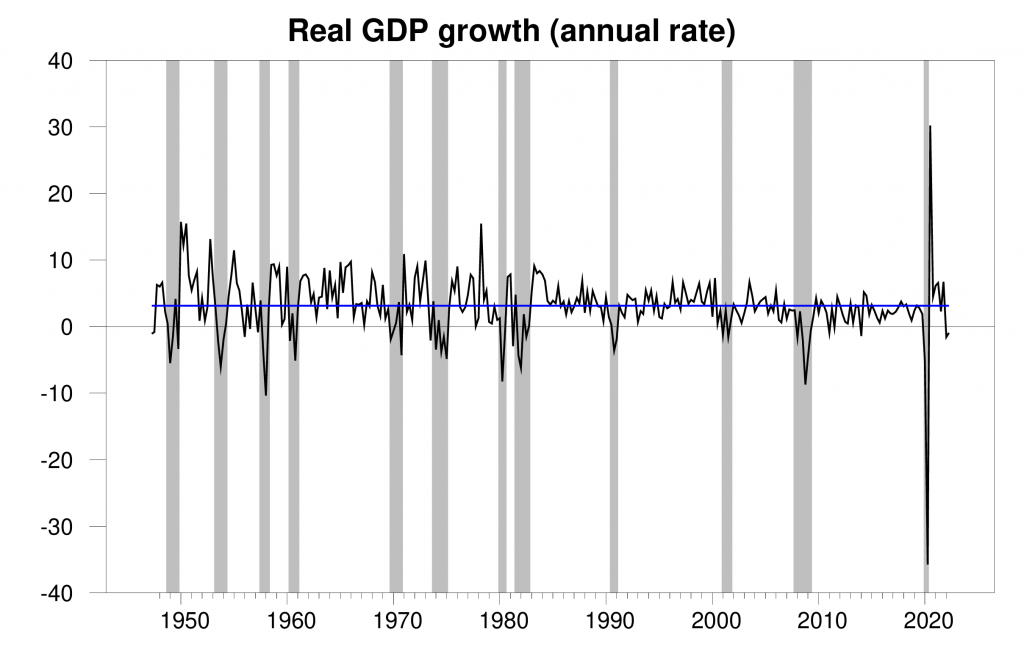

The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP fell at a 0.9% annual rate in the first quarter. That makes two quarters in a row of falling real GDP, which is one rule of thumb for declaring the economy to be in a recession. The current economic weakness could certainly develop into a recession. But the evidence isn’t convincing that a recession is already under way.

Real GDP growth at an annual rate, 1947:Q2-2022:Q2, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

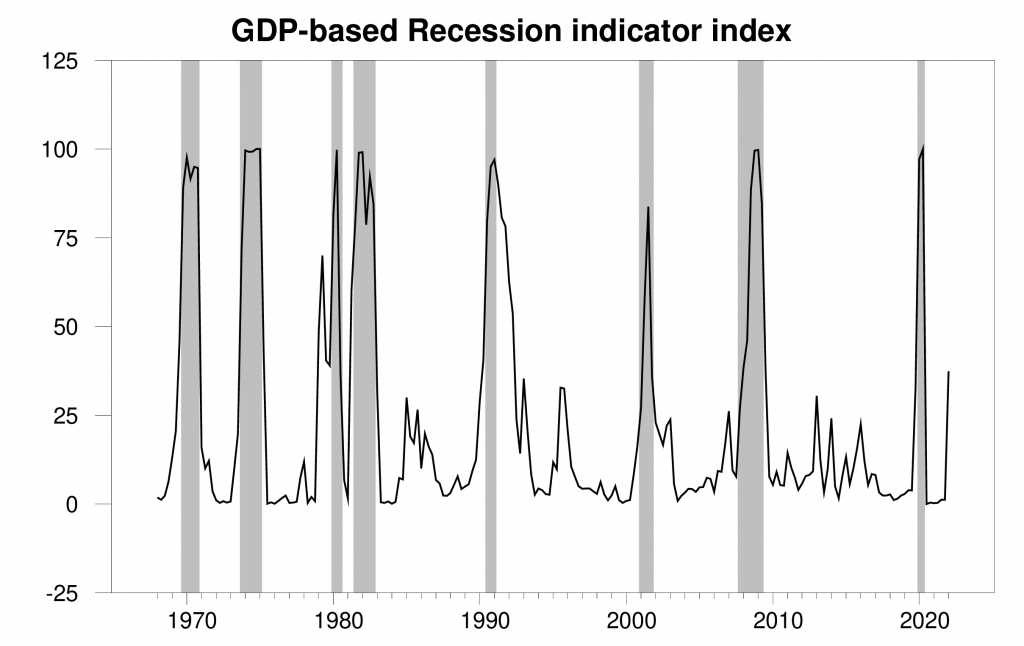

The new data raised the Econbrowser recession indicator index up to 37.4%, flashing a clear warning sign. This is an assessment of the situation of the economy in the previous quarter (namely 2022:Q1). The index takes into account the fact that we’ve now seen two consecutive quarters of falling GDP, but still finds the evidence inconclusive as to whether the U.S. economy started a recession in the first quarter. When Marcelle Chauvet and I first developed this index 17 years ago, we announced that we would only declare a recession to have started when the index rises to 65% (see pages 14-15 in our original paper). If the Q3 GDP report causes the index to rise above 65%, we would announce a recession at that time, and also use the full range of revised historical data available at that time to determine the date at which the recession likely started. Here at Econbrowser we’ve followed that procedure to the letter as the data unfolded in real time over the last 17 years, successfully dating in real time the beginning and end of the two recessions since we started this blog.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2022:Q1 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

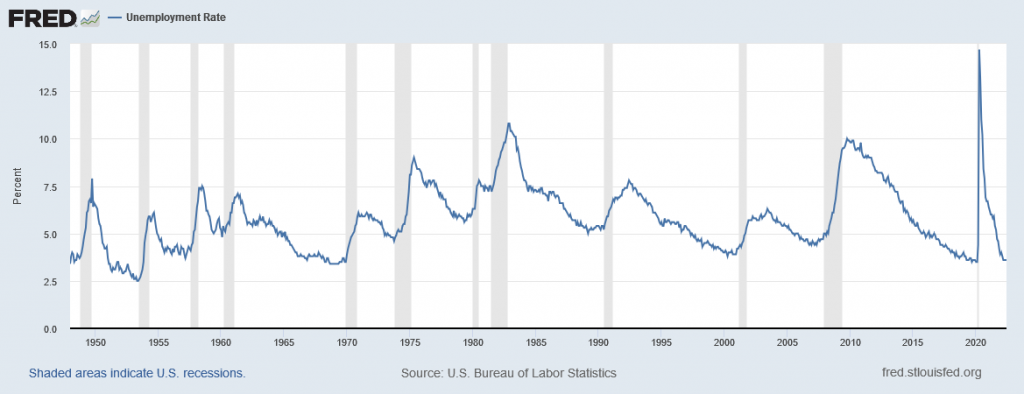

This index is based on the GDP data alone. But other indicators reinforce the conclusion that you can’t clearly say that a recession has already started. A sharp rise in the unemployment rate is one of the defining features of every historical recession. How could we be 6 months into a recession with the unemployment rate still at 3.6%?

Notwithstanding, a faithful reader reminds me that I haven’t been keeping the emoticon for our Little Econ Watcher up to date. This is a more subjective assessment of the overall message from a variety of economic indicators. I’m sad to report that he’s now turned decidedly  .

.

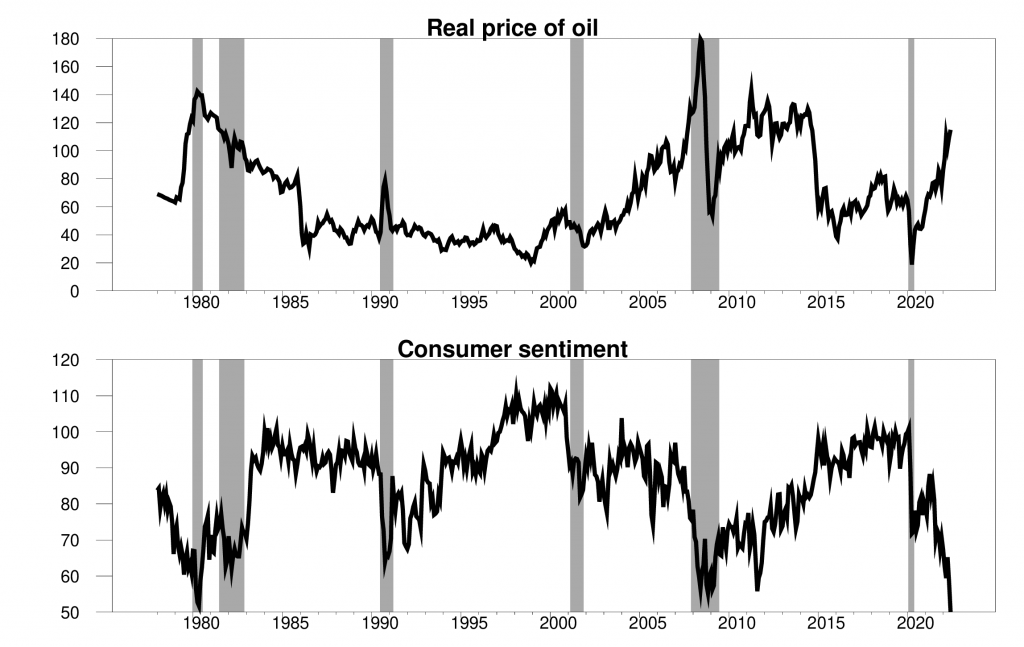

Ten out of the twelve recessions in the United States since World War II were preceded by a sharp spike up in the price of crude petroleum. If 2022 does develop into a full-blown recession, that will bring the count up to 11 out of 13. One of the mechanisms by which oil price spikes contributed to historical downturns was by causing a significant souring in consumer sentiment. That’s certainly been part of the story this time as well.

Top panel: real price of oil (WTI divided by CPI) in 2022 dollars. Bottom panel: University of Michigan survey of consumer sentiment. Monthly, 1978:M1 to 2022:M6.

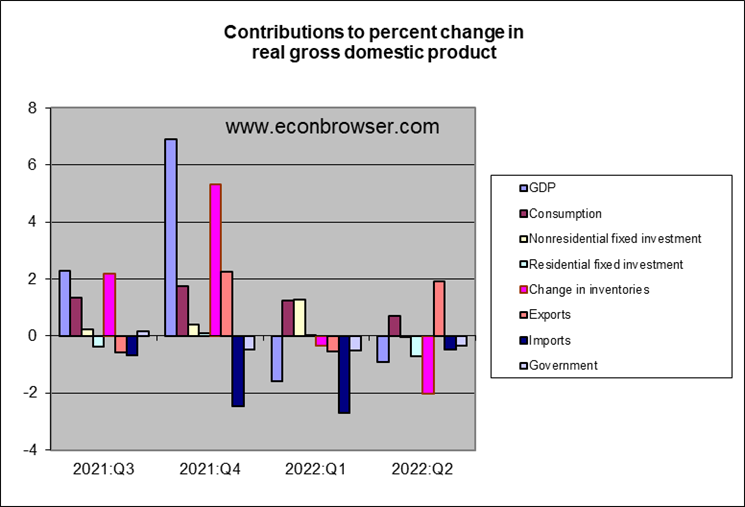

Worried consumers surely contributed to the weak growth in real consumption spending so far this year. But the biggest single factor in the negative GDP growth in Q2 was a drawdown in inventories. More goods were sold than produced. A build-up in inventories was a factor making 2021:Q4 growth look strong and the draw-down now is a factor making 2022:Q2 growth weak. Real final sales have been more stable over the last year than real GDP.

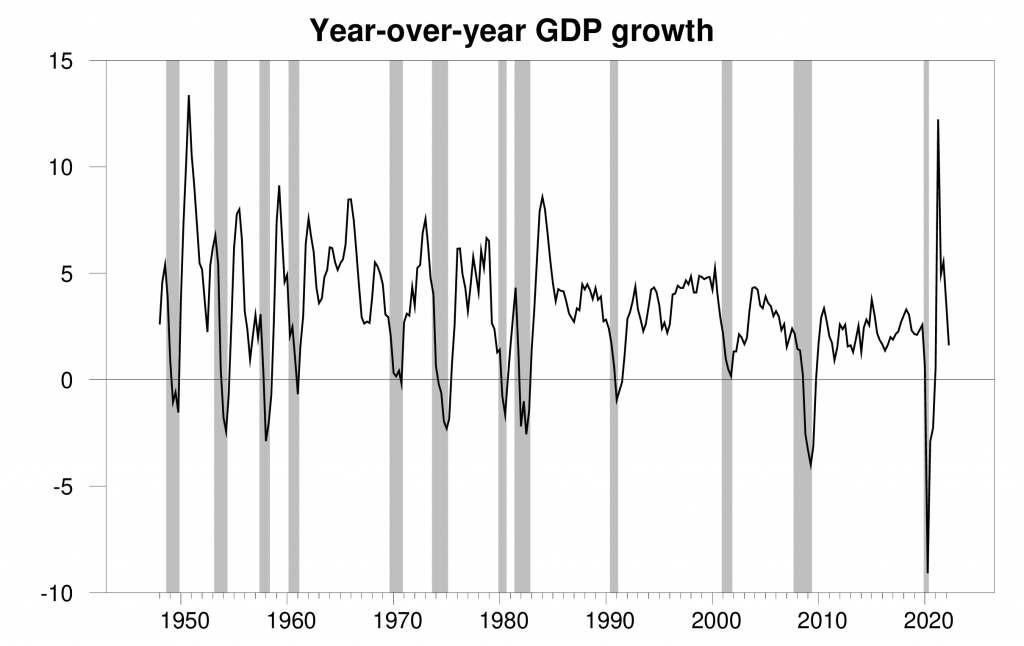

And year-over-year GDP growth is not quite so alarming.

A curious feature in the Q2 GDP numbers was seemingly strong exports. A fifth of the $100 B increase in real exports in Q2 was attributed to petroleum and petroleum products. But this just corrects an anomalous drop in petroleum exports in the Q1 report. Petroleum exports are now back where they were in Q4 of last year. My view is that quarter-to-quarter export growth was stronger than reported in Q1 and weaker than reported in Q2.

The big concern looking forward is housing. It’s too early for the Fed’s tightening cycle to show up in residential construction spending. But if the Fed continues to hike, eventually it surely will. And if the current economic slowdown does turn out to be the beginning of the 13th postwar recession, that will likely be the deciding factor.

Here’s the bottom line: no recession so far, but plenty to worry about  !

!

A sharp rise in the unemployment rate is one of the defining features of every historical recession. How could we be 6 months into a recession with the unemployment rate still at 3.6%?

That is the question raised by the likes of Dr. Yellen and a lot of other smart people. Of course the RECESSION Cheerleading squad gets all frustrated when asked to participate in the real world.

Now I get that this rate is a lagging indicator, which has me wanting to beg the Federal Reserve to cease and desist from raising interest rates at this moment.

Hey I raised that before her. There has been no rise in unemployment either. One might also add if a recession was in force then the FED would not have to raise rates anymore

I thought the Republicans cared about our troops:

https://www.msn.com/en-us/news/politics/blindsided-veterans-erupt-in-fury-after-senate-republicans-suddenly-tank-pact-act/ar-AA1059jE?ocid=msedgdhp&pc=U531&cvid=1617c46b25914f57821b8b6c139316fb

Blindsided veterans erupted in anger and indignation Thursday after Senate Republicans suddenly tanked a widely supported bipartisan measure that would have expanded medical coverage for millions of combatants exposed to toxic burn pits during their service. Supporters of the Sergeant First Class Heath Robinson Honoring Our Promise to Address Comprehensive Toxics Act — or PACT Act — overwhelmingly expected the House-passed bill to sail through to the president’s desk for signature. But in a move that shocked and confused veteran groups Wednesday night, 41 Senate Republicans blocked the bill’s passage, including 25 who had supported it a month ago.

Steven Kopits +1

Menzie Chin -1

Congratulations to Steven Kopits for his correct out-of-consensus call that the first print of 2Q would be negative, prompting the markets and the average voter to believe we are in recession, just as he predicted they would. Steven stuck to his guns despite unrelenting criticism from Menzie, pushback from Jeff Frankel that the first print is more likely to be positive than negative, and continuous contempt from the cackling cacophonous chorus of concurrence in the comments.

Well done Steven!

Apparently, Ricky feels remiss in not pitching in to politicize economic data till now. Here he is, trying to catch up by spouting nonsense about market and public reaction to today’s GDP report.

Markets conclude from the data that we’re in recession? The S&P500 ended the day up over 1%. The ten-year Treasury yield moved less than 1 basis point. That GDP report sure was a wake-up call!

The public concluded we’re in recession? According to what poll? Ricky “knows” how the public feels the same way Steve Bannon was going to tear the government a new one in his court case. Baloney.

Macrodunce,

Obviously you don’t follow market news. If you did, you’d know that a recent poll showed that 58 percent of the public thought we were in recession before we got the negative print on the 2Q number. That percentage will be even higher now. Steven is right and you are wrong.

You don’t seem to understand markets either. The market already priced in a mild recession along with more interest rate hikes. The last two quarters of GDP results reduce the probability that the Fed will do the additional interest rate hikes the market was expecting. That’s good for stocks, at least given current information. Steve is right and you are wrong.

Also, don’t think I didn’t notice that you tried to change the subject from Steven getting the forecast right, which is the main point.

Look, Rickie has his panties in a twist!

Your claim was that yesterday’s data were ‘prompting markets and the average voter to believe we are in recession’. Present tense and all that. You’ve scrambled to change your claim. Now, what people thought before the data were released is relevant? Now. your predictions is evidence?

You’ve man-splained the market reaction,but that’s not evidence, either. You don’t know why markets responded the way they did.

This is your usual chest-thumping baloney, a bunch of tricks learned from watching too much faux news.

And I didn’t change the subject. You makes the claim about the response of people and markets. I responded to that. How is that changing the subject.

5-star comment.

Rick,

While Steven “got it right,” he did so for the wrong reasons. He was pushing a decline in consumption, making lots of noises about low consumer sentiment. In the end, consumption continued to rise. What gave us this decline of GDP was that even though the change in inventories continued to be positive, they continued to grow, the change in the change of inventories was negative, they grew at a slower rate. That was the main item that gave us the negative GDP outcome, and I do not remember him forecasting that.

As Macroduck noted, final sales rose. But hey – the Usual Suspects never cared about the details.

Barkley,

I don’t think we should move the goal post by requiring that Steven not only have gotten the headline forecast right, but also have identified how the subcomponents would move. That’s a standard that no other forecaster is held to.

The simple fact is that he got it right and didn’t waiver despite the tremendous push back from Menzie and others. I think it’s only fair to acknowledge that, especially since a lot of people on this blog have cast personal as well as professional aspersions.

The difference between getting it right and getting it right for the right reasons is the difference between dumb luck and professional abilities.

Anyway, the actual print was so close to 0 that getting it right/wrong was pretty much a flip of the coin thing – and it could be revised back to a small positive numbers before all is said and done.

Sure the blind hen can stumble over a golden nugget every now and then, but I would not be impressed.

There has been some interest expressed here in Gross Domestic Income for Q2. In Q1, real GDI rose while real GDP fell (ignoring future benchmark revisions), and those two should, in theory, do the same thing by the same amount, every time.

In Q1 real personal income accounted for 87% of real GDI. The ratio flops around a good bit, but the high 80s is pretty normal. With real personal income accounting for a large part of real GDI, it’s possible for GDI to fall when personal income rises, but it’s not easy.

So far in Q2, we have real personal income only through May. If we assume no change in real personal income in June, with no revisions to prior months (don’t get all fussy, children – these are conventional assumptions when only part-way through a quarter) real personal income will have risen in Q2, but not by much. I get between 0.1% and 0.2%, but I’m bad at math.

We also know that the payroll index (hours worked x hourly wages) rose 1.1% in June, while CPI rose 1.3% in June. The index only accounts for something less than half of GDI and CPI is the wrong deflator, but what else ya gonna do – no change in real personal income looks like an OK, sloppy assumption for June.

Median usual weekly real earnings are now only about 1% above where they were when Trump took office.

Could this be why so many are so glum about the state of the economy and why so many think we’re in a recession?

But apparently the state of the American workforce is not something that affluent economists take into consideration when determining whether we’re in a recession or not…but tens of millions living in the real world certainly do…

So, through most of the history of Gross Domestic Income, personal income was a fairly reliable predictor. The Covid came along:

https://fred.stlouisfed.org/graph/?g=Sicn

Oh, well. With today’s release of June data, real personal income fell by 0.2% in Q2 (not annualized):

https://fred.stlouisfed.org/graph/?g=SieS

That’s the smallest drop since a big gain in Q1 2021. In each of those quarters real GDI rose, so I got to nothin’.

How about addressing Median usual weekly real earnings?

https://fred.stlouisfed.org/series/LES1252881600Q

How can economists comfortably say that the economy is not recession if the average worker’s income is in recession?

Apparently, economists think that if the top 1% do well enough, we can pretty much avoid any recession, regardless of how the vast majority fare. And apparently economists simply can’t understand why so many are complaining if the “economy” (read: top income earners) are not losing ground (yet).

Off topic, until it isn’t –

China aims to bail out the property sector to the tune of $148 billion:

https://www.reuters.com/markets/rates-bonds/chinas-cbank-targets-148-bln-financing-cash-strapped-developers-ft-2022-07-28/

We’re back to that old “liquidity vs solvency” thing. It’s bad to let a frightened credit system tank your economy. It’s also had to bail out insolvent firms in a sector with massive excess capacity. Let’s see how this goes.

@ Macroduck

It’s going to be engrossing viewing. I’d say “fun to watch” but I don’t want people to think I’m a sadistic bastard.

https://www.nytimes.com/2022/07/28/opinion/recession-inflation.html

July 28, 2022

How Goes the War on Inflation?

By Paul Krugman

The U.S. economy is not currently in a recession. No, two quarters of negative growth aren’t, whatever you may have heard, the “official” or “technical” definition of a recession; that determination is made by a committee that has always relied on several indicators, especially job growth. And as Jerome Powell, the chair of the Federal Reserve, noted yesterday, the labor market still looks strong.

That said, the U.S. economy is definitely slowing, basically because the Fed is deliberately engineering a slowdown to bring inflation down. And it’s possible that this slowdown will eventually be severe and broad-based enough to get the R-label. In fact, on this question I think I’m a bit more pessimistic than the consensus; I think the odds are at least 50-50 that history will say that we experienced a mild recession in late 2022 or early 2023, one that caused a modest rise in the unemployment rate. But what’s in a name?

The real question is whether a moderate slowdown, whether or not it gets called a recession, will be sufficient to control inflation. And the news on that front has been fairly encouraging lately.

Obviously gasoline prices are down — almost 80 cents a gallon from their mid-June peak. (Remember those scare stories about $6 a gallon by August?) More important, business surveys — which often pick up economic turning points well before official statistics — are starting to suggest a significant drop in broader inflation. For example, a survey from S & P Global found that while private-sector companies are still raising prices, the rate of inflation is “now down to a 16-month low.”

Financial markets have noticed. The expected rate of price increase over the next year implied by inflation swap markets (don’t ask) has plunged from more than 5 percent in early June to 2.45 percent as of Thursday morning. Medium-term inflation expectations are also down.

Now, it’s much, much too soon to declare victory in the fight against inflation. There have been several false dawns on that front over the course of the past year and a half. And there’s plenty of room to argue about the level of “underlying” inflation — a vaguely defined term, but roughly speaking the part of inflation that is hard to get down once it has become elevated.

Serious economists I talk to are very anxious to see Friday’s release of the Employment Cost Index, which is supposed to measure what’s happening to, um, employment costs. Will it confirm or contradict the apparent slowing of wage growth visible in simple measures of average wages and at least one influential survey?

Well, we’ll have to wait and see….

https://www.nytimes.com/2022/07/26/opinion/recession-gdp-economy-nber.html

July 26, 2022

Recession: What Does It Mean?

By Paul Krugman

There’s a pretty good chance the Bureau of Economic Analysis, which produces the numbers on gross domestic product and other macroeconomic data, will declare on Thursday, preliminarily, that real G.D.P. shrank in the second quarter of 2022. Since it has already announced that real G.D.P. shrank in the first quarter, there will be a lot of breathless commentary to the effect that we’re officially in a recession.

But we won’t be. That’s not how recessions are defined; more important, it’s not how they should be defined. It’s possible that the people who actually decide whether we’re in a recession — more about them in a minute — will eventually declare that a recession began in the United States in the first half of this year, although that’s unlikely given other economic data. But they won’t base their decision solely on whether we’ve had two successive quarters of falling real G.D.P.

To understand why, it helps to know a bit about the history of what is known as business cycle dating.

A modern economy is a constantly changing thing, in which individual industries rise and fall all the time. (Remember video rental stores?) At some point in the 19th century, however, it became obvious that there were periods when almost all industries were declining at the same time — recessions — and other periods during which most industries were expanding.

To understand these fluctuations, economists wanted to compare different recessions and search for common features. But to do that, they needed a chronology of recessions, one based on a variety of measures, since G.D.P. didn’t even exist yet as a concept, let alone a number regularly estimated by the government.

A seminal 1913 book * by the American economist Wesley Clair Mitchell is widely credited with beginning the systematic empirical study of business cycles. In 1920, Mitchell helped found the National Bureau of Economic Research, an independent organization that soon found itself devoting much of its research to economic fluctuations, and began offering a chronology of business cycles in 1929.

Since 1978 the N.B.E.R. has had a standing group of experts called the Business Cycle Dating Committee, which decides — with a lag — when a recession began and ended based on multiple criteria, including employment, industrial production and so on. And the U.S. government accepts those rulings. So the official definition of a recession is that it is a period that the committee has declared a recession; it’s an expert judgment call, not a formula….

* https://fraser.stlouisfed.org/files/docs/publications/books/mitch_buscyc/mitchell_buscyc.pdf

As for the “argument,” Menzie Chinn and Jeffrey Frankel were of course technically correct. The economy is too obviously healthy for there to be a recession now; several months from now possibly, but not now. However, a “popular” argument can be made that we are in a recession and there is considerable unease that makes the argument appear sympathetic. For me, the unease that developed last year as energy prices increased called not for traditional monetary policy alone but for a price “policy” such as China has successfully used and Isabella Weber and James Galbraith suggested:

https://fred.stlouisfed.org/graph/?g=SgrQ

January 30, 2018

Consumer Prices for United States, United Kingdom, Germany, France and China, 2017-2018

(Percent change)

“The economy is technically healthy”…depends greatly on whose health you’re measuring. If you’re talking about the top 10%, then, yeah, the economy is probably doing pretty well.

But if you deepen your analysis to include the whole population, the story is undoubtedly quite different.

What flummoxes me is that economists look at the whole economy to judge its health but then ignore the distribution of income. Can you really say that the economy is doing great if it’s really only the top 10% (or 0.1%) who are doing well while the rest lag behind or even lose ground? Shouldn’t the US economy be technically in a recession if a majority of its households are in recession? https://global.chinadaily.com.cn/a/202207/15/WS62d0ca93a310fd2b29e6c82b.html

And why is it that economists seem so mystified that so many are so glum about the economy? Don’t they realize that they are talking about two entirely different data sets–one is aggregate data, and the other is the majority of the population, whose experience often varies significantly from the aggregate. As we know from long experience that most economists should know by now, the expression that a rising tide does not lift all boats is a lousy analogy for a highly unequal US economy.

China Daily? The penny drops!

Johnny, I’ve been trying to figure out who holds you leash and now you’ve offered a hint. You lie endlessly about what economists think and do, seeming to come from a progressive starting point. You’re also a Putin-hugger. Putin is anything but progressive.

Now, you bring us poll results from a Chunese source which were published earlier in the U.S. press. It’s starting to make sense – you work for the Chinese? That would explain the mix of west-bashing, Putin hugging and pretense of progressive bias.

Is the pay good?

Majority of Americans think US in recession: poll

THINK? POLL?

This is one instance when Johnny boy could not even understand the title of his own link.

pgl…you don’t like polls? The results are justified by data that I linked to showing, real usual weekly earnings are way, way down.

Of course, an affluent economist like pgl thinks that we should disregard the opinion of those damned deplorable…

Interesting, isn’t that the poll was mostly not covered by the mainstream media. It’s not the only poll to have similar results. Oh, but I forgot, the mainstream media is owned by the 1%, and the last thing they want is for people to get out the pitchforks.

Kudos to a China Daily for publishing what’s seemed not fit to print by the “free” press!

Macroduck asserts that poll results were published earlier in the US press…but naturally provided no link…his usual modus operandi…assertions with no links. The most widely read media outlet that I found to have covered it was Newsweek. And then there were some investor-oriented publications.

It’s sad when foreign outlets are among the few to tell us what’s happening in our own country…

JohnH,

Nobody, certainly not “economists,” are remotely mystified why so many in the US are “glum” about the economy. It is because of inflation. This is not news. And most of us are aware that it has been high enough to lower the real incomes of much of the population, which is probably why so many people think the US is in a recession.

So, wouldn’t you agree that the headline for the current situation should read: AMERICA TECHNICALLY NOT IN RECESSION; AVERAGE HOUSEHOLD IN RECESSION?”

The current discussion focused only on the first part of the headline while data for the second part was release almost simultaneously. Why the bias?

No, Johnny. That headline would be dumb. Households are still adding jobs. That’s not a recession. And households don’t have recessions. Economies do.

What you want is for your hyper-emotional hyperbolic style to rule the world. That would be obnoxious, so no thanks.

https://www.nytimes.com/2022/07/28/health/covid-deaths-black-hispanic-rural.html

July 28, 2022

In Rural America, Covid Hits Black and Hispanic People Hardest

At the peak of the Omicron wave, Covid killed Black Americans in rural areas at a rate roughly 34 percent higher than it did white people.

By Benjamin Mueller

The coronavirus pandemic walloped rural America last year, precipitating a surge of deaths among white residents as the virus inflamed longstanding health deficits there.

But across the small towns and farmlands, new research * has found, Covid killed Black and Hispanic people at considerably higher rates than it did their white neighbors. Even at the end of the pandemic’s second year, in February 2022, overstretched health systems, poverty, chronic illnesses and lower vaccination rates were forcing nonwhite people to bear the burden of the virus.

Black and Hispanic people in rural areas suffered an exceptionally high toll, dying at far higher rates than in cities during that second year of the pandemic….

* https://www.medrxiv.org/content/10.1101/2022.07.20.22277872v1

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

July 21, 2022

American Academy of Pediatrics

Over 14 million children are reported to have tested positive for COVID-19 since the onset of the pandemic according to available state reports; over 311,000 of these cases have been added in the past 4 weeks. Approximately 6.1 million reported cases have been added in 2022.

Cumulative Number of Child COVID-19 Cases

14,003,497 total child COVID-19 cases reported, and children represented 18.6% (14,003,497 / 75,463,921) of all cases

Overall rate: 18,605 cases per 100,000 children in the population

Thankfully, looking at the bar chart above, we will likely be spared the usual suspects claiming that imports reduced GDP in Q2.

This ain’t rocket science. It’s right there in the name “Domestic”. There are no imports in GDP. There are those who use the GDP accounting identity to argue otherwise, but no matter what accounting method you use for convenience, imports must always total to zero, nada, nothing.

Now, even a 7-year-old knows that subtracting zero from a number does not change it but even some people who claim economist credentials seem unable to grasp that elementary concept. It’s embarrassing.

Wow… There are commenters here who put party above country. There are commenters here who pretends to knowledge they don’t have. (There is near complete overlap between those two groups.) There are commenters who make up stuff about what economists think and what economists know without having any real idea. (Again, lots of overlap with the pretenders.)

But to plant your flag on the dunghill of “imports don’t count” is just weird! Where are you getting this? Why have you not read an economics book to see what all the (mathematical) fuss is about?

I have tried to walk him threw this before so thanks for making this point one more time. If I had bought a case of French wine instead of that Robert Mondavi wine – my consumption would have gone up but not California sales.

Joseph has made some solid comments on this blog, and showed a willingness to learn new things. This has me mystified. But I’m pretty certain unlike Kopits, Don Stryker and some of our other folks joseph is not being malicious here. Maybe he stumbled on a heterodox economics website and it’s got him fuzzy-eyed.

Maybe Menzie can correct him in a gracious way and we can get his weathervane pointed the right direction.

Well, Moses, since you jumped in here, would you be so kind as to comment on the following statements. Which are false?:

1. GDP is domestic product. By definition it does not count imports.

2. In any accounting method for calculating GDP, imports must sum to zero.

3. Subtracting zero from any number does not change it.

4. If imports sum to zero in the calculation of GDP, how can imports reduce GDP?

@ joseph

Well, I’m going to paraphrase other people’s words here who are much smarter than me but put it in simple terms. Ironically I was at the bank this morning, so sorry for the slow answer:

Quantitatively “aggregate demand” (sometimes short-handed “AD”) is the same thing as GDP. So how do we get aggregate demand?? There’s a nice formula for that:

C + I + G + (X – M) (I guess Simon Kuznets gets most the credit for this formula, happy to be corrected)

C = Consumer spending on goods and services

I = Investment spending on business capital goods

G = Government spending on public goods and services

X = Exports

M = Imports

https://fredblog.stlouisfed.org/2018/09/do-imports-subtract-from-gdp/

https://research.stlouisfed.org/publications/page1-econ/2018/09/04/how-do-imports-affect-gdp

Put in the most simplistic way~~GDP is measuring the domestic (home) nation’s production (output). But imports are not part of domestic (home nation) production, because by definition they are produced by foreign nations.

1. This statement is TRUE, if you mean by “count” they are not included in final GDP numbers

2. False, imports are not “required” nor do they “naturally” sum to zero.

3. True, self-evident

4. False, imports do not “sum to zero”. Nearly any/every country has some amount of imports, even relatively “closed” countries like China and Russia. And if imports are larger than exports (M > X) then when you subtract imports from exports ( X minus M) you get a “negative” number, and this will lower the final number for (“AD”/GDP) produced from the above “AD”/GDP formula/equation.

Moses,

Excellent.

I cannot improve on what Moses has written, but I can offer a numerical example –

I buy a Canadian guitar. (Y’all know about Canada’s excellent guitars, yes? Bunches of cherry wood, for some reason.) My consumption is one guitar, but U.S. production of my guitar (ignoring inputs imported to Canada from the U.S.) is zero. How do we avoid counting that guitar as U.S. production? Subtract one imported guitar.

If that was not clear, I can do it again with Scotch. Or a German harmonica.

Moses, number 2 is absolutely correct. By definition there are no imports in GDP, therefore any imports used in the calculation of GDP must sum to zero. Is that not clear by elementary arithmetic?

That is not the same as claiming there are zero imports in the trade balance. We are talking about GDP here, not the trade balance. Don’t confuse the two. Once again, there are zero imports in GDP, by definition.

As to your accounting identity: GDP = C + I + G + (X – M)

that’s were people get confused because they think that because M appears in there imports must be a component of GDP.

Imports (M) are only in there because there are equal hidden imports in C and I and G that should not be counted as domestic production. So M, which explicitly appears in the identity, is offset by the Ms that are implicitly in C and I and G. They exactly offset each other. So not only does M in the identity not mean there are imports in GDP, but M is intentionally inserted there to make sure that imports in GDP sum to zero.

So you might ask, why don’t we just measure domestic C and domestic I and domestic G and then we wouldn’t have to subtract M at the end. The reason is simply convenience. It’s harder to distinguish domestic from imported products at the point of sale. It’s just easier to just add them all up and subtract imports at the border.

Is that clear?

There goes my 2nd (4th??) career as Menzie’s TA and coffee fetcher. It was looking so good there for a few moments.

Joseph,

First of all, I note that for once I agree with Moses. Very clear on this one, Moses, congratulations.

Joseph, all you are doing with your verbiage is confusing things with statements that are just nonsense. Your one accurate point is that indeed why we have to go in and explicitly subtract out imports in the Kuznets equation is that at the point of sale we are not able to easily to distinguish the domestic from the imported goods. So, it is easier to add up all those final sales and then go in and separately pull out the imports and subtract.

Where you get xompletely confused and make yourself look like CoRev claiming he can divide by zero is when you start making claims about5 how “imports sum to zerol.” I think most of us know what you are trying to say, but this is, sorry, simply not true and not worth going on about. Moses’s discussion of this, added on to by Macroduck is correct.

Macroduck. The way GDP is typically computed is GDP = C + I + G + (X – M)

C includes all guitars including your imported guitar. And then M subtracts that imported guitar. There is one imported guitar in C and one imported guitar in M. The result of C minus M is zero imported guitars. Those imports sum to zero, as they must by definition.

Did that imported guitar in M subtract from GDP? No it did not. It only removed a guitar from C that should not be counted in GDP to begin with because it is imported.

You could have written GDP = domestic guitars + I + G + X.

Imports don’t appear at all in that identity. It simply means you have to be more discriminating in counting guitar sales.

That we instead subtract imported guitars at the end in the standard identity is merely an accounting convenience because it is easier than only counting domestic guitars. Count all guitars in C, then later throw out all the imported ones in M. That doesn’t reduce GDP. It just removes a imported guitar from C which shouldn’t have been counted to begin with.

Imports always sum to zero in GDP.

Joseph,

Why are you explaining to me what everybody else has been explaining to you for weeks? You’ve caught on and now you’re pretending you need to explain to us?

You already looked foolish. Now, you’re making it worse.

Barkley Rosser: “Where you get xompletely confused and make yourself look like CoRev claiming he can divide by zero is when you start making claims about5 how “imports sum to zerol.”

Of course they sum to zero. By definition there are no imports in GDP. Therefore imports must sum to zero. That is a basic fact of mathematics. Do you really deny a basic fact of mathematics? If so, you are hopeless.

The entire reason for including M in the identity is as a fudge factor to make the sum of imports zero. There are an undetermined number of imports included in C and I and G. We don’t know exactly how many imports are in each of C and I and G, but we do know the total is M. We negate those by subtracting M. The result is zero imports. There are no imports in GDP.

You can read it yourself from the Federal Reserve:

https://fredblog.stlouisfed.org/2018/09/do-imports-subtract-from-gdp/

As they say, the M in the GDP identity is an accounting variable, not an expenditure variable. It is inserted to balance the equation.

We are having a long tutorial on a basic concept – national income accounting. You know this reminds me a lot of Modern Monetary Theory where they spend 10 pages lecturing Keynesians on what we have known since the 1940’s.

Great…….. the cliché cheap shot at MMT. About the only thing this thread was missing/

I’m on my 2nd “Tall Boy” wine cooler can here. I’d like to say something that’s very important to me, that I forgot to say earlier, and there’s ZERO sarcasm here. It means a great deal to me on a personal level, that Macroduck felt I did pretty good on my explanation to Joseph. It means a lot to me. And If I didn’t also like/respect joseph I wouldn’t have done my very best to answer joseph’s question. I ask all here who are regulars to please leave this here, the last thought/blog comment on it here./

https://www.youtube.com/watch?v=pxBARWspfkY&list=RDa7WjXqmR7yg&index=3

Joseph,

Sorry, but you are the one who is hopeless here. We all get it. The problem is you keep saying things that are nonsense.

Note, you cite the Fed. Does the phrase “imports sum to zero” appear at all in that link you provided that is supposed to support this ridiculous nonsense you keep saying? No.

Again, you have the right idea, but then you make statements that are now what you mean and that just wrong and ridiculous. It is clear that you do not understand what you are writing. But, when you write “imports sum to zero” that does not mean what you think it means. Are you getting this yet?

Please do not make yourself look as stupid as CoRev who actually did double down once on his dividing zero vy zero to get zero nonsense, but then shut up about it. You jusr keep saying this totally nonsensical thing, which you clearly think means something other than what it says.

Wait, pgl, are you saying you are also a zero denialist? It’s a simple concept. By definition GDP contains no imports, that is zero. Therefore in any accounting method you choose for GDP, imports must sum up to zero.

Did you read the Fed’s take on it?

https://fredblog.stlouisfed.org/2018/09/do-imports-subtract-from-gdp/

https://youtu.be/3NWd8HL-mXk?t=927

Let me do a simple analogy using Park Slope and Gowanus (both Brooklyn neighborhoods but Gowanus is a lot like Germany and Park Slope is Switzerland). Let’s say Park Slope consumes $1 million in beer and wine each year with all of the wine produced here at our park but all of the beer from a microbrew in Gowanus. I enjoy both products as do my neighbor.

So let’s say domestic consumption of our wine is $600,000 per year and we consume $400,000 in Gowanus beer.

Now most people would say we consumed $1 million in beer and wine with 40% of them those foreigners in Gowanus.

Now you could define domestic consumption as the wine only if you want to. But there is a six pack of beer in my frig right now and sorry dude – I’m not sharing it with you. After all – you incessant nonsense causes me to want one right now.

Joseoh,,

In a certain formulation, imports are simply not playing a role at all in GDP. That is most definitelhy NOT the same thing as them “summing to zero.” That remains a gobsmackinglhy idiotic remark. Period.

What do you mean by “you could define domestic consumption as the wine only if you want?” There is not “want” about . That is the very definition of domestic consumption. There is no other definition. The beer is imported. By definition it was never part of domestic consumption. Domestic consumption is consumption of domestically produced products. There are no imports in domestic consumption. There is no beer in domestic consumption, by definition.

Do you not understand the definition of GDP? There are no imports in GDP, by definition. Imports in GDP are zero. It’s simple enough a child can understand. Why do you dispute this simple fact?

Barkley Rosser: “In a certain formulation, imports are simply not playing a role at all in GDP. That is most definitelhy NOT the same thing as them “summing to zero.”

What do you mean “in a certain formulation”. By definition there are no imports in GDP, in any formulation. They must equal zero. Is that not true?

In pgl’s example, you start with gross expenditures of domestic wine plus imported beer, C in the GDP identity. To get GDP, you then must subtract imported beer, M in the identity. C minus M = domestic wine + 0 imports. The imports sum to zero, which they must by the definition of GDP.

The imports in C minus the imports in M equals zero. Is that not true? It is a simple question.

https://news.cgtn.com/news/2022-07-28/Chinese-mainland-records-119-new-confirmed-COVID-19-cases-1c1Pd55j7RS/index.html

July 28, 2022

Chinese mainland records 119 new confirmed COVID-19 cases

The Chinese mainland recorded 119 confirmed COVID-19 cases on Wednesday, with 86 attributed to local transmissions and 33 from overseas, data from the National Health Commission showed on Thursday.

A total of 507 asymptomatic cases were also recorded on Wednesday, and 7,167 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 229,185, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-28/Chinese-mainland-records-119-new-confirmed-COVID-19-cases-1c1Pd55j7RS/img/2c5e5b3b273b42bfa3a708c04c1546c2/2c5e5b3b273b42bfa3a708c04c1546c2.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-28/Chinese-mainland-records-119-new-confirmed-COVID-19-cases-1c1Pd55j7RS/img/d8fa4331b42542128666ed94d850a9d1/d8fa4331b42542128666ed94d850a9d1.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-28/Chinese-mainland-records-119-new-confirmed-COVID-19-cases-1c1Pd55j7RS/img/4030e2a44004404cb8023ac8bb634644/4030e2a44004404cb8023ac8bb634644.jpeg

https://www.worldometers.info/coronavirus/

July 27, 2022

Coronavirus

United States

Cases ( 92,761,865)

Deaths ( 1,053,969)

Deaths per million ( 3,171)

China

Cases ( 229,066)

Deaths ( 5,226)

Deaths per million ( 4)

As a matter of data I am not sure how much sense it makes to take a bunch of quantitative parameters and turn them into a single categorical parameter (that presumably signifies an economic downturn). In particular the GDP and its components give a much more detailed understanding of the movements in our economy than a single yes/no call. If GDP is down, which components are driving a reduction, are those components likely to reverse, etc. I have no doubt that the Fed’s one-two punch of raising rates and selling assets will slow the economy, but the fear of self-sustaining processes seem way overblown.

Well, yeah. I kinda think there is a history here which cannot be escaped. There has always been the idea of recession (depression, contraction, crisis…) and science (including social science) embraces formalism, so we’ve got formal definitions of recession.

The formal (AKA “technical”) definition of recession adopted in the U.S. is “whatever the NBER decides”. While that may not be satisfying to everybody, it’s better than a provisional contraction, no matter how small, in only one measure of economic performance, no matter what other measures are doing.

If we are going to use the term – and it sounds like you’d be fine without it – then it would save a lot of time and prevent a lot of politically motivated blathering if we stick with “whatever the NBER decides”.

Agree – and the problem is that a lot of people seem to use their own definitions and mostly for political purposes. If they want there to be a recession, they will make up or use a “definition” that will give them a yes answer. A lot of people want to use the answer to make decisions in real time and a “whatever NBER decides” unfortunately comes way too late for that. So I am not sure this simplistic categorized parameter is serving anybody enough that it should be headline grabbing news. A focus on GDP changes and the 2-3 items pulling up and pulling down would probably be a lot more useful – without stretching brains beyond the breaking point.

Of course, right now we have some politicians who think that somehow it is unfair or some sort of politically rigged game that we shall have to wait probably until after the midterms for the NBER committee to finally make an official decision on whether what we have seen in the last two quarters is a recession or not. They want to be able to have that headline that there is a recession before the midterms for political purposes, although in their own media I think they are not worrying too much about the official definition and going with the old Shishkin criterion and simply declaring that indeed we are indeed in a recession.

From the way I understand it, the ports clog of 2021 is what’s causing this. Then over the first half of 2002 it unclogged…..fast. Now we have way too much furniture, cloths, electronic goods ete. Orders have ceased and imports are stalled as businesses reduce the stockpiles. The trade deficit will likely collapse for several months going forward. We see this further in dispersion of jobless claims mostly hitting import/export workers(some mortgage jobs, but the primary dealers have pretty much outsourced originations to nonbanks).

So it’s a old school inventory build that needs a price cut to solve. But the government doesn’t count it until the product is sold, so it looks like a drop in inventory/GDP. No wonder Bezos is grumpy. Fire sale deals make billionaires sad.The

Eventually this will collapse CPI…….hard.

Oders are a leading indicator, so a good thing to watch. So far (May for factory orders, July for durables), there is no sign of a decline in aggregate:

https://fred.stlouisfed.org/graph/?g=SgBu

Your comment seems directed at import orders, which are less steady, but rising in the most recent month:

https://ycharts.com/indicators/us_ism_manufacturing_imports_index

What seems to be going on is that there is an excess of inventories in some, but far from all, industries and sectors. So we read about inventory overhang in retail and in housing (which is a slightly different matter), but overall demand is strong enough to keep orders rising in aggregate.

A stall in aggregate orders – manufacturers, durables or imports – would be a bad sign. Heck, even a stall in service orders would be bad.

NICELY said!

I have been saying coming up to this that the main driver of the outcome would be changes in inventories, which I was unwilling to forecast as it seemed that the data on them was unreliable. However, there have been a lot of media stories reporting a surge of inventories, at least in some sectors, with much complaining about that. It looked like there might be rising inventories.

However, as we see from the numbers you report, Jim, inventories apparently declined substantially, with that putting the GDP number into negative territory for the quarter. But, I must say, I am mystified how to reconcile those numbers with all those media reports. This simply reconfirms for me that a lot of strange things are going on in the economy.

Like Macroduck, I am interested in the income numbers, with us seeing an increase of GDI in Q1 that more than offset the decline in GDP. It looks that personal income has risen substantially, more than enough to offset the Q2 GDP decline. But I guess we shall have to wait to see the bottom line on what GDI does.

As it is, Steven Kopits has not taken up my challenge to him to make a forecast of GDI, although he is enjoying having called the GDP decline, even if it looks like he did so for the wrong reasons. I do not remember him saying it would be inventories changes, but that looks to be the big player, as i said it would be whatever they proved to be.

Of course, that item that is the biggest negative in the GDP report for Q2 as Jim reports is not “changes in inventories.” It is changes in changes in inventories. Inventories continued to rise in Q2, but at a slower rate. There is the leading source of the Q2 GDP decline.

As it was, in 1947 we had two quarters of GDP decline, but NBER did not call that a recession. Employment did not decline. Those GDP declines were also driven by the changes in changes of inventories.

Barkley,

I notice that for 2022Q1 the Change in Real Private Inventories, was 188.5 billion chained 2012 dollars SAAR and for 2022Q2 the change was 81.6 billion, so inventories went up for 2022Q2, but the change in the change was negative resulting in the negative 2.01 effect on Gross Private Domestic Investment. Were you expecting a positive change in the change?

I think we need to do all of this in terms of second derivatives!

In effect the second derrivatives involved are those of stocks of things, in the case of what constitute investment in the GDP accounts that would be private capital formation, housing construction, and net changes inventories. So the stocks involved are the private capital stock, the housing stock, and the stock of inventories. The first derivatives of those are what enter GDP, private capital formation, housing construction, and net changes in inventories. If we are interested in the change in GDP, then the relevant items are the derivatives of those first derivative items, the second derivatives, so the change in private capital formation, the change in residential construction, and the change in the change in inventories

So, yes, just to be clear: what is labeled “change in inventories” really should be labeled “change in change of inventories.” But, that is indeed a mouthful.

We may or may not be in a “recession” depending on how you want to define “recession”, but perhaps we can agree that we are in a “pause from positive growth”? 😉

The issue seems to be one of mixed signals.

Employment is still growing: https://www.bls.gov/ces/

Retail sales are still growing: https://tradingeconomics.com/united-states/retail-sales

Inventories, private domestic investment, and government spending are decreasing: https://www.cnbc.com/2022/07/28/gdp-q2-.html

Inflation is still on the mind of consumers and a pullback in spending may be inevitable: https://fortune.com/2021/07/22/infaltion-what-finance-ceos-are-saying/

“We’re not in recession, but it’s clear the economy’s growth is slowing,” said Mark Zandi, chief economist at Moody’s Analytics. “The economy is close to stall speed, moving forward but barely.”

Well since you are terrified that we were on an inflationary spiral, a little less growth should be greeted as good news. Oh pardon me – I just got you in trouble with Kelly Anne.

Good try at another snide remark… fail!

https://news.cgtn.com/news/2022-07-29/China-s-FDI-inflow-up-17-4-in-H1-1c3vHKzKDxC/index.html

July 29, 2022

China’s FDI inflow up 17.4% in H1

Foreign direct investment (FDI) into the Chinese mainland, in actual use, expanded 17.4 percent year on year to 723.31 billion yuan in the first half of the year, the Ministry of Commerce said Friday.

In U.S.-dollar terms, the inflow went up 21.8 percent from a year ago to $112.35 billion, according to the ministry.

China’s high-tech industries saw a rapid FDI increase of 33.6 percent in the first six months. Specifically, foreign investment in high-tech manufacturing rose 31.1 percent, while that in the high-tech service sector jumped 34.4 percent.

The service industry received 537.13 billion yuan of foreign investment in the period, up 9.2 percent from a year earlier….

https://fred.stlouisfed.org/graph/?g=lLmk

January 30, 2018

Personal consumption expenditures price index and Personal consumption expenditures less food & energy price index, 2007-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=twwl

January 30, 2018

Personal consumption expenditures price index and Personal consumption expenditures less food & energy price index, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=G5WZ

January 4, 2020

Real Average Hourly Earnings of Private Production and Nonsupervisory Workers, * 2020-2022

(Indexed to 2020)

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

https://fred.stlouisfed.org/graph/?g=G5Ya

January 4, 2020

Real Average Hourly Earnings of All Private Workers, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=QeCl

January 4, 2018

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2017-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Indexed to 2017)

Steven Kopits +1

The Field -1 (with very few exceptions)

Well done Mr. Kopits! Please keep posting here. I look forward to reading your comments.

For those readers like me who have not spent a lot of time thinking about the “change in the change” in inventory and the impact on GDP, below is a link to a blog by a former World Bank economist, Frank J. Lysy that may be useful.

https://aneconomicsense.org/2012/01/08/contribution-to-gdp-growth-of-the-change-in-inventories-econ-101/

Unfortunately, the example is easier to understand than trying to compute the real-world effect of the change in the change in inventory on GDP.

Dude, unsold inventory is the contraction. They panicked last fall at the port clog. Over raised prices as a result, then it unclogged in a Jeff Daniels fashion. Deflation is coming.

Oil and gas multinationals are not exactly hurting:

https://www.msn.com/en-us/money/markets/exxon-mobil-chevron-report-record-earnings/ar-AA106oqd?ocid=msedgdhp&pc=U531&cvid=a95a6a9d319f42c2a3fe5ff17d46821c

July 29 (UPI) — Exxon Mobil and Chevron reported record profits in the second quarter that shattered industry estimates, resulting in soaring stock prices Friday as futures for U.S. crude oil spiked nearly 3%. Exxon Mobil Corp. posted $17.9 billion in earnings in the second quarter while Chevron reported earnings of $11.6 billion during the same three-month period, more than tripling last year’s second-quarter earnings of $4.7 and $3.08 billion respectively. The news comes a day after Shell Corporation announced $11.5 billion in second-quarter earnings, aided by high prices for gasoline and natural gas, which have both been affected by Russia’s war in Ukraine.

But Chuck Grassley says if they have to pay taxes, we will have a recession. He needs to retire as his brain has left the building.

OK I am in a bad mood as I’m writing on how Rio Tinto lost a transfer price case in Australia. Three cheers for the tax authorities. Rio’s CFO is bitching about paying $8 billion in worldwide profits which of course exceeded $30 billion last year. Wuss.

Omicron vaccine to be in your neighborhood soon:

https://www.cbsnews.com/boston/news/moderna-omicron-covid-19-vaccine-66-million-doses-booster-shots/

The Biden administration said Friday it has reached an agreement with Moderna to buy 66 million doses of the company’s next generation of COVID-19 vaccine that targets the highly transmissible omicron variant, enough supply this winter for all who want the upgraded booster. The order of the bivalent shot follows the announcement last month that the federal government had secured 105 million doses of a similar vaccine from rival drugmaker Pfizer. Both orders are scheduled for delivery in the fall and winter, assuming regulators sign off on their effectiveness. The Pentagon said the Moderna contract was worth $1.74 billion.

Just let me know when I can get this vaccine!

Eurozone inflation reported at 8.9%. OK, get ready for the blame Biden crowd. After all – he did put NATO back together after Trump trashed it.

Profits are up for many companies. The press keeps telling us compensation is also way up but Kevin Drum keeps us honest:

https://jabberwocking.com/worker-pay-and-benefits-are-falling/

Since the beginning of 2021, ECI has risen 6% while inflation has gone up 11%. Employers are paying their workers less, and compensation certainly hasn’t been keeping pressure on inflation. Just the opposite. For the record, real ECI was down a whopping 4.6% last quarter on an annualized basis. Keep this in mind if you’re wondering how corporate earnings can be so strong when we’re supposedly heading into a recession.

Also keep this in mind when Republicans like Grassley say we cannot raise taxes on the rich.

https://www.nytimes.com/2022/07/29/opinion/wages-inflation-workers-prices.html

July 29, 2022

Wonking Out: Much Ado About Wages

By Paul Krugman

At one level, the wages and salaries employers pay their workers are just another price — in this case, the price you pay for the use of someone’s time and effort. If I were a Marxist (which, by the way, I am very much not), I’d say that in a capitalist system, employment becomes commodified, a purely monetary transaction rather than a human relationship.

But employment is, in fact, a human relationship, and this makes a difference even in a market economy.

You can see this difference in the numbers, by comparing the behavior of wages over time with those of goods everyone agrees are commodities. Here’s the movement since 2002 of two prices, of oil and of U.S. labor, as measured by the Employment Cost Index (more on that shortly):

https://static01.nyt.com/images/2022/07/29/opinion/krugman290722_1/krugman290722_1-jumbo.png?quality=75&auto=webp

Workers aren’t a commodity.

Oil prices have alternately plunged and soared, depending on demand and supply conditions in the global market. Wages haven’t; they’ve grown continuously, although the rate of growth has varied a bit. Why the difference?

Bear in mind that there were two episodes of mass unemployment over that stretch, after the 2008 financial crisis and during the Covid pandemic. Post-2008, in particular, unemployment benefits were quite limited, and many Americans were desperate for work. Why didn’t employers take advantage of this desperation by demanding that workers accept big pay cuts? After all, there were plenty of other workers who would be eager to take their jobs if they refused.

Well, in 1999 the Yale economist Truman Bewley published a book on this topic, “Why Wages Don’t Fall During a Recession.” Unusually for an economist, he tried to answer the question by actually talking to people — specifically employers, who seemingly could have demanded givebacks from their workers during the 1990-91 recession and the long “jobless” recovery that followed. Why didn’t they take advantage of the opportunity?

The answer, he found, came down to the fact that workers aren’t barrels of oil or bushels of soybeans….

Three brilliantly clear and persuasive essays on the current state and prospects of the economy, echoing the precisely detailed descriptions of Menzie Chinn:

https://www.nytimes.com/2022/07/29/opinion/wages-inflation-workers-prices.html

July 29, 2022

Wonking Out: Much Ado About Wages

By Paul Krugman

https://www.nytimes.com/2022/07/28/opinion/recession-inflation.html

July 28, 2022

How Goes the War on Inflation?

By Paul Krugman

https://www.nytimes.com/2022/07/26/opinion/recession-gdp-economy-nber.html

July 26, 2022

Recession: What Does It Mean?

By Paul Krugman

ltr to be given a Tik Tok account?

https://www.msn.com/en-us/money/other/a-pr-arm-of-the-chinese-government-inquired-about-starting-a-tiktok-account-to-spread-propaganda-report-says/ar-AA1074Xy?ocid=msedgdhp&pc=U531&cvid=95bc1630038646d58331befa9c4da58f

A PR arm of the Chinese government inquired about opening a TikTok account that would push pro-China propaganda, Bloomberg reported.

The account wouldn’t have identified it as affiliated with China’s government, the report said.

Leaders in the US and abroad have sounded the alarm on the app and its connections to China.

No worries as I do not do Tik Tok.

The simple economic model I use:

https://fred.stlouisfed.org/graph/?g=AuPx

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=Se7b

January 15, 2020

Shares of Potential Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

(Indexed to 2020)

— to be given a Tik Tok account?

— to be given a Tik Tok account?

— to be given a Tik Tok account?

[ A Joseph McCarthy-like way in which a bully has chosen to write. The prejudice really needs to be controlled, if not overcome. ]

If the shoe fits, don’t repeatedly put it in brackets and whine about it.

You have repeatedly refused requests from our host to desist from playing Chinese propaganda in comments. Pointedly refused. Now you grouse when other commenters point out that you’re a lackey for China’s government. Boo boo.

I am absolutely gobsmacked at the obtuseness of self-identified economist Barkley Rosser in the most basic and elementary facts of arithmetic.

Rosser claims that the statement “imports sum to zero in GDP” is a false statement.

It’s simply unbelievable.

By definition, there are no imports in GDP. The amount of imports in GDP is zero. Imports in GDP must sum to zero. Zero is zero.

If you use an accounting method that uses imports in the calculation of GDP, they must sum to zero, by definition.

This is just incredible, zero denialism. I am astonished.

Joseph,

You are “absolutelhy gobsmacked”? Have you not yet figured out that the rest of us are absolutely gobsmacked that somehow you are unable to understand what you write? It is true that imports do not directly enter into GDP. But explaining this by writing this utterly false and idiotic phrase that “imports sum to zero in GDP” does not do it. You need to explain it differently.

Again, in the Kuznets accounting equation they most certainly do not “sum to zero.” Actually, they enter as a negative number as they are subtracted, although what is being subtracted is a non-zero positive number.

Please do not waste everybody’s time by trying to justify this ridiculous formulation you have kept on repeating. We know what you are trying to say. You are just to incompetent to figure out how to say it accurately and correctly without falling into a stupid toilet, gobsmacking your own head on the way in.

Joseph,

Let me clarify further. The problem is the phrase “imports sum to zero,” which sometimes you have let stand alone, at other in conjunction with “GDP.” Alone it suggests summing over all the components of imports to get the total. That is obviously not zero. Combining it with “GDP” mostly avoids that but remains unclear. Is this net imports? Obviously not zero. As noted, summing with GDP suggests it is out there playing a role, as in the Kuznets equation, where, again, imports not zero.

The accurate statement would have made it clear that imports are not a part of domestic production, which is what GDP is. But trying to say that by using the phrase “imports sum to zero” was both misleading and inaccurate/

Does this mark a turnaround in oil prices? And eventually prices at the pump?

“Oil Prices Soar As Market Shrugs Off Recession Fears… The market cannot seem to brush off the tight supply situation that currently exists. Another bullish factor for crude oil on Friday was the Energy Information Administration’s publication of its numbers for U.S. crude oil production for May, which showed that U.S. crude oil production actually fell in May instead of rose, contrary to the EIA’s latest estimates from its Short Term Energy Outlook.”

https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Soar-As-Market-Shrugs-Off-Recession-Fears.html

Anyone want to discuss blowback from sanctions that have largely failed to accomplish their goal?

Daughter: what are sanctions, Daddy?

Father: sanctions are something that hurts Russia.

Daughter: are we Russians?

JohnH,

“blowback from sanctions”? Wow, your Putin troll game is just so blatant.

Do note that despite this headline about “Oil prices soar….” WTI is at about $98 per battel, still below $100, up from a low of about $94. This is “soaring”? You are not even a very competent troll, JohnH. This is a joke.

It seems that my view is starting to gain traction. Simon Jenkins in The Guardian:

“ A rare student of this subject is the American economic historian Nicholas Mulder, who points out that more than 30 sanctions “wars” in the past 50 years have had minimal if not counterproductive impact. They are meant to “intimidate peoples into restraining their princes”. If anything they have had the opposite effect. From Cuba to Korea, Myanmar to Iran, Venezuela to Russia, autocratic regimes have been entrenched, elites strengthened and freedoms crushed. Sanctions seem to instil stability and self-reliance on even their weakest victim. Almost all the world’s oldest dictatorships have benefited from western sanctions.”

https://www.theguardian.com/commentisfree/2022/jul/29/putin-ruble-west-sanctions-russia-europe

The only other tool in the US toolbox is war, occupation, and quagmire: Korea, Vietnam, Iraq, Afghanistan…

If you watched US foreign policy, as I have for decades, you already know this ends…yet another other pointless and futile misadventure.

Folks like Barkley have been around almost as long as I have but seem to have learned nothing…and are always ready to believe the propaganda and cheer yet another pointless and futile fiasco.

If The Guardian can now publish dissenting opinion, how long before other major media platforms join in? And then, how long before people catch on and force an end to this nonsense?

JohnH,

Excuse me, but if sanctions are not to be used against Russia for invading Ukraine, then what do you think should be done? Nothing?

You have a couple of times said you oppose the invasion. But otherwise all you have done is denounce any and all actions the US has engaged in to try to help the Ukrainians, not just sanctions, which do indeed cut both ways although the evidence is that indeed the Russian ecoomy is being hit much harder than others and is facing shortages of lots of necessary inputs for its military production, as well as the US supplying arms to Ukraine.

Is there anything you think the US or any other nation should do to help Ukraine, or should we all just sit back and say “we oppose it,” while Putin just kills thousands of civilians and conquers the entire naion? That seems to be where you are at, which looks to most of us to be utterly morally repulsive and disgusting.

Child: Daddy, did you oppose Hitler in WW II?

Daddy: No, our country also did bad things so I think did not oppose Hitler in WW II.

Child: Oh.

Oh dear, JohnH, I have wronged you with that child discussion, given that you have stated you actually oppose Putin’s invasion, even though you think the US complaining about it is worse than the invasion itself. So, here is a revised version, following up.

Child: Daddy, I keep having nightmares about gas chambers after you said you did not oppose Hitler in WW II.

Daddy: I must correct this, Child. I did oppose Hitler in WW II. But, given the awful behavior of our own nation, I more vigorously opposed supporting any effort to resist Hilter in WW II.

Child: Oh thank you, Daddy,that will certainly allow me to sleep better.

Now here is a brilliant “new” concept. If you want to reduce numbers of abortions, you have to make the alternatives to having an abortion more possible.

https://www.nytimes.com/2022/07/30/world/europe/poland-abortion-ban-single-mothers.html

Poland instituted an abortion ban almost 30 years ago and that didn’t reduce the numbers of abortions – just drove them underground. Those who felt they had no alternatives to ending the pregnancy either took care of it at home with illegal pills or traveled to a more civilized place that could help them (are you listening Texas?). Even a hard core Catholic priest found that the only way to make a difference was to set up systems that help a woman taking care of a child she otherwise would not be able to raise.

Perhaps the best comment on this issue to date. Thanks for that!

https://markets.businessinsider.com/news/stocks/stock-market-outlook-fed-less-behind-inflation-curve-investors-think-2022-6#:~:text=There%20are%20growing%20signs%20that%20the%20Federal%20Reserve,chain%20%28including%20food%29%20for%20secular%20inflation%2C%22%20Lee%20said.

Who is Fundstrat’s Tom Lee? Do anyone think he has certain insights? He is making some rosy predictions such as low inflation next year and a strong stock market.

Now I would love to suggest the RECESSION cheerleaders have no clue what they are babbling about (they don’t) but I’m not as eager to jump on some CNBC bandwagon as they seem to be.

https://www.youtube.com/watch?v=7qBZEmkdIFE