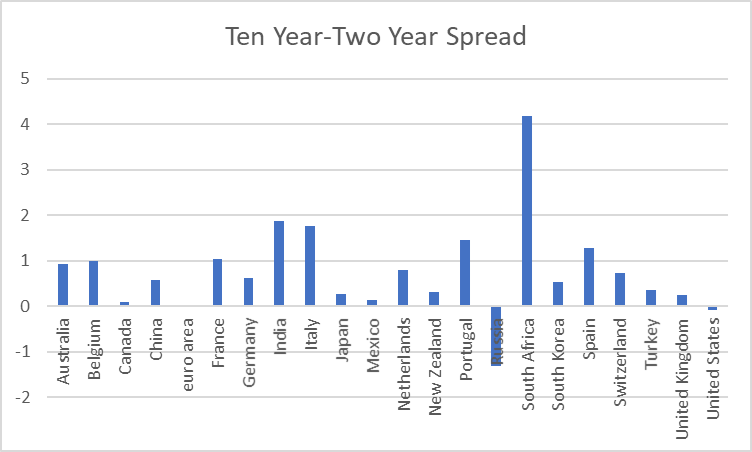

There’s been a lot of commentary regarding the inversion of the US yield curve, specifically a negative 10yr-2yr spread. Here’s a graph depicting 10yr-2yr spreads (aka “2s10s”) for several economies.

Figure 1: Ten year minus two year spreads as of 4/1/2022, %. Source: WorldGovernmentBonds.com, accessed 4/2/2022.

Note that there is little cross-country research on the predictive power of this spread for recessions. Chinn & Kucko (2015) analyzes 10yr-3mo, Mehl (2014) investigates 5yr-3mo for emerging markets. Haubrich (2021) [ungated 2020 wp version] reviews some of the more recent cross-country evidence.

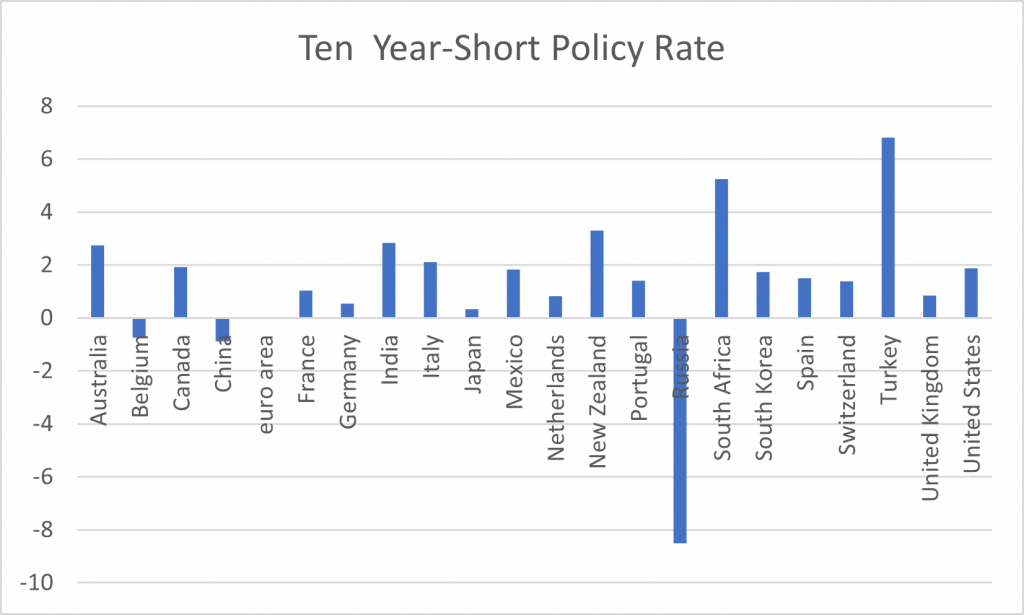

The Economist used to report the 10 year and 3 month rates in easy form, but stopped a while back (here’s my post from August 2019 noting the 10yr-3mo inversions). TradingEconomics.com reports 10 year and policy rates. Here’s a figure comparable to Figure 1.

Figure 2: Ten year minus policy rate spreads as of 4/1/2022, %. Source: TradingEconomics.com, accessed 4/2/2022, and author’s calculations.

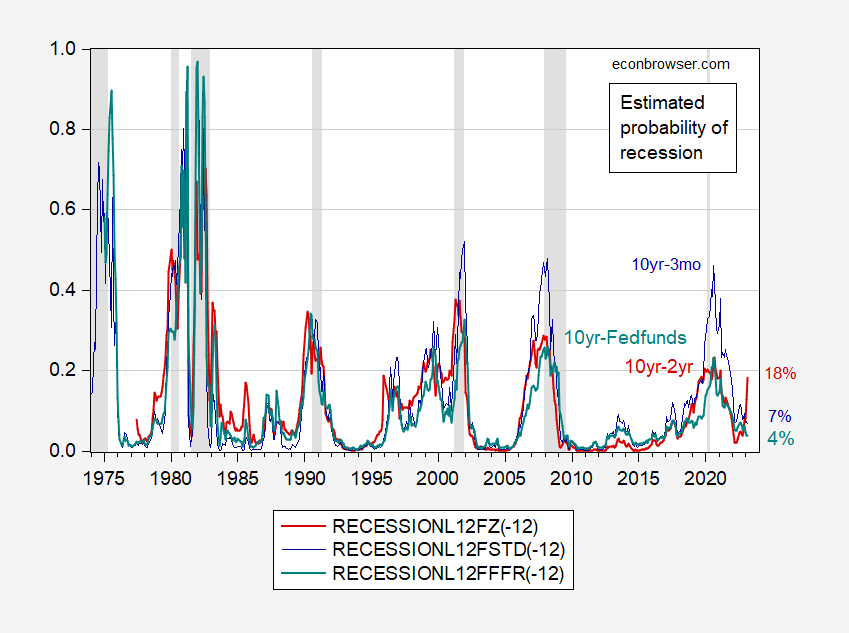

What to make of these developments? A graph of recession probabilities for the United States from the 10yr-2yr and 10yr-Fedfunds (bluered, teal, respectively) and for comparison 10yr-3mo (redblue). is suggestive that we might not want to pay too much attention to the 2s10s (even if such inversions have preceded all the recessions for which we have data).

Figure 3: 12 month ahead estimated probability of recession using 10yr-3mo Treasury spread (blue), using 10yr-2yr spread (red), using 10yr-Fed funds (teal). NBER defined recession dates peak-to-trough shaded gray. Source: Treasury via FRED, NBER and author’s calculations.

https://www.msn.com/en-us/news/world/germany-says-west-to-agree-more-sanctions-on-russia-after-bucha-killings/ar-AAVOgCh?ocid=msedgdhp&pc=U531&cvid=d5df0d7eea324012b8bd16168177183b

So Putin’s pigs go into Bucha and murder citizens there. But of course Putin’s pigs deny they did what they did. I know – nothing new as Putin has always been a war criminal. Alas – a few people here think it is cute to say these murders are not really Putin’s doing.

Is it not trendy enough to look at funding costs?

rsm,

There is no point in even trying to do so because the error margins are so large we have no idea what they are.

BTW, still waiting to hear about any recession or depression in US history that was caused by these “funding costs” you are so fixated on. Did your brother also die because of them as well?

https://www.brookings.edu/blog/ben-bernanke/2018/09/13/financial-panic-and-credit-disruptions-in-the-2007-09-crisis/

《[…] external finance premium, the difference between the all-in cost of funding a risky private borrower and the cost of lending to a perfectly safe borrower like the U.S. government. 》

Runs occurred on a variety of forms of financing, including asset-backed commercial paper, structured investment vehicles and other conduits, securities lending, and money market funds. The repo market, which was critical for the daily financing operations of many intermediaries, especially investment banks, was hit particularly hard. Eventually, runs and the contraction in funding generated broad selloffs on numerous other securities unrelated to the housing market, like corporate bonds and securities backed by student loans and credit cards. This spread of the panic to non-mortgage credit caused the external finance premium to spike for both households and firms, with potentially severe effects on the real economy (see Gertler and Kiyotaki, 2015).》

Any questions?

it started basically as a margin call on a select few financial institutions. they could not meet the margin call, and thus sold off quality assets at steep discounts in what amounted to a short squeeze. aig was selling insurance on products they new nothing about, and could not cover.

Thus, funding strains caused a real recession, amirite? Would Poszar agree with me, or with Bark’s-worse-than-his-biteme Lossssser, eh?

No, rsm, you are not right. The funding problems came as a result of the fundamental problem of an overvalued real estate market crashing.

Amirite? Yes I am and you are not.

“Thus, funding strains caused a real recession, amirite? ”

no. when the financial crisis precipitated, it was not due to funding strains. it was the result of poor investment decisions by one set of parties, and another set of parties who chose not to continue those investment decisions. that is how a market works. this produced losses. better analysis of real estate assets and debt instruments would have avoided the financial crisis. it was not created by funding strains. and I will point out you are changing your argument from funding costs to funding strains. please get your story straight.

rsm,

How is it that you cannot tell the difference between a complete financial crash due to a real estate bubble collapsing that brought down related overleveraged derivatives in the shadow banking sector and something caused by “funding costs”? It certainly is true that eventually in the collapse funding costs rose, especially for certain entities. But it was not some exogenous increase in funding costs that brought on the collapse.

No wonder your late brother lost money so badly in the financial markets if he was listening to this sort of nonsense from you.

the story is becoming more clear. rsm and family lost a bundle during the financial crisis. now he is looking for others to blame, because it certainly could not be his fault. he is upset because the markets did not behave as he has so accurately predicted, and that resulted in his losses. there must be something wrong with the markets. because his models are infallible. he is much too smart to be wrong about the markets, unless something artificial is impacting its performance. that just has to be the case, in his mind.

The financial crisis *WAS* about funding costs, it’s just the idea that that’s the entire story is ludicrous. Context will tell you that it’s not actually about “funding costs.”

The problem with the financial crisis was asymmetric information. The public suddenly realized there was this problem called “subprime mortgages” which were bundled into assets that could also be backing for other lending. So anything that looked even remotely like “subprime mortgages” people bailed on. That’s why interest rates went up when the Fed was going all out to flood the economy with liquidity and even buying up the bad assets. That’s “funding costs” in context. That’s what turned a few hundred billion in bad debt into a financial crisis that cost trillions.

Do we call that “funding costs”? No, that’s crazy, even though they played a part.

Poor little gnat, pretending to be a gadfly.

If, by the cost of funding, you mean the fed funds rate, take a look at figure 3.

If, by the cost of funds, you mean overall borrowing cost, well a good many borrowing costs are represented in the figures and text Menzie has provided.

If, by funding cost, you mean the cost of a failure to pay on loan of collateral, that’s kinda legalistic for an economics blog. It is, however, the only funding cost definition that is generally ignored here. So assuming you aren’t a complete idiot (really straining to give you the benefit of the doubt here), why do you want Menzie to write about default on collateralized debt? ‘Cause ya know, he regularly addresses funding cost as meant in all other common definitions of the term.

So please, tell us what you have in mind when you yammer on about funding cost.

Fiona Hill is smart at what she does:

https://www.msn.com/en-us/news/world/fiona-hill-says-putin-casting-invasion-of-ukraine-as-a-proxy-when-its-a-post-imperial-land-grab-and-says-more-countries-need-to-oppose-him/ar-AAVOJ9V?ocid=uxbndlbing

A former US official and expert on Russian President Vladimir Putin said he’s been trying to paint the crisis in Ukraine as a proxy war and more countries need to stand up against him. “As Putin is making this a proxy war, he’s saying to everyone else, this is like the Cold War, this is like Korea or Vietnam. This is not the case. Putin has decided to invade a neighboring country. It’s a post-imperial land grab. It’s based on history, his grievances, his view of Russia’s place in Europe,” Fiona Hill, the former senior director for Europe and Russia at the United States National Security Council told CBS’s Face the Nation on Sunday. Hill said Putin is framing this war as something between “the United States and Russia for Ukraine.” “The one thing that we have to be very careful about now, I mean, I know that President [Volodymyr] Zelenskyy is really making a massive appeal for more help from the United States, from the West, from NATO, and from other allies, the European Union. But we really need to get other international actors to step up,” Hill said.

Of course we have here our Putin poodles (including JohnH and Bruce Hall) who want deny all of what Dr. Hill said. Never mind the barking Putin poodles and pay attention to this lady.

‘All warfare is based on deception.’ sun tzu

got to quote the think tankocracy, do yeh?

He quoted Fiona Hill, widely viewed as one of the leading experts on Russia in Washington. She does happen to currently sit at the Brookings Institution, which is also probably indeed the top think tank in Washington. She is as good as it gets. Calling a quote from her “deception” and “think tankocrqcy” is just stupid. You make yourself look more and more ridiculous here with each subsequent comment you post on the invasion of Ukraine.

tankocracy credentialism!

Anonymous,

Gag, you are such an idiot. Fiona Hill was an expert before she was at the Brookings Institution. She was the Russia expert on President Trump’s Security Council, even though he was and remains a total Putin footpad almost as bad as you are. Brookings was pleased to have her after she served in that highly sensitive position.

I suppose we should give you some brownie points for coming up with “tankocracy,” whatever that is, but throwing around such an odd term in now way shows that Fiona Hill is not someone extremely knowledgeable and smart. She was clearly both of those before joining Brookings simply reaffirmed her credentials, which she had already earned. What dumb stuff.

Five reasons why many African nations choose to remain neutral.

https://www.nakedcapitalism.com/2022/04/russias-war-with-ukraine-five-reasons-why-many-african-countries-choose-to-be-neutral.html

Former colonies seem not to agree that this is a colonial land grab…and they should know.

Why should they know any better than anyone else? And why should we believe it is a history of colonialism that dictates their current position, rather than pragmatsm?

Johnny, you don’t seem to know any more about diplomacy than you do about economics.

Johnny boy could not be bothered to articulate those alleged 5 reasons so I checked the link which returned

Oops, we couldn’t find the page you were looking for

Johnny boy just assumes these were 5 sound reasons but as usual he is as clueless as it gets.

https://www.iol.co.za/news/africa/russias-war-with-ukraine-five-reasons-why-many-african-countries-choose-to-be-neutral-74cee20e-7379-4fef-a776-7a81d34f5ab8

JohnH provided us with a broken link to the story he is trying to hype which tells us two things: (1) he is too lazy or stupid to find a link that works; and (2) he never read the discussion.

But yes I found a link and actually read this discussion, which struck me as blaming NATO for Putin’s war crimes. Such an argument is both stupid and disgusting in my view but read it for yourself since JohnH never bothered to.

JohH,

Africa sharply split in the General Assembly. I counted. It looks to be that 26 voted to condemn the Russian invasion against 24 that either voted to support Russia, abstained, or did not vote. So looks like a majority did not go along with the argument in this piece.

Of course only one actually agreed with the Russian position, Eriritra, pretty pathetic.

You are getting really desperate, aren’t you.

un: irrelevant!

Sorry pgl, macroduck, and Rosser. What you’re parroting is US propaganda. I’m not denying that there may be some truth in what’s being reported, but what’s happening in Ukraine is largely lost in the fog of war. Even DOD doesn’t really know what happened in Bucha: “ Pentagon can’t independently confirm atrocities in Ukraine’s Bucha, official says.”

https://www.reuters.com/world/pentagon-cant-independently-confirm-atrocities-ukraines-bucha-official-says-2022-04-04/?taid=624b43bd3225ef0001288ec4

Now for an entirely different view, you might consider what people are saying in India, which has no axe to grind on either side:

https://www.indianpunchline.com/fake-news-in-kiev-heralds-cruel-april/

Did any of you ever consider that there might be another perspective? Apparently not.

We have a long, sordid history of government lying and infotainment hyping military matters from the sinking of the Maine to Cam Ranh Bay and Saddam’s WMDs. What is sad is that highly educated people like macroduck and Rosser swallow it all hook, line and sinker. What ever happened to intellectual skepticism?

Fool me once, shame on you; fool me twice, shame on me. Yet the foreign policy establishment repeatedly fools the American publicly freely, without notice or consequence, except when a war gets too protracted, pointless and futile for it to be ignored.

JohnH,

This is in fact serious war crimes stuff. Russian sources claim “fake news” that bodies in Bucha put there by Ukrainians after Russians left, with some claims they were actors and not even dead. But, sorry, Ny Times has published satellite photos from two weeks earlier when Russians were there. Same bodies lying on street in same positions. And witnesses who survived are all saying “Russians did it.”

Oh, and you really should not link to sources as being credible that spell the name of the Ukrainian capital as “Kiev,” How stupid are you?

Not to worry, John. The Russians specialize in easily fooling fools as your posts increasingly show.

We are parroting? Pretty sure Barkley enumerated, pgl researched your link and I made fun of you. None of those amounts to parroting.

But of course, truth is never the point with you. You rely in cheap debating tricks; tools of the propagandists trade. Because you’re a tool.

“People saying?” People say all kinds of stuff. You have provided a steady stream of evidence of that.

You have been on the side of the Russians in your comments here since before Russia expanded its invasion of Ukraine. So what if you can find text that agrees with your bias? Anybody can do that. Doesn’t prove anything.

The war crimes in Bucha did occur. But of course you must deny, deny, deny. I guess Putin’s favorite pet poodle also doubts the Holocaust.

Did JohnH even read his first link beyond the headline?

“We’re seeing the same imagery that you are. We have no reason whatsoever to refute the Ukrainian claims about these atrocities — clearly, deeply, deeply troubling,” the official said, speaking on condition of anonymity.

Dude – you have zero credibility here.

You read the headline in your second link which was Fake news in Kiev heralds cruel April.

Fine but I read the entire post and NOWHERE did he deny that war crimes happened in Bucha. Come on Johnny boy – we have been over this before. Quit claiming some post said something before you actually READ it. Damn!

i have to give credit to macroduck. i think he called it correctly first. i argued that Johnh was a conservative posing as a liberal on this site. i was wrong. Johnh is affiliated with russia. his goal is not to disparage liberals or conservatives, but to disparage the western democratic way of life. and try to do it posing as some sort of so liberal with an occasional shot at the trump party and constant shots at the democratic party. Johnh is an apologist for the war criminals in moscow. as if we cannot see the burnt out shells of the cities putin has assaulted during the siege of ukraine. hey Johnh, those burnt out buildings are not movie props. they are evidence of war crimes.

That’s the kind of bizarre comment you get from the finance left typified by Naked Capitalism.

The Ukraine invasion isn’t early 20th century colonialism. So what? It’s mid-20th century imperialism. Not Victoria, but Hitler.

Totally weird comment.

Lisa McClain is from Michigan all decked out in her MAGA hat, which I’m sure gets Michigan resident all exited especially when she says dumb stuff like:

https://www.msn.com/en-us/news/world/lisa-mcclain-lauds-trump-for-bin-laden-capture-which-happened-under-obama/ar-AAVOwc4?ocid=uxbndlbing

“While President Trump was in office, we didn’t have a war and I think he made three peace treaties,” McClain said during her speech. “Caught Osama bin Laden and Soleimani, al-Baghdadi. And this president is weak. And I’ll tell you weakness breeds aggression. We need strength.”

Of course OBL was taken down in 2011 by the US military. If this dumb witch with a B check the basic facts, the President was Obama and not Trump and the VP was Biden.

Is there something in the water of Michigan that corrupts the brains of people who live there or what? DAMN!

Its not like facts play an important role in maga communication efforts.

From the ECB website:

“We may conclude (asset purchases) in the third quarter if the data show that the outlook for inflation will not weaken. Any change to our interest rates will only come some time after the end of our net asset purchases and be gradual.”

This is a far less aggressive plan for tightening than the Fed’s, which helps account for the steeper coupon curve in Eurozone countries. Eurozone country economies are more exposed to damage from Russia’s attack on Ukraine, so the balance between growth and inflation risks is quite different for the ECB (and to heck with the single mandate).

Which

Also worth noting, I think, is that 10y/ECB rate has been inverted in much of the Eurozone until just recently. That has been viewed as an oddity or an abomination, but not as a recession forecast.

Menzie,

Being an old yield curve junkie I always took the short rate as the official cash rate in that country. Why are you taking the 2 yr old bond yield.

Not Trampis: Because in the US, 2s10s and 3m10s are common spreads to look at. And I could easily download 2s10s from worldgovernmentbonds.com. Otherwise I’d have shown 3m10s, which is my preferred measure for prediction (as documented in Chinn-Kucko (2015).

I had problems with the Haubrich ungated link. In case anyone else had the same problem:

https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID3726137_code882697.pdf?abstractid=3726137&mirid=1

https://www.msn.com/en-us/news/world/kinzinger-rips-tucker-carlson-after-russia-s-atrocities-in-ukraine-revealed/ar-AAVNNxu

It seems Tucker Carlson extended an invitation to have Adam Kinzinger appear on Tucker’s show. Watch this clip of Kinzinger explaining why he will never appear on Tucker’s show. You will be glad you did.

Now we know Princeton Steve is all happy to appear on some of the more vile Faux News shows. Of course Princeton Steve and his total lack of integrity cannot even hold Kinzinger’s shoes.

Goya Black Beans are now some 40% more expensive than they were just last year. Now the right wing media outlets are pushing this “explanation” ala Goya’s MAGA hat wearing CEO – Ukraine!

https://www.msn.com/en-us/foodanddrink/foodnews/goya-foods-ceo-says-war-in-ukraine-affecting-food-supply-chain/ar-AAVOEwT?ocid=uxbndlbing

Funny – I never knew he sourced his beans from Ukraine.

Buy more before the prices go higher.

One wonders why more people don’t appreciate what the Dems are doing to them.

Don;t be silly, T. Shaw. Popular opinion of Biden’s economic performance is very low, with that overwhelmingly due to the high rate of inflation. Almost nobody is praising him for having one of the lowest rates of unemployment ever seen.

I am sure if inflation were near a record low but the unemployment rate was very high GOPs would be going on and on about how terrible he was because of the latter. Duh.

Duuuuuuuuuuuuuuh.

Why is it that several of you are so abysmally stupid?

An analyst interviewed on the BBC, who’s name I missed, argued that there is a close relationship between wage increases and Fed monetary policy. He suggested that intersest rate markets are pricing in too few rate hikes, based on the rise in wages. This amounts to Dudley’s point that the Fed has to avoid rapid wage gains in order to maintain stable inflation.

There has actually been a good bit of variability in the relationship between hourly income and the fed funds rate over time:

https://fred.stlouisfed.org/graph/?g=NRhd

The recent gaps is, however, the widest on record.

Dudley’s argument amounts to a denial of the possibility that the relative prices (incomes) of labor and capital could change, that labors relative income could rise relative to that of capital. In fact, income shares of labor and capital have not been stable over time. Which is pretty much the same as saying there is variability in he wage/fed fuds gap. Labor’s share of income has recently been at an historic low level:

https://fred.stlouisfed.org/series/LABSHPUSA156NRUG

If the wage/fed funds gap argument wins the day among FOMC members, we’re in for a rough ride.

On the other hand, if the FOMC were sensitive to a rapid rise in real incomes, that ship has sailed. Inflation-adjusted labor costs are already falling:

https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/?utm_source=series_page&utm_medium=related_content&utm_term=related_resources&utm_campaign=fredblog

And by the way, the Employment Cost Index, which gives a clearer indication of the pressure of wages on the cost of production, rose less than other measures of labor cost and after adjusting for inflation, is lower now than before the Covid recession.

If the Fed cares about real incomes (which create the potential for excess demand) and about per-unit cost pressures, then it should not make rising nominal wages a central feature of policy making, as Dudley has argued it should.

Wages in the lower end have been helped by increasing the minimum wage many firms offer. But that is overlooking their justification and blaming inflation . Many former minimum wage jobs are being completed through technology. Notice how much less time you are able to spend in a checkout line with proper use of apps? Curbside and delivery options are widely available today. Not all wage gains are due to inflation. Plenty of benefit has been gained through technology progress.

Professor Chinn,

I am confused about the “RecessionL12 FZ(-12)”.

Am I wrong in thinking the probit model should be of the form

“Recession(+12) c gap”? Thus, meaning to me that the recession forecast applies to a period 12 months after the interest rate gap period.

Why does Macronyuknyuknyuk consistently ignore finance? If a firm’s stock is rising, can’t they compensate employees with stock options instead of wages?

First of all spell the man’s name correctly. Secondly, his understanding of finance is a lot better than yours. You are a worthless little pest so move along and pollute some other blog.

BTW anyone stupid enough to write “If a firm’s stock is rising, can’t they compensate employees with stock options instead of wages?” should read up on SFAS 123. What – you do not know what that means? Of course not as you are an idiot.

rsm, you mean like the many tech companies did last year, including facebook? now their employees are extremely unhappy, because the current options are worthless since the stock dropped. you mean those stock options? many tech companies that gave out stock options to employees last year are having difficulty retaining those employees, because effectively they were given a pay cut.

Employee stock option compensation is like getting paid in lottery tickets. Which is why many employees prefer wages. Of course rsm does not get this as he has no clue what options even are.

Zoltan Pozsar, who is among the best at keeping track of money market activity and its implications for financial markets, has published a sort of “theory of everything” piece for Credit Suisse. It is intended to be a clients-only publication, but you can find a PDF easily enough by searching ” Credit Suisse Bretton Woods III” or “Zoltan Pozsar Bretton Woods III”.

Some of his conclusions are standard market stuff – inflation will be higher, interest rates will be higher, commodities will be treated as scarce (he says treated as reserves, but that strikes me as a way of glamorizing his thesis), and central banks will be at a loss to deal with dislocation in commodoty markets.

All well and good. Those are the kinds of things lots of people are saying right now, but Pozsar argues there is a regime change under way in global finance. Maybe he’s right, but he’s just a money market guy. He’s a really good money market guy and the rest of the financial analyic world has special respect for good money market guys, but I don’t know whether he is legitimately a “theory of everything” thinker.

Anyhow, the world is abuzz with his paper, so the curious might want to have a look. Sorry I couldn’t manage to provide a link, but it isn’t meant to be available to the sans-culottes.

The paper by Pozar was easy enough to find. I honestly don’t buy his conclusion about China. They have enough problems trying to stabilize the real estate market and continue to rely on manufacturing for export not to mention their failed COVID policy.. Considering floating container ships of commodities is laughable. Some commodities such as grains are perishable and seeing floating boats with soya, corn or wheat is just bizarre. I’m still not seeing any manufacturing innovation coming from mainland China. Most of the Chinese companies and by association companies that have been acquired still do the bulk of design and engineering outside the US. We just got a new Cafe range that is made by the GE subsidiary of Haier that is a Chinese appliance company who has purchased a number of like companies over the years. The design of the range came out of the US. I think the same is true of Fisher-Paykal appliances that are made in New Zealand. This stuff is all high end with good profit margins. China cannot afford to screw these markets up though it would all be good for the Bosch group if they did.

Yeah, it sounds a bit like Pozsar has forgotten carrying costs in his thinking about commodity reserves. Gold is a very poor analogy because of the far lower maintenance cost relative to other commodities, and even gold has cost-of-carry issues.

More broadly, finance guys sometimes miss economic and political issues that others see. As a for-instance, there’s a big, productive chunk of China that faces the possibility of inundation in coming decades. Kinda tosses a wrench into China-focused regime-change schemes.

It’s also worh notig that China holds large stocks of many commodities already, and has bought up commodity production abroad. The optimal level of stocks may have changed, but that alone doesn’t amount to regime change.

Apparently, Blackrock’s analysts were impressed enough with Pozsar’s piece to crib heavily from it, though again, some of the ideas common to Pozsar and Blackrock are pretty widely accepted. It’s the “regime change” notion that I find interesting:

https://www.marketwatch.com/story/get-ready-for-a-new-world-order-that-drives-stocks-and-bonds-blackrock-11649110028?mod=mw_quote_news

Pozsar has also been proven right about FRA-OIS spreads (think dollar scarcity or interbank lending risk):

https://www.reuters.com/business/us-funding-stress-metric-rises-again-2022-03-04/

http://www.news.cn/english/20220404/18e6d26e97dc44bfad5c0b138e1782dc/c.html

April 28, 2022

Eyeing food security, China strengthens domestic grain supply

CHANGSHA/HARBIN — The passing of Chunfen, or the spring equinox, on March 20, signaled the start of China’s busy spring farming season, with modern farm machinery working full tilt at plowing and other essential tasks.

Strenuous efforts nationwide are being made to guarantee the country’s grain security amid the global climbing up of grain prices.

With increasing investment in agricultural science and technology and the promotion of superior grain varieties, China has shown great confidence in guaranteeing stable domestic production and supply amid uncertainties in the external environment.

Of late, rumbling farming machines have been shuttling back and forth on a little patch of arable land at the juncture of Dashiwan and Huayuandong villages, in the city of Yiyang, in central China’s Hunan Province.

Thanks to the local farmland protection and supervision authorities, the arable land, once converted into a fishpond for leisure fishing, has once again witnessed the bustling activity of spring farming.

Since 2020, Yiyang has vigorously expanded its arable land for agricultural production, adding over 342 hectares.

Similar basic guarantee measures to ensure that spring farming proceeds in good time have been rolled out across the country.

Heilongjiang Beifeng Agricultural Means of Production Corporation has a market share of about 50 percent in the province’s fertilizer market.

The price of fertilizers has been on the rise this year, generally up over 30 percent compared to the previous year, especially potash fertilizers, which have doubled during the period, said Liu Yanming, the company’s general manager.

In response to the rising prices of relevant production materials, the central government has allocated 20 billion yuan (3.14 billion U.S. dollars) to issue one-time subsidies to the farmers growing grain across the country. The country also released 1 million tonnes of national potash fertilizer reserves to the domestic market to meet production needs during this year’s spring farming period.

New technological innovations have also been adopted to develop superior grain varieties.

“This year, we’ve conducted tests on over 20 new soybean varieties,” said Luan Xiaoyan, a seed-breeding expert at the soybean research institute of Heilongjiang’s provincial academy of agricultural sciences.

As the country’s largest soybean production base, Heilongjiang sees its soybean planting area accounting for more than 40 percent of China’s total. Local agricultural authorities have recommended 23 new superior soybean varieties for breeders over the years, helping boost the yields.

A novel soybean variety called “Heinong 84,” which was developed by Luan and her team, is their major breakthrough in integrating high-quality traits such as high yield and resistance to pests, and was granted national approval last year.

“It was beyond my expectations when the average yield per mu (one mu equals about 666 square meters) exceeded 200 kg,” said Zhang Xianwu, a farmer in Mulan County, Heilongjiang Province. Zhang planted over 530 hectares of the “Heinong 84” soybean last year….

Man, this reminds me of Khruschev-Era Soviet propaganda. Our valiant cadres are marching ever forward in blah, blah, blah.

200 kg per mu is about 86% of the yield from the latest U.S. soybean harvest. Not something to brag about.

Menzie, your commentary before Figure 3 mis-identifies the colors. You say ‘blue, teal respectively’ but mean ‘red, teal respectively’. 10yr-3mo is blue, not red.

Gridlock: Thanks! Fixed now.

Did I ever note lawyers are generally evil people with few talents but big egos? I’m looking over some slides on how to draft intercompany loan contracts (let’s just say these clowns make easier things confusing). The author of these slides must be a variant of Dr. Evil:

‘The Lender hereby agrees to grant a loan to the Borrower in U.S. Dollars and in an aggregate principal amount not exceeding One Thousand Four Hundred Million U.S. Dollars (US$ 1,400,000,000).’

Of course this loan amount is One Billion Four Hundred Million US dollars.

But why make billions when you can make millions?

Kinda sorta makes basic income look doable, huh, cuz t’would be but a drop in the bucket of money creation already occurring?

Wages Up by $1.2 Trillion Since Biden Takes Office, $9,400 per Household

https://cepr.net/wages-up-by-1-2-trillion-since-biden-takes-office-9400-per-household/?emci=9373ec67-38b4-ec11-997e-281878b83d8a&emdi=21b3d8c0-38b4-ec11-997e-281878b83d8a&ceid=4616197

‘The $1.2 trillion increase refers to all labor income, which counts employer provided health care insurance, pensions, and other benefits. More importantly, these data are not adjusted for inflation, but even when price increases are factored in, labor income is still up by 1.6 percent from when President Biden took office.’

Real compensation is up but Dean Baker notes how the press would tell us otherwise. Then again Bruce Hall kept repeating the same lie over and over that real compensation was flat under Obama but soared under Trump even after Dr. Chinn called out this serial liar in a special post debunking Brucie’s lie. But check out the chart provided by Dean Baker after he wrote:

‘For those who want a picture of how labor income growth since Biden took office compares with prior years, here’s the picture since 2010.’

Dean’s chart confirms what Menzie wrote and contradicts the repeated lies from Bruce Hall. But yea – you knew that Bruce Hall lies a lot already!

good deal for the participating ….

how great for us on social security who got a 5.9% (over the 1.6% for work participants) raise!

LOL! Glad to see I’m living rent free in your head.

Perhaps you should have studied a little about philosophy and perspective: https://www.sloww.co/blind-men-elephant/

In that regard, I’ll refer you back to the link you so assiduously ignored: https://fred.stlouisfed.org/series/LES1252881600Q

You may not like that perspective, but it’s there in the St. Louis Fed’s repertoire. Economists are a little like those six blind men trying to describe the elephant.

“Glad to see I’m living rent free in your head.”

So you want to be Econned’s minnie me. But do note everyone here hates this troll too. Two things you have to do to hold his stinky shoes – learn to think (which you never do) and learn to be honest (which he sometimes do but not you).

” I’ll refer you back to the link you so assiduously ignored”

Are you this incredibly stupid? After Menzie pointed out the obvious – that real wages by your measure were rising under Obama. I would call you Mr. Magoo but he has better eye sight then you do.

Yes Brucie – we get it. You are the dumbest troll that ever lived. Hands down!

I will refer you to that link again.

https://fred.stlouisfed.org/series/LES1252881600Q

Yes, real wages (median, not mean which can be skewed by a small portion of the population that have gotten large increases) did “rise” over 8 years from the Q1:2009 to Q4:2016 from index value 345 to 349 or <1.2% over 8 years. Wow! I'm impressed by your technicality. Did you have to get out your jewelers loupe to notice what I had already told you?

What a dolt!

Look – repeating your total confusion does not yield clarity. Moving the goal posts to support your dishonesty does not mean you win the football game. Now if you want to remind us over and over again that you are a lying troll, we get it. We got it a long time ago. Try moving onto a topic you understand – assuming there is one.

I think I know why Bruce Hall is so off the charts stupid. Did a surgeon botch a labotomy some ten years ago eradicating Bruce’s memory? After all it is really dumb chirps like his latest that tell us he does not remember the two big economic events during Obama’s first term:

(1) Everyone knows except our village idiot that Bush43 left us with the worse free fall of the economy since the early 1930’s. It eventually turned around thanks to fiscal stimulus that should have been bigger but McConnell tried to block any recovery efforts. FYI Bruce – real compensation does not exactly rise when the economy is in a massive output gap;

(2) Obamacare which raised real fringe benefits for many workers. Real compensation rose during Obama’s first term even if real wages not including fringe benefits may not have. Everyone gets this except for our village idiot Bruce Hall.

Keep chirping Bruce – reminding us that you are both dishonest and dumb is always welcomed.

I just saw on the news some tweet that reminds me why children should not have Twitter accounts:

Madison Cawthorn, a Republican congressman from North Carolina, has gone on the House floor to argue the definition of a woman to be “xx chromosomes, no tallywhacker”. Though he purports that his definition is based on science, he is incorrect because he is ignoring the scientific evidence that there are women who are born with androgen insensitivity syndrome and have xy chromosomes.

One more recommendation – never allow Madison Cawthorne near any elementary school.

BTW, while it is not a traditional reason for doing so in recent years, especially in nations running nominally negative interest rates, two year government securities have often had the lowest yields of any length.

Do Macrokrusty and Looosey realize that Poszar is one of the originators of the phrase “supply chains are just payment chains in reverse”?

https://www.msn.com/en-us/news/politics/white-house-chief-of-staff-ron-klain-hits-back-at-sen-ted-cruz-for-saying-ketanji-brown-jackson-would-be-the-furthest-left-justice-in-supreme-court-history/ar-AAVQnei?ocid=uxbndlbing

There are 11 Republicans on the Senate Judiciary Committee who took to blatant lies to support their racist votes against putting Ketanji Brown Jackson on the Supreme Court. Of course Ted Cruz was the #1 racist and liar so good for Ron Klain for calling this joke of a Senator out.

Here it means “make up stuff to smear the black candidate because she is black.”

In politics, that’s often what ‘racist’ means. I’m not sure where your confusion stems from.

Just a note on Japan’s 2s/10s spread – The BOJ began a massive intervention last week to keep 10-year yields within target. The plan was to continue the intervention this week. Japan has a much longer history of inflation undershoot and the BOJ is not yet convinced inflation has returned for good.

Treasury has a nice graphic representation of the term structure of inflation expectations here:

https://www.clevelandfed.org/our-research/indicators-and-data/inflation-expectations.aspx

There are several buttons on the page. Just hi the one labeled “expected inflation term structure”. A potential cause of the 10s/2s inversion is clearly shown.

The other buttons are also worth a look.

《A potential cause of the 10s/2s inversion is clearly shown.》

ALIENS, amirite?

《A potential cause of the 10s/2s inversion is clearly shown.》

Is it aliens?

https://news.cgtn.com/news/2022-04-04/Chinese-mainland-records-1-405-new-confirmed-COVID-19-cases-18WWQqVNmso/index.html

April 4, 2022

Chinese mainland reports 1,405 new COVID-19 cases

The Chinese mainland recorded 1,405 new confirmed COVID-19 cases on Sunday, with 1,366 linked to local transmissions and 39 from overseas, according to data from the National Health Commission on Monday.

A total of 11,862 new asymptomatic cases were also recorded on Sunday, and 83,364 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 156,143, with the death toll at 4,638.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-04-04/Chinese-mainland-records-1-405-new-confirmed-COVID-19-cases-18WWQqVNmso/img/6affcf2fdd54482e948c25bebbda5ee1/6affcf2fdd54482e948c25bebbda5ee1.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-04-04/Chinese-mainland-records-1-405-new-confirmed-COVID-19-cases-18WWQqVNmso/img/e98a573761ac467aa2d8b2e6d36b4575/e98a573761ac467aa2d8b2e6d36b4575.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-04-04/Chinese-mainland-records-1-405-new-confirmed-COVID-19-cases-18WWQqVNmso/img/be36c4bca5f84314a46b81a6c7459f27/be36c4bca5f84314a46b81a6c7459f27.jpeg

https://www.worldometers.info/coronavirus/

April 3, 2022

Coronavirus

United States

Cases ( 81,832,612)

Deaths ( 1,008,198)

Deaths per million ( 3,015)

China

Cases ( 154,738)

Deaths ( 4,638)

Deaths per million ( 3)

What happened to the daily new positive tests number?

Was the explosion of over 11K new cases today too much for you?

https://www.nytimes.com/interactive/2021/world/china-covid-cases.html

The fact that China’s new cases numbers are now more than 3 times as high as at the previous record peak would seem informative to me.

Why don’t you calculate death per cases (China 1 death per 33 cases, US 1 death per 81cases), that would be more informative than just saying the obvious that if the pandemic is less severe death from pandemic is also less severe.

Your attempt to manipulate narratives by cherry-picking data are pathetic. The readers here are numbers people, they can look through Faux presentations.

Let’s try this again:

On Feb. 22, two days before the start of the war, I commented this:

[M]ake no mistake, those Russian soldiers will have no compunctions about killing anyone they’re told to. Putin has already foreshadowed a kind of genocide of Ukrainians, a collective punishment. The women will all be raped. You can count on that. That’s what the Russian soldiers did in Budapest in 1945. That’s the least of it. Torture, imprisonment, murder, that’s all part of it.

The discoveries in Bucha and other places underscore that my analysis was prescient. Everything that I predicted– and more — has come to pass. Putin is and will be regarded as a war criminal; Russian soldiers will be branded as war criminals; and Russia will come to earn a collective guilt similar to that of the Germans in World War II.

President Zelensky made a historical address in this regard. You should watch it: https://www.youtube.com/watch?v=P72_DNt_Btg

Have you not figured out. NO ONE gives a damn what you have written or will write. So stop this self promotion of worthless word salad.

US secretary of state: Bucha shows Russian campaign “to kill, to torture, to rape, to commit atrocities”

https://www.cnn.com/europe/live-news/ukraine-russia-putin-news-04-05-22/index.html

No surprise to anyone who knows the Russians.

This from the self appointed “expert” that thought there was an economic solution. Seriously dude – do not lecture us on how horrific Putin is. We all knew that well before you did.

Did anyone notice, Phil Gramm, the man at the center of the cause of the swaps and derivatives crisis of 2007–2008 had the unmitigated gall to pretend he cares about “consumer welfare” in the editorial pages of WSJ. Makes my blood boil.

There was at least one good one this week:

https://www.theguardian.com/us-news/2022/apr/05/trump-admits-election-defeat-historians-zelizer-princeton

Apparently the orange abomination is just as good at “manipulating” credentialed historians as he is at “manipulating” Putin. He needs to focus on the non-college crowd a little bit more.

Whenever one of those MAGA hat wearing liars declares that rising murder rates are a Democrat issue, the Third Way have the data and the MAGA hat wearers are doing what they do – lying:

https://www.thirdway.org/report/the-red-state-murder-problem

Turns out murder rates per capita are higher in Red States. But that is what one gets when one has lack gun control laws combined with general hatred of anyone who isn’t a white dude.

Perhaps the question is not how do expectations (pick your own measure) and inflation align, but how the unexpected and inflation align.

https://finance.yahoo.com/finance/news/fed-probably-wrong-inflation-one-171551289.html

#1 reason: blame it on the low acceptance of the COVID vaccines (really?).

Scott Summer has his own take on this.

https://www.econlib.org/what-caused-the-high-inflation/

For those with a different perspective:

https://www.sloww.co/blind-men-elephant/

Did you actually READ your 1st link? Let me help you out here. Its #1 reason was that people decided not to get the vaccination. in other words, there were people stupid enough to listen to scum buckets like Bruce Hall. Congrats Brucie boy – you are responsible for the rise in inflation rates. Well done!

Scott Summer’s “explanation” includes this gem:

“Fed policy was clearly too expansionary last year, and as a result aggregate demand (M*V) rose at an excessive rate.”

Hey Brucie – did you not read all of Dr. Chinn’s posts that clearly showed this crude version of monetarism is basically junk science. Let me give you a clue. Velocity is not a fixed constant.

That Blind Man and an Elephant was sort of cute but poor Brucie boy so lacks any self awareness that he does not realize he is one of those blind men.. Each of every one of his rather stupid comments shows this to be true!

While food costs are a big concern even in well off countries, absolute food scarcity is a serious and growing problem for some:

https://www.politico.com/news/2022/04/05/deepening-global-food-crisis-ukraine-russia-00023124

Good to see that the White House is paying attention.

And bad to see that Russia’s new battle plan makes harvesting Ukraine’s wheat less likely than it already was.

“As Russian forces refocus the brunt of their military assault on Ukraine’s food-producing southeast, U.S. officials and lawmakers are struggling to help ward off a deepening crisis both inside Ukraine and for fragile economies around the world already reeling from climate disasters and Covid-19. Russia’s military is pushing further into Ukraine’s wheat fields, which could jeopardize millions of tons of grain set to be harvested in July — threatening sustained shortages in countries across Africa and the Middle East that rely on Ukraine as a major source of their grain and sunflower oil to feed millions of people.”

Good to see this story got who is to blame correctly – Putin. As opposed to that constant drivel from JohnH that all these difficulties are the fault of NATO and the US.

https://www.msn.com/en-us/news/politics/sarah-palin-insulted-joe-biden-picked-black-woman-for-supreme-court/ar-AAVVzrl?ocid=uxbndlbing

It seems the worst nominee for Vice President ever (tea bagger racist Sarah Palin) wants to be relevant again so this pathetic excuse of a person has declared that Ketanji Jackson Brown is not qualified to be on the Supreme Court. Like this lying witch with a B is qualified for anything other than dog catcher. Oh wait the nominee is a black woman so Sarah Palin naturally believes she is only to be Palin’s house keeper. Pathetic.

2s10s now about +9 basis points, but the forward curve is closer to -50.

Brainard and Daley pushed yields up yesterday, still rising today.

Odd times in financial markets. Treasury yields have risen very rapidly, by some accounts, faster than ever before. Financial conditions, by conventional measures, are tighter than at any time since the Covid collapse or the 2016 junk bond scare (oil-driven):

https://fred.stlouisfed.org/series/NFCI

The Fed, which had been operating under low-inflation in an economy which had suffered repeated financial shocks, has-been in the habit of engaging in “verbal easing” whenever serious market stresses cropped up. Now, the Fed is dealing with inflation and is doubling down on hawkish comments in the face of market stresses. When doves sound hawkish, that’s strong stuff.

Financial markets overshoot. They overshoot for both mechanical and emotional reasons. (Toll Brothers shares down 35% ytd.) There may be some respite as shorts are covered after sell-offs, as happened with stocks through much of mid and late March, but volatility naturally lowers asset prices, adding to the effect of fundamental weakness.

When market participants run into regime change, they often run for cover. Never mind the new fad of declaring a new world financial order is a-blooming. The “Fed put” has been shelved for now, and that’s regime change with immediate consequences for investors. Could get interesting.