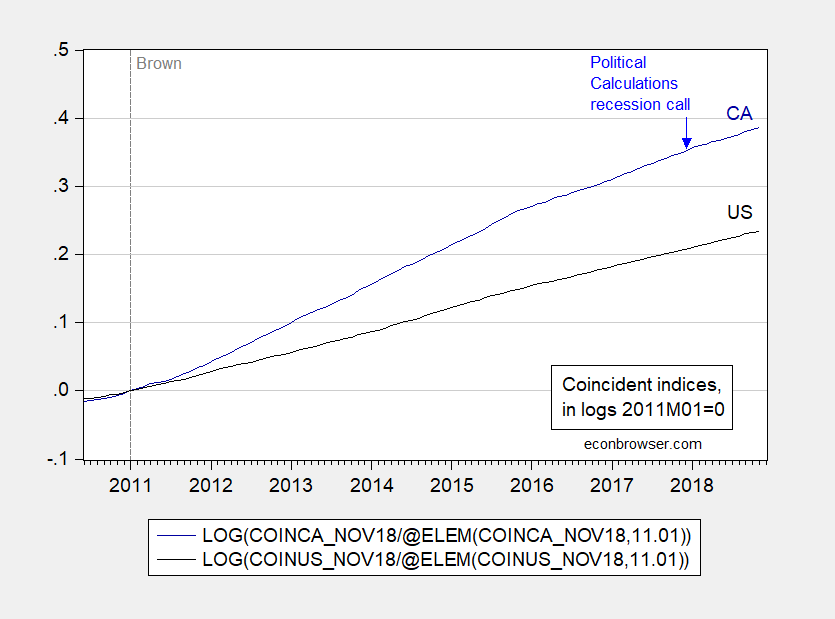

November coincident indices from the Philadelphia Fed are out. Time to re-evaluate this assessment from a year ago in Political Calculations that California was in recession.

Going by these [household survey based labor market] measures, it would appear that recession has arrived in California, which is partially borne out by state level GDP data from the U.S. Bureau of Economic Analysis. [text as accessed on 12/27/2017]

The release provides an opportunity to revisit this question (the November employment figures are discussed here). It’s (still) unlikely that a recession occurred.

Figure 1: Log coincident index in US (black), and in California (blue), both in logs, normalized to 2011M01=0. Blue arrow at timing of Political Calculations recession conjecture. Source: Philadelphia Fed and author’s calculations.

According to my work with Ryan LeCloux, the growth elasticity of real GDP with respect to coincident index is about 0.60 (statistically significant), so we can be reasonably certain that GDP is still trending up.

Trump wants his wall before agreeing to end this stupid shut down. I have an easy solution – have a picture of our arrogant and attention starved President standing next to this wall:

https://www.britannica.com/topic/Great-Wall-of-China

OK – you and I both know this is the Great Wall of China. But here’s the thing. Your typical Trump supporter is really stupid and would likely not catch this reality.

good article, chinn