That’s the title of my October 18th Global Hot Spots talk, sponsored by the Wisconsin Foundation and Alumni Association (Fluno Center, 1:30-2:30).

I was going to use this graph as my motivation:

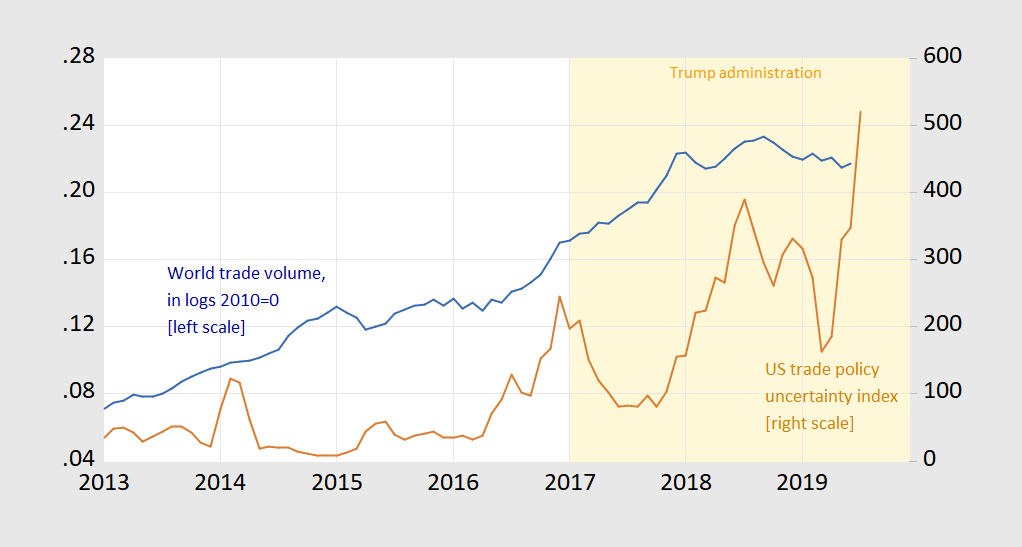

Figure 1: Log trade volume index, 2010=0 (blue, left scale), and Trade Policy Uncertainty (right, brown). Both series three month centered moving averages. Light orange shading denotes Trump administration. Source: CPB Netherlands Bureau for Economic Policy Analysis, Baker, Bloom, Davis policyuncertainty.com, and author’s calculations.

Heightened trade policy uncertainty has been associated with a decelerating and then contraction of world trade volumes – certainly cause for worry.

However, with the news that the Trump administration is contemplating restricting capital flows to China, I fear I might have to devote some time to how Trumponomics might encompass the emplacement of capital controls on the US.

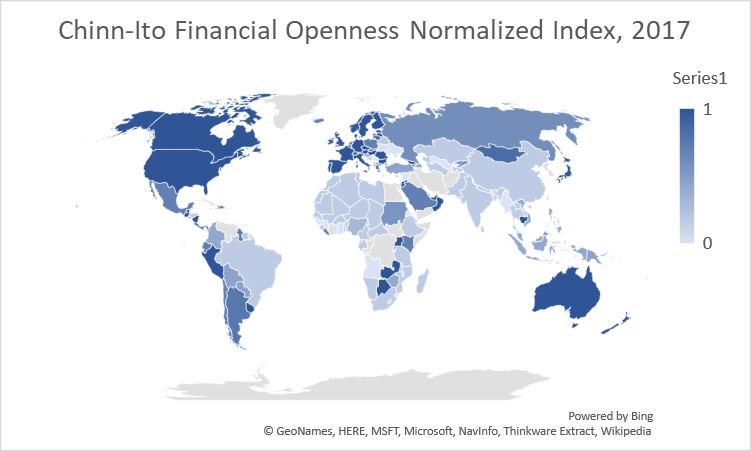

Consider a map of financial openness in 2017 (normalized index, 1 to 0. The darker, the more open, as measured by the Chinn-Ito de jure index.

Right now, the US is one of the most financially open economies in the world, which when combined with strong institutional development, has resulted in the US being a financial center. Restricting capital flows would result in making the US show up as “whiter” in the map above.

My view: willy-nilly attempts (after all, who thinks the current policy framework is coherent?) to punish China by closing the American economy will likely cause tremendous collateral damage.

I see that Greenland is quite white on your map. Maybe that’s another reason Trump wanted to buy it.

Is it the rising level of policy uncertainty that’s associated with declining trade volume, or is it the increasing volatility of trade policy uncertainty. Come to think of it, it’s kind of hard to get your head around the intuition of “increasing volatility of uncertainty.” Whatever…but that’s what the data seems to be telling us.

So as usual, it makes no difference how China conducts business with foreign companies (but heck with the collateral damage). It makes no difference that China has illegally militarized the South China Sea(but heck with the collateral damage). It makes no difference that China’s level of openness from your chart stinks(but heck with the collateral damage). It makes no difference that China through its Belt and Road is trapping small countries into terrible debt traps(but heck with the collateral damage).

No doubt, Menzie, this subject matter is important. But its too important for your usual and lazy single approach to the matter because politics has become more important to you than your profession. This problem is large, growing and not limited to President Trump. You want to do good, and you don’t like capital restrictions, then rather just criticize, come up with a valid solution that accomplishes the goals of the United States.

Ed

Ed Hanson: Thank goodness you have stopped abusing me with anti-rho discourse, applauding the evisceration of the Department of Natural Resources by the anti-scientist Scott Walker, and have now moved to ranting about the Chinese threat.

I actually believe the Chinese *are* a threat in the South China Seas. And for this, you want to slap tariffs on the Chinese, and delist their companies from American exchanges? Maybe we should instead beef up our forces in the Pacific (and stop diverting DoD money to build a useless wall on our southern border). After all, tariffs/capital controls will hurt *both* China and the US.

But I get the feeling some people just want to be a bull in a china shop, destroy things, and then see how they can be reassembled in an improved fashion. Haven’t seen Trump manage to pull it off so far. (I know, I know, CoRev thinks the Chinese will collapse in a quivering yellow heap very soon).

(On the other hand, I *am* thankful you have stopped trying to argue US interest rates are falling because things are going *so* well here.)

@ Menzie

Menzie Menzie Menzie……. [ Sighs in extreme exasperated fashion with a small pause ] Don’t you know the rules of MAGA America now?? You have every right to criticize yellow countries. But white guys (of the MAGA strain, more on this on a late November calendar date) ask the you do it in the correct “hate on” fashion. Where instead of nudging Chinese policy makers in a better direction, you make blanket statements directed at all Mainland China citizens in an extreme condescending fashion. Otherwise white guys of the MAGA strain will wonder “What’s the point in criticizing!?!?!?!”

Signed, Creepers/Degenerate White Uncle Moses, coming to a Thanksgiving table near you.

BTW, my annual Thanksgiving symposium on race relations will be a half minute after I expel gas from Aunt Marjorie’s onion mix stuffing.

Ed Hanson Do you think bailing out of the TPP was a good idea? Do you think pushing Iran into the Chinese orbit is smart geopolitics? Do you think Trump’s opining about what a waste of money it is to have US troops in South Korea is a good way to contain Chinese expansion? Do you think Trump’s deafening silence about Hong Kong sends the right signals to President Xi? Or the way Trump has hung the Japanese out to dry? Is there any evidence that Trump’s tariff war is doing anything to inhibit China from taking all those actions you cited? You really should abstain from voting until you get a whole lot smarter on the issues. Consider that a public service announcement.

Trump should register as the representative of a foreign power.

Like Ed Hanson has much understanding of the economics “profession.” His rants involve politics and political ideology. Very little economics involved.

Hey, Ed. OK with me if your refer to yourself as Noneconomist Jr. You’ve earned it.

As usual Menzie, not only did you missed my point, you actually imply words to me that I have not made, disguised by a question mark.

Since you missed it, again here is my point. I asked you to bring forth a solution to the problems with China. I asked you not just use the simple and lazy method of ‘President Trump is wrong’ and no need to go further than this. The problems are real, come up with your solution.

Ed

PS. I stand by the US interest rates are benefited by its top safe haven status.

Ed Hanson: I’ll get to your first question in a full post. On your point that US interest rates benefit from safe haven aspects — who disputes that? But you argued that US interest rates were *falling* because of safe haven aspects, which to a first approximation should be a level effect. Why are US interest rates falling *faster* than foreign — even when the US economy is arguably doing better than the rest-of-the-world. Inquiring minds want to know (your explanation)!

“I asked you to bring forth a solution to the problems with China.”

Now that is one Herculean task. But I bet had Hillary Clinton become President, her government would find such a solution. BTW Ed – we would love it if you put forth this grand solution!

Menzie

So you are going to continue to divert from the point of the post. So be it. “Does the Safe-Haven Aspect of the US Explain Declining Treasury Rates” is what you titled the thread and then wrote I so surmised. No, I never surmised safe haven was the only reason. So I will put it in a different way to make the point. Suppose the US decided that money is just paper that is printed and it could stay ahead of inflation. (ala Zimbabwe) No longer would the US be considered a safe haven, and if the more stable money was needed, interest rates would go up to attract it. Safe haven -> lower interest rates.

Ed

PS. What a minor subject to divert from such an important subject. Looking forward to promised full post.

Ed Hanson: Why should I not note your egregious lack of ability to understand correlations, science, and economics, if you are going to pontificate now on national security concerns? I would guess I have more experience and understanding of the Section 232, Section 301 trade remedies, the estimates of costs of intellectual property infringements, and national security procedures (including CFIUS) than you do…but if you want to froth at the mouth about the Chinese threat and how tariffs and delisting Chinese firms are going to address the challenges, well please go ahead. But don’t pretend you are an authority on this, or any other subject (as far as I can tell).

Hey Ed! This talk is live in 3 weeks. Why not attend so you can dazzle the crowd with your comments? The December 6 discussion looks interesting:

Historian David Fields will speak on how the division of Korea was much more than a last-minute decision taken by two colonels in August 1945. Instead, it happened in a much longer sequence of events that has its origin in the 19th century — in an obscure treaty — and in Americans’ belief in their own exceptionalism. Fields will discuss his new book on the origins of the division of Korea and how this history shapes events on the Korean peninsula today.

“Restricting capital flows would result in making the US show up as “whiter” in the map above.”

Isn’t that Trump and the Republican Party’s primary objective?

joseph: Ah, got the joke! Yes, it is.

Giuliani Declares He Won’t Cooperate With Adam Schiff In Ukraine Investigation

https://talkingpointsmemo.com/news/giuliani-wont-cooperate-schiff-investigation-ukraine?fbclid=IwAR2sk5T6Md2LO3VgFOweQmoGg–AsnHaPalqjIjUwdtszoPBCMt91-uFR_Y

I guess RUDY is scared of questioning by Schiff. It seems he wants Sean Hannity to ask the only questions.