I keep on getting missives from the IIMR. Here’s today’s, from a Tim Congdon:

In May the annual increase in M3 broad money in the United States of America was 25.5%, the highest figure in modern peacetime history. (My source here is the research company, Shadow Government Statistics (www.shadowstats.com, to whom I express thanks.)

What’s the concern? In an earlier article, Congdon worries about inflation:

I am very worried about a sequel in which annual inflation takes off into the double digits, at

least in the USA.

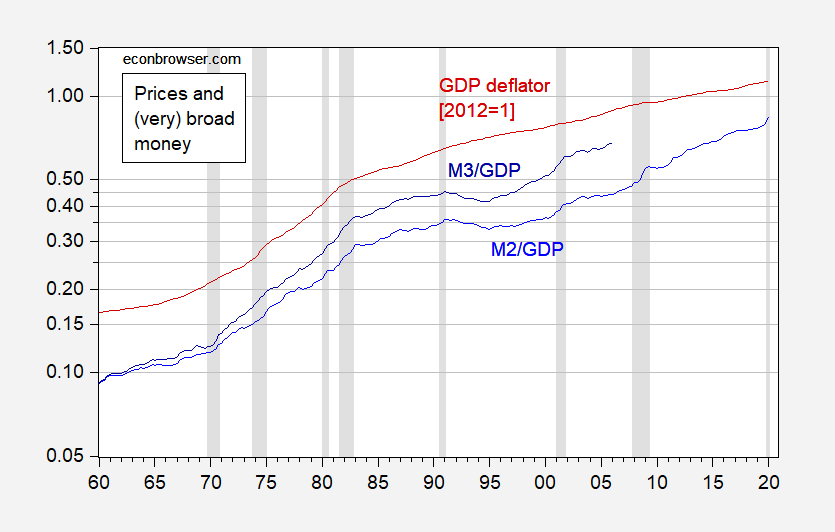

Well, what does M3 look like vs. the price level (I use Fed data through 2006Q1, and show M2 until 2020Q2; for concerns about Shadow Government Statistics as a data source, see Jim’s post)?

Figure 1: End of quarter M3 to real GDP ratio (dark blue), end of quarter M2 to real GDP (light thin blue), and GDP deflator, 2012=1 (red), both on log scales. Q2 observation based on 6/22 M2. NBER defined recession dates shaded gray. Source: Fed, BEA, NBER and author’s calculations. [note: OECD’s M3 measure shown in a previous version is identical to Fed’s M2 measure.]

It’s hard to see the correlation, except in the very long run, between the price level and the money-income ratio (implied by the quantity theory with velocity constant). In fact, application of the Johansen multivariate cointegration tests, with a variety of assumptions regarding trends, fails to reject the null hypothesis of zero cointegrating vectors in favor of one.

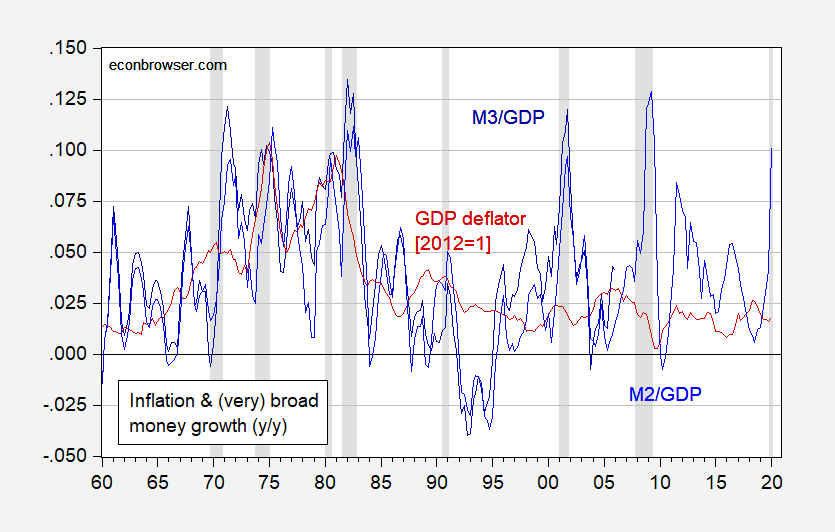

What about growth rates (which could exhibit a relationship if velocity were time varying)? Here’s the corresponding graph, using y/y growth rates (in logs).

Figure 2: 4 quarter log difference of M3 to real GDP ratio (blue), M2 to real GDP (light thin blue), and GDP deflator (red). Q2 observation based on 6/22 M2. NBER defined recession dates shaded gray. Source: Fed, BEA, NBER and author’s calculations. [note: OECD’s M3 measure shown in a previous version is identical to Fed’s M2 measure.]

There is a positive correlation, with adjusted R-squared of 0.13 0.27. That being said, it’s hard to know what direction the causation goes… so count me not yet worried about hyperinflation.

Update, 7/7 noon Pacific: Debate over inflation in Deutsche Bank’s current issue of Konzept, between Oliver Harvey vs. Robin Winkler and George Saravelos here.

It is funny how holdover monetarists keep changing which measure of M they focus on. Back in the 50s-70s Uncle Miltie and his allies focused on M1, and there were some periods when the empirical relation looked pretty strong. But then it became easier to move depoists around from checking to saving and M1 stopped working as well, and the focus shifted to M2. And then somewhere in the mid-80s M2 stopped workibg so well, and even Friedman abandoned strict monetaoris prior to hs death. But now we have M3, oh ever broader than ever. But it looks like it does not work all that well either. Oh well.

He does realize that is going to crash down like a plane swooning this summer???? Just a dumb dumb analytical take.

I have it on good authority Mike Woodford is the “go to guy” on this topic:

https://www.nber.org/papers/w7853

A little bird whispered this into my ear in Hebrew. I’ll never tell.

This was also discussed on page 174 of Krugman’s “Peddling Prosperity”.

Didn’t we go through this just over a decade ago? I guess this dude picked M3 because FRED publishes a series on M2 velocity which fell considerably when M2 was increased back then. Yea I remember the hyperinflation of 2009 not.

30-year Breakeven Inflation Rate (T30YIEM)

https://fred.stlouisfed.org/series/T30YIEM

Let see what the market is saying using a very long run measure of expected inflation. 1.55% per annum! OMG hyperinflation!

“In May the annual increase in M3 broad money in the United States of America was 25.5%, the highest figure in modern peacetime history. (My source here is the research company, Shadow Government Statistics”.

Why not use FRED. April to April the increase was only 18% but yea monetary growth took off only in the last few months. So maybe. But note M2 growth which FRED reports more currently has seen a 24.5% increase over the last year. Oh wait GDP/M2 has tended to decline when M2 increases rapidly.

This is probably irrelevant to the US, but the confusion over what different sources report as being the M3 series is a reminder that as one goes to broader and broader measures of the money supply, things can get kind of fuzzy. Thus, and this has never been made public and I am not supposed to do so, but it was some time ago and MBS is a creep, so I happen to know that for a period of time some time ago different parts of the Saudi Arabian central bank (SAMA) were using different measures of M3. Really. They had two different series for M3, and they were quite different. I never did find out what was the source of this, and I do no know how long it took them to get that straightened out, but I suspect that they have done so by now.

When the velocity of money become unstable, Friedman gave up on his “k rule” – the notion of controlling nominal growth (thereby controlling inflation) by maintaining steady growth in money supply. I don’t believe he published a formal retraction, but he told the FT in 2003 that “The use of quantity of money as a target has not been a success.”

Friedman’s “Lunch with the FT” interview is apparently gone from the internet, but its footprint can be found in various places, for instance:

http://www.freerepublic.com/focus/f-news/937366/posts

There is an obvious difference between Friedman and people who think like Congdon. Friedman discovered an observable and, for a while, durable relationship in the data and based his thinking on that relationship. Having observed the relationship, Friedman was also able to observe when the relationship no longer held. Congdon operates on received wisdom. In faith-based analysis, change in structure is immaterial.

By the way, Fed thinkers seem mixed on the issue of whether money supply growth creates much risk of inflation. Public comments and meeting minutes show that, until mid-2019, some officials were worried about the risk of inflation. Others were concerned that they had lost the ability to increase inflation to target – echoing Friedman’s recantation.

The Fed seems very much in the business of mitigating financial shocks as a means of addressing its mandates. Money flows into asset prices, not so much into consumer prices. That fact seems lost on inflationistas.

One point on which Fed officials seem in agreement is that fiscal policy ought to be used forcefully to boost economic activity when rates are at the lower bound. To paraphrase, money growth is not very powerful when rates are near zero. If that is the case, then how does money growth induce inflation with rates near zero?

Actually, many of them do. If the Fed targeted asset inflation, it would change things considerably.

Just a random thought meant to encourage discussion. I am wondering what portion of the “disconnect” in the relationship between money supply and the economy, can be attributed to the fact that much of the money that’s being injected into the system is being used to “service” public and private debt?? I’m not saying it’s a dominant factor, but I have a suspicion that it’s a larger portion than many people might imagine, and I’m wondering if anyone out there is up to humoring this line of thought?? Again, I would phrase it as a “lesser factor”, but at the same time, larger than most people would “peg” it. If anyone would like to humor this thought or shoot it down as garbage, I would like to hear their thoughts.

‘When the velocity of money become unstable, Friedman gave up on his “k rule”’

For those of us who read some of the truly brilliant writing of Milton Friedman the fact that he would also subscribe at times to dumb monetarist rules of thumb when discussing economics with certain lay people always struck me as a mystery. Yea I get one has to deal with dumb people from time to time but please. Then again one really has to dumb down everything for the current President of the United States.

As I noted in my first comment above, for all its simplicity and arguably simple-mindedness, back in the 50s and 60s and even into the 70s Friedman’s simple M1 monetarism did pretty well at correlating well with the price level, as the quantity theory predicts when velocity remains stable. There was a huge literature on empirical studies back then debating whether V or the mpc or other crucial variables were more stable than which.

As it is, basically after Volcker really ran a monetarist policy during 70-82, it broke down badly around the mid-80s, and policy has been oriented to targeting interest rates ever since. Heck, the Volcker period was the main one when Friedman’s policy got a strong test in the US, although Friedman and other monetarists complained at the time that the Fed was not really doing it right. But in fact policy during the 50s and 60s was mostly focused on managing interest rates, even as Friedman ans his allies argued they should have been focusing on managing M1. As it was, probably the strongest arguments for monetarism came from those like Karl Brunner who liked to point to West Germany and Switzwerlans where supposedly the central banks followed strict monetarist policies and had reasonably solid GDP growth combined with low inflation.

But all of this has long since gone out the window.

Don’t forget that MZM had its day in the sun too.

Oooops! Volcker’s monetarist policy ran from 79-82, not from 70-82. But probably most of you knew that already.

Donald is likely learning disabled, as Mary Trump explains. I think many of his base supporters are LD also, which explains why they identify with him so strongly.

In fact, as I travel around the internet, learning disabilities seem to be very common. I am not being sarcastic. I would love to see studies of K-12 teachers’ perceptions of the extent of learning disability in the general population. Dyslexia is likely very widespread and untreated.

There have been inflation freaks screaming since 2008 and the bailouts. Every day we have been told inflation is lurking, we need to do something about it before it gets here. Hogwash. You show me an inflation problem, and then lets fix it. Not before it happens. Anybody who warns you to change course because of inflation risk has an agenda that is simply not working in todays environment.

Apparently trump could not even get into college without paying somebody to take his sat’s for him. When your own family calls him a sociopath, its gotta be bad. No wonder rick stryker worships the ground trump walks on. Based on the fraud conducted by trump while stealing his inheritance, his taxes should most definitely be made public.

This has nothing to do with this thread, but as the most recent one this is a clean spot and moment to say this.

So I have been taking seriously the comment by dilbert dogbert that the feuding between me and Moses Herzog resembles a bad bar fight that “should be taken outside,” as well the remark by Willie that he does not read much of what Moses writes, as well as knowing that both Menzie and Jim would prefer to have more civilized discussion here.

So, as it is not possible to “take the fight outside,” I am going to seriously make an effort to simply withdraw from it. I know I have made such promises in the past and failed, but I am going to try again. Clearly Moses is off his rocker in repeatedly posting the same quotes from me and attacks on me while never admitting for one second that he has been caught being wildly wrong on various things. My efforts to either defend myself or point out his errors simply seem to encourage him to more of the same. So I shall try simply not to respond to any more of his personal attacks, although I shall continue to make what I hope are reasonable comments on factual aspects of some of his posts.

Please wish me luck and stay well, you all.

It appears my attempts to turn this blog into a salon for my long-distance learning class on Gender Studies related to current events in the news has failed.

[ Even though I imagine to myself Menzie groaning and mumbling at his computer monitor, accompanied with slight intestinal pains, wondering how he has put up with me for so long, I enjoy this little joke ]

For the record Menzie, I do like the woman. It’s just she keeps making really bad errors in judgement. Not going to authorities in such situations falls under the category of bad judgement. She’s smart and at root a good person. You know, she’s kind of like “your sister” who keeps going out with bad guys, and you can’t figure out why she keeps going out with those same bad guys, that’s all.

The proper American spelling is “judgment.” Adding an e between the d and the g is strictly a British convention.

proper american spelling???

When you yanks learn english we might take notice!

Can I add monetarism had its day when banking was heavily regulated. It was hopeless after that for reasons Barkley elucidates.

NT,

Arguably American English is a separate language, or at least dialect. You Ozzies and Kiwis, not to mention the ever-exciting Canadians, do use the Queen’s English. rather than the American variety.

the ever-exciting Canadians, do use the Queen’s English

I believe the Canadian spelling is “judgement, eh”.

@ Junior

You didn’t think they called me Moses “International Man of Intrigue” Herzog for nothing, did you??

Inflation has not been over 4% annually during this century. Since 1982, it has exceeded 5% exactly one year. https://fred.stlouisfed.org/graph/?g=gJ4

Meanwhile, the Fed’s balance sheet has increased 10 fold during this century. https://fred.stlouisfed.org/series/WALCL

Inflation has as much relevance to policy as the gold standard.

Paul,

You are overstating this. Yes indeed high income nations have not had noticeable inflation. But in fact there are nations in the world where inflation is now raging, although several years ago they were not. But now we see Venezuela in actual old fashioned borderline hyperinflation. In the last year the folllowing nations had inflation exceeding 30%: Zimbabwe (yes, they are back), Sudan (north), Lebanon (now having a massive econ collapse that may lead to serious problems across the Middle East), Argentina (right, another old story), and, oh, South Sudan.

We are talking about inflation in the usa. The other examples of inflation, such as venezuela, are probably caused more by political dysfunction rather than monetary policy, as we are discussing. Hyperinflation seems to result from political policies, not simply poorly managed monetary policy.

Barkley,

I accept completely that the countries you list have severe inflation problems. The problem with your analysis is that these places are barely countries at all because they have no functional governments. Basically, they are tribal regions that have devolved into political chaos. Thus, their local money has no value at all and they must rely on other currencies, such as the U.S. dollar, for their economies. For example, Venezuela’s dollar economy, i.e., the black market, is likely not ravaged by inflation. Probably the exact opposite is the true state of affairs.

In any event, comparing the U.S. economy to South Sudan is not valid. OTOH, many small economies with their own currencies are not inflationary at all, e.g., Norway, Switzerland, Singapore. The indisputable fact is that the Fed has not hit its 2% inflation target on an annual basis since 2007, and it is very unlikely to hit it this year or next. https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA#0

Paul,

I agree inflation in US does not seem imminent or at all likely, not anytime soon anyway. However, neither Argrentina nor Zimbabwe are in “political chaos” and lacking “functional government.” Heck, even Venezuela has a functional government, if one that runs awful policies. What is a bit worrying is my point that a few years ago, none of these nations was running a noticeable inflation. Even Venezuela had stable prices some years ago. This hyperinflation is a recent phenomenon. So, inflation can reappear even after it appears to have been brought totally under control.

while related, it is important not to mix hyperinflation caused by politics with inflation caused by monetary policies. hyperinflation is the result of a lack of confidence in the government, not simply monetary policies. prior to trump, i would have argued hyperinflation could not occur in the usa. today, my feeling is a bit different. but it would be caused by a collapse in the peoples confidence in the government, and not by fed policy. this would different from inflation as typically discussed by economists. old zimbabwe and current venezuela had hyperinflation, because citizens had no faith in their governments. different causes require different analysis and fixes.

Inflation was pretty much 2%+ since 2015. Not your best effort.

i think you need to look at the graph a little closer rage. you are not correct.

Dear Folks,

Isn’t this just saying that velocity in the U.S. is falling? The COVID-19 crisis has probably made it fall more.

Julian