From Ha, Kose, and Ohnsorge, One-Stop Source: A Global Database of Inflation:

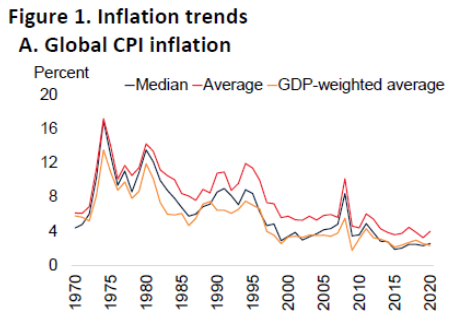

This paper introduces a global database that contains inflation series: (i) for a wide range of inflation measures (headline, food, energy, and core consumer price inflation; producer price inflation; and gross domestic product deflator changes); (ii) at multiple frequencies (monthly, quarterly and annual) for an extended period (1970–2021); and (iii) for a large number (up to 196) of countries. As it doubles the number of observations over the next-largest publicly available sources, the database constitutes a comprehensive, single source for inflation series. The paper illustrates the potential use of the database with three applications. First, it studies the evolution of inflation since 1970 and document the broad-based disinflation around the world over the past half-century, with global consumer price inflation down from a peak of roughly 17 percent in 1974 to 2.5 percent in 2020. Second, it examines the behavior of inflation during global recessions. Global inflation fell sharply (on average by 0.9 percentage points) in the year to the trough of global recessions and continued to decline even as recoveries got underway. In 2020, inflation declined less, and more briefly, than in any of the previous four global recessions over the past 50 years. Third, the paper analyzes the role of common factors in explaining movements in different measures of inflation. While, across all inflation measures, inflation synchronization has risen since the early 2000s, it has been much higher for inflation measures that involve a larger share of tradable goods.

Here’s one figure from the paper.

The database is here.

Ha, Kose and Ohnsorge guest contribution on current prospects for inflation here.

I just got the official transcript from the Joe Biden to Xi Jinping phone exchange:

Biden: “I really think that orange creature is a d*ck.”

Xi: “Me too!!!! OK, let’s have some pig-liver-and-intestines soup!!!!”

Biden: “Cool Bro!!!! My wife had me rehearse this next diplomatic statement, hold on, I’m trying to remember…… I don’t care who says you’re a princeling descendent of the Party Elite, you know a disgraceful loser when you see one!!! Do you understand that?? What was your name again?? My wife Jill told me this was the number for my Geriatric Psychiatrist.” [Garbled background noise, sounds like middle aged woman] ” Jill, stop talking!!! No, you didn’t say that 3 days ago!!!! It was just now you said that. I can’t listen to two people at the same time Jill!!!!”

Xi: “Huh?? What did you do with Tigger and Eeyore!!! You white ghost devil!!!!!”

Moses,

So, still refusing to admit how wrong you have been so many times on the distribution of Native American ancestry among Euro-Americans? Sure looks like it. Yeah, maybe if you say nothing about it everybody will forget about that link you provided so clearly showing how wrong you have been and maybe you can even repeat yet again your mistaken arguments and everybody will nod their heads.

No, instead we get some silly trash from you like this supposed phone conversation. Yuck.

I’m the one who hunted down the actual paper itself, when you were the coward who could only manage a bad Quora link. And I quoted from the paper itself, multiple times. Which stated that the related Native American admixture data was near to uniform. When you only have a minute amount that pops over say 4% admixture what would you call that?? It takes more than a tiny tiny portion falling outside of say 4% admixture to say that it’s skewed. In other words, to take an oddball example but tust to exhibit the point~~ if you had 2,000 men, and of those 2,000 men 1,998 were under 6’2″, it would tale more than 2 men who were 7 feet tall to “skew” the data. So when the data shows that group is minutely small, you don’t necessarily have to see a distribution curve to figure that out. Which was part of the reason I showed the white-to-Brunswick green shading of the graph for the 50 states. Even though white-to-Brunswisk green graphic is not a distribution, it doesn’t take much imagination to see that if the data was put on such a distribution, it sure as hell wouldn’t skew the overall data. Which is why no one but commenter “baffling” has taken Barkley’s cause.

And I’ll tell you something else. I don’t think Menzie is too shy to “put me in my place” if I’ve been in serious error. One time I made a bad error reading a graph, which I realized was pretty egregious after Menzie corrected me. And he’s been more than happy to point out what he feels is my mistaken impression of the severity of the effects of Brexit (which I view as being milder than Menzie does). And I have to say, of the times Menzie has stepped in to referee this one, it strikes me as mostly sheepish attempts to defend you, and never stating I was wrong—that the data is closer to uniform, than it is to “skewed”. And again, just to drive the point home once more, it’s VERY unlikely you would have “skewed” data when the Native American population has been “intermingling” or “procreating” (if you prefer) with the European American (“white”) population over a long period of time. The paper asserts that in early American history, there may have been a large amount of “interactions” resulting in “admixture” to European Americans roughly TWELVE generations ago. Twelve generations of admixture is not apt to result in something which results in a “skewed distribution”. Probably a frightening thought to you Barkley, but there you go.

People are welcome to read the paper themselves. I’ll give you a link which should work much better than Barkley’s cowardly (and sad) Quora link, when he was afraid to get caught with his pants down. If the link doesn’t work, just tell me and I’ll put up 4-5 other links to the paper to make certain everyone can find one that works for them:

https://digitalcommons.chapman.edu/sees_articles/27/

BTW, over what must be over 2 years we’ve had this argument (seems more like 5 years), I’m the only person who actually gave a direct link to the paper on this blog, which said something entirely different from what Barkley claimed it did. PhD Barkley cannot manage links on this blog for some reason. I’ll let Barkley’s students try to make out why that might be.

Holy cow. How many times must this basic fact be point out. A GENE IS NOT A POPULATION AND AN EVEN DISTRIBUTION ACROSS A GENE DOES NOT IMPLY AN EVEN DISTRIBUTION ACROSS A POPULATION!

Menzie at one point made it clear he does not like tomment on topics he does not consider himself too be an expert on, and I believehe made it clear that population genetics is one of those fields he does not consider himself expert on.

I shall remind you that when you first made this completely idiotic argument based on misreading that quote you keep mentioning several people pointed out how wrong you were. They have not wasted their time doing so since, leaving that duty to me. But I also remind you that nobody ever has here agreed with your interpretation of this, nobody, not one person. Does this not strike you as perhaps odd if in fact you were correct? A bunch of people have told you that you are wrong, and nobody has agreed with you.

Also, Moses, Table S7 in this more recent paper you linked to very clearly shows that the distribution is not even and indeed looks skewed. At least one other person here agreed with me on that and nobody has disagreed, while you have simply continued to ignore what that Table shows or have vaguely suggested that it shows an even distribution, or maybe a nearly even distribution. It most certainly does not.

Deal with it. You have been dead wrong about this all along and now cannot face up the fact that you have provided a link that clearly shows it.

It’s the same paper. Put your dentures in the solution and take some vitamin E. Time for grampsies to get his memory sleep.

Moses,

What a total drooling moron you are. There it is right in the Abstract. They note “regional differences” in ancestry numbers “due to historical events.” Duh. THE DISTRIBUTION IS NOT REMOTELY EVEN.

Oh, and while you do seem to know quite a bit about China, something I have praised you for previously on more than one occasion, you still operate under the fantasy that somehow ltr is male.

Moses,

Maybe you are tired of this and in retreat as you keep falling smack on your face with everything you post on this, but it might be worth again reminding you and everyone of some very basic and obvious elements in among those “historical’ factors that lie behind the “regional differences” in these ancestry distributions that are mentioned in the Abstract of this paper you just linked to.

First of all, and really just screamingly obvious, is that the distribution of the Native American population itself is nowhere near even or random around the country. It is already a skewed distribution, with their numbers highly concentrated in a fairly small number of mostly western states. This means that it is much easier for Euro-Americans in those states to meet and “admix” with Native Americans to produce offspring and later descendants with mixed ancestry.

Then there is another element that further reinforces that. It is that the Euro-Americans in those mostly western states (Wisconsin is the state east of the Mississippi with the highest Native population) tend to be more those whose ancestors have been here a long time, giving them more of a chance to have ancestors who engaged in such admixing.Elizabeth Warren, the person you were initially vendettaing when you got into all this is a good example, a Euro-American with ancestors who have been here many generations, with her Native ancestry dating far back, and who also lives in a state with a lot of Native Americans, the one you do, Mose, Oklahoma.

OTOH, in eastern states, especially northeastern large ciities, one finds lots of Euro-Americans in ethnic neighborhoods who, if not themselves immigrants from Europe with almost certainly zero Native ancestry, then children of immigrants or grandchildren. In short, they are not like Warren with her ancestors dating way back for generations with the resulting opportunities for such admixing.

So, putting both of these facts togehter it becomes pretty obvsious for anybody with even a smidgeon of a brain to see why we should not be surprised to see North Dakota having a way higher percentage of Native American ancestry in its Euro-American population than one finds in New Jersey. Maybe you still do not get why this means the distribution is not even, but I bet everybody else reading this does.

As I have been studying the history of the 1970s for years, and especially the oil price inflation and its pass-through in core inflation, I am surprised by some of the figures in this database about that period … From may 1970, oil prices for consuming countries increased very substantially, as transportation costs sky-rocketed for several months, before OPEC price increased from january 1971.

I do not see that in the database ??

I shall publish soon a long blog on inflation in the 1970s, on the monetarist narrative on 1970s inflation, on the Vietnam war, and on oil prices. If you have interesting data or informations, please tell me.

What is your blog?

The introduction chapter is here (sorry for the poor english) :

Lepetit . (2021 b) – August 15th 1970 : Oil and the end of the Bretton Woods Monetary System – Chapter 1 : Introduction – 15/08/2021

https://www.linkedin.com/pulse/august-15th-1971-oil-resource-constraint-end-bretton-woods-lepetit/

It explains the global Economic History research project, and it gives some of the sources used, as The Oil Import Question fascinating report ; the Dallas Fed monthly reports, the Survey of Current Business monthly reports …

Lepetit,

I do not understand why you claim that oil prices starting rising in 1970 when they did not. The first big increase was indeed that which came during the Yom Kippur War in Fall 1973. This sort of incorrect argument by you rather damages the credibility of this project of yours.

1) The Middle East troubles began in May 1970, with Lybia production and Syria pipeline (Tapline). The first producer prices increase came beginning of 1971 with the Tehran and Tripoli Agreements. Then price escalation went on, especially from1972, as can been seen in the World Bank monthly oil price series

2) But my main discovery is that producer price is just part of the problem. In the 1970s, transportation costs (tanker freight) for oil were of the order of magnitude of production costs. With the events in the Middle East, they started to climb mid 1970. The impact was strong on Europe, which depended on oil from Mediterranean, and had to switch to Persian Gulf Oil.

The impact was weaker on the US oil market, where oil imports were quite small, les than 20%. Still the consequence was a domestic price increase in november 1970, the one you can see in the Fred database series.

See : Report on Crude Oil and Gasoline Price Increases of November 1970 – Office of Emergency Preparedness – April 15, 1971

Required reading for Sen. Manchin or, at least, some of his staffers. He needs some better talking points. (Also, it is interesting to watch political leaders flop around when you get past their talking points. Walker was famous for it – there is a reason – he dropped so quickly when attempting to go national. The trick – most GOP leaders play is just to repeat b.s. as fact. They are not interested in addressing reality.) Thanks for posting.

It also doesn’t help, certainly in the “modern era” when you run for President and don’t have your 4-year University degree. It just doesn’t come across too well.

Although with the QAnon and MAGA brain trust, soon to be co-chaired by sammy and CoRev, this could in the near term horizon be viewed by some voters as “a positive”.

https://www.yahoo.com/news/veronica-wolski-chicago-woman-center-144200146.html

Wolski obviously attended the Joe Rogan “I’m a macho poser” School of Medicine, where deworming drugs for large animals are used as a cure for a whole litany of health issues, including, I assume, whooping cough.

Presidents Clinton and Obama joined Biden at Ground Zero this Saturday and George W. Bush joined Biden to give a speech in honor of Flight 93.

So what did Donald Trump do – joined his retarded son to cover a boxing match where 58 year old Evander Holyfield got beat up. What a sad joke:

https://www.huffpost.com/entry/donald-trump-boxing-election-rigged_n_613f19ffe4b0628d095da1f4

Though I am sure the reference was an error, when a person is ridiculed by referring to that person as “ret—–,” the effect is to ridicule people who have a range of disabilities. Such ridicule is incorrect and unfortunate.

It’s my personal opinion people are overly touchy about this term. It should be considered in the context in which it is used. In today’s climate I don’t blame Menzie for filtering these type words, it gets back to job security and a host of other issues. That being said, outside of school children, I doubt many adults mean to be putting down those who meet the “technical definition” of the word. They only mean it to represent people who are low IQ, or people who do dumb things. What word police never seem to understand is, when these words get controlled, it turns into whack-a-mole. Either new words are created to represent the same meaning, and/or they pop up in darker places of society. All of these prejudices still exist in society, and will always exist in society whether the words are clamped down on or not. We play word police much more in 2021 than say in 1973. Do you see MAGA/QAnon as a step up from Nixon circa 1968?? Theoretically….. the word police should have fixed this by now. What this is about is not children feeling verbally abused or ostracized from their peers —nothing has changed there. The word police are mostly there for to placate parents who wince when they hear a word to describe their children’s affliction which they got out of circumstances external to their own making/control.

I sometimes use the term “special ed” instead of the “r word”, but that term has become so antiquated, I have this feeling that only 5% of my audience knows what I mean when I say “special ed”. I do use the “r word” sometimes in verbal communication, but you might be surprised the lengths to which I would go to defend someone in this condition, if someone was being mean to them or pecking at them somehow.

This looks like a mind-boggling amount of work. A high-quality universal inflation database should, I hope, reduce some of the carping I see about not using the ‘correct’ inflation series in research by commenters. I know some carping will remain-some people just can’t help themselves, as shown in a previous comment.

Kudos to the authors!

While I much admire the paper on and compiling of the inflation database, I have been troubled by the limited assistance given by the World Bank to nations such as Argentina that have experienced extended or repeated periods of damaging inflation. Joseph Stiglitz has been similarly bothered and was severely criticized for expressing this. What might be done in and for Argentina and why is this not addressed by the Bank?

https://fred.stlouisfed.org/graph/?g=vq78

January 15, 2018

Consumer Prices for Argentina, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=mu2X

January 15, 2018

Real Broad Effective Exchange Rate for Argentina, 2007-2021

(Indexed to 2007)

ltr: The IMF has usually been tasked with assisting countries facing balance of payments and financial crises, as well as other issues related to macroeconomic stabilization. The World Bank is more concerned with, well, development (where Argentina is perhaps first in line as a medium income country).

The IMF has usually been tasked with assisting countries facing balance of payments and financial crises…

[ Thank you so much. Joseph Stiglitz was chief economist at the World Bank during the Asian currency crises and as Argentina was approaching “depression,” and I thought that Stiglitz wanted the Bank directly involved only to be thwarted. I was wrong then and appreciate being corrected.

The correction was important. ]

https://www.nytimes.com/1999/11/25/business/outspoken-chief-economist-leaving-world-bank.html

November 25, 1999

Outspoken Chief Economist Leaving World Bank

By Richard W. Stevenson

Joseph E. Stiglitz said today that he would resign as the World Bank’s chief economist after using the position for nearly three years to raise pointed questions about the effectiveness of conventional approaches to helping poor countries.

Mr. Stiglitz, who joined the World Bank in February 1997 after serving as chairman of President Clinton’s Council of Economic Advisers, said he would leave the bank at the end of the year and would soon return to his academic post at Stanford University.

His departure will remove from Washington perhaps the most outspoken voice in the debate over how rich countries can best aid economic development in poor and crisis-afflicted nations. Over the last two years in particular, Mr. Stiglitz had antagonized officials at the International Monetary Fund and within the Clinton administration by criticizing their response to the financial crisis in Asia and their strategy for encouraging the development of democratic capitalism in Eastern Europe and the former Soviet Union.

Mr. Stiglitz said the decision to leave had been his. Treasury Secretary Lawrence H. Summers praised Mr. Stiglitz as a ”major creative and intellectual force,” and administration officials said the United States had not sought Mr. Stiglitz’s removal. Caroline Anstey, a spokeswoman for the World Bank, said Mr. Stiglitz had ”absolutely not” been forced out, and the bank’s president, James D. Wolfensohn, praised Mr. Stiglitz for having helped to move the institution ”away from the so-called Washington consensus.”

But Mr. Wolfensohn has suggested in the past that Mr. Stiglitz was too quick to second-guess the international aid agencies and the big industrial nations that control them. ”I think that his recent things about Russia, in my judgment, are not wholly correct,” Mr. Wolfensohn said during the bank’s annual meeting this autumn. ”I think to stand back later and say, ‘If you’d done it my way everything would have been different,’ is a little generous to yourself.”

And Mr. Stiglitz made no secret today of feeling constrained in his ability to speak out as freely as he wished. He said he was looking forward to the unfettered freedom of expression afforded by his return to the academic world.

”Whenever you’re in an organization there are some pressures,” Mr. Stiglitz said in an interview. ”I felt that it was important for my intellectual integrity to be able to express myself as forcefully as I thought was appropriate.”

A liberal with a strong belief that governments and institutions have a significant role to play in economic development and that market forces cannot be counted on to deal with every problem, Mr. Stiglitz challenged the prevailing orthodoxy among policy makers in Washington.

He said that the monetary fund went overboard in Asia in demanding that the countries ensnared in the financial crisis cut their budgets, arguing that fiscal austerity sometimes extracted too high a price from poor people without generating a corresponding improvement in international economic confidence.

He took issue with the view held by the fund and the United States government that controls on the international flow of capital were counterproductive or impractical, saying that in some cases it was justified to restrict short-term flows of money in and out of a developing economy. He said industrialized countries sometimes pushed developing nations too fast to deregulate their financial systems.

And he suggested that the United States and the monetary fund had failed to acknowledge that their prescription for Russia — quick privatization of state-owned industries, an end to state oversight of the economy, abolition of price controls and an opening up to the rest of the world — had not produced the intended results and indeed had left many people worse off.

”Mr. Stiglitz has been a very strong advocate for the poor and the excluded, and he’s been one of the best things in the World Bank in the last decade,” said Seth Amgott, a spokesman for Oxfam, which promotes poverty-fighting policies. ”He’s also been very pointed and insightful in discussing the role of the I.M.F. We’re not used to that kind of candor.”

Mr. Stiglitz won few friends among economists and policy makers at the Treasury Department and the monetary fund. But his message was greeted enthusiastically in poor countries, and he said he was leaving the bank feeling that he had helped to stimulate a more vigorous debate about the policy prescriptions that wealthy nations impose on developing countries….

https://www.nytimes.com/1999/12/02/business/world-bank-economist-felt-he-had-to-silence-his-criticism-or-quit.html

December 2, 1999

World Bank Economist Felt He Had to Silence His Criticism or Quit

By Louis Uchitelle

For Joseph E. Stiglitz, the choice was stark: Either silence his criticism of global economic policies as practiced in Washington or resign as chief economist at the World Bank. He resigned, and in doing so focused attention on the uncertain role of academic economists in positions of power.

As Mr. Stiglitz sees it, Washington has failed to keep pace with the latest thinking on sustaining growth in developing nations. There is an ”intellectual gap between what we know,” he said in an interview, ”and what is still practiced” at the Treasury Department and the International Monetary Fund.

Yet there is an inherent tension in Mr. Stiglitz’s position. As the World Bank’s chief economist, he has had a seat at the policy-making table. The World Bank, in effect, has helped to make the decisions that Mr. Stiglitz criticizes, an unusual role for an insider. Nevertheless, James D. Wolfensohn, the bank’s president, openly supported Mr. Stiglitz in his views — voicing criticism publicly only once, in October. Mr. Stiglitz’s dissents generated an unusual amount of debate over the proper policies for the global economy, particularly after much of Asia, joined later by Russia, Brazil, and other developing countries, plunged into turmoil shortly after Mr. Wolfensohn and Mr. Stiglitz joined the World Bank.

”It has become obvious to me that it would be difficult to continue to speak out as forcefully and publicly as I have on a variety of issues and still remain as chief economist,” Mr. Stiglitz said. ”Rather than muzzle myself, or be muzzled, I decided to leave.”

His premature departure, announced last Wednesday and effective on Jan. 1, removes from Washington the most outspoken critic of the practices that the big industrial nations favor in their relations with the developing world. Those practices emphasize open markets, unrestricted borrowing from foreign lenders, rapid privatization, balanced budgets, a minimal government role and various austerity measures when crises strike.

Daily business updates The latest coverage of business, markets and the economy, sent by email each weekday. Get it sent to your inbox.

Mr. Stiglitz, who has been the leader in developing theories that challenge standard economic policy, also emphasizes open markets. But he argues that markets on their own frequently fall short of the promised prosperity, and a little government intervention can usually improve the outcome.

The Treasury and the I.M.F., for example, insisted that the East Asian countries in difficulty raise interest rates to restore investor confidence. Higher rates scare investors, Mr. Stiglitz replied, and produce recessions that are more damaging than if governments held rates down. Controls on short-term lending from abroad became another point of contention. Mr. Stiglitz contends that developing countries should limit such loans to avoid the huge defaults and devaluations that can occur when foreign lenders lose confidence and demand repayment, precipitating a crisis. But even after that happened in East Asia, policymakers frowned on setting limits on short-term lending, although they are more open to the practice now.

”The Stiglitz group represents one of the most important innovations in economics in the last 100 years,” said Kenneth J. Arrow of Stanford University, who has altered his own views as a result of the Stiglitz influence. Mr. Arrow’s early research, emphasizing the efficiency of a laissez-faire market system, had helped him to win a Nobel Memorial Prize in Economic Science in 1972.

But Mr. Stiglitz’s style is another matter. It raises the question, in Mr. Arrow’s mind, of what an economist who takes a job in Washington should do when his expertise tells him that policy decisions are bad economics. Should he go public, or should he confine his disagreement to closed-door discussions with other officials and then, once the decision is made, remain silent?

The 56-year-old Mr. Stiglitz, who came to Washington from Stanford University, is the most prominent example in this decade of the outspoken approach. Two other top economists in government represent the opposite style, publicly endorsing official policy and indeed formulating much of it. They are Lawrence H. Summers, the Treasury secretary who came to Washington from Harvard University, and Stanley Fischer, the I.M.F.’s first deputy managing director and formerly of the Massachusetts Institute of Technology.

Both sent word through aides that they were not available to comment. Among economists, speculation had circulated for weeks that Mr. Summers had pressed Mr. Wolfensohn to silence Mr. Stiglitz. Amid official denials of any such behind-the-scenes moves, Mr. Stiglitz said that he had come to the conclusion that he could no longer continue to speak out bluntly and remain at the World Bank.

”In a sense, there was a question of personal and professional integrity,” Mr. Stiglitz said. ”Remaining silent when people were pursuing wrong ideas would have been a form of complicity.”

Mr. Arrow, while intellectually leaning toward Mr. Stiglitz’s views, has mixed feelings about public dissents. ”You certainly want debate, and you cannot always have it behind closed doors,” he said. ”But you cannot do one policy and have the world on notice that you might switch to another. It is very hard to define the rules of this game.”

Olivier Blanchard, an M.I.T. economist, is more definite. ”Much of the content of the Stiglitz message, the role and the complexity of institutions needed to make markets work, is something that most of us feel at ease with,” he said, ”But the style has some of us unhappy. The issue is not lose the message, but do it in a way that is more productive politically. That is an aspect that Joe has ignored.”

Not surprisingly, Mr. Stiglitz disagrees. Less visible, more diplomatic dissent is suitable, he says, when there is time for gradual change. But ”it became very clear to me that working from the inside was not leading to responses at the speed at which responses were needed,” he said. And when dealing with policies ”as misguided as I believe these policies were, you have to either speak out or resign.” …

http://www.imf.org/external/np/vc/2002/070202.htm

An Open Letter

By Kenneth Rogoff,

Economic Counsellor and Director of Research,

International Monetary Fund

To Joseph Stiglitz,

Author of “Globalization and Its Discontents”

Washington D.C., July 2, 2002

[ A public letter, that strikes me as reflecting institutional policy insensitivity as well as being incorrect and unfortunate. ]

meanwhile, back in the US, in the most recent inflation report, producer prices are now a record 8.3% higher than a year ago, with the price index for final demand for goods now up by a record 12.6% from a year ago, while the index for final demand for services is up by a record 6.4% from a year earlier…

“Two-thirds of the broad-based increase in August can be traced to the index for final demand trade services, which rose 1.5 percent.”

final demand trade services measures increases in retail margins; hard to see how that wouldn’t show up in CPI, but i guess we’ll see tomorrow..