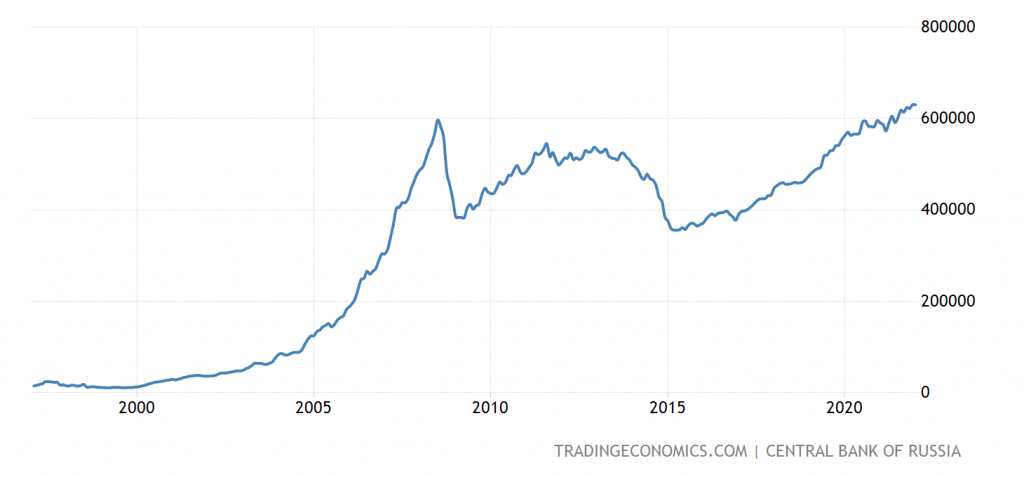

A recent NY Times article noted that Russia had taken measures to insulate itself from economic sanctions, including building up foreign exchange reserves. It’s true reserves are high, and in relative terms more so once one considers that nominal GDP [in USD terms] is smaller than in 2014.

Figure 1: Russian international reserves in mn.USD.

Regarding reserves (NYT):

“This is what gives Putin his freedom of strategic maneuver,” Adam Tooze, a Columbia University economic historian, has written.

In normal times, with limited external debt (about 2/3 of reserves), the country should seem fairly safe against a conventional run. On the other hand, the currency is already depreciating even while the nominal policy rate is pretty high.

Figure 2: RUB/USD, up is a ruble appreciation.

Figure 3: Russian Central Bank policy rate, %.

Back in 2014, when sanctions were placed on Russia in response to the illegal annexation of Crimea and proxy war in the Donbas region, Russia’s external account came under pressure, as discussed here [1] [2] [3]. In the event of a conventional force strike into the remainder of the Ukraine, sanctions are likely to be more harsh. Whether the greater reserves will be sufficient to allow the Russian economy to weather the retaliation depends on a lot of factors. In narrow terms, the fact Russia runs a trade and current account surplus is helpful. The decline in nonresident holdings of ruble assets probably makes them less vulnerable to a flight [1] (although one could very well imagine well-connected residents trying to effectuate capital flight). Russia’s degree of financial openness is lower as of 2019, 0.48 compared to 0.72 in 2014, according to the Chinn-Ito index, so the authorities might be better placed to stem such flight.

Still, a lockout from the international transfers system (SWIFT), or as seems more likely now, sanctions against state owned banks, are qualitatively different from a sudden stop induced by fear of losses.

In any case, look for some interesting times in Russia’s external accounts and currency.

The metrics here are important in the short-to-medium term. As the US NEWS link indicates, European lenders’ exposure to Russia stands in the way of cutting Russia off from SWIFT. So why, after Russia invaded Ukraine in 2014, are Europeans lending in Russia? Oh, yeah, profit before principle, same as always.

Part of any sanctions package should be a credit stop. Not only would that be a painful sanction I n itself, but it would allow cutting Russia off from SWIFT in response to future aggression.

Great point, and one a lot of people are missing.

This reminds me, why have we never gotten to the bottom of donald trump’s accounts at Deutsche Bank?? There was tons of discussion about this. Mueller found nothing related to those accounts!?!?!?!?! Count me among the nonbelievers on that score. Banks have tons of blood and their hands, and the fact they never get prosecuted while we all sit around getting upset about “triggering” words, and someone who got their elbow brushed by the opposite sex while walking through a doorway tells us a lot about the society we live in.

And the Federal Reserve and/or ECB has no idea about these crimes committed with these bank accounts with their minutia of data?? Tell me another one.

Was I the only one surprised that the U.S. dollar’s share of Russian currency reserves is only 16%?? I am aware the dollar isn’t what it used to be–but 16% got my attention. I guess for Menzie and Professor Ito this is “old news”, but wow, that borderline shocks me.

Moses,

It is a combination of both wanting to keep the USD down plus also having much more trade with European nations, so lots of euros in the reserves.

This thought-provoking FX post is far outside my experience and knowledge.

So, I looked up the balance of US FX reserves as of January 2022 = $40.7 billion. Source Federal Reserve. Russia has approx. $600 billion.

Also noteworthy are the policy rate near 10% and the ruble bouncing around 70 to 80 to the USD.

T.Shaw: An important distinction between the US and the Russian Federation is that the US dollar is a freely floating currency, while the Ruble is on a managed float. See discussion of the 2014 episode. If you would like to know what what that means in terms of say the Trilemma or the undergraduate econ model (Mundell-Fleming) see here.

Thank you. I’ll remember the distinction.

When I was in school, the US was on the gold standard.

T.Shaw: Then fixed exchange rate regime is appropriate, unless you are the center (as the US was) during the Bretton Woods period.

The eurodollar (as opposed to Eur/Usd) market exists largely to allow Soviet and Easter Bloc financial activity in something other than Usd. Every other western industry was subject to Cocom restrictions. Western banks, for some reason, have always managed to provide good service to strategic rivals of the west.

https://news.cgtn.com/news/2022-02-16/Chinese-mainland-records-102-confirmed-COVID-19-cases-17GW9fQn600/index.html

February 16, 2022

Chinese mainland reports 102 new COVID-19 cases

The Chinese mainland recorded 102 confirmed COVID-19 cases on Tuesday, with 46 linked to local transmissions and 56 from overseas, data from the National Health Commission showed on Wednesday.

A total of 28 new asymptomatic cases were also recorded, and 751 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 107,196, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-02-16/Chinese-mainland-records-102-confirmed-COVID-19-cases-17GW9fQn600/img/70f8880fc71c4e3ea83326b9eaa35926/70f8880fc71c4e3ea83326b9eaa35926.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-02-16/Chinese-mainland-records-102-confirmed-COVID-19-cases-17GW9fQn600/img/80f01ee021364bbaa3a7d74274c3d2f0/80f01ee021364bbaa3a7d74274c3d2f0.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-02-16/Chinese-mainland-records-102-confirmed-COVID-19-cases-17GW9fQn600/img/f2649d63ea2e492e9d51e04e1946f143/f2649d63ea2e492e9d51e04e1946f143.jpeg

https://www.worldometers.info/coronavirus/

February 15, 2022

Coronavirus

United States

Cases ( 79,629,064)

Deaths ( 949,248)

Deaths per million ( 2,841)

China

Cases ( 107,094)

Deaths ( 4,636)

Deaths per million ( 3)

too many americans dying since feb 2021.

the recently announced big increase in natural gas sales by russia to china is in euro’s. i suppose china is accumulating many euros, too.

and raskins on the fed favors two different undersriting standards one ‘tightly wrung out’ on petroleum project loans and one for ‘loosely unsuitable’ loans to renewable energy projects dependent on subsidies.

will that be seen in fdic financials?

must be okay ecb and eu member banks do it al the time.

https://news.cgtn.com/news/2022-02-05/China-and-Russia-ink-new-deals-on-energy-cooperation–17psVBDce8E/index.html

February 5, 2022

China and Russia ink new deals on energy cooperation

As China and Russia announced to strengthen cooperation in energy sector, oil and gas giants from two sides signed new deals this week….

Raskin sn’t yet on the Fed.

You’ve given us some words on quotation marks. How about some links. I don’t think I want to rely on your reading of anything related to climate change.

we are even….

i do not dispute you, i haven’t time for that

https://news.cgtn.com/news/2022-02-16/China-s-CPI-up-0-9-in-January-17GYgQm0rIc/index.html

February 16, 2022

China’s consumer, producer price inflation growth slows in January

China’s consumer price index (CPI), a main gauge of inflation, rose by 0.9 percent year on year in January, down from the 1.5-percent increase a month ago, the National Bureau of Statistics (NBS) said Wednesday.

The figure was below institutions’ expectations. Bloomberg and Nomura economists had forecast a 1-percent increase and a 1.1-percent increase, respectively.

The January CPI is generally stable as related departments worked to secure supply during the Spring Festival, said senior NBS statistician Dong Lijuan.

Food prices fell by 3.8 percent last month compared with a year ago, contributing to a 0.72-percentage-point decline in the CPI.

Due to the high-base effect of the same period last year, the price of pork dropped by 41.6 percent on an annual basis, compared with a 36.7-percent drop in December. Vegetable prices fell by 4.1 percent year on year, compared with a 10.6-percent increase in December, Dong said.

https://news.cgtn.com/news/2022-02-16/China-s-CPI-up-0-9-in-January-17GYgQm0rIc/img/3ed574dadf864bfb8cabc3e6bd47a832/3ed574dadf864bfb8cabc3e6bd47a832.jpeg

China’s falling CPI growth paves the way for more aggressive easing measures against growth headwinds, Lu Ting, Nomura’s chief China economist, said in a note….

you see how quickly those reserves declined following the financial crisis and crimea invasion? i would imagine the decline will be even more spectacular if they invade the rest of ukraine. one could argue the build up of reserves creates a cushion. but it also allows for a more dramatic collapse. and a coordinated economic embargo could last for longer than they can hold out. i am sure putin is already aware of this, and probably willing to pay that price to increase his stranglehold on the russian empire.

Biden’s biggest leverage on Putin is destruction of the ruble. If the ruble goes to 100/USD, the Russian economy will be in a depression and the oligarchs who support Putin may abandon him. The Russian billionaires care about their wealth, not Putin’s fantasies about Ukraine. Czar Putin may end up like Czar Nicholas II.

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Gross Domestic Product based on purchasing-power-parity (PPP) valuation * for Brazil China, France, Germany, Hong Kong, India, Indonesia, Japan, Macao, Russia, United Kingdom and United States, 2007-2021

2021

Brazil ( 3,438)

China ( 27,608)

France ( 3,322)

Germany ( 4,843)

India ( 10,181)

Indonesia ( 3,530)

Japan ( 5,634)

Russia ( 4,447)

United Kingdom ( 3,276)

United States ( 20,940)

* Data are expressed in US dollars adjusted for purchasing power parities (PPPs), which provide a means of comparing spending between countries on a common base. PPPs are the rates of currency conversion that equalise the cost of a given “basket” of goods and services in different countries.

https://fred.stlouisfed.org/graph/?g=mGFd

January 30, 2018

Total Reserves excluding Gold for China, United States, India, Japan and Germany, 2007-2021

https://fred.stlouisfed.org/graph/?g=LW3G

January 30, 2018

Total Reserves excluding Gold for Russia, Indonesia, Brazil, France and United Kingdom, 2007-2021

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=924,134,534,158,111,&s=BCA_NGDPD,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Current Account Balance as percent of Gross Domestic Product for China, Germany, India, Japan and United States, 2007-2021

2021

China ( 1.6)

Germany ( 6.8)

India ( – 1.0)

Japan ( 3.5)

United States ( – 3.5)

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=223,132,536,922,112,&s=BCA_NGDPD,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Current Account Balance as percent of Gross Domestic Product for Brazil, France, Indonesia, Russia and United Kingdom, 2007-2021

2021

Brazil ( – 0.5)

France ( – 1.7)

Indonesia ( – 0.3)

Russia ( 5.7)

United Kingdom ( – 3.4)

PJ O’Rourke passed away. Not really a fan, but still notable. One of those deaths that if you tried to explain to someone under 30 how big he was they would never “get it”. The political right’s version of Hunter Thompson?? You be the judge.

Wrote a pretty bad, quite thin book on Adam Smith. Mainly an effort to say “Adam Smith agreed with us” while O’Rourke was on Cato’s payroll.

Russia is in the midst of a “pivot to the east” (reminiscent of the U.S. several decades ago). As trade and ties strengthen with China, Russia further isolates itself against both U.S. policies and currency while potentially strengthening China’s case as the Yuan being an alternative global currency to the U.S.

https://www.thebalance.com/yuan-reserve-currency-to-global-currency-3970465

So, one question is: Does constantly making Russia a bogeyman as a convenience for U.S. politicians end up a costly strategic blunder by accelerating Russia’s move away from Europe and toward China?

https://news.yahoo.com/china-russia-see-u-global-165634757.html

Note: Russia’s oil trade with the U.S.

https://www.statista.com/statistics/1094286/us-imports-of-russian-oil-and-petroleum-products/

Note: China’s importation of crude oil

https://tradingeconomics.com/china/imports-of-crude-petroleum-value

Other questions: If U.S. stopped importing Russian oil, how long would it be before China replaced its imports of U.S. oil with Russian oil? Who gets hurt? Maybe Prof. Hamilton can answer that.

no

russia economic interests coincide one a large energy supply the other a large energy demander.

geographically neighbors

geopolitically, both skeptical of the us’ value as uni-pole…..

geographically neighbors

[ Look to the Shanghai Cooperation Organization membership:

https://en.wikipedia.org/wiki/Shanghai_Cooperation_Organisation#Member_states . ]

https://news.cgtn.com/news/2022-02-05/China-and-Russia-ink-new-deals-on-energy-cooperation–17psVBDce8E/index.html

February 5, 2022

China and Russia ink new deals on energy cooperation

As China and Russia announced to strengthen cooperation in energy sector, oil and gas giants from two sides signed new deals this week.

China National Petroleum Corporation (CNPC) and Gazprom signed a long-term sales and purchase agreement for natural gas to be supplied via the Far Eastern route on Thursday, according to a press release by CNPC on Saturday.

The signing of this document is an important step towards further strengthening the mutually beneficial cooperation between Russia and China in the gas sector, Gazprom said in a press release on Friday.

As soon as the project reaches full capacity, the volume of Russian pipeline gas supplies to China will grow by 10 billion cubic meters, totaling 48 billion cubic meters per year, according to Gazprom.

“It is indicative of the exceptionally strong mutual trust and partnership between our countries and companies,” said Alexey Miller, Chairman of the Russian energy giant.

Meanwhile, Russian oil producer Rosneft also signed a deal with CNPC on Friday to supply a total of 100 million tons of oil through Kazakhstan over 10 years and the crude oil will be processed at factories in northwest China to meet the country’s needs for petroleum products, according to Rosneft’s press release….

I think your point is in the mind of US policy makers – they are being mild with Russia so as to not push them more into china’s orbit. Same with possible Iran deal.

They already have lots of trade in this area, so this is not such a big deal.

While mostly this looks to have Xi supporting Putin, I note that China is a net oil importer, so while Putin may enjoy the higher crude oil prices from his threats against Uktaine, Xi will not like it if he invades and the price goes soaring past $100 per barrel.

Russia’s “ nominal GDP is smaller than in 2014???” Real GDP grew since 2014.

https://fred.stlouisfed.org/series/NAEXKP01RUQ652S

JohnH: Yes, in nominal USD terms (so if you are dividing reserves in $, you want to divide by GDP in $). In nominal ruble terms, Russian GDP is higher, as is constant ruble GDP.

“It’s true reserves are high, and in relative terms more so once one considers that nominal GDP [in USD terms] is smaller than in 2014.” is indeed what you wrote. Now I would normally look in Russia GDP in nominal terms relative to their measure of prices (constant rubles) as JohnH notes but given how they have managed their float. PPP considerations may be a bit crazy,

Russian GDP is well below its 2013 level. It had been rising significantly before Czar Putin began his adventures in Ukraine. The Russian economy has been in a slump ever since due to western sanctions which will be much more severe if Putin makes more mistakes. The oligarchs will not be happy.

https://fred.stlouisfed.org/series/MKTGDPRUA646NWDB

https://www.imf.org/en/Publications/WEO/weo-database/2021/October/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2021

Gross Domestic Product based on purchasing-power-parity (PPP) valuation * for Brazil China, France, Germany, Hong Kong, India, Indonesia, Japan, Macao, Russia, United Kingdom and United States, 2007-2021

2021

China ( 27,608)

United States ( 20,940)

India ( 10,181)

Japan ( 5,634)

Germany ( 4,843)

Russia ( 4,447)

Indonesia ( 3,530)

Brazil ( 3,438)

France ( 3,322)

United Kingdom ( 3,276)

* Data are expressed in US dollars adjusted for purchasing power parities (PPPs), which provide a means of comparing spending between countries on a common base. PPPs are the rates of currency conversion that equalise the cost of a given “basket” of goods and services in different countries.

https://fred.stlouisfed.org/graph/?g=KinA

August 4, 2014

Real per capita Gross Domestic Product for Russia and Germany, 2000-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=KipC

August 4, 2014

Real per capita Gross Domestic Product for Russia and Germany, 2000-2020

(Indexed to 2000)

I simply cannot get excited about a so-called forthcoming war.

Putin is nowhere as stupid as Trump so he will make a logical decision.

There is a lot more downside if Russia invaded than upside.

He could like hitler ( sorry about godwin’s law) get very lucky when he successfully invaded europe but surely putin would remember when Hitler ran out of luck when he invaded the ussr.

He seems like a good man altogether.

https://www.rferl.org/a/the-second-chechen-war-in-photos/30185257.html

I almost forgot Putin’s humanitarian work in Moscow

https://www.rferl.org/a/putin-russia-president-1999-chechnya-apartment-bombings/30097551.html

http://cup.columbia.edu/book/the-moscow-bombings-of-september-1999/9783838206080

https://www.amazon.com/Moscow-Bombings-September-1999-Examinations/dp/3838206088/ref=sr_1_2?crid=2QXPA8AC5THL8&keywords=moscow+john+dunlop&qid=1645061701&sprefix=moscow+john+dunlop%2Caps%2C74&sr=8-2

“March 18 marks the sixth anniversary of Russia’s illegal annexation of Crimea. Attention now focuses on the Russian-Ukrainian conflict in Donbas, a conflict that has taken some 14,000 lives, but Moscow’s seizure of Crimea — the biggest land-grab in Europe since World War II — has arguably done as much or more damage to Europe’s post-Cold War security order.”

It’s pretty normal to kill citizens in your own nation’s capitol as a pretext for a civil war. Just ask donald trump. He says it’s ok if they are treated to violence, tear gassed or killed, as long as they are Blacks or other “nondesirables” :

https://www.washingtonpost.com/investigations/2020/06/08/timeline-trump-church-photo-op/

Downside for Putin has to be imposed. The “excitement” you refuse to join serves to maintain support for imposing a downside. If we all shrug, the downside shrinks. The smaller the downside to invading, the greater the likelihood of invasion. I’m willing to make a bit of noise in service of avoiding war in Ukraine.

The last US ambassador to the Soviet Union, who was translator in the embassy during the. Cuban missiles crisis and an expert on Russia: “ I cannot dismiss the suspicion that we are witnessing an elaborate charade, grossly magnified by prominent elements of the American media, to serve a domestic political end. Facing rising inflation, the ravages of Omicron, blame (for the most part unfair) for the withdrawal from Afghanistan, plus the failure to get the full support of his own party for the Build Back Better legislation, the Biden administration is staggering under sagging approval ratings just as it gears up for this year’s congressional elections.”

https://consortiumnews.com/2022/02/16/ukraine-crisis-should-have-been-avoided/

Fortunately Gen Z is less gullible than the older generations about these kinds of psyops: lGen Z cares immensely about foreign policy… Gen Zers have also grown up navigating the fallout of the post-9/11 wars. The same survey found that over 70 percent of these voters, a higher proportion than any other age group, agree that “the wars in the Middle East and Afghanistan were a waste of time, lives, and taxpayer money and they did nothing to make us safer at home.” And two-thirds of Gen Z voters believe that the United States “should prioritize economic and diplomatic efforts, rather than military action, to protect our interests around the world.”

https://responsiblestatecraft.org/2022/02/02/wont-get-fooled-again-gen-z-all-done-with-old-rationales-for-war/

your first paragraph is simply peddling in conspiracy theories. ridiculous. here is your tin foil hat.

JohnH,

I happen to know Jack Matlock, and that is a serious piece, more so than most taking his broad position. He makes a lot of good points, such as how unwise it was for the US to withdraw from the ABM treaty. However, he does ignore certain important matters. One of those is that the nations who did join NATO in 1997 seriously wanted to and had for some time, e.g. Poland. He also completely ignores Putin’s invasion and annexation of Crimea against all knternatoinal law, this where he messes up most seriously, fundamentally undercutting his general argument.

As for the second piece, whatever the views of Gen Z are, the article is all about Iran, not Russia. On that matter I agree, but it is irrelevant to this situation.

The precisely predicted invasion took place just a anticipated today. And lo and behold, a splendid invasion it was. Shock and awe on a scale not seen since the much hyped Israeli attack on Iran in 2012.

Oh, wait! Neither happened, despite a constant beating of drums, pounding of chests, and gaudy colors of yellow journalism splashed across our screens and newspapers.

Wolf!!!

Now, like a charismatic doomsday cult leader, the propagandists will recalibrate their message to prepare the true believers for the true, ineluctable Armageddon awaiting humanity at a date TBD as needed.

But will it be enough to distract the public’s attention from the Afghan fiasco, omicron, inflation, and decreasing poll numbers of the current incumbents? We’ll, when all else fails, incumbents generally give it a shot!

https://www.toronto99.com/2022/02/15/chris-hedges-us-traditionally-solves-domestic-political-crises-by-waging-war/

Why should Putin care about any economist fables about trilemmas? Can’t his hackers produce dollars for him on command, if he deems it necessary?

I want to thank Menzie for his excellent seminar earlier today at JMU. I am sorry nobody here took advantage of participating. Doing so would have given you the opportunity to see Menzie in action live: articulate, clear, witty, and knowledgeable about “what is down in the weeds,” as he put in reply to a question, not to mention a genuinely good guy. Thanks, Menzie, you were great!.

Barkley Rosser: My thanks to Barkley and his JMU colleagues for a gracious invitation to share my obsession with uncovered interest parity with a engaged and lively audience. That’s an academic’s dream experience!

Most welcome, Menzie, and thanks again. There was lots of positive feedback from my colleagues.

Again, to all of you out there, you missed a real opportunity to see Menzie in action doing well and explaining complicated things very clearly.

I’m very serious about my privacy or I would have requested the ZOOM link, sorry I missed Menzie’s lecture.

I note. Moses, and to all the others here operating under fake names, that if you had sent me a request without saying your fake name, I would not have known who you were and your precious privacy would have been preserved. Indeed, I pointed that out earlier. But, for better or worse, none of you took me up on it, even though none of you would have had your pathetic privacy revealed. And, as a matter of fsct, if any of you, even some who have annoyed me, as you have quite a bit, Moses, had revealed your true identity to me and asked me not to reveal it publicly, i would have honored that. I do sit on rather large amounts of stuff. That is just standard operating procedure, even if you all think I am some kind of mean guy out to get you or something. Nah, I keep proper confidences.

BTW, and this is addressed most specifically to 2slugbaits, I sort of recognize the claim made by him that for some people going by fake names they want to maintain the ID they have created and use fore continuity of their thoughts and past utterances. For him that has some credibility, given the consistently high level of his remarks in terms of intelligence and knowledge. But that does not hold for many others who should probably be glad to have people here forget about some of their previous utterances.

But even with that, some who change their fake names, their contributions are so distinctive we are able to figure out that it is still them. I could name in this regard a very regular commentator here whom I shall not name, although most will know who she is.

Also, again, I do recognize that there are some people with patticular professions who need to keep their IDs secret, but it is my observation that there are some here who claim this without having much credibility in doing so. But I would have kept the IDs secret of anybody who wished it, and this continues to hold, even if I thought they were being silly about it.

Michigan State has another supply chain pressure index developed by Jason Miller.

https://www.linkedin.com/posts/jim-moore-2315804_supplychain-supplychainmanagement-shipsandshipping-activity-6886782469396336640-pSKw

Robert Handfield, one of Miller’s collaborators writes: “Many analysts are asking this question – as they weigh off the good news from earnings season, against the warnings of the Fed that inflation will result in increased interest rates. However, one thing I don’t hear a lot of people talk about is the impact that clogged supply chains has on all of these outcomes – earnings, inflation, and revenue. (By the way, I’ve been talking about the role of inflation due to supply chain shortages since last August)” …when Powell was still arguing that the shortages would soon ease [well worth a read]…

[The MSU] index is pretty bleak. Look at the problems we’ve had in 2020 – and then compare them to 2021. Then look at the trajectory of the 2021 index – and which way it is headed. It kind of reminds me of the Omicron spike, only it is unlikely to go down as rapidly as it occurred, but will likely remain very high. Moreover, the index suggests that such problems will continue to recur in 2022… these disruptions and pressures will not diminish for some time, as the current set of problems related to labor shortages, port problems, COVID cases, and insufficient capital investment will continue through 2022.”

https://scm.ncsu.edu/scm-articles/article/whats-the-outlook-for-inflation-and-supply-chain-relief-in-2022-jason-miller-blog-3

When the issue is the supply chain, it’s best to talk with experts in the field of logistics and supply chain management…

john kemp shared the following in his daily e-mail on energy

https://www.bakerinstitute.org/media/files/files/d18d1719/ces-wp2-russiagas-021122.pdf

detail analysis of european energy dependence and possible reaction to russian cuts…

The study is not bad but not very good. If you know a little bit about electricity generation in Europe, esp. Germany then it is obviuos that the following conclusion is wrong:

“Insofar as alternative energy sources are concerned, wind and solar are ruled out for short-term

surge capacity because wind and solar generation resources are non-dispatchable, so they are

outside policymakers’ control. This does not mean they wouldn’t be able to increase output

during different periods of time, but given their variability they would also not be available

during other periods.”

We are talking about energy, therefore each kWh not generated by NG turbinses are a win. The saved NG is stored in caverns, which according to the authors are available. The current situation with excellent wind power for weeks and a not too cold winter helps a little bit.:-)

Then the authors should try to understand, that some of the electricity generation by NG is convenient but not essential, there is still enough mid-load coal power availabel. E.g. in Germany around 10-15% of the NG could be substituted with coal.

The partial solution in the medium term is of course to increase PV and windpower and to think harder how to use bio-gas. It is nonsense to use in in large scale for base load. Withinin the next two decades the energy transition will gut more than 70% of the NG demand.

Putin cannot switch off wind and solar power for weeks at a time. he can do so with natural gas. somebody on this blog likes to talk about intermittent and unreliable energy sources. that will be natural gas in Germany for the foreseeable future. you may lose wind for a day on occasion. not weeks in the middle of winter.

Yep. Power and energy are coupled in case of electricity, however, usually one of the two clearly dominates the situation. It sounds stupid to talk in an energy context – Germany has storage facilities for about 10 weeks of NG demand – about dispatchable generation, this argument only makes sense in a discussion about reliable power.