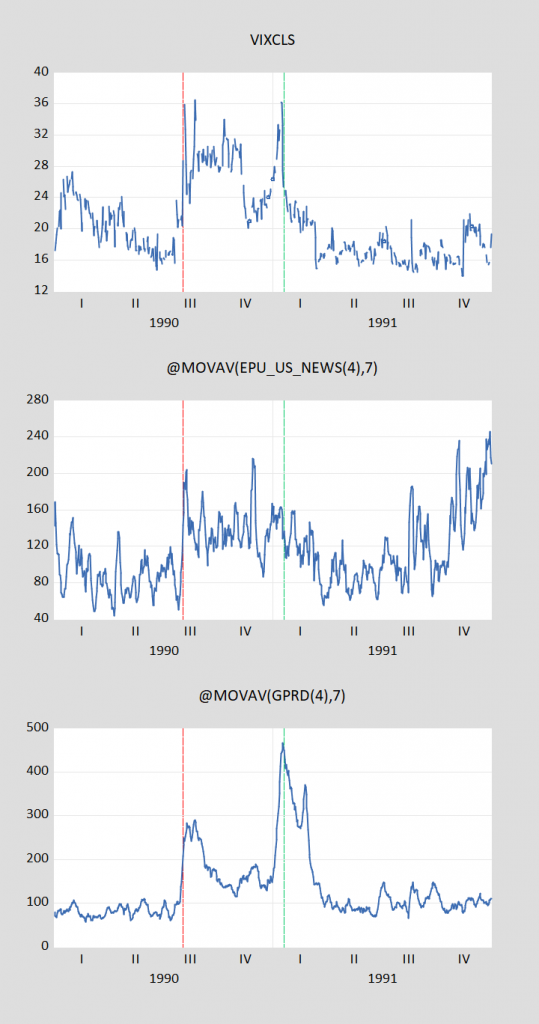

Looking back to one of the last major ground conflicts. In August 1990, Saddam Hussein’s forces invaded Kuwait. Here’re some risk and uncertainty indicators — some developed afterwards — for that period.

Figure 1: Top graph, VIX; Middle graph, Economic Policy Uncertainty index, 7 day centered moving average; Bottom graph, GeoPolitical Risk index, 7 day centered moving average. Red dashed line at invasion of Kuwait at 2/8/1990; green dashed line at beginning of aerial assault at 1/17/1991. Source: CBOE, policyuncertainty.com via FRED, Caldara-Iacoviello.

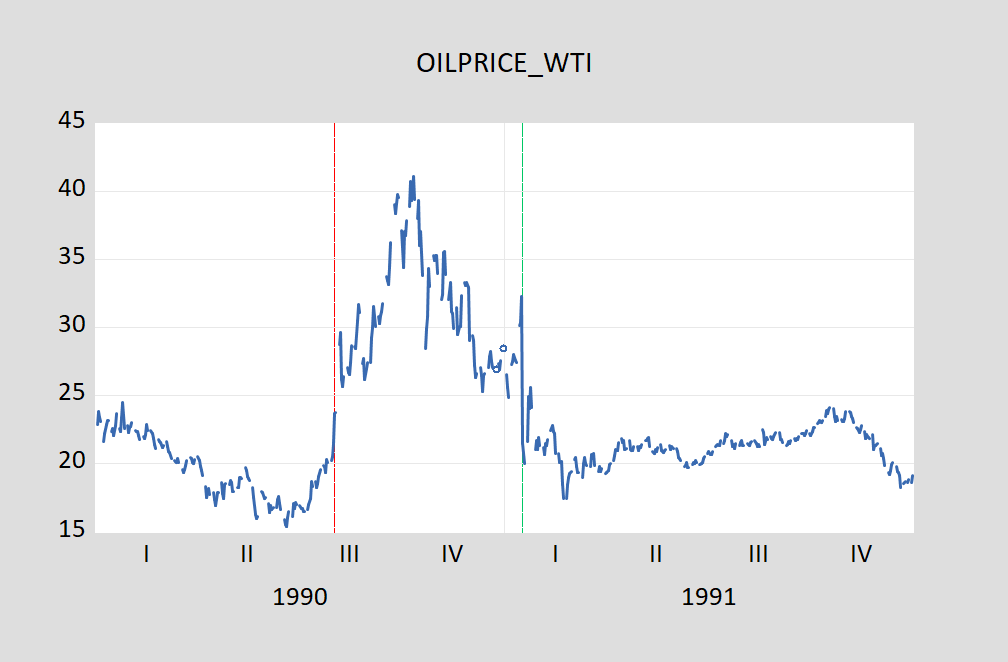

Heightened perceived risk and uncertainty are likely to have financial sector implications. Of course, that attack was also associated with real developments, including an oil price shock.

Figure 2: Price of oil, West Texas Intermediate, $/barrel. Red dashed line at invasion of Kuwait at 2/8/1990; green dashed line at beginning of aerial assault at 1/17/1991. Source: US EIA via FRED.

The invasion and spike in elevated risk and uncertainty measures coincided with the NBER peak in 1990M08; a short recession ensued, with a trough in March 1991. (On the other hand, the increase in oil prices and risk and uncertainty measures in 2003 did not coincide with a recession (although a recession had recently occurred starting in March 2001, before 9/11).

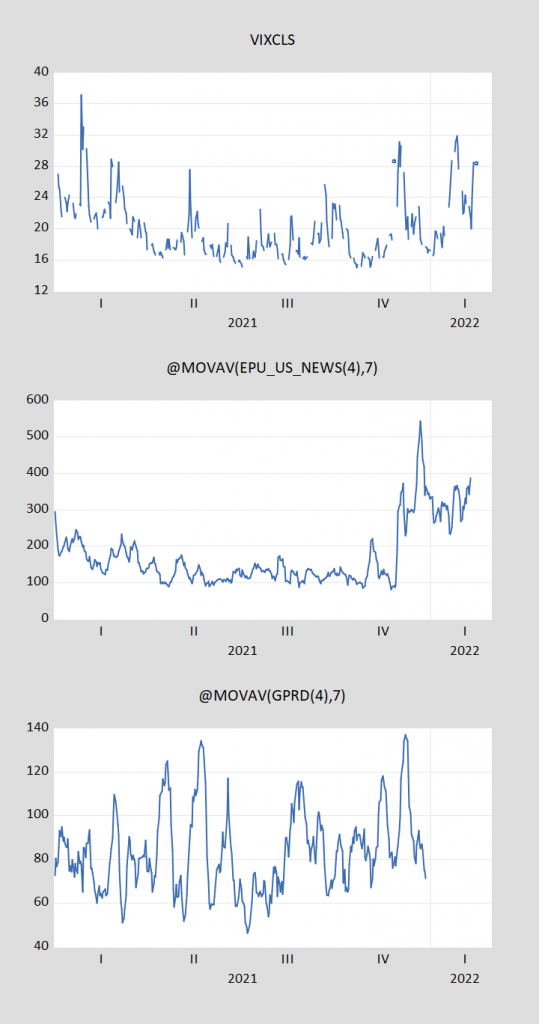

Where are we now?

Figure 3: Top graph, VIX; Middle graph, Economic Policy Uncertainty index, 7 day centered moving average; Bottom graph, GeoPolitical Risk index, 7 day centered moving average. Source: CBOE, policyuncertainty.com via FRED, Caldara-Iacoviello.

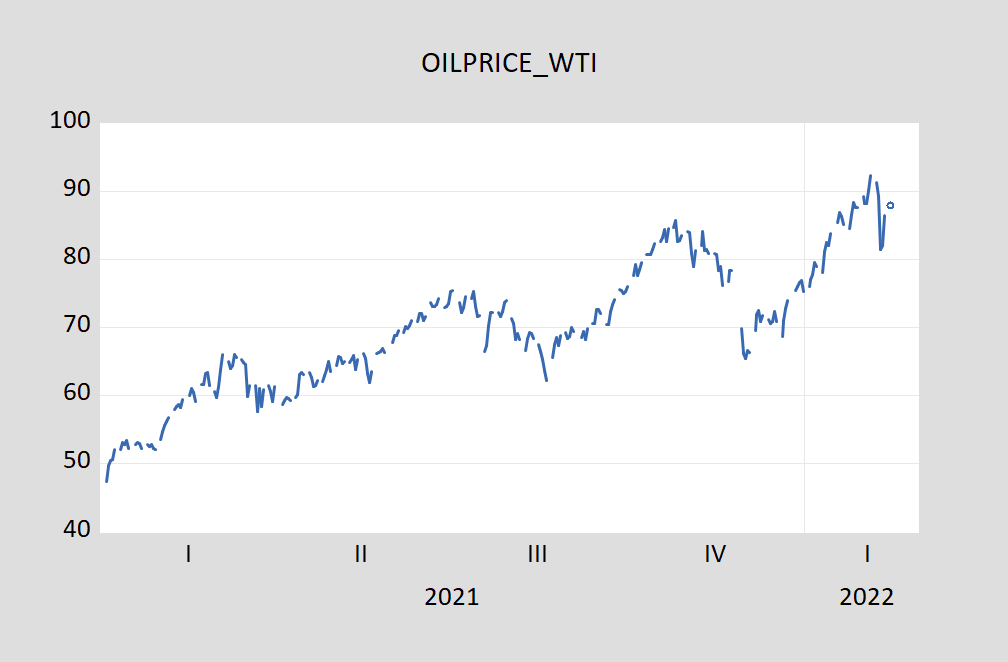

Figure 4: Price of oil, West Texas Intermediate, $/barrel. Source: US EIA via FRED, updated using Tradingeconomics.com.

When looking at the graphs, be sure to note the scales differ. In particular, the most recent peak in GeoPolitical Risk (140) is lower than where it was at the time of the invasion of Kuwait (around 200).

Heightened risk and uncertainty will in the short term hit equity markets, longer term if persistent tend to depress investment and economic activity more generally (by reducing aggregate demand). On the other hand higher oil prices (if persistent) will exacerbate cost-push inflation. Net effect on inflation – ambiguous, with it going different directions at short versus longer horizon. The impact on economic activity of higher oil prices directly, I refer to Jim’s analyses (e.g., here).

Good recounting of risks to the world economy, at SCMP.

2-14-22 WTI price: $95.46

https://oilprice.com/oil-price-charts/45

About the same as Brent: $95.71

Remembering the war hysteria of 2012, when war with Iran seemed imminent…

“The media plays a big role in making a war with Iran seem inevitable. Stephen Walt, a professor of international affairs at Harvard’s Kennedy School of Government, says the media coverage in general has been simplistic and in some ways rather disappointing.

“Given that we’re talking about issues of war and peace here where you would want the media to take enormous efforts to be tough, skeptical, probing and accurate,” Walt says. “Instead they have contributed to a certain war frenzy that in some ways came out of nowhere.”

Walt doesn’t dispute the existence of the tension with Iran and the possibility of a conflict. But he does say the media has a responsibility to probe the motives behind some of the discussions about Iran and look more carefully at the claims being made.”

https://www.wkar.org/2012-03-10/a-war-with-iran-rhetoric-or-a-reality

Of course, war with Iran never happened, despite the frenzied drum beat of the establishment media. Someone I know actually read the tea leaves correctly and decided it was a great time to visit Iran…no hordes of tourists to contend with.

Alastair Crooke, a former British diplomat, opines on what this kerfuffle is all about: “ Strikingly, China is saying the same explicitly [as Macron said implicitly]: The authoritative Global Times in an editorial warns that the U.S. is instigating conflict in Ukraine in order to tighten bloc discipline – to corral European States back into the U.S.-led fold. No doubt, China makes the connection that Ukraine provides the perfect pivot for shepherding Europe towards America’s next stage of requiring a united front with the U.S. for the later task of barricading-in China, behind her borders.”

https://www.strategic-culture.org/news/2022/02/14/nord-stream-geopolitics-of-keeping-germany-down-russia-out-and-instability-ukraine/

In any case, the dispute with Russia has been around for a long time, and It’s not going to go away anytime soon, invasion or no invasion. And yellow journalism will have a profitable narrative for some time to come,

So if Putin invades you will defend him blaming the NY TIMES. I trust he pays you well

Did the US invade Iran even with all the media hysteria? No, they just parroted US propaganda, and hyped the threat of war…ad nauseum.

pgl, you really need to read publications besides The NY Times to understand what’s really going on. Reading Alastair Crooke is a good start. Here’s another piece on the role of energy. https://www.juancole.com/2022/02/overcame-prevent-dependence.html

None of this is covered by the Mainstream media, only the war hysteria.

“you really need to read publications besides The NY Times to understand what’s really going on.”

Kind of funny from the troll who contends that if Krugman writes something not on the pages of the NYTimes – it does not count. BTW – I’ve been reading Juan Cole for many years. Try to keep up.

in the “unofficial” early brid which too many of us associated (and some retired) read each morning which capsilizes pentagon related news from many sources a headline: “attack on ukraine wednesday”

we heard it first on early bird!

it is noteworthy that: last week jake (one of hillary’s russia collusion cheerleaders) sullivan stated: invasion of Ukraine “could begin during the Olympics, despite a lot of speculation that it would only happen after the Olympics.”

does anyone know how many gallons per mile a russian armor column burns?

if some pentagon reporter has not been given satellite photos of 3000 oil tank trucks……

get your popcorn.

Yeah, BBC reported today that Zelensky said the attack would occur on Wednesday. ABC said tonight thatZelensky played down an imminent attack. The propagandists are having a hard time getting their stories straight.

Best to tune out anything that comes out of Washington or London. Here’s a well informed outside source that does not have a dog in the hunt:

https://www.indianpunchline.com/biden-dials-back-belligerence-toward-russia/

Bhadrakumar seems to have a better finger on the the pulse than any establishment infotainment outlet.

i am madder at putin than pgl!!

i should have sold my vix play yesterday!

Putin had his seperatists in Eastern Ukraine attacks which took out even kindergartens. This is his false flag to start a war but to blame Ukraine. It seems Putin’s pet poodle (JohnH) cannot note what is happening, Of course he cannot as Putin is both a murderer and a liar and JohnH’s new job is to amplify the lies from Moscow. When the blood of children appears in the news – JohnH will do his job and deny it all. He is that quite of person.

Wow reporting on something that occurred five days ago. Way to avoid what happened today. There will be blood on Putin’s hands if he continues this campaign of disinformation and aggression. It that blood should be on your hands but I’m sure you will find some dishonest way of evading any responsibility. It is what you do.

I trust he pays you well.

I trust he pays you well.

I trust he pays you well.

[ Precisely the way in which people were destroyed during the days of Joseph McCarthy. ]

Why not drop fentanyl on Russian soldiers and turn them into junkies? (Anyone else thinking about why the US lost Vietnam?)

Why don’t we have nonviolent options, like paying Russians not to fight?

rsm,

a lot of soldiers came back from germany in vietnam era with a ‘monkey on their backs’…..

Apparently Putin and Lavrov held a press conference in Moscow. Lots of long talk by Lavrov about Russia/NATO relations. This is looking like a deal in the works. Crucial meeting later today is visit to Moscow of German Chancellor Scholze. There seem to be a few loose ends to seal the deal. But indeed I am holding that noise out of Moscow is looking like no invasion.

Apparently no meeting with Scholze, but the happy talk on Russian media continues. I think one remaining loose end is something out of Zelensky and Ukraine, maybe a mumble about not wanting into NATO any time soon. as it is, while it may not be good for the Olympics, I think it is good for world peace that the Russian skater has been allowed to skate, with Russian media saturated with the Winter Olympics. That gives Putin a win so he can pull back with face intact, more or less.

It’s interesting to note that Secretary of State Blinken has stated they see zero signs of Russian troop withdrawal near Ukraine. But the fact you think a 15 year old ice skater is the pivot point for a war might make a great Saturday Night Live skit.

Damned once every 10 days alcohol injection giving me hallucinations again. Thank goodness Barkley Junior is keeping me on track:

https://www.nytimes.com/2022/02/15/world/europe/germanys-chancellor-prepares-to-meet-with-putin-as-the-tone-of-the-crisis-shifts.html

https://www.npr.org/2022/02/15/1080773439/after-talks-with-ukraines-president-germanys-chancellor-meets-with-putin

Old guy…… airport…… two old men making comments standing aside each other….. German flag in background……. it’s really strange what resveratrol will have you imagining in your mind. Gotta see that doctor again. What’s his name, Oz?? Phil???

https://www.theguardian.com/world/live/2022/feb/16/ukraine-russia-latest-news-live-putin-biden-kyiv-russian-invasion-threat?page=with:block-620dae1d8f086f7273b86779-pinned#block-620dae1d8f086f7273b86779-pinned

I’m hopeful that doesn’t contradict what Marina Rosser is seeing on Russian State TV or I’m gonna have to search out new moles.

De-escalation. Seems as if Russia is moving troops/weapons away from the Ukraine border. Maybe there will be no winter war in Europe.

So [7 AM, 15 Feb] equities futures are up; UST 10 year [2.05%], gold/silver, oil are down.

It looks like Senator Schumer needs to borrow some of Barkley’s Vitamin B-12 supplements

https://twitter.com/jamiedupree/status/1494037487035076613

I’d say Pelosi’s B-12 supplements but I’m pretty certain she’s not taking any.

BTW, if you’re into following the happenings of U.S. Congress you could do much worse than Jamie Dupree:

https://jamiedupree.substack.com

He’s not quite as good as https://twitter.com/LisaDNews , but still he’s pretty good.