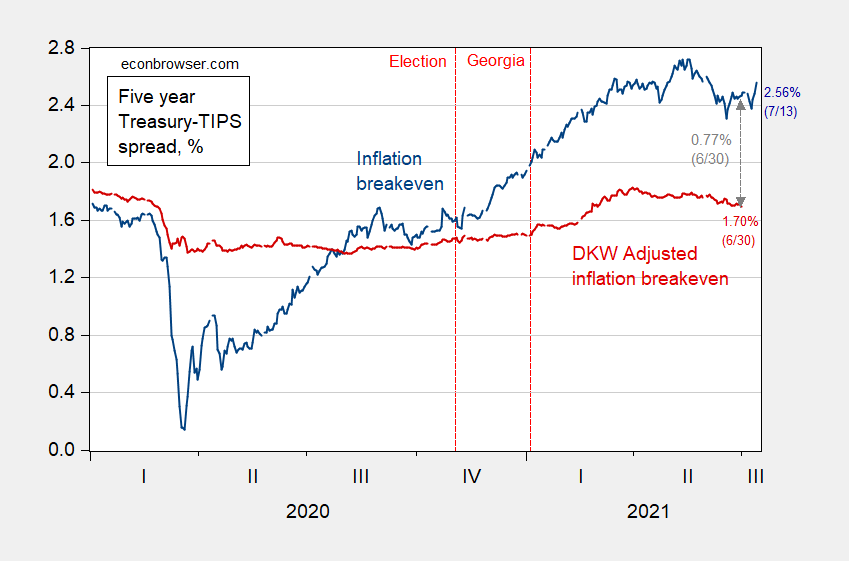

As of 7/13:

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue, left scale), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red, left scale), both in %; and S&P 500 index (black, right log scale). Source: FRB via FRED, Treasury, KWW following D’amico, Kim and Wei (DKW) accessed 6/4, and author’s calculations.

The 5 year breakeven increased by 8 bps going from yesterday to today (I’m taking the “news” as the CPI surprise discussed here); and remains 16 bps below the recent peak on 5/18. That 8 bps increase is pretty substantial since the standard deviation of daily changes is about 4 bps since 2000 (excluding the extreme movements in 2008).

CPAC now openly inviting people who exhibit violent inclinations to their events. Hope the NRA loving CPAC is checking people for firearms before they enter.

https://www.salon.com/2021/07/09/stewart-rhodes-founder-of-right-wing-oath-keepers-militia-spotted-at-cpac/

Would be interesting to know how many children are at theses CPAC events with people like Stewart Rhodes walking around as an invited guest. The name Timothy McVeigh pops into my head for some strange reason.

When reading this story and about trump’s claims that he knows who “murdered” Ashli Babbit is, why wouldn’t a member of the CIA, FBI, etc be doing immediate interviews with donald trump asking him who exactly had told him this, under what context, if he had tangible proof the conversation had ever occurred (phone records), a definitive time the conversation occurred etc.

https://www.forbes.com/sites/jemimamcevoy/2021/07/11/trump-claims-to-have-new-information-about-ashli-babbitts-death-as-he-all-but-confirms-2024-presidential-run/?sh=129659c24933

If anyone else made up these LIES that the orange creature does, it wouldn’t be 72 hours until a federal agent was knocking on their door asking them the details and who had told him this, on grounds of national security. He says this crap and our federal government sits on its hands like nothing happened. If he knows something it is the federal government’s responsibility to conduct an interview, preferably with a video camera or audio tape rolling as this orange bastard all the sudden becomes a deaf mute. If he has time to jack his ugly disformed mouth on FOX news, then he has time to tell federal agents. Who told him this, when he was told this, where he was told this, why he waited to share this now, and who he was protecting by hiding the person’s idenitiy who killed Babbits. He is not the President now, He has no legal claim to hide this information.

If there is no federal agency interview (there should in fact be multiple fed agencies wanting an answer to this question) related to this matter, we will then know beyond any doubt, that Joe Biden is also an enabler of this orange colored bastard and abomination to the human race.

Menzie, it should be clear by now that nobody should take these adjusted inflation expectations seriously. There have been epochal, monumental enormous changes in the world in the last 24 months and they have round tripped only about 30-40 bp. If an impending second great depression, followed by record-breaking fiscal expenditures (and the promise of more in the pipeline even as the output gap closes) can’t generate more volatility in this series as the probabilities of depression and hyperinflation go up and down, then what can? It’s useless, unless your goal is purely sophist, to justify a policy action or inaction.

“Formereconomist Says Market Rates Mean Nothing Because Last 18 Months Variation Has Been ‘Small’, News at 11” Good people of the metropolis, Keep it tuned in to station KPOO.

What utter misrepresentation. I give large credence to market rates; I am contesting Menzie’s adjustments to the breakevens, which are not market rates; you cannot trade his adjusted inflation expectations. Try reading what I wrote before you mock it. The variation in raw breakevens has obviously been significantly larger than the 30-40 bp I cited in the adjusted inflation expectations.

If you’re going to be so absolutely wrong, at least try not to be so smug and childish while being absolutely wrong. It’s unbecoming, and you should be ashamed.

I apologize for misrepresenting your views, that was not my intention. I’m sorry for that.

If someone gives me the point spread to a game I can wager on in Vegas, can I “trade” that point spread?? Probably not. That however does not mean there isn’t “market information” or “market expectations” embedded in the Vegas point spread. As well as different components of risk embedded in that specific game’s Vegas point spread.

You know what that 30-40 bp variation or “volatility”, if you prefer, is?? I would argue it is largely the market’s reaction or “adjustment” to the government intervention (“stimulus”), during MAGA and post MAGA, which certainly post MAGA, was largely appropriate.

Now would you put more credence on the latest from Judy Shelton?

formereconomist: Well, show me what works better. The unadjusted series? See https://econbrowser.com/archives/2021/06/assessing-market-forecasts-of-inflation-at-5-year-horizon for some numbers.

Yes, the unadjusted series better captures expectations. The post in your link discusses whether expectations are good at predicting, which is an altogether different question than “what series better captures expectations?”

It is fair to expect expectations to swing more than 40 bp as probabilities of deflation and then very-strong inflation move around by double digits. Whether those expectations ultimately prove good forecasts depends on a lot of new developments between forecast horizon and date of expectation-formation.

To really be fair in evaluating those expectations, you’d have to freeze policy (and other shocks) at the moment of expectation formation.

formereconomist: Er, “To really be fair in evaluating those expectations, you’d have to freeze policy (and other shocks) at the moment of expectation formation.” — I don’t know of anybody who does statistical evaluations of forecast performance the way you are suggesting. Certainly, that’s not a standard in exchange rate forecasting which I’m most familiar with. Can you provide me with a scholarly evaluation in this vein (peer-review, or working paper)?