ADP released its August numbers, showing slow growth.

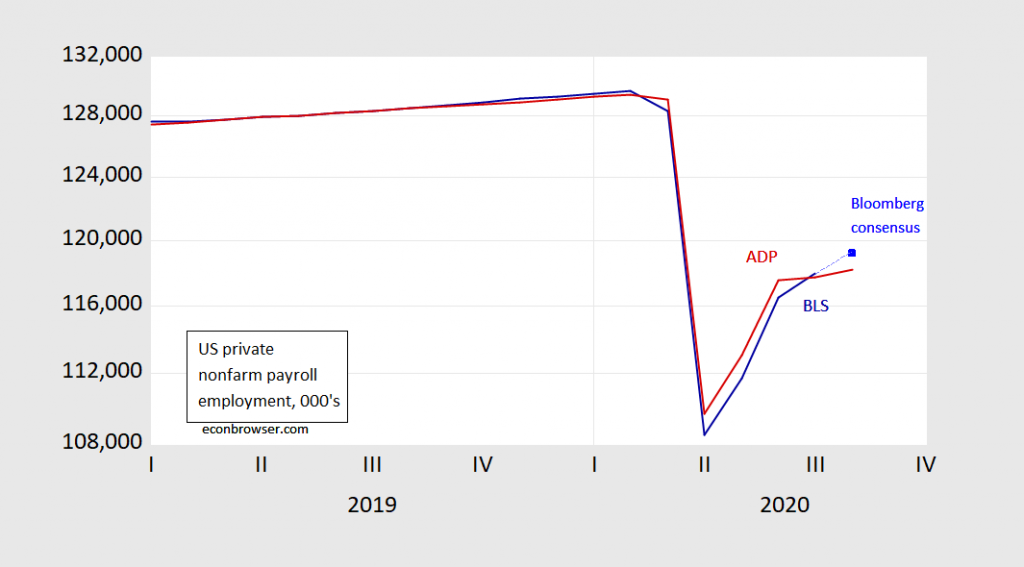

Figure 1: Private nonfarm payroll employment (blue), Bloomberg consensus (light blue square), and ADP private nonfarm payroll employment (red). Source: BLS, ADP via FRED, Bloomberg accessed 9/2/2020, and author’s calculations.

In the past, the ADP release has had only limited predictive power for the BLS number, above and beyond what is contained in the previous month’s number — at least in normal times (see this post).

Both Reuters and Trading Economics say the average of the ADP forecasts was a 950k rise. That 428k number might be another indication to our good friend AS to slide his payrolls number down (unless his original was quite negative to begin with, I forgot what his exact number was). I remember he said it was already set because the rules of the competition.

From Barron’s journalist Lisa Beilfuss

“Lydia Boussour of Oxford Economics expects an increase of 1.4 million, for example, while Diane Swonk of Grant Thornton is looking for a rise of 800,000.

The 2020 Census alone probably added about 295,000 temporary hires to August payrolls, Swonk says. The effect is later than in normal census years, thanks to the pandemic, and Boussour notes that the Census Bureau recently reported 288,000 workers received pay during the August payroll survey week, compared to 50,000 during the July survey week.”

https://www.barrons.com/articles/fridays-jobs-report-is-likely-to-affirm-slowing-recovery-heres-what-to-watch-51599078008?$HeadlineQueryString$=&tesla=y

From a Cornell study linked in the same Barron’s media story:

https://www.jobqualityindex.com

I haven’t read the hardcopy of today’s (I should say Wednesday’s I guess) WSJ. I’l check now though it’s a little late to be making forecasts I guess. First Friday in September went and snuck up on me.

Moses,

My official entry number was negative, but I don’t have confidence in any of my single forecasts this month regarding the change in non farm payroll. Perhaps if I averaged all of the various models I tried, I may come close, which maybe I should have done even though the various forecast evaluation tools seemed to indicate a forecast close to zero as mentioned. Quite frustrating that a model that has been close enough in prior months may be off the mark this month.

@ AS

Don’t beat yourself or the models themselves up too much. The virus makes these times very much the anomaly, and I would have been apt to go more negative myself, so. As long as you remembered to put your census numbers in your computations I don’t see what more you could have done (the teachers “back to school” may also throw things off?? Barrons link also touches on that). Just file this one away in the memory banks, because sometime in your lifetime another “pandemic” is apt to happen again (what was the time gap between SARS/”bird flu” and COVID-19??) I wager a shorter time frame than imagined. We’re apt to have another pandemic in roughly that same time interval going forward, so you’ll have the advantage of this experience when targeting your numbers then. I’m a little confused, I thought the numbers were coming out today, or is it Friday?? I can never keep it straight if it’s Friday or Thursday, but it must be Friday, aye??

The good news on my stupid confusion is, this gives me a chance to still throw out a number on the nonfarm payrolls aye?? One day before still counts yeah?? sort of?? You have me thinking more, and I ‘m gonna show you how much respect I have for your numbers. Before, I was gonna guess on the low end. Swonk is pretty good at her job, I wish I knew what Bachman’s numbers were on August nonfarm, because I would toss his in there as well. But I was just gonna slide down Bachman’s number a little, and I WAS going to guess a 720,000 rise in nonfarm payrolls. But your forecast, I give you credit for being on the ball, so I’m gonna lower my forecast to 600,000 increase. See how I cheat and use your hard work?? It’s so hard gauging numbers during this time frame. Even people like Diane Swonk would tell you that.

1.371 million, was close to the consensus. You know I’d like to say there’s something there that makes the number more positive than it actually is, but the reality is most economists (rightfullly) had the Census numbers tacked on. It’s those damned professional economists gain!!!! They actually know what they’re doing. It’s nuts. Dadgammit blasted numberlovers.

Just see if you can tabulate what the numbers were, and what made the difference in your numbers and theirs, and swing that bat again. I was only 7 hundred and seventy thousand off. I’m thinking BLS has to have some more minutia on the numbers posted somewhere. I’ll read tomorrow’s WSJ and see if there’s anything to be gleaned.

Moses,

Interesting that the Econoday Consensus range of change in non farm payroll was: 435,000 to 2,000,000. It would be very interesting to see what some of the models are, but I guess they must all be proprietary.

https://us.econoday.com/byweek.asp?cust=us

I think my personal range of change was about -600,000 to 2,000,000.

Maybe I should throw-out the high and the low forecasts and average what remains. I have a difficult time finding a non farm payroll model that is consistently accurate from one month to the next.

“Only” was a joke there, in case that wasn’t picked up on. My beer-belly degenerate guess for non-farm payrolls was way off. I’m blaming Michael Jordan’s shoes for this error. And I don’t even know what that means. I did get 2nd quarter GDP right. I got the timing of the recession relatively close (if giving yourself a wide margin for error counts, I did say before July 31). That means I’m batting .667 still and am better than Ted Williams. That’s my story—and I’m not wavering on that.

@ AS

Maybe I am the last person who should discuss this as my 600k rise was also way off. But, you have heard Menzie occasionally say something like “this model includes no judgement” or “this number includes no judgement” I think meaning you’re very strictly going by numbers crunched, But I think even professional economists kind of “reserve the right” to kind of adjust the weight of the fruit by leaning their elbow on the platform of the digital weight reader. You know?? You can also kind of try to find a “mean” or “median” forecast. I know that feeling of wanting to find that “magic bullet” in getting numbers. But no one has found it yet, unless I suppose of you want to include DSGE models, but I don’t think they’ve even found the “magic elixir” there with DSGE yet. I think you can use some anecdotal. Read your Bloomberg articles, as many free ones as you can get–or pay if you have the pocket change, WSJ also. If you find just one article like this one I will link to, just one of these articles each day you can sometimes get a “feel” for what the numbers might be, or some ideas in your head when your preferred forecasting model of choice gives you a negative number and the consensus is a 1.4 million rise.

https://www.wsj.com/articles/retail-stores-add-jobs-as-shoppers-return-11599244193

That graph in that article is super good. I advise you to take a good long look at that, like the type of look you might take if you were deciding between two expensive sports cars. And read that commentary on the graphs in the story. Notice how certain sectors will rebound faster than others. And notice how they’re still talking about the unemployment aid from Congress. That unemployment aid, however it ends up being done is going to be hard to put in your model, along with how quickly sector X, sector Y, and sector Z rebound. You can kind of use your own personal judgement on how much weight from your elbow leaning on that fruit scale (forecast model), after you get your read out from the digital fruit weight scale (forecast model) based on your personal judgement on those factors.

Sometimes even just leaning in on one single “expert” (Diane Swonk, Bachman of Deloitte) that you personally respect and just averaging the difference can get you a much better number, I don’t know what Bachman’s number was, but I bet it was very close if he gave one, and averaging Swonk’s with your own at the very least would have improved your final number.

@ AS

“Calculated Risk” of Bill McBride fame (I’m guessing you already know) is also a good website to try and “get a feel” for what numbers might be before they come out. Again, a lot of economists will tell you that’s kind of a “garbage” way to do things, but I think if you just use it to “calibrate” whatever number you’re getting out of your model, it’s not going to hurt your final estimates. Right now it says the next big number is going to be CPI. I’m guessing it’s going to show next to zero on inflation. If it bumps then I assume the next debate would be was it a demand bump in prices or was it dictated by supply shortages?? And on and on. But I think very soon we’re going to see evictions rise and some other negative stuff. So, it’s so much info to take in right now. If you’re someone like Menzie, aside from the human suffering, which I am certain bothers Menzie on some levels, it’s gotta be like walking around in the candy store. No shortage of classroom examples in 2020.

Weird…… I don’t see a lot of discussion about payrolls in the Tuesday edition of WSJ. Maybe they figure regular subscribers get enough data on the WSJ Surveys?? They do mention ISM on page 2, which was up to 56 from 54.2 in July. Some economists are taking this as super positive news—but I don’t see it myself. I still remain pretty negative for whatever that’s worth. That story on page 2 also has a nice little graph Menzie might enjoy looking at. Not “earth-shattering” info, but just another little visual data point to look at.

BTW, on the same page it says Sensitive Stevie Mnuchin is starting to s***[edited MDC] his pants on getting relief funds from Congress. Don’t you love comedy central on an early Thursday morning??

In other news I got all 5 DVDs of the entire 5 film Rambo series, including “First Blood” and “Last Blood for $19.95. If you exclude tax that’s $4 per film. Score one for the man with the emotional/social maturity of a 12 year old. WOOP!!!!! WOOP!!!!

Employment grrowth has been much slower than GDP growrth, although I guess we have known that from the numbers, even if this looks like the first graph I have seen of it. Employment generally seems to be a lagging indicator.

This bounceback is much slower than the rate of decline, so much so that I would not call this a “V.” I am not sure what it is, although back before it became clear that GDP was going to look like a V briefly, many of us were forecasting something more like this for GDP, a much slower rate of initial recovery, although there were many labels given for that.

Interesting stuff:

https://www.nytimes.com/2020/09/02/us/politics/trump-biden-russia-election.html?action=click&module=Top%20Stories&pgtype=Homepage

It’s interesting to note (for me anyway) that neither of the two vaccines mentioned is my preferred Oxford-AstraZeneca candidate, which still seems like to me to be the best choice—at the moment.

https://www.nytimes.com/2020/09/02/health/covid-19-vaccine-cdc-plans.html?action=click&auth=login-email&login=email&module=Top%20Stories&pgtype=Homepage

What do the two MAGA vaccine candidates have in terms of an advantage over the Oxford efforts? Glad to hear anyone’s thoughts on that.

Anyone know what “Princeton”Kopits has been up to recently?? Seems like he’s been conspicuously quiet lately……..

https://www.nytimes.com/2020/09/02/technology/peacedata-writer-russian-misinformation.html?action=click&module=Top%20Stories&pgtype=Homepage

“Job cuts announced by U.S.-based employers in August totaled 115,762, 116% higher than the August 2019 total of 53,480, according to a monthly report released Thursday by global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc.

August’s total is 56% lower than the 262,649 job cuts announced in July. It is the highest total in August since 2002, when 118,067 job cuts were announced. So far this year, employers have announced 1,963,458 cuts, 231% higher than the 592,556 cuts tracked in January-August of 2019. Announced job cuts in 2020 have surpassed the previous record annual total of 1,956,876 recorded in 2001.

“The leading sector for job cuts last month was Transportation, as airlines begin to make staffing decisions in the wake of decreased travel and uncertain federal intervention. An increasing number of companies that initially had temporary job cuts or furloughs are now making them permanent,” said Andrew Challenger, Senior Vice President of Challenger, Gray & Christmas, Inc.”

https://www.challengergray.com/press/press-releases/115762-job-cuts-august-highest-number-cuts-tracked-single-year-record

Sebastian

Sebastian,

There is a quirk in tune Challenger data. Some firms don’t announce cut queen they happen. There is often a big adjustment at year-end, which shows up as a one-month drop. Beause of the magnitude of job cuts this year, we may see a shocking number (at first glance) later this year.

Ohhhh, my aching typo. “cut queen” should be “cuts when”.

I bet it’s the spell check, it takes the mistyped Q and runs with it. I mean, part of it is my bad typing, but I mean really, what kind of program takes small errors and makes them worse and makes you sound like you were born in a foreign land. I went into settings and turned it off, it drives me nuts man, everything I type with that on takes 25% longer. Chinn becomes “China”—you know how rude that would make me look, like an intentional typo—spellcheck changes that EVERY time. There’s others that escape me, but you can’t have any fun with the language in that spellcheck, some of the “fixes” are nightmares, makes “queen” look like a beauty,

Donald Trump is soliciting voter fraud among his North Carolina supporters:

https://www.reuters.com/article/us-usa-election-trump-vote/trump-encourages-supporters-to-try-to-vote-twice-sparking-uproar-idUSKBN25U0KK

U.S. President Donald Trump has urged residents in the critical political battleground of North Carolina to try to vote twice in the Nov. 3 election, once by mail and once in person, causing a furor for appearing to urge a potential act of voter fraud. … Voting more than once in an election is illegal and in some states, including North Carolina, it is a felony not only to vote more than once but also to induce another to do so.

Attorney General Jabba the Hut (also known as William Barr) was asked about what Trump did and the little fata$$ said he does not know what the law is in North Carolina. I guess Barr is the dumbest AG ever so let’s help chubby tubby out. Not only is it illegal to vote twice in North Carolina but it is also a crime to solicit voter fraud. Trump therefore committed a felony and should be locked up and prosecuted.

The brazenness of this cabal of Keystone Kops is breathtaking. And the amazing thing is that they will probably get away with it. Who knows, bunker boy may even cling to power somehow.

Keystone Kops or Fletch:

https://www.youtube.com/watch?v=Hjsfs49SRbc

Morning Joe compared Team Trump to this classic movie this morning!

In an important announcement yesterday, Governor Whitmer of Michigan declared that gyms can now open for business.

“In order to open safely, gyms are limited to 25% of their capacity. We know that makes it impossible for gyms to operate profitably and they will certainly fail, but my decision is designed to show that I am pro-business before the November elections. Thanks for letting me provide you with false hope, once again.”