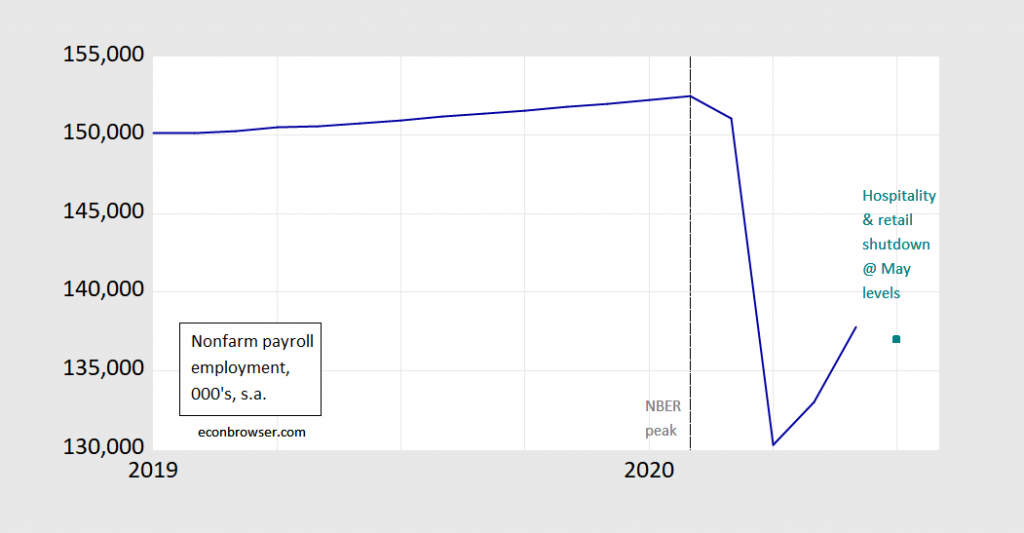

Some idle speculation as we head into more closures: What if hospitality and leisure and retail employment dropped back to May levels, and the rest of nonfarm payroll employment increased by 2 million (it increased by 1.972 million in June). Then what would overall employment look like?

Figure 1: Nonfarm payroll employment as reported (blue), and NFP if hospitality & leisure and retail employment both fall back to May levels, and the rest-of-NFP employment rises by 2 million (teal square). Source: BLS and author’s calculations.

This is not a forecast; rather it’s a conjecture.

Some states in trouble, see this post.

The cloudy plastic ball says it is a forecast. The w will be asymmetrical. That does not make it go away.

We could have had a swoosh or a radical or whatever, but we blew it. The question of whether there will now be a W in the jobs data involves two responses, private and public. If we allow the private response to dominate, we may see a series of Ws; private hiring and layoffs may create a feedback loop which creates successive further rounds of hiring and layoffs. If the public response dominates, one big drop in employment could allow the U.S. to cut its infection rate as other, better led countries have done. A big, decisive employment W is a question of political will. A continued series of little Ws would represent a further failure of political will.

The initial public response to the pandemic was in many states quite late. The transmission rate had already fallen because of the private sector response by the time public action was taken. The renewed acceleration of the spread is the result of both the public and private action, but is mostly a failure of the public response. We can’t expect price signals or whatever to coordinate private action in a pandemic. When private coordination fails, government must step in, but government has not done so effectively.

In some U.S. jurisdictions, the fact that ICU beds were not overburdened seems to have driven the decision to lift restrictions. Other countries have driven transmission rates down to the point that they can deal with flair-ups quickly and effectively before re-opening. In the U.S., it’s OK for people to suffer and die, as long as they do it in a nice, clean hospital bed.

We need a big employment W and greatly expanded testing to achieve what other countries have achieved. We have so far chosen to fail. Until that changes, it’s a succession of wobbles for us, with all the suffering, death and economic harm that come with that choice.

Clearly we are in a situation where there are serious differences between sectors regarding what is happening. Just as this sort of thing discombobulates price indexes, it also messes up parameters in various models. All forecasts at this point are highly uncertain beyond the now gone second quarter, even as it will still be quite awhile before we finally get definitive numbers on the second quarter. By then, nobody will care; it will have been superseded and be irrelevant.

I appreciate your point, Menzie. several threads ago, informing that Jim Hamilton has described the NY Fed Nowcast as “top down” while the HIT (? former Macroeconomic Advisers) is more bottom up based. I usually support the latter, but at this time I doubt the micro relations of the latter group, more optimistic about the second quarter outcome, will ultimately tell the aggregate GDP story. It may be that the simplified view from ignorance will prove more accurate than the well-modeled behavior.

Barkley Rosser: To clarify, NY Fed was top down, Atlanta Fed GDPNow is bottom up.

Thanks for the correction, Menzie.

Hmmmmm, I like conjecture, sometimes great ideas come out of conjecture. I don’t have any deep thoughts at the moment, other than Barkley Junior says consumption was around 8% in May, so really, there’s nothing to worry about. I think he calls this the “Barkley Junior 2nd Quarter GDP Gambit”. Well, he doesn’t call it that, one of his colleagues named it after Barkley Junior because he was afraid people might think the entire department had something to do with it. It’s flattering for Junior really if you think about it. See if you take the number 8 from the May consumption, and you ride your bicycle in the shape of an 8 in the parking lot, you then realize you can literally ride that route forever, so then it becomes infinitum, then you take the consumption for May, multiply it by infinitum, and you get what Barkley calls “BS of Barkley GDP”. The paper is coming out in the “Journal of Chaos Theory for Mall Security Guys” in very late July, which has been peer reviewed by interns at “Kopits’ Excess Deaths Of Not-Really Americans Consultancy”.

I don’t know, I think it’s gonna work out.

Funny you should bring up chaos theory, Moses. It turns out I am the President-Elect of the Society for Chaos Theory in Psychology and Life Sciences. Their annual conference was supposed to be July 22-24 in Toronto this year, but we have organized it to be a virtual Zoom one. I have organized the program, which I put up in two posts on Econospeak yesterday. It is open to one and all, with a registration deadline of July 6.. You can attend, Moses, and impress everybody there by calling me “Barkley Junior.” Everyone will get a big kick out of it.

You’re taking all the piss out of it. If it doesn’t annoy the hell out of you, you’ve sucked all the fun out of it. I’m still ragging on you for your 2nd Quarter call though.

And you have not yet figured out that you are falling totally flat on your face with this ragging? Maybe you cannot apoologize, but, heck, are you going to notice that the June employment report came in like double what was being widely forecast? Or is noting something like that beneath you, especially since it makes most of what you are babbling about completely ludicrous?

From Barkley Blowhard’s own keyboard on June 27th:

“ ‘Possibility’ it might be as high as -20% for second quarter? It now looks like consumption is highly likely to be positive for the second quarter kills any chance of overall GDP growth for the second quarter being -20% or lower. Heck, I would be very surprised if it is lower than -10%.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237778

I encourage one and all to pay attention in late July when initial BEA numbers on 2nd Quarter GDP come out. Then you’ll find out why he’s been fleecing Virginia tuition payers for years now.

https://www.breezejmu.org/news/jmu-s-comprehensive-fee-one-of-highest-in-virginia/article_567197d6-ca0a-11e9-8a68-e39a2f15d005.html

I also suggest anyone attending his class that has to spend more than 30 seconds listening to him discuss economics request an immediate tuition refund.

Moses Herzog: I agree it is highly unlikely that consumption in Q2 will be higher than in Q1. In order for that to occur, 2020M06 consumption will have to be 16517 bn (SAAR) with all previous consumption figures un-revised.

Depends on if the forecasters are using the flawed methodology or more accurate representation of who is actually working.

Menzie,

I do not know what the probability of consumption at end of Q2 being higher than Q1 is, but it seems to me you may be understating it. Let us review some BEA data on consumption that I have posted before and that I doubt you will question, although if you do, I would be curious what you would pose as more believable numbers, although I am assuming these are monthly percentage changes, not annualized rates, an issue I have had confusion over and apologized for.

Feb. 0.0%

March -6.6%

April -12.6%

May 8,2%

Do you dispute these numbers, Menzie?

Now, assuming those are not too far from correct, for Q2 to end up higher than Q1,, all that is needed, as I pointed in a previous post, is for the growth in May and June to offset the decline in April. That means that if consumption grows in June by more than about 4.4.%, Q2 will end up higher than end of Q1. Is this not correct, Menzie?

Now while we do not have consumption for June, we do have estimates for employment growth for both May and June, which presumably correlate strongly with both consumption and output, although as I have noted a lot of normal relations are broken down now, so all kinds of things might happen. Nevertheless, here are the repoorted employment change numbers for May and June in absolute numbers:

May 2.5 million

June 4.8 million.

So, the June number is nearly twice the May number. Now for several reasons I am not going to suggest that this means indeed that consumption or GDP will grow in June at twice the rate it did in May, although I did pose that possibility in an earlier post when the June employment number came out. But I note that for Q2 consumption to be less than that at the end of Q1, consumption in June must grow at some rate less than about 4.4% while it grew at 8.2% in May. Is it reasonable to posit that while employment was growing in June at nearly twice the rate it was in May, that consumption would instead grow in June at something like half the rate it did in May? Somehow this does not seem all that probable, although you are declaring that for it not to happen is “highly unlikely.”

I can see a couple of possible caveats that might bring about the result that you claim is not “highly unlikely.” One is that when you talk about quarterly consumption you are talking about some average rate over the whole quarter, not end of quarter numbers. If that is the case, then certainly I shall go along with you. You have much higher consumption in Januarey and February than you have in April or May and quite likely June as well. So, indeed, the probability that the average level of xonsumption in Q2 will be higher than the average level of consumption in Q1 I would certainly agree is “highly unlikely.” But that claim does not look so likely if we are talking about end of quarter numbers.

The other caveat gets down to specific dates of the estimation of these data, an important matter. So indeed, as I have noted, those employment numbers come out mid-month, actually slightly before mid-month, like the 12th of the month. So, that May number includes the second half of April, during part of which almost certainly employment was falling. The “June” number is really second half of May anf first half of June, a period when employment was probably growing at its max rate, with that rate quite likely slowing down in the second half of June. But consumption numbers are probably coming from later in the month and covering a later period for the month than the employment numbers. So we may not be able with much confidence impute how much June consumption will grow compared to May consumption growth by looking at the reported May and June employment reports. Am I being reasonable here?

Barkley Rosser: I am comparing quarter to quarter data, not end-of-quarter vs. end-of-quarter. However, Q/Q is convention. I have 2020Q1 consumption (SAAR) at 13179 bn Ch.2012$ (June 25th release), and I have 2020M04 and 2020M05 consumption at 11062 and 11955 respectively (SAAR), all in Ch.2012$. 13179 = (1/3)x(11062 + 11955 + X) ==> X = 16520. Consumption will then have to surge 38% (not annualized) in June in order to have Q2 consumption exceed Q1; see this graph.

I concur, matching 2020M03 consumption is easily possible — all you need is 5.4% growth (m/m not annualized).

Fair enough, Menzie. I think I have made it clear I agree that it is “highly unlikely” that overall Q2 consumption will exceed overall Q! consumption, but I am glad to see that you “concur” that it is “easily possible” that end of Q2 consumption might be higher than end of Q1 consumption.

BTW, I was kind of wondering what set off this bizarre ramble by Moses, and then I remembered: he just got caught with his pants down going on about how way off I was with my forecasts that leading forecasters were appearing to under forecast economic activity in the second quarter. He was being quite eloquent about it. And then the June employment numbers came out, oh, about double in growth compared to the leading forecasts. Oooops! So I could not resist descending to a playground “Nyah…” I absurdy suggested he apologoze, but long experience has shown that Moses does not do that. Rather he just doubles down with more silly nonsense as he has done now. But. hey, it is true that if one turns an 8 on its side it dies becine a sign of infinity. So, congratulations, Moses!

Barkley Junior’s own words on June 27, 2020:

” ‘Possibility’ it might be as high as -20% for second quarter? It now looks like consumption is highly likely to be positive for the second quarter kills any chance of overall GDP growth for the second quarter being -20% or lower. Heck, I would be very surprised if it is lower than -10%.”

https://econbrowser.com/archives/2020/06/gdp-nowcasts-june-26th#comment-237778

I invite one and all to watch the initial BEA 2nd Quarter numbers which will come out in late July, so they can see the true worth of Junior’s insights on just about any topic.

Moses,

My my, you have now posted this twice. Do you think that doing so will impress anybody with your brilliance and acumen?

I have responded to Menzie’s comment above, so will not repeat it here, but let me be more precise in saying that it looks to me that there is a pretty good chance that comparing end of quarter numbers (Menzie might be referring to average overall quarter numbers, an important difference D2 might well end up ahead of end of Q1 for consumption.

But that aside, I note that in my discussion of overall quarterly GDP changes, when I mentioned -20% and -10%, I was referring to quarterly percent changes, not annualized ones, and then noted that I had gotten confused about some numbers being monthly or quarterly versus annualized, for which I apologized. Anyway, for quarterly changes, I think I shall stick with those numbers, which is what I meant. But i am much less certain that those numbers will hold for annualized rates. So, just to be clear, we could easily have a negative second quarter GDP change that is more negative than -20% on annnualized basis while not being more negative than -20% on quartlerly percent terms.

As it is, you have still not recognized that the June employment report came in with roughly double the growth amount forecast by “leading forecasters,” a fact that has made quite a few of your recent posts look pretty ridiculous. I asked for an apology, given that many of those posts included lot of irrelevant personal insults. But, of course, rather than apologizing you have literally doubled down on not only ignoring that you have been rather off, but also in larding it on with the personal insults. If I did not already know that you imitate Donal J. Trump in this regard, I wold say that you should be ashamed of yourself, but as it is, you are quite beyond being ashamed of yourself, at least in pubic (oh, yeah, I know, you have admitted being ashamed of supporting Tulsi Gabbard, so you are not quite at DJT levels on this shemelessness matter).,

@ Barkley Junior

In other words, you’re already back-pedaling. Like someone who bet on Frazier in the last Ali-Frazier boxing match and wants to change his wager in the 8th round. Because everyone here with a brain knows you were talking about SAAR, which is what 98% of people who quote BEA GDP are referring to. But you apparently, belatedly, have figured out you’re going to look like a complete A$$ in late July when those numbers come out. And I will keep quoting you. Ad-infinitum

This is becoming increasingly hilarious, Moses. You have never put forward any numbers at all. The most you have done is vaguely support the more negative forecasts without ever hanging your hat on a single one. I also remember that back when we were all arguing about what letters the pattern might look like you for awhile seemed to push “L,.” That suggest no growth at all, and that has been waaaay wrong, with it looking more like the V-shape I shifted to calling for as the immediate upturn pattern, even as I argued even before you returned from “vacation” that it would slow down, which is what Menzie’s post here today is arguing. Look at the pattern: it is pretty much what I called shortly before your return: a short V pattern followed by a slowdoen.

You, however, with not a number to your name is stuck with having forecat an “L,” which is absolutely not what has happened. I have pretty well called it, and you have been way dead wrong, utterly and totally, but no, I shall not waster everybody’s time by repeatedly posting this hard fact.

Anyway, you kept insisting that even though you were not putting out any numbers, I must do so. And sure enough the minute I do so you starte repreatedly posting them and claiming I shall look like maybe as big of a fool as you currently look like with your totally wrong forecasts. I have donr some clarifying of what I meant, not back pedaling, and I have never said which particular data source I was relying on, although you seem to insist it must be SAAR, even though BEA are official government numbers. In any case, I think my claim that it is unlikely that Q2 GDP will be more than -20% lower than Q1 GDP is not too bad, although it could still be the case.

Anyway, Moses, if you are going to post predictions of how I am going to have all this mud on my face quite some time down the road when all this gets fully known, I shall post reminders that you were wildly off in forecasitng an “L” recovery that was utterly and totally wrong..

I also remind that I was the first person here who was not just some knee jerk Trumpanzees claiming there would be a V that would then just zoom on to November, to note that world GDP had hit bottom and was turning around, and that US GDP was likely to do so soon as well. Neither Menzie nor Jim H made any such observations at the time, but neither did wither say I was srong. That was in late April when I did that, and I remind that my observation was based on a paper in Nature arguing that global carbon emissions had hit bottom around April 7 and had returned to increasing. That initial increase was very slow, so that reinforced the view I held than that the US would not have a V-shaped recovery but more of a gradualy one, a view you also ridiculed because you were pushing the zero recovery flat L pattern. Anyway, when the data came in on the May employment numbers showing a much sharper tutrnaround, I was the first here to change my view in light of the new data to say we might have a short term V-like recovery, which seems to have happened, even as it now seems to be slowing, something I also called.

You have called none of this, and you were dead wrong with your L forecast,. Of course you were on vacation for some of this time period, but you seem not to have figured out a single thing during your absence, well, maybe one thing, but we shall stay away from that.

https://talkingpointsmemo.com/edblog/catastrophe-2

Josh Marshall’s Catastrophe is a must read:

I seldom think anything good about Donald Trump. I hate what he has done to the country. I hold his enablers even more responsible for what has happened on his watch. But today I feel that stew of emotions in a new deadening way I have seldom experienced. I am baffled and aghast and angry in a way I seldom have been.

The US is not experiencing a surge. We are back to exponential growth in the virus just as most of the rest of the wealthy, industrialized world is moving on. COVID is not done for them of course. There are masks and mitigation and distancing and people are still falling ill. Some are dying. But most of these countries have beaten Covid down into low enough numbers that they can get about the business of a new form of social and economic life.

More than 57 thousand new cases were reported today. I was dumbfounded by that number even though the trend pointed to it. This is almost triple the number of cases of three weeks ago. This is a national catastrophe and one due almost all to ourselves, to a litany of horrible decisions and even more simple abdications of responsibility. And yes it really all goes to Donald Trump who has tried to deny the problem whenever possible and when he engages it does so through the prism of assigning blame to someone else for anything that goes wrong. The concept of service, responsibility is entirely alien to him.

We’ve watched a ragged, lying, stupid and absurd performance going back five months. Any sense of national integration and unity has come apart like a torn necklace. No wonder the result is so bad and we’re alone in the world.

The White House tonight it’s shifting to a new message: “We need to live with it.” It is this brazen effrontery to point us to their failure and tell us, “deal. That’s just how it is.”

We are often helpless before nature and fate but the different outcomes in so many life parts of the world that it is neither nature or fate which have brought us to this pass.

Being President is a hard job and this was an historic challenge. That’s the job. It’s on you. You may not be at fault but you’re responsible. You can imagine good presidents of the past and bad struggling under the weight of this crisis. He’s done none of that. It’s all been a matter of blaming states for not having enough ventilators or tests, making covid denial a centerpiece of his movement. His whole record in the crisis has been denial and then finding nonsensical arguments that a crisis befalling the country to which he was elected head of state somehow has nothing to do with him. The states have to fend for themselves and the federal government takes care of itself, as though the federal government is anything but the expression of and protector of the people.

And then he just decided he was done. He got bored. It wasn’t fun anymore. He shuttered his largely ineffectual task force and moved on. He wanted rallies. He made masks a sign of being a Democrat and a wuss.

But covid hadn’t moved on.

He went golfing.

I think Trump has done the wrong things to deal with the Covid pandemic because he lacked the capacity to do the right things. Even in an economy with low unemployment, enjoying a long expansion, following an administration which had taken governance seriously, Trump was not capable of doing the day-to–day work of leading the executive branch. His list of accomplishments in governmeent is heavily weighted toward dismantling what others had built instead of building anything new.

Dealing with a disaster of his own making – soy bean prices, for instance – was hard enough. Dealing with a crisis not of his own making required more than just cutting checks to constituents, and doing more is hard. He lacked the capacity to drive a governmental response and had not hired or retained enough good people to fill the gap in leadership. It may be that the only response available to him, mentally and emotionally, was to pretend the problem would go away.

Why get in the way of others doing their best, spurning masks and distancing? They are reminders that he is on the wrong side of this problem. He vilifies anything on the other side of a debate. China and Mexiico (to name only two) on trade. Murdering, raping drug-dealer immigrants. And now we are apparently at war with left-wing radicals?

Trump is incapable of doing anything useful. Passively doing nothing is not the Trump style. Actively doing nothing may be one of Trump’s few talents. And here we are.

He is very good at making a mess and dumping it on others. He made a mess. Now he is attempting to dump it on somebody else. That is pretty hard to do as POTUS. This was not going to end well. And now it is not ending well.

I sent a post on this topic to one of the earlier ones but it apparently got lost in the Internet. I think we are going to see a recovery in waves with unemployment increases going forward. The airlines industry has been keeping a lot of employees on the book but now as it appears airline travel will not rebound to pre-pandemic levels a lot of them will be laid off. American Airlines has said it is overstaffed by 20K employees including 8K flight attendants. Other major carriers may be in the same position. Commercial real estate looks to be a risky investment as offices may not come back to 100% in house use as remote commuting becomes more common. If you were in the meeting planning business for a large organization, would you be organizing a large meeting right now? I don’t know how large the year Economics Association meeting is but maybe Menzie can chime in. Would they even schedule an in person meeting for the first half of 2021?

those of us who are retired and have a decent amount of disposable income are not going to get on an airplane or dine in a restaurant for some time to come. We are supporting some of our favorite restaurants through take out. they have opened for dine-in service two weeks ago but the three times I stopped by to pick up dinner there was nobody seated at all. I don’t go by a single month of BLS reporting as the numbers are too squishy. We will see what the next month’s numbers look like.

This is just back-of-the-envelope stuff, but how much would it cost if we closed all dining and drinking establishments? Obviously, this is an extreme measure, but I’m just trying to get a sense of how much this worst case scenario would cost.

I’m setting the baseline at Feb 2020. The BLS tells us that this subsector of the leisure and hospitality sector had 12,303,000 jobs in Feb 2020 (peak employment). The BLS doesn’t have wage and hour data for this subsector, but it does for the larger leisure and hospitality sector; therefore, I’ll use leisure and hospitality wage and hour data as a proxy for restaurant and bar workers. Feb 2020 average weekly hours = 25.8 and average hourly wage = $16.85, so weekly wages = $434.73. So that means we a 100% shutdown of restaurants and bars would see a cost of 12,303,000 * $434.73 ~ $5.35B per week, or $278.2B per year, or about 1.3% of GDP in 2020Q1. We could fully reimburse all lost wages for restaurant and bar workers at a cost of 1.3% of GDP.

Of course, wages aren’t the only cost that restaurant owners face. Typically wages account for ~ 25% of total restaurant costs, so total costs of shutting down for a year would be $278.2B / 25% = $1112.8B. This guesstimate is very roughly in line with BEA’s 2019Q4 estimate of Gross Output (i.e., Final Value Added + Intermediate Inputs) of $910.4B (see BEA GDP-By-Industry Table “Gross Output By Industry” Line 87). But if restaurants are shut down, then they won’t be incurring food costs, which typically account for ~35% of total costs. Subtracting food costs gives us a new total cost of $1112.8B * 65% = $723.3B. So instead of eating at restaurants, food will be consumed at home. After all, people still have to eat. It’s just that the “value added” component of eating will shift from restaurants to home chefs.

Summing up, it looks like we could completely shut down restaurants and bars and fully reimburse workers and restaurant owners for something like $723.3B, or roughly 3.4% of GDP. And as an additional check on this number I took BEA’s 2018 “Use Table” values for final and intermediate value inputs and constructed a 73 x 73 Leontief I/O matrix. Reducing the value of the food and drinking final demand by 100% and then backing out the losses to farms and grocery stores (which wouldn’t see a loss in sales, only different customers), I get a gross output loss of 3.33%, which is pretty close to the back-of-the-envelope calculation using lost wages.

If we can halt the spread of the virus at a cost of 3.4% of GDP, then I’ll take that deal any day.

@2slugbaits – it’s more complicated than your analysis. Tom Coliccio, a restaurant owner and judge on the TV show “Top Chef” has been very outspoken on what needs to be done. He’s done a couple of podcasts that I’ve listened to in the past two months. Here is a link to one of them: https://www.npr.org/2020/05/07/851778405/table-for-none-tom-colicchio-explains-what-restaurants-need-to-survive

You need to account for lost rent payments and supply disruptions. Restaurants buy stuff in bulk containers and individuals do not. It is not easy to turn around packaging lines for the consumer market. Wait staff make money of tips and that aspect is hard to factor in if you are providing close down payments. There are some other issues as well.

I agree with your main point, just pointing out the analytical issues.

Alan Goldhammer I don’t especially disagree. My back-of-the-envelope estimate does include stuff like rent payments because those are included in the BEA’s I/O data that accounts for all intermediate inputs; however, it obviously does not include supply disruptions. In fact, early on I posted a couple of comments about my concern with “bullwhip” effects across supply echelons as consumer demand replaces institutional demand. Just for yucks I even did some “bullwhip” guesstimates using the (now deprecated) “R” package “SCperf” assuming suppliers estimate demand using AR1 or moving average or exponential smoothing forecasts. Agree that tips are not accounted for, but we can probably estimate an upper bound.

A little good news from NYC on the restaurant situation. A lot of the Park Slope (Brooklyn) ones were serving food that people enjoyed sitting at tables outside. I’m just hoping our very careful governor does not freak out at what is happening in other states. We are pulling through and slowly reopening. Maybe the restaurant owners should demand proof that their customers are New Yorkers as we don’t need the damn mistakes being made in other states.

You mean now that it’s been shown that a large segment of the original wave across American states came from New York?? Maybe your “very careful” governor will have you shipped to the nearest long-term care facility if you enter the latter stages of the virus–be careful.

https://www.propublica.org/article/fire-through-dry-grass-andrew-cuomo-saw-covid-19-threat-to-nursing-homes-then-he-risked-adding-to-it

I’ll say this, the man puts on a very convincing show, but Cuomo’s personal morality level is maybe a 1/4 step above donald trump’s. Don’t get fooled like I was with Tulsi Gabbard, ok?? Not to mention I was also fooled by Herman Cain and Jim Traficant. But enough about my idiocy, let’s talk about yours. I mean, really, let’s talk about yours.

“Maybe your “very careful” governor will have you shipped to the nearest long-term care facility if you enter the latter stages of the virus–be careful.”

Gee Moses – I never imagined you would pull a Bruce Hall. Yes NY was overwhelmed at first but this hit job misrepresents what and why things happened. Now in Brucie’s case he is trying to absolve Trump by attacking certain governors. The reality is that NY did not have enough testing in early April. We do know.

Now Moses – are you also trying to absolve Trump by spreading hit jobs on governors who took the responsibility that the White House did not.

BTW – I am not necessarily a Cuomo fan so attributing “very careful” to me is a wee bit dishonest. Cuomo is not perfect but alas he is the best we got right now.

@ pgl

I’m sorry if it disheartens you, similar to your friend Barkley Junior, that when I use your own words against you, it makes you feel flustered and a certain vexation. But “very careful” were your exact words to describe Cuomo in your comment—stretch your own eyes about 5 inches above to read it. I suggest you take up your objections with the part of your brain that composes words as you type if you feel it’s “unfair” I broadcast them back to you.

‘Moses Herzog

July 5, 2020 at 12:51 pm’ followed by one of Uncle Moses usual lectures that totally misses the point.

Yea I did use the term “very careful” as snark. I guess the art of snark is something Uncle Moses never learned. Even after i used the term “freak out” in reference to Governor Kill Joy.

@ pgl

Well sure, that makes “perfect sense” that was what you meant in the general context of your comment on Cuomo. I am glad New Yorkers are so tough and thick-skinned. Saves you the trouble acting like you’re butt-hurt.

What really really frightens me, is that after donald trump got a pass from New York AGs over decades to go on and infect the rest of America with the virus of his winning personality, that Cuomo will have a “hit job” done on him by a NY court system renowned for dragging its feet on political corruption. I’m hopeful for commenter pgl that New York’s patron saint of honesty and moral rectitude isn’t the victim of a “hit job on governors” (this must be snark also?? She’ll let us know)

https://www.nytimes.com/2018/03/13/nyregion/percoco-corruption-bribery-trial-cuomo-guilty.html

https://www.nytimes.com/2018/03/18/nyregion/cuomo-percoco-corruption-albany.html?searchResultPosition=4

I hope I can be forgiven for quoting a different New York “rag” than the more famous one. I didn’t want to be accused of ignoring Upstate New York opinions:

https://www.syracuse.com/opinion/2018/03/ny_gov_cuomo_joseph_percoco_corruption_is_no_aberration_editorial.html

Still, I hope this isn’t some kind of “hit job on governors” (check with me later to verify if the phrase in quotations is snark). One of my biggest fears in life, possibly the only thing that worries me more than one of my older relatives getting COVID-19, is if “hit jobs on governors” are being perpetrated.

Moses,

You can quote me all you want, although you make yourself look like a raving lunatic by quoting the same thing three times within the space of two threads, and I stick with what you have quoted, assuming it is interpreted correctly. What I find annoying is all the accompanying name calling and related insults. After all, you claim I have been “fleecing Virginia tuition payers for years,” but really, Moses, this is just silly. Are you aware that in 2011 I received an award from the State Council of Higher Education in Virginia as an Outstanding Faculty Member? Not many of these are given out.

But, hey, I am sure that they will demand it back if you let them know when all the data comes out that I made an inaccurate prediction about what the US economy would do during the second quarter of this year. I mean, nobody important is making any mistakes forecasting the economy now, although for two months running leading forecasters have been way wrong about what employment growth would be, and I have been the first person who regularly comments on this blog to point out that the economy seems to have been performing better than widely respected forecasters have been doing. No, nobody should take any awards away from all those folks, but if in the end I am off about some of the second qquarter numbers, well, the tuition payers of Virginia must be informed.

One thing I find interesting is that back in the Obama years (remember those) – all I heard from Fox News/GOP was “OMG – the policy uncertainty is going to kill business investment!” – actually the exact opposite was true = Obama WH clearly and consistently stated their policy goals and tried to implement them. You may not have agreed with their policy but you knew what it was. For the past three years I’m unsure of the Trump policy goals/GOP beyond randomly putting tariffs on other countries. Even now – no clearly stated policy on pandemic or economy. The WH just seems to be a re-election campaign promotion – with no policy that I can make out beyond ensuring we know Trump can drink from a glass. It is like a promotion for “Trump’s Revenge – American Carnage – More of the Same” How do businesses invest in such an environment? – Thanks!

Samuel, I can’t give you the more illuminating responses like Professor Chinn can (and there is zero facetiousness in that sentence). But what I would express is that when you hear the people on Fox News, WSJ, and outlets on the far right use the term “policy uncertainty” (which yes, they beat like a dead horse when Clinton and Obama were in office), what it really is, is a “coded language”, a “dog whistle” for the wealthy or a “subtext”. “Political uncertainty” in that context means “policies that hurt the top 1% in personal wealth”.

I have my own personal subjective theory (based on nothing Menzie has directly expressed) that maybe Menzie felt a similar type nausea. loathing, and disgust when right-wing media outlets beat this to death under President Obama, and Menzie has chosen to give them a little dose of their own medicine, when suddenly the term “political uncertainty” has become a “null and void” term on FOX and WSJ, post January 2017.

Dr Chinn, I know you have posted several times on policy uncertainty but I have yet to read much of anything in the business press about it. They are just treating the election as another horse race – who is ahead in the polls! Maybe an article or two about Biden’s policy – but those are treated almost like an afterthought or as juxtaposition with the criminal clown candidate.

https://abcnews.go.com/US/coronavirus-live-updates-texas-hospitals-100-capacity/story?id=71604937

Florida has 200 thousand cases of COVID-19?

But no worries as Trump has declared that 99% of these cases are harmless. Where the heck does Trump get his incessant nonsense? Oh wait – he is reading those comments from Bruce Hall.

Or maybe Florida has between 2 and 4 million cases:

https://www.cnbc.com/2020/04/21/coronavirus-cases-are-likely-10-to-20-times-higher-in-us-than-reported-former-fda-chief-gottlieb-says.html

So when 30 thousand people in Florida die, their stupid governor (he is babbling on the TV right now) will pull a Bruce Hall call this good news as only 1% of them died. Anything to make Trump look good no matter how dishonest the statistics are. Like who gives a damn about granny as she probably would have voted for Biden anyway.

As a bartender would say to Moses and the others pissing at each other. Please take it outside.

dilbert,

Near as I can tell, it is Moses that starts the “pissing.” Some of us do try to defend ourselves somewhat when he starts in on this stuff. Do you recommend that we just ignore it and take it without commenting when he engages in this stuff? As you probably know, I am his favorite target. Do please check; he always starts it. Sometimes I just ignore it, but he seems to be completely losing it, going off the deep end with more and more of these unwarranted attacks. Your advice on how to deal with it would be most welcome, dilbert.

While I was on a self-imposed hiatus from the comment section of this blog, which I wanna say was about 5 weeks (happy to be corrected) there were 3 regular commenters on this blog who were either compared to me or accused of being me by the great narcissist Barkley Junior. NONE of whom, were people we have sometimes referred to as “the usual suspects” but commenters of a different vein. Their crime?? Disagreeing with….. Barkley Junior.

Draw your own conclusions.

There was exactly one, Moses, macroduck, who attempted briefly to channel you after I poked at him kind of hard. He fell on his face, rather resembling you in that regard, and retreated to the sideline for such activities.

I note that I think what set him off was me referring to a comment he made as “silly.” His comment was in fact factually incorrect, but “silly” may have been too mean. But he came on gangbusters with a whole slew of namecalling with several posts and various claims. But all his factual claims in these posts ended up being shown to be incorrect. He then returned to his usual generally well-informed and reasonable commentary, but, presumably, Moses, you do have at least one mostly silent ally in him with your various personal attacks. He at least was responding to me calling something he said “silly.” You just come out of nowhere with your attacks, even when I have been agreeing with things you have been saying, as you have done just now. Heck, even when you noted we were in agreement, you could not resist adding uncalled-for name calling to that commentary. Everybody here can see that, maybe even macroduck, although I have no wish to put him on the spot at all.

I know this data is regional, but I still think it’s an interesting little look at the data, and seemingly one of the more recent surveys:

https://www.philadelphiafed.org/research-and-data/regional-economy/nonmanufacturing-business-outlook-survey/2020/nbos0620

To me, this spells very low inflation for as far as the eye can see. And to many peeps, that’s not an especially deep observation. And it’s not deep, but I have seen at least two analysts on FT recently push the “inflation could be around the corner” alarm bell. And I thought to myself “How could FT run a story on inflation when there is near zero chance of that happening!?!?!?!?” Then I thought of Menzie’s dead on target perspective that often those selling inflation are often trying to sell gold etc. And I also thought that “FT” is not above carrying TBTF banks’ water bucket around, and carrying large insurance companies’ water bucket around for the right amount of advertising revenue given to their publication/website. So, “FT” certainly would not be above selling a firm’s gold etc. in the false front of “warning our readers on the fat tail risk of inflation”.

Update on the vaccine situation:

https://www.nytimes.com/interactive/2020/science/coronavirus-vaccine-tracker.html?smtyp=cur&smid=fb-nytupshot

If you go down to the very last link in the article it will take you to that journal article that I think they are saying has yet to be published (or one very similar). I have problems with paywalls on this sometimes, but this one will even allow you to download the ENTIRE journal, which has some other interesting stuff, some COVID-19 some not. So grab it if you like free stuff:

https://www.nytimes.com/2020/07/04/health/239-experts-with-one-big-claim-the-coronavirus-is-airborne.html

I tend not to believe that it hangs in the air that long, because I think the transmission rates–such as “Rt” or “R-Nought” would have jumped much higher both in the initial stages of transmission (back in late 2019 or whatever) and even clear up to know. If it spread by airborne particles “hanging in the air” that long, I think “Rt’ would easily have gone above 3.0 in many places, and even now in the “superspreader” events—such as inside the BOK Center in Tulsa for example.

*excuse me, “clear up to now” I should have typed.

This obsession on the part of the academics is just plain stupid! I’ve addressed this in my newsletter already: https://agoldhammer.com/covid_19/ (and it’s free; just drop me an email if yo want to receive it daily). Of course transmission is airborne. What is not known is what the true infectious dose is and how much are in micro-droplets. Plain common sense tells you that: enclosed spaces with poor ventilation present a risk. Avoid such places, but if you must enter, wear a mask and keep the visit as brief as possible!

As I often note, much of COVID-19 knowledge is subject tot he Rumsfeld Paradigm: https://en.wikipedia.org/wiki/There_are_known_knowns

@ Mr. Goldhammer

It appears we agree on this, which makes me happy because I very much respect your views on this topic. My opinion was based on a much smaller knowledge base than your own, still I just felt when you look at the transmission rates, it didn’t seem to add up, in a “back of the envelope” or mental shorthand math kind of way. For the record, I think the surface contaminant thing is slightly overdone as well. That’s not saying people shouldn’t wash their hands regular (the reality is people should ALWAYS do this, but 3/4 of white trash America thinks that running their hands under tap-water for 2 seconds without soap makes them civilized), but this thing where “Supermarket X” has to close 12 hours for surface contaminant wipe-downs doesn’t make a lot of sense to me. In the end, the 12 hour store closures don’t hurt anyone, so I don’t think it’s worth yelling about—but I also don’t think it’s really helping in the containment dept.

“I tend not to believe that it hangs in the air that long, because I think the transmission rates–such as “Rt” or “R-Nought” would have jumped much higher both in the initial stages of transmission (back in late 2019 or whatever) and even clear up to know. If it spread by airborne particles “hanging in the air” that long, I think “Rt’ would easily have gone above 3.0 in many places, and even now in the “superspreader” events—such as inside the BOK Center in Tulsa for example.”

That is an argument that works with wrong assumptions. In some studies it was clearly demonstrated that small particles, which can easily form an aerosol, carry the visrus. However, these small paticles are known to lose water and the virus is very sensitive to this. A better statement is that for small particle it has not been shown that they are infectious after some time.