Headline vs. Trimmed vs. Sticky Price:

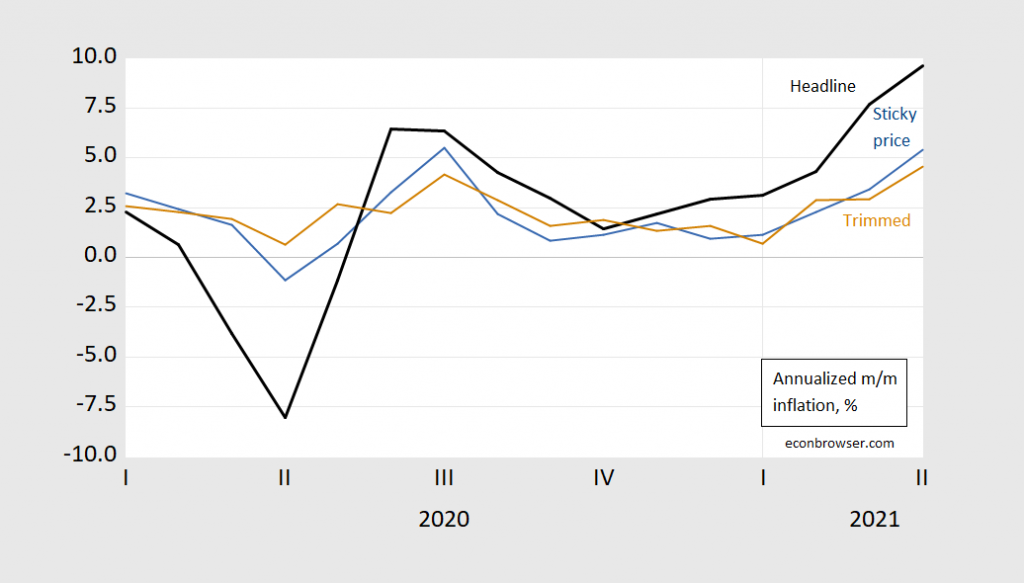

Figure 1: Month-on-month annualized inflation rate for CPI-all (black), 16% trimmed (brown), and sticky price (blue). Source: BLS, Cleveland Fed, and Atlanta Fed via FRED, and author’s calculations.

Update, 5/13 4:30pm Pacific:

Sticky price CPI discussion. Econbrowser post.

Trimmed mean CPI discussion.

You have COVID shutdown related supply interruptions and also flood the economy with money, what did you expect?

What we do have is an economy that can quickly adapt to fixing supply problems. That is on the positive side. And we don’t have an administration that will discourage investment through capital gains tax increases, pay people not to work, or try to implement a Green New Deal. Oh…. wait….

Another comment putting forth the absurd notion that treating capital gains income like other forms of capital income just kills investment. Gee Sammy – where have you been? We missed your hysterical right wing clown shows!

pgl,

It doesn’t kill investment, it reduces it. When you run a pro forma for an investment proposal, you look at after tax returns, not pre tax returns. So when you reduce the return via higher taxes, it makes it less likely that you will invest.

Do you have a shred of credible evidence that a higher capital gains tax reduces investment? Of course not. Otherwise you would have cited it. BTW – an appearance on Fox and Friends by Kudlow the Klown is not credible evidence.

“So when you reduce the return via higher taxes, it makes it less likely that you will invest.”

i am not sure we see evidence that this actually occurs. on the business side, it is very likely the company will reinvest those profits back into the company rather than extract them and pay the tax? actually the opposite of what you are stating.

Sammy is incomplete on the theory and MIA on the evidence.

baffling,

Cap Ex is not an immediate expense for income tax purposes .

sammy, does not change the fact that a higher tax does not keep a business from investing in its future. you are simply incorrect in your assertion.

have you ever declined a promotion because it put you in a higher tax bracket? didn’t think so.

sammy It sounds like you’re confusing the corporate tax rate and the capital gains tax rate. The effect of an increase in the corporate tax rate is ambiguous and depends upon the deductibility of interest, inflation, depreciation, etc., but not necessarily the corporate tax rate itself. As to the capital gains tax, there is nothing in economic theory that says a capital gain must be re-invested in a project with a higher social return. Taking a capital gain and buying Renaissance artwork does nothing to make the economy more productive. And in order to realize a capital gain, the seller has to be able to find a buyer who is foolish enough to overpay for unproductive capital. The entire liquidity argument is a joke.

Which is an argument against treating different kinds of income as anything except income. When capital gains are treated differently from regular income, that’s a distortion caused by tax policy. It leads to inefficient asset allocation. But you knew that, right?

It is. Now if Sammy knew even an ounce of basic financial economics, he would indeed know that. But I have my doubts that any of the Usual Suspects could pass the midterm in Finance 101.

Another observation that puts paid to Sammy’s logic. Stock market returns and especially bond returns are low right now. From my perspective, it appears there’s too much money looking for a safe place to park, and not enough money actually attempting to do anything useful. Low returns don’t seem to be deterring cowardly money from the stock and bond markets. Higher returns, before or after tax either one, don’t seem to be drawing cowardly money to investment. Why do you suppose that might be?

Mian and Sufi have expanded their thesis regarding the centrality of household debt to economic cycles: https://scholar.google.com/scholar?q=mian+sufi+indebted+demand&hl=en&as_sdt=0&as_vis=1&oi=scholart#d=gs_qabs&u=%23p%3D6D-lYLD4IlkJ

One new element is that high income inequality leads to increased household debt. High earners are not normally entrepreneurs and so put their saving into financial investment instead of productive capital.

There may be an additional wedge between returns demanded from financial investment and real investment, beyond that created by easy diversification of financial risk, as a result of income disparity.

And Strain. I always forget Straub.

Willie,

Stock market returns…are low right now? Really? Looks like it keeps hitting all times records. Tramp said it would collapse if he lost the election, So, I just checked on the Dow Jones and the S%P 500 since Nov. 3, 2020 when Biden was was elected. Neither has remoteliy collapsed.

For the DJIA, on 11/3/20 it was 26,635. Today it ended near 34,382, a 27 percent rate of increase in half a year (I leave it to people much smarter than I am to figure out what that translates to as SAAR, but it is a lot more than 27%).

As for the more important S%P, it is about the same. on Election Day it was 3310 and now is about 4174, oh, only a 26 percent over a half year. Gosh, one can make more with Dogecoin!!!! What pathetic returns. Obviously Tramp’s forecast of a complete collapse was completely correct.

@ Barkley Junior

Look on the BEA site or in some good economics texts, it’ll tell you.how to do SAAR Junior (although that’s usually not done too much on equities returns that I know of). Menzie’s students probably even know. It’s a good way to avoid embarrassment when criticizing the Fed, regional Fed banks, CBO, and paid investment professionals on their GDP forecast numbers being “wrong”. Egg on your face and such. You can do it, I have faith in you Junior.

Surrey, bet eat ist hapless, Moses. Nut owny Eye nut spill coorechtly, Eye doo nut no howe two reed. know whey Eye kin doo imme off thus.

Saab!

Well, if the increase stops dead there, then on Nov. 3, 2021 the raw annual rate of increase of both would be less. However, if the increase continues similarly, then on Nov. 3, 2021 the raw annual rate of increase would be much higher for both.

However, given that BEA applies particular cutoff dates for its estimates, none of which coincide with Nov. 3, undoubtedly any official SAAR estimates would be different than those raw estimates. Bet ass Eye aim innabel two reed, Eye kin note phigyour et ought.

Willie,

If by stock market returns you mean yield, then you are quite right:

https://www.quandl.com/data/MULTPL/SP500_DIV_YIELD_MONTH-S-P-500-Dividend-Yield-by-Month

Total return has lately been above average, but not extraordinary.

https://www.sciencedirect.com/science/article/abs/pii/016517659290225N

I get the fact that Sammy has allergies when he reads real economics but this paper is now 29 years old, is only 4 pages, and uses basic finance. But yea – Sammy prefers to listen to Fox and Friends:

Does reducing the capital gains tax rate raise or lower investment?

The effect of taxation of capital gains on the decision to purchase a risky asset is explored within a theoretical framework similar to that of the capital asset pricing model. Tax rate reductions have two offsetting effects. One is to raise the after-tax expected return while the other is to increase the amount of risk borne by private agents. Conditions for determining which effect dominates are derived.

“When you run a pro forma for an investment proposal, you look at after tax returns,”

People who actually get financial economics will also note your look at systematic risk on an after-tax return basis, which this paper does. But not Sammy as he learned his economics watching Glenn Beck and Sean Hannity.

Sammy, I’m amazed at the willful deceit and cognitive dissonance exhibited by liberals, especially economists. With production components, commodities’ prices, rising by YUGE fractional amounts, these same folks can not admit their inflationary impacts. Worse, they won’t and can not admit their future inflationary impacts. POLICY, POLICIES impact economics! Energy and other commodity production policies especially so.

Downplaying the headline numbers is cognitive dissonance. Why do they need this? After decades and especially the past 4 year attacks on conservative economic polices, they can not admit there is such a dramatic difference in REDUCED performance. We are just seeing the start of this building inflation bubble. We will see more and more longer/lengthy comparisons to camouflage and lower the inflation differences, but they will fail to forestall their coming defeat in the midterm election.

So much word salad, so little time. At least you did not even try to defend Sammy’s cap gains nonsense.

Aaaaaaawwwww, a fresh new member of the John “Grumpy Economist” Cuckrant Fan Club. Good times……..

https://www.youtube.com/watch?v=HW__RbdScPM

CoRev gets angry when he sees American soybean farmers making more money under a Democrat President. CoRev cries every night looking at the soybean futures that he shorted:

https://quotes.ino.com/charting/?s=CBOT_ZS.K21

CoRev Since when are you competent to discuss economics? In the past you’ve prided yourself on your refusal to even read basic econ textbooks. The current rise in prices is due to two main factors. The first is just a mechanical effect due to the sharp plunge in prices a year ago. The second effect is a transient supply shock as the economy adjusts to imbalances due to the pandemic. Both of these effects were well understood and expected. That’s why the bond markets had a “meh” reaction. As to an impending “inflation bubble,” you’ve been predicting that for decades. You’re still living in the disco era. Time to put away the leisure suits, ditch the gold chains and roll-up that shag carpet. Then sit down and try to construct a plausible scenario in which inflation becomes a persistent problem. Hint: there’s this entity called the Fed.

2slug,

CoRev learned his econ while doing spaceballs for the Apollo program. Don’t you remember?

“…4 year attacks on conservative economic policies….” Really, CR?

Which “conservative economic” policies are you referencing? Tax cuts always pay for themselves? Reducing deficits? Free trade? Billions in additional subsidies?

You supported a guy who proudly referred to himself as the “King of Debt”. Same guy who once suggested stiffing holders of U.S. notes and bonds by redeeming them at less than full value.

Are these the some of the “conservative principles “ you’re espousing?

Nonsense. You don’t know, and can’t know, the future effect of policy on economic performance. And while “one can’t know” would also be true, I mean you, CoRev, can’t know. Lower tax rates have not reliability led to faster growth since the days of Reagan, as your team has promised, based on claims that tax cuts must lead to faster growth. Extraordinary monetary largess has not reliability led to inflation since 2000, contrary to what you claim to be inevitable.

Your accusation, which oddly conflates liberals with economists (somewhat to the surprise of Mssrs. Mankiw, Taylor, Cochrane,…) relies on your non-existent ability to see into the future. You cannot honestly accuse liberals of cognitive dissonance I you cannot honestly claim certainty that inflation will become unacceptably high.

Policies, in all caps or otherwise, do affect economic outcomes, but not in ways that you (and I mean you, CoRev) can readily predict.

Sooo, you’re just making noise to cover for sammy?

CoRev,

Well, welcome back. I personally find this odd reappearance after quite a long time as a bit weird, given that I very recently here mocked both you and Moses Herzog for your past worthless claims of special knowledge of rocket science and related mathematics, Uncle Mose not too long ago declaring I was lying when I said I personally knew the late Walter Rudin, author of “baby Rudin,” the “bible” of econ grad students for studying real analysis. He was humiliated on that.

So I mocked the two of you when I mentioned reading a book by my late father, regarding whom you and I have had debates and you also made a complete fool of yourself, that contains the really hard core serious math of rocket science. When I mentioned this before I did not mention that its publication was long delayed because its contents were classified, and it is far beyond the real analysis or the late Walter Rudin. I brought it up in connection with ltr’s unfortunate claims about supposed Chinese government control of the return to earth of its space object, which I noted based on recently reading my late father’s books was a lie.

So, I snottily noticed that you and Moses would not like my comment. Mose has at least had the sense on this matter to lay low, and I recognize that you have not commented on it here. But in fact your post here, after all this time, is just gibberish, not even worth comment. So I just dump on you for old nonsense you spouted in the past on the US space program. There at least you sort of occasionally made accurate observations. This comment is not even as reasonable as gibberish would be.

Barkley, poor Barkley, you have yet to show any actual knowledge about rocket science and particularly tracking of space vehiles. Had you ever used related space tracking terms such as , suborbital, orbital, lunar, deep space, orbit insertion and re-entry, and/or C-Band and X-Band radar then an argument framework might have been established. Since, they were never used, but you insisted that your father discovered and saved the APOLLO Program due to his finding that the space craft’s and other clocks were not synchronized causing a TIME SHIFT and orbital (calculation) differences.

Your assignment of importance has been poppycock since your 1st pronouncement, and just indicated your lack of knowledge. Failure to discuss the actual space missions your father’s findings impacted is a critical factor for supporting your claim of importance.

CoRev,

Oh, does this mean you agree with ltr’s posts about how the Chinese were completely controlling the exact reentry to earth of their space vehicle? Perhaps you can explain to us how they did that, please, if you do agree with her posts on this matter.

@ Junior

I never claimed anything related to your nonsense on Walter Rudin. And Menzie wonders why I call you senile and in early dementia. That’s a factual lie. I’d ask for an apology for that lie, but I know you don’t do apologies. I don’t doubt you met the man. What I doubt is you “personally knew” Walter Rudin. You say you “personally know” academics all the time here, who you probably only passed in the hallway at one time or another. Everyone here with any perception at all knows you don’t “personally know” some of these folks. Just coming across them at work, or your father asking you to shake their hand, does not mean you “personally know” them. “Personally know” implies at least mild friendship. Of which, again I very much doubt you were with Walter Rudin. Why don’t you tell us, please share with us, all these “personal stories” of how you either co-wrote a paper with Walter Rudin, or even “broke bread” with him. I tell you what, I think I’d even settle for all the times you ate at the UW-Madison cafeteria with him, just to show how full of cr*p you are. Did your father write a paper with Rudin?? ONE SINGLE paper?? WOW you are desperate for significance. Why not let your own academic work stand on its own???

I might add here, I’ve never argued these funny stories about “saving the Apollo space mission” from Barkley. I thought it was self-evident enough to ALL reading the claim, to avoid raining on the man’s little dream land. I’ll just say this, if there was a cure for baldness, do you think they could keep that product on store shelves?? If the cure for male baldness actually existed how long would that stay on the shelves at Wal Mart etc before selling out from word of mouth alone?? You wouldn’t even have to run a TV advertisement on that. Now ask yourself how easy ANY story about saving a space mission would sell in magazines, newspapers, and books. Do a Key word search on the man’s name with Apollo space mission and watch the hits you get. Just try it out as a lark. PLEASE do it.

“and it was my late father who was responsible for that matter getting fixed, which is the entirety of what I claimed (along with noting that indeed without that being fixed people going to the moon in Apollo would have gone into deep space, although you have very stupidly claimed that not fixing this problem, which you also have claimed never needed to be fixed, would not have destroyed the Apollo program). You have simply revealed once again that you have been lying about this and do not know what you are talking about regarding the space program, even if somehow you actually did get an award or two somehow in connection with it.”

https://econbrowser.com/archives/2019/06/how-well-have-predictions-of-trade-war-victory-done-soybean-edition#comment-227130

Folks, I have shocking news to tell you…….. The Apollo program would have continued, even presuming the error would not have been found by ANOTHER mathematician (as it most likely would have been found) before the launch. They may have given the following mission program another name, but for all intents and purposes, it just would have been a continuation of the American space program, no matter what silly name they wanted to attach to it.

Directed to all: Seriously, people sharing their personal experiences — who they have met, what they have written, what businesses they had — is something a commenting facility on a blog is supposed to enable. Such exchanges can sometimes enrich the discussion. People should not be criticized for sharing experiences unless they themselves feel their own experiences should not be shared.

Moses,

I am sure you are right that if my late father had not caught that timing error in the Apollo mission somebody else probably would have figured it out in time to avoid having US astronauts fly off into deep space.

My late father did not write a paper with either Walter or his estimable wife, Mary. I did once have a conversation with Walter about complex analysis and economic theory in my parent’s basement. It was about how this varied from real analysis of Lebesgue meausres of genericity of dynamic general economic equilibria. He said there was not much difference except for some unusual cases from the real analysis of this matter. My late mother used to have Mary to tea quite often.

Oh, to CoRev, of course I have absolutely no idea about any of those things you brought up, pitiful Junior me. You must have found out about them while working on spaceballs for the Apollo program. That was before my time and waaaaay over my head, all the way into outer space.

Barkley, thank you for FINALLY admitting: “I am sure you are right that if my late father had not caught that timing error in the Apollo mission somebody else probably would have figured it out in time to avoid having US astronauts fly off into deep space.”

and

“Oh, to CoRev, of course I have absolutely no idea about any of those things you brought up, pitiful Junior me. … That was before my time and waaaaay over my head, all the way into outer space.”

Those were my points from the beginnings of this discussion. “way over your head!”

FYI, I had a heart attack and ensuing quad by-pass operation. My priorities changed dramatically there after.

“FYI, I had a heart attack and ensuing quad by-pass operation. My priorities changed dramatically there after.”

funny how you complain about barkley talking “way over your head”. as i recall corev, you were “way over your head” when you tried to attribute your clogged arteries to genetics and side effects from long term medicine use, rather than the most likely culprit-a lifetime of poor decision making on diet and exercise. sounds like you are on the mend, hope you are making better choices with your second chance.

CoRev,

While it may have been (we shall never know) that somebody else would have solved the timing problem bugging the US space program (the problem predated Apollo), it remains a fact that it was indeed my late old man who figured it out.

As for my remark about things you mentioned being “way over my head,” well, I am sorry you had to go through heart surgery, something I have done as well, although not quite as bad as yours sounds to have been, so I have a lot of sympathy. But I am afraid that having has such surgery is not a good excuse for not catching obvious sarcasm, which was exactly what my comment was.

Indeed, I note I brought this matter up to refute ltr’s absurd posts about how the Chinese were “controlling” the location of descent of their recent vehicle. I note that WaPo has referred to it as an “uncontrolled trajectory.” It is nice for the Chinese that they got their Mars rover on Mars, something the US did quite awhile ago initially. But, of course all this old stuff you dragged out to impress everybody all had to with tracking objects, not controlling them, and so completely irrelevant to the issue I was addressing. Thus your comment was only worth getting sarcastic ridicule, which I supplied, but you were too out of it to figure out what was going on and somehow thought this was some triumph for your silly comments.

Also, CoRev, I personally know that recovering from heart surgery does make one think about things pretty seriously, and you say your priorities have changed. That may be, but it seems you still make comments here that frequently make little or no sense and frequently lack any factual support. I shall not dredge back to the past, which you have moved beyond, when you told us countless contradictory stories about what your role in the US space program was and which or what awards you got , and on and on. It really went on way too far and long to make a list. In contrast, what I have said about my late father’s role has been consistent and I think pretty clear.

Oh, I will add that of the books I was looking at, one was for an intelligent popular audience and is still in print, easily readable. But the one I was referring to that I was rereading for the first time in a long time, came out a good time later, and its contents were classified for quite some time. As it is, it is so hard to read they should probably not have bothered to classify it at all (just kidding, real rocket scientists can read that sort of thing that is unreadable to nearly everybody else, and I am sure you would not be able to, CoRev).

“Sammy, I’m amazed at the willful deceit and cognitive dissonance exhibited by liberals,”

Wow! Talk about projection!

Your commenting history is replete with attempted refutations of concise, clearly explicated, widely accepted economic theory, economic data, and statistical analysis. And what do you use to try to counter these uncontroversial theories, data, and analysis? Forty year old conservative dogma that has been passed by years ago by new data and better forms of analysis.

The knowledge of economic theory and economic & statistical analysis that you, sammy, and all the other Usual Suspects possess in total is much too small to fill a thimble, yet you are adamant about shouting your ignorance to the world and arguing, from your basis of ignorance, with those who know and understand these topics far, far better than you do. You owe it to yourself to learn some economics, and not just the perfectly competitive neoclassical paradigm, as well as some basic statistics.

Oh, and use your search engine to find and read about zombie economic theories. Those zombies have eaten your brain.

sammy or try to implement a Green New Deal

So your investment advice is to buy into stranded capital and white elephants like pipelines, coal mines and oil rigs?

@2slugbaits

Did you forget as the former owner of a failed restaurant that sammy is the master of stranded capital?? All his former employees still have fond memories of informal MMA matches in sammy’s office for their minimum wage checks.

https://econbrowser.com/archives/2020/07/economists-public-letter-on-recovery-policy#comment-238792

The good news is, all of sammy’s former workers now have a better boss, and sammy has an incredibly bright future as a MyPillow sales rep. If he has the highest sales of pillows for the month, he gets a free trip to Mara-a-Lago for a Mike Lindell hosted and meth-infused Hee Haw Hoedown.

Sammy, it’s always easy to know when a comment hits center target if the replies are personal attacks or ignore the comment’s points.

Well, I was gonna put a self-imposed temporary moratorium on making comments this blog. But I can’t help it, something just happened almost made me puke my cookies. I just saw a cameo by Steve Mnuchin in Warren Beatty’s “Rules Don’t Apply” . This bastard steals families’ homes with fraudulent mortgages and fraudulent possessions of people’s houses and Beatty puts him in his film?!?!?!?! WOW, real class. I’m glad I got a free library copy, ‘cuz if I felt I gave one penny to this SOB Mnuchin I’d be looking for razors and a large bowl of ice right now.

“Headline vs. Trimmed vs. Sticky Price”

Maybe for the entire gang – could you explain what trimmed and sticky price represent. Now for Bruce Hall, maybe an explanation of why the increase in Atlanta’s gasoline prices over the last week were not recorded in APRIL’s CPI figures.

LOL! Good one! You got me there! Oh, wait, you didn’t.

Meanwhile, this hack who has no background in economics whatsoever, has expressed some concerns:

https://www.msn.com/en-us/money/markets/inflation-could-spike-to-20-in-the-next-few-years-as-the-us-money-supply-explodes-says-wharton-professor-jeremy-siegel/ar-BB1gLivu\

After being range bound between 1-2% since 2Q2012, Core PCE has been extremely volatile over the past 4 quarters. https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA

Once the economy normalizes over the rest of the year, inflation trends will come into focus. Right now it is all noise and no signal.

Sticky price CPI (www.atlantafed.org/research/inflationproject/stickyprice) has just been through (is still in?) it’s most volatile period since the Great Moderation. So, yeah, noisy.

On a y/y basis, sticky price CPI is up just 2.4% (2.3% core) and that only after running negative through a good bit of last year. Fed officials will be pleased with evidence of reflation, but probably not convinced.

at what level of inflation would you say we have a problem? especially on a sustained basis?

For starters, I’d say there is no “we” at rates of inflation which do not erode long-term growth prospects. Inflation is all winners and losers until growth prospects suffer.

There is clear evidence that inflation or 10% and higher is harmful to growth. There is clear evidence that deflation is harmful to growth. The cost in terms of stabilization policy is high at both extremes. So approaching zero and approaching 10% are both fish and to be avoided.

I think here is a good bit of institutional religion in the economics profession regarding the wonders of 2% inflation. With clear evidence of damage around zero and 10%, I think 2% is too low as a target. That is not a strong belief on my part because I think the tools we use to raise inflation mostly benefit the rich in a disinflationary environment. If we relied on basic income, jobless benefits, (green) public works and the like for economic stabilization, I’d be much happier with efforts to boost inflation into a 3% – 5% range. I like 5% because it’s the mid-point between dangerous extremes. I share down to 3% because I, too, grew as a member of the church of Volcker.

Wow. I assure you “fish” is not the word I wanted. “Risky” is better. “Shave” rather than “share”.

I understood that the 2% standard came from John Taylor when he first promulgated his eponymous Rule. Given his assumptions about the values of some of his parameters, the formula burped out 2%. This simply stuck around due to inertia, the fact that neither Taylor nor other conservatives updated their priors on those parameter values, and because conservative policymakers believed something along the lines of, “If I have to accept the existence of inflation, I can go as high as 2%, but NO HIGHER THAN THAT BECAUSE REASONS.” So after all this time, we still have … 2 % as their acceptable target.

ISTR our host trying out various parameter values to generate new target values, but of course he’s not bound by ideological strictures. I can’t find the post after doing a lazy search, and I don’t feel like devoting any more time to it. Sorry.

I would guess that the winners in a >5% inflation scenarios would be those in the higher income brackets while the losers would be in the lower income brackets who tend to have fewer assets and relatively fixed incomes. If so, the current monetary expansionism leading to higher inflation would seem to hurt the “little people” whom the progressives so vocally profess to want to save while contributing to greater fortunes for those who ride a stock market fueled by megabucks out of DC. https://www.cnbc.com/2021/05/07/jeremy-siegel-on-why-inflation-may-only-cause-a-blip-in-stock-bull-run.html

Because our population has been rapidly aging, the likelihood is an increase in the number of people who will not be able to compensate for higher than 5% inflation. https://www.census.gov/newsroom/press-releases/2020/65-older-population-grows.html

See Bruce Hall’s attempt to be a progressive below all concerned about how the little dude will lose if inflation exceeds 5% (which it will not). But come on man.

WTF? Bruce Hall and JohnH did a Vulcan Mind Meld or what? Could someone tell our village idiot that Social Security benefits are indexed?

BTW those who have a lot of long-term government bonds might just seen their values decline if inflation takes off. Yea I get these simple realizations are too much for Bruce “no relationship to Robert” Hall.

Trimmed mean is the best figure to look out. Our Central bank regards this as the best measure of inflation and it is good you yanks have finally caught up.

Seems to me it is transitory in nature and without wages rising to overcome this it will remain transitory

In the links provided, the Cleveland Fed says that the median CPI is the best predictor of future inflation for the U.S.

Krugman in today’s NYT: “Before 2007 it was expensive for people to hold money, because cash yielded no interest while bank deposits paid less than other assets like Treasury bills. So people held money only because of its liquidity — the fact that it could readily be spent. When the Fed increased the money supply, this left the public with more liquidity than it wanted, so that the money would be used to buy other assets, driving interest rates down and leading to higher overall spending.” https://www.nytimes.com/2021/05/13/opinion/cryptocurrency-inflation.html?action=click&module=Opinion&pgtype=Homepage

Exactly who is the “public” Krugman is writing about here? The bottom 60% who live hand to mouth? Or the affluent and wealthy?

The “public” in question is anyone with money in a bank account.

Helpful?

He means well. If “your” knowledge of economics is relatively low, as it is for 80% (???) plus of Americans (I think the number is probably higher than that, but trying not to be a condescending jerk), when you read phrases like “It was expensive for people to hold money” It’s very likely to make steam come out of your ears. I think I figured this out in my early-to-mid teens. Maybe you figured it out when you were 9 or 10. Most people don’t. There’s a large portion of Americans out there, with ZERO disposable income (speaking of phrases that could make a person’s blood boil who is living paycheck-to-paycheck~~”disposable income”) who read these phrases and aren’t getting the intended meaning. I always wondered if they used terms like maybe “extra leftover income” if it might be easier to grasp. But once these phrases take hold in the culture or inside social circles it’s kinda hard to change them just because a portion of people aren’t “getting it”. But I think economists (certainly economists in a classroom context) might stop and think about that a little bit.

This is how shysters and frauds like Suze Orman, ZH, and Tony Robbinsmake a mint, they cater to those who dislike economics language. (I was trying to remember the one from the late 1980s my Dad liked for awhile –Charles G-something?? He had some bestsellers in the late 1980s and some TV shows, middle aged with blonde hair and a blonde mustache) It doesn’t matter if Orman’s advice is garbage, at least they can understand her bad advice.

JohnH may mean well but his incessant stupidity is an embarrassment to progressives. And you actually cheer him on?

Insulting people for the sole reason of insulting them, generally does not attract them to your group’s campfire. That’s how many of them get attracted to folks like donald trump. Hillary found out going around insulting a large segment of voters was the sure fire way of losing a race she’d have had a better chance (a good chance) of winning if she had learned when and where to STFU.

https://abcnews.go.com/Politics/shattered-authors-bill-clinton-pushed-tone-hillarys-campaign/story?id=46974506

https://www.youtube.com/watch?v=ws5CucYZzC4 <—-1 minute 26 second WSJ channel video of Hillary.

The appropriate reply for Hillary would have been "I was wrong" "I'm sorry" "I apologize", possibly put an arm around on the girl's shoulder, Even the ubiquitous "I want to make this right, I want to fix this" would have been better than a rude brush off. And I'll tell you something else, you can call it "misogynist" or anything that makes you feel good about one of the worst political campaigners this nation has ever seen: Bill Clinton would have taken that lemon and turned it into lemonade in about 2 minutes flat.

I do get why you like Hillary though, lots of similarities in your bedside manner when offering doctor’s advice.

Moses,

Ah yes, you are indeed the expert on “insulting people for the sole reason of insulting them.” Or maybe you have more noble motives such as out of control hatred and sadism.

JohnH has his daily regime where he has to do some sort of Krugman bashing no matter how stupid and dishonest it may be. It is sort of like having his morning orange juice.

The ‘who’ is the same as ever. When the money supply increases, those who live hand-to-mouth, as you put it, spend quickly… if the money is put in their hands. And then it accumulates in the accounts of those who can afford to not live hand-to-mouth.

Putting guys like this in a seat of power is how MAGA people who are ashamed they voted for the orange abomination explain they voted for a living monster??

https://www.theatlantic.com/magazine/archive/2021/06/brett-kavanaugh-supreme-court/618717/

If you’re a Republican/MAGA fool who voted for the orange abomination, you need to find a better rationalization for a 2016 vote that is heinous, blasphemous, disgusting, and a desecration committed on America’s youth than inserting a man as a Supreme Court Justice whom you’d be mortified if he was teaching your daughter in a K-12 school setting.

Average price for a gallon of gas at the station: $3.02

https://gasprices.aaa.com

Well, that only makes us 98 cents per gallon short, or about a 25% rise from here to get to “Princeton”Kopits, infamous oil expert, prediction. We’re giving Kopits until end of June 2021, ‘cuz Kopits is, like, a genius, and stuff.

I venture to say oil rig count will go up, as it does Kopits may be in for a shock on how slow that price rises. More than likely as time wears on closer to June 2021 supply will outstrip demand.

Excuse me, June 2022. That would be unfair if we only gave him to June 2021.

Make it 2080 and with inflation, his forecasts are bound to do as well as DOW 36000.

on wednesday i paid $2.79 for premium at costco. usually regular is about $0.25 less. the gas lines were full. not sure why we have such a surge in buying in texas. the gas is stuck here and not being shipped to the east. should have dropped in price due to oversupply. i paid $2.49 rather recently.

https://fred.stlouisfed.org/graph/?g=w3Wk

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=wGeV

January 15, 2018

Sticky Consumer Price Index less Shelter, 2017-2021

(Percent change)

It’s going to be fun to watch:

https://www.marketwatch.com/story/oil-futures-remain-higher-as-eia-reports-a-smaller-than-expected-fall-in-us-crude-supplies-2021-05-12?mod=article_inline

https://static.nytimes.com/email-content/PK_sample.html

May 13, 2021

Wonking Out: Return of the monetary cockroaches

By Paul Krugman

Alert! Wonk warning! This is an additional email that goes deeper into the economics and some technical stuff than usual.

Some years back I tried to make a distinction between zombie ideas — ideas that should have been killed by evidence, but just keep shambling along, eating people’s brains — and cockroach ideas, false beliefs that sometimes go away for a while but always come back.

And lately I’ve been noticing an infestation of monetary cockroaches. In particular, I’m hearing a lot of buzz around how the Fed’s wanton abuse of its power to create money will soon lead to runaway inflation — or maybe that we’re already experiencing high inflation, but it’s being hidden by dishonest government statistics.

There was a lot of talk along those lines a decade ago, but it faded out as it became obvious to everyone that hyperinflation just wasn’t happening. Now it’s back, I think for a couple of reasons.

For one thing, we are seeing some actual inflation as a recovering economy runs into bottlenecks — shortages of lumber, shipping containers, used cars, etc. I believe, and the Fed believes, that these shortages are temporary, that this is only a blip and that inflation will subside; but we could be wrong, and at least there’s some substance to this concern.

But a lot of the money-printing panic is, I believe, coming from the crypto crowd. I’ve been in a number of extended (and determinedly civil) discussions with boosters of Bitcoin etc., doing my best to keep an open mind. What happens in these discussions is that skeptics like me keep pressing for an answer to the question, “What problem is cryptocurrency supposed to solve, exactly?” And at some point the answer always devolves to some version of “Fiat money is doomed because the Fed won’t stop running the printing press.”

So it seems to me that it would be useful to talk about why that’s a really bad take, and has been a bad take over and over again for the past 40 years.

To be fair, printing huge amounts of money to pay the government’s bills does in fact lead to high inflation. Take the example of Brazil in the early 1990s:

https://static01.nyt.com/images/2021/05/13/opinion/130521krugman2/130521krugman2-articleLarge.png

Yes, printing money can cause inflation.

But nothing like that has happened in the U.S., even during periods when monetary aggregates like M2 have increased dramatically. Anyone claiming that big increases in M2 presage surging inflation was wrong again and again since the 1980s. I mean really, really wrong:

https://static01.nyt.com/images/2021/05/13/opinion/130521krugman3/130521krugman3-articleLarge.png

M2 hasn’t been much use for decades.

Why?

There are actually two big fallacies in the “printing press goes brrr -> inflation” story.

One of them is what I think of as the doctrine of immaculate inflation: the notion that an increase in the money supply somehow translates directly into inflation without causing economic overheating along the way. Many people have fallen for that fallacy over the years. Among them was no less a figure than Milton Friedman. He looked at rapid growth in M1 during the early 1980s:

https://static01.nyt.com/images/2021/05/13/opinion/130521krugman4/130521krugman4-articleLarge.png

Friedman’s mistake.

And from 1982 to 1985 he repeatedly predicted a resurgence of inflation: 8 percent for 1983, double-digit for 1984, 8 to 10 percent for 1985.

Obviously none of that happened. Instead, a slack economy with high unemployment led to declining inflation over the whole period:

https://static01.nyt.com/images/2021/05/13/opinion/130521krugman5/130521krugman5-articleLarge.png

Inflation, not immaculate.

Today’s inflationistas, however, don’t know anything about that history.

The other fallacy of the modern inflationistas is that they don’t understand how the role of money changes in a world of very low interest rates, even though we’ve been living in that kind of world for a very long time.

Before 2007 it was expensive for people to hold money, because cash yielded no interest while bank deposits paid less than other assets like Treasury bills. So people held money only because of its liquidity — the fact that it could readily be spent. When the Fed increased the money supply, this left the public with more liquidity than it wanted, so that the money would be used to buy other assets, driving interest rates down and leading to higher overall spending.

But when interest rates are very low — which they have been for years, basically because there’s a glut of savings relative to perceived investment opportunities — money is, at the margin, just another asset. When the Fed increases the money supply, people don’t feel any urgent need to put that cash to more lucrative uses, they just sit on it. The money supply goes up, but G.D.P. doesn’t, so the “velocity” of money — the ratio of G.D.P. to the money supply — plunges:

https://static01.nyt.com/images/2021/05/13/opinion/130521krugman6/130521krugman6-articleLarge.png

Money just sits there these days.

These aren’t new insights….

https://fred.stlouisfed.org/graph/?g=E0Qp

January 30, 2018

Consumer Price Indexes for New and Used cars & trucks, 2017-2021

https://fred.stlouisfed.org/graph/?g=E0Qu

January 30, 2018

Consumer Price Indexes for New and Used cars & trucks, 2000-2018

an infestation of monetary cockroaches. We have there here as in Princeton Steve, Bruce Hall, and the return of SAMMY!

“ Fewer than half of all adults (47%) say they have emergency or rainy day funds that would cover their expenses for three months in case of sickness, job loss, economic downturn, or other emergencies; 53% say they don’t have this type of savings on hand.”

https://www.pewresearch.org/social-trends/2020/04/21/about-half-of-lower-income-americans-report-household-job-or-wage-loss-due-to-covid-19/#many-adults-have-rainy-day-funds-but-shares-differ-widely-by-race-education-and-income

Most of the 53% who can’t cover such an emergency presumably have money in the bank—at least right after pay day, but I doubt that they count in Krugman’s definition of “the public.”

You needed a second daily dose of worthless Krugman bashing? Dude – you really need to get a life.

https://www.nytimes.com/2021/05/13/opinion/inflation-fears.html

May 13, 2021

What Do Used Car Prices Say About Biden’s Agenda?

By Paul Krugman

So, should President Biden scrap his economic agenda because Americans are rushing to buy used cars?

OK, I’m being a bit snarky here, but only a bit. That’s pretty much what economists trying to draw big conclusions based on Wednesday’s inflation report from the Bureau of Labor Statistics are saying.

It’s true that while almost everyone was expecting a spike in consumer prices, the actual spike was bigger than expected. The one-year inflation rate went above 4 percent, surpassing its previous recent peak, in 2011.

It’s not silly to ask whether unexpectedly high inflation means that the economy has less room to run than both the Biden administration and the Federal Reserve have been assuming; that could be true, and if it were, Biden’s spending plans might be excessive and the Fed might need to consider raising interest rates sooner rather than later.

But neither the details of that report nor recent history support those concerns; they suggest, on the contrary, that policymakers should keep their cool. This doesn’t look at all like 1970s stagflation redux; it looks like a temporary blip, reflecting transitory disruptions as the economy struggles to recover from pandemic disruptions. And history tells us that it’s a very bad idea for policymakers to panic in the face of such a blip.

To see why, let’s revisit what happened in 2011, the last time we saw this kind of inflation blip.

There was a surge in consumer prices in late 2010 and into 2011, driven mainly by rising prices of oil and other raw materials as the world recovered from the 2008 financial crisis. Consumer price inflation hit 3.8 percent, just a bit below the latest reading.

And inflation hawks went wild. Representative Paul Ryan (remember him?) grilled Ben Bernanke, the Fed chairman, over his easy-money policies, intoning, “There is nothing more insidious that a country can do to its citizens than debase its currency.”

Bernanke, however, refused to be rattled. The Fed stayed focused on “core” inflation, a measure that excludes volatile food and energy prices and that it (rightly) considers a better gauge of underlying inflation than the headline number. And the Fed’s cool head was vindicated: Inflation quickly subsided, and the dollar was not debased.

Policymakers elsewhere weren’t so levelheaded….

https://fred.stlouisfed.org/graph/?g=E0Qu

January 30, 2018

Consumer Price Indexes for New and Used cars & trucks, 2000-2021

https://www.pewtrusts.org/~/media/assets/2014/06/state_public_pension_investments_shift_over_past_30_years.pdf

an interesting article on the makeup of pension funds over time (until 2014). just an observation. inflation seemed to be an issue during the period of time that pension funds were predominantly funded by fixed income-prior to the 1990’s. since then, equity assets have been the dominant investment in pension funds, as well as individual 401k’s. sustained consumer inflation has not really been a problem during this time period. asset inflation has occurred quite a bit during this period.

how much do pension and retirement funds drive this inflation and asset bubble picture? and if they play a significant role, why would one expect sustained consumer inflation to be a problem going forward?

Moderna just released its financials for the first 3 months of 2021 and like damn!

Sales in just 90 days were $1.94 billion.

Cost of production = only 10% of sales, which did not surprise me.

Selling costs a mere 4% of sales – I guess this stuff sells itself.

R&D costs = 21% of sales.

So operating profits represented 65% of sales. Damn!

https://www.fool.com/investing/2021/05/05/why-moderna-could-triple-its-covid-vaccine-sales-n/

Following up on the financials news from Moderna. In 2021QI, it sold just over 100 million in vaccines. Moderna hopes to produce and sell up to 1 billion doses for the entire year. And it wants to produce and sell 3 billion doses in 2022.

We had to endure some economic know nothing babble that Moderna was limiting supply to exploit its alleged monopoly power. But wait – they are racing to be first to market with Pfizer, AstraZeneca, J&J, and Sinovac. Each doses costs a mere $2 to produce, literally sells it self, and is currently priced at $1.70 per dose, Limiting production given this market makes no sense but then our economic know nothings write a lot of things that make no sense.

Funny thing – the stock price for Moderna has moderated of late which shows biopharma is never a sure bet. But I do not feel exactly sorry for Moderna’s wealthy shareholders. Get vaccinated as there are freebies for doing so from Shake Shack!

Donald Trump and Jared Kushner batted themselves on their backs for the Abraham Accords who they claimed was a good deal for the Palestinians. Back then I worried that they had just stabbed the Palestinians in the back. After all the two state solution was killed. The homes of the Palestinians were further at risk to be taken over by right wing Zionists. And guess what?

https://www.msn.com/en-us/news/world/how-the-abraham-accords-precipitated-new-israeli-palestinian-violence/ar-BB1gHTzS?ocid=uxbndlbing

This Zionist ploy has blown up in the face of peace loving citizens of Israel. Biden is scrambling to clean up Trump’s mess. I just hope the Israelis finally wise up and get rid of their war mongering Prime Minister.

I support Israel, I don’t support Netanyahu. He has been corrupt going back decades. There were many signs, the nail in the coffin for me was when both Noam Chomsky and Norman G. Finkelstein were refused entry into Israel. When this happened, then you knew the extremist elements there had won out. And they keep re-electing Netanyahu after multiple cases of public corruption. Eventually Israel will retake any of those lands they have Biblical claim to. But it would be nice if Israel could do it in a less violent manner, and one in which does not violate international law. That includes taking the settlements in the current time frame and doing things like shooting phosphorus bullets into hospitals.

https://www.democracynow.org/2019/3/4/it_is_time_to_indict_israel

https://www.amazon.com/Gaza-Inquest-into-Its-Martyrdom/dp/0520295714

The book is from University of California Press

This second book written by Norman G. Finkelstein (more recent) is from “OR Press”

https://www.amazon.com/I-Accuse-Norman-Finkelstein/dp/168219227X/ref=pd_lpo_14_img_1/146-2429106-4382544?_encoding=UTF8&pd_rd_i=168219227X&pd_rd_r=641aaf7a-ccba-4777-94cc-f912d2442898&pd_rd_w=k98NB&pd_rd_wg=Ct92e&pf_rd_p=a0d6e967-6561-454c-84f8-2ce2c92b79a6&pf_rd_r=6SQT99V2XRSHZM1BBP8B&psc=1&refRID=6SQT99V2XRSHZM1BBP8B

Norman G. Finkelstein’s mother was a survivor of the Warsaw Ghetto, and his father was a survivor of Auschwitz. He doesn’t tolerate lies from any party or nation irregardless of his deep affection towards that nation.

Grammar Police Alert: No such word as “irregardless.” It’s a convolution of “irrespective” and “regardless.”

Oh, I’ve been busted. You still see/hear it used sometimes, but I guess it’s bad form. I’ll try to break the habit.

Given the inability of a generation of people who talk for a living (news blatherers and the like) to handle simple noun-verb agreement as to number, we Henry Higgenses are citizens of another country.

@ macroduck

I’ll spare Menzie for just once and not put the Youtube link up, I’ll just tell you I can suddenly hear the booming voice of Stanley Holloway singing in the background. With a little bit o’ luck, you’ll find one of the greatest musical performances in movie history. And probably my greatest hero in life (joke).

Laoshi Fang introduced me to that wonderful song. Well, I probably heard the song before but Laoshi Fang taught me to love it.

pgl,

This may be my revenge for you accurately supporting Moses in criticizing for me misspelling “McKinnon.” That was reasonable to do. So now you must deal with me supporting Moses on this matter. Whining about using “irregardless” is ridiculous.

So, pgl, the word you claim is “no such word” has existed for over a century. In that regard it resembles other “non-words” as “normalcy” and more relevant “inflammable.” Yeah, “irregardless” means the same thing as “regardless,” but, hey, “inflammable” means the same thing as the older “flammable.” Want to pick a fight also with “inflammable.” Sigh.

“Normalcy” is not quite the same as the odd words that look like the exact opposite of older versions that mean the same thing. But in terms of logic this is sort of like the “negative double problem”: in English a double negative is a positive, but in many other languges it is a reinforced positive, and in fact in colloquial usages in English we see this as well, e.g., “I ain’t gonna do that!”

Tsk tsk, pgl, :-).

Wait – I was not the Grammar Police here. To be honest, I just skipped right over this Moses piece as I often do.

Barkley Rosser I think you meant that comment for me, not pgl. To be clear, I was just giving Moses a little good natured ribbing about using “irregardless.” It’s commonly used and if you believe English is a living language, as I do, then it is certainly a word; however, it is one of those words that grates on me whenever I hear or read it. No doubt something that harkens back to my 6th grade teacher Mrs. Steitz. We started every day with three hours of grammar and diagramming sentences. Yes, they used to do that back in the day. Also, using “irregardless” would always inflame (see what I did there?) a response from my retired English professor middle brother. Another one of my pet peeves is the word “utilize”, a favorite in government writing. You take a verb “to use” then convert it to a noun “utility” and then turn the noun back into a verb “utilize.”

@ pgl

NO worries pgl, none of my comments against Andrew Cuomo, the man you called “Our nation’s leader” on Covid-19 response as he was lying about death counts, and you were breeding for the White House slobbering on yourself discussing Cuomo’s book launch, have affected his current standing as the Governor of New York. A plethora of your fellow New Yorkers have defended Cuomo’s sexual harassment and molesting of multiple women behind his long-term girlfriend’s back. The sophistication and “progressiveness” of New Yorkers nipping this problem of Andrew Cuomo’s lust in the bud is impressive. pgl, Tell your jogging buddies you’re proud of New York’s response to Cuomo’s uncaged lust, ok?? Just to signal your feminist bonafides, ok??

https://www.wsj.com/articles/andrew-cuomos-loudest-supporters-women-for-governor-cuomo-11619958600

“I ain’t NOt gonna do that!” Sorry, my bad. My Biden-Pelsosi s problem is clearly striking again, :-).

Oh wow, double-barreled s manifestations on my part. Apologies to both 2slug and pgl, not to mention the estimable Moses. Clearly ai am completely losing it. Time to go for a long trip into the outer depths of space!

Mose (this is one of those times I wish you were not using a fake Jewish name, really, very seriously),

I agree with your opening comment that “I support Israel, I don’t support Netanyahu” I shall not go on further here about this. In the next days I shall post on this matter at some length on this matter.

Look forward to your post. Netanyahu has spent the last 20 plus years undermining whatever progress we ever made in getting real peace in this region. For the life of me – I cannot imagine any smart Israeli that supports this racist war monger.

pgl,

It is now up on Econospeak.

https://www.nytimes.com/2021/05/13/opinion/cryptocurrency-inflation.html

May 13, 2021

Wonking Out: Return of the monetary ———–

By Paul Krugman

[ Though the essay is important and though I posted the essay, I find the title, which the writer chose, disturbing. The New York Times should have changed the title. I should have pointed this problem out immediately. ]

FYI, the author of an op-ed column does not get to choose the title. It’s always chosen by the newspaper, with or without the consent of the author. That’s how it works.

I can’t decide if I’m crazy or merely stating the obvious by saying I would think the Sticky Price line would be a more anticipatory number than “trimmed”. Anyone not named Kopits or John “Grumpy Economist” Cuckrant have any thoughts on that???

Always good to remember: price increases and inflation are two different things. They may be related sometimes, and sometimes not.

pgl: ” Each doses costs a mere $2 to produce, literally sells it self, and is currently priced at $1.70 per dose, “

Have you looked at Moderna’s Q1 report? They report $1.9 billion in revenue on sales of 102 million doses. That comes to $17 per dose. Cost of sales was 11% or $2 per dose. Moderna can only maintain that 800% mark up if they can keep another company from manufacturing and selling their product at a cheaper price.

In addition, Moderna received $2.5 billion in U.S. government grants up front to fully fund R&D and clinical trials. The up front funding included a guaranteed fee for the first 100 million doses, regardless of whether the trials were successful or not.

Moderna risked nothing. The government paid for everything up front. The government should own all of the patents and rights.

“That comes to $17 per dose.”

Thanks for correcting my typo there. Moderna did incur a wee bit of the R&D but yea – the government subsidized the mess out of this.

“Moderna can only maintain that 800% mark up if they can keep another company from manufacturing and selling their product at a cheaper price.”

Ah yes – the dreaded patent system. Of course there can be some me too treatments, which in a way Pfizer is.

I agree. If we’re going to socialize the risks, we must socialize the rewards as well

It goes further than this. Big Pharma are some of the biggest transfer pricing tax cheats ever.

Paul Krugman, in fact, writes the headings for his New York Times columns. Krugman has explained just this to readers. The heading about which I complained was unfortunate and Krugman should not have written such a heading, nor should the New York Times have printed this heading:

https://www.nytimes.com/2021/05/13/opinion/cryptocurrency-inflation.html

@ ltr

It’s not a reference to race. Though I could see how a person residing within a TV brainwashed and government micromanaged education system pounding in a population wide inferiority complex could make that person involuntarily flinch every time someone used a derogatory term in a sentence. You realize when you wake up every morning putting on the very large self-adhesive target sign on your back it only makes it more tempting for the donald trumps of the world to partake right?? You’re easier to upset than the person looking in the mirror over their shoulder asking their spouse if their butt is too fat.

http://www.xinhuanet.com/english/2021-05/15/c_139947277.htm

May 15, 2021

China succeeds in first Mars landing

BEIJING — The lander carrying China’s first Mars rover has touched down on the red planet, the China National Space Administration (CNSA) confirmed on Saturday morning.

It is the first time China has landed a probe on a planet other than Earth.

“The Mars exploration mission has been a total success,” Zhang Kejian, head of the CNSA, announced at the Beijing Aerospace Control Center.

After the success was confirmed, the control center in Beijing was filled with cheers and applause.

“It’s another important milestone for China’s space exploration,” he said.

The Tianwen-1 probe touched down at its pre-selected landing area in the southern part of Utopia Planitia, a vast plain on the northern hemisphere of Mars, at 7:18 a.m. (Beijing Time), the CNSA announced.

It took ground controllers more than an hour to establish the success of the pre-programmed landing. They had to wait for the rover to autonomously unfold its solar panels and antenna to send the signals after landing, and there was a time delay of more than 17 minutes due to the 320-million-km distance between Earth and Mars.

Tianwen-1, consisting of an orbiter, a lander and a rover, was launched from the Wenchang Spacecraft Launch Site on the coast of southern China’s island province of Hainan on July 23, 2020. It was the first step in China’s planetary exploration of the solar system, with the aim of completing orbiting, landing and roving on the red planet in one mission.

The name Tianwen, meaning Questions to Heaven, comes from a poem written by the ancient Chinese poet Qu Yuan (about 340-278 BC). China’s first Mars rover is named Zhurong after the god of fire in ancient Chinese mythology, which echoes with the Chinese name of the red planet: Huoxing (the planet of fire)….

Am I nuts or does John Fradkin look like he has significant Asian ancestry?? I’d say “part Asian” but I don’t know if that’s considered offensive wording now.

Uh-Oh…….. it appears “the other shoe has dropped” for one of our conservative/MAGA Republicans. Kids….. this may not be pretty:

https://news.yahoo.com/gaetz-associate-agrees-cooperate-federal-185605380.html

https://images.app.goo.gl/2MixShzLA864wLeu9

Republican “family values” appears to be a complex concept. I’m still confused after the last roughly 35-40 years what the divorced Ronald Reagan meant by it. Is Gaetz doing the “family values”??