If demand is so high, why are real rates so low (even admitting Fed QE, forward guidance, etc.)?

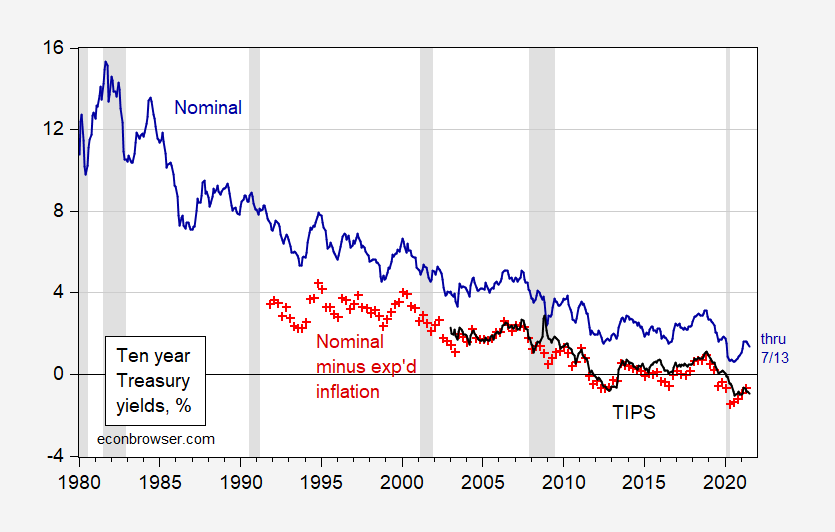

Figure 1: Ten year Treasury yield, % (blue), ten year TIPS yield (black), ten year yield minus ten year expected CPI inflation (median) (red +), all monthly averages of daily data, %. July 2021 observation is average of daily date through 7/13. NBER defined recession dates shaded gray, except for last recession assuming trough at April. Source: Federal Reserve via FRED, Survey of Professional Forecasters/Philadelphia Fed, NBER, and author’s calculations.

As of today, the TIPS ten year yield is -0.94%.

https://fred.stlouisfed.org/series/DFII10econ

This real rate has been negative 1% or so for the last 12 months. Of course we know Trump left Biden a horrific macroeconomy and we also know McConnell wants to keep it that way.

Still holding out hope for a drop in oil/gas before the end of August. I have roughly 80% confidence this is going to happen. Honestly for me and my small circle, that’s the only thing that’s annoying me inflation wise. And actually not even that other than the principle of the thing that I believe we are overpaying on a true demand supply basis. i.e. I think there is something here distorting the “market” price of oil and gas too high. Admittedly I don’t know what that is, but I do feel this strongly, and my best guess is it has something to do with speculators/traders. I think, as I have said before here, that if you overlay the gasoline graph on top of the oil graph for the last 6 months, it supports this idea. And if others reading this blog have ideas on why those numbers would criss-cross one another, I’m very happy to listen to your thoughts.

Natural gas seems too high as well. There seems to be a distortion in that market as well. Not sure of the cause.

Moses,

OPEC still exists and has actually been successfully imposing quotas on its members as well as maintaining something of a deal with non-OPEC membet Russia, not to mention that somehow the US and Iran have yet to get the JCPOA deal back in place so that Iran’s exports are about one tenth of what they were before Trump pulled the US out of the deal and reimposed sanctions.

I don’t think this is the base cause of the overly high prices for oil or gas (it’s actually worse for gas if you’re looking after roughly January 2021). Although I am sure there are many people who would agree with you. I think a lot of this will get back to if UAE actually plans on boosting supply or if they are mostly bluffing. At some point the temptation gets too high. Iran can’t do much about their situation in the short-term, but others will start to desire increasing supply. I suspect it will be either Russia or UAE that bails first. With more and more cars moving away from fossil fuel, they have a limited window for making money. The more they ask for now, the more they encourage the transfer over to the newer energy sources.

Moses,

When you talk about “gas” I am not sure if you are talking about natural gas or gasoline. I have no comment on natural gas, just not following it.

On gasoline, I think a more likely reason for a pop in the gradual rise of crude oil prices, which I think does explain rising gasoline prices largely, would be US production picking up noticeably, which it has been slow to do, or a big return by Iran. I think big spikes of production out of UAE or Russia not all that likely.

Steven probably right we shall see further in creases in both crude oil and retail gasoline prices, although I think there is probably more of an upside bound than he does, and a greater chance they could go down some time later this year (probably not a crash). But if US production does pick up more and the US and Iran fail to get back into their deal, a gradual upside push looks likely for some time to come.

In last sentence, if US production does NOT pick up more….

It’s always a special pleasure (however commonplace or customary) making Barkley Junior look like an A$$-hat.

Junior says: “I think big spikes of production out of UAE or Russia not all that likely.”

https://www.reuters.com/world/middle-east/oil-prices-extend-losses-investors-brace-more-supplies-2021-07-15/

From the Laila Kearney authored Reuters story:

“Brent crude settled at $73.47 a barrel, dropping $1.29, or 1.7%. U.S. West Texas Intermediate (WTI) crude settled at $71.65 a barrel, down $1.48, or 2.2%. The slide continued Wednesday’s losses, after Reuters reported that Saudi Arabia and the United Arab Emirates had reached an accord that should pave the way for a deal to supply more crude to a tight oil market. A deal has yet to be solidified, and the UAE energy ministry said deliberations are continuing.”

Moses Herzog: Nice application of concept of “news”, but price moves could reverse if the rumor proves untrue, or spike does not ever appear…

@ Menzie

While your comment is fair enough, I don’t think Reuters exactly indulges in rumors, nor (outside of the editorial section) does the WSJ generally. BOTH news organizations have reported this has been in the works for awhile now. i.e. the signatures may not have been made to the agreements, but there is strong reason to believe there will be.

And I’ll tell you something~~UAE is full of a lot of arrogant leaders. Men who are basically used to and accustomed to having their way on nearly everything. They don’t mean for it to be out in the public sphere they want supply raised and then back down like sheep. I think I know enough about human nature in my middle aged years, I can say that.

I kind of was under the impression anyway that you held Reuters news copy as a little higher than Breitbart News Menzie. Have you got “breaking news” for me that you felt them as one and the same??

Moses Herzog: Agreements fall apart all the time. OPEC has come to agreements before and things have fallen apart. In fact, in general, there is “cheating” in the cartel, insofar as OPEC really works as Saudi Arabia working as swing producer…

Well, to the extent there is a “spike” it is not due to the UAE. Its production is now up 40,000 bpd, which is a smidgeon. The news, which I did not forecast and I think few are really picking up on, is that the main source of increase is Saudi Arabia, with its production up by ten times as much as UAE’s is. Yes, an extra 400,000 bpd does make a difference, and no, i did not foresee that one. But then Moses did not either. It is a total surprise.

BTW, since Moses is so keen on showing me to be an A$$, I shall grant him being right on something else. It now looks that indeed Iran is not going to reenter negotiations on the JCPOA with the US until after Raisi becomes president next month. It seems the two sides have agreed on the basic timeline of getting back into the agreement. What is holding back agreement is nonsense positions being taken by each side.

In any case, this means Iran less likely to be providing extra production any time soon, although it seems that KSA has stepped in unexpectedly to be the one increasing production the most, thus pulling crude oil prices down a bit (a decline that has now halted, btw).

@ Menzie

All of the following is said with due respect to someone whom I am well aware is my intellectual superior

You know I am not the argumentative type Menzie [ Imagines Menzie nearly falling to the floor trying to contain his own laughter ] but……. let’s say you’re right (I think you ARE right here in the general sense) and negotiations have a 50/50 chance to “fall apart” or indeed are broken. For the record, I think the deal will be made, UAE will get their way on increased supply. You would at least agree with me that if they are broken and/or deals aren’t made that heavily weighs towards more supply, not less. And that if ANY OPEC players cheat here, again nearly ensures more supply not less, that UAE is apt to increase the amount they put out on world markets. This in fact is probably the only reason a juggernaut like Saudi Arabia entertains UAE negotiations to begin with. because they know having them under the Kumbaya tent of OPEC is more useful to them then having them dictate their own supply level. i.e. If anyone cheats or breaks THIS (as of yet unmade) agreement that:

A) supply will inevitably increase whether the deal is signed or not.

B) If ANY country cheats on supply levels, UAE will surely as H*LL cheat on the supply (increasing it,) as well.

Barkley Rosser: “BTW, since Moses is so keen on showing me to be an A$$, I shall grant him being right on something else. It now looks that indeed Iran is not going to reenter negotiations on the JCPOA with the US until after Raisi becomes president next month.”

Moses Herzog: [ Fainted 5 minutes ago, drooling on old carpet, with NYT copy ink from newspapers strewn all across the floor smearing his face. ]

I would add here, given that it seems that most observers, including Steven Kopits (although he has noted here the extra capacity amounts OPEC members have and noted the possibility of them increasing output in some pattern as prices rise) ,have not foreseen that it would be Saudi Arabia that would be the one increasing production in a way to halt the rise in prices that had been going on, UAE an essentially irrelevant player despite the headlines, that the upper limit on prices looks much more serious. A $100 price now really would depend on some extraordinary development in a major producer, such as the Houthis succeeding in seriously damaging a major portion of the Saudi production facilities and shutting them down. This is not out of the question as fully a third of Saudi production comes from one field, al Ghawar, long by far the largest conventional pool of oil in the world. I doubt the Houthis could completely shut it down, as there are two separate major sites producing from that pool. But shutting down one of those could suddenly cut production by over a million bpd, which would be sufficient to generate a sudden spike in oil prices, with the Houthis having hit some important parts of the Saudi production facilities in the past.

Regarding Saudi strategy, they may well have decided that a price about where it is now, in the $70-80 range per barrel is just fine with them. With this increased production, they are probably making a sufficient amount of money at current prices to achieve their internal budgetary goals, after some of the belt tightening that they have done (and maybe they might go back to their efforts to raise money by partially re-privatizing ARAMCO if they need more). But the underlying motive might well be the longer run one suggested by Moses, although he did not follow through on this to forecast this Saudi production increase. But for a long time, going all the way back to 1979 actually, the Saudis have been more than any other OPEC member looking at not wanting the price of oil to get too high out of fear of stimulating oil importers to accelerate moves to get off using oil in various ways, something that has indeed been going on since at least 1979,, when they increased production to slow the massive price rise that followed the collapse of oil production in Iran during the Islamic revolution there then..

The question arises as to why did they allow the price to be above $100 per barrel a decade ago for an extended period of time, while now it looks that perhaps they have resumed their older role of restraining price increases, especially to that level that they allowed to be in place for a several year period? One is clearly the heightened push to develop electric cars in many countries, notably with the dramatic development and expansion of Tesla, but also such moves in China as well. The other is probably also due to the increased shale production capability in the US due to fracking, with the Saudis wanting to keep US production in line and aware that a price too much above $70 per barrel seems to lead to increased US production, even if that increase has been slow to appear now. There have in fact been hints in the last week or so of some increases in US production beginning to happen finally. So the Saudis may be acting to cut off or delay both of those developments.

If they are serious about this, then it will be highly unlikely that we shall even see an $80 per barrel price, as Goldman Sachs had been forecasting, unless, again, there is some extraordinary sudden reduction of production in one of the leading producers, which can still happen. We still have nearly half a year left in 2021, plenty of time for the unexpected to occur.

Actually we should keep in mind that there is someone lurking about here who is a bigger expert on this than either Steven Kopits or me, much less Menzie. That is Jim Hamilton. But he has clearly lain low on all this, and he has tended mote to comment on the impact of oil price changes on macroeconomies than on forecasting what is happening with oil prices themselves, per se, which is a difficult business.

To Moses, the sooner you realize that this is not at all about the UAE, except for a lot of misleading headlines, the better. The actor who has moved to change the price situation is the one none of us called and most continue to fail to realize is the key one here, Saudi Arabia. UAE’s 40,000 bpd increase is a drop in the bucket, essentially irrelevant and arguably just a cover for the Saudis to make their move.

Upon thinking about it, the last time I have seen Jim H. really get into the weeds here on global oil production, not even on prices per se, was quite a long time ago. It was the last time there was a frenzy over whether or not we were reaching “peak oil” production. He very carefully assessed that issue, which proved to be overblown. But that was really quite some time ago, and he has stayed away from those kinds of issues here in any substantial way since then and has avoided commenting on this matter at all during these more recent relatively undramatic events in the oil markets.

After all, also to keep peoples’ thoughts in perspective, even a jump to $100 per barrel before the end of the year would be insufficient to trigger the kinds of negative impacts Jim has long studied arising from high oil prices on macroeconomies around the world. Again, we had such prices for nearly a half decade a full decade ago, and we did not get the sorts of stagflationary outcomes that happened in the 1970s. There is no reason to believe such a jump now would trigger such outcomes if they did not do so back then.

This long thread is clearly coming to its end, but I shall add a few more items on this oil price matter.

One is that I think the Russians also view $70 per barrel as a not-too-bad price. Most reports have it that this is high enough for Putin not to be facing super internal budget pressure. But like the Saudis, they also have some concerns about overly high oil prices leading to substitution away from oil by importers, not to mention US production ramping up and cutting their market share.

I would also note for those who would like to follow oil markets more closely, a good site that not only reports daily changes in prices of various types of crude and other things, but at any moment has five links to related stories that can be very informative. The site is https://oilprice.com .

Oh, and one more comment.

I also do not rule out a collapse to $0 per barrel. What would lead to that? A major collapse of aggregarte demand. What could cause that? Appearance of a new variant of Clovid-19 that cannot be stopped by existing vaccines, which could trigger a return to massive lockdowns all over. Hopefully this will not happen, but, again, we have nearly a half year to the end of 2021, and almost anything can happen.

https://www.reuters.com/business/energy/opec-meets-agree-oil-supply-boost-prices-rise-2021-07-18/

I’d leave this comment blank, with just the Reuters link, but I can’t resist mentioning, on the 19th of July (today), roughly five days after we had this little debate, WTI Crude closed below $67. It turns out that Reuters is not David Pecker’s National Enquirer, and commenter “Moses Herzog” doesn’t just say things just for the sake of saying things and get super-glue in his shorts reading his own comments. Who knew??

Barkley – I have a question that relates to interest rates. I was reviewing some really stupid paper on intercompany financing where I will not bore you with the gory details but these clowns had to use the 5-year swap rate for some reason where they got everything wrong including what the 5-year swap rate wrong for the relevant date (October 15, 2020).

Knowing FRED reports these things on a daily basis, I looked up with these rates have been over the past couple of years. And now here comes the question. This rate was not reported for March, April, or May of 2020. Do you know why? Was this related to the financial freak out at the start of the pandemic.

If Menzie knows – he is welcomed to let us know.

Now back to critiquing this really stupid paper.

pgl,

Sorry, I do not know why that swap disappeared for awhile. Maybe Menzie or somebody else knows.

Looks like a data quality issue in the FRED data. USD Libor swap rates went down during the period and liquidity was maybe a bit low, but nothing crazy. See no relation to the LIBOR cessation. The market is still liquid as of today there, not so much in the alternative SOFR OIS.

@ Peter

I’m honestly glad to have my theory shot down, because I didn’t know. Just on some levels I thought it made sense in absence of a definitive answer. So thanks for clearing that up. I think eventually SOFR or Ameribor or whichever RFR wins the day will end up being a much better system than Libor. But if large TBTF banks desire, I’m sure someone will come up with a way to “game” RFRs as well, but hopefully it will be much more difficult than it was for British bank traders to cheat and swindle their international customers.

The reason for the slow change off of Libor was because for a long time Libor was “the only game in town” and if there were any other interbank rates, I think they did largely follow Libor’s lead. Which is one of the reasons it was time to get rid of it, along with the fact that British banks kept gaming the system at others’ cost. i.e. When Libor was being “gamed” with false bids, it was NOT a true “market rate”.

@ pgl

It could have something to do with LIBOR rate cessation. The timing of that is pretty near to the months you gave.

Swaps are basically the longer term version of LIBOR so what you suggest makes sense.

https://fred.stlouisfed.org/series/TEDRATE/

FRED reports LIBOR rates for this period but the TED spread spiked so one has to wonder who in the world would base a loan on the LIBOR rate during that mess.

@ pgl

My understanding is they are very short term loans (the majority anyway), “overnight” loans, and don’t vary too much. Though I am sure they “spike” from time to time in high risk environments like 2008. They were being manipulated by some banks or bank traders, so now they are switching over slowly, because in this case it does not make sense to rip the band aid off quickly.

There’s been a ton of discussion about this lately I am sure on “FT” behind the paywall and also on FTAlphaville:

https://www.ft.com/content/2f3939bf-a40d-473a-810d-6da145effd51

https://www.ft.com/content/e5f1ebbb-2e7b-46cc-88ce-b0a1c48ea1ee

Britain is being kind of baby-ish about it (kind of like some people are on monthly numbers being annualized) because they were used to having things their way on the Libor, and it was mostly British traders (as I recall, happy to be corrected) who were screwing up the rate numbers with “disingenuous” (to put it in a family friendly way) market bids.

For the record, my guess on the LIBOR cessation putting gaps in the quoted numbers on the 5 year swaps was pretty much a stab in the dark, so I may be totally wrong, however it does seem to make sense, when they are making a transition away from LIBOR, and there’s been some civilized arguments still on how the new system should be done.

Maybe Menzie can ask one of his Finance pals at U-W Madison, I bet they know the reason for the gaps on quotes. I was a Finance major, so I’m afraid you’ve shamed me a little bit on this one.

https://www.isda.org/2021/03/05/libor-cessation-and-the-impact-on-fallbacks/

Admitting to a little naivette but the term cessation was new to me even though I have been falling the panic among certain eggheads over the phase out of the use of LIBOR. US Libor rate reporting will continue for another 2 years but to be frank, I will not miss this overly hyped rate. It is after all just another interbank rate. And one could base floating rates off of the government treasury bill rate if one wanted to.

But no there are the usual idiots in transfer pricing writing hundreds of worthless pages on how the world comes to an end when we do not have LIBOR quotes. I guess this is why I have resorted to speed reading as the day job used to have me be an expert on deciphering continuous utter nonsense. Of course this is why we should start with the maxim – first we kill all the lawyers.

“falling the panic”

following the panic. Yes speed typing has lend to some rusty brain cells too.

pgl,

I do not know the relationship between LIBOR and those swaps. But I happen to agree that there had been increasing problems with LIBOR, including the widely reported manipulations by mostly British parties. it was clearly time to reduce the importance of this flawed indicator.

Curiously, its move to global importance dates to the beginning of the eurodollar market around 1958, although I stand to be corrected by Menzie if wrong on this. That coincided with the beginning of US-Soviet trade, with the Soviets not wanting the financing to be handled in the US. So London became the place, with US dollars there being involved, and LIBOR the key rate for setting things, although LIBOR certainly had previously been important in the UK, and thus almost certainly in at least those parts of the world earlier that used the British pound a lot.

I feel like i’m slightly embarrassing myself somehow mentioning this, but was anyone else here sad when they hear Paul Orndorff had died?? 71 years old. Man when I was a kid Paul Orndorff was the man. Lot of good memories there. I actually probably remember him more from the Southern circuit or the old “GCW” on TBS. Most people will remember him from his WWF days. My maternal Grandpa used to watch that while it looked like he was in a coma in the leather lounge chair. It’s funny the things that will capture your imagination when you are little. JKG, Peter Lynch, Louis Rukeyser, Benjamin Graham, and Lester Thurow would come later, heh.

Mr. Wonderful was part of a class action lawsuit against WWE related to

long term neurological injuries that WWE did little to address. Alas, he eventually got dementia. Whether that had to do with his recent death, I’m not sure.

Funny……..

https://deadline.com/2021/07/sacha-baron-cohen-lawsuit-victory-ray-moore-who-is-america-borat-1234791912/

https://deadline.com/wp-content/uploads/2021/07/Sacha-Baron-Cohen-Roy-Moore-order-july-13-2021.pdf

High five!!!!!!

‘Cause demand isn’t all that high? Domestic demand, as of Q1, was above the pre-recession peak, but below the pre-recession trend.

Why have real yields been so low so so long, near zero before the pandemic? I agree with the point (I believe) you’re making, but it’s tricky to argue from low real yields when those yields have been the subject of head-scratching for quite some time.

‘Cause demand isn’t all that high? Domestic demand, as of Q1, was above the pre-recession peak, but below the pre-recession trend.

This statement is untrue per EIA STEO data.

Total US oil consumption in Q1 2019, the best comparable period pre-pandemic, averaged 20.18 mbpd. In Q1 2021, it averaged 19.2 mbpd, a whole 1 mbpd less. Indeed, US oil consumption was above Q1 21 levels for every month until March 2020.

This is no less true for gasoline demand, 8.0 mbpd in Q1 21 and 9.0 mbpd in Q1 2019, and average 9.4 mbpd in 2019.

This is similarly true for distillate (diesel), which averaged 4.3 mbpd in Q1 2019 and 4.0 mbpd in Q1 2021.

What is true is that product supplied has largely returned to normal in the last two weeks and should consolidate this level in the next month. Distillate demand is above average, gasoline demand a bit low but closing on normal quickly, and jet fuel demand still down around 25% and will be for some time.

macroduck is talking about demand in general, not just oil prices

It sounds like the chief economist for Fox and Friends is backing down from his vaunted forecasts about US gasoline prices and world oil prices reaching $100 a barrel!

Yep.

Menzie was talking about the overall economy and you chime in with data on one specific good? Yea we get you have a brain leaking oil but could you at least TRY to understand the context of the post before making a total fool out of you again?

As for oil prices, OPEC+ is sitting on all the incremental supply. Therefore, the question is whether the cartel releases oil in anticipation of demand (a volume-led strategy) or only upon the realization of certain prices (a price-led strategy). In an up market, OPEC would ordinarily use a price-led strategy. Thus, prices will rise and OPEC will add supply with a lag, which is what we are seeing now. The EIA expects oil markets to be effectively in balance for the back half of the year; OPEC sees a draw of greater than 2 mbpd. Given that OPEC controls supply, one is inclined to give greater credence to OPEC forecasts. I would note that US excess crude inventories will be exhausted at the current rate by around Labor Day, after which US refiners will be scrambling to find incremental sources of oil. This is consistent with a rapid rise in oil prices.

There are any number of game theoretic considerations. For example, US supply has been doing a bit better. OPEC still has about 5 mbpd of spare capacity, and they probably want to put this back into play before US shales can collect themselves (if, indeed, they ever do). Iran is also a wild card, although somewhat on the sidelines. And the whole UAE thing would normally be bearish for oil markets, but can Middle East producers really resist the siren call of some really meaty oil pricing? We’ll see, but the balance of the analyst community has been calling for higher oil prices in H2 2021.

@ “Princeton”Kopits

All of the discussion has been to increase output/supply. “Meaty” pricing isn’t “meaty” to the Middle East if they’re cutting their nose off despite their face by losing larger state revenues in exchange for slightly higher margins. You’re the “oil expert”?? Damn…… you are dull. Can’t you just save this for the toothless illiterates listening to OANN and leave the normals alone??

Kevin Hassett has been waiting 20 years for the DOW to reach 36000. I bet by 2040 your little forecast of $100 a barrel of oil will eventually pan out!

pgl,

Now now. I think $100 per barrel not too likely before end of year, but it is not like Dow 36000, which in nominal terms we are not far from right now, just below 3500. But Dow 3600 we have never seen.

OTOH, we have seen nominal crude oil over $100 per barrel several times and for some extended periods. I think the peak on WTI was at $147 per barrel in July 2008, with it crashing to around $30 per barrel by November. So, $100 per barrel, we have been there and done that several times already, not that big of a deal frankly.

@ Barkley Rosser

New technologies have changed the circumstances, in case you were sleeping. And your grandkids (hopefully) have a very different attitude about burning a tank of gasoline then you have most of your life. Even the most wild of forecasts at the moment don’t put oil at $100 until end of 2022, NOT the end of this year, so you and CluelessKopits are in an “elite” club of “thought” right now.

Of course you are correct but I was having a little fun at Princeton Steve’s expense. I hear all sorts of scary stories about traveling. Now I recently mailed the State Department to renew my passport and the news is trying to scare me that it will take a while. For now – I have no plans to travel any time soon.

Moses,

Oh, it has been awhile since you indulged yourself in stupid attacks on me, so here you go, making yourself look like a total ignorant moron, not for the first time. Before going further, I shall note that I follow energy markets very closely and have been publishing in refereed journals with GS citations on it since Steve Kopits was still wearing diapers. You won’t find it, but I publicly forecast in print in 1969 that OPEC would soon push prices up by limiting supply, which they did in 1973. You are in way over your head attempting to somehow show I do not know what I am talking about on this matter, you pathetic joke.

So what makes you think I have some attitude about a tank of gasoline worthy of scorn? I have been driving a hybrid vehicle for a decade now. What kind of car do you drive, Moses? What is its gas mileage?

“New technology”? Oh, you mean shale? Yes, I have noted in almost all my comments on this that shale in the US is the most likely reason we shall not see $100 per barrel this year, even as it is not impossible. The US shale sector, as I just noted here, has been responding slowly to the rising prices.

Or maybe by “new technology” you are thinking about non-fossil-fuel using vehicles. Yeah, they are coming in, but that is a long run story, not one of any relevance for what happens by the end of this year, much less by the end of next.

Your claim that “even the most wild forecasts do not see $100 per barrel before the end of 2022r” shows you do not closely follow the oil sector blogs. In the last month or so they have been reporting on “groups of investors” who are making exactly that forecast for 2021 as Steve Kopits has done, although maybe pulling back from. Again, I think it highly unlikely, as I have repeatedly said, and as I just said above, the US shale sector being the most likely reason. But they are slow to ramp up production. What could happen, especially if we see some supply snag in some major exporter, could be a short term runup to $100 or even higher, but with that not staying for long as indeed various supply sources would kick in. But again, those sources are by and large not that instantaneous enough to offset a sudden surge in price, and we have historically seen quite a few of these, with prices within short periods of time tripling or quadrupling. So, if you think this is out of the question, you are just exhibiting your clearly massive ignorance on this topic.

And again, we have seen #100 per barrel in nominal terms quite a bit (and a lot more in current real terms). So in nominal terms the average price for the whole year was above $100 per barrel for both 2011 and 2012, and the price got above $100 in 2008, 2013, and 2014. In real terms the average crude price was basically above $100 per barrel for the whole first half of the teens, and we did not have an outbreak of inflation or stagnation, although it is possible that this was another factor in the economic policy uncertainty that was going on in that period that EConned got so worked up about.

Anyway, a $100 per barrel of crude would really not be that big of a deal if it happened sometime later this year, especially as I think it would not stick around for awhile. This is not 2011, and even then it was not that big of a deal.

Barkley Rosser,

Thanks for the free rent – it’s mighty spacious!!!

Barkley Rosser

July 14, 2021 at 7:09 pm

There was a lot in this comment that was spot on. I did not notice at first the totally unneeded small mention of ubertroll Econned until this ubertroll had to toss out his usual self serving stupid comment. In the future – let’s not give this total waste of space any attention (even though this worthless ubertroll clearly craves it).

I can ALWAYS count on the clown PaGLiacci to keep my name out there. It’s always amazing that someone with so little to say can have so many comments. As always, I appreciate your persistent adoration. Give me a honk honk!!!

pgl… don’t get too upset, your mind is one of my primary residences – Barkley Rosser’s skull is only one of my vacation spaces. Keep honking, PaGLiacci, keep honking.

It’s interesting to note, in the city I live in when Blacks were protesting as part of the BLM movement, there was some minor property damage done to local businesses, Many of the Black protesters were charged with “Terrorism” for the property damage by the city DA, David Prater, and had to “plead out” while serving time, and some spending more than a year in jail:

https://www.yahoo.com/lifestyle/capitol-rioter-joined-white-supremacist-163000669.html

https://freepressokc.com/protest-leaders-surrender-at-jail-after-da-decides-to-press-state-charges/

Remember, MAGA folks and Republicans are always telling us how much they respect law enforcement, but by all appearances the only time Republicans and MAGA respect the law, is when the American judicial courts can send Blacks off to prison for half their mortal lives, and hand people like Mr. Michael Curzio two days in jail, after serving a very short time for murder.

Gee, GoshGolly, I just can’t figure out why Black Americans think America’s law system and courts are complete G*ddamned joke, can you???

We are not in Kansas anymore.

But Nebraska does not look all that different.

http://www.xinhuanet.com/english/2021-07/14/c_1310060802.htm

July 14, 2021

Over 1.4 bln doses of COVID-19 vaccines administered in China

BEIJING — Over 1.4 billion doses of COVID-19 vaccines have been administered in China as of Tuesday, as the country continues to ramp up its inoculation drive, the National Health Commission said Wednesday.

[ Over 500 million additional doses of Chinese vaccines have already been distributed abroad, while the Global Vaccine Alliance has just asked China for 100 million doses. ]

When TIPS first became available on the market I wonder how many of the purchasers thought they were going to get negative yields?? Just a question that pops into my head that I don’t hear too many people discussing out-loud, but am certain I am not the first person to wonder. Like if you had taken a survey when they were first offered, what percent of the purchasers of TIPS bonds would have said they expected a negative rate at some point in time or another??

Krugman back in the day was suggesting the Bush43 fiscal stance would drive up interest rates. He has noted since that this forecast did not pan out.

https://www.nytimes.com/2003/03/11/opinion/a-fiscal-train-wreck.html

March 11, 2003

A Fiscal Train Wreck

By Paul Krugman

With war looming, it’s time to be prepared. So last week I switched to a fixed-rate mortgage. It means higher monthly payments, but I’m terrified about what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits.

From a fiscal point of view the impending war is a lose-lose proposition. If it goes badly, the resulting mess will be a disaster for the budget. If it goes well, administration officials have made it clear that they will use any bump in the polls to ram through more big tax cuts, which will also be a disaster for the budget. Either way, the tide of red ink will keep on rising.

Last week the Congressional Budget Office marked down its estimates yet again. Just two years ago, you may remember, the C.B.O. was projecting a 10-year surplus of $5.6 trillion. Now it projects a 10-year deficit of $1.8 trillion.

And that’s way too optimistic. The Congressional Budget Office operates under ground rules that force it to wear rose-colored lenses. If you take into account — as the C.B.O. cannot — the effects of likely changes in the alternative minimum tax, include realistic estimates of future spending and allow for the cost of war and reconstruction, it’s clear that the 10-year deficit will be at least $3 trillion.

So what? Two years ago the administration promised to run large surpluses. A year ago it said the deficit was only temporary. Now it says deficits don’t matter. But we’re looking at a fiscal crisis that will drive interest rates sky-high.

A leading economist recently summed up one reason why: “When the government reduces saving by running a budget deficit, the interest rate rises.” Yes, that’s from a textbook by the chief administration economist, Gregory Mankiw.

But what’s really scary — what makes a fixed-rate mortgage seem like such a good idea — is the looming threat to the federal government’s solvency.

That may sound alarmist: right now the deficit, while huge in absolute terms, is only 2 — make that 3, O.K., maybe 4 — percent of G.D.P. But that misses the point. “Think of the federal government as a gigantic insurance company (with a sideline business in national defense and homeland security), which does its accounting on a cash basis, only counting premiums and payouts as they go in and out the door. An insurance company with cash accounting . . . is an accident waiting to happen.” So says the Treasury under secretary Peter Fisher; his point is that because of the future liabilities of Social Security and Medicare, the true budget picture is much worse than the conventional deficit numbers suggest….

https://fred.stlouisfed.org/graph/?g=me3k

January 4, 2018

Interest rates on 10-Year, 5-Year and 2-Year Treasury Securities, 2000-2021

https://fred.stlouisfed.org/graph/?g=u4E3

January 30, 2018

Federal Debt as a percent of Gross Domestic Product, 2000-2021

Thanks. That is the column I was thinking about.

https://twitter.com/BrankoMilan/status/1220139143944200194

Branko Milanovic @BrankoMilan

Out of some 350 harmonized surveys from 51 countries and over some 50 years that @lisdata has, the most unequal three data sets are all from South Africa.

4:20 PM – 22 Jan 2020

https://fred.stlouisfed.org/graph/?g=F5TG

August 4, 2014

Real per capita Gross Domestic Product for China and South Africa, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=F5TJ

August 4, 2014

Real per capita Gross Domestic Product for China and South Africa, 1977-2019

(Indexed to 1977)

https://fred.stlouisfed.org/graph/?g=Al2G

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Mexico and South Africa, 1977-2019

(Percent change)

https://fred.stlouisfed.org/graph/?g=Al2J

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Mexico and South Africa, 1977-2019

(Indexed to 1977)

Peter

July 15, 2021 at 8:15 am

Thanks for the comment. May I clear up any confusion here – which in part may be my fault. LIBOR rates have been reported consistently – it was 5-year SWAP rates that were not being reported. Cessation as I understand the term stands in a couple of years. Now as far as LIBOR rates being currently very low, there were a couple of factors here. Treasury bill rates have fallen but the TED spread had a temporary spike starting in early March 2020. This financial freakout also showed up in corporate bond spreads but was reversed as 2020 continued:

https://fred.stlouisfed.org/series/USD3MTD156N