OK, changed my mind, I’m coming back to comments. Menzie sent me this video begging me to come back. I thought he prostrated himself a little, but hey, it’s ME, right??

https://youtu.be/dQw4w9WgXcQ?t=42

Dear Menzie and Folks,

Let me ask you all something regarding this, and it may not be the dumbest question you will get. Suppose inflation picks up in 2019, to 3% or 4%. The stock market is apparently worried about the Fed policy, but it is possible to go to the opposite side of the field from Menzie, and think the Fed tightening has been too slow, if you think inflation would be a serious problem instead. Given the budget deficits, with relatively high GDP growth and low unemployment rates, it is possible to wonder about this. A very nice description of recent deficits is in

https://www.thebalance.com/current-u-s-federal-budget-deficit-3305783

If there is going to be inflation, there is a choice: gradually tightening Federal Reserve policy, or a big jump to convince people about seriousness. This was the same problem Paul Volcker and the Federal Reserve face in 1979 and the early 1980s. Which policy do you all prefer?

Julian

This starts with “Many people blame the deficits on entitlement programs. But that’s not supported by the budget.”

Fair enough but it said there were 3 reasons for these deficits. I agree that higher defense spending and tax cuts for the rich belong on this list.

But his third reason comes down to entitlement programs, which his opening dismissed.

OK – there are TWO reasons. Glad we could edit this discussion!

“teams” is teams.

Larry S v Larry K is stark depending on your pole.

“Norming teams” in DC display my consultant rule: “none of us is dumb as all of us”. Whether appointed by democrat crooks or wayward republican deplorables.

While Trump opposition (aka centrist permanent war profiteering party) called a Theranos peddling, Hoover ‘scholar’, war monger, ‘warrior’ cultist an “adult” running the pentagon for profit corporate murder enterprise. Makes me worry less about the list.

ilsm: OK. Kudlow and Summers are the same in intelligence and knowledge about the workings of the economy, in your book. Will note that down for future reference.

I have a big book!

I was thinking running the Harvard team “helping” Russia evolve……

http://cepr.net/blogs/beat-the-press/can-we-blame-larry-summers-for-the-collapse-of-russia

Kudlow is not a contender there either.

David Warsh (Economic Principals) wrote a lot about that in the day.

I have a lot of respect for Dean Baker but there are two very weird things about this little essay of his, which was written on August 2, 2013:

“By comparison, Lukoil, Russia’s largest private oil company, had a market value of $268.8 billion on August 2, more than 30 times as much as the payments that Russia’s government received for all the assets it sold over this 8-year period.”

Oil is Russia’s number 1 export so the market value of Lukoil in 2013 when oil prices are very high would be quite large indeed. But I trust Dean knows that oil prices during the 1990’s were low and dropping. This is important for two reasons. The market value of Lukoil would have been a lot lower back then. And the drop in oil prices was a major reason for the woes of the Russian economy. Odd that Dean never mentioned that. Is Summers responsible for low oil prices?

Now to the debate between Blinder and Summers – it was about the state of the U.S. economy. WTF does not have to do with the woes of the Russian economy?

Yes ilsm in his zest for a little Summers bashing pulls out a very weird discussion that ilsm did not understand!

pgl,

Harvard faculty was in to bashing Summers as well! 2Slugs is in the ball park.

Not sure Putin would be so rich today without Summers’ Harvard “consulting” help.

Why Summers kept Andrei Schleifer on…..?

https://www.thecrimson.com/article/2006/2/10/tawdry-shleifer-affair-stokes-faculty-anger/

Schleifer was awarded a John Bates Clark Medal in 1999! Too.

There is a tawdry tread among democrat aperatchnik. From Clinton through Obama and many hangers on.

Where does Lukoil come from…… state assets are sold at huge discount whether by Maggie Thatcher or Yeltsin.

Do you think the royals took the ARANCO IPO off because Trump’s Iran embargoes are seeing oil declines?

You have a talent for thinking beyond those you want to diss.

ilsm: I read the Crimson back in the 1980’s, but seriously, that’s your source?

islm: Yes, that’s one thesis…

“pgl,

Harvard faculty was in to bashing Summers as well! 2Slugs is in the ball park.”

This is followed by ilsm’s usual incoherent babbling. He cannot defend the weakness of his 1st Summers bashing link so he just goes off on utter nonsense. Hey islm – you have no point here so just move on.

ilsm Larry Summers is plenty smart and understands macro inside and out. His problem has never been a lack of intelligence or knowledge. What Summers oftentimes lacks is good judgment despite (or maybe because of) his high IQ. And it’s not just the Russia thing. His tenure as president of Harvard was shot through with head scratching mistakes and self-inflicted wounds. And he owns some of the blame for the financial deregulation that set the stage for the Great Recession. So I always listen closely to what Larry Summers says, because he’s very bright and makes smart and interesting arguments. But sometimes you need to take a timeout and question Summers’ judgment. Sometimes Summers forgets to ask himself if he’s playing against nature or a human.

As to Kudlow…well, he’s just a village idiot who lacks both knowledge and judgment. A BS artist just like his current boss.

Summers is indeed far from perfect. But yes – he is a very smart person.

I get that Yeltsin’s Russia was a disaster. But Dean Baker’s August 2, 2013 post was really awful in a lot of ways. And what he got right was already discussed in great detail by Stiglitz in Who Lost Russia.

But this is all way over ilsm’s head (assuming Russia troll bots have heads).

Summers won the John Bates Clark Medal award in 1991. Then again Kudlow has won the Stupidest Man Alive award many times. So yea – I guess you would consider Kudlow on the same plane as Summers!

pgl

http://cepr.net/blogs/beat-the-press/can-we-blame-larry-summers-for-the-collapse-of-russia

Way ahead of Kudlow!

Good grief! Yes Dean Baker takes a lot of cheap shots at fellow economists. Nothing new here. BTW – I have suggested trolls like you read Joseph Stiglitz’s Who Lost Russia. An excellent account of how Yeltsin’s crony capitalism was a disaster. Of course you might be disappointed as Stiglitz does not go all economist bashing.

Let’s note two things ilsm failed to grasp:

“Alan Blinder, who was also on the panel and one of Summers’ colleagues in the administration as a member of the Council of Economic Advisers, provided an interesting contrast in his own presentation.”

Blinder is not part of the “Harvard” crowd – he taught at Princeton. More importantly:

“Corruption infested every aspect of the privatization. Those with connections in the government were able to become billionaires almost overnight, as they were allowed to buy Russia’s businesses and resources at a small fraction of their market value.”

All true. And people like Lawrence Kudlow supports this corruption aka crony capitalism. If ilsm thinks this episode is one where Kudlow got things right – he is as clueless as ever.

I’m sorry – Summers won this award in 1995 not 1991. Here’s why:

https://www.aeaweb.org/about-aea/honors-awards/bates-clark/lawrence-summers

Krugman won it in 1991. Of course islm hates Krugman too. Go figure!

The common use of the expression freak out illustrates to what extent the narcotics sub-culture has gone mainstream.

Seems appropriate use of terminology in this case; the right hand January 2019 column reads like a very bad ‘trip’. Pass the orange juice.

Interesting, how the far right column list is devoid of women. Probably because the MAGA team believes that women should take shelter during crises.

As it is hard to imagine the lower house Democrats bending to Trump’s wish for a massive Wall along the Mexican border, I fully expect Trump to take his bid for the Wall right to the edge and to concurrently lash out in all kinds of directions early in the month of January 2019. Should keep Mnuchin and fellow firefighters busy.