That’s what reader Ed Hanson surmises:

Why are long term interest rate coming down. There is one obvious answer. The world sees the US as the safest and best place to invest with their bond holdings because of rigorous US economy brought on by the Trump administration with its tax and reduced regulation policy. Perhaps it is this circumstance of inversion that means it is not indicating recession, at least for the US.

Just glance at today’s Economist for an alternative interpretation:

Pakistan, Argentina and Peru have year-on-year increases in the ten year rate (no change for Egypt and Saudi Arabia). Every other country experiences a decline.

So, as long term US Treasury rates continue to collapse, think “slowdown” rather than Trumpian triumphalism.

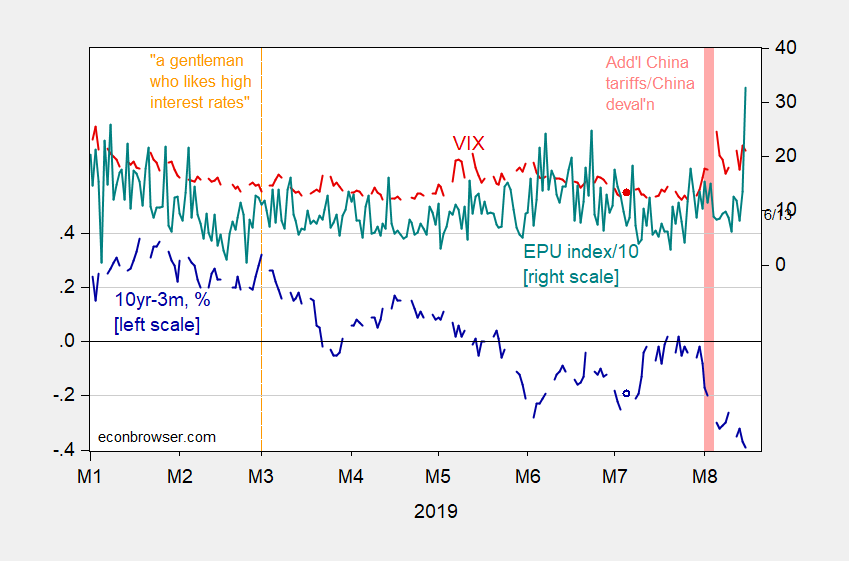

Figure 1: 10 year-3 month Treasury spread, % (blue, left scale), and VIX (red, right scale), and economic policy uncertainty index divided by 10 (teal, right scale). Source: Federal Reserve via FRED, FRED, and policyuncertainty.com, accessed 8/15/2019.

Menzie, you don’t think that Italy’s drop of 154 basis points and Turkey’s drop of 450 basis points signals them as a safe haven??? Come on Menzie, Ed Hanson has done a lot of research on this. Are you gonna tell Hanson after all the deep late night migraine pains, burning the midnight oil, and spreadsheet walkthroughs he’s done on this and you’re going to tell Hanson that rate drops aren’t signaling Italy and Turkey as safe havens???—-Hanson just plopped down 7,500 USD he was gonna spend on his 4 year old daughter’s new Kawasaki ATV to drive around the mobile home trailer park. Menzie, you Hanson’s bro….. what up wit dat man???

Hmmmm, so they all have a strong consumer base&spending, low unemployment rate and are growing around potential.

“think “slowdown” rather than Trumpian triumphalism.”

Under Ed’s Trumpian triumphalism, we would see people selling foreign assets to buy more U.S. government bonds. Which would be consistent with a higher U.S. stock market and higher interest rates on foreign bonds.

But the data shows a lower U.S. stock market and lower foreign interest rates. Wait – people are selling U.S. stocks to buy U.S. bonds. So this is not more investment demand, it is less investment demand. Only Ed would think these events would lead to more U.S. economic growth!

Menzie

Headline News:

Menzie Chin of The University of Wisconsin Predicts that the US Will Be in Recession Before the end Of 2020.

This was finally revealed after months of his hinting that this was the case; as shown by a reply on the Econbrowser website. To the following prediction of a commenter on his blog “Perhaps it is this circumstance of inversion that means it is not indicating recession, at least for the US”. Menzie objected. This objection makes clear that Menzie, as an economist, has firmly predicted a recession by the end of 2020/

Ed

Ed Hanson: Or, maybe you can use the word I actually used — “slowdown”.

Do you have a substantive rebuttal?

By the way, my last name is “Chinn”. I’d think after years of commenting on this blog, you could at least get that straight.

Professor Chinn

Perhaps I know the spelling but can’t type, sorry

Come on Ed. If you are calling to act like a child, please don’t act like a spoiled little brat.

This is the same nonsense from the corporate press. In the eve of the Dec 2007, which was predicted by the yield curve inversion, then, we were told the only reason of the inversion was that China was buying the long end. Not to worry about a recession. There the famous “conundrum.”

Or simply supply and demand. A glut of capital with few productive outlets lowers rate everywhere, just some countries more than others, and a few basket cases bucking the trend.

I see that Denmark has a current account balance of 6.8% of GDP. So why would Trump think that Denmark would want to sell Greenland?

Actually Denmark is a position to buy certain U.S. territories. Let’s sell them places like Alabama and Wyoming. Fewer hard red states would be good for the US. And maybe the Danes could finally educate their new residents.

But wait! There’s more. With this TV offer we’ll throw in Mississippi absolutely free. Now how much would you pay?

That lowers the sale price. My ancestry is gen-u-wine Appalachian. Those flatlanders in Mississippi are a negative asset.

We live in a world of a single worldwide interest rate and each country’s bond yield is partially a function of the other major countries interest rates.

For well over20 years I have used the average of the British, German and Japanese bonds as a factor in my valuation model of the US bond market.

Interestingly, this variable has a greater weight in my bond equation than fed funds.

But you also need to look at the interaction of the bond and currency markets on each other. A strong currency may mean that domestic rates are too high.

Yesterday Trump economic advisor Peter Navarro said the Rupert Murdock owned Wall Street Journal sounded like the China People’s Daily. Yep, Murdock and the Wall Street Journal are communists!

It is impolite to say out loud that Peter Navarro is a complete and total loon – befitting his boss? Recall that he was chosen by Jared Kushner to be Trump’s foreign economic advisor because Jared was browsing Amazon for books about China and came across Navarro’s “Death by China.”

Jared has been using Amazon to shop for something on predicting the stock market and has found this “classic”:

https://www.amazon.com/Dow-36-000-Strategy-Profiting/dp/0609806998

Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market Paperback – November 14, 2000

by James K. Glassman, Kevin A. Hassett

When’s the next recession.

More and more interesting stories about Biden’s campaign financing and how he pimps out his political clout to enrich his family relatives. Not sure if I ever linked it in Menzie’s blog but there was also a story about him using this so his saintly Catholic sons could lounge around doing nothing collecting hedge fund money from people who wanted political favors from “middle-class Joe”:

https://www.politico.com/story/2019/08/15/james-biden-bungalow-ukraine-donor-1463645?nname=playbook&nid=0000014f-1646-d88f-a1cf-5f46b7bd0000&nrid=00000165-6d96-d5e0-abe5-6d9e93880000&nlid=630318

When you look at the fact Ukraine’s relationship to Russia is similar to North Korea’s relationship to China. They are a proxy, and Putin and Manafort etc had their fingers in every pie in Ukraine. Now imagine donald trump brings this up in a debate (gee-whiz, you think trump would do that?? Let’s ask Barkley Junior). If trump brings this Ukraine funding up (and the useless Biden sons pimping out influence for free play money) in a debate right after Biden discusses Russiagate (which no thanks to senile Pelosi has now been deflated of all its air and has now become a running joke to everyone) all people are going to do is laugh at the senile man who can’t connect two properly worded sentences together. Biden’s use of the English language makes me wanna check him for some Rosser family DNA.

And people say being a member of MAGA doesn’t come with special rewards?? Come on people!!!

https://www.nytimes.com/2019/08/16/us/politics/trump-fat-shames-frank-dawson.html

What is the IQ of a man, his leader basically says he looks like a large farm animal and right after that he pledges allegiance to him?? That would be on the same level of intelligence as hiring someone to co-edit a large dictionary who can’t make it through a blog comment without an error. But I digress…..

https://www.youtube.com/watch?v=FbjiKIKzY3c

I hear Frank Dawson and Donald Trump decided to start going to the gym together!

@ pgl

In 2019 context that somehow seems perfectly believable. Satire has now become reality. Other than the fact of course that donald trump would view such a gesture to the common man as “totally beneath him”. I like your humor here, but remember, only “liberal elitists” engage in such loathsome activities as rubbing elbows with the common man or rubbing elbows with those in different demographic groups.

https://images.app.goo.gl/V86yHwu7MovWzCcu9

That image is “nauseating” isn’t it?? I bet that image in the link just gave “Princeton”Kopits a serious case of the dry heaves.

* Is anyone else amazed this story is 10 years old now?? WOW.

https://www.theguardian.com/world/2009/jul/24/obama-race-row-beer

For some reason I don’t fully understand (no, I wasn’t drunk), last night I was channel surfing and paused to watch Trump’s rally on C-SPAN. They warmed up the crowd with some country music and lots of rock with a macho theme (e.g., Survivor’s “Eye of the Tiger”, Rolling Stones “Play with Fire”, some AC/DC stuff, etc.). Trump arrived on stage and launched into yet another one of his rambling, stream-of-consciousness rants. He got stalled over some ridiculous game he played over the campaign slogan for 2020. It went on and on and on and on. The crowd was falling asleep. Trump showed unusually low energy….”Sleepy Donald.” He was just repeating the same old stuff that he’s been trotting out over the last four years. The crowd clearly was in love with his cult of personality, but I got the sense that some of them might have been disappointed with his summer rerun. They were expecting dinner & a show and all they got was lousy hat and one fat President ridiculing one of his fat supporters. After a while I turned to the Cubs game, which was equally disastrous. Pedro Strop has got to go. Worst relief pitcher in baseball.

They’re gonna make the playoffs though yeah?? That dude with Cincinnati sure lit them up a few days ago. He looked like the new freaking Rod Carew.

Should we appoint you “Chief Tabulator of Trump Rally Boot Outs”?? I know you have much better things to do, but you could get “street cred” as an Antifa spy.

He should play for the Mariners. They do not have a rotation. They have drive by pitching.

https://twitter.com/crampell/status/1162307835339952131

When Obama was president and the official economic statistics were good, Trump said they were fake. When Trump became president and inherited the exact same stats, suddenly they were real. Now that they’re turning south, they’re fake again.

https://www.washingtonpost.com/politics/trump-banking-on-strong-economy-to-win-reelection-frets-over-a-possible-downturn/2019/08/15/04a85352-bf67-11e9-b873-63ace636af08_story.html …

Check out on Catherine Rampbell’s twitter the excerpt of what Trump said on how economists are presenting “biased data”. Trump’s latest rant sounds a lot like what we get from our Usual Suspects.

http://www.tampabay.com/florida-politics/buzz/2019/08/16/memo-reveals-a-house-republican-strategy-on-shootings-downplay-white-nationalism-blame-left/

“Memo reveals a House Republican strategy on shootings: downplay white nationalism, blame left

The GOP memo falsely pinned the El Paso massacre and other notable mass shootings on the left”

These lying clowns cannot bring themselves to stand up to Trump’s divisive racism. These cowards cannot stand up to the NRA and let real gun legislation pass. But these traitors can lie to us by blaming LIBERALS for White Nationalist. I would be shocked but this has been their standard playbook for way too long.

Of course these clowns are not alone. I bet this memo was written by Bruce Hall.

NPR interviews Paul Krugman for 12 insightful minutes:

https://angrybearblog.com/2019/08/paul-krugman-radio-interview-regarding-current-conditions.html#more-51493

He starts by noting the inverted yield curve is “an effect not a cause” followed by noting the cause may be people being very concerned about future economic growth. Why the concern? A lot of what he notes goes to the uncertainty caused by Trump’s on again and off again trade policies and a general feeling that the Trump economic team has no clue how to address any future economic difficulties.

You have the data right in front of you, people paying a 25% premium for true AAAA

Gérman 10 year bunds, even more for Swiss, nearly the same for our good Hanse brothers Dutch, Danes, Swedish. and then you talk about risky US bonds as “The world sees the US as the safest and best place to invest”

You Muricans are not capable to balance your budget even after the longest boom in written history

That rant almost made The Rage seem coherent.