With the Republicans in the House maximizing policy uncertainty, I think it useful to recount some of the recent research on how uncertainty is affecting output. In particular, I want to go beyond the talking point which asserts that regulatory uncertainty is depressing output (data free analysis here), given that we know empirical results asserting the level of regulation depresses output are not robust [1].

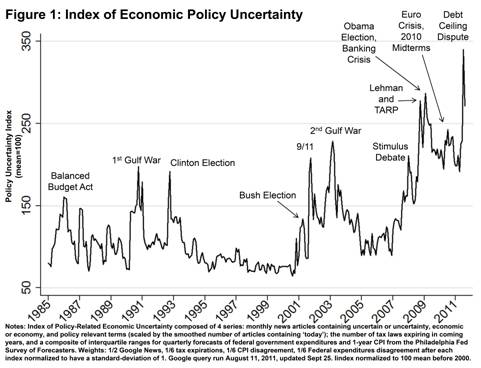

One of the recent papers attempting to measure policy uncertainty is Baker, Bloom and Davis (2011), who develop an index of economic policy uncertainty, shown below:

The authors:

“… construct an index from three types of underlying components. One component quantifies newspaper coverage of policy-related economic uncertainty. A second component reflects the number of federal tax code provisions set to expire in future years. The third component uses disagreement among economic forecasters as a proxy for uncertainty.”

So when the authors find a large impact of uncertainty on output, it is important to note that it is primarily macro policy uncertainty, such as uncertainty regarding tax measure expirations.

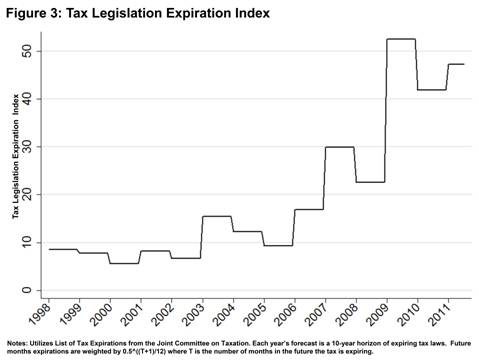

Figure 3 from Baker, Bloom and Davis (2011).

The finding that macro and macro policy uncertainty seems to dominate in terms affecting output leads to the question of channels. Treasury Assistant Secretary Jan Eberly argues that deficient demand is the main reason why unemployment is high; I find her arguments persuasive.

…

If regulatory uncertainty was a major impediment to hiring right now, we would expect to see indications of this in one or more of the following: business profits; trends in the workforce, capacity utilization, and business investment; differences between industries undergoing significant regulatory changes and those that are not; differences between the United States and other countries that are not undergoing the same changes; or surveys of business owners and economists. As discussed in a detailed review of the evidence below, none of these data support the claim that regulatory uncertainty is holding back hiring.

Business Profits

If regulation was a significant drag on business today, we would expect to see profits constrained after recent regulatory reforms were passed into law. However, corporate profits as a share of gross domestic income have about recovered their pre-recession peak, and earnings per share in industries most affected by recent regulatory changes, such as energy and health care, have among the highest earnings per share of those in the S&P 500. This growth is inconsistent with a corporate sector held back by regulation.

Trends in Workforce, Capacity Utilization, and Business Investment

If regulatory uncertainty was the primary problem facing businesses, firms would prefer to use their existing capacity and current workers as much as possible, while avoiding building additional capacity until they are more certain about the contours of future regulation.

Specifically, if demand was strong but businesses were concerned about future regulations, they would increase the hours of the workers they already employ rather than hiring additional workers. We have seen no evidence of this in the data: the average work week for private employees has been roughly flat for the past year. Similarly, if demand were strong, firms could easily expand using existing capacity without taking on the cost and risk of added capacity. However, the share of total potential industrial output in use remains 3 percent below its long-run average. Low capacity utilization is inconsistent with concerns about future regulatory risk, but aligns with weak demand holding back current production.

At the same time, business investment has led economic growth over the last few years. Since the end of the first quarter of 2009, real investment in equipment and software has grown by 26 percent – about five times as fast as the economy as a whole. However, businesses would not increase investment if they thought that future regulation posed a threat to their ability to operate profitably.

Financial Indicators

If regulatory uncertainty were having a significant impact on business performance, we would expect this to be reflected in capital markets. However, financial indicators do not provide any evidence in favor of this hypothesis.

As shown in the chart below, corporate bond yields are low across a range of industries, suggesting that firms in industries facing greater regulatory risk, such as insurance and energy, are not being priced out of the market.

…

However, it is possible that macro policy uncertainty itself reduces aggregate demand; in Uncertainty Shocks in a Model of Effective Demand Susanto Basu and Brent Bundick of Boston College write:

This paper examines the role of uncertainty shocks in a one-sector, representative-agent dynamic stochastic general-equilibrium model. When prices are flexible, uncertainty shocks are not capable of producing business-cycle comovements among key macro variables. With countercyclical markups through sticky prices, however, uncertainty shocks can generate fluctuations that are consistent with business cycles. Monetary policy usually plays a key role in offsetting the negative impact of uncertainty shocks. If the central bank is constrained by the zero lower bound, then monetary policy can no longer perform its usual stabilizing function and higher uncertainty has even more negative effects on the economy. Calibrating the size of uncertainty shocks using fluctuations in the VIX, we find that increased uncertainty about the future may indeed have played a significant role in worsening the Great Recession, which is consistent with statements by policymakers, economists, and the financial press.

For me, the policy conclusion emanating from all three of these pieces is that if there is important policy uncertainty, it is that related to fiscal policy. Empirical (i.e., econometric) evidence that regulatory uncertainty is important is, to my knowledge, non-existent. Hence, we can conclude that repeated crises over the raising of debt ceilings, continuing resolutions, and the like should be avoided.

Why did Obama strangle Simpson-Bowles in its crib?

That would have moved us toward both fiscal sustainability and policy certainty.

All Obama has to say is “20%”, and we’re moving briskly away from fiscal uncertainty.

If regulatory uncertainty was the primary problem facing businesses, firms would prefer to use their existing capacity and current workers as much as possible, while avoiding building additional capacity until they are more certain about the contours of future regulation.

Yes. During the Obamacare debates I made exactly the same point in an exchange with CoRev. With interest rates near zero the opportunity cost of ramping up production prior to regulations going into effect is very low. If a business genuinely believes imminent regulations will hamper production and competitiveness, then that is an argument for ramping up production today. Many conservatives who imagine themselves as having exceptional business acumen (think Mitt Romney) don’t seem to get this basic inter-termporal trade-off.

I am having trouble with the conclusions of this paper. Business profits are strong due to productivity increases and a week dollar. A lot of those profits are due to overseas units and not necessarily robustness in the US market. Remember too that businesses must invest capital in the short term to reap profits later. The profitability of corporate America is due to technology investments in the 2000’s that are paying off now.

So drops in aggregate demand might suggest a lack of investment in companies. Companies invest in CapEx as well as employees since new employees take a year to pay for themselves. Therefore the data presented above in my view does not disprove the belief that regulation or the fear of regulation is strangling investment and hiring.

A very interesting paper. Looks like a very credible effort to quantify what usually sounds like right-wing praddle, and shows that uncertainty does negatively impact the economy. Take a look at the decomposed index in Table 1, which shows what is driving the policy-related component of the index: monetary policy and taxes. Regulations of various sorts have little contribution to the current elevated level of the index.

Steve: resolving policy-related uncertainty will require a lot more than a statement from the President. I am sure you are a talented energy analyst, but your comment reveals more than a little ignorance about how our government works.

I find it very strange that, while regional Fed presidents (such as Richard Fisher in Dallas) have been emphasizing the role of uncertainty in limiting recent growth, the empirical evidence of such an effect seems to have been lacking up to now. It is almost as if they did not have a research staff, or a responsibility to critically analyze such economic arguments.

Doesn’t the Baker, Bloom and Davis paper have a causality problem?

We know that output growth is much more volatile in recessions than in expansions. Similarly, output forecasts are more uncertain as the probability of a recession increases. If recessions are predictable, I’d expect measures of forecast uncertainty to correlate with reduced future growth even if there is no causal link here.

Now, Baker, Bloom and Davis try to avoid this by focusing on what they call “policy uncertainty.” Their Tax Legislation Expiry Index sounds like a nice way around that problem. However, I worry that they’re combining it with three other measures that aren’t immune to that problem. (Worse: their base case index gives that legislation index a weight of 1/6.) Two of the three other components are forecast uncertainty; I worry they’ll suffer from the reverse causality problem I mentioned above. The third is a google news search that mentions the term ‘uncertainty’ or ‘uncertain’ plus the terms ‘economic’ or

‘economy’ near words like “policy”, “tax” or “deficit”. Again, when recession fears rise, we may see more stories about how those fears create economic uncertainty and the impact of a potential recession on taxes, deficits, etc.

Is it just me, or is there a problem here?

Actually we have data on both domestic and foreign profits and domestic profits are growing at all time record rates.

For example after tax domestic profits economic profits per unit of real nonfinancial output are now at 127 (SA $)as compared to the last cyclical peak of 100 in 2006.

The next time you quote some right wing talking point maybe you should check if it has any basis in reality.

Spencer we are trying to have a mature, intelligent discussion about the paper. If you disagree fine but please stop with the right wing/left wing garbage. Can we have an intelligent discussion economics discussion please?

Having said that growth and profits are not the same thing. Clearly corporations are cashing in their technology investments and sending folks home. Productivity for those surviving workers is now through the roof and profits with it. That was prudent management expecting a long, deep recession on the part of US corporations. However profits don’t mean growth Steve. You can cut costs to achieve profits but growth requires CapEx and people.

And of course the small business survey shows no increase in the percentage complaining about regulations or taxes, but a huge increase in complaints about demand.

A good example of uncertainty is the light bulb case. Knowing the rules would change meant companies invested. Now they have uncertainty caused by the rules being postponed. To focus only on the uncertainty issue and not the point that the rules helped domestic producers compete against Asian companies, to the extent there is a “war” against regulation that means companies face increased risk in capital investment. Why buy new, better equipment if the promise is regulations will be changed to make that equipment less valuable to the business you expect under the regulations? The point is simple: uncertainty occurs when threats to the status quo occur. These can be bad or good but in bad times when demand is horrid the effect is to delay investment.

The Baker, Bloom, Davis paper is one of the seminal papers of the decade. The Google subcomponent index taps into the informational content of the internet quantifying the regulatory burden impact on GDP like nothing hitherto. The salient point of the paper is the drop in in GDP growth consequent upon regulatory and other uncertainty this past 3 years. Using the Google subcomponent (data available from link in paper) to compare the level of policy uncertainty in the 1985-1995 decade to the level this past 3 years, a simple regression of this variable on real GDP growth finds growth (not level) 2.3% lower during the Obama administration (my work not that of the paper). Level under Obama: 225. Level in 1985-95: 56. Movement from lower level to higher level is impeding GDP growth by 2.3% points annually. This simple regression result is clearly biased by omitted variables, etc. etc. Yet it is first-step clear and evident econometric evidence of how this administration is impeding the growth of the economy. Note that only a portion is due to the Republican House that had no power until the final year of the data.

“Why did Obama strangle Simpson-Bowles in its crib?”

It included revenue increases. It had no chance of passing the GOP House.

Steve

Doesn’t the graph give the impression the banking crisis happened at the same time Obama took office??? In fact the crisis happened roughly one month before (and obviously some would say 2007). I guess you would say “that’s obvious” but people don’t remember these dates as accurately as you might think and even for those who pay attention well things start to blur.

People have already forgotten Paul Ryan’s (and many other Republicans) attempts to kill Medicare and Medicaid for the younger generations, and that was just 8 months ago. I would venture to say most toothless people carrying a poster with our nation’s Pres and Hitler mustache accessory would tell you the events (his election and the bank crisis) happened simultaneously. I don’t think the labeling of the graph helps much.

A sure conclusion when reading the model s outcomes

they do not deny a general malaise.

Tempting to enrich the prospective with more trivial figures such as military spending growth by country,to add a reserve on the financial sector peaceful reading (see the CP growth and trend,see the build up of financial debts vs commercial industrial debts)

More mundane,it is tempting to include a tracker,the financial world is found of them.

The double men trackers and professional track records.

May be, there are educative patterns to be read on historical perspective.Among few,but much more if one wishes to look.

Bloomberg

Bini Smaghi Says ECB Shouldn’t Shirk From QE If Deflation Becomes a Danger.

King Says Crisis Threatens Europe’s Economy as Stability Outlook Worsens.

To those of you who want to blame “regulation” for depressed growth, you are not reading the BBD paper very closely. Their evidence clearly shows that the current level of economic uncertainty is largely the result of uncertainty about taxation and macroeconomic policy (see Table 1). All of the regulation-related components of the index have little contribution to the current elevated level of the index.

Why uncertainty about taxation? The paper points out that we currently have an unusually high number of temporary tax provisions that continue to be extended for short periods of time. Our inability to come to an agreement to let these expire, or extend them for longer periods, or make them permanent, I think is driving the uncertainty around taxation. Our elected leaders–both the president and congress–are unable to strike a grand bargain to eliminate this source of uncertainty.

Why uncertainty about macroeconomic policy? Given some of the unprecedented actions of the Fed over the last several years, necessitated by the financial crisis, it is now more difficult to see how macroeconomic policy will evolve over the next few years to unwind the actions of the past few. Maybe the Fed needs to shed more light on its intended actions to bring its balance sheet back in line with historical norms.

MarkOhio –

If you read my comments, you’ll know I think in terms of a Three Ideology Model. This model suggests there are three durable objective functions–ideologies–each of which can be optimized with the tools of economics. The ideologies can also be treated as a portfolio, and we can think about trading off one against the other.

Now, when Obama calls for taxes on the wealthy, he is making a purely egalitarian argument. As you may recall, I have contended that the egalitarians are not on the median voter boundary. This tends to make Obama seem out of touch and irrelevant–that’s my read on him in recent times.

The notion of a 20% cap of Federal spending is liberal (libertarian, if you must). It’s about fiscal responsibility and implicitly acknowledges property rights–something which egalitarians are loath to do by definition. It says to the taxpayer, “We want you to pay, but if we ask now, we won’t ask for more later.” This is a critical element of legitimacy in asking for higher taxes from the taxpaying class.

I have stated earlier that I believe the fiscal conservatives are on the median voter boundary on the left. Thus, by moving to a liberal (libertarian) argument, Obama moves to the median voter boundary, a position from which it’s possible to drive policy. So the key to relevance for Obama is to make a liberal, not egalitarian, case. With that, he can exercise leadership.

Now, you may argue that I do not spend my days in the political arena, which is true enough. You may further argue that the Three Ideology Model is not recognized in academia, and that it up-ends how ideologies are treated in academic economics. This is also true.

But the Three Ideology Model combined with principal-agent theory is a hugely powerful tool for understanding the world. I use it literally every day and it makes diagnosing certain problems in political economy very simple.

So, in my opinion–based on the analytical tools that have proved useful to me in the past–the key to gaining the high ground for Obama is moving to an explicitly liberal (fiscally conservative) posture that acknowledges the property rights of independent voters. With that, he will have the ideological pre-requisites for achieving a deal. Without it, stalemate and unresolved confrontation are more likely.

JBH: it might be a bit early in the decade to declare a paper among the most seminal, but the results you report are potentially interesting. To understand them better, could you please explain how the Google index is calculated for the 1985-95 decade? (I thought Google’s founders were still in high school back then.)

Bankers are complaining about regulations. But the biggest “uncertainty” threat is the failure to limit their leverage and to demand greater transparency in their balance sheet reporting. Goldman with an estimated 20% change of failure? (See cite below.) The failure to demand payment for the insurance provided to the TBTF’s is simply outrageous.

http://www.bloomberg.com/news/2011-12-22/bankers-complaint-of-uncertainty-obscures-reluctant-disclosure.html

Steven Kopits: The call for higher taxes on the wealthy is not based on a purely egalitarian argument. For example, the 2010 Nobel Laureate in Economics recently argued for quite high top marginal tax rates (and for capital taxes) purely on the grounds of economic efficiency. You might find his arguments interesting.

http://pubs.aeaweb.org/doi/pdfplus/10.1257/jep.25.4.165

However, different business people in many different forums have complained about the uncertainty generated by polices in this administration. So they are lying?

Are they ALL republicans trying to bad mouth the President? I have trouble believing that.

Regulation uncertainty cuts a number of ways. When Cap and Trade was a certainty, there was a rush to be first in line with a low carbon footprint [I’ll skip excessive quotes here]. Then Cap and Trade became uncertain and dead. There was less of a rush, but still movement in the low carbon footprint direction because the EPA picked up the regulatory banner dropped by C&T. But now the news of manipulation and rigging of loans [policy driven by an administration desperate for a win in the alternative energy/low carbon footprint arena] has begun a new round of uncertainty.

Nothing is done in a vacuum… either in the marketplace or in Washington. Attempting to pinpoint the effect of regulations [except perhaps in the area of cost to the consumer] is a shell game. No wonder you are having a hard time finding the little ball.

More regulations –> higher consumer costs –> reduced demand –> lower profits –> cost reductions –> higher efficiency –> higher profits –> more regulations. A fine recipe for economic growth.

Anonymous: Google searches traditional news media by date, the newly invented shovel digging up prehistoric archived bones. See the paper, p. 4. As for this paper being seminal, it is a matter of two things. Reading enough of the greats in their original to get the texture of seminal. And cultivating thinking about a field, in this case economics, in the Mendeleevian sense of there being gaps for economic elements not yet discovered.

Steve Kopits:

I think your appeal to the median voter theorem sounds right. I have worked in government my whole career, and maximizing the chance of (re)election is the objective function that is optimized by elected officials and their challengers. And given our winner-take-all electoral system, appealing to the median voter is the way to maximize your chances of (re)election.

Presidential candidates have to do that for the NATIONAL median voter. Congressional candidates do that for their DISTRICT median voter. The two medians can be very different, thus the deep divide in our current national government. A fairly large chunk of Congress is appealing to a median voter that hates the president for being the first non-white male to be elected president. Appealing to this median voter requires such representatives to avoid compromising with the president on anything.

You may recall that Speaker Boehner and the President had reached a grand bargain on fiscal policy during the debt ceiling debate, only to have that scuttled by the Southern Republicans who must not appear to compromise with the President. So the President is not the barrier to more certain fiscal policy, it is the Southern Republicans.

MarkOhio

Do you offer any evidence that Republicans oppose major portions of the President’s agenda because he is a “non-white”? Is there any polling, statistical data, or policy paper you can refer to to support your assertion?

Is it possible, just possible that Republicans oppose they President’s policies because they think they are bad for the economy and the country?

Martin:

I don’t have the evidence you seek. But outrageous claims that the President is a socialist, an Islamic radical, or the anti-christ have nothing to do with his policies. These claims are not made by Republicans in general, but a specific segment of the party that tends to represent conservative southern congressional districts. And the President has shown a willingness and ability to compromise with more reasonable Republicans (e.g., Speaker Boehner). Such compromises seem to be invariably scuttled by the same southern Rs that also spew a lot of anti-Obama lies. So you can’t say these Rs are opposing the President’s policies, as their opposition is to any compromise with the President negotiated by the leaders of their own party. Such opposition persists even when it threatens the financial ratings of the nation. What can explain such seemingly irrational political behavior? I think the simplest explanation is an appeal to a racist median voter. Maybe you have another more reasonable explanation. Please share.

MarkOhio asks: “What can explain such seemingly irrational political behavior? I think the simplest explanation is an appeal to a racist median voter. Maybe you have another more reasonable explanation. Please share.”

After stating: “I don’t have the evidence you seek. But outrageous claims…”. Then Mark goes on to make another set of unsupported outrageous claims.

I would not presume to try to answer questions from the sort of mind that makes such ignorant and unsupported generalized and outrageous political statements.

I sit on several boards. Whether managing a manufacturing company in the mid-west or an alternative energy porject financing company, I can assure you that uncertainty is the sine qua non of management. Without uncertainty, there would be no need for management. Additionally, board members may be held peronally liable for decisions they make which do not account for all humanly available risks. I am not a good economist as I find it hard to measure, much less believe in an index of uncertainty. However, I have observed that when uncertainty hits a high level boards freeze. (One cannot be held liable for refusing to make a decision to invest when one has too many unanwered questions). I have not observed that simply economic uncertainty or simply regulatory uncertainty (subject of prior econobrowser article) freezes boards. I do believe on only anecdotal evidence that the combination has a multiplier effect. There is a point where too many uncertain variables prevents managers from making a reasonable business judgment. As that is the standard to which we are held, we have no choice but to vote “no.” Since I serve in several different industries, I see many sources of uncertainties that effect one business but not the other. The one uncertainty that effects all is the tax code. In my opinion an overhaul of the tax code–up, down, or neutral–would largely neutralize much of the uncertainty as it would allow five year planning. Managers can plan around problems, but cannot plan around vacillation.

I have to agree that my claims of racism against the President cannot be supported by evidence. But I still feel the unwillingness of some Rs to compromise is driven, in large part, by racist reaction to the first non-white president. I don’t mean to say that all who disagree with the president are racist. I do believe, however, that some in congress elected largely from rural southern districts, represent constituents who are very resentful of Obama’s election, and would punish any elected representative who showed a willingness to compromise with the president. Thus, the inability to reach a compromise on almost anything, despite the president’s and other representatives’ efforts.

I have spent part of my day trying to find some suggestive evidence in polling data, specifically geographic and party-differences in approval ratings available on the Gallup site.

See presidential approval by state here: http://www.gallup.com/poll/148874/obama-job-approval-higher-states.aspx

The most extreme disapproval does not occur in the South, as might be consistent with my claims. Instead, it appears strongest in Rocky Mountain West, although a number of Southern states are represented. But Obama also fares OK in other Southern states. Bottom line: geographic variations do not support my narrative.

Differences in approval ratings by political party might also be suggestive. If the differential in approval between the president’s party and the opposing party are much larger for Obama than other past presidents, this may be suggestive of racism. To investigate, I look at approval by party since Truman near the end of the 3rd year in office. Data is here: http://www.gallup.com/poll/124922/Presidential-Approval-Center.aspx

Truman Jan1952: 42% D approval vs 5% R approval=37% difference

Eisenhower Dec1955: 91% R vs 61% D = 30% difference

JFK Oct1963: 77% D vs 30% R = 47% difference

LBJ Dec1967: 62% D vs 30% R = 32% difference

Nixon Dec1971: 84% R vs 35% D = 49% difference

Ford Jan1976: 66% R vs 35% D = 31% difference

Carter Jan1980: 65% D vs 40% R = 25% difference

Reagan Dec1983: 83% R vs 33% D = 50% difference

Bush I Dec1991: 75% R vs 30% D = 45% difference

Clinton Dec1995: 81% D vs 18% R = 63% difference

Bush II Dec2003: 88% R vs 22% D = 66% difference

Obama Dec2011: 80% D vs 10% R = 70% difference

Although President Obama has the biggest difference in approval recorded for a president nearing the end of their third year in office, the difference is not that much larger than seen for both Clinton and Bush II. This evidence may simply show growing polarization, regardless of race. On the other hand, the lowest approval among Rs of any president since Truman may be suggestive of some kind of racism, at least among some of the electorate.

Looking for academic studies, the evidence for racially motivated resistance to the President is mixed. Here are some links to studies I found through Google Scholar:

http://www.psych.udel.edu/pdfs/publications/Hehman_Gaertner__Dovidio_2011.pdf

http://pol-sci.uga.edu/courses/2010/bullock2010_reading1.pdf

http://www.princeton.edu/~amas/papers/Mas_Moretti_AEA.pdf

http://www.cerium.ca/IMG/pdf/lewis-beck-tien-nadeau.pdf

MarkOhio I appreciate the intellectual honesty to test one’s beliefs against the evidence. I admit that I find the “uncertainty” argument compelling but have found no compelling evidence to support it other than the anecdotal comments by various CEOs and business leaders.

However I still have trouble with the idea that members of Congress would resist the President’s policies based on race. Whether you support the president or not there are reasonable arguments to be made against the president’s economic and domestic policies.

Members of Congress are not elected to support or defeat the President they are elected to craft and vote for legislation they feel improves the lives of their constituents. If they feel a bill does not they should vote against it.

MarkO, my mission is near to completion. After extensive research, you find little evidence of your conviction, but continue with your belief/idea. “I have to agree that my claims of racism against the President cannot be supported by evidence.” So finding no support you shift attention to: ” But the unwillingness of some Rs to compromise is driven, in large part, by racist reaction to the first non-white president.”

From your own comments I can only assume that you are predisposed to these false beliefs, and no level of evidence will change your mind.

That’s sad.