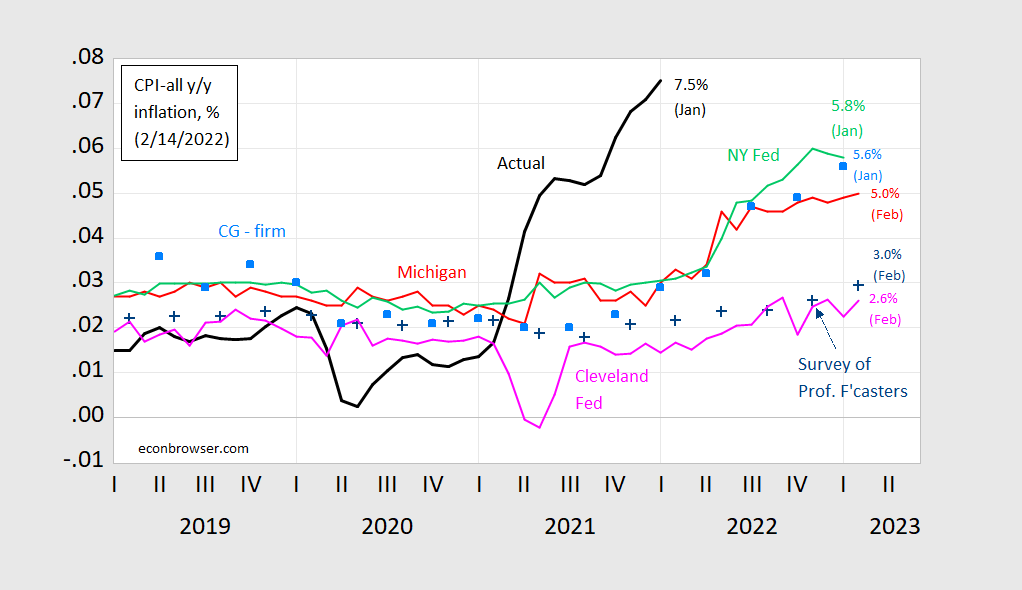

Economists’ expectations rise, while household measures trend sideways.

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

A reminder that — as all expectations of y/y inflation move up — consumer/household based expectations are higher than those from economists and other forecasters, and (as discussed here), upwardly biased. Currently, household expectations are about two and a quarter percentage points higher than economists’ expectations.

Stephanie Kelton: “ The way I see it, inflation is a complex and dynamic process, with potentially many underlying drivers. It takes a certain hubris to assert that by nudging a single price—the federal funds rate—higher, the entire economy can be shifted back onto to a stable inflation path. My view is that any effort to rein in inflation must start with an autopsy of the problem…

As any medical doctor or auto mechanic surely knows, you have to figure out what’s causing a problem before you can resolve it. Prescribing antibiotics to fight a viral infection or replacing the alternator to stop the radiator from overheating won’t improve the situation. To successfully deal with an inflation problem, you have to get the diagnosis right.

That’s why the debate over what caused our current bout of inflation is so important. In my view, the White House was on the right track with this attempted autopsy in July 2021. If firms are abusing their market power and gouging customers to earn “excessive” profits, then it’s important to know that. If the main drivers are mostly related to bottlenecks and the pandemic, then it’s important to understand that too.”

https://stephaniekelton.substack.com/p/how-do-you-solve-a-problem-like-inflation

So far, it’ seems obvious that there is no consensus among economists as to what the underlying problem is, and they’re in deep denial that corporate price gouging might contribute to it. Given this disarray among policymakers and advisors, can anyone have faith in forecasts or solutions to address inflation?

Wow – this MMT rant went on and on more than usual:

“I’ve gotten a lot of questions about the current bout of inflation and what—if anything—it teaches us about Modern Monetary Theory (MMT). Did Congress “experiment” with MMT, and does the run-up in inflation mean that MMT has “failed”? Now that inflation is here, what does MMT tell us to do about it? This post tackles those questions.”

I’m sure but her essay never really said anything specific. It was more than all things are possible. MMTers have a weird habit of just going on and on and on. Testing hypothesis – not her thing.

How did a lack of agreement (which you assert, but do not demonstrate) become “disarray”? Just so you can sing your one note again.

That one note is that you have some mystical understanding of the workings of the economy which has escaped trained economists. Funny how, back when you actually tried to prove your points, you were routinely demonstrated to be wrong. So much for your mystical understanding. These days, you don’t even try.

Speaking of mystical understanding, I think I can let you in on a little secret about debate among specialists. Debate focuses on disagreement. Non-specialists (that would be you) easily get the impression that specialists don’t agree about much because non-specialists only hear the debates. Non-specialists haven’t learned the foundations, on which there is general agreement. A non-specialist wih a big enough ego (again,, that would be you) is likely to say to himself “since the specialists don’t agree on anything, my ideas are as good as theirs.” But that non-specialist would be wrong.

BTW – Kelton never endorsed Johnny Boy’s new little thesis. Yes – it was briefly mentioned in this long Kelton rant but she mentions everything including the kitchen sink.

You would have thought that those famed specialists would have dug a little deeper nine months ago to assess the potential severity and impact of the supply chain issues. I mean, the looming problem at US ports has been known and was documented years ago. It was a crisis waiting to happen…and then it happened. And a common response among economists was to blithely brush it off, downplay its potential severity, and declare it transitory…something that “the market” would fix in no time. IMO this nonchalance verges on professional malpractice and raises serious questions about the competence of those economists.

Stephanie Kelton also raises the issue of corporate price gouging. Once again progressive commentators have been missing in action…or worse: “ Biden’s linkage of monopoly power to inflation is facing vehement, almost hysterical, criticism from all sides, including many progressive commentators. And I find that vehemence puzzling; I think it says more about the commentators than it does about the administration.”

https://www.berkshireeagle.com/opinion/columnists/paul-krugman-why-are-progressives-hating-on-antitrust/article_630fc1f4-78b1-11ec-a283-4fb89175dacf.html

What I have observed is that the silence of economists on the issue of market concentration contributing to inflation has been deafening…massive denial. Curiously there is a paucity of data. But digital [dot] com did a survey. (Imagine their chutzpah!!!) Their “findings revealed that more than half of retail businesses are using inflation to drive up prices higher than what’s necessary to offset increased costs… Over half of retailers have increased prices by 20% or more on average.” https://digital.com/half-of-retail-businesses-using-inflation-to-price-gouge/

No corporate price gouging? No market power contributing to inflation??? Hah!

If economists don’t believe the findings, maybe they could at least do the American public a favor and start doing their own surveys instead of sitting on the sidelines, content to ignore the issue of market power’s contribution to inflation.And, who knows, actually diagnosing the drivers of inflation, as Stephanie Kelton recommends, might actually lead to more accurate forecasts and to policies appropriate to getting this inflation under control.

Did you read what Macroduck wrote? You dismiss any indication that economists have addressed this. Oh wait – they were not writing for the NYTimes so you never read what they wrote. Could we please stop your uninformed rants on just about every topic where you have no clue?

“What I have observed is that the silence of economists on the issue of market concentration contributing to inflation has been deafening…massive denial. Curiously there is a paucity of data.”

This is lie. Never mind we have provided you citations dating back to the 1970s. You choose not to acknowledge there has ever been any research as you have not read something written this week. JohnH – carnival barker barking so hard he could not even find his umbrella if it started raining.

Yeah, economists are great at theory but in the case of monopoly pricing power, they’re are seriously deficient in applying the theory to present-day reality.

pgl in particular downplayed any notion that oligopoly had any relevance to today’s inflation, even denying that a company with a generally recognized near monopoly was operating in anything but a perfectly competitive market.

Public policy is debated not only is obscure academic journals but also in the media. The only people whom I have observed talking about monopoly power’s contribution to inflation are non-economists like Robert Reich. While there may well be others, most have kept a low profile. To debunk my claims, macroduck is free to link to economists who have talked about corporate concentration’s role in today’s inflation in the mass media.

The same is true of the severe impact of specific supply chain bottlenecks, such as the problems in the ports. Again, it was non-economists who called attention to potentially serious problems, while economists were missing largely in action in diagnosing the severity.

It seems that when economists get caught ignoring major current drivers of major problems, they just refer to academic research often done decades ago, not noting that it was their responsibility to make the connection to current events.

What you “have observed” is evidence of what I observed about you – you’re ignorant of the subject on which you express strong views. Other commenters here have point to the literature on market structure, showing that economists do study market concentration. You, who apparently don’t read past the popular press, “observe” nonsense. Your beef is with the press and you don’t even know it.

It is as you noted but this troll still writes nonsense and just plain lies

“You would have thought that those famed specialists would have dug a little deeper nine months ago to assess the potential severity and impact of the supply chain issues.”

actually, economists have been on top of the supply chain issue for some time. but they are not the ones who need to solve the problem. that has to be done by the businesses.

But remember – these economists are not “famed” economists. I guess JohnH considers Menzie to be just a run of the mill economist. Now if some economist on JohnH’s preapproved list did write on this topic – JohnH would come back and retort it was not in the NYTimes this week. That is how this lying troll rolls!

Stephanie Kelton and another female economist have lately been savaged by prominent male economists for suggesting analytical approaches to the broad price increases being experienced. The gender matter strikes me as germane to the bashing of the ideas, and I would agree that an analysis of the price increases being experienced is important. I am interested in or concerned about the price effects of our trade policy and our sanctions policy.

I do not object to analytical approaches but throwing in everything including the kitchen sink is not an analytical approach.

https://fred.stlouisfed.org/graph/?g=tr30

January 30, 2018

Producer Commodities Price Index, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=zYmJ

January 30, 2018

Producer Commodities Price Index, 2017-2022

(Indexed to 2017)

A question that I think needs asking is about the extent to which commodity price increases can be focused on sector by sector to limit the increases and keep them from filtering through to producers and consumers. Right now, China is focusing on increasing prices in and erratically priced iron ore. Through 2020 and 2021, this sector by sector focus has been highly successful for the Chinese:

https://fred.stlouisfed.org/graph/?g=Gb0g

January 30, 2018

Consumer Prices for China, United States, India, Japan and Germany, 2017-2021

(Percent change)

Yes, China’s system and its systematic approach to solving problems lends itself to solving problems that drive inflation. I can’t imagine that the government would have let a gigantic problem, such as insufficient capacity at ports, arise and fester, particularly when the problem was identified years ago.

Here, the report was consigned to the filing cabinet. Nothing was done. And then when the problem hit the economy, no one knew what had happened, there was no plan B, or even a fix, except to ignore it and rrely on the free market, which won’t solve it, because the problem is fragmented, and because port facilitates are no in the free market…they are owned by local governments. Meanwhile economists, failing to understand the problem and its potential severity, blithely asserted that it would just magically go away, fixed by the free market, and proclaiming that inflation would be transitory…don’t worry, be happy!

Macroduck is free to provide evidence, which he has so far failed to do, that Team Transitory ever did its homework last summer, expressed its reservations, and broadcast them to the American people in the mass media.

Just as Johnny did, you have made an assertion without providing evidence. Evidence of gender bias would show that female economists have had their analytic approach criticised by males to a greater extent than male economists. You got anything like that?

Your long habit of uncritically repeating anything China’s regime says may have gotten you out of the habit of worrying about evidence. Some of us still think evidence is nice. Real evidence, not the pablum served up by Chinese news services.

You’ve relied on an opinion as evidence . That’s easy dodge. It ain’t evidence.

More to the point in the context of this discussion, criticism of Kelton is not criticism of “female economists”. It’s criticism of Kelton. She’s not much of an economist.

https://www.nytimes.com/2021/02/23/business/economy/economics-women-gender-bias.html

February 23, 2021

For Women in Economics, the Hostility Is Out in the Open

Studies have found that the field is plagued by a singular problem of gender bias. The latest evidence comes from the types of questions posed at seminars.

By Ben Casselman

This is a serious issue but dragging it into one of JohnH’s insane rants is an insult to the cause.

Writing with deserved respect:

https://www.nytimes.com/2022/02/06/business/economy/modern-monetary-theory-stephanie-kelton.html

February 6, 2022

Is This What Winning Looks Like?

Modern Monetary Theory, the buzziest economic idea in decades, got a pandemic tryout of sorts. Now inflation is testing its limits.

By Jeanna Smialek

The sun was sinking low over Long Island Sound as Stephanie Kelton, wearing the bright red suit jacket she had donned to give a virtual guest lecture to university students in London that morning, perched before a pillow fort she had constructed atop the heavy wooden desk in her home office.

The setup was meant to keep out noise as she recorded the podcast she co-hosts, a MarketWatch production called the “Best New Ideas in Money.” The room was hushed except for Ms. Kelton, who bantered energetically with the producers she was hearing through noise-blocking headphones, sang a Terri Gibbs song and made occasional edits to the script. At one point, she muttered, “That sounds like Stephanie.”

What Stephanie Kelton sounds like, circa early 2022, is the star architect of a movement that is on something of a victory lap. A victory lap with an asterisk….

The point is deserved respect. Arguing over policy is another matter, but respect is necessary as Paul Krugman fortunately realized and offered “extreme apologies.”

Stephanie Kelton is of course a fine economist and assuredly does not “rant.”

https://www.nytimes.com/2017/08/18/upshot/evidence-of-a-toxic-environment-for-women-in-economics.html

August 18, 2017

Evidence of a Toxic Environment for Women in Economics

By JUSTIN WOLFERS

A pathbreaking new study of online conversations among economists describes and quantifies a workplace culture that appears to amount to outright hostility toward women in parts of the economics profession….

Justin Wolfers is a professor of economics and public policy at the University of Michigan.

https://web.stanford.edu/~pdupas/Gender&SeminarDynamics.pdf

February 2, 2021

Gender and the Dynamics of Economics Seminars

By Pascaline Dupas, Alicia Sasser Modestino, Muriel Niederle, Justin Wolfers and the Seminar Dynamics Collective

Abstract

This paper reports the results of the first systematic attempt at quantitatively measuring the seminar culture within economics and testing whether it is gender neutral. We collected data on every interaction between presenters and their audience in hundreds of research seminars and job market talks across most leading economics departments, as well as during summer conferences. We find that women presenters are treated differently than their male counterparts. Women are asked more questions during a seminar and the questions asked of women presenters are more likely to be patronizing or hostile. These effects are not due to women presenting in different fields, different seminar series, or different topics, as our analysis controls for the institution, seminar series, and JEL codes associated with each presentation. Moreover, it appears that there are important differences by field and that these differences are not uniformly mitigated by more rigid seminar formats. Our findings add to an emerging literature documenting ways in which women economists are treated differently than men, and suggest yet another potential explanation for their under-representation at senior levels within the economics profession.

Most MMTers are dudes – and yes they rant on and on. This is not a gender issue so stop trying to make it so.

You’ve once again veered into dishonesty in response to a challenged. You are not qualified to say who is a fine economist, yet here you are, pretending. Not honest.

ltr is getting beyond absurd. First of all Jeanna Smialek is reporter and not an economist. So maybe she is impressed with Kelton’s blog posts. Secondly blog posts are not academic research. And economist bloggers – male and female – get criticized all the time.

Now if Kelton were doing serious academic research and someone here trashed her simply because she is a woman, I would be the first to slam that. Witness the garbage Dr. Lisa Cook has gotten from certain right wing trolls (yes Princeton Steve – we are looking at you). And you can read my comments in defense of her as well as those of Dr. Chinn.

But let’s remember where this got started. JohnH decides without basis that he knows more than actual economists and he cites a long blog post from Kelton that provided ZERO academic research to support Johnny boy’s recent rants. And we said so.

For some incredibly insane reason – ltr decides we are attacking the academic work of a woman economist. ltr often goes off on some really weird tirades. This one is the weirdest of them all.

@ JohnH

I didn’t know Kelton had a substack. Thanks for making me aware of this.

The digital [dot] com showed that “ Over half of retailers have increased prices by 20% or more on average.”

A survey of voters showed that 54% of voters blame a lack of competition for inflation.

https://assets.morningconsult.com/wp-uploads/2022/01/18172429/220118_competition-among-companies-inflation-2.png

A Universityof Chicago poll of economists showed that only 7% agreed that a “significant factor behind today’s higher US inflation is dominant corporations in uncompetitive markets taking advantage of their market power to raise prices in order to increase their profit margins.“ 67% disagreed.

https://www.igmchicago.org/surveys/inflation-market-power-and-price-controls/

There you have it: a giant disconnect between economists and data that shows corporations using pricing power to raise prices in advance and in excess of inflation. A second giant disconnect is between economists and the general public.

Quite simply, the public gets what economists don’t, Isabella Weber explains, “ And as a matter of fact, what we have seen is that profits are skyrocketing, which means that companies have increased prices by more than cost. In the earnings reports, companies have bragged about how they have managed to be ahead of the inflation curve, how they have managed to jack up prices more than their costs and as a result have delivered these record profits.”

https://www.tpr.org/2022-02-13/economist-explains-record-corporate-profits-despite-rising-inflation

With economists’ current attitude, the profession is likely to be saddled with its greatest failure since their failure to see the Great Recession coming.

https://twitter.com/paulkrugman/status/1477247341212184577

Paul Krugman @paulkrugman

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

6:56 AM · Jan 1, 2022

Isabella Weber and Stephanie Kelton deserve only respect. I assume this is finally clear enough.

I agree. Isabella Weber seems to understand how business decision makers think, which is truly refreshing, since they are often the ones who set prices, not impersonal, mystical market forces.

Wow – you have a found a friend in Xi’s lackey! I pity Menzie for having to endure such bozos!

You are so off the point and so utterly dishonest here that it is highly insulting. Try reading what I just wrote about this farce at pgl

February 16, 2022 at 9:36 am

Dude, the public is buying stuff at higher prices. Blame who needs to be blamed.

https://www.nytimes.com/2019/09/30/opinion/economics-black-women.html

September 30, 2019

‘It Was a Mistake for Me to Choose This Field’

Black women are underrepresented in economics, which is bad for everyone.

By Lisa D. Cook and Anna Gifty Opoku-Agyeman

Economics is neither a welcoming nor a supportive profession for women. In 2017, Alice H. Wu, now a doctoral student in economics at Harvard, published an eye-opening study of online conversations among economists that provided convincing evidence that overt sexism was a serious problem in the field. Last year the economist Roland G. Fryer Jr., a star of the Harvard department, faced sexual misconduct allegations, prompting calls to condemn the widespread sexual harassment and discrimination in the profession. (In July, Harvard suspended Professor Fryer for two years.)

But if economics is hostile to women, it is especially antagonistic to black women….

Lisa D. Cook is an associate professor of economics and international relations at Michigan State University. Anna Gifty Opoku-Agyeman is a research scholar in economics at Harvard University.

As I noted – Lisa Cook is right. But this does not have a damn thing with how JohnH is abusing a blog post from Dr. Kelton. You need to stop this farce as you have been mislead by Johnny boy.

Since my other announcement was sort of buried in another thread, I shall post this once more. Anybody interested in seeing Menzie present his paper that was posted here, “The New Fama Puzzle,” via Zoom at James Madison University at 4 PM EST Wednesday, Feb. 16, should contact me by email at rosserjb@jmu.edu, and I can send you the link.

best wishes for a successful presentation!

I know that by the time my comment is moderated and posted the regular trolls will have saturated this thread with their usual complaints about economics, vaccines, the decline of the West, etc…

Over the next few months we will probably all be getting a good lesson in “regression to the mean”–most of which will be courtesy of the Fed playing “catch up” on monetary policy. Another major factor will be improvements in the supply chain, inventory write-downs, and reduced demand in certain sectors. I think economists have some sort of graph to describe this scenario and its effect on prices.

I’ll offer this dumb anecdote: At the beginning of the pandemic there was a run on hand sanitizer and it became as rare as gold and as valuable as Bitcoin. About a year ago hand sanitizer reappeared on store shelves and we stopped talking about how liquor companies were manufacturing it as a patriotic gesture. Yesterday at my grocery store there was a carboard box in the bagging area of the checkout lane that said “Free Sanitizer”–it was full of quart, pump bottles of the stuff.

One point as disagreement, as I otherwise agree completely. If inflation slows in the next few months, it’s likely to be for reasons other than Fed tightening. The combination of “long and variable lags” to the effect of monetary policy and the apparent diminished effect of monetary policy in a low-rate regime probably means little impact on inflation from Fed tightening for some time. Contractionary fiscal policy, easing supply constraints and overstuffed closets are more likely causes of near term cooling of inflation.

Gee – you realize that several factors affect inflation. Wow – I realize that too. So does a lot of those prominent economists who JohnH claims are too stupid to get this. OK – JohnH is a blatant liar. But you knew that.

So do me a favor and tell ltr she has been duped by this lying troll as no one here is attacking the academic credentials of a woman economist.

https://news.cgtn.com/news/2022-02-15/Chinese-mainland-records-80-confirmed-COVID-19-cases-17Fjgqfvz0Y/index.html

February 15, 2022

Chinese mainland reports 80 new COVID-19 cases

The Chinese mainland recorded 80 confirmed COVID-19 cases on Monday, with 40 linked to local transmissions and 40 from overseas, data from the National Health Commission showed on Tuesday.

A total of 44 new asymptomatic cases were also recorded, and 791 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 107,094 with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-02-15/Chinese-mainland-records-80-confirmed-COVID-19-cases-17Fjgqfvz0Y/img/414e9328d9c147c088d41c3e9eb0c950/414e9328d9c147c088d41c3e9eb0c950.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-02-15/Chinese-mainland-records-80-confirmed-COVID-19-cases-17Fjgqfvz0Y/img/81f0eb1f820b4fe085a44e403152a18a/81f0eb1f820b4fe085a44e403152a18a.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-02-15/Chinese-mainland-records-80-confirmed-COVID-19-cases-17Fjgqfvz0Y/img/67373c23c83c4063a5ceb22c6166bfb7/67373c23c83c4063a5ceb22c6166bfb7.jpeg

https://www.worldometers.info/coronavirus/

February 14, 2022

Coronavirus

United States

Cases ( 79,520,665)

Deaths ( 946,180)

Deaths per million ( 2,832)

China

Cases ( 107,014)

Deaths ( 4,636)

Deaths per million ( 3)

https://tradingeconomics.com/china/coronavirus-vaccination-rate

February 15, 2022

Over 3.05 bln COVID-19 vaccine doses administered on Chinese mainland

The number of COVID-19 vaccination doses administered per 100 people in China rose above 211.

I’ve already shown my personal bias on this topic, so I’ll keep the mouth of my keyboard shut on this topic ATM. I think I remember something about “limits of your personal knowledge” recently in one of these threads er something.

Regarding producer price changes released today, both the data series below seem to be following a linear trend since mid 2020, subject to a break-point unit root test.

Using a trend model, the producer price index by commodity: final demand, FRED series, PPIFIS, showed a trend forecasted change of 1.1% compared to 0.95% reported for January 2022. This trend model forecasts a 0.85% change for February 2022.

Using a trend model, the core producer price index, FRED series, PPIFES, showed a trend forecasted change of 0.96% compared to 0.80% reported for January 2022. This trend model forecasts a 0.70% change for February 2022.

Ivan Reitman passed away. One more thing to make me feel old. As if Harold Ramis checking out wasn’t enough.

Oh my, I think she used the “S word” in “The New Yorker”. Western civilization as we once knew it, has now ended:

https://www.newyorker.com/culture/the-new-yorker-interview/is-alexandria-ocasio-cortez-an-insider-now?utm_source=twitter&utm_medium=social&utm_campaign=onsite-share&utm_brand=the-new-yorker&utm_social-type=earned

I’ll lend her my pitchfork any time.

https://www.carbonbrief.org/analysis-how-china-is-powering-the-winter-olympics-2022-beijing

February 9, 2022

Analysis: How China is powering the Winter Olympics 2022 in Beijing

By Lauri Myllyvirta and Xing Zhang

China is branding the Winter Olympics 2022 in Beijing as the first “green” Olympic games, including the first games to run on 100% renewable electricity.

In a new analysis for Carbon Brief, we show that the desire of China’s leadership to showcase clean energy development and make it a part of the country’s international image, while important in itself, is backed by real developments on the ground.

Zhangjiakou, the mountain city in China’s Hebei province that is hosting the skiing events of the games, has renewable energy capacity exceeding that of most countries in the world – and a pioneering “Zhangjiakou Green Electric Grid” built to deliver power from the city to neighbouring Beijing.

Moreover, the pilot renewable power grid is a scale model of a much larger plan that the Chinese government is rolling out nationwide, as it aims to peak carbon dioxide (CO2) by 2030 and reach carbon neutrality by 2060….

Zhangjiakou

If the city was a country, its combined wind and solar capacity would be the twelfth largest in the world, as shown in the chart below, behind Brazil but ahead of Vietnam.

[ Graph ]

At an average operating rate for January-February, wind and solar power generation in Zhangjiakou during the 17 days of the games will be around 2,300GWh, about 10 times the projected electricity consumption of the Olympic venues during this time.

china recently licensed the construction of a large coal fired electric generation facility. 2021 montana coal resumed shipping to china.

and the leaders last week agreed to a large increase in multi year russian natural gas sales provided from russia’s pacific rim production.

belt road initiative (bri) includes gas and oil pipelines.

much of china remains a developing nation.

somewhere i saw where china put their economy ahead of green ‘science projects’ …..

China is greening at a ferocious rate, but China is growing and going to keep growing. There is no contradiction here, and China is meeting and exceeding all sustainable growth commitments made before the United Nations. President Xi repeatedly emphasizes China’s green growth, and building towards the Olympics shows just what this is about:

http://www.xinhuanet.com/english/20220130/2a88b83e12f243229603a54653e3d140/c.html

January 30, 2022

Xi leads China’s energy development on green path

BEIJING — Chinese President Xi Jinping inspected a thermal power plant on Thursday during his trip to north China’s Shanxi Province, his third visit to energy-based enterprises during the past few months.

It followed visits to the Shengli Oilfield in Dongying City, east China’s Shandong Province, in October last year, and a chemical enterprise under the China Energy Investment Corporation in Yulin City, northwest China’s Shaanxi Province, in September.

These visits shed light on where China’s energy development is heading as the country strives to safeguard energy security and pursues a green path to advance energy revolution….

The reported January 2022 PPI was up 9.7% year-on-year. That’s an improvement from 9.8% in November and December 2021.

Additionally, the early February 2022 consumer confidence measure came at 61.7 sharply lower from the 67.2 previous reporting.

Are households slipping into a state of anxiety?

If they are, they have nobody to blame but themselves. Excessive spending.

Noise, amirite?

rsm: If R-squared of regression of actual on expected were zero, I’d say yes. As a matter of fact, no.

Faux News and other Trumpians are screaming that something Hillary may have done is worse than Watergate allegedly basing it on a John Durham court filing. Of course this filing said no such thing on top of the fact that Durham just made up intellectual garbage to produce his little filing:

https://jabberwocking.com/john-durham-throws-yet-more-chum-into-fox-news-waters/

It is interesting that this is all coming out just as Mazar has distanced itself from Trump.

‘Hypocrisy is the tribute that vice pays to virtue.’ Francois Duc De La Rochefoucauld

Committee votes on Powell, Brainard and Raskin are delayed because Republican members didn’t bother to show up. Same old Republicans.

It’s almost enough to make you wistful for John Boehner isn’t it??

They must still be hoping Biden picks a couple of village idiots such as Stephen Moore and Judy Shelton.