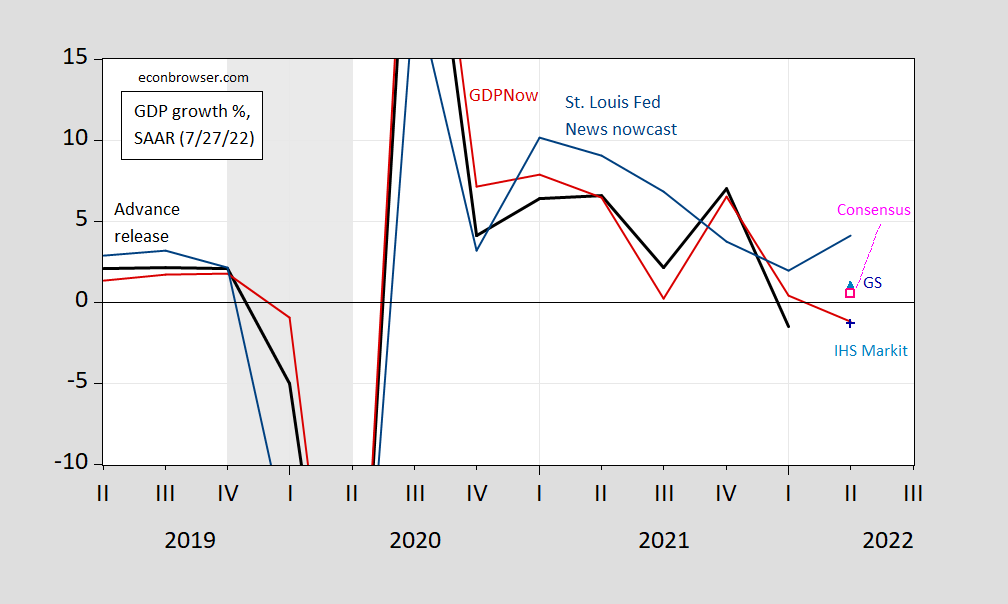

These pertain to advance release numbers coming out tomorrow, recalling that they will be revised two times before end-September, as new data comes in. A slight change in views since 5 days ago.

Figure 1: Actual advance GDP growth rate (black), Atlanta Fed GDPNow for 7/27 (red line), St. Louis Fed News index for 7/22 (teal line), IHS Markit for 7/27 (sky blue triangle), Goldman Sachs for 7/27 (blue +), Bloomberg consensus as of 7/27 (pink open square), all in %, NBER defined peak-to-trough recession dates shaded gray. SAAR. Source: BEA via ALFRED, Atlanta Fed, St. Louis Fed via FRED, IHS-Markit, Goldman Sachs, Bloomberg, and NBER.

Since last post on 7/22, GDPNow has moved up from -1.6% on 7/19 to -1.2% on 7/27. IHS Markit is up from -2% to -1.2%. Goldman Sachs has moved up from +0.5% to +1%. Bloomberg consensus as of this morning was +0.5% (all growth rates Q/Q SAAR).

Bloomberg correctly states, based on Bloomberg consensus, “US Economy Seen Narrowly Averting Back-to-Back Contractions” (rather than “recession”, since NBER could still determine a recession started, depending on what other indicators show).

Someone gets Mike Pence:

https://www.msn.com/en-us/news/politics/pence-has-erect-posture-but-flaccid-conscience-says-ex-trump-official/ar-AA101DqB?ocid=msedgdhp&pc=U531&cvid=3e0a89b03ddd4366aaf66ea51128380c

Speaking on CNN, Miles Taylor said: “If you want to know what the Mike Pence vice-presidency was like, Mike Pence is a guy with an erect posture and flaccid conscience. He stood up tall but he did not stand up to Donald Trump.”

Taylor is a ultra maga

https://news.cgtn.com/news/2022-07-27/China-pledges-to-develop-renewables-amid-global-energy-shock-1c0VIohDdD2/index.html

July 27, 2022

China pledges to further develop renewable energy amid global energy shock

China will continue increasing the proportion of non-fossil electricity consumption despite the current global energy shock, as the country marches closer toward its carbon neutrality goals, officials said on Wednesday.

Zhang Jianhua, head of National Energy Administration (NEA), said China’s ongoing development of non-fossil energy was unabated by the tight global energy supply last year, even when a number of European countries had restarted their coal-fired power plants.

The proportion of coal consumption in the country dropped from 65.8 percent in 2014 to 56 percent in 2021. The average annual decline of 1.4 percentage points was the fastest in history, said Zhang.

He added that the proportion of clean-energy consumption rose from 16.9 percent to 25.5 percent over the same period, accounting for more than 60 percent of the increase in total energy consumption.

“From now to 2030, we anticipate the proportion of non-fossil energy consumption to keep growing at an average rate of 1 percentage point per year, and we are able and confident to attain the goal of carbon dioxide emissions peak by 2030,” said Zhang.

China has set a goal of peaking carbon dioxide emissions by 2030 and achieving carbon neutrality by 2060.

The country is on track to gradually reduce the consumption of fossil fuels while ensuring energy security, said Zhang….

while licensing new coal gen plants

and going back to oz for coal

“Goldman Sachs has moved up from +0.5% to +1%.”

Now Stevie using all of his macho bravado tried to pin me down to some claim that GS was the gold standard (something I have never said) but that is when this fishing fool thought GS was forecasting a recession. I guess this news means he will go back to calling GS a bunch of incompetents. After all Stevie’s entire reason for living rides on us having a recession in Q2 so he can go all MACHO MACHO MAN.

why do you suppose fed stayed w/.75?

1) Consistency – making 75 bps the regular “big” hike means less market volatility.

2) A hike that is 25 bps larger or smaller at any given meeting makes little difference other than as a signaling device. Notice the reaction in money market futures to today’s signal.

3) Dollar appreciation, asset price decline and mortgage rate rise have all been rapid this year. Those rapid changes amount to stress in financial markets, and the Fed avoids excess market stress when possible. See points 1 and 2 above.

Maybe other stuff, too, but that’s all that comes immediately to mind.