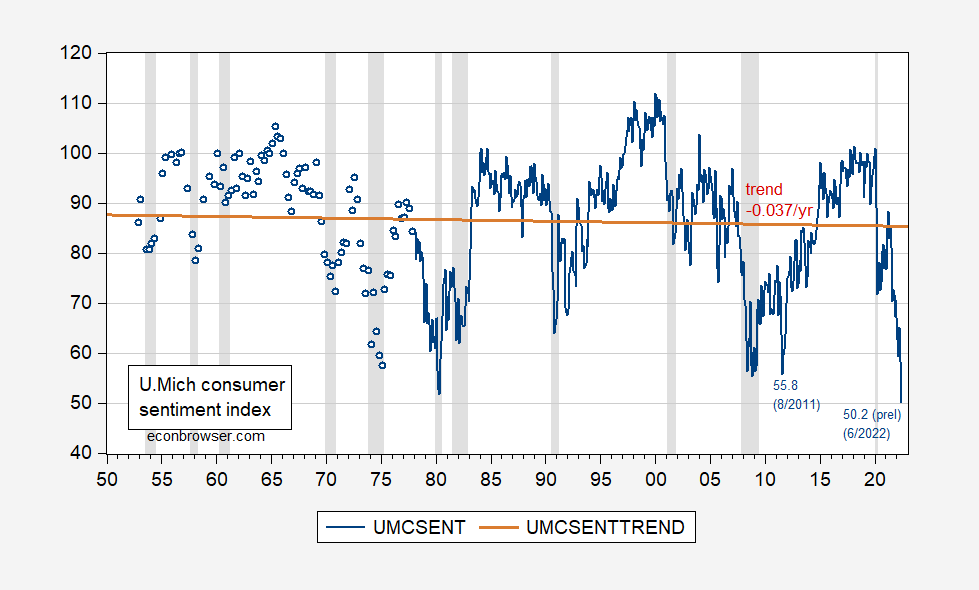

That’s a comment by a reader. The index is indeed correlated with recessions, but not necessarily with oil shock recessions only, nor is it always an indicator of a recession.

FIgure 1: University of Michigan Consumer Sentiment Index (blue), linear trend (red). June 2022 observation preliminary. NBER defined peak-to-trough recession dates shaded gray. Source: University of Michigan via FRED, NBER, and author’s calculations. [Updated 6/10/2022]

Note that the indicator was lower in August 2011, but — as pgl noted — no recession occurred.

As for whether sentiment predicts recessions, see this post. The evidence that sentiment is a leading — as opposed to concurrent — is weaker.

Kopits reminds me of my refrigerator. I can’t see inside but I’m still certain the lights aren’t on.

Another Princeton Steve “hypothesis” with no theoretical foundation. Oh wait – he does not need theory. He just makes it up as he goes.

pgl,

Now now, he has his theory of “suppression,” which can be read right of a graph, although I am not quite sure which one or how…. :-).

Technical or not a recession is what too many are feeling. Worse, the voters have a very easy comparison from what it was like just before your policies and Chief were implemented and elected.

Keep whistling by that ole graveyard in denial of the policy failures you espouse, but the voters still know.

Gee – those increases in employment with the unemployment rate dropping to 3.5% must be the worst economy ever. CoRev is in intense competition for dumbest troll ever.

https://www.rollingstone.com/politics/politics-news/multiple-gop-lawmakers-sought-pardons-for-trying-to-overturn-biden-win-jan-6-committee-1365796/

What was presented last night in a way was known to anyone paying attention for a while. Trump wanted Pence executed, Trump sent those domestic terrorists on a mission to beat up on law enforcement officials and overwhelm the Capitol so Trump could be made dictator. Yes Trump is the lowest scum traitor in our history.

We also know certain GOP members of the House are Trump sycophants. But they needed pardons? For what? Oh yea – aiding a traitor.

One of the bigger stories, which amazingly, many people have missed or ignored, is the REAL reason Mike Pence refused to get into the car to leave the Capitol. That is a big big big deal that is not registering with people. Trump had Secret Service allies (he had chosen) in the car to pick up Pence (or Secret Service leadership allies who sent those agents). The plan was to take (kidnap??) Pence and take him to one of the nearest military bases to leave Pence stranded while the insurrection raged at the Capitol.

https://www.yahoo.com/news/mike-pence-refused-car-amid-190922983.html

Folks, this is what I have told you for a long time, we don’t need to watch “X-Files” and things and create/manufacture conspiracy theories. We have plenty of REAL ONES in real life.

And in another attempt to save himself Mike Pence was also the person calling in the national guard. Trump refused to do that. So Mike Pence saved his own ass twice and as collateral damage also saved democracy.

Ivan,

But at the same time the hearings were happening, Sean Hannity on Fox News was informing everybody how Trump approved using the National Guard four days earlier, but it was Nancy Pelosi and Mayor Bowser who would not call them in! This is what the MAGA world will think. They do not need to hear about Ivanka disbelieving her dad’s election fraud claims. So good of Fox to protect them from that.

I know – its like two parallel universes. And Fox is counting on their listeners not being able to find out which is real and which is a lie/distortion.

What does one do with 50% of the American population? They are too dangerous to be left alive, but since the left is less keen about slaughtering its enemies, we can’t very well round them up and line them up against the wall, can we? What about re-education camps? Or forced sterilization? I suppose the first thing would be to ban all religious teaching since that seems to be the foundation for willful ignorance and violence.

Of course, if you have less radical ideas, I am open to discussion, but it’s been a few hundred years and the average right-wing American is still a racist, xenophobic, homophobic, misogynistic asshole. This in itself is not a problem except that he is also heavily armed and coming for YOU and ME!

And the reason Trump wanted Mike Pence to be safe was that if it all went south and Trump was kicked out, he had to be followed by a President who would pardon Trump for all his crimes – and Nancy would never do that.

Meeeeeeeehmorieeeeeeeeeeeeeez,

Can it be that it was all so simple then?

Or has time re-written every line?

If we had the chance to do it all again

Tell me, would we?

Could we?

Memories

May be beautiful and yet

What’s too painful to remember

We simply to choose to forget

https://images.app.goo.gl/Bk7qBYfgQLrxaJfs7

(Where’s Barbra Streisand when you need her???)

Well, this comment did not age well…in a New York minute!

Another casualty of Xi’s failed zero Covid policies. Entrepreneurs are leaving China (just like they are getting out of Russia). The future seems full of dark clouds for two of the worlds big dictatorships.

https://www.nytimes.com/2022/06/10/business/china-economy-covid-zero.html

https://english.news.cn/20220610/dd4ae2946ce74b6283570ef9f9e65056/c.html

June 10, 2022

China’s consumer prices stable, factory prices ease

BEIJING — China’s inflation cooled in May, with consumer prices growing at a rate unchanged from the previous month, and the rise of factory-gate prices slowing to 6.4 percent, as measures to ensure supply against COVID-19 disruptions take effect, official data showed Friday.

The consumer price index (CPI), a main gauge of inflation, rose 2.1 percent year on year last month, said the National Bureau of Statistics (NBS). On a monthly basis, the CPI edged down 0.2 percent, compared to the 0.4-percent uptick in April.

Food prices reversed the 0.9-percent gain in April to fall 1.3 percent month-on-month, mainly weighed down by the 15-percent price drop in fresh vegetables with market supply boosted and logistics smoothed, according to the data.

The price of pork, a staple meat in China, registered a year-on-year dive of 21.1 percent, but increased 5.2 percent over April. Hog production has gradually tempered, meanwhile the stockpiling of pork to replenish state reserves continues, noted Dong Lijuan, a senior statistician with the NBS.

Driven by global food price hikes, the prices of flour, grain products and plant-based oils ticked up by 0.8 percent, 0.8 percent and 0.7 percent over the previous month, said Dong.

The prices of gasoline, diesel, and liquefied petroleum gas went up by 27.6 percent, 30.1 percent, and 26.9 percent year on year, respectively.

China has vowed to leave no single grain unreaped during this year’s summer harvest and keep the supply of coal-fired power stable in order to underpin price stability. By Monday, the country had harvested around 55 percent of its winter wheat, beating last year’s halfway date by two days.

To further ensure energy security, the country also plans to launch a number of new wind, solar and coal-fired power projects this year and enhance storage for resources like coal and crude oil.

The core CPI, which excludes food and energy prices, gained 0.9 percent year on year last month, unchanged from April.

Friday’s data also showed that China’s producer price index (PPI), which measures costs for goods at the factory gate, rose 6.4 percent year on year in May.

The figure moderated from the 8 percent year-on-year increase registered in April. On a monthly basis, China’s PPI gained 0.1 percent, compared with the 0.6 percent increase in April.

Both the monthly and year-on-year growth rates of PPI continued to narrow thanks to the effective coordination of epidemic control, economic and social development, and measures to ensure smooth and stable industrial and supply chains, Dong said….

https://english.news.cn/20220609/e70cea41120348c3af95c332e8c3a888/c.html

June 9, 2022

China’s foreign trade rebounds amid stronger economic recovery momentum

BEIJING — China’s foreign trade rebounded in May, a sign of overall recovery as the government’s policy package to stabilize the economy while containing COVID-19 resurgences started to pay off.

The country’s total imports and exports went up 9.6 percent year on year to 3.45 trillion yuan last month on top of April’s 0.1 percent expansion, official data showed Thursday.

In the first five months of 2022, the country’s foreign trade volume gained 8.3 percent year on year to 16.04 trillion yuan, outpacing the 7.9 percent growth in the January-April period, according to the General Administration of Customs (GAC).

In U.S. dollar terms, total foreign trade came in at 2.51 trillion U.S. dollars in the five-month period, up 10.3 percent year on year.

In the first five months, exports grew 11.4 percent year on year while imports rose 4.7 percent, leading to a trade surplus of 1.84 trillion yuan, customs data showed….

https://news.cgtn.com/news/2022-06-10/Chinese-mainland-records-45-new-confirmed-COVID-19-cases-1aK9ZFXlZL2/index.html

June 10, 2022

Chinese mainland records 45 new confirmed COVID-19 cases

The Chinese mainland recorded 45 confirmed COVID-19 cases on Thursday, with 30 linked to local transmissions and 15 from overseas, data from the National Health Commission showed on Friday.

A total of 106 asymptomatic cases were also recorded on Thursday, and 3,058 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 224,580, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-06-10/Chinese-mainland-records-45-new-confirmed-COVID-19-cases-1aK9ZFXlZL2/img/c01727518ee34df3a366a17d31489415/c01727518ee34df3a366a17d31489415.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-06-10/Chinese-mainland-records-45-new-confirmed-COVID-19-cases-1aK9ZFXlZL2/img/b03820b189094fa79558fddd94517c66/b03820b189094fa79558fddd94517c66.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-06-10/Chinese-mainland-records-45-new-confirmed-COVID-19-cases-1aK9ZFXlZL2/img/3253626ff136455bbe937c14b91e9d7d/3253626ff136455bbe937c14b91e9d7d.jpeg

https://www.worldometers.info/coronavirus/

June 9, 2022

Coronavirus

United States

Cases ( 87,114,740)

Deaths ( 1,035,320)

Deaths per million ( 3,093)

China

Cases ( 224,535)

Deaths ( 5,226)

Deaths per million ( 4)

Policy is working – housing markets are cooling rapidly.

https://qz.com/2175572/three-signs-the-us-housing-boom-is-petering-out/

Question is whether the Fed can stop itself from self sabotaging and listening to those who predicted high inflation 15 out of the past 1 events.

A well-known economist (waiting for pgl’s insults) claims that inflation is closer to what was experienced in the 1970s and a severe recession is the only cure.

https://news.yahoo.com/larry-summers-claims-prove-inflation-100000750.html

The housing market is beginning to cool down with 30-year mortgage interest rates hovering near 5.5%. Still not bad, but with more Fed hikes coming we can expect the sales spigot to be closing in the second half of the year and prices to start falling (“demand destruction”?).

https://money.yahoo.com/housing-market-cooling-off-173703861.html

New vehicle sales may not be affected as much by interest rates as the continuing supply shortage of chips, and the aging of the national vehicle fleet would indicate that if the supply of new vehicles improves, so will sales for awhile. However, an actual recession might make consumers less willing to shell out $40-70K for a new vehicle. As the nation is forced into buying EVs, it is likely that the average age of vehicle will increase for awhile unless those tax credits stick around for a lot longer. Central planning of the markets has always had its problems.

After the failure of the Build Back Better bill in late 2021, the existing proposals for the expansion of the EV tax credit were abandoned. The EV tax credit remains at $7,500 for all electric models except those made by Tesla and General Motors. Several months later, it seems that revisions to the credit are returning to lawmaker agendas. In President Biden’s State of the Union address, the President voiced support for revisiting EV tax credits in 2022.

https://joinyaa.com/guides/ev-tax-credit-2022/

We may be seeing “demand destruction” for oil and gas with regular gasoline prices essentially at $5/gallon nationally. But that’s “non-core” CPI so that doesn’t count, just as it hasn’t mattered as prices have been increasing for the past year and a half, right pgl?

The Michigan Index might not be an indicator that we are in a recession… yet… but it certainly indicates a lot of economic uneasiness among consumers. Anyway, Larry Summers is just another consumer, right pgl?

Since Bruce Hall is too stupid to noticed that Summers actually wrote a paper, he it is for others to judge what he is claiming:

https://www.nber.org/system/files/working_papers/w30116/w30116.pdf

Now we get the paper is WAY OVER Brucie’s little brain which is why he is limited to copying and pasting some stupid Yahoo headline.

So, you agree with me, but you just don’t want to agree with me. Waaah!

Summers may be a good economist but no I do not agree with whatever stupid turd words you may have written today. I would say nice try but your latest is anemic even for you.

Anyway, Larry Summers is just another consumer, right pgl?

Since Bruce Hall is too stupid to noticed that Summers actually wrote a paper….

pgl is too dense to perceive sarcasm.

Is Putin’s pet parrot losing it because your chirping here is weak even for you. BTW – Summers must be consumer a lot of pizza given his waist line is beginning to rival Trump’s.

Aw, pgl. Fat shaming. Keep running fast from those bunnies. Keeps you nice and trim.

BTW, core inflation was up only 5.8% in May yr/yr. See, no problem. Those stupid consumers are worried about food and fuel. Smart people like you don’t eat and run wherever you need to go.

Keep doing that.

Bruce Hall

June 10, 2022 at 8:07 pm

Core inflation fell but Bruce Hall writes it rose? Liar, stupid, both? We all vote both.

We may be seeing “demand destruction” for oil and gas

That stupid line reminds me of the BS from Princeton Steve. He should sue you for plagarism. Unless the two dumbest people ever are co-authoring a paper. That would be good for quite a few chuckles!

Up to a point, the demand for gasoline is relatively inelastic. $5/gallon is still not affecting driving habits that much, but another 25% increase probably will. If you remember the 1970s, people did a lot of things to reduce their cost of travel. Carpooling was a big thing. The rapid movement to small cars. I suppose that was all about ecology.

Well, maybe you don’t remember. Old uncle Joe is betting big time that people will be forced (painful transition) into EVs if he can get the price of gasoline high enough for them to ignore the cost of those little suckers and the inconvenience of charging them. It’s a little shell game of “find the affordability”. You can’t, but maybe you can be convinced with enough propaganda. EVs are barely getting out of that $10,000 for a 42-in plasma TV stage. Without those federal tax credits, GM and Tesla buyers don’t get the bennies of other people subsidizing them, but old uncle Joe is trying to get Congress to not only reinstate those credits, but increase them. GM is addressing that. It dropped the price of the 2022 Chevy Bolt by $6,000. I wonder how much they are losing per vehicle to be politically correct?

https://electrek.co/2022/05/27/which-electric-vehicles-still-qualify-for-us-federal-tax-credit/

Inelastic – you are actually attempting to use economic words you do not understand. Yep – you are a clown.

Aw, pgl. Are you really that insecure? Come on, man! You’ve been wrong for the past year, so I understand your anxiety.

“Up to a point, the demand for gasoline is relatively inelastic.”

Anyone with an IQ above the single digits might realize that oil and gasoline prices have reflected more of a shift of the demand curve than a movement along a demand curve. The collapse of oil prices in 2020 was due to Trump’s decision to let COVID19 run wild depressing the US and world economy – so oil prices fell along a supply curve. 2021 was the Biden recovery and yes oil prices rose along the supply curve as demand curves shifted outwards.

So only an economic know nothing would focus on the inelasticity of demand rather than movements along the supply curve. Of course Bruce Hall is also too stupid to realize that OPEC’s supply elasticity is a lot higher than the supply elasticity for US oil producers.

Yea – he is really DUMB.

Aw, pgl. Trump still living in your head? Come on, man!

When the governors shut down the economy the Keynesian rules went out the window. And OPEC’s supply elasticity is not all that great.

https://www.cnbc.com/2022/06/03/oil-markets-opec-has-limited-spare-capacity-russia-is-less-relevant.html

Keep trying. Eventually you make be correct… accidentally.

Bierka now claims: “Anyone with an IQ above the single digits might realize that oil and gasoline prices have reflected more of a shift of the demand curve than a movement along a demand curve. ”

Really?!? I thought the price was due to the Russo-Ukraine war cutting supply not demand.

Would the NYC jerk get his stories straight. After almost 2 decades of reading his incoherence i doubt ever seeing it.

“CoRev

June 11, 2022 at 5:15 am

Bierka now claims: “Anyone with an IQ above the single digits might realize that oil and gasoline prices have reflected more of a shift of the demand curve than a movement along a demand curve. ”

Really?!? I thought the price was due to the Russo-Ukraine war cutting supply not demand.”

CoRev cannot keep up Bruce Hall’s lies. He is actually trying to claim the US supply curve is elastic. But come on CoRev – have you ever considered the possibility that world demand can rise even as Russia supply falls? Oh wait – you are still struggling with soybean economics. Never mind.

Bierka – the NYC Jerk writes even more gibberish. Soon we should here again about externalities.

Consumption is down about 5%, but as not deteriorated materially in the last few weeks.

From the abstract:

this paper constructs new historical series for CPI headline and core inflation that are more consistent with current practices and expenditure shares for the post-war period. Using these series, we find that current inflation levels are much closer to past inflation peaks than the official series would suggest. In particular, the rate of core CPI disinflation caused by Volcker-era policies is significantly lower when measured using today’s treatment of housing: only 5 percentage points

of decline instead of 11 percentage points in the official CPI statistics. To return to 2 percent core CPI inflation today will thus require nearly the same amount of disinflation as achieved under Chairman Volcker.

So the authors are pretending that the current core inflation rate is fully incorporated into long-term expectations. I cannot wait for other macroeconomists to weigh in how naive this assumption is. Of course we have market measures of expected inflation that reach very different conclusions.

Hey Bruce – it would have been nice had you READ their paper before mouthing off with your usual MAGA BS. Of course given your lack of macroeconomic knowledge, it is highly doubtful that you would have realized the authors entire paper was based on a questionable assumption.

Waiting for an actual economist to weigh in, pgl. But even if Summers is wrong, what’s another 8%+ month of inflation, eh? We’ve merely moved from temporary inflation to painful transition.

I guess you are waiting for Lawrence Kudlow to weigh in then because he plays an economist on the TV. And your boy Trump this clown understood economics. But I will say this for Larry as dumb as he is – he is way smarter than Bruce Hall.

Aw, pgl. Former Secretary of the Treasury is “dumb”? President of Harvard is “dumb”? Managing partner of a hedge fund is “dumb”? Come on, man!

Classic [edited -mdc] envy on your part.

“Bruce Hall

June 10, 2022 at 8:18 pm

Aw, pgl. Former Secretary of the Treasury is “dumb”? President of Harvard is “dumb”? ”

I can only imagine what got deleted but this comment starts off with another Bruce Hall LIE. I did not say Summers was dumb. I did critique his latest paper which Bruce Hall linked to but clearly never read.

Now I did say Bruce Hall is dumb. He proves that with each and everyone of his incredibly stupid comments.

CoRev

June 11, 2022 at 5:15 am

After a series of really dumb variations of the dumb dog chasing its own tail ala Bruce Hall, CoRev has to be the alpha dog barking away and chasing his own tail too. None of the comments from these rapid dogs is even worth responding to as neither is even trying to make a point or be even remotely honest.

Slavering Bierka (aka the NYC Jerk) claims: “After a series of really dumb variations … None of the comments from these rapid dogs is even worth responding to as neither is even trying to make a point or be even remotely honest.”

1st, I am personally pleased to know that he thinks I am RAPID, and probably faster than he.

2nd, even though, he claims our comments “is even worth responding to”, over and over and even over again he does respond. It’s this uncontrolled/uncontrollable that he has earned the name Bierka.

3rd, NYC Jerk is a term he used himself, although I don’t remember if it was self explanatory, but it definitely is appropriate.

I wonder if Econned is getting a little giggle from his recent interactions?

Lord – the neighbors have to be upset at all the barking from CoRev the dog as he chases his own tail!

CoRev,

You keep barking a lot with your Bierking baloney, which does suggest that indeed your IQ is very low, not the only thing indicating that.

I always said Donald Trump would throw his own mother under the bus. He certainly threw each of his former wives under the bus. But my – he just threw his eldest daughter Ivanka under the bus:

https://www.msn.com/en-us/news/politics/trump-says-ivanka-trump-doesn-t-understand-elections-after-she-disowned-his-claim-that-the-2020-vote-was-stolen/ar-AAYiM31?ocid=msedgdhp&pc=U531&cvid=fbb596a457744ed0b6fd89f044d3ffdc

Ivanka knows what we all know – Biden won. Ivanka bothered to tell the truth. And for that – daddy attacks his own daughter. The most disgusting slime ever,

“A comment by oil markets analyst, Steven Kopits…” would be preferable.

Better still – a comment by our favorite boob. No Stevie – you are a joke at being an oil markets analyst. So stop padding your pathetic resume.

I will have a formal presentation on this topic over the next few days. Best I can tell, we are in a recession which began around March 19th.

Don’t waste your time as no one is going to read it and we all know it will be your usual waste of space.

You know when it’s been over a year since we’ve been on FOX and for 4 years the MAGA White House never gave him an entrance badge that Kopits’ car is only running on fumes at this point. I’m afraid Kudlow and Stephen Moore have proven they’re better at rimming the parasite host.

As for this bit: “Note that the indicator was lower in August 2011, but — as pgl noted — no recession occurred.”

The three low months referred to are August, September and October 2011. September was the nadir.

You will know that the Biden administration is currently releasing crude from the SPR, averaging 876 kbpd over the last five weeks. But until two weeks ago, there was another record holder of SPR releases. Care to guess the dates? 5 August to 2 September 2011, that same period when consumer sentiment indicated a recession without a recession appearing. Looks like another oil price shock then, too.

And indeed it was, in Europe. From Q3 2011, we saw a brutal recession emerge in Europe, one which lasted five quarters with the trough in Q1 2013.

So what was the difference between the US and Europe during this period? The rapid growth of shale oil production, which the US had and Europe did not. Still, the US did not exactly prosper during this period, which was when Larry Summers revived the term ‘secular stagnation.’

So, yes, the US is in a recession, and yes, it has the characteristics of an oil shock, and yes, it will be worse in Europe, and yes, the Ukrainians had better get off their asses if they want to maintain their funding from the US and western Europe.

“The three low months referred to are August, September and October 2011. September was the nadir.”

Gee Gilligan – that is what I said. Which in no way changes Dr. Chinn’s point.

OK. you’re on the record that everything is fine. I’m on the record that the economy is unwinding fast.

Let’s roll the film and see how the story unfolds.

I never said everything is fine but OK you are an expert at lying.

No. You’ve used the present tense. We don’t wait to see how things unfold, except in the sense that the NBER takes its time in declaring recession dates. If there is a recession under way now, you get a gold star. If not, you’re wrong as wrong can be. “Unwinding” doesn’t count.

I am saying the numbers say we are in a recession now. We won’t have a first crack at that until the Q2 GDP numbers are issued in July.

“I’m on the record …” Only the most arrogant clown ever writes this way. This is why we all despise you troll. Ease up on the overinflated ego.

“I’m on the record that the economy is unwinding fast.”

You have been saying the sky is falling for years. This is why we call you Chicken Little. A strong labor market and the idiot from Princeton thinks the world is coming to an end. Yawn!

“On the record” means that it has been written down in a publicly accessible place with a date stamp of some sort, ie, it can be confirmed or refuted after the fact. A comment on Econbrowser meets those criteria.

Steven Kopits

June 13, 2022 at 7:42 am

You have to define the term you use to prove over and over that you are one arrogant dork? Wow – you do have a problem.

I was thinking it was 2014–2016 when Summers brought Secular Stagnation to the fore, not 2011. Wow, I get confused so easily.

Nov. 2013

https://en.wikipedia.org/wiki/Secular_stagnation

Did Stevie write that Wiki definition? It was perhaps the most off the wall stupid definition of Secular Stagnation I have ever read.

Then what is your forecast? What you have got, guy? Anything? Anything at all? Are we in recession or not? If not, what is your outlook? Enlighten us with your genius.

You said we would have $100 oil before summer’s end 2021. How did that work out for you before war broke out in Europe late February 2022?? What would “experts” like you and Barkley do for a living if Americans had a memory that lasted longer than what they ate for lunch?? I guess like Barkley Rosser you think that after you make a blog comment the comment link evaporates into the ether??

Have you written down all of your incredibly bozo forecasts? If so, produce your record of forecast errors. I bet they are enormous. If not – then you are nothing more than a fraud. As in your worthless consulting practice.

on a different note, I must say the start of the jan 6 hearings was quite compelling. especially the good work of Cheney. who would have thought I could use the name Cheney and the word good in the same sentence? better than her father. what is being made abundantly clear is that trump was told from many folks that the idea of a “stolen” election was false, and he continued to knowingly weaponize the idea in direct conflict with the constitution of the United States. as we move through this process, it appears to me that people should understand the term “big lie” should actually be applied to the trump position. all of you fools still pushing this “big lie” agenda have simply been subject to the biggest con in our nations history. trump has pulled off the BIGGEST CON IN OUR NATIONS HISTORY. take a look around the room to see who the suckers were. every maga person out there just got taken by the con man. perhaps the greatest grifter in our nation’s history.

Liz Cheney is much better at politics than your average Democrat, if they let her guide some of the proceedings of 1/6 it would be a master stroke. She has nothing to lose at this point. If (from a purely political standpoint) Democrats had a Cheney in place of a clueless Pelosi calling the shots, I suspect both houses of congress would be controlled by the Dems by now. But, that’s a hypothetical dreamland.

Infantile.

Liz Cheney is far more capable than the Dimwits on the ‘select’ committee to gull the American people into forgetting $10 gasoline, $6 dozen eggs, the crashing of their 401ks, the intent to murder half of the US Supreme Court, etc., etc., etc.

Well, see, we both agree Liz Cheney is better than most Democrats at politics. Can you feel the love tonight?? Channelling Elton John.

The Michigan Index just posted a record low. Are we in recession? Give me a break.

Nope. It’s a worthless index based around energy prices. With prices oh about ready for a notable decline, what do you think will happen to it in the future????? Maybe it should be abolished?

Actually the Michigan consumer sentiment index is not based on oil prices even if Princeton Steve keeps claiming otherwise. Stevie is both stupid and a liar but you are right that this Michigan CONSUMER SENTIMENT index is rather worthless.

You’re on the record, so am I.

On the record – you are just an arrogant moron. On the record – no one talks like that except the worst oil consultant ever. Your ego is so overinflated you might just explode.

It is called the Michigan consumer sentiment Index. I told you this the last time you labeled this incorrectly. And as Barkley noted – consumption demand is still strong. So NO you little twit – we are not in a recession now. So give us all a break and stop writing stupid garbage. And try reading this post before you mouth off again.

Record low?

https://tradingeconomics.com/united-states/consumer-confidence

The Michigan consumer sentiment in the US fell sharply to a record low of 50.2 in June of 2022, well below market forecasts of 58, preliminary figures showed. The current economic conditions subindex sank to an all-time low of 55.4 (vs 63.3 in May) and the expectations gauge plunged to 46.8, the lowest since May of 1980.

Lowest since May 1980 is not a record low. So you are a liar as well as being really stupid!

The University of Michigan issued its first Index of Consumer Sentiment in November 1952 The survey was conducted quarterly until 1978 and has been conducted monthly since January 1978.

The current reading, 50.2, is the lowest in the sixty years of the survey.

You can find the data here: http://www.sca.isr.umich.edu/tables.html

And, of course, you don’t need me to tell you that.

…seventy years…

The lowest in 60 years is not the lowest ever. Listen troll – you need to take preK writing before uttering your next lie.

Lowest ever recorded. My guess is that you’d have to go back to the Great Depression to challenge May’s index number, but the survey was not yet conducted. Therefore, it is indeed the lowest ever read for the survey, but if you want to limit it to just the last seventy years, sure. I don’t think it changes the interpretation much, does it?

…seventy…

Read your own link. It is NOT the Michigan Index. Try the Michigan consumer sentiment index which one table clearly notes:

COMPONENTS OF THE INDEX OF CONSUMER SENTIMENT

CURRENT INDEX

EXPECTED INDEX

The current index is not at an all time low. Yea – these consumers have dismal expectations but then all economists know consumers are not that great at forecasting.

But Stevie never realized the overall index has separate components. Heck he still have not figured out the fuil name. Yes – he is that stupid.

I am sorry that you are struggling to understand to which index I am referring. I am distinguishing the U Mich Index from the Gallup Index, which is similar.

Steven,

I am on record as agreeing with Menzie on this. Michigan sentiment index might be a leading indicator, although it is not one of the standard ones. But it is not a coincident indicator. It says absolutely nothing about current production or income or jobs, which are what go into determining if an economy is in recession or not.

As it is, we are very clearly not in a recession right now, as the previous post by Jeffrey Frankel argues, and the mountain of evidence Menzie provides also shows. That said, where Summers may prove right, is that if inflation continues to be high, and it has accelerated again this past month, the Fed might pull a Volcker and push the economy into a recession with a sharply tightening monetary policy. This is certainly a real possibility.

As for oil prices, well, crude oil prices have gone down now for two straight days, although I am not going to forecast them. But demand in China seems to be kind of weak. The Goldman Sachs forecast may well not pan out, and Biden’s begging of MbS, distasteful as it is, might also work.

Official data showing consumption still holding up, but an anecdote that suggesting it may be beginning to slow down where I am is good local friend who owns a furniture store just told me that over the last week his business has “fallen through the floor.” We shall see.

BTW, another story out of Russia not in western media, where there have been stories about things better than expected economically in Russia, is that the Duma has just passed a law allowing the government to block people from withdrawing money from their bank accounts. At least some people there are freaking out. Supposedly Putin having trouble paying for his war, despite supposedly strong oil revenues.

The Michigan Index is a coincident indicator of consumer sentiment, which in turn is influenced heavily by inflation, gasoline prices, and unemployment. In similar recessions, the index was in the range of current readings at month 5-7 of the recession as subsequently determined by NBER dating. This would suggest that the recession started in January (or even November). Given that Q1 GDP was in fact substantially negative, a negative print on Q2 would be consistent with the Index numbers. With two consecutive negative quarters, H1 2022 would qualify as a recession by ordinary standards.

Steven,

OK, this is picky, but I am getting frustrated with people using sloppy terminology here. The Michigan index is not “a coincident indicator of consumer sentiment.” It is a measure of consumer sentiment. Your statement would be like saying “the measure of the GDP is a coincident indicator of the GDP.”

You do accurately note some of the things that affect it. But the question has been what does it do, and you have made claims that make it look like it is a coincident indicator of GDP. That is most definitely is not. Period.

Whenever the index has been near the current level — it has never actually been this low before — the US has already been in recession 5-7 months. If you want to use the index in that context, then it is a lagging indicator for recession at its current level. Typically, the coincident reading for the index at the start of a recession is in the 62-67 range. This, however, depends on the type of recession. For major oil shocks like 1974, 1980, 2008 and now, that read of 62-67 read is a pretty good indicator for the start of the recession historically.

So, to be specific, the index at the start of the oil shock recessions as determined ex-post by NBER dating:

Arab-Israeli War (1974): 61.8

Iran-Iraq War (1980): 67.0

Great Recession (China Depression, 2007): 75. (oil demand, not supply, shock)

Russia-Ukraine War (2022): 67.2 (posited)

The readings for the start of non-oil shock recessions per NBER dating:

1970 Recession: 78.1

Dot.com Bust (2001): 91.5

Gulf War I (1990) : 88.2

Pandemic Suppression (2020): 101

These latter episodes did not see all of the stressors of oil shock recessions. For example, the 1970 recessions saw high inflation, but low historically real oil prices and low unemployment. This was also true in the dot.com bust and mostly during Gulf War I, when there was a lot of talk about high oil prices, but only a short period of them, and they never reached the 4% of GDP threshold which I use as the rule of thumb for an oil shock. Both Jim Hamilton and I ordinarily characterize this as an oil shock recession, but in terms of the Index, it probably does not qualify, or kind of qualifies. I

The Pandemic Suppression saw low inflation, low oil prices, but a big jump in unemployment. The entry reading was 101, which in fact is consistent with a healthy expansion, not a recession. The Suppression remains problematic from the business cycle perspective, not only due to the reading, but because it did not meet the two quarter rule. Indeed, peak to trough was only two months. That’s why, among others, we might want to use the term ‘suppression’, rather than ‘recession’, to distinguish the dynamics from an ordinary recession.

To sum up: By historical standards using the Michigan (as opposed to Gallup) Index and NBER dating, the current downturn, if it proves to be so, belongs in the category of classic oil shorts and is most similar to 1974 and 1980. By those standards, the US entered recession in Q1, and possibly as early as November of last year.

Let’s see what the Q2 GDP numbers say, but if we are to use Michigan Index, we are in a recession already, and have been throughout 2022.

It is also called the Michigan consumer sentiment index which has a current component and a component of expectations of the future. Of course Stevie is too dumb to realize they surveyed consumers.

“The readings for the start of non-oil shock recessions”

What – recessions can be caused by factors other than oil? Stevie finally figured this out? Cook – we can now ignore all of his previous stupid rants.

The Pandemic Suppression

Wow – it is no longer the made up term suppression. Stevie has made up a whole near meaningless term. The Pandemic Suppression!

Steven,

OK, I see you are applying “suppression” to the pandemic recession. Do note that Menzie has made it clear that while the two quaeter GDP decline was once the definition of a recession, it is not any more, with the NBER making its judgments based on a variety of factors. They certainly recognized that the 2020 recession was highly unusual, but I am sure they will not take up your term.

The funny thing here is that you have now provided data that completely undoes your effort to claim that because the Michigan consumer sentiment index is now very low the US economy must be in a recession. The crucial datum is that 101 number at the pit of the 2020 recession, the one you call the “Pandemic Suppression.” As I noted previously, there is not such a precisely close relation between output and sentiment. And sentiment is simply not what constitutes the state of the economy, even if it reflects peoples’ states of mind.

Funny thing is that I am dealing with papers on this topic at my journal, but obviously I am not in a position to talk about them more specifically. But indeed, they confirm that while there is some relation between sentiment, broadly defined, and the state of the economy, it is surprisingly weak and shaky frankly.

Factors other than oil matter? Gee – you just contradicted thousands of your previous dumb comments!

Am I reading Stevie correctly – the ultimate moron of all time thinks the Great Recession was caused by high oil prices? Never mind the collapse of the banking sector, the collapse of residential investment, etc. It was an oil shock.

Seriously – I never imagined anyone could be this effing stupid.

Faux News refuses to cover the 1/6 hearings but the Communists who run Fox Business are. And Bret Baier has declared the Trump looks really bad in this:

https://www.msn.com/en-us/tv/news/fox-news-anchor-bret-baier-says-donald-trump-looks-really-bad-in-jan-6-hearings-footage-video/ar-AAYjpZ2?ocid=msedgntp&cvid=5c1535a2669c43a8a9b7fceeaf2bd5bc

I hope Mr. Baier has an updated resume as we know he is about to be fired for telling the truth.

https://www.washingtonpost.com/investigations/2022/06/10/ginni-thomas-election-arizona-lawmakers/

Virginia Thomas’s efforts to have a fraudalent set of electors from Arizona is not only stunning but is likely a very serious crime. No one can be married to this traitor and at the same time serve on the Supreme Court. Assuming Clarence Thomas has even an ounce of ethics, he has a choice:

(1) He could divorce this criminal; or

(2) He can stay married to the ugly hag but then he must resign from the Supreme Court.

There is no middle ground.

One of the hallmarks of intelligence is the ability to discriminate. Higher intelligence allows greater degrees of discrimination between cases. Expertise similarly allows greater discrimination between cases.

Economists can tell the difference between inflation and recession. The general public, having less expertise, has a harder time telling the difference. Economists can also tell the difference between a general decline in output and employment and a worsening in public mood. Non-economists might have a harder time.

Smart economists can keep multiple factors in mind when assessing the economy. Less smart economists can handle fewer factors.

A non-economist of limited smarts might have both problems at once – mistaking public mood for economic activity and limiting analysis to only a tiny number of factors.

Not that our august commentariate includes any such benighted individuals.

You have a gift for putting into eloquent prose what the rest of us wish we had said. Of course this is so eloquent that Princeton Steve might not realize you were referring to him. After all he is “on the record”.

I suppose then you put Yellen and Powell into the “less smart economists can handle fewer factors” category, considering the mess they’ve made of the economy.

are they responsible for the war in ukraine? or the supply chain issues private companies have created?

you can blame biden for getting enough shots in arms that our country does not face pandemic deaths like a year ago. that has allowed us to open up the economy, which has contributed to the inflation. guilty as charged there. if trump had his way, we would still be unvaccinated with thousands of deaths per day. was that the outcome you preferred steven? at least inflation would have been under control.

By the way, the survey showing that the majority of the public thinks the U.S. is in recession also shows a strong political bias. Fewer than half of Democrats say we are in recession, while 70% of Republicans do. So the reality is that opinions about recession are tainted by political views. As such, those opinions don’t help us much in assessing the economy. It’s also not clear they help us much in predicting consumer behavior. Mostly just another sign that partisanship is a drag on society.

I guess the Republicans all tuned into Tucker Carlson for his Nobel Prize winning economic discussions.

Let us not disregard the yield curve, the best of a bad lot when it comes to forecasting recession. The curve remains positive. As a forward-looking indicator, it says we won’t be in recession any time soon. There has been not strong signal in the recent past suggesting we are in recession now.

Let us not forget the Sahm rule, which indicates very strongly that the U.S is not in recession:

https://fred.stlouisfed.org/series/SAHMREALTIME

So what with employment strong by a variety of measures, output growing by a variety of measures, and no indication from the more reliable current and leading indicators of recession, no-one with a reasonable level of economic literacy has reason to think we are currently in recession.

Macro, we are [may] not [be] in a recession by official measures, but you can look around and see there is a retrenching going on. Home sales are reflecting that. The stock market is reflecting that. Consumer spending is beginning to reflect that. It may take some fine dancing by the Biden Administration to keep this country out of an official recession. To the extent that fuel prices remain as high as they are or go higher, you can expect a depressing impact on the economy. The transportation costs are not going to be absorbed by businesses and many consumers are already making difficult choices.

You can argue that current inflation is supply driven, not demand driven, but it really doesn’t matter. The supply chain may not be broken, but it is severely hobbled and looks to remain that way for awhile. Ships are still stranded offshore. US rail freight movement has declined. Truckers are struggling to afford diesel fuel. US oil production lags 2019. These are not positive developments. If Biden can’t fix these problems, don’t look for Happy Days. Consumers are being priced out of many markets and a correction is sorely needed.

“White-hot inflation has forced the average American household to cough up an extra $460 per month,”… compared to: “2018 and 2019, when annual inflation averaged 2.1%.” https://nypost.com/2022/06/10/inflation-costing-americans-an-extra-460-per-month-analysis/

Voters well remember that recent history. They also can impart credit for the current policies which are causing this added cost. Whose policies? Please stop denying all YOUR articles and comments espousing them for the past years. The MI index is showing their awareness of this added cost and their concerns.

More recently we’ve seen articles and comments claiming that we’re not in a recession and then oh crap, we’ve got the down turning first quarter. Whether we reach a technical definition of recession before we vote won’t matter.

The voters know and will show their feelings at the polls

The NYPost is known to all New Yorkers as tabloid trash with a sports section thrown in. They actually note this with no qualification?

“Having inflation at 8.5% on a year-ago basis, compared with the 2.1% average growth in 2018 and 2019, is costing the average household $346.67 per month to purchase the same basket of goods and services as they did last year,” Sweet told The Post. “However, the pure cost for households for having inflation running at 8.5% is $460.42 per month.”

Never mind nominal wages have risen by more than this 2.1%. Never mind many of these same households receive COVID relief. Never mind that people are still consuming more.

You know CoRev – you make a total fool out of yourself with your soybean rants but I would have expected more from even you on this issue. But maybe you are indeed dumber than Bruce Hall – the Village Idiot.

Bierka – NYC Jerk, I thought my comments weren’t worth responding to, but over, and over and over again you do. Not coherently, but you just can’e he;p yourself.

This comment is outrageous though, “You know CoRev – you make a total fool out of yourself with your soybean rants but I would have expected more from even you on this issue. ” Remember my request for that ole list of Biden’s successful policies? Remember the whole series of articles re: soybeans and tariffs, and how bad it was for…?

I guess an enlightened Prez like Biden must have immediately removed them. That’s probably the reason soybean prices are double what they were during the long discussion.

Oh wait. The tariffs are still there and soybean prices are double. Another successful Biden policy, but which one?

It is amazing how you spin all sorts of meaningless word salad. You should sell all that salad as you would have to keep prices really low to sell such substandard food. It would be your part in fighting food inflation.

BTW moron – with the world demand for food up and the supply from Ukraine down – one would expect soybean prices to rise. You don’t get this as you pretend you are the world’s foremost ag economic professor! Snicker.

Bierka – the NYC Jerk, wow! Speaking of word salad.

Bow wow wow wow wow wow!!!!!

CoRev: That would also make Biden responsible for the “European area’s” 8.1 inflation rate measured by Eurostat (ec.euro.eu) and reported by CNBC.

‘Euro zone inflation hits yet another record high as food and energy prices soar” CNBC, 5/31.

Also saw today a comparison of gas prices with an equivalent gallon of gas in Germany selling at $8.79. Biden must be running amok there too.

Same piece pegged Russia’s equivalent ppg at $3.03. Not bad until you remember per capita income in Russia (as measured by the World Bank) is about 4X less than Germany’s and about 6X less than ours.

Way back in 08, an acquaintance accused me of cheering the economic downturn. Not so, I said. I got children and their spouses (and numerous family) working.

Same situation today. Those gleefully anticipating a recession must not have much to lose or simply don’t care who loses.

Nonecon, “Those gleefully anticipating a recession must not have much to lose or simply don’t care who loses.” or it can be re-stated as: “Those gleefully anticipating a ever higher inflation due to unrealistic policy to curb ?climate change? must not have much to lose or simply don’t care EVERYONE loses.” I question ?climate change? since there is no clear definition of what is being affected.

If you can’t define the issue you are surprised by the result. We warned you for years that your policy goals were inflationary. Now we, the residents of the world, have to live with your poor policy judgement, ignorance and denial of the associated inflationary result.

None of your latest word salad addresses the points he made. Come on dude – we get you are dumber than Bruce Hall so relax.

How about “we, residents of the world…”.?

Reminiscent of “Workers of the world, unite!”

Maybe CoRev is coming out of a Marxist closet he’s been hiding in all along. Hey, he has nothing to lose but his chains!

“We warned you for years that your policy goals were inflationary.”

You mean for the decade after the financial crisis, when you argued inflation was right around the corner, and we remained sub 2% for the decade? What about all those years you were wrong ? You have not been vindicated in the least corev. You wanted to practice austerity during the worst financial crisis since the Great Depression, for crying out loud.

Baffled – coward, show us the quoted comment where I made the claim: “when you argued inflation was right around the corner”

I’ll wait again as you deflect and ignore the request.

then explain to me exactly what years you warned us that policy goals were inflationary, corev. those were your words quoted above. or were you in favor of the stimulus implemented during the Obama years?

An equivalent gallon of gas in Greece is approaching $10.

Sorry, Greece. CoRev for years warned me that my policies were inflationaryand that you will suffer as a result of my poor judgment.

Don’t take it too personally. I also am responsible for inflation in the UK, France, the Netherlands…you name the country, it’s my fault.

Condolences also to Belgium where May inflation was 9.9% and Slovakia where it measured 11.8%. Mea culpa.

Baffled – coward, I’ll wait again as you deflect and ignore the request.

“We warned you for years that your policy goals were inflationary.”

corev, i take from YOUR comment above that for years you have been warning that inflation (is right around the corner). if i am incorrect, by all means please explain what you meant by that statement. what “years” are you referring to? and if you were warning about inflation, under what time frame did you expect it to then occur. you are welcome to clear up YOUR position, if so desired. but i can only go by what YOU write down on this blog. or was this meant to be a vague and imprecise statement?

Baffled – coward, and there’s the deflection. Next you’ll claim its based upon a false assumption. 😉

corev, that is not deflection. that is simply your comment, and I am giving you the opportunity to clarify to the readers exactly what you meant. apparently my interpretation was not what you meant. by all means, please correct me about your quote.

So 7 out of 10 republicans think we are in a recession.

https://awealthofcommonsense.com/2022/06/timing-a-recession-vs-timing-the-stock-market/

That says something about the toxic brew of ignorance and Fox news disinformation.

Ivan, how did you get to Fox News from your reference? It wasn’t in there.

BTW, those pesky Republicans are leading those ~60% ignorant independents and almost 1/2 those insane Democrats who beleive we’re in a recession. Are they all Fox New viewers? Are you?

Did you bother to read this?

The unemployment rate is still 3.6%. Wages are rising. Consumers are still spending money like crazy. We could be in a recession right now but the fact that the U.S. economy added 1.2 million jobs in the past 3 months would seem to counter that argument. Maybe this is just a poorly worded survey or maybe people really hate inflation. Yes, inflation is the highest it’s been in 40 years but high inflation does not mean we are currently in an economic slowdown.

He is right but most Republicans believe we are in a recession. Why? Because they are as dumb as you are. But maybe they did not get this from Faux News. Maybe these morons are reading your dishonest and dumb comments.

Bierka the NYC Jerk, you are not Ivan, so why are you incoherently responding to my request of him?

To be fair – there are a lot of dumb doomsday comments on the economy ala MSNBC. Stupidity among the press is getting bipartisan.