Like I said four years ago. By Trump’s own criterion, the trade war was lost. My view – that was a stupid criterion in any case.

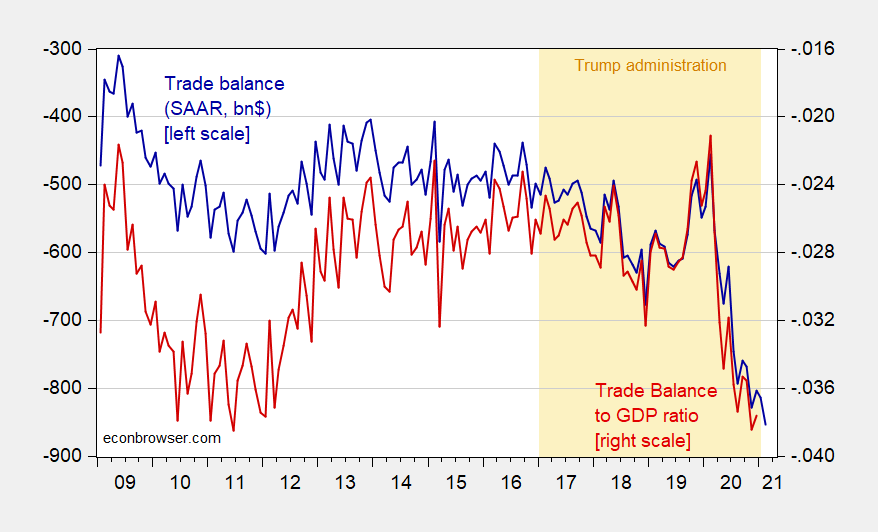

Figure 1: Annualized trade balance (billions $, SAAR) (blue, left scale), and trade balance to (interpolated) GDP ratio (red, right scale). Orange shading denotes Trump administration. Source: BEA, and author’s calculations.

Even if one takes Mr. Trump’s quasi-Marxian view that only goods matter in the trade balance, one finds a similar pattern.

Figure 2: Annualized merchandise trade balance (billions $, SAAR) (blue, left scale), and merchandise trade balance to (interpolated) GDP ratio (red, right scale). Orange shading denotes Trump administration. Source: BEA, and author’s calculations.

I expect further increase in the trade deficit, given the greater fiscal impulse in the US relative to our trading partners, and a still elevated dollar value (relative to 2014).

Hard to argue. Maybe it’s my German blood seeping out, but I will admit the trade deficit aggravates me on some levels (and yes I will admit the goods portion of it gets my attention more the service sector, I’m not saying that’s the best theory-wise, I’m just saying it’s my “natural inclination”. Although maybe that says more about me getting old than my ethnicity). But I don’t think having a trade deficit is a “be all end all” either, and I’ve tried (much against my inherent inclinations) to see it as two sides of a coin as much as I can, and also see the better ways to solve it, if it is to be “solved”. Certainly NOT the way the orange abomination thought it was supposed to be done.

FRED provides series on real exports as well as real imports of goods and services. What jumps out to me is how real exports literally flat lined in 2018 and 2019 while real imports continued to grow pre-pandemic.

Of course imports fell (as did exports) in 2020. Who knew Trump’s plan to reduce imports was to let COVID-19 run wild. MAGA!

https://fred.stlouisfed.org/graph/?g=oyRs

January 15, 2018

Real Exports and Imports of goods & services, 2007-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=D0K4

January 15, 2018

Real Exports and Imports of goods & services, 2007-2020

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=xyDV

January 15, 2018

Real Net Exports, 2007-2020

https://fred.stlouisfed.org/graph/?g=ACju

January 15, 2018

Shares of Gross Domestic Product for Exports and Imports of Goods & Services, 2017-2020

https://fred.stlouisfed.org/graph/?g=D1fW

January 15, 2018

Shares of Gross Domestic Product for Exports and Imports of Goods & Services, 2017-2020

(Indexed to 2017)

The stimulus was in significant part spent on imports, as was the 2018 tax cut. No surprise here. We are stimulating the global economy with our massively increasing debt.

Oh Lord – here he goes again with the claim we are going bankrupt with wasteful spending. Like a family buying clothes with their stimulus check is less important than some bozo in Princeton speculating on oil. What is the matter Steve – Glenn Beck has not invited you on his racist show yet?

The 2018 tax cut??? TCJA became law in 2017 (alas). Didn’t your right wing buddies say it would lead to an investment boom? You need to hang out less with Fox and Friends and people who actually get economics.

In one of your patented long winded pointless stupid and rant pompous rants on how economists have allegedly lost our way (it was really stupid even for you) you tossed out something on the 60% debt/GDP “rule”. I just replied my thoughts on your latest nonsense. But it does seem there was a nice discussion of this weird idea written back in 2010. Maybe you should take the time to read it:

https://voxeu.org/debates/commentaries/there-optimal-debt-gdp-ratio

BTW it does mention Domar’s early papers on this topic which I noted to you earlier. But I’m sure you have no idea who Domar even is.

i too thought that might be the case, Steven, so i checked January retail sales ($579.1 billion) against January goods imports ($221.1 billion); however, about $100K billion of those goods imports were capital goods or industrial supplies and materials, meaning consumer goods, automotives, and food imports were only about 20% of retail sales…so it wasn’t hardly a “significant part [that was] spent on imports”

Fact checking Princeton Steve? You do know that might crash his dishonest consulting business!

The pandemic has brought our attention to lots of new technologies including Venmo. It seems Matt Gaetz sent a total of $900 to 3 very young ladies presumably to help them with their student tuition. What a guy! Oh wait!!!

https://www.thedailybeast.com/gaetz-paid-accused-sex-trafficker-who-then-venmod-teen?ref=home&via=twitter_page

If I recall correctly, you disclosed awhile back that you were a research assistant for Peter Navarro. And while you have been quite critical of Trump’s policies on trade (and I agree with those criticisms) I don’t recall your criticizing Navarro. Wasn’t he a vigorous supporter of those policies? Perhaps the source of the thinking behind them?

Gene Laber:

https://econbrowser.com/archives/2018/06/on-china-applying-19th-century-remedies-to-21st-century-problems

https://econbrowser.com/archives/2017/01/more-on-the-trade-deficit-and-economic-growth

Menzie may have taken more unfair and unjustified hits for this than the inaccurate sucker punches he has had to endure on China bilateral trade with the USA.

Gee I once co-authored a piece on tariffs v. quotas with someone who is both a monetarist and an advocate of balance budgets. I guess our paper on international trade makes me a hypocrite on macroeconomics.

I still remember the day I first heard P. Navarro was going to be a Trump pick. Vaguely aware of PN’s odd ideas I googled his name and it took maybe five minutes to conclude the guy was completely whack-a-doodle. Within ten minutes a sense of dread for America’s future swept over me. @ltr’s above graphs, especially the last one confirm at least some of the terrible premonition. I suppose on the third chart the dead-cat like bounce up would be China preparing for the pandemic. They obviously had a clearer grasp of what was coming and laid in grains. Also I really have to entertain the additional possibility Xi belatedly realized Trump was the best thing that ever happened for his sundry programs to sew division and discord between America and it’s allies. So where could Xi help Trump get reelected such that is was a win-win for China? By funneling money to Trump’s staunchest racist base voters. To little, to late. TTL for conservative older black voters. …

File under “never saw this coming?”:

https://www.washingtonpost.com/health/2021/03/31/navarro-pandemic-supply-contracts-trump/

I have no idea why Rachel Campos-Duffy is smiling like Moaner-Lisa on a rave-drug, but, “I will have what she is having!”:

https://www.youtube.com/watch?v=Mjy1obWgoCU

An interesting aside: since 2015, the US has imported more from Vietnam than it has from Malaysia, Thailand, Singapore, Indonesia, or the Philippines.

One more: on a five-year average basis, the US imported almost exactly the same share of total merchandise from Japan in 1985-89 (20.4%) as it did from China in 2015-19 (20.7%). Japan sourced products comprised 18.3% in 1990-94, and those from China 19.0% in 2010-14.

When suppliers move from one non-US location to another, it does only one thing to the US economy: lower costs. Otherwise, why move?

Vietnam is making apparel. They also buy aluminum from China do a little processing and then sell it to us. Gross values are not the same as value added.

Gross values are exactly the same as jobs lost, to a politician.

And, that’s all that really matters in the arena of trade politics.

WTF? When Vietnam makes smart phones – most of the jobs are Koreans, Taiwanese, Japanese, etc. workers. Vietnam merely does the assembly which requires only a modest number of Vietnamese workers. Please try to follow the conversation.

Census tells us the gross value of the imports from Vietnam:

https://www.census.gov/foreign-trade/statistics/product/enduse/imports/c5520.html

Apparel, shoes, and furniture plus about $10 billion in cell phones. Of course about $9 billion of that is imported components with only $1 billion in Vietnam value added.

The pandemic seems to have scammers arising out of every corner. Some may be a bit clever but the email I just got had to be from a really dumb one. The message was basically “give us your password because we are about to access some sensitive information”.

Yea right. Delete!

My wife lately has been receiving calls on her phone from the “law enforcement arm of the federal reserve” warning of serious violations of federal law. We’re also in deep trouble with the “IRS” and have been since 2015 and should have had our “Social Security” stopped the same year.

We’ve also had dozens of “warrants” issued for our immediate arrests.

My wife usually hangs up quickly. I, on the other hand, prefer “answering” and showering as much profanity as I can on the “federal agent” before he/sometimes she disconnects or returns fire .

I must admit hearing the “agent” mangle profanities in English can be entertaining. I’ve always been easily amused.

The IRS does not call people. So this is clearly a scam. Do not hand out your passwords.

Neither does Social Security or the Federal Reserve. If they did, I would be writing this from Leavenworth. I ran out of “original profanities” on the scam “agents” long ago. We stopped counting when our “IRS” calls numbered over 100.

a side note, a new book is coming out on nancy pelosi. a short excerpt here. pretty interesting if you want to learn a little bit about the background of madam speaker

https://www.usatoday.com/in-depth/news/politics/2021/04/09/bracing-battle-inside-nancy-pelosis-war-donald-trump/7053833002/

its sometimes hard to really appreciate those who break through the glass ceiling in real time…

Now now, baffling, Moses Herzog has made it clear that Nancy Pelosi is not only s—–e, but a corporate shill who eats way too much fancy ice cream. Shame on you for this comment.

Oh, for a substantive comment here, I remind everybody that the US has not run a positive trade surplus for well over 40 years. A chronic trade deficit (and also usually current account deficit) is a price to be paid for having your currency be the dominant world currency. Many around the world regularly whine about how US consumers are exploiting foreign workers by getting their products for nothing essentially because all we give them is promises of future payments that never arrive, although we do make the interest payments.

This situation has become increasingly weird with decades now of the US having a negative net indebtedness position while still maintaining a surplus in the portion of the current account that records capital income payments. Those foreigners are still suckers buying our financial assets that pay doodley-squat while our investors only buy foreign assets that pay high returns, enough so to keep that capital income flow in surplus even as our net indebtedness mounts and mounts and mounts.

Yes the Dark Matter puzzle. Is this foreigners buying low return US government bonds while we get high returns on foreign direct investment, unmeasured increases in the value of US created intangible assets, or evidence of transfer pricing manipulation?

I think this was the most recent post when I brought up Dark Matter:

https://econospeak.blogspot.com/2017/01/disneys-transfer-pricing-and_8.html

Of course I was fretting on some Republican tax deform idea that never made it into law.

So, prior to the 1970s the US dollar was not the dominant world currency?

Perhaps running Reaganesque budget deficits might have something to do with selling massive amounts of T-bills, driving up the capital account, which whittles away at the current account … ? Just a thought.

David,

Prior to the 1970s the USD was even more dominant as the US economy was more dominant. But it was a different system with largely fixes exchange rates among the major currencies after the 1944 Bretton Woods conference. Heck, IMF SDRs exactly equaled the USD, although now they are worth a weighted basket of currencies, the USD still the most important one.

A crucial thing that happened was that through the 1950s the US lead in manufacturing and in general economically after the devastation in other nations during WW II meant that we easily held our own in international trade. So we regularly ran trade and current account surpluses, leading to a problem in other nations of a “dollar shortage.” This changed in the 1960s as Germany, France, and Japan all rebuilt and then newly expanded, becoming competitive in trade and beginning to run trade surpluses with the US, which could not adjust by devaluing due to the fixed exchange rates (with still a nominal link to gold in place). US deficits mounted. This led to the crisis of 1971 and then in 1973 to the full move to floating exchange rates, with the new mechanism in place of people wanting the USD for its international currency use pushing the value of the USD up. It is no surprise the last time the US ran a trade surplus was just a few years after that move to floating exchange rates.

As elsewhere, Menzie can correct me if I have any of this wrong.

As your Intro to the Bretton Woods monetary system (which I first came across as an undergrad in the 1970s) clearly shows, the dollar was in fact the top dog back when the US ran trade surpluses … contrary to your own comment.

Isn’t history fun?

Oh gag. I said that the USD was top dog from the 40s into the 60s. You do not seem to get it. You are not very smart, David.

The mechanism by which the trade deficits become large and chronic involves the USD becoming overvalued from a current account equilibrium perspective due to the demand for it for leading currency uses. But that can only happen when exchange rates are floating so that the high demand for USD leads it to appreciate.

The Bretton Woods system was one mostly of fixed exchange rates, although they could be occasionally adjusted, which periodically happened as the British pound would get devalued periodically. But the USD rate with other major currencies was never adjusted until the system ended in the early 70s, so this deficit-inducing appreciation did not happen.

There was, as I mentioned accurately, a gradual change in the trade balance from essentially chronic trade surplus from the mid-40s into the early 60s as several of the war-damaged economies rebulit and expanded. Mostly this was a problem of these nations: Germany, Japan, and France, developing bilateral surpluses with the US, de Gaulle famously demanding gold transfers in the early 60s, which led to some being moved from one vault to another in the basement of the NY Fed. But overall it was more a matter of the US surplus declining rather than an outright emergence of a deficit, although that did finally come, pushing the US to end the system and let the currencies float.

Do you get it now, or do you want to make some more stupidly “contrary” remarks, David?

I don’t care what David says, I am certain Barkley has forgotten much more about the effects of Bretton Woods than David has ever learned. I’ve really gotten tired of Barkley bemoaning the fact he exchanged all his Roman denarii coins for tulips in his midlife years around the early autumn of 1637. If I was alive back then I could have told Barkley that reality TV futures were the way to go. I also nagged Barkley endlessly to “take the under!!!!” on the Lopez-Rodriguez marriage engagement that Vegas set at 5 years, but he never listens to me.

https://americanindependent.com/mitch-mcconnell-joe-biden-budget-defense-spending-pentagon-deficit/

So McConnell says we are spending too much on infrastructure but we are not spending enough on instruments of war. McConnell is worried about deficits but he adores tax cuts for the rich. But how dare Biden provide tax relief for those who are struggling to make ends meet.

Good to know where McConnell’s priorities lie!

Pages 16 and 52 may provide some more quick color to crafty Mitch’s priority “lie”,

https://oldcc.gov/sites/default/files/resources/Fiscal%20Year%202017%20Defense%20Spending%20by%20State%20Report.pdf

The defense spending is a meaningful amount of the TN state GDP. What I find interesting is how much some of his southern peers in the Congress and Senate, where the congressional members openly toyed with Insurrection on January 6, 2021, also depend on defense spending in their own ways. It pays to keep one’s friends close and one’s enemies even closer I’m told. Why is curious about TN is the large allocation to “Other” spending. Vague. Porky? Perhaps priorities don’t lie as much as reveal where the truth lays?

The charts on page 14 are telling especially the one showing defense spending as a percent of state GDP. The military industrial complex in action.

https://fred.stlouisfed.org/graph/?g=tr30

January 30, 2018

Producer Commodities Price Index, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=zYmJ

January 30, 2018

Producer Commodities Price Index, 2017-2021

(Indexed to 2017)

https://news.cgtn.com/news/2021-04-09/China-s-CPI-up-0-4-pct-in-March-ZjsXW5NwOs/index.html

April 9, 2021

China’s March factory gate prices jump on rising commodity prices

China’s producer price index (PPI), a measure of factory gate prices, jumped 4.4 percent in March due to rising international commodity prices, particularly prices for metals and oil, and ramped-up domestic production and investment, data from the National Bureau of Statistics (NBS) showed on Friday.

March PPI data beats a median forecast of a 3.5 percent rise polled by Reuters economists.

“Unlike previous cycles, this recent rise in PPI inflation was mainly the result of surging global commodity prices, which are mainly being driven by monetary easing and huge fiscal stimulus (especially in the U.S.) outside of China,” Lu Ting, Chief China Economist at Nomura told CGTN.

Affected by an increase in the price of imported iron ore, the price of ferrous metal smelting and rolling processing industry surged a yearly 21.5 percent, NBS data showed.

https://news.cgtn.com/news/2021-04-09/China-s-CPI-up-0-4-pct-in-March-ZjsXW5NwOs/img/574d2e89fc3d47a4974393d9aa096cce/574d2e89fc3d47a4974393d9aa096cce.jpeg

“International crude oil prices continued to rise, driving the increase in domestic oil-related industries,” said Dong Lijuan, a senior statistician with the NBS….

I would love to see a debate between Warren Buffet and Princeton Steve on how much is too much debt. After all – Princeton Steve’s 60% debt/GDP rule is discredited among most economists and makes no sense from a present value analysis of government financing. But this all escapes Princeton Steve so hopefully Mr. Buffet could put this in terms of business economics.

Let’s try this analogy from a review of the financials for Berkshire Hathaway Energy, which generates $20 billion in revenues each year and has debt = $50 billion. OMG a debt/revenue ratio = 250%. Is Princeton Steve selling this enterprise short? I would not and here’s why.

The $50 billion in debt plus the equity placed in this huge enterprise is financing $86 billion in fixed assets, which generates $4.2 billion per year in operating profits. The debt generates only $2 billion in interest expenses, which is because markets are allowing it to borrow at an average interest rate = 4%. So the credit rating for this enterprise is quite good even if its debt/revenue ratio is more than four times Princeton Steve’s magical but stupid 60% “rule”.

Of course Mr. Buffet understands basic financial economics. Princeton Steve does not.

I love it when Princeton Pompous puts his foot in his mouth over and over again as in his exchanges with Menzie where he claimed Menzie did not care about depreciation even though it was supposedly so easy to measure. Never mind estimating economic depreciation is not easy but catch some of the back and forth:

Steven KopitsApril 9, 2021 at 2:21 pm

And who are they? Why not introduce us to the literature. Or maybe you don’t think net vs gross matters?

Menzie fires back with a lot of excellent blog posts he wrote that involved net v. gross. I guess Princeton Pompous did not understand a one of them. Menzie then writes:

‘Experts on capital depreciation: Hulten; Wykoff; Fullerton; Bronwyn Hall; Diewert’

Wait – I knew the late Frank Wykoff who passed away last summer. One of his classics was published in 1980:

Economic Depreciation and the Taxation of Structures in United States Manufacturing Industries: An Empirical Analysis | NBER

by Charles R. Hulten & Frank Wykoff

Princeton Stevie pooh even said depreciation was not that important in the 1970’s. I’m sure Hulten and Wykoff would find such an assertion both incredibly funny and very insulting at the same time.

Until August, 1971, when Pres. Nixon closed our gold window to foreigners trying to redeem dollars for gold, the foreign trade deficit was critically important. As Keynes said, “Never in history was there a method devised of such efficacy for setting each country’s advantage at variance with its neighbours’ as the international gold (or, formerly, silver) standard. For it made domestic prosperity directly dependent on a competitive pursuit of markets and a competitive appetite for the precious metals.”

For the past half century, foreigners have been happy to redeem their dollars for our Treasury bonds, of which we have an unlimited supply. There is no need to ship boatloads of metal around the world and the foreign reserves of most countries are safely invested in U.S. securities. So our trade deficit means essentially nothing now — we have been running trade deficits every year from 1975 while doubling total employment (pre-covid) during that time and reducing unemployment to a 50 year low.

Our standard of living is several orders of magnitude higher than 50 years ago as those of us who lived through that era well know. Even expensive countries such as Norway are affordable for Americans to visit and the U.S.D. is accepted everywhere. IOW, Ross Perot was an idiot and Trump was equally stupid but added racism to the equation.

Fortunately, neither one was able to do too much damage to international trade. We should heed Keynes’ advice: ” an immoderate policy may lead to a senseless international competition for a favourable balance which injures all alike. And finally, a policy of trade restrictions is a treacherous instrument even for the attainment of its ostensible object, since private interest, administrative incompetence and the intrinsic difficulty of the task may divert it into producing results directly opposite to those intended.”

This Nixon shock was not the first time we got off the gold standard. FDR took us off the gold standard during his first term, which was key to recovering from the Great Depression. Nixon of course was listening to Milton Friedman and not the likes of Judy Shelton and Stephen Moore.

Friedman? In 1971, Nixon was quoted as saying he was “now a Keynesian in economics”.

It’s hard to know what Friedman believed since he apparently didn’t know himself in his 1966 letter to Time: “In one sense, we are all Keynesians now; in another, nobody is any longer a Keynesian.”

While FDR did abandon the gold standard in 1933, it was re-established at Bretton Woods for international trade by U.S. Treasury official Harry Dexter White who was the principal advocate. Keynes fought White throughout the conference, but the U.K. position was no match against the U.S. White’s gold standard scheme was obviously flawed, but at that time the U.S. had the gold and therefore it had the rule.

Nixon did not care about economic theory. He only did what was practical regardless of prior agreements. Fortunately, his practical choice turned out to be the right choice: international trade has increased nearly 6000% since then versus 500% before 1971 in the post WWII era.

Trade may have grown since the early 70s, but overall GDP growth in the then-leading economies has been slower since. Most in those nations view the 30 year period after WW II as “the golden age,” with things not so great since, although in many East Asian nations they have grown more rapidly since then. I note the mid-70s also coincides with the moment of greatest income equality in those leading nations, with that reversing and becming more unequal since in nearly all those countries since as documented by Piketty.

Having lived throughout most of the post-WWII era, I can say that my standard of living improved by several orders of magnitude after 1971. For example, before 1971, my parents had to think long and hard before they splurged for a 19″ color TV (no remote) and a used car with A/C. Thanks to foreign trade, those two icons of American consumers have radically improved. Hand held calculators were the iPhones of that time and digital watches were status symbols along with microwaves.

Since 1971, we have been trading theoretical money for real goods from East Asia that have improved our lives dramatically while East Asians have risen out of periodic starvation and destitution. The 3 decades after WWII were hardly a “golden age” for Japan and China compared to post-1971.

Our constant and massive trade deficits since 1975 have been the fuel for global growth and job creation that even Keynes could not imagine, but he did have hope: “International trade would cease to be what it is, namely, a desperate expedient to maintain employment at home by forcing sales on foreign markets and restricting purchases, which, if successful, will merely shift the problem of unemployment to the neighbour which is worsted in the struggle, but a willing and unimpeded exchange of goods and services in conditions of mutual advantage.”