Today we are pleased to present a guest contribution written by Jongrim Ha (Senior Economist), M. Ayhan Kose (Chief Economist and Director) and Franziska Ohnsorge (Manager) from the World Bank’s Prospects Group. The findings, interpretations, and conclusions expressed in this blog are entirely those of the authors. They do not necessarily represent the views of the World Bank, its Executive Directors, or the countries they represent.

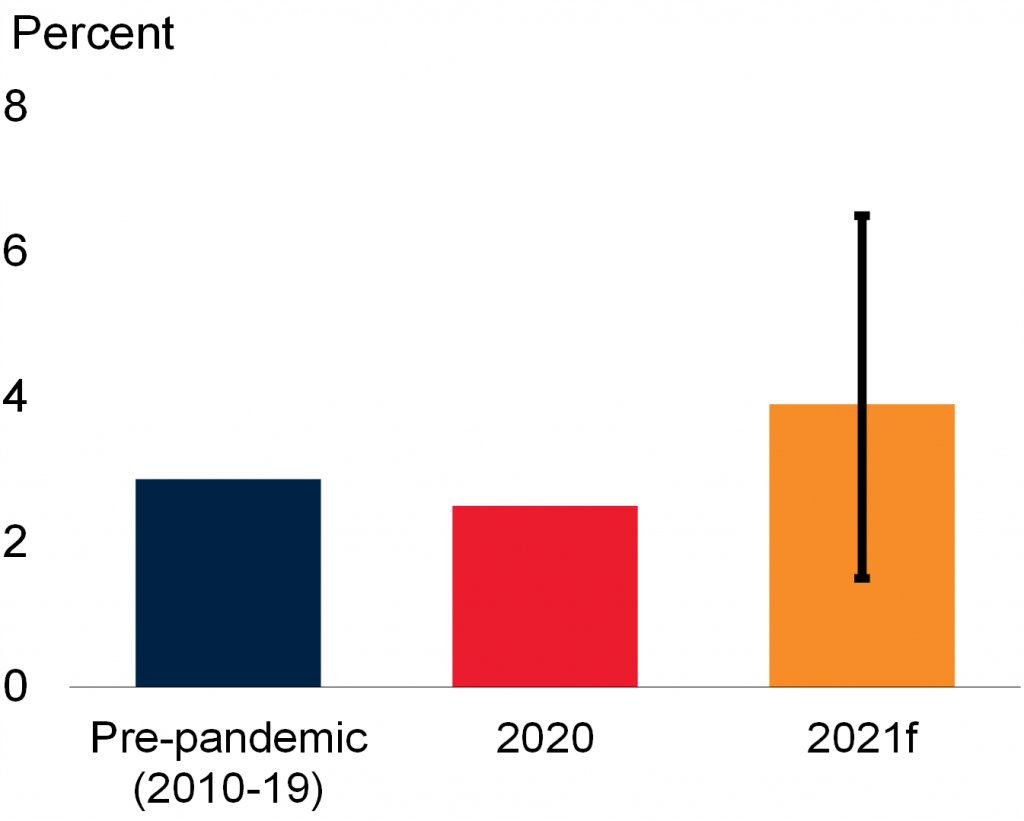

The COVID-19 pandemic plunged the global economy into its deepest recession since the Second World War. Amid a collapse in demand and tumbling oil prices, global consumer price inflation declined by 0.9 percentage point between January and May 2020 (Figure 1). This decline was about one-third more pronounced in advanced economies than in emerging market and developing economies (EMDEs).

Since May 2020, however, inflation has picked up. By April 2021, inflation had risen above pre-pandemic levels in both advanced economies and EMDEs. The inflation pickup was broad-based and present in about four-fifths of countries. As a result, the 2020 global recession featured the fastest subsequent inflation upturn, after the most muted inflation decline, of the five global recession episodes of the past 50 years.

Figure 1. CPI inflation

Sources: Haver Analytics, IMF International Financial Statistics, World Bank. Note: Median of year-on-year headline consumer price index (CPI) inflation in a sample of 81 countries, of which 31 are advanced economies and 50 are EMDEs.

Looking ahead, as the global economy gradually reopens, monetary and fiscal policies continue to be accommodative to support the recovery, and pent-up demand is being released in advanced economies. For major advanced economies, some have raised concerns that this confluence of factors may generate significant inflationary pressures (Summers 2021; Blanchard 2021; Landau 2021).

Others, in contrast, see little reason for concern, at least for many advanced economies, because of the temporary nature of price pressures, well-anchored inflation expectations, and structural factors still depressing inflation (Ball et al. 2021; Gopinath 2021; Krugman 2021; Powell 2021; Clarida 2021).

In a new study, we analyze the main drivers of recent developments in global inflation and consider prospects for inflation in coming months (Ha, Kose, and Ohnsorge 2021).

Drivers of recent movements in inflation

Fluctuations in aggregate demand, oil price movements, and supply disruptions contributed to global inflation developments during the pandemic. We estimate the role of each of these factors in a factor-augmented vector autoregression (FAVAR) model that consists of global inflation, global output growth, and oil prices. The model deviates from recent work in this area (Charnavoki and Dolado 2014; Ha et al. 2019) in three dimensions to accommodate the circumstances of the 2020 pandemic. First, the model employs monthly data rather than quarterly or annual data, to minimize concerns over endogeneity among variables. The use of monthly data is particularly important when the pace of recessions and recoveries differs. Second, on top of the standard sign restrictions, an additional set of narrative restrictions is imposed for the periods of large oil price fluctuations. Third, the model allows for time-varying volatility in the global variables to reflect large fluctuations in these variables around global recessions and oil price shocks.

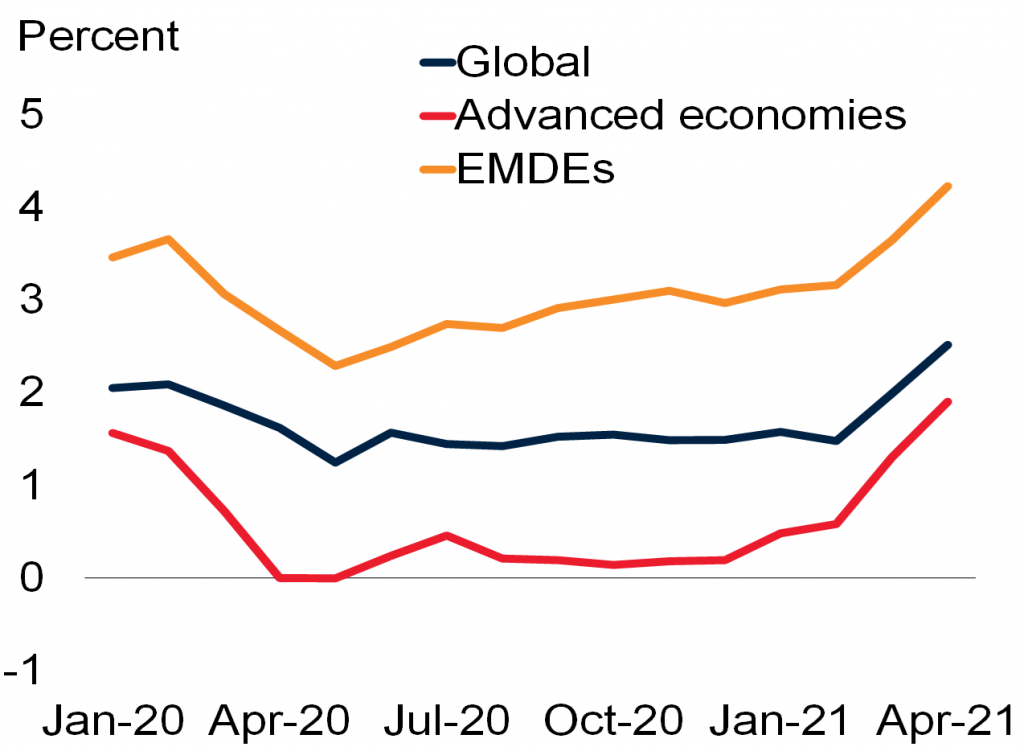

The estimation results suggest a sequence of changing disinflationary forces in January-May 2020 that were subsequently unwound (Figure 2).

- Between January and May 2020, four-fifths of the decline in global inflation reflected the collapse in global demand as consumption and investment dropped sharply amid lockdowns and uncertainty about policies and growth prospects. Another one-fifth reflected the plunge in oil prices. Within this five-month period, however, the forces affecting inflation shifted. In February and March 2020, the decline in global inflation was in almost equal measure due to the plunge in oil prices and a collapse in global demand, but the disinflationary impact of the collapse in global demand intensified in April.

- During June 2020-February 2021. From June 2020, as international trade and global manufacturing activity rebounded, supply factors began to lower inflation. A sharp rebound in demand, however, raised inflation as consumption shifted from in-person to online transactions. For the period from June 2020 to February 2021, demand pressures accounted for virtually all of the increase in global inflation and these were partially offset by improved supply conditions.

Figure 2. Contributions to monthly changes in global CPI inflation: 2020-21

Source: Ha, Kose, and Ohnsorge (2021). Note: Contributions to changes in year-on-year headline consumer price inflation from the previous month for 81 countries, of which 31 are advanced economies and 50 are EMDEs, based on a factor-augmented vector autoregression (FAVAR) estimation. Monthly data. Residual is omitted from the graph.

Near-term inflation prospects

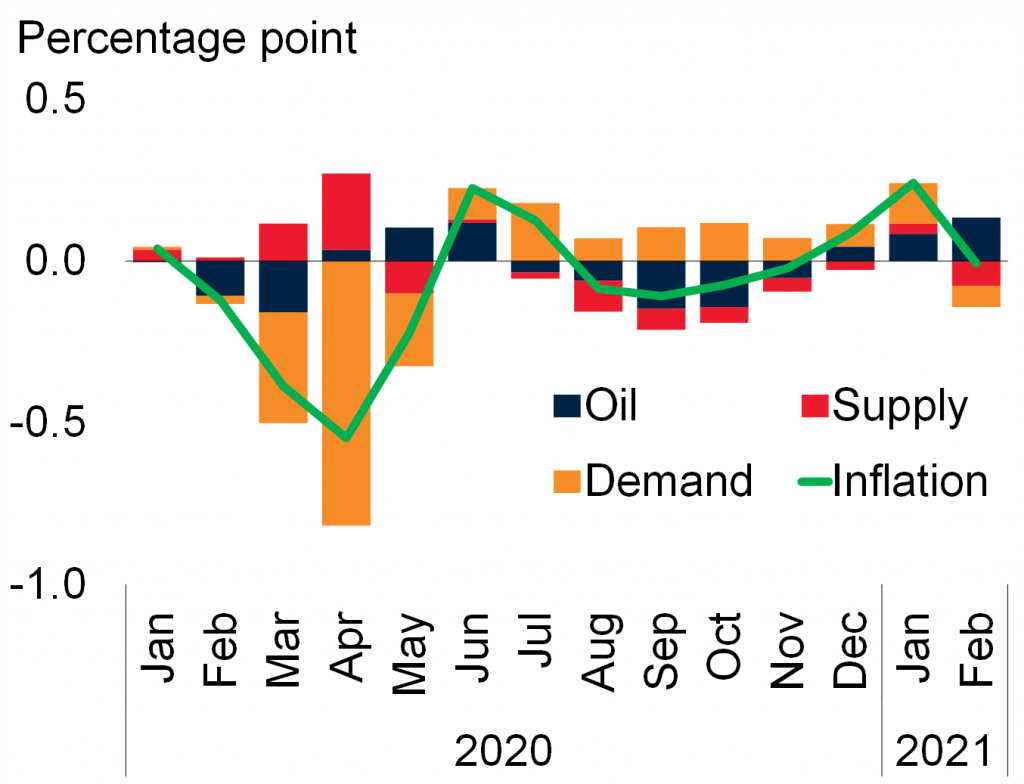

The global recession of 2020 was unusually severe but short. This was also reflected in inflation developments. The accompanying inflation decline was unusually muted and short-lived. Looking ahead, some factors point to an increase in inflation over the near term but stable low inflation over the long term. The same FAVAR model is used to project global, advanced-economy and EMDE inflation in coming months that would be consistent with the growth and oil price forecasts presented in the June 2021 Global Economic Prospects report of the World Bank.

- Global inflation. Global output growth is expected to be 5.6 percent in 2021 and oil prices are expected to average $62 per barrel over the year as a whole (World Bank 2021). This suggests an increase in global inflation by 1.4 percentage points in 2021 (from 2.5 percent in 2020 to 3.9 percent in 2021; Figure 3).

Figure 3. Model-based inflation prospects

Sources: Ha, Kose, and Ohnsorge (2021). Note: Conditional forecasts of global inflation based on quarterly factor-augmented VAR model of global inflation, global GDP growth, and oil price growth. Vertical line indicates 16-84 percent confidence bands.

- Inflation in advanced economies. In advanced economies, inflation is expected to rise to 1.8 percent in 2021 (from 0.5 percent in 2020)—a bit higher than the 1.4 percent average over the 2010s. For virtually all advanced economies, the model-predicted moderate inflation rise would bring inflation closer to inflation targets.

- Inflation in EMDEs. For EMDEs, estimations suggest that inflation will rise to 4.6 percent from 3.1 percent, well above the average over the 2010s of 3.8 percent. It would be a touch above the mid-range (3.8 percent), but still below the 5.1 percent upper bound of the average inflation-targeting EMDE’s target range.

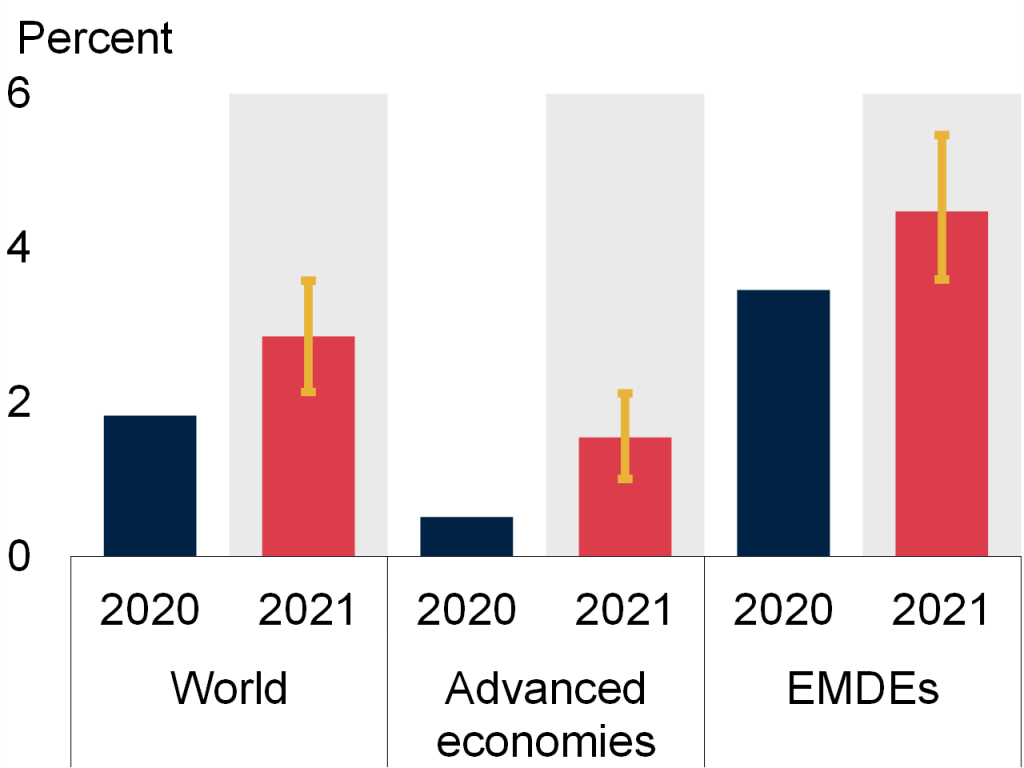

Inflation expectations. Consistent with the model-based inflation forecasts, survey-based consumer price inflation expectations suggest that global inflation is expected to rise by about 1 percentage point in 2021, from its low rate in 2020 (Figure 4). The expected inflation rise is broad-based, in both advanced economies and EMDEs. Forecasts of headline CPI inflation by major central banks also suggest a moderate increase in inflation in 2021 (by 1.5 percentage points in G7 economies and 1.2 percentage points in seven large EMDEs). Finally, although the data are limited to a few advanced economies, market-based inflation expectations point to a similar conclusion: breakeven implied inflation (measured as the spreads between nominal and real 5-year bond yields) has risen since April 2020 and recovered to pre-pandemic level by January 2021.

Figure 4. Survey-based inflation prospects

Sources: Consensus Economics, IMF World Economic Outlook, World Bank. Note: Average headline CPI inflation expectations for 2021 based on surveys of May 2021 in 57 countries (31 advanced economies and 26 EMDEs). 2020 indicates actual inflation rates. Yellow whiskers indicate maximum and minimum minimal responses.

Policy implications

Inflation is expected to moderate beyond 2021 as global growth settles at a lower level, commodity prices stabilize, and supply bottlenecks are eased. Over the longer-term, well-anchored inflation expectations point to continued low and stable inflation. As long as expectations remain anchored and any inflation increase—even above target ranges—is temporary, there may not be a need for a monetary policy response. The short-term increase in inflation might, however, extend over the longer term if policy makers are unable to keep inflation expectations anchored.

Structural factors—such as demographics, forces of globalization, and improvements in policy frameworks—supported disinflation over the past decade. However, if the recovery from the pandemic coincides with a turning point in some of these forces, the expected inflation pickup in 2021 may extend and, in EMDEs, could risk de-anchoring inflation expectations. Concerns over poorly anchored inflation expectations and the possibility of permanently higher inflation may compel EMDE central banks to tighten monetary policy earlier, or more strongly, than warranted by their cyclical positions.

Similar policy responses may also become necessary in some EMDEs if concerns about advanced-economy inflation prospects causes investors to reassess inflation risks and result in a sudden increase in global borrowing costs. In EMDEs with flexible exchange rates and limited financial vulnerabilities to exchange rate movements, currency depreciation may help buffer some of the impact of tightening financial conditions on activity. In other EMDEs, however, financial stability concerns may force central banks to tighten monetary policy more than warranted by the strength of their economies’ recovery. In part due to concerns about financial stability and inflation expectations, a number of EMDE central banks that had implemented expansionary monetary policy in 2020 have begun to tighten policy in 2021.

References

Ball, L., G. Gopinath, D. Leigh, P. Mishra, and A. Spilimbergo. 2021. “U.S. Inflation: Set for Take-off?” VoxEU.org, CEPR Policy Portal, May 7.

Blanchard, O. 2021. “In Defense of Concerns over the $1.9 Trillion Relief Plan.” Peterson Institute for International Economics blog, February 18.

Charnavoki, V., and J. Dolado. 2014. “The Effects of Global Shocks on Small Commodity-Exporting Economies: Lessons from Canada.” American Economic Journal: Macroeconomics 6 (2): 207-237.

Clarida, R. 2021. “U.S. Economic Outlook and Monetary Policy.” Speech at the NABE International Symposium, May 12.

Gopinath, G. 2021. “Structural Factors and Central Bank Credibility Limit Inflation Risks.” IMF Blog, February 19.

Ha, J., M. A. Kose, and F. Ohnsorge, and H. Yilmazkuday. 2019. “Sources of Inflation: Global and Domestic Drivers.” In Inflation in Emerging and Developing Economies: Evolution, Drivers, and Policies, edited by J. Ha, M. A. Kose, and F. Ohnsorge, 143-204. Washington, DC: World Bank.

Ha, J., M. A. Kose, and F. Ohnsorge. 2021. “Inflation During the Pandemic: What Happened? What is Next?” Working Paper DP 16328, CEPR.

Krugman, P. 2021. “Stagflation Revisited. Did We Get the Whole Macro Story Wrong?” Krugman wonks out (blog), February 5.

Landau, J. 2021. “Inflation and the Biden Stimulus.” VoxEU.org, CEPR Policy Portal, February 8.

Summers, L. 2021. “The Inflation Risk is Real.” Washington Post. May 24.

World Bank. 2021. Global Economic Prospects. June. Washington, DC: World Bank.

This post written by Jongrim Ha, M. Ayhan Kose and Franziska Ohnsorge.

RIP Charlie Watts.

I really loved you dearly.

I was never a big Charlie Watts fan to be honest. He never struck me as way above average in the talent dept. Similar to Ringo Starr, just not that impressive. He was “dependable” and “workmanlike”, so in that sense he is to be admired. I was trying to think of songs where the drums stuck out in my mind. “Emotional Rescue” was one I remember. “She’s So Cold”. I thought “Dirty Work” was an underrated album but even on that one I’m hard-pressed to think of drum work that stood out in any song other than standard beat-keeping.

I dunno. I remember either reading or hearing interviews from at least 10 years ago that greatly admired his ability to use “standard beat-keeping” to curb the wretched excesses of his bandmates. The interviewees thought this was a Herculean accomplishment.

In the last two days, I’ve heard interviews with actual drummers that are/were impressed that he brought a jazz drummer’s sensibilities and techniques to the Stones’ sound. They think he made a major contribution to the music and made it much better than a simple “beat-keeping” drummer could or would have.

Personally, all of my favorite Stones songs predate Emotional Rescue. From that point up to now, I just don’t care for the songs very much. I even saw them at JFK Stadium in Philadelphia (FWIW, George Thorogood opened) on the Tattoo You tour, but that experience didn’t make the album any better, either then or now. The old songs really kicked a$$, though.

Tattoo You was solid. Lots of good songs there. I thought “Waiting On A Friend” was a nice little ballad. I remember hearing some people say they thought that song had homosexual undertones to it, but I never got that until they mentioned it. I’m certain it could be steered that way with the lyrics if one chose. But to me it was more like a “guys out on the town”, or just the simplicity of regular friendship.

Often I think drummers can get a lot more attention and critical raves just by making proper mic placement and capturing the sounds in the studio properly. If you listen to Steve Jordan on Keith Richards’ solo albums the drum sound is pretty good. I’m thinking of the “Talk Is Cheap” album I got when it came out (yup, on cassette). Now you can have a laugh riot making jokes about the vocals on that album, and I basically wouldn’t disagree, but the other aspects of that album, including the studio sound of the drums/percussion on that record are pretty outstanding in my book. If no one knew and they credited Charlie Watts’ name on Steve Jordan’s drumming would anyone have noticed?? At the risk of sounding crass or rude, I doubt anyone would have noticed the difference.

Moses,

So we get it that you admire drummers like Ginger Baker who engage in dazzling pyrotechnic solos and backdrops. Aside from “defining the parameters of rock music” as Watts is quoted as saying of his role in the Rolling Stones, aside from providing the solid base for the pyrotechnics of Jagger and Richards, he was primarily a jazz musician, as noted above.

He was originally recruited by the band’s founder and namer, Brian Jones, who would get overwhelmed by Jagger and Richards when they joined. But Richards had to make a special appeal to keep Watts around, who had long found rock to be “dreadful.” His idols were Miles Davis and Coleman Hawkins, and he had several jazz bands of his own on the side over the years.

Aside from his steady beat and strong openings in songs like “Satisfaction,” “Jumping Jack Flash” and ” Gimme Shelter,” where one can hear his subtle jazz aspect is in lower key songs like “Ruby Tuesday,” “Angie,” and “Wild Horses,” not the driving hard rock stuff, although he was always the central key in all that.

But, perhaps, you are unhappy that he did not engage in shocking public conduct such as chowing down expensive ice cream while snorting cocaine.

I don’t have a problem with Jazz drummers, quite the opposite. Max Roach could make a very strong case as the greatest drummer of all time. But he didn’t just do “boom, bash, boom, bash, boom, bash” in metronome rate with two drum fills the entire song and call himself great. And the level of music education in America that knows Charlie Watts’ name, vs the number who know Max Roach’s name, tells you everything you need to know. That is, namely, most of them don’t know sh1t, and like guys like Charlie Watts and Ringo Starr because of their associations with other musicians, rather than any great technical prowess. Better than average?? Yes. Great?? NO

as somebody who played the drums when i was younger, i have respect for both the flashy drummers (bonham, rich) and the more laid back drummers, like henley, collins and, yes watts. you need the drummer to fit into the band properly. people poke fun at watts and ringo. but imagine what those bands would have sounded like with bonham, instead. its a little bit dishonest to claim bands like the Beatles and Stones are legendary, and then criticism of the members as lacking. legendary bands do not have lacking members, in my opinion.

As a current (hack) drummer and adequate upright and electric bass player, I have a whole lot of respect for both Charlie Watts and Ringo Starr. They were solid, fit in with the music they played, and were not distracting. Watts was actually an accomplished swing and jazz drummer, which you would never know just from listening to the Rolling Stones. Ringo was a sessions guy before George Martin suggested him to the Beatles. They weren’t hacks, like this rank amateur.

I hear old Uncle Moses thinks Chopin sucked at piano. His musical tastes are limited to chop sticks.

@ pgl

It appears none of your time in New York City has improved your feminine chirping. Your hero Andrew Cuomo, who you called “our nation’s leader in Covid-19 policy response” can flip shit better than that. Practice on the NYC subway and then try again. Pick out one of the subway riders not wearing pants, probably a good candidate for your finding a fellowship.

https://news.yahoo.com/ny-governor-adds-12-000-145951063.html

Moses Herzog

August 25, 2021 at 11:17 am

My Lord man – you are now rivaling Rip van Winkle for being out of touch. For one – I was never a Cuomo Democrat even though a liar like you claims I was his campaign manager. But come on – everyone on the planet knows we have dumped this clown a long time ago.

But please continue with your parade of pointless and stupid lies. You after all have eclipsed Donald Luskin as Stupidest Man Alive.

Moses,

“feminine chirping”? What?

Oh, is this more of your fixation with how bad lots of older powerful women are again? Will you be accusing pgl of publicly eating lots of expensive ice cream next?

Idea for future topic:

https://store.miningintelligence.com/

China is very interesting in Afghan mines with rare earths such as lithium. Of course these minerals are crucial for electric vehicles. I wonder what the folks at Telsa are thinking here.

As Cheryl Rofer pointed out on Nuclear Diner and on Lawyers, Guns, and Money, being interested is a far cry from exploiting. The extraction equipment needs to be transported to the mining sites somehow, and the ore transported to refineries, or massive refining capabilities need to be built near the mines, which also requires transport of refining equipment and construction materiel and equipment. Afghanistan’s road network is abominable, and I don’t foresee anybody undertaking the expense and effort to build the roads or to build a railroad through the Hindu Kush.

I will grant that economic rent is the difference between the price of a commodity and the costs of extraction as well as transportation to market. Maybe some wise person has a decent forecast of the expected future price of lithium and the projected economic costs of extraction and transportation.

Not to mention the fact that the Chinese would staff the ranks of management with Chinese nationals, not Afghans, and would extract whatever profit came from the operations for Chinese use. They would not endear themselves to the Afghans, and would end up dealing with the same kind of indigestible problem that everyone else who doesn’t just leave Afghanistan alone has always dealt with.

One of the more funny things to me here is how people keep on bringing up the Fed tools and powers. I don’t think it’s going to take much action from the Fed Res at all to avoid inflation here. There’s no need for a dam when there’s no rushing waters.

What Volcker damage did in the early 1980’s is an excellent example of your analogy here.

“I don’t think it’s going to take much action from the Fed Res at all to avoid inflation here.”

Preach it, brother, preach it!

Regarding the apparently larger surge of inflation in the EMDEs, which has not had much attention and I thank the authors for highlighting it, something else related to them that has not gotten much attention is that in the last several years we have seen several of those nations move into high inflationary states after a period when we had basically no nations having high inflation, say over 100% per year for several years at least.

Of course the first out the door and most dramatic was Venezuela, where I gather the rate has come down somewhat from its hyper level to a still high level. But others such as Argentina were showing acceleration even before the pandemic. I am curious what the pattern of this set of increases is. Are certain regions experiencing it more than others such as maybe Latin America, an area that has a history of high inflation?

Since you mentioned Argentina and Venezuela, I thought I would quote the key portion from my new link on how those bean counters deem an economy to be highly inflationary!

‘The report identifies seven countries as having three-year cumulative inflation rates of more than 100%: Argentina, Iran, Lebanon, South Sudan, Sudan, Venezuela, and Zimbabwe.’

“China is very interest[ed] in Afghan mines with rare earths such as lithium.”

Lithium is not a rare earth element. And not particularly rare — more plentiful than lead and tin, for example.

Who knew? Accountants (aka bean counters) define a highly inflationary economy as one where the price level triples in 3 years:

https://mnetax.com/dozen-countries-deemed-highly-inflationary-for-accounting-standard-purposes-45477

Only seven nations made their latest list with 5 others coming close. Now right wing alarmists might think the US is one of these nations but I hate to inform them that these bean counters did not put the US on their little list!

https://news.cgtn.com/news/2021-08-24/The-G20-s-COVID-agenda-12Z1XEDKRNe/index.html

August 24, 2021

The G20’s COVID agenda

By Jeffrey Frankel

Finance ministers, central bank governors, and political leaders are hard at work preparing for the 2021 G20 Heads of State and Government Summit in Rome on October 30-31. With the COVID-19 pandemic stretching well into its second year, the meeting will come at a time of heightened uncertainty about public health and the global economy. And though the mechanisms of international cooperation have been weakened by the pandemic and remain bruised by former U.S. President Donald Trump’s legacy, they are more important than ever.

“Cooperation” need not refer to international coordination of national monetary or fiscal policies. For the most part, countries on their own can move those levers in whatever direction is best for them. Instead, the G20 should focus on financial stability, trade, and vaccination. This is in addition to other important areas, especially the existential issue of global climate change, which should and will receive a lot of attention.

Over the course of 2020, most countries responded to the health crisis and economic recession with government spending. But emerging markets and developing economies (EMDEs) cannot finance deficits as easily as can Europe and the United States (with its “exorbitant privilege” conferred by the dollar’s global dominance).

Fortunately, many of these countries managed to meet the acute need for increased spending without having to pay sky-high interest rates, owing to the aggressive monetary stimulus provided by the U.S. Federal Reserve and other major central banks. The initial declines in EMDE currencies, securities prices, and commodity prices in March 2020 were reversed after the Fed’s easing.

But now it is August 2021, and every country must contend with a higher debt-to-GDP ratio. At some point, the Fed will signal an end to monetary easing and a coming increase in interest rates. Whenever that happens, investors will pull out of risky assets and lose enthusiasm for EMDEs. Suddenly, EMDE debtors could face potential financial crises like those that struck in the 1980s and 1990s (or, on a lesser scale, like the 2013 “taper tantrum,” when the Fed triggered EMDE capital flight by suggesting that it would soon start to wind down its asset purchases).

Accepting that there may be a bubble component to today’s high prices for risky assets, the financial situation appears particularly fragile. Some say that soaring markets reflect economic fundamentals; for example, high price-to-earnings ratios in the U.S. stock market are said to be justified by the promise of digitalization and other productivity-enhancing technological innovations. But I would point to the surge in some financial innovations that do not enhance productivity….

Some people in America still remember, that what always made America great, from her early beginnings, was, the TEAM concept

http://sports.yahoo.com/nfl-cowboys-jerry-jones-getting-covid-19-vaccine-team-accountability-we-rely-on-each-other-to-win-182624862.html

And this also, at least at such and such past time, was why Americans cherished sports. At its heart, sports is an exhibition of what amazing things can be done when people operate thinking not just about themselves, but also about the person lined up along their shoulder.

Not some cult of personality bastard wearing a red hat with a 4-letter anachronistic message and preaching hate.

“ All measures confirm that market rents have rebounded sharply since the beginning of the year. The current pace of increase is the fastest ever and is still gaining traction. It will become soon a key problem for Fed policymakers in a context where the shelter component of the CPI (also the PCE Price Index) tend to lag market rents. This delay can be explained by data construction and suggests that the recent spike in market rents will impact Fed inflation measures in the coming months. ”

https://www.christophe-barraud.com/u-s-rents-rise-most-on-record/

A “sustained run-up in rents could represent a bigger challenge to the Federal Reserve’s view –- shared by most investors –- that the current spike in inflation will prove transitory.” https://www.bloomberg.com/news/articles/2021-07-06/soaring-u-s-rents-are-the-sticky-inflation-with-staying-power

JohnH: We have already panel 1 of the semiannual measurement of rents in the July CPI figures (see BLS documentation here). We have a measure of sticky price inflation as plotted in this post. You can observe that inflation thus measured declined in July. So those articles could be right, but it’s not a given yet.

Until recently, I bet that most homeowners had absolutely no idea how much their home would rent for. Why would they? Fortunately, we now have Zillow to give us a ball park. My house has increased 82% in value in the last ten years and from what I can see, its rental value has increased at least 25% in the last couple years. This increase is not unusual in urban America. It will be interesting to see if the answers to the question reflect Zillow’s deeper understanding or whether homeowners just continue to shoot blindly when they answer the question.

IIUC, homeowners are surveyed as part of the CES, and BLS uses that only to determine the expenditure weights, while OER is imputed from surveys of actual market rents.

The idea that JohnH relies on Zillow is rather amusing. But I will say his comments here while quite limited are FAR more illuminating that the incessant bloviating on the housing market from “consultant” Princeton Steve.

Gotcha. Thanks for the clarification. Zillow seems to be reporting rentals to be rising at a slightly faster pace…about 1% faster in real terms.

https://www.zillow.com/research/july-2021-zillow-market-report-29992/

I think part of the problem here is that the BLS indices of housing costs that are generally reported in the news only in in real terms. Meanwhile Zillow reports a 9.2% rise while BLS reports 2.3%, the general—and totally natural response—is to ask what planet the people at BLS are living on…putting into question their credibility.

Even so, adjusting the Zillow reported rental rate increase for inflation to make it equivalent to BLS, the result comes out at least 1% higher than BLS.

The BLS may soon have to publicise its in figures more prominently and in current terms, not just real, to avoid the impression that it is telling people not to trust their lying eyes.

JohnH: The July 2021 CPI release itself states (at paragraph 11):

These figures are all in nominal terms.

Zillow provides a valuable service by providing news releases in a way that the general public can understand…not just in an obscure currency (1982-1984 dollars.)

The information also serves as a good sanity check on BLS data, which traditionally served as the only game in town.

“I think part of the problem here is that the BLS indices of housing costs that are generally reported in the news only in in real terms. Meanwhile Zillow reports a 9.2% rise while BLS reports 2.3%, the general—and totally natural response—is to ask what planet the people at BLS are living on…putting into question their credibility.”

WTF? It is not credible to do inflation adjusted figures? We have a new candidate for the dumbest comment of all time. BTW if you actually knew how to read these series, BLS also reports its series in nominal terms.

Others have asked to stop writing such incredibly stupid things. And yet you continue? Why do your embarrass your mother this way?

Zillow has a vested interest in fluctuating real estate values. You should be at little a little wary of their work.

“not just in an obscure currency (1982-1984 dollars.)”

It is the US$ which I guess is a foreign currency. Doing things in inflation adjusted terms makes it obscure??? Lord – you are the dumbest troll ever!

“The current pace of increase is the fastest ever and is still gaining traction.” Inflation is “gaining traction” either because it is accelerating or because prices are rising in a way that is likely to become entrenched — an acceleration in sticky-price inflation. Neither is true as of the most recent data release.

“It will become soon a key problem for Fed policymakers in a context where the shelter component of the CPI (also the PCE Price Index) tend to lag market rents.” The writer is claiming facts not in evidence — why does this happen so much? — in this case by tacitly asserting that he knows a “key problem for the Fed” when hhe sees one. A couple of things the writer appears to have missed. First, the spike in home prices and rents is in large measure a supply-side problem, which means the Fed doesn’t really have good tools to deal with it. Raising rates might dampen demand by raising mortgage rates, but it wouldn’t address the underlying problem of inadequate housing. Raising rates might worsen the problem of housing scarcity.

Second, a general, persistent rise in inflation is the thing the Fed wants to avoid. A rise in rental rates is not general. Rising rents would have a hard time becoming a “key problem” if prices in general stabilize. You’ve quoted the wrong guy. Barraud is a forecaster, not a Fed watcher.

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index Rent and Owners’ Equivalent Rent, 2020-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Fn2j

January 15, 2018

Consumer Price Index Rent and Owners’ Equivalent Rent, 2017-2021

(Percent change)

In the housing markets I have been following, housing prices seems to be doing a dance with rentals, soaring like raptors on a rising wind.

I bet Zillow data could confirm this…or not.

https://fred.stlouisfed.org/graph/?g=x1E2

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2017-2021

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=oCkD

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2000-2021

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=x2fE

January 30, 2018

Case-Shiller Composite 10-City Home Price Index / Owners’ Equivalent Rent of residences, 1992-2021

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=oi59

January 15, 2018

Sticky Consumer Price Index less Shelter, 2007-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=oi5a

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2007-2021

(Percent change)

https://news.cgtn.com/news/2021-08-25/Chinese-mainland-reports-20-new-confirmed-COVID-19-cases-130sxR7LNvy/index.html

August 25, 2021

Chinese mainland reports 20 new COVID-19 cases

The Chinese mainland recorded 20 new confirmed COVID-19 cases on Tuesday – 4 local transmissions and 16 from overseas, the latest data from the National Health Commission showed on Wednesday.

In addition, 11 new asymptomatic cases were recorded, while 476 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 94,707, with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-08-25/Chinese-mainland-reports-20-new-confirmed-COVID-19-cases-130sxR7LNvy/img/c4f6db0ffa2d40c8838e97f86baf05f7/c4f6db0ffa2d40c8838e97f86baf05f7.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-08-25/Chinese-mainland-reports-20-new-confirmed-COVID-19-cases-130sxR7LNvy/img/77ecf25217ad4fb2b8bf5a725efa3d0e/77ecf25217ad4fb2b8bf5a725efa3d0e.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-08-25/Chinese-mainland-reports-20-new-confirmed-COVID-19-cases-130sxR7LNvy/img/581cf9d11e7e43ae8075417c8ea70ef5/581cf9d11e7e43ae8075417c8ea70ef5.jpeg

http://www.news.cn/english/2021-08/25/c_1310147920.htm

August 25, 2021

Over 1.97 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.97 billion doses of COVID-19 vaccines had been administered in China as of Tuesday, data from the National Health Commission showed Wednesday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 1.975 billion doses of Chinese vaccines administered domestically, another 800 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

August 25, 2021

Coronavirus

United Kingdom

Cases ( 6,590,747)

Deaths ( 132,003)

Deaths per million ( 1,933)

China

Cases ( 94,707)

Deaths ( 4,636)

Deaths per million ( 3)

I grew up as an economist with expectations as a core of models. But more recently I’ve started to wonder how useful it is empirically. We now have an interesting experiment, in which novel short-run sources of inflation (used cars, logistics costs) affect headline numbers. Now us wonks know the Atlanta Fed’s sticky-flexible price index, and perhaps that sort of analysis is more widely diffused than my use of “wonk” implies. Anyway, we may have a chance to use “novel” contributions to transitory inflation to play around with how expectations are formed, and whether they really feed back into the anchoring of inflation.

This may be old hat, as in retirement I’m focused on the auto industry, and no longer periodically dip into the macro literature. I don’t even scan macro-oriented blogs much, obviously this morning is an exception.

Hi, Mike. So when did you retire? My wife Marina did two years ago, but I am still chugging along here at JMU, with my first classes today.

I grew up as an economist with expectations as a core of models. But more recently I’ve started to wonder how useful it is empirically. We now have an interesting experiment, in which novel short-run sources of inflation (used cars, logistics costs) affect headline numbers. Now us wonks know the Atlanta Fed’s sticky-flexible price index, and perhaps that sort of analysis is more widely diffused than my use of “wonk” implies. Anyway, we may have a chance to use “novel” contributions to transitory inflation to play around with how expectations are formed, and whether they really feed back into the anchoring of inflation.

[ Nicely pointed out. ]

http://www.news.cn/english/2021-08/25/c_1310148501.htm

August 25, 2021

South Africa’s unemployment rate rose to 34.4 percent from 32.6 percent in the second quarter of 2021, according to data released by Statistics South Africa.

JOHANNESBURG — South Africa’s unemployment rate increased to 34.4 percent from 32.6 percent in the second quarter of 2021, data released by Statistics South Africa (Stats SA) revealed on Tuesday.

This was the country’s highest joblessness rate since the first quarter of 2008.

Releasing the report, Statistician General Risenga Maluleke said unemployment went up by 584,000 to 7,8 million when compared to the first quarter of this year. The expanded definition of unemployment rose by 1.2 percent to 44.4 percent compared to the first quarter.

The expanded definition includes people who have given up job hunting. Maluleke said the number of discouraged work-seekers increased by 5.9 percent after the number rose by 186,000….

[ Distressing and dangerous. ]

The cite has lots of employment market data dating back to 2000:

http://www.statssa.gov.za/publications/P0210/P02102007.pdf

Note that the overall unemployment rate from 2000 to 2007 was always above 20%. The South African labor market is a far cry from the US labor market.

Thank you.

http://www.statssa.gov.za/

Statistics: South Africa

https://fred.stlouisfed.org/graph/?g=FBxA

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa, Kenya and Ghana, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=FBxG

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa, Kenya and Ghana, 1977-2020

(Indexed to 1977)

Folks, I want all of you to know (try to remember the 100 gallon vats of sarcasm I’m known to carry with me here to the blog from time to time) that when Barkley Junior and pgl, well, when those two political, like, geniuses, and stuff, from NYC and Harrisonburg told me Copmala Harris was going to make a great VP political candidate, and helpful to Democrats clear into 2024, I never had a single doubt. Never. Not for a millisecond did I think Copmala was a disaster in the making. I want all of you to know that.

https://twitter.com/pollsterguy/status/1430543904504434698

Moses,

Um, I do not remember saying anything about what was going to happen with Harris beyond the election. Offhand I would note that Biden has been dumping several unpopular and difficult problems on her as her responsibility that cannot be resolved easily, especially as a VP. Handling the situation at the border is an example. Is there anything anybody can do with that situation which will increase their popularity?

We get it that she is on the list of powerful women you do not like, Moses, which has been sick sick sick all along. So here you go again reminding everybody how much of a demented nut case you are with this odd bit of information.

What is Moses chirping about here??? I guess he had a lot of expensive wine again.

pgl,

Do keep in mind that Moses has claimed to prefer inexpensive wines. Expensive ones are for meanie snobs like me. But, yes, that is probably it, not full-blown psychosis but merely a bit too much of something along those lines.

“So here you go again reminding everybody how much of a demented nut case”

I just read some shrill attack on Atlanta and a bunch of other stuff drunk Moses keeps going off on where Atlanta was supposed to be the most segregated city. Now Moses did praise Brookings for its hawkish take on something to do with foreign policy (nothing new there) even if this demented drunk could not tell us who from Brookings he was citing and even what they really said. So I found this from Brookings which has its own simple summary measure on a neat little map. After all for a demented drunk like Moses, we need to keep this at the preK level. But take a look:

https://www.brookings.edu/blog/the-avenue/2015/12/08/census-shows-modest-declines-in-black-white-segregation/

Atlanta is far from the top of segregated cities. Yes – old drunk Moses has to make up a lot of pointless pathetic lies in his stupid personal attacks.

Atlanta is a haven for the broadminded, pgl has proven that here many times:

https://www.nbcnews.com/news/us-news/atlanta-mom-files-complaint-alleging-daughter-s-grade-school-segregated-n1276584

That must have been a LONG time ago. Oh wait, it says August 11, 2021. That’s weird…….

That’s the first link that came up, after a 5 second search (4 seconds due to my slow typing). I wonder how hard it would be to search for others?? Well, we could check with political expert pgl and dig more at what “pgl” calls “center-right” Brookings. ‘Cuz, like, we all know Brookings Senior Fellows are always hanging out in the lower socio-economic hangouts in Atlanta or when not doing that they’re bashing Atlanta area private schools that find “other reasons” to exclude Blacks from a solid education. Who would dare say Atlanta has a piss poor record on segregation issues?? Surely not white male Atlanta born and raised pgl, so, that solves that question. White male raised in Atlanta must have a “keen sense” when people feel left out. No doubt. I believe that……

For the record, according to a list estimated at Berkeley, Atlanta is currently the eleventh most segregated city in the US. Detroit is Number One.

You found one nut case in Atlanta? Yea I’m sure all of your neighbors are progressive people who have been vaccinated. Oklahoma – the most liberal state in AMERICA!

Mary Lin Elementary School is one school. Dude – it is a big city. But I’m sure your schools are all perfect. After all you live in Oklahoma. Nuf said.

Every allegation is true in your book? Your research skills missed this:

https://atlantaintownpaper.com/2021/08/parents-refute-claims-of-segregation-at-mary-lin-elementary-school/

BTW Susan Rice is filing sexual harassment charges against you later today. Of course she has to be correct so do confess your sins.

Any of the readers here (including Professor Chinn) I strongly encourage to read the following data, some of which is presented in easy to understand visual form. The part that might be interesting to many people is the visual which is almost dead center in the middle if you thought of “the middle” as halfway down the scroll down of the page, which shows a map of North Fulton County, and South Fulton County, along with small purple circles and small green circles identifying both the location and associated characteristics of those individual schools inside Fulton County.. It cross-refernces performance grades of individual schools for college and career readiness with racial composition of the schools.

https://bppj.berkeley.edu/2019/10/16/fall-2019-journal-race-segregation-and-education-in-georgia/

Now, for a white male like pgl, who probably grew up in Atlanta when these school conditions/choices were even worse for Blacks than they were in say 2017 and/or now, I wouldn’t expect empathy from him or empathy from any person randomly chosen who brags about their own family ancestors’ confederate army rank. But if you showed that Fulton County map to most Black people, or showed the visual data in the map to Black parents raising children in Atlanta, they would find the data presented in that graph unacceptable. For those weak in geography, Fulton County is the same County the city of Atlanta is located in. It is segregated STILL, and it is stratified. Which produces the expected results shown in the graph. Blacks denied the resources and tools and quality instruction needed to properly prepare them for a 4-year University education. Not that that fact would bother pgl or Barkley Rosser in the least way.

I wonder who are the regular readers of “Atlanta InTown” and if most of their sponsors are those selling Atlanta area real estate, and Atlanta area tourism?? Well, there’s no way that publication would want to attempt to deny racial favoritism or stratification of Atlanta and Fulton County public schools if their main goal is selling local area real estate, is there?? NO, “impossible” “Atlanta InTown” might have an agenda with their white suburbs based audience and real estate broker sponsors.

“Since its founding in 1994, Atlanta Intown’s mission has been to publish hyperlocal news that informs and empowers our readers and helps build community.

Each month, Atlanta Intown distributes 27,000 copies to homes and businesses in neighborhoods throughout Atlanta’s most influential and dynamic neighborhoods. Copies are mailed to homes in Midtown, Morningside, Virginia Highland, Ansley Park, Candler Park, Druid Hills, Emory, Inman Park, Old Fourth Ward and all the places in between. Additional copies are available at local restaurants, hotels, businesses and arts venues.”

pgl, If your specialty is transitive prices, I think your choice of “unbiased” citations must be the crappiest of anyone writing papers on that specialized topic.

Me thinks the reply to this stupid tweet was direct at you:

‘That’s because we are watching them use the same tactics they used on Hillary Clinton. Misogyny is key to this poll.’

Congrats on having a female Governor now, since New York state’s inhabitants are too dumb to know a corrupt leader when they see one. Since a female leader was finally installed for, not chosen by New York’s typical voter who I can assume is nearly, though not quite as dumb as pgl. Now pgl can celebrate that New York was behind 30 other American states in having its first female Governor installed for them (New York state residents had at least 2 other solid female Governor candidates they refused to vote for). I hope that doesn’t upset pgl, since pgl felt Andrew Cuomo was “our nation’s leader in Covid-19 policy response”

https://econbrowser.com/archives/2020/04/the-council-to-re-open-the-economy#comment-235838

Political expert pgl’s exact words from his comment: “Cuomo hosted a conference call with the governors of the Northeast Region which expressed some smart ideas including the need for testing. Cuomo is basically our national leader given we still have a pack of clowns occupying the White House.”

https://econbrowser.com/archives/2020/08/why-do-we-care-about-retail-sales#comment-240219

This comment was very female friendly:

https://econbrowser.com/archives/2018/06/the-trade-war-to-date#comment-211367 I can find more female friendly permalinks by pgl, if he likes. We can do this……

This for the former female candidate for New York Governor–running against pgl’s hero Andrew Cumomo:

https://econbrowser.com/archives/2018/06/the-trade-war-to-date#comment-211387

“pgl” said: “You had to Google to find some “economist” none of us ever heard of? Oh wow – PeakDishonesty has turned to the socialist EPI. I guess next you will be supporting Cynthia Nixon!”

Here’s another classic from pro-female pgl on candidate for Governor of New York Cynthia Nixon:

“Seriously? Look – I’m not that big of a fan of Cuomo but the progressive legislation this article touts were things Andy believed and pushed for. If you think Cynthia Nixon was the driving force – you are dumber than I ever gave you credit for.”

https://econbrowser.com/archives/2021/01/business-cycle-indicators-january-4th#comment-247153

This last pgl comment was made, in reply to this article https://theintercept.com/2019/07/11/new-york-state-progressive-democrat-primaries/ being posted on this blog, which illustrated that Andrew Cuomo had a similar proclivity to Nancy Pelosi in his “Oops!!! Gosh Golly darn, tarnation jiminitty!!! Thunderation by Saint Goobar of Harrisonburg!!! I’ve failed to pass legislation/laws which help the common man AGAIN!!!!

Anyone paying attention in New York, knew this The Intercept article to be dead on accurate, but that didn’t jive with pgl’s problem with a trueDemocrat female candidate with policies friendly to the common man, instead of favoring Andrew Cuomo’s corrupt friends in corrupt construction contracts and vending contracts etc.

This last one, is pgl when he was gushing with man-crush love over Cuomo’s book:

While New York continues combating COVID-19, Gov. Andrew Cuomo has taken the time to write a book looking back at the state’s experience “climbing the mountain and coming down the other side” while dealing with the pandemic.

“American Crisis: Leadership Lessons From The COVID-19 Pandemic” is set to be released by Crown Publishing on Tuesday, Oct. 13, three weeks before Election Day.

The announcement of Cuomo’s book comes a day after he was a prominently featured speaker at the Democratic National Convention, harshly criticizing President Donald Trump, leading to a series of scathing tweets from Trump in response.

I’m not entirely sure about the publication date but rumor has it coming out in October – just before the election.”

https://econbrowser.com/archives/2020/08/why-do-we-care-about-retail-sales#comment-240219

It was later shown the book pgl was gushing with love over, was found to be illegally funded/promoted with campaign funds.

In closing, I will give a “by the way”, there were other females who ran against Cuomo, I am thinking specifically back to the year 2014, Zephyr Teachout, Who I praised on this blog more than once, an example I can give from 2 years and 11 months ago:

https://econbrowser.com/archives/2018/09/political-calculations-concludes-no-externalities-internalized#comment-217207

I have praised many women on this blog, Barkley Junior and “pgl” only care to highlight when I criticize those females who made them look like A$$e$, because, well, Copmala Harris doesn’t clean windows, and Copmala doesn’t visit the “riff-raff” at the southern border until pressed to do so. And Cynthia Nixon isn’t going to give money to corrupt state vendors. So “Cynthia Nixon had nothing to do with pushing Cuomo to ‘adjust’ his S***” [edited MDC], according to our resident Georgia born and raised “New Yorker”.

Moses,

Yes, you have praised a few women. The peculiar thing is that nearly all of them somehow end up getting described by you according to “temperature,” as in a high temperature. I think there might be one or two you praised without this moniker indicating your desire to go to bed with them.

Uh you do know Susan Rice declined horny old Uncle Moses advances. She may be a bit neocon but she ain’t that stupid.

“This last one, is pgl when he was gushing with man-crush love over Cuomo’s book”

Go back and read the link I provided about this book scheduled to be released just before the Biden-Trump election date and you might notice the entire point of this was to show up the incompetence of Trump’s handling of COVID-19.

I see that old Uncle Moses gets angry with any criticism of Trump these days. The incompetence behind the Doha Agreements has really gotten Moses upset.

Now when Mike Pompeo runs for President in 2024, I bet he hires old Uncle Moses as his campaign manager.

You really need to get back on your meds.

I keep wondering how people think that getting the Covid-19 or the Delta variant is going to be “easier” than just taking the vaccine. How do they figure getting the virus itself will go better than taking the vaccine?? Can anyone out there tell me what the “logic” there would be?? I’m fascinated to know how being eaten by an adult lion in the jungle is easier than facing a baby lion with a muzzle over its jaws??? I wanna hear how this works. The human mind is an interesting thing, and I want to know how the vacuous category of mind operates.

https://www.yahoo.com/news/unvaccinated-pregnant-nurse-unborn-baby-151737417.html

https://news.cgtn.com/news/2021-08-26/Chinese-mainland-reports-26-new-confirmed-COVID-19-cases-1328qqD9Z2E/index.html

August 26, 2021

Chinese mainland reports 26 new COVID-19 cases

The Chinese mainland recorded 26 new confirmed COVID-19 cases on Wednesday – 3 local transmissions and 23 from overseas, the latest data from the National Health Commission showed on Thursday.

In addition, 19 new asymptomatic cases were recorded, while 467 asymptomatic patients remain under medical observation.

This brings the number of confirmed COVID-19 cases on the Chinese mainland to 94,733, with the death toll unchanged at 4,636.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2021-08-26/Chinese-mainland-reports-26-new-confirmed-COVID-19-cases-1328qqD9Z2E/img/0688e0e490574b38b11bb373932c7545/0688e0e490574b38b11bb373932c7545.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2021-08-26/Chinese-mainland-reports-26-new-confirmed-COVID-19-cases-1328qqD9Z2E/img/440907ce50244cee875ad3ce0c031221/440907ce50244cee875ad3ce0c031221.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2021-08-26/Chinese-mainland-reports-26-new-confirmed-COVID-19-cases-1328qqD9Z2E/img/65b98eb65ecb4fb9b525812fd120d8b0/65b98eb65ecb4fb9b525812fd120d8b0.jpeg

http://www.news.cn/english/2021-08/26/c_1310150223.htm

August 26, 2021

Over 1.98 bln doses of COVID-19 vaccines administered in China

BEIJING — More than 1.98 billion doses of COVID-19 vaccines had been administered in China as of Wednesday, data from the National Health Commission showed Thursday.

[ Chinese coronavirus vaccine yearly production capacity is more than 5 billion doses. Along with over 1.988 billion doses of Chinese vaccines administered domestically, another 800 million doses have been distributed internationally. A number of countries are now producing Chinese vaccines from delivered raw materials. ]

https://www.worldometers.info/coronavirus/

August 26, 2021

Coronavirus

United Kingdom

Cases ( 6,628,709)

Deaths ( 132,143)

Deaths per million ( 1,935)

China

Cases ( 94,733)

Deaths ( 4,636)

Deaths per million ( 3)

JohnH is on another one of his tirades writing one incredibly dumb comment after another. It seems JohnH has been hired by Zillow to promote their reporting of the cost of housing as being superior from the BLS who JohnH thinks is the only other game in town. I’m sure Case and Shiller are rolling on the floor over the notion that they have not provided useful data on the housing market. But take a look at how the BLS calculates its owner’s equivalent rent series as its primary rent series:

https://www.bls.gov/cpi/factsheets/owners-equivalent-rent-and-rent.pdf

First thing to notice is that this is a nominal series – because JohnH seems to think this is inflation adjusted. It clearly is not.

Now BLS will report in addition to nominal series a conversion to inflation adjusted (in this case real rent). For some dumb reason JohnH claims BLS has shot its credibility for reporting both series. Seriously? BTW reporting things in real terms is not reporting in a foreign currency – another JohnH claim.

But the main thing here is that BLS takes a lot of care in reporting this useful information. Rather than attack the hard working folks at BLS – may I suggest JohnH lead the Zillow efforts at calculating owner equivalent rents. I’m sure that would be very reliable – right?