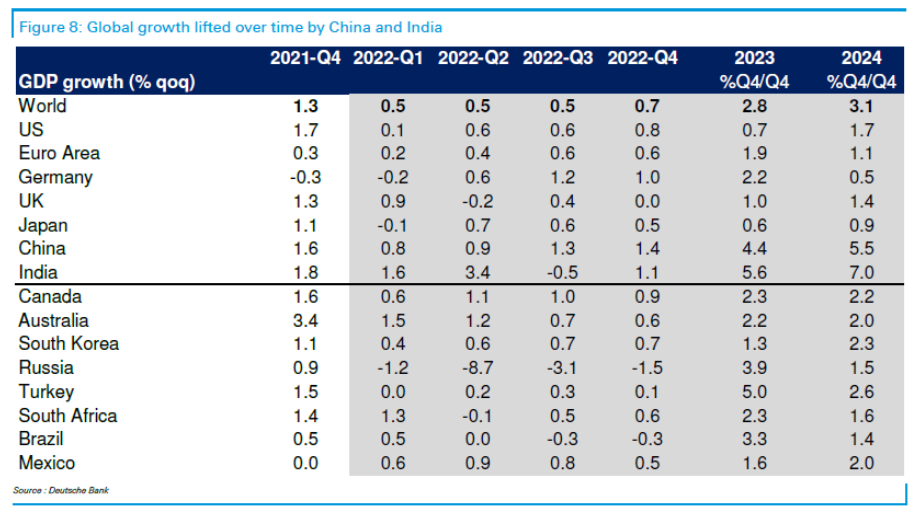

From Folkerts-Landau and Hooper at Deutsche Bank, yesterday:

…inflation in the US and Europe has now reached levels that have forced the Fed and

the ECB to pivot their monetary policy stances dramatically. As a result, we now

expect the US economy to be in outright recession by late next year, and the EA

in a growth recession in 2024…

Source: D. Folkerts-Landau and P. Hooper, World Outlook, 2022-24: Over the brink, Deutsche Bank, April 5, 2022.

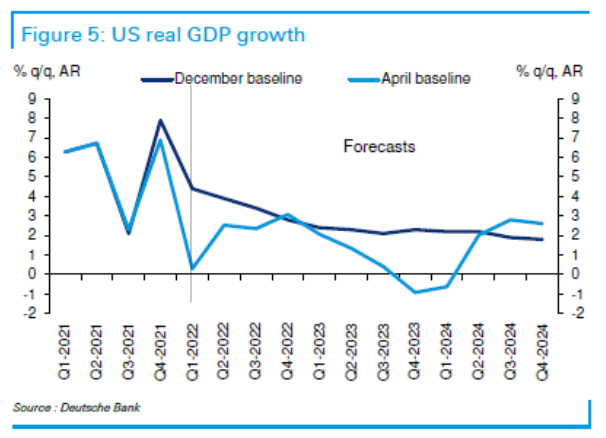

This forecast is considerably more pessimistic than this December baseline, predicting a recession in 2023Q4:

Source: D. Folkerts-Landau and P. Hooper, World Outlook, 2022-24: Over the brink, Deutsche Bank, April 5, 2022.

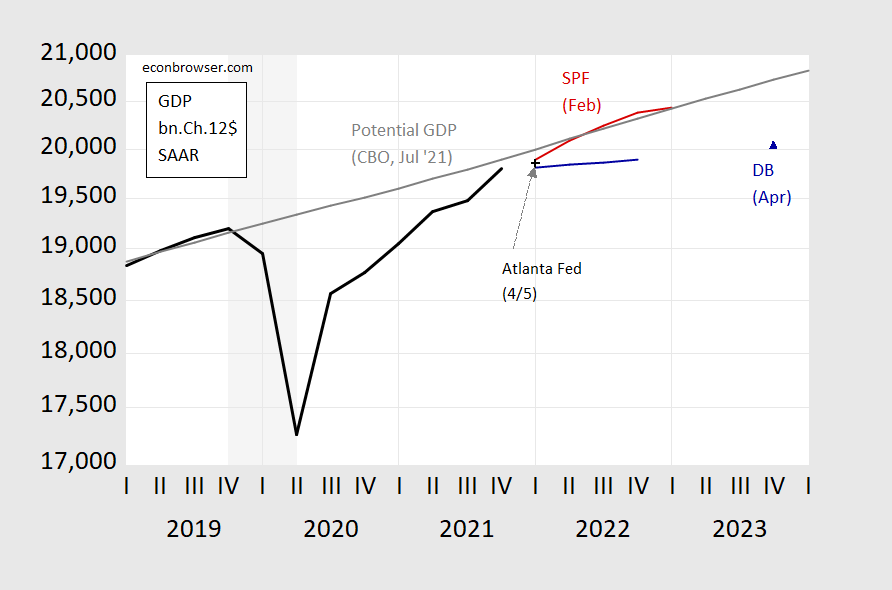

The forecast is also considerably less optimistic than the Survey of Professional Forecaster’s February consensus. Of course, a lot has happened since the SPF forecasts were collected (at end-January).

Figure 1: GDP (black), Atlanta Fed nowcast of GDP (black +), Survey of Professional Forecasters February mean (red), and Deutsche Bank forecast (4/5), all in billions Ch.2012$ SAAR. NBER defined recession dates peak-to-trough shaded gray. Source: BEA, Atlanta Fed, Philadelphia Fed, Deutsche Bank, NBER, and author’s calculations.

While 10yr-3mo and 10yr-2yr indicators do not suggest a high probability of recession through March 2023 (the 10yr-2yr spread went positive yesterday), the DB forecast for recession in late 2023 pertains to a horizon more than a year out.

So the Russian Ministry of Finance was supposed to be $650 million in interest payments but it could not so it wired a bunch of roubles which of course is of questionable value:

https://www.msn.com/en-us/money/markets/russia-says-it-sent-650-million-bond-payment-in-rubles-after-us-treasury-blocked-dollar-transfers/ar-AAVVepp?ocid=msedgntp&cvid=97e6fe3c21e940e6a094505abd16c0c6

Is Russia in default? Putin says no and I bet the King of Debt and his best buddy (Donald Trump) would say yes but the credit rating agencies have other views.

The ability to document Russian war crimes and their victims, almost in real time, is amazing.

https://www.cnn.com/2022/04/07/europe/ukraine-mother-shot-russian-forces-bucha-intl-cmd/index.html

What human being would ever hand over their money in a store for a Russian product, knowing that this is what they are helping to finance? If this is where my money goes, I would rather do without.

Repeating myself:

Odd times in financial markets. Treasury yields have risen very rapidly, by some accounts, faster than ever before. Financial conditions, by conventional measures, are tighter than at any time since the Covid collapse or the oil-driven junk bond scare in 2015-6:

https://fred.stlouisfed.org/series/NFCI

The Fed, which had been operating under low-inflation in an economy which had suffered repeated financial shocks, has been in the habit of engaging in “verbal easing” whenever serious market stresses cropped up. Now, the Fed is dealing with inflation and is doubling down on hawkish comments in the face of market stresses. When doves sound hawkish, that’s strong stuff.

Financial markets overshoot. They overshoot for both mechanical and emotional reasons. (Toll Brothers shares down 35% ytd.) There may be some respite as shorts are covered after sell-offs, as happened with stocks through much of mid and late March, but volatility naturally lowers asset prices, adding to the effect of fundamental weakness.

When market participants run into regime change, they often run for cover. Never mind the new fad of declaring a new world financial order is a-blooming. The “Fed put” has been shelved for now, and that’s regime change with immediate consequences for investors. Could get interesting. Could add to recession risk.

PIMCO had an interesting note saying that yield inversions don’t mean what they used to. It wouldn’t have gotten my attention much if it wasn’t so closely timed with the DB recession call. A person can argue the two things aren’t “mutually exclusive” facts, but just kind of interesting.

according to reports from the fed minutes

“Officials acknowledged that passive runoff of mortgages likely may not be sufficient, with outright sales to be considered “after balance sheet runoff was well under way.””

this is the first time i have seen the fed mention outright sales of holdings, rather than runoff alone. but they note this would be a good deal into the future.

i heard a concerning comment from a fed member the other day. she said that high inflation was as bad as being unemployed. i find this concerning. high inflation is nothing like being unemployed. that should not be made an equivalence. unfortunately, the fed is beginning to lay the ground work to defend rate hikes at the expense of workers losing their jobs-collateral damage if you will. this is a poor interpretation of the dual mandate.

how they get to reducing 60B in treasury and 35B in mbs a month……?

remains to observe.

“she said that high inflation was as bad as being unemployed. i find this concerning. high inflation is nothing like being unemployed. that should not be made an equivalence.”

That is strange and I do disagree with her (and agree with you). But the board is making up for lost time. They should have been turning slightly hawkish back in the early fall and they didn’t. They should not have been so sanguine about the supply issues, and blaming everything on supply is a cop-out. So far, no credibility worries, but that may change.

Dual mandate aside, the public *HATES* inflation – there is no doubting it. They seem to hate it more than just about anything.

Brainard is the one who said that. It was part of her discussion of how much worse inflation is for the poor than the rich. She’s widely considered a dove.

There is also the ever-present assertion that tightening need not induce recession. Harker said it. Most of ‘m say it. Yeah, well…

Tightening in response to a positive demand shock logically needn’t result in recession, though the record ain’t good. Tightening into a negative supply shocks? I don’t see how logically you get the job done without recession. Reducing demand to match supply means recession.

Unless the supply shock is transitory…

was not sure who said who, so was vague about it. but looked it up. brainard talked about the bond runoff conditions. Mary daly talked about inflation being the same as losing ones job. if brainard made similar comments, then looks like that is now the consensus view from the fed.

agree with you that tightening need not result in a recession. but most likely will, or at least feel like it. it really all depends upon how high (and quickly) they raise rates. do you raise them enough to snuff out inflation, or simply to threaten it? I can live with 4%, or even 5%, for a while if it keeps unemployment low and the economy humming. and of course, the Ukraine issue could cause recessionary issues, worldwide, without any reference to inflation in the usa.

“I don’t see how logically you get the job done without recession. Reducing demand to match supply means recession.”

If the supply shock is transitory (looks to be resolving itself, though slowly) and expectations are still well-enough anchored, then I don’t think it’s crazy to suggest the possibility of a soft landing.

that statement is just an acknowledgement of the negative convexity of mbs. they are anticipating prepayment speeds to fall as rates rise, so the natural runoff will be slower than it would be if rates had stayed constant.

Certainly part of the equation, but perhaps not all. Ud un-off, the $35 billion figure ( for instance) is an upper limit. Under out right sales, it’s a fixed pace.

Predictably is important because under sales, primary dealers need to round up cash for the transaction.

Details really matter.

https://news.yahoo.com/tom-cotton-says-ketanji-brown-151019555.html

“You know, the last Judge Jackson left the Supreme Court to go to Nuremberg and prosecute the Nazis,” Cotton said, referring to Robert Jackson, who was appointed by President Harry Truman to lead cases against German war criminals. “This Judge Jackson may have gone there to defend them.”

Todd Cotton has done the impossible. He went even lower than Ted Cruz could ever go. I guess simply voting no simply because she is a black woman was not racist enough for this piece of garbage.

leaping to ‘racism’ is world class jump!

From the head of the KKK who thinks blacks are only good for shining your shoes. Run along little troll.

Is Jackson unqualified? No. She is extremely qualified.

Is Jackson ideologically radical in any way? No. Her record shows nothing like that.

Is she soft on pedophiles? Turns out that story is made up, and whatever Republican senators are trying to pin on her, they could have also pinned on Republican appointees they voted for.

Is she defending Nazis at Nuremburg?

See, that last one is just plain racist BS. Who else with Jackson’s profile (save for her race) would get this kind of comment?

Merrick Garland never went through this abuse but then he was not even considered by the Senate thanks to Mitch McConnell.

You find this surprising at all coming from a guy like him? I’m sometimes amazed at how low these guys can go and still get reelected. It just goes to show how gerrymandering works.

Tom Cotton is a senator, so gerrymandering doesn’t apply to him. Votes for him are statewide. Lots of voting racists.

That is low.

Landau…….. well the name checks out he knows what he’s talking about. I respect them for sticking their neck out this early on their forecast. I would lean to agree that eventually a recession happens before end 2023, but not willing to make a hard prediction yet. I still got a bad ouchy from my low inflation prediction.

The list is growing. Larry Lindsey has forecast a recession in the summer of this year. I think he needs to take a look at job growth before he say that again.

Putting out his cardboard display sign for 2024 presidential candidates “Will sell my soul for food”.

Wasn’t Larry Lindsey the fellow who told us that the Bush43 tax cuts would lead to incredible long-term growth rates. How did that work out?

Interesting graph related to car sales (the 2nd graph down is more expository):

https://fredblog.stlouisfed.org/2022/04/new-vehicle-sales-and-auto-price-inflation-since-the-pandemic/

“The FRED graph below shows the same data with different axes for each series: right axis for the sales and left axis for the price index. Notice how much easier it is to understand the price and quantity dynamics for such a simple adjustment of the graph.”

A well known proposition for scaling data. Now Bruce Hall linked to this FRED Blog post as if he discovered something new. Then of course he blamed all of this dismay on Biden’s socialism leading to a shortage of semiconductors followed believe it or not by a link to a story when properly understood noted the Just in Time inventory approaches he strongly advocated turned out (drum roll) to be a main cause of the same semiconductor shortage.

Oh wait – I’m stating the obvious …. Bruce Hall is not the sharpest pencil in the box.

https://www.nytimes.com/2022/04/05/business/lael-brainard-inflation.html

April 5, 2022

Caviar and canned tuna: Top Fed official points out income-based inflation gaps.

Lael Brainard, a governor of the Federal Reserve, highlighted the impact of inflation on the poor and pledged to act to cool off rising prices.

By Jeanna Smialek

Caviar and canned tuna are grouped into the same category for the purposes of measuring the inflation rate in America, and Lael Brainard, a governor of the Federal Reserve, thinks that is obscuring the nation’s ability to understand the different price-related challenges facing households.

Ms. Brainard, President Biden’s nominee to be the Fed’s next vice chair, gave a speech on Tuesday about the gaps in inflation across income groups — remarks in which she also emphasized the urgent need to bring price gains under control and the Fed’s dedication to that effort.

Low-income households spend 77 percent of their incomes on necessities, compared with 31 percent for higher-income households, she pointed out. Those differences may make it harder for poorer families to dodge rising prices, but it is hard to gauge exactly how much more intensely inflation hits low earners.

That’s because of the way it is measured: Inflation indexes give products weight based on how much people across the economy spend on them, so luxury products that only rich people buy are counted alongside the basic food, energy, clothing and other daily needs that lower-income Americans devote their paychecks to acquiring.

“Households with different levels of income may purchase significantly different items even within the same elementary index categories for goods and services,” Ms. Brainard said, noting the example of caviar and canned tuna.

That could be a problem: Tuna may go up sharply in price amid a fish shortage that increases costs of production, for instance, whereas caviar, as a luxury good, may have higher profit margins to begin with and increase less. Or there may be more substitutes for caviar….

https://fred.stlouisfed.org/graph/?g=MN2G

January 15, 2018

Consumer Price Index for Food and Energy, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MN3g

January 15, 2018

Consumer Price Index for Food and Energy, 2017-2022

(Indexed to 2017)

I tend to buy high quality tuna rather than canned tuna but no I do not buy caviar.

An important point. This highlights the fact that inflation is a tax, and with every tax comes difference in incidence. And it’s the little guy that usually gets screwed the most.

In an economy where the poor are forced to purchase necessities on credit because they don’t earn a living wage, an increase in interest rates will be a double tax. They will continue to have to pay higher prices as inflation remains high and then pay more in interest on the money they’ve borrowed as the Fed raises rates.

Expect a large jump in bankruptcy filings in the next 6-12 months.

Irving Fisher might ask: What if their wages are growing faster than their debt payments? Inflation is good for existing debtors. Trouble is, you don’t want it to be too good, or you’ll be juicing the consumer market and making inflation worse.

Also, if low-wage consumers can manage their debts in good times, I’m not sure what the problem is. It’s a good thing, not a bad thing, that lower-income people have better access to credit than they used to.

https://fred.stlouisfed.org/graph/?g=NQNw

January 30, 2018

Consumer Price Indexes for food and energy in Euro Area, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=NT1G

January 30, 2018

Consumer Price Indexes for food and energy in Euro Area, 2017-2022

(Indexed to 2017)

Perhaps the Biden Administration can convince Congress to pass some $8 trillion budgets for the next few years. That should prevent a recession until after the next election for POTUS. Of course, there might be a slight inflation problem.

https://www.cnbc.com/2022/03/29/feds-patrick-harker-says-he-thinks-the-us-can-avoid-a-recession-even-amid-troubling-signs.html

You were in such a hurry to chirp some Trumpian BS that you could not bother to read even the title of your own link?

Fed’s Patrick Harker says he thinks the U.S. can avoid a recession, even amid troubling signs

BTW an $8 trillion per year Federal budget would not be such a bad idea if we bothered to reverse those stupid 2017 tax cuts for the rich. But I need to apologize your little cute chirping with old fashion reality. So wear that MAGA hat and go back to your worthless chirping.

LOL! Still trying to pick nits. I didn’t write that the US was going into a recession, did I? No. You inferred that I wrote that.

Deutschbank and Patrick Harker discuss the possibility of a recession and that it could be avoided. I didn’t disagree, did I? No. I just gave the Keynesian solution. Spend, baby, spend.

Ignore that inflation behind the curtain.

Thanks for reminding us that none of what you wrote should be taken seriously since you cannot stand behind any of your little chirps. Bruce Hall – total waffling troll.

Check your facts. Fiscal policy over the next several quarters, in current law, is contractionary:

https://www.brookings.edu/interactives/hutchins-center-fiscal-impact-measure/

It would take considerable additional deficit spending from the federal government to make fiscal policy neutral. Contractionary fiscal policy is, for now, adding to recession risk.

This is freshman year stuff.

… in current law…

There’s the rub versus what I wrote, eh?

Still doesn’t mean what you wrote was well thought out. You write partisan tripe and then quibble about whether you can be held to account. I won’t let you off the hook just because you play word games.

What you wrote was worthless gibberish. Comparing that to a real analysis? You are indeed a moron.

Bruce Hall thinks facts are Commie plots.

“Fiscal policy reduced U.S. GDP growth by 3.3 percentage points at an annual rate in the fourth quarter of 2021, the Hutchins Center Fiscal Impact Measure (FIM) shows.”

Their very 1st sentence. I guess Bruce Hall did not read that far. He could have looked at the graph, which did show some stimulus earlier in 2021 and a MASSIVE fiscal stimulus in 2020 when Trump was President. Now Bruce Hall pretends all fiscal stimulus is bad, bad but did he bitch about Trump’s fiscal stimulus? Of course not as Kelly Anne Conway pulls this troll’s chain.

bruce, you seem to be rooting for a recession? is there a reason why you would want such an event to occur? why the anger?

bruce maybe short…..

baffling, why would you think I’m “rooting” for a recession?

I do think that there needs to be some correction to the course that we are on. Choose you poison:

• increase government spending ($8 trillion budget?) to avoid, as Macroduck points out, the contractionary fiscal policy and … increase debt and inflation

• increase government spending and taxes, as pgl would have it, and increase inflation and debt … and the risk of private sector contraction

• increase interest rates and change nothing else increasing the risk of recession, but dampening inflation

• let things play out without changing anything and risk recession and inflation

Do you have another scenario in mind?

Why would you be cheering for a recession? Seriously – from the MAGA hat wearing troll who celebrates people getting COVID.

“increase government spending and taxes, as pgl would have it, and increase inflation and debt … and the risk of private sector contraction”

A balanced budget fiscal changes does not increase the deficit and it does not increase aggregate demand. But you just said both happens. Seriously Bruce – you do not get even the most basic things. So WTF should anyone take your dumb chirps seriously.

Increase government spend and taxes. No need for other choices.

A private sector contraction? Oooo, scary! A private sector contraction which avoids recession is exactly what you get with well-calibrated fiscal policy in the face of recessionary pressure. It is the difference between liquidationism and Keynesianism.

You will, of course sputter about just laying out the options, but you seem to be rooting for liquidationist policy, as long as Democrats hold the White House.

Your words: “That should prevent a recession until after the next election for POTUS.”

Even after you noted: “you write partisan tripe and then quibble about whether you can be held to account.” Notice Bruce Hall continued to quibble whether he can be held to account. Let’s be clear – Bruce Hall has always been Steno Sue for Kelly Anne Conway so blame her as Brucie boy is just following orders.

https://news.cgtn.com/news/2022-04-06/Chinese-mainland-records-1-415-new-confirmed-COVID-19-cases-190hkwUb6y4/index.html

April 6, 2022

Chinese mainland reports 1,415 new COVID-19 cases

The Chinese mainland recorded 1,415 new confirmed COVID-19 cases on Tuesday, with 1,383 linked to local transmissions and 32 from overseas, according to data from the National Health Commission on Wednesday.

A total of 19,199 new asymptomatic cases were also recorded on Tuesday, and 113,950 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 158,793, with the death toll at 4,638.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-04-06/Chinese-mainland-records-1-415-new-confirmed-COVID-19-cases-190hkwUb6y4/img/75a38724545943e481cd20ca5c8affb1/75a38724545943e481cd20ca5c8affb1.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-04-06/Chinese-mainland-records-1-415-new-confirmed-COVID-19-cases-190hkwUb6y4/img/0dccc47d24af497e91899d367cdca0c6/0dccc47d24af497e91899d367cdca0c6.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-04-06/Chinese-mainland-records-1-415-new-confirmed-COVID-19-cases-190hkwUb6y4/img/59e931e821c74ca3b23b078627404d5d/59e931e821c74ca3b23b078627404d5d.jpeg

https://www.worldometers.info/coronavirus/

April 5, 2022

Coronavirus

United States

Cases ( 81,900,012)

Deaths ( 1,009,390)

Deaths per million ( 3,018)

China

Cases ( 157,378)

Deaths ( 4,638)

Deaths per million ( 3)

Over 20,000 new cases yesterday (16 K the day before, and 13K the day before that). Doesn’t take a genius to see that China is in deep doo-do.

https://www.nytimes.com/interactive/2021/world/china-covid-cases.html

They’re predicting a recession a year and a half out? That’s gutsy, I’ll give them that.

Do the DB forecasters have a good track record? I mean, no one has a good track record in recession calls, but in general, do they often get things right?

Remember the Great Recession which started Dec. 2007. Donald Luskin denied we were in a recession as late as September 14, 2008. That’s nutsy.

I was just trying to find an answer for you on that. It’s actually hard to believe there isn’t a research paper on this topic—but more broadly for commercial banks in general. I will keep hunting but this brings me to a recent pet peeve of mine. Lately Google search seems to be regressing. Google used to be exceedingly good at narrowing down to exactly what you wanted (especially if you used quotation marks in the search). Now when I do searches like this, they just upload whatever very recent topic they think “Joe Six Pack” and “Karen Wants to Talk to the Manager” is searching for in the last 16 hours, and it’s incredibly aggravating. The type of thing that might make you say “to hell with it” and start using DuckDuckGo.

Oh, to pine for the days when I was in college, searching on Netscape Navigator and getting it on the first click. Thanks for F’ing Netscape over dry lube Bill Gates. You’re a hero to creepers adulterating bosses everywhere.

@ AndrewG

This is the best I could find to answer your query. That’s not to say there aren’t better research papers out there or better answers, but it’s about the best I could do. The pdf is free I think if you want to DL it.

https://www.elibrary.imf.org/view/journals/001/2000/077/article-A001-en.xml

It’s thick with math, but here is the summary conclusion closely related to your question:

•How well do forecasters predict recessions?

The simple answer is: “Not very well.” Only two of the 60 recessions that occurred over the sample were predicted a year in advance, two-thirds remained undetected by the April of the year in which the recession occurred, and in about a quarter of the cases the forecast in October was still for positive growth (albeit small). In eighty percent of the cases, the forecast made in October of the year of the recession underestimated its extent. This predictive failure is well-known in the case of U.S. recessions; the contribution of the work here is to show that it is a ubiquitous feature of growth forecasts. This predictive failure could arise either because forecasters lack the requisite information (in terms of reliable real-time data or reliable models) or because they lack the incentives to predict recessions; further work would be needed to discriminate between these two classes of theories.

There was another paper that discussed machine learning predictions of recessions:

https://www.mdpi.com/2227-7390/8/2/241

Thank you for this MH. Oh, I am already totally convinced that economics is, at present, incapable of predicting recessions with the kind of regularity that we come to expect for other kinds of predictions. That’s why I find it funny when others even try.

It’s basically impossible right now. My proof? There are no insurance products that explicitly protect against recessions. You need to have information on expected losses over defined horizons in order to create an insurance policy, and we just don’t have that kind of information, or at least not any models that can make good predictions with the data we have. Some of this is the sparsity of data (there are billions of people whose health can be predicted, but only one economy).

Another bit of evidence is the fact that recessions are often due to the revelation of new facts that cause a panic. Take the 2008 panic.

What I was wondering was specifically Deutsche’s forecasting history. I don’t watch these things too carefully (partially because of what I just mentioned).

There are things such as derivatives, swaps, puts, and shorts, and I am sure many other kinds of instruments. These are in essence insurance. The main reason they are not labeled as insurance is if they were labeled insurance then that would tag on regulations that finance companies and investment banks don’t want to have to deal with. I got in an argument with an FT journalist over this. But it’s not that important, she just got her panties in a wad because banks are FT’s biggest underwriters, so she had to wave the naughty finger at me for calling derivatives and swaps insurance because pointing out the equivalence is upsetting to investment banks. They are afraid one person observing what it is will spread like a virus and they will have to explain why the “two” financial products are treated differently. They are already messing their trousers when guys like Gary Gensler discuss clearing houses for derivatives and the like.

I assumed this was “understood” or subtext when writing the comment just above, but specifically I mean “insurance against recessions”, and these things do in fact exist, even if they don’t meet the technical definition of “insurance”.

Well, pretty much parroting what you just said Andrew, finance folks, investment houses and bankers, as a general rule, are not shy about tooting their own horn. Even if they only get one single call correct they will bang the big bass drum an inch from your ear so you never forget. Elaine Garzarelli became a near household name when she got one equities market crash correct in 1987. She was everyone’s favorite TV guest, maybe similar to Jeffrey Gundlach in the current era. Now about 3 people remember her name.

Oh and I forgot to mention: While I am not personally acquainted with the literature on recession predictions (or any kind of prediction for that matter) I suspect the sparsity of papers you found is indicative of the fact that it would be news if there *WERE* good models for recession prediction. It’s not news that there aren’t! Dog bites man stuff.

Besides, the whole world would look different if we could predict recessions somewhat ahead of time. Policy could intervene before the bottom fell out. Hell, maybe we wouldn’t even need policy if market participants would just adjust their behavior in anticipation. But it ain’t so. In a way recessions are due to huge information gaps – among market agents (“What? the banks have a bunch of bad debt?!?”) and among policymakers (“What? We raised interest rates too fast??”).

There is a policy truism about the predictability of recession – if policymakers could foretell recession, they’d prevent it. In a world of predictable recessions, there would be no recessions.

Well, there’d be no recessions except recessions of choice. Volcker chose recession. Only when “opportunistic disinflation” came along did the idea that policy makers would avoid recession if they could come along. Opportunistic disinflation is not operative right now.

Oh, I do go on sometimes. Anyhow, the point is that recession forecasting could help prevent recession, which would make recession forecasts self-defeating. If forecasters were good enough, they’d have the kind of record laid out in that paper.

@ Macroduck

I’m not entirely certain of what you said at the beginning of your comment. Let’s say you were the head of a Kleenex company or a tissue company used to wipe people’s noses. And some guy said he had an inoculation for the common cold and flu. What would you do with that information?? The Fed is not as puritanical as the economics profession (the same profession which fills many Fed jobs) keeps telling us they are. I think recent stories about the FOMC members trading stocks supports what I have been telling Menzie on some of this for awhile now. I mean if the economics profession beat the drum any harder on what saints the FOMC anf broader Fed are, they’d be entering Catholic priesthood territory on how the media is out to get them for caretaking of people’s children

Sometimes, I use too many words and end up being unclear. If recessions were forecastable in time to be prevented, policy makers could prevent them. They don’t prevent them. So recessions aren’t forecastable in time to prevent them. The Volcker stuff was because policy makers sometimes would choose to cause recession.

I don’t think your wording was that bad or that you used too many words, I think this is just something we mildly disagree on. A lot of it is subjective and many smart people disagree with me on this, so not wanting to go into samurai mode on this. Mainly my argument is, if people have more secure jobs/livelihoods by not solving a problem, that is often what they do. Imagine a state that has a major problem with wildfires during a drought year after year, and never makes any effort to rid itself of cedar trees. Will the fire department make a concerted effort to get rid of cedar trees or play poker at the station??

Don’t ask me why I use this specific example……..

I think you’re thinking too hard about this. Read Macroduck’s last comment again (maybe after a snack or something) and I think it’ll click.

No one wants recessions. Policymakers certainly don’t. If they could prevent recessions, they would. But they can’t, because recessions are hard to predict, and (on a related note) their character (which would inform policy) is hard to predict.

That’s a great way to put it. And yes, the Volcker disinflation was on purpose, because the Fed had lost credibility. Another great point.

I have said it before, and I will say it again. contrary to what many want to claim, Volcker was not a great man. he was a man who caused a great amount of unnecessary pain to much of the country. he did not need to do what he did, to help control inflation. it was not necessary to be so brutal.

I hope so, as my brain is rather limited. The fact I interact with you is prima facie evidence of that.

https://www.msn.com/en-us/news/world/russia-is-promoting-outlandish-and-ridiculous-propaganda-about-the-killings-in-bucha-fact-checkers-say/ar-AAVWeP5?ocid=uxbndlbing

A few things are undeniable. Putin is a butcher and a serial liar. What the Russians did to the citizens of Bucha were horrific war crimes. Of course Putin and his allies are denying reality. One of Putin’s allies is JohnH who went recently echoing Putin’s disgusting propaganda. But as this story notes – their is substantial evidence of the war crimes committed by Putin’s pigs. By now this deny, deny, deny nonsense is akin to saying the citizens of Bucha deserved to be slaughtered.

https://www.msn.com/en-us/news/politics/house-to-vote-on-criminal-contempt-referral-for-trump-aides-navarro-and-scavino/ar-AAVVyOV?ocid=uxbndlbing

The House about to vote that Peter Navarro’s refusal to testify to the 1/6 committee represents criminal contempt.

Dr. Hamilton might want to check Kevin Drum’s conversion from the price of oil per barrel to the price of gasoline per barrel:

https://jabberwocking.com/oil-is-up-gasoline-is-up-any-other-questions/

‘When the price of oil goes up, so does the price of gasoline. To get the price of gasoline, just divide the price of oil by 36 and then add 70 cents.’

Divide by 36 and then add $0.70? I thought it was closer to divide by 40 and add $1 (the approximate sum of refinery margins, distributor margins, and excise taxes).

I like Kevin Drum, but I’d leave the time series stuff to the guy who literally wrote the book on it (Hamilton).

Kevin does old fashion regressions while Dr. Hamilton does co-integration. It would be interesting to see a post noting the differences between the two approaches.

That’s still time series analysis though.

I love that Kevin Drum tries hard to look at the data, and tries harder than most journalists who work with data. But it doesn’t always work. For example, here he doesn’t think detrending is important. Now I’m not a time series guy myself (I have to read Hamilton and others even for the basics!) but that seems like one of those things you should do.

Well I’ll say one thing that I think you and Kevin Drum are right about: You *can* do very basic OLS to address time series correlations in a rough-and-ready way. Actually Menzie Chinn (who could forget more than I would ever know about the subject) does this all the time!

I’m just *generally* skeptical of the data crunching and regression-interpretation Drum does. He’s great but he has his limits and he often doesn’t respect them, leading to not-so-useful conclusions.

https://www.msn.com/en-us/news/world/hungary-s-authoritarian-leader-breaks-with-the-eu-saying-he-ll-pay-for-russian-gas-in-rubles/ar-AAVV344?ocid=msedgdhp&pc=U531&cvid=651b356a4cf942459bffd167f5203c26

Hungary’s authoritarian leader breaks with the EU, saying he’ll pay for Russian gas in rubles

Wait – Princeton Steve has told us that Orban is a smart leader. But his nation is now buying Russian energy using rubles. I guess smart can still include being evil.

FL&H have the Eurozone growing faster than the U.S. next year, despite more food and energy supply problems than the U.S, as well as arguably greater political risk. I assume that’s a recognition of a wider output gap for Europe, but output gaps don’t set speedlimits much except in good times.

The non-technical magic dowsing stick isn’t so sure we are going to have a recession. Inflation? Yes. That’s already here. But I’m not sold on recession yet. It will depend somewhat on what happens in Ukraine. I don’t think US interest rates will rise fast enough to wipe out job growth, and job growth will prevent a recession. The Great Recession fooled me badly on how long it lasted, and the timing of the Trump recession was a bit different from my expectation, but the dowsing stick has been reasonably accurate. It’s due to be wrong, so maybe we do have a recession coming.

The reason is the amount of money that’s going to get spent on weaponry going into Ukraine. There’s stimulus, and then there’s war, which is a stimulus on steroids. If Ukraine wins quickly (or Russia wins quickly but that’s only a remote possibility from the looks of things), then we could have the post-war contraction in 2023 or maybe even starting this year. If it is a protracted war and the US and its allies dump billions into supporting the Ukrainian efforts, then I don’t expect a recession until it is over. If the war spills over into NATO territory and becomes a more general war, then we will be on much more of a war footing than we have been at any time since 1945 or so. We didn’t go all in anywhere after VJ Day. Maybe this is when we do if it spills over. Then we will have a very different economy than any of us under about the age of 85 can remember anything about from personal experience.

Harkening back to the parable of the six blind men and the elephant, here is another perspective about inflation and policy, which seem to be complicating the efforts to avoid a potential recession.

https://marginalrevolution.com/marginalrevolution/2022/04/why-is-the-u-s-inflation-rate-especially-high.html

Supply chain problems have gotten a lot of blame for some of the inflation, particularly as it applies to vehicle manufacturing and rightly so. There certainly is adequate demand for vehicles and if you drive around the Detroit area you can see massive parking lots filled with vehicles that are completed except for some microchips.

https://fredblog.stlouisfed.org/2022/04/new-vehicle-sales-and-auto-price-inflation-since-the-pandemic/

One team of supply chain experts see a silver lining in that:

https://www.msn.com/en-us/money/companies/ecu-professors-believe-pandemic-is-bringing-positive-changes-to-supply-chains/ar-AAVWt3h

it seems that neither politicians nor economists or corporations were prepared for addressing a pandemic and resulting manufacturing and labor issues plus a war. These are extraordinary times so a certain amount of bumbling and differing perspectives can be expected.

Count Tyler Cowen as one blind man who sees too much government spending. Count Scott Summer ia another blind man who sees only too much monetary polcicy. Count Bruce Hall as the ultimate blind man who sees only the dictates from Kelly Anne Conway. Now the elephant? He is about to step on the 3rd blind man which would be a great service to the rest of us.

Bruce Hall is about as dumb with his parables as Ted Cruz was reading Green Eggs and Ham.

I don’t even like the man, but his name has been continuously misspelled in this comment thread. His last name is Sumner. He may have the brain of a frog, but let’s give proper attribution here. Somewhere out there a man named Scott Summer is going “what the hell did I do wrong??”

“massive parking lots filled with vehicles that are completed except for some microchips.”

This is from the moron who told GM and Ford to go with Just in Time Inventory.

From the 3rd link which is another one that Bruce Hall failed to read beyond the headline:

“Doctors Jon Kirchoff and John Kros are supply chain experts in ECU’s College of Business. The two have been researching ways in which manufacturers and retailers have changed their operations in response to the pandemic.

Kirchoff says companies have been developing better technology for tracking and locating critical materials and supplies as well as shortening supply chains by trying to source materials closer to home. He says more companies are using a global strategy to map supply chains that help determine the best locations of suppliers, customers, and operations.

Kirchoff says the last two years have taught many companies that they can’t continue conducting business as usual. “They get stuck in a certain way of doing things and as long as that is working companies continue to do that. Covid has changed all that and made innovation paramount and trying to fix some of these problems.”

Kirchoff says many companies are working on strategies to better prepare for any future risks and disruptions as well.”

Can we summarize this for our resident dummy – Bruce’s Just in Time Inventory management approach is seen as being rather STUPID. Of course this troll will now insist he never advocated Just in Time Inventory. As macroduck noted – he is just that kind of weasel.

https://www.janushenderson.com/en-us/advisor/article/semiconductor-shortage-why-more-than-tech-investors-should-care/

An excellent discussion of how the auto sector got hit by not having enough semiconductors. Now we know Bruce Hall is too lazy to read, too dumb to comprehend, and too dishonest to ever admit his MAGA hat wearing zest to blame Biden the Communist for all bad things is beyond absurd.

So let me simply note for our incredibly dumb and dishonest troll that the authors do not blame Biden for this mess but they do blame that Just in Time Inventory management approach (the one Bruce Hall said was the only way to run a business) was a complete disaster.

“These are extraordinary times so a certain amount of bumbling and differing perspectives can be expected.”

True.

Congress just re-instated Lend-Lease!