Juan E. Castañeda (Director) and Tim Congdon (Chairman) of the Institute for International Monetary Research at the University of Buckingham write today:

With the M3 velocity of circulation at 1.04, equilibrium nominal national income comes out as roughly $29,000b.

…if nominal GDP needs to rise by 30% in a period of 18 months to two years, and if real output cannot go up in that period by more than, say, 8%, then the rest of the adjustment has to be seen in the price level. Continued boom between now and Q4 2022 in which real output rises by 8% and the price level by 20% would in fact result in a 30% jump in nominal GDP

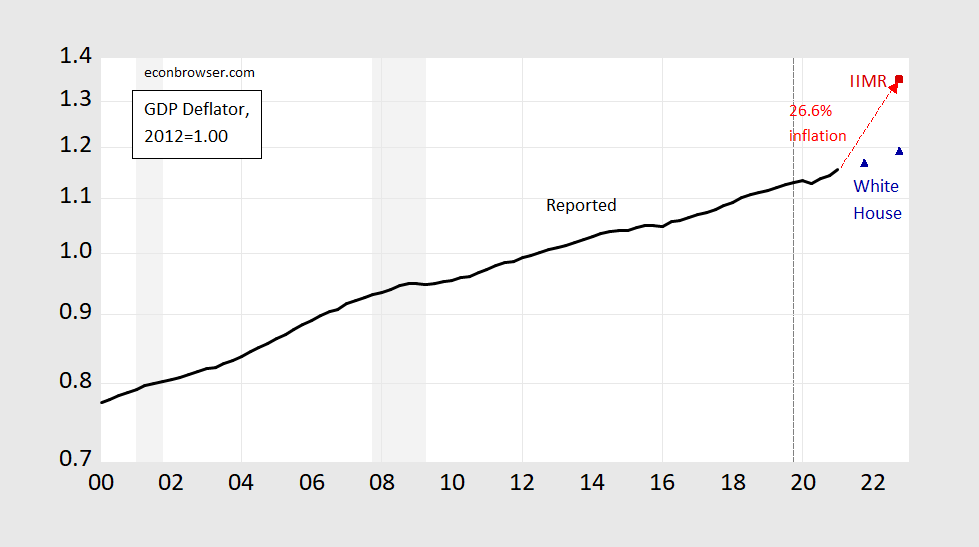

Using the calculations implicit in their study, I derive the following graph of the GDP deflator (assuming 7% real growth by end 2022 ).

Figure 1: US GDP price deflator (black), IIMR implied deflator as of 2022Q4 (red square), White House FY22 forecast implied deflator (blue triangle), all 2012=1 on log scale. IIMR calculation of price level assumes 7% growth. NBER defined recession dates shaded gray, dashed line at NBER peak date of 2019Q4. Source: BEA, 2021Q1 2nd release, IIMR (June 14, 2021), White House (May 2021), NBER, and author’s calculations.

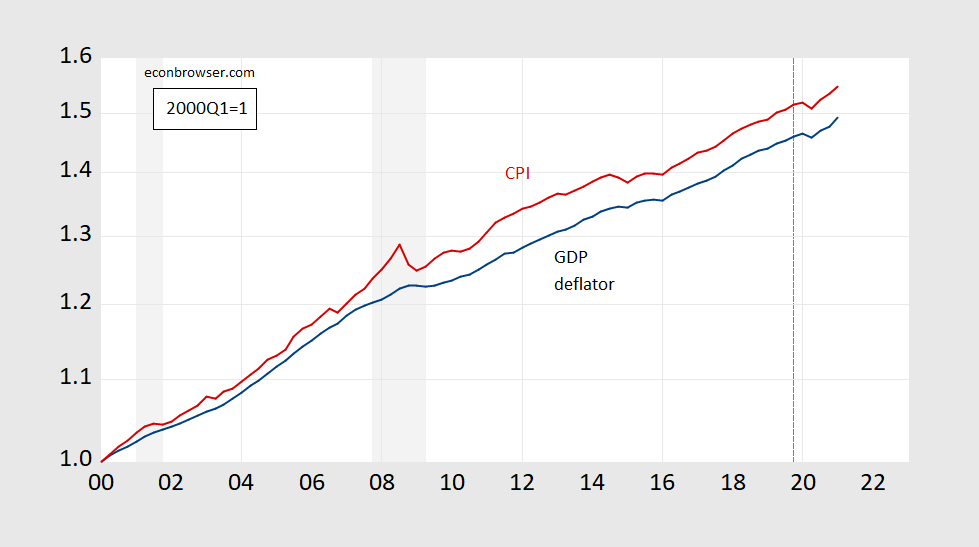

As the authors note, the approach is essentially using the Quantity Theory, MV=PY. Use M3 for money (M), assume V (velocity) is mean reverting, obtain PY (nominal GDP), and then assume Y cannot rise more than a certain amount (7%, or 8%, depending on location in text). M3 is a broader measure of money than M2 (post 2006 data sourced from Shadowstats). If my calculations are correct, this implies the GDP deflator will grow at 26.6% (annual rate) through 2022Q4. Over the 2000-2021Q1 period, the CPI has grown about 31% faster than the GDP deflator, so that suggests a CPI inflation rate of about 34.5% for the next 1.5 to 2 years. (Figure 2 shows the evolution of the two series).

Figure 2: GDP deflator (blue), and CPI-all (red), both 2000Q1=1, on log scale. NBER defined recession dates shaded gray, dashed line at NBER peak of 2019Q4. Source: BEA 2021Q1 2nd release, BLS, both via FRED, NBER and author’s calculations.

Time will tell whether the Quantity Theory or some other approach (e.g., Phillips curve) proves more accurate. I discuss the past forecasting record of the Quantity Theory in this post.

Addendum, 6/15, 4:30pm Pacific:

How plausible is the prediction of a 29,000 bn GDP? A key part of the Castañeda-Congdon argument is that (1) nominal GDP is determined by the quantity of broad money assuming a value of velocity, and (2) velocity is predictable and mean reverting. On (2), standard unit root test results (ADF, DF-ERS) applied to the available M3 measure of velocity (1959-2006) indicate that one can’t reject a unit root null at conventional levels, and can typically reject a trend stationary null (KPSS) at 5% level.

In other words, a key assumption in the Castañeda-Congdon calculation is questionable.

From their website:

“The chart above shows the average annual % change in quantity of money, broadly-defined, and nominal national income in the various countries, 1981-2018. The relation between changes in the amount of money and changes in nominal income is quite evident in the data, and it does hold in very different economies all across the world. This is one of the fundamental relations in monetary economics we use in our analysis of monetary policy and financial regulation and their expected effects on the economy.”

This is not true for GDP/M1 or for GDP/M2. Too bad FRED does not provide GDP/M3 as I doubt this velocity is exactly stable or predictable either. But hey they have to sell their BS somehow.

FRED does provide data on M3 and on GDP so I dumped these series into FRED for the 1981Q1 to 2021Q1 period. We used to here that M3/GDP hovered around 1.8. Well it sort of did but it was well over 2 during the late 1990’s. But yea this velocity was still 1.8 through 2008. Since then it has plummeted reaching something akin to 1.1 by last quarter.

These clowns claim GDP/M3 is stable and predictable. I wish I were better at providing the graph as it would show how utterly bogus these clowns really are.

pgl: Picture of M3 in this post (thru 2006): https://econbrowser.com/archives/2020/07/very-broad-money-and-the-price-level

Interesting that GDP/M3 fell during the 1970’s just like GDP/M2 did.

Wait – does GDP/M3 track GDP/M2 for the entire 1950 – 2020 period?

https://fred.stlouisfed.org/series/M2V

If so, why use something not reported by FRED? Oh yea – because it would be so easy to debunk the claims this crew is making.

IIRC, our host posted a discussion of the money base M2 being a poor predictor of inflation, so I wouldn’t expect that adding large time deposits, institutional money market funds, short-term repos, etc, would add any predictive ability. This discussion was WAY back in the mists of time, you know, of last week? two weeks ago? Even with all that time passing, I doubt that these guys have a firm basis for their bizarre prediction.

@ Dr. Dysmalist

I think sometime in the past commenter pgl mentioned Milton Friedman winked at him during a presentation. Maybe this is the “winky winky at pgl” clause which “grandfathers in” antiquated ideas which were actually kinda dumb to begin with. Maybe pgl can clarify how special the wink was from Monetarist Friedman and we can all go from there??

Why do you lie so much? Especially such petty pointless lies.

I thought you felt special, like one of “the chosen ones” when the Quantity Theory Jedi Master Milton Friedman winked at you during your presentation?? See, I got it all wrong.

I always thought Barkley made a mistake engaging with your petty pointlessness but he does have one thing right – you are the most worthless commenter here. Time to ignore you given your clear emotional issues.

@ pgl

But….. but…. but….. I thought you said multiple times on here you “skipped” my comments??? How odd……..

I do enjoy your mutual admiration society with Barkley Junior though. Makes me think of the old Wonder Twins cartoons. [ Meanwhile, back at The Hall of Justice ] “Form of!!!!!!….. an RV septic tank!!!!!!”

https://fred.stlouisfed.org/graph/?g=EJUj

January 15, 2018

Gross Domestic Product and M3 Money Supply, 1960-2021

(Indexed to 1960)

https://fred.stlouisfed.org/graph/?g=EJUF

January 15, 2018

Gross Domestic Product and M3 Money Supply, 2000-2021

(Indexed to 2000)

@ ltr

I have some good news for you. Something sure to make you happy ltr. Taiwan is strengthening its trade relations with America, and also sending them more efficacious vaccine (i.e. not garbage). It appears Taiwan prefers Moderna and Pfizer over Beijing’s Psychofram. Go figure……

https://www.wsj.com/articles/u-s-taiwan-to-launch-trade-talks-11623097659

ltr: You have to be careful. The M3 series you have plotted is the OECD’s definition of M3 which matches essentially US defined M2. The Fed stopped publishing M3 in 2006, so you have to get the Shadowstats version (or rebuild it yourself) to show the M3 Castaneda and Congdon are using to show data up to 2021.

The M3 series you have plotted is the OECD’s definition of M3 which matches essentially US defined M2….

— Menzie Chinn

[ Good grief, the graph I constructed bothered me, but I did not know why and was foolish enough not to look to the explanation since I remember reading the Fed had an M3 measure.

Avoid being careless! I am grateful for the correction. ]

Off-topic

This is the link for Wisconsin. You can pick any state you like for the data pertaining thereto.

https://nlihc.org/housing-needs-by-state/wisconsin

I am still worried about how evictions will play out in different states. Somewhere, I assume on the NLIHC website they have data that breaks down on how renters are not receiving federal aid for their housing hardships due to the virus~~because individual states are doing a crappy job of distributing the money. I’m assuming this is something similar to a “white paper” but I cannot find it. If anyone else knows where that link is and finds it before I do and put it in this thread, I would appreciate it. I can’t buy you a beer, but I would still appreciate it.

Just use the pulldown menu. I’m gonna keep hunting for this SOB paper.

https://nlihc.org/housing-needs-by-state

Just as an example the state of New York just started taking applications for assistance on June 1.

https://theintercept.com/2021/06/10/covid-rental-assistance-tenants/

Maybe it’s not a “white paper”. It appears this dashboard is the best I am gonna do. I don’t think people in this situation geberally would read Menzie’s blog, but it might help some people know who they are supposed to contact in their state. I’d be so happy if it did:

https://nlihc.org/era-dashboard

This story link is not directly related to housing/rents but gives you an idea of how bad some states are at distributing federal money allocated to needy people in their state:

https://www.koco.com/article/unemployed-oklahomans-demand-answers-after-oesc-freezes-some-claimant-cards-due-to-suspected-fraud/36720524

So I can only assume that these guys are attempting to make ShadowStats look smart in comparison.

It seems impolite just to sit back and throw rocks at people, but the word antiquated pops into mind.

“So I can only assume that these guys are attempting to make ShadowStats look smart in comparison.”

IMO, they’re succeeding.

I bet you did not watch Fox and Friends this morning. Had you done so, their chief economist Princeton Steve made an appearance praising this weird dude as a great macroeconomic forecaster. Yes – the audience at Fox and Friends is THAT stupid.

By “this dude” do you mean Castaneda or Congdon or somebody else, pgl?

Congdon. That 20 minute podcast of his was really quite the weird show.

I think pgl is referring to the “ShadowStats” guy. It’s all part of pgl’s 2021 “Honesty In Comments” rock and roll world tour.

You are not only worthless – you are lazy too. You might actually go to that institute’s website as his podcast is up and it is off the charts funny. Me? Getting back to my promise of ignoring the most worthless petty old man ever.

UK extending their lockdown to July 19th—related to “Delta” version. I also read that some respected people are predicting a “resurgence” of the virus in the 5 American states which have been the worst on getting citizens to take the vaccine. I don’t know which 5 those would be, but my intuition tells me that the state I currently reside in would be one of those 5.

Where is your basketball update telling us Trae Young never passes. After all 18 assists for the first 4 games sucks. Oh wait – 18 assists in game 4 alone.

Not only are you the worst analysis either. Not only do you lie. You duck the conversation when the Hawks win.

Young shot 31% from the field, and literally breathed a sigh of relief after the Sixers missed the last 3, in Atlanta. Hardly the stuff one would label inspiring. Unless you like to watch “hero ball” which you obviously do.

You are such a two faced little lying [edited MDC]. Your original criticism was he never passed the ball. Now you move the goal posts? Give me a break. You are an idiot.

@ pgl

That criticism of not distributing the ball enough also stands. One game doesn’t clear someone of generally selfish play. Or did your hero Stephen “Keep the Wifey Quiet” Smith teach you one game of high assists means you’re an all-pro point guard??

It is worth noting though when Trae Young passes the ball it increases his team’s chance of winning, which the Monday game 3-point win verifies.

“Unless you like to watch “hero ball” which you obviously do.”

I just listened to Glenn Doc Rivers explain why his team lost. Doc knows more basketball than you could ever imagine and he did use the term hero basketball to refer to the 76ers. He also credited with how the Hawks outplayed his team. Yea – Doc knows basketball. You on the other hand know how to be a complete a$$ 24/7. Last word with you on this topic as you have always been a complete waste of time.

@ pgl

I might add, when someone makes legit sports points, and the other person doesn’t like those legit points so yells out “You are the KKK!!!”, people tend to lose interest in argumentation or even discourse with such a person. Maybe you can debate this with your Governor Andrew Cuomo, the man who hides death counts of the elderly and you labeled “our nation’s leader on Covid-19 response”. If he’s not too busy molesting his office staff today. Or perhaps Stephen A. Smith can give you pointers on “how to keep the wifey quiet”. This is the “sports expertise” you prefer apparently. These two are better at being politically correct in your eyes than I am, and I apologize for not meeting your/their standard.

Next time I see a sports commentator comparing two similar style players, playing the same position on the basketball court who happen to be Black (which 75% of the NBA is) I’ll remember to yell out “You are the KKK!!!!”. I learn so much from you pgl, but I am afraid what new things you will “discover” about me on any occasion I have the temerity to present a view different from yours.

Now if you ever made an actual point during your incessant and contradictory babble – I’d fall out of my chair. I’m done discussing basketball with you as you are beyond clueless.

@ pgl

You “got me” on that one. Only you and your hero Stephen “Keep the Wifey Quiet” Smith should be allowed to discuss these things. Especially when comparing two coincidentally Black players, playing the same position, of similar body build, of similar season stats, similar playing style, in a sports league composed of 75% Black athletes. Then, ONLY the local gym guy pgl may be allowed to discuss basketball.

We get you pgl. We totally get you. Someday pgl, maybe you can turn the entire world’s human population into small terracotta figurines and pontificate to the figurines from on-high~~~your lifelong dream finally become true. Your utopian model of the exchange of views decisively secured.

“Especially when comparing two coincidentally Black players, playing the same position, of similar body build”

One more time pointless little liar. It was you that said Trae Young = Russell Westbrook. Which is when I declared you to be a stupid racist. And yea I did note Stephen A. apologized for going over board. You go overboard all the time and never apologize. So hate Stephen A. but he clearly is a better person than you are.

So keep chirping your BS as you do not even realize you are calling out yourself. The sheer definition of stupidity.

“UK extending their lockdown to July 19th—related to “Delta” version. I also read that some respected people are predicting a “resurgence” of the virus in the 5 American states which have been the worst on getting citizens to take the vaccine.”

These are two completely different aspects of the issue:

1) The Delta variant is more infectious than the others, it will become the new wildtype, it is trivial that it will hit parts of the population that are not vaccinated.

2) The issue in UK is that even with a high vaccination level, esp. for the typical risc groups, the number of infected people increases exponentially. High infection levels in young population may not be an issue per se, however, some experts fear many thousand deaths during summer this may indicate that vaccination is not that good, the situaion is a little bit unclear for me. Checking hospital admissions and daily deaths the next three weeks may be a good idea. Hopefully we get hard data.

I just wasted 20 minutes watching that discussion by Tim Congdon. First of all this dude is beyond arrogant. We were right – the Federal Reserve has no clue. But right about what? This dude is fast and loose with even the numbers he cherry picks. Let’s see. M3 growth is 26% and inflation is less than 5%. That is his evidence for his crack pot Quantity Theory???

I guess there is one benefit from watching this arrogant nut case. It is a great preview for the next appearance on Fox and Friends by their chief economist Princeton Steve!

If my calculations are correct, this implies the GDP deflator will grow at 26.6% (annual rate) through 2022Q4. Over the 2000-2021Q1 period, the CPI has grown about 31% faster than the GDP deflator, so that suggests a CPI inflation rate of about 34.5% for the next 1.5 to 2 years.

Wow!

Good post. This is what good macro analysis should be all about.

It might be worthwhile to comment on how and when the Fed might react to these sorts of numbers.

I thought you might appreciate this monetarist whack job. Yea I watched the 20 minute presentation from this arrogant know nothing who put together some of the most meaningless garbage ever – thinking the whole time that this is the kind of BS presentation you are known for.

But let me make this really simple even for a know nothing like you. The Quantity Theory is based on the twin assumptions that velocity is constant and real GDP grows at a steady rate not affected by aggregate demand. The latter assumption is definitely questionable but just try graphing velocity = GDP/M3 and tell us that this is a stable constant. Seriously – Princeton Stevie boy knows less about macroeconomics than he knows about basic finance.

I was quoting Menzie, whom I do not consider a ‘monetarist whack job’.

Steven Kopits: I do hope you understand that the calculations I am talking about pertain to using Castaneda and Congdon numbers. I personally think the logic of their analysis is confused, as indicated in the post linked to at the very end of the post.

I have no problem with that. But then I would expect the section might read something like:

“If my calculations are correct, this implies the GDP deflator will grow at 26.6% (annual rate) through 2022Q4. Over the 2000-2021Q1 period, the CPI has grown about 31% faster than the GDP deflator, so that suggests a CPI inflation rate of about 34.5% for the next 1.5 to 2 years. Of course, this is unlikely to happen because, as you can see on the graph, something, something, M2 M3 slowing velocity of money diversion from GDP to assets something something…” The section needs some kind of narrative of why your own calculation is wrong with some associated projection of inflation rates based upon your analysis. If your view is that inflation will remain below 4% on average for the next two years, well, ok, make the case, show us the mechanics.

Instead, your sentence to me reads like pure CYA, like a guy who looked at the numbers and thought, “That’s a lot of liquidity! Maybe I need to go on the record suggesting it could cause real inflation in the medium term.” That’s how it reads to me. But I would welcome a post with a title like, “Why the Inflation rate will stay below 4% through 2022”

Steven Kopits: I think I’ve noted my views on likely inflation numerous times, so that those who pay attention know what I think about the Quantity Theory (as indicated in the post linked to at the very end of the post), and this post. If you read the addendum, you have additional information on why I am skeptical of the calculations – i.e., M3 velocity is not apparently trend stationary.

So you think inflation is not going over 4%. Is that right?

Like I said – your reading comprehension skills are lacking.

“But then I would expect the section might read something like”

Princeton Steve lecturing our host on how to write??? Pretty amusing since Princeton Steve never learned how to read!

You know Stevie – your reading comprehension skills are dreadful so permit me to pluck this key line:

“assume V (velocity) is mean reverting”

Now anyone who has plotted GDP/M3 or GDP/M2 over time knows that this assumption is beyond absurd. In a word, our host was mocking this monetarist nut job. And you thought he was praising this fool’s forecasting model??? Damn – the stupidity burns!

https://fred.stlouisfed.org/graph/?g=mttP

January 30, 2018

Producer Commodities Price Index, 2007-2021

(Percent change)

ttps://fred.stlouisfed.org/graph/?g=zYej

January 30, 2018

Producer Commodities Price Index, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=EEyN

January 30, 2018

Global Price Index of All Commodities and Industrial Materials, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=EL6Z

January 15, 2018

Global prices of Industrial and Agricultural Raw Materials, 2017-2021

(Indexed to 2017)

https://cepr.net/william-cohan-predicts-disaster-from-low-interest-rates-yes-we-have-seen-this-movie-before/

June 15, 2021

William Cohan Predicts Disaster from Low Interest Rates: Yes, We Have Seen This Movie Before

By Dean Baker

In a New York Times column * today, William Cohan, a writer and former investment banker, warned of impending disaster if the Federal Reserve Board does not quickly move away from its low interest rate policy. Cohan tells readers:

“But many people wonder if Jerome Powell, the chairman of the Fed, has reckoned with the power of the easy-money monster the central bank spawned all those years ago. They worry that Mr. Powell has helped inflate bubbles in housing, lumber, copper, Bitcoin and stocks, bonds and other assets. The evidence is mounting: The Consumer Price Index, a gauge of inflation, rose 5 percent in May from a severely depressed number a year earlier — the fastest rate in nearly 13 years. And that’s just one worrisome indicator.”

The piece goes on to warn of all the horrible things to come if Powell does not soon start to raise interest rates. The basic story is that we have bubbles in many markets that will collapse, costing investors in these bubbles hundreds of billions, or even trillions, of dollars. [It is worth noting that lumber prices have been plummeting in the last few weeks.]

If this sounds familiar, that might be because Mr. Cohan had a very similar column ** in the NYT a couple of years ago. In August of 2019, Cohan warned that “only the Fed can save us now,” and urged Fed Chair Jerome Powell to stand up to Trump and raise interest rates. The piece begins:

“Here’s the moment I realized the next financial crisis is inevitable.”

We find out that this was the moment when he realized when he was listening to a speech where Powell indicated that he had no plans to raise interest rates.

Later Cohan explains:

“But although a sense of euphoria spread through the room, as well as through debt and equity markets, I was overcome by a sense of dread. A decade of historically low interest rates has begun to warp our economy. As we learned to our collective horror during the 2008 financial crisis, a period of sustained low interest rates forces investors on a desperate search for higher yields, inflating asset prices and the risks of owning loans and debt of all kinds.”

To be clear, there are undoubtedly many bubbles in the U.S. economy right now. Bitcoin is the most obvious example, but we also have the proliferation of non-fungible tokens, as well as many stock prices that bear no relationship to plausible estimates of future earnings.

But none of this sets the stage for a 2008-09 disaster. In the years leading up to the Great Recession the housing bubble was driving the economy. This was easy to see for anyone who bothered to look at the GDP data the Commerce Department publishes every quarter. Residential construction had increased from its normal rate, which is around 3.5 percent of GDP, to a peak of 6.8 percent of GDP. Similarly, soaring house prices led to a consumption boom, as people spent based on the bubble created equity in their home.

Then the bubble collapsed, and housing construction fell to less than 2.0 percent of GDP due to overbuilding during the bubble. There was nothing to replace the loss of 4.8 percentage points of GDP of annual demand (more than $1 trillion in today’s economy). Similarly, the bubble driven consumption boom collapsed, costing us another 3-4 percentage points in demand.

This was the story of the Great Recession. The financial crisis was just the market working its magic on the banks and other financial institutions that had been reckless in issuing and marketing loans.

If we were to see a similar collapse in asset prices today it would have no comparable impact on the real economy….

* https://www.nytimes.com/2021/06/15/opinion/infaltion-federal-reserve-powell-biden.html

** https://www.nytimes.com/2019/08/31/opinion/sunday/trump-fed-recession.html

“In a New York Times column * today, William Cohan, a writer and former investment banker”

I could mean and suggest to Dean not to waste his time with the uninformed nonsense from an investment banker but the NYTimes did run this nut job piece by Cohan. Hey Cohan’s rant is a lot like the intellectual garbage from Princeton Chicken Little Steve. If the NYTimes wants to go even lower than Fox and Friends, I’m sure Stevie will write a column for them.

“To be clear, there are undoubtedly many bubbles in the U.S. economy right now. Bitcoin is the most obvious example, but we also have the proliferation of non-fungible tokens, as well as many stock prices that bear no relationship to plausible estimates of future earnings.

Gee the busting of the Bitcoin bubble! This is not going to have any material impact on the US economy. Dean did note that the collapse of the housing market back in 2008 had a large impact but he is not stupid enough to claim we have a housing bubble now. No only the chief economist for Fox and Friends (Princeton Steve) is stupid enough to beat that drum.

https://fred.stlouisfed.org/graph/?g=E4pc

January 15, 2018

Monetary Base, M2 Money Stock and Consumer Price Index, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=wo3b

January 15, 2018

Monetary Base, M2 Money Stock and Gross Domestic Product, 2007-2021

(Indexed to 2007)

https://fred.stlouisfed.org/graph/?g=BkzA

February 25, 2015

Velocity of M2 money stock, * 1960-2014

* http://krugman.blogs.nytimes.com/2015/02/25/monetarism-in-winter/

The velocity of M2 — the ratio of nominal Gross Domestic Product to a broadly defined version of the money supply — has turned out to be hugely variable.

Paul Krugman

https://fred.stlouisfed.org/graph/?g=E1g5

January 15, 2018

Velocity of M2 Money Stock, 1960-2021

This is even more variable than oil prices. Oh wait – Princeton Steve is convinced that oil prices will soon hit $100 a barrel. And of course he is now a dedicated believer in this defunct Quantity Theory. Which is why Princeton Steve has been banned from the campus of Princeton University!

It seems there are some wrong interpretations… if money supply measures were to *continue* to grow at recent unprecedented rates, the US should expect unwanted inflation. However, I don’t think most economists believe this to be the case (and the data thus far supports this as the uptick in M2 growth experienced at the start of the pandemic has since abated https://fred.stlouisfed.org/graph/fredgraph.png?g=ELsS) . Inflation expectations also support this. We shouldn’t forget that the monetary lags are long and monetary lags are variable. We must also point out that financial frameworks have evolved since the simple Monetarist framework was constructed.

#MiltonIsMyHomeboy

Long and variable lags? I bet your most recent economic text was written when JFK was President.

JFK? Here’s Econbrowser’s own Jim Hamilton just over a decade ago:

“Given a longer time frame (and I think 12 months is still too short), I believe a target average for the nominal growth rate becomes more credible. But that’s because I believe in long and variable lags, with much that can happen that is beyond the Fed’s control that matters for output and prices. The Fed influences, but does not control, nominal GDP growth.“

https://www.cato-unbound.org/2009/09/28/james-d-hamilton/yes-lags-are-long-variable

“The Fed influences, but does not control, nominal GDP growth.“

Credit to Dr. Hamilton for rejecting the stupid Quantity Theory that you want to endorse. Or do you have an [edited MDC] clue what any of these discussions are even about? Didn’t think so!

So you concede long and variable lags. I guess that is settled.

You’re obviously either confused or ignorant.

First… Friedman himself did not believe that monetary policy is the sole factor in determining output (see, e.g. page three of this note from Friedman to Mark Thoma https://economistsview.typepad.com/economistsview/2009/07/milton-friedmans-letter-i-do-believe-there-is-gold-in-them-there-hills.html) and I’m not sure even the strongest proponents of nominal income targeting would think such but I suppose it’s possible.

Second… the equation of exchange (MV=PY) is not the same thing as QTM (maybe YOUR textbooks are one of the ones that erroneously suggests this). The former is a tautology and the latter a theory with varied descriptions about the relationship between monetary aggregates and prices. However, Hamilton’s above response was to the suggestion of NGDP targeting as a potential approach to the Fed’s policy framework. And, irrespective of his views on QTM, the quote above is not suggestive of JDH’s views on QTM.

“the equation of exchange (MV=PY) is not the same thing as QTM (maybe YOUR textbooks are one of the ones that erroneously suggests this). The former is a tautology and the latter a theory with varied descriptions about the relationship between monetary aggregates and prices.”

A discredited theory that has underlying assumptions that would make even Robert Lucas fall on the floor laughing. But I can only imagine someone who cuts and pastes stuff he does not comprehend has no clue what microfoundations even are.

“So you concede long and variable lags.”

I never disputed that. But if you think this is the same thing as velocity being constant – then you really are dumb. Of course your inability to write coherently may be based in your total lack of understanding of basic economics.

Okay, you didn’t “dispute it” you just made a snide remark basically insinuating it’s not up to date. Tomato vs tomato?

Of course you’re suggesting things ive never stated re: velocity. Of course your inability to understand words on a screen may be based in your total lack of understanding of basic reading comprehension. Put away your clown nose.

“EConned

June 16, 2021 at 6:39 am

You’re obviously either confused or ignorant.

First… Friedman himself did not believe that monetary policy is the sole factor in determining output”

Stop the presses. Econned finally figured out something I have noted all my life. I’m not the idiot who is endorsing MV = PQ and conflating it with other things Dr. Friedman wrote.

You strike me as being more confused that those characters in One Flew over the Cuckoo’s Nest. Get back to us when you make your mind what you are trying to say. Not that you’d ever be capable of writing it coherently.

Better tell Rich Clarida, vice chair of the Federal Reserve Board and long-time leading scholar of monetary policy that he shouldn’t be stuck in the 60’s and be more careful with words in his capacity as a representative of the Board…

“First, because of Friedman’s long and variable lags, monetary policy should be—and, at the Fed, is—forward looking. Policy decisions made today will have no effect on today’s inflation or unemployment rates, so good policy needs to assess where the economic fundamentals are going tomorrow to calibrate appropriate policy today.”

https://www.federalreserve.gov/newsevents/speech/clarida20200221a.htm

Once again – long and variable lags is not the same thing as the proposition that velocity is constant. Come on man – if you are going to quote economists, first try to grasp what they are trying to say. Good luck with exams at WaLaLa U.

I never once insisted such. It seems that your clown nose is blocking your vision.

So Econned finally admits that his confused babble has nothing to do with this post. Got it!

pgl – you portray some of the worst attributes of internet commentators – needlessly argumentative, routinely fabricating baseless claims, and endless obfuscation.

Your commentary is very Trump-like with its broad generalizations not supported by evidence and a healthy mix of changing topic to fit your desires. I’m happy to engage if you comment respectfully about the topic but unless you prove you’re capable, I’ll happily ignore your comments.

EConned,

Apparently due to your still believing a version of the QTM that Milton Friedman himself stepped away from late in his life in the face of the evidence, you seem to have a problem reading.

Go look very carefully at what both Jim Hamilton and Richard Clarida wrote. They both accept that there are “long and variable lags in monetary policy.” What neither said was that there are long and variable lags from any measure of the money supply and nominal GDP.

Your problem is that monetary policy has not been about money supply since around the mid-1980s when the stability of V for most measures of the money supply broke down. It has been all about interest rates: see even the Taylor Rule. Indeed, it has generally been about interest rates except for a brief period from the late 70s to the mid 80s frankly.

So, when Hamilton and Clarida talk about long and variable lags from monetary policy on the nominal GDP, they are talking about the Fed’s interest rate (and some other) policies on that, not what is going on with any measure of the money supply.

Barkley Rosser,

Your first paragraph is flatly false and was made totally without merit, so it seems maybe it is you who has a problem reading.

Your second paragraph is merely restating what I’ve already stated (so maybe we can also chalk this up to your reading problem) but also makes an incomplete assertion (see below).

Your third paragraph is asserting my “problem” which is a “problem” that does not in fact exist for me (see, e.g., your reading problem mentioned previously). However, (and at the very minimum up until relatively recent changes to the FOMC’s framework IOR, ON RRP, etc) you must acknowledge there was a relationship with the fed funds target and monetary aggregates so your “mid-1980s” and “all about interest rates” is a tad disingenuous frankly. Even a freshman Macro101 student knows that for decades the committee used OMO’s to impact their target rate.

Your fourth paragraph is again ignoring that the CB’s actions do impact monetary aggregates even if it is not their target. As reiterated from above (because of your reading problem I’m hopeful a2nd time is the charm), the central bank’s actions impact interest rates and monetary aggregates and do so with lags.

Oh dear, EConned, you are almost worse than someone else here. Not a single thing in this comment of yours holds up.

So, first paragraph: Milton Friedman never overtly rejected his own monetarism, but late in his life he switched to supporting inflation targeting. Now if one is a hard core monetarist this means continuing with the earlier hard core Friedman argument that central banks should target rates of growth of this or that monetary growth measure. But it was clear that when he came out in about 2007 (just before the Great Recession) that central banks should “target inflation” he was accepting what most of them were doing anyway by that time and had for decades already, although they were doing doing so by manipulating interest rates, if not always by following Taylor rules, but for sure none of them had been doing so by paying much attention to this or that money supply measure. MF had quietly caved.

Regarding the second paragraph you are lying. We already have a worthless disgusting liar on this blog who should be thrown the h out. Now you are joining him. No, “EConned,” conman, neither Hamilton nor Clarida repeated Friedman’s argument that the long and variable lags had to do with measures of the money supply doing so with respect to nominal GDP as you claimed. They clearly said it involved “monetary policy,” which, as I noted, has since the mid-1980s focused on interest rates, not monetary aggregates. Do you wish to contest this? Read what they said. Neither ever says a word about money supply. It is all about monetary policy. You are just lying here outright.

Your comment on my third paragraph, besides being simply wrong: Fed and others have focused on interest rates and not any measure of M since the mid-80s, is simply incoherent. You throw around bizarre acronyms in your attempt to disprove this clear fact. Oh, “IOR, ON, RRP,” not to mention the apparently super important “OMO” all brought about a policy that focused on “M” rather than interest rates? Sorry, but no; this sort of stuff is just delusional, almost as bad as a super frequent commentator here on his worst days puts here.

At least in your comment on my fourth paragraph you sort of recognize that indeed the Fed (and all other central banks) do not target any measure of the money supply, while claiming that what they do still influences those measures over long and variable time lags. So what? Since those measures now have no relation to nominal GDP given the collapse long ago of the stability of any measure of V, it is not surprising that they pay no attention to those measures and focus instead on interest rates, as they have since the mid-80s in the case of the Fed, and for good reason.

Now remember he declared:

“’m happy to engage if you comment respectfully”

Seriously? This arrogant troll. What a load of BS.

Econned must be a lawyer given his argumentative reply to your sensible comment. But he did not address either:

(1) the empirical observation that velocity is far from a constant

(2) QTM is a defense of a silly ratio but fails to address what behavior lies behind it

But what do you expect from someone too stupid and yet too arrogant to even concede that some FRED graph he popped up did not tell the reader whether it represents a percent change per year v. per month. How lame is that?

Barkley Rosser- you are continually and grossly misrepresenting my comments in every single statement that you’ve made and you have the audacity to assert “We already have a worthless disgusting liar on this blog who should be thrown the h out. Now you are joining him.” This is a flat-out misrepresentation of my comment. While I’m glad that you use your real name, I’m appalled that someone with your background is so awful at reading comprehension. You should seriously be ashamed of yourself and consider a complete reassessment of how you approach discussing.

HahahahahahhaahHah. I can’t not reply to this pgl individual who obviously has zero clue how FRED works. It’s hilarious. They comment

“But what do you expect from someone too stupid and yet too arrogant to even concede that some FRED graph he popped up did not tell the reader whether it represents a percent change per year v. per month. How lame is that?”

Anyone who works with this data knows that FRED graphs will properly display if a monthly series “represents a percent change per year v. per month.” THAT’S lame!!! You’re probably the only person who saw that graph and didn’t know what it represented. Put away your clown nose and bozo shoes, you’ve embarrassed yourself far too many times commenting you clown.

“EConned

June 17, 2021 at 11:57 am

Barkley Rosser- you are continually and grossly misrepresenting my comments in every single statement that you’ve made”

Poor little Econned. He pulls this garbage all the time. Of course his inability to communicate clearly may be part of the problem but this arrogant little troll thinks he does not need to communicate to us clearly.

“Anyone who works with this data knows that FRED graphs”

Well computer programs do what computer programs do. It is up to the person using the computer program to go the extra step. But we see Econned is too incompetent to edit and provide a useful label for his readers. Of course the utter disdain he has for everyone else equates to this arrogant troll thinking he is too important to do so.

You know Econned – in the real world, you will lost and eventually unemployed. Fine by me even though we will have to support your incompetent arrogance living off the government dole.

pgl – first, you didn’t quote my entire comment

second, you are flat wrong. Just admit it that you don’t understand how FRED works. It labels the data and does so properly. Anyone who works with FRED knows this.

“the uptick in M2 growth experienced at the start of the pandemic has since abated”

People looking at your FRED graph might get the wrong idea that M2 has been growing at a mere 1.25% per annum over the last 6 months. But your poorly labeled graph misleads. The average increase per month is 1.25%. Annualize that and one gets a very different picture. Of course I’m not the kind of brain dead monetarist that you likely are. But one thing is clear – you need to take basic lessons in graphing economic data.

Only brain-dead innumerate Econbrowser commenters who can’t read a graph would assume the things you suggest. Go talk to Carlos Garriga if you don’t like the graph.

I can read your graph which is why I knew it was so poorly labeled that one need to go back to the source data.

Come on dude – you need to up your game if you plan to get an undergrad degree from WaLaLa U.

It’s clearly labeled to anyone with fully functioning eyeballs and there’s absolutely no need to go to the source data. Stop clowning around.

I can too read graphs. Nyaaa!!!! Nyaaa!!!

https://www.propublica.org/article/national-debt-trump

“Federal debt held by the public as a percentage of gross domestic product since 1900.”

Now that is a clear labeling – some Econned is incapable of providing.

pgl – there’s nothing on the graph that is misrepresented. Not a single item. Instead of making baseless claims without being specific, please point out exactly what your issue is with how the graph is labeled.

“EConned

June 16, 2021 at 11:27 am

pgl – there’s nothing on the graph that is misrepresented.”

Is this troll the dumbest dork of all time? I did not say you misrepresented anything. I made very clear why your graph was poorly labeled. But if you are THAT stupid not to get my simple point – OK!

But it isn’t poorly labeled to anyone with an iota of experience with data. Again, “ Instead of making baseless claims without being specific, please point out exactly what your issue is with how the graph is labeled.”

“EConned

June 16, 2021 at 3:33 pm

But it isn’t poorly labeled to anyone with an iota of experience with data. Again, “ Instead of making baseless claims without being specific, please point out exactly what your issue is with how the graph is labeled.”

I was very clear. Growth per month v. growth per annum. I guess to a mental midget like you – this did not sink in. Arrogant, rude, and beyond stupid you are.

pgl – you’re just not understanding how FRED works.

I tried leading the horse to water but it looks as if I am going to have to dunk its dense head into it…

FRED data is labeled “percent change” if it is ((x(t)/x(t-1)) – 1)*100 and this is proper

FRED data is labeled “percent change from a year ago” if it yoy change and this is proper

What on this or any other planet is so difficult for you to understand about this??? FRED does the calcs and the labeling. It does so properly and there’s nothing that you’ve said to suggest you have any clue about how data is represented in FRED nor about how data should be represented in general. Not that he’s the official arbitrator of data viz, but I guarantee you Menzie doesnt have a problem with how the graph that I posted was labeled.

Your water pistol flower lapel joke ran its course long ago.

EConned: Please don’t infer from my silence implicit approval. I understood the units on the graph by virtue of having dealt with the raw data myself in a statistical package. Had I graphed the data using EViews, I would’ve annualized the data, or selected the annualized option in FRED, in order to minimize confusion among those who are less familiar with the data. Obviously, what you showed is not *wrong*, per se.

Menzie,

I did not “infer from [your] silence implicit approval” (as an aside, the baseless assumptions on this blog are borderline mind blowing), I inferred implicit approval from your knowledge of data. And thanks for now explicitly affirming.

“Only brain-dead innumerate Econbrowser commenters”

This is your idea of having a respectful discussion? Lamest troll ever!

That was a reply to your starting the disrespect and I have no regrets.

Now you are blaming the St. Louis FED? They provide a great tool but it up to you to use it properly. But you don’t bother as of course we are all beneath you I guess. You are pathetic.

Hahahahhaha. Actually it’s you who is blaming the 8th district because when graphing a series FRED will accurately and automatically display the data as it is used – the tool labels series transformations and only someone without knowledge of how FRED works would make the outlandish claims that you have. Now, be gone… you’ve left your friends in the clown car waiting outside long enough.

I’m aware Alzheimers is a disease which causes an extreme amount of family suffering. But I’m wondering, when you do a short amount of research into the effects of a drug, and that drug “tinkers with” the processes of the brain, a pretty complicated and not totally understood organ of the human body, what is the “wisdom” of that?? It causes the brain to actually bleed. Does that sound intelligent??

Well…… Aducanumab causes bleeding of the brain, let’s give it to people in a vulnerable segment of the population, early on in the disease (because that is supposedly when the drug is most effective in achieving claimed results), and then “ask questions later”. Yeah, what could possibly go wrong??

http://www.xinhuanet.com/english/2021-06/15/c_1310008958.htm

June 15, 2021

Over 900 mln doses of COVID-19 vaccines administered in China

BEIJING — Over 900 million doses of COVID-19 vaccines have been administered in China as of Monday, the National Health Commission said on Tuesday.

The commission vowed to ensure a steady vaccine supply and continue to facilitate mass vaccination.

China announced on June 3 that it had administered more than 700 million doses of vaccines, and has since administered another 200 million doses in less than two weeks’ time.

@ ltr

Don’t you think it’s great that the people in Democratic Taiwan are getting a much more efficacious vaccine than the haphazard vaccine being forced on people in mainland China?? It must make Taiwanese people feel proud they have the right to VOTE for their leaders, and therefor get better quality leadership, and an actual efficacious vaccine that will save lives, instead of a fraudulent vaccine only aimed at protecting Beijing leaders’ reputations.

ltr, why don’t you move to Taiwan and have a happier life??? Maybe get a new job outside of the propaganda industry….. you know…. broaden your horizons a little.

This may be considered old news, but I think it’s interesting to look at these numbers from a New jersey primary. This was a REPUBLICAN primary. Hirsch Singh openly and vehemently supported donald trump’s claims of a “rigged” 2020 presidential election:

https://www.washingtonpost.com/elections/election-results/new-jersey/

My question, to a lot of very dumb Republican politicians out there is HOW LONG ARE YOU GOING TO VOLUNTARILY LOAN OUT POWER TO DONALD TRUMP, THAT HE DOESN’T EVEN HAVE???? I hope you keep doing it, because when donald trump splits the vote down the middle of your own party, as a Democrat I can tell you it’s going to be loads of fun watching your boat sink. So, PLEASE keep loaning out power to the orange creature he doesn’t even have. It’s great with cheddar flavored popcorn and Torani syrup flavored soda pop. I appreciate the future joy Republicans are delivering to my big screen TV.

The authors (Castaneda & Congdon) write: …we challenged the consensus view that Covid-19 would lead to a disinflationary process lasting for some years.

That was never the consensus view. They’re just making stuff up. The consensus view was always that there would be a spike in prices after the pandemic started to abate for exactly the same reasons that prices plunged as the pandemic took hold. The authors just created a strawman consensus. Intellectual dishonesty at its worst.

Outstanding point, and not one which could have been gleaned without reading the links beyond Menzie’s post. Darn you avid readers and your reserved observations.

Our judges deem this a 5-star comment.

And we are awaiting their triumphant declarations (in a year or two), that it was their musings today that prevented this hyperinflation from materializing.

A reader referred to the approval of a drug to treat Alzeheimer’s disease:

https://www.nytimes.com/2021/06/15/opinion/alzheimers-drug-aducanumab-fda.html

June 15, 2021

The F.D.A. Has Reached a New Low

By Aaron S. Kesselheim and Jerry Avorn

Aaron S. Kesselheim and Jerry Avorn are internists and professors of medicine at Harvard Medical School, where they direct the Program on Regulation, Therapeutics and Law at Brigham and Women’s Hospital.

https://cepr.net/patents-are-a-bad-way-to-fund-the-development-of-drugs-46541/

June 7, 2021

Patents Are a Bad Way to Fund the Development of Drugs #46,541

By Dean Baker

The New York Times reported * on the decision by the Food and Drug Administration to approve the drug aducanumab, as a treatment for Alzheimer’s disease….

* https://www.nytimes.com/2021/06/07/health/aduhelm-fda-alzheimers-drug.html

Pail Krugman setting the stage for the application of monetary policy by Fed led by Jerome Powell:

https://www.nytimes.com/2020/03/03/opinion/coronavirus-economy-interest-rates.html

March 3, 2020

Can the Fed and Friends Save the Economy?

On putting too much faith in central bankers.

By Paul Krugman

Markets were in a state of near panic, deeply worried about the economic outlook. But then the Federal Reserve stepped up: its chairman issued a statement strongly suggesting that he would cut interest rates. And the market experienced a huge relief rally.

No, I’m not talking about Monday’s big market bump. I’m talking about Dec. 5, 2000, in the middle of what we now remember as the bursting of the dot-com bubble….

For any Mike Konczal fans out there, he’s got an Opinion piece up at the New York Times. You can read it online right now if you have access past the NYT paywall, or you can be like me and pick up a hardcopy NYT tomorrow.

BTW, Konczal’s Opinion piece in NYT made me think of something. Although his blog might be labeled “inactive”, I think JW Mason’s blog has to be one of the most underrated economics blogs on the internet, and Mason is also kind enough to provide an RSS feed which many bloggers sadly no longer do. Of course being a tag-along pal of Konczal’s was all Mason had to do to prove he was awesome and intelligent to me.

http://jwmason.org/articles/

Anyone remember this guy?? Postmaster General Louis DeJoy. A real “winner” similar to our “beloved” Betsy “Bride of Satan” DeVos. DeJoy, you may recall, was trying to delay absentee votes and U.S. war veterans votes in the 2020 election to tilt the election towards donald trump (is this what trump was talking about when he mentioned “rigged”??~~trump just forgot to say it was rigged to favor trump).

https://www.washingtonpost.com/national-security/louis-dejoy-fbi-investigation/2021/06/03/4e24e122-c3d3-11eb-93f5-ee9558eecf4b_story.html

In a congressional hearing last year, DeJoy disputed he was trying to affect the vote.

“I am not engaged in sabotaging the election,” DeJoy said at the time. “We will do everything in our power and structure to deliver the ballots on time.”

The WaP story, authored by Matt Zapotosky and Jacob Bogage, goes on:

DeJoy has adamantly disputed that he broke the law. Asked at a hearing in August by Rep. Jim Cooper (D-Tenn.) if he had repaid executives for making donations to the Trump campaign, DeJoy responded: “That’s an outrageous claim, sir, and I resent it. . . . The answer is no.”

When The Post later published its report, Rep. Carolyn B. Maloney (D-N.Y.) said the House Committee on Oversight and Reform, which she chairs, would begin an inquiry and asserted DeJoy may have lied to the panel under oath.

and more…….

“A Post analysis of federal and state campaign finance records found a pattern of extensive donations by New Breed (DeJoy’s company) employees to Republican candidates, with the same amount often given by multiple people on the same day. Between 2000 and 2014, 124 individuals who worked for the company together gave more than $1 million to federal and state GOP candidates. Many had not previously made political donations, according to The Post’s analysis.

“He would ask employees to make contributions at the same time that he would say, ‘I’ll get it back to you down the road,’ ” one former employee, speaking on the condition of anonymity out of fear of retribution from DeJoy, told The Post last year. ”

So the orange creature had it right all along, 2020 was indeed rigged, the orange creature just forgot to mention who it was rigged for. I’m certain “sammy” “CoRev” “Ed Hanson” “Bruce Hall’, and “Princeton”Kopits all support THIS category of election rigging, so no Republicans will lose sleep over that.

https://news.cgtn.com/news/2021-06-16/China-to-launch-Shenzhou-12-spacecraft-carrying-3-astronauts-on-Thu–118idk88wqQ/index.html

June 16, 2021

China to launch Shenzhou-12 spacecraft Thursday carrying three astronauts

By Gao Yun and Wang Yizi

China will launch its Shenzhou-12 spacecraft, carrying astronauts Nie Haisheng, Liu Boming and Tang Hongbo at 9:22 a.m. on Thursday, the China Manned Space Engineering Office announced on Wednesday.

Currently at the launch pad at the Jiuquan Satellite Launch Center in northwest China, the Long March-2F Y12 rocket carrying the Shenzhou-12 spacecraft will be refueled with propellant this morning.

Nie will serve as the commander of the flight crew.

Three other astronauts, Zhai Zhigang, Wang Yaping and Ye Guangfu, make up the backup crew.

Read more: Here are the first astronauts set to live in China’s space station

The Shenzhou-12 flight mission is the first manned space mission to take place during the construction of China’s space station.

It has multiple tasks, including technology verification in such areas as astronauts’ long-term stay in orbit, space supply replenishment, extravehicular activities and operations, and in-orbit maintenance.

It will also test for the first time the search and rescue of astronauts at the Dongfeng landing site, carry out multidisciplinary space applications and experiments, and comprehensively assess the functions and performance of each system performing the mission to further examine their compatibility and coordination.

As scheduled, the Shenzhou-12 spaceship will, after orbital injection, conduct rendezvous and docking in fast automated mode on to the front port of the Tianhe core module to form a complex with the core module and the Tianzhou-2 cargo ship.

The astronauts will then move into the core module and start working and living with a synchronized work and rest arrangement between space and ground. After staying for about three months in orbit, they will return to the Dongfeng landing site onboard the re-entry capsule.

Currently, the complex of the Tianhe core module and Tianzhou-2 cargo ship is in stable condition with all equipment working normally and ready for rendezvous and docking of astronauts to move in.

“All the pre-launch preparations have also been basically completed,” said Ji Qiming, assistant to the director of the office.

9 flight missions ahead for space station construction

China has planned 11 missions to complete the construction of its space station by the end of 2022, namely three launches of space station modules, four cargo vessel flights, and four manned missions.

The recently launched Tianhe core module and the Tianzhou-2 cargo spacecraft have already formed a complex operating in orbit.

The upcoming Shenzhou-12 mission boasts four features, said Ji….

An old and very inside observation: at times M3 estimates by certain central banks have been confused, with different sections of those banks providing competing estimates of M3. I think this is a problem not resolved, although I agree with most here that these measures are not really all that important.

[The central bank in question was that of Saudi Arabia, some time ago.]