Reader rtd writes: “…it is virtually guaranteed that after a nation’s business cycle trough, that same nation’s employment growth will display an upward trend”, but when asked about the euro area, argues “The Eurozone is a conglomerate of nations with varying fiscal policies, ideologies, cultures, and the list goes on and on. Please don’t compare apples with hand grenades.”

So here is the case where employment does not rise relative to trough.

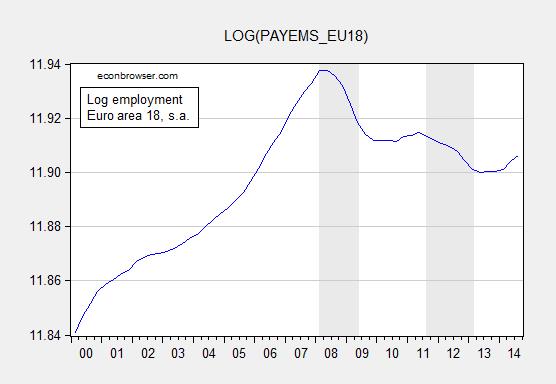

Figure 1: Log employment in euro area 18 (fixed composition), seasonally adjusted. CEPR defined recession dates shaded gray; end date for second recession is from OECD. Source: ECB, CEPR, OECD via FRED, and author’s calculations.

Inspection of US data indicates that employment falls for some time after the trough in the last three recoveries. That’s where the term “jobless recoveries” comes from.

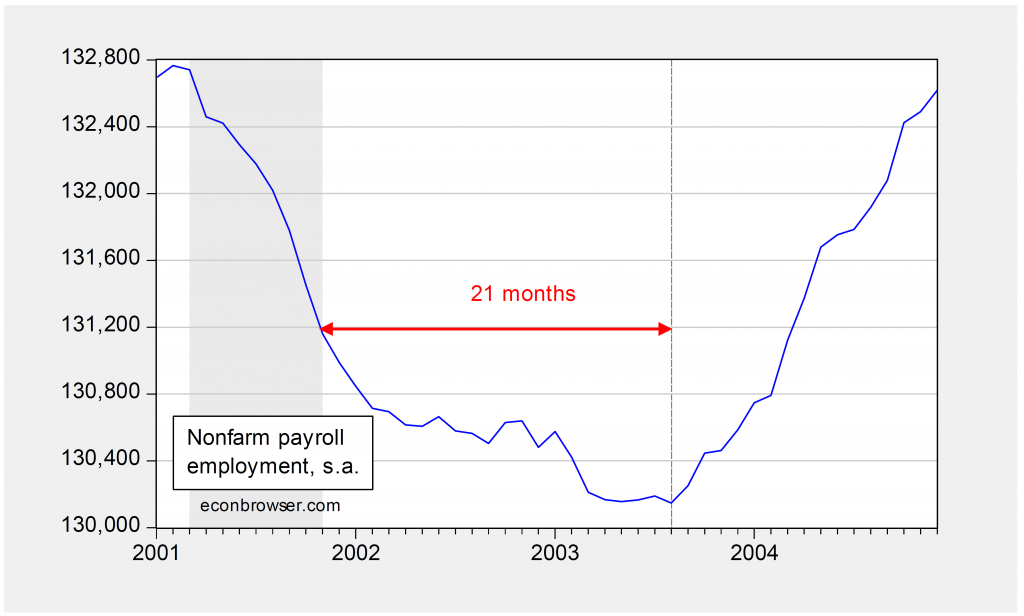

Update, 9pm Pacific: Here is a close-up on US employment trends after the 2001M11 trough.

Figure 2: Nonfarm payroll employment, thousands, s.a., (blue). NBER defined recession dates shaded gray. Dashed line at employment trough. Red arrow indicates the 21 months between trough and increase in employment. Source: BLS and NBER.

Menzie,

Despite claiming I was going to focus on posts from (the objective, non-partisan, and rational) Dr. Hamilton going forward, I suppose, since you’ve called me out I’m obliged to respond.

Some important points:

1) Please go back to the conversation and include the omitted sentence which immediately preceded the quote you’ve provided in this post: “Paul, you’re taking Menzie’s approach assuming all else is equal.” This comment intended to reference, among other things, the differences in comparing a nation (e.g.: the US) with independent $policy with that of the Eurozone where a single $policy is applied to nations with, as stated, “varying fiscal policies, ideologies, cultures, and the list goes on and on”.

2) Please go back to the conversation and include my comment which immediately succeeded the quote you’ve provided in this post : “Okay, so we’re going to ignore the differences in $policy now?” This comment was intended to reference the differences in comparing a nation (e.g.: the US) with an independent $policy with that of the Eurozone where a single $policy is applied to nations (plural) with, as stated, “varying fiscal policies, ideologies, cultures, and the list goes on and on”.

3) I know where the term “jobless recoveries” comes from. There’s a difference in saying “Inspection of US data indicates that employment falls for some time after the trough in the last three recoveries” versus comparing presidential administrations which last years at a time for the US. Post the same graph for the US and you will see employment increase after BC troughs, there is no denying this. My point, which should be clear is that it’s disingenuous to simply compare Bush vs Obama job gains when Obama entered office during the middle of a historic recession and Bush entered office when job gains were peaking pre-NBER recession, not to mention the differences in $policy and other factors.

4) You creating this post so clearly vindicates nearly every word that I typed in the previous blog post.

Thank you.

rtd: Hah, if you say so. You said it was a virtually guaranteed that employment rose; all I am doing is documenting that that is not so.

So, we can’t compare relative to troughs or to peaks because, after all, policies differ? I think that is the logical conclusion of all your text.

Thanks again!!!

But your “documenting” is disingenuous as I mentioned $policy numerous times, even in the exact same replies and adjacent replies.

The logical conclusion of all my text is that, as stated numerous times, it is sloppy and partisan for a trained and well-respected economist to have a blog post simply comparing employment growth between two administrations that almost couldn’t have been more different in the baseline/beginning. IMO it’s preying on the innumerate & economically illiterate. It’s important to me that you, as someone who is clearly not innumerate & economically illiterate (also, I’m not claiming to be an expert in either area), uphold these important values as some others (e.g.: your co-blogger Dr. Hamilton) seem to do with every word that they type. You’re a teacher & I feel the lessons that you often teach are dogma & subjectiveness. Just my opinion.

Also please add the omitted:

“With one beginning near the trough of one of the worst economic downturns in modern history, it was virtually guaranteed an upward trend with the other administration experiencing the exact opposite – implying causation or relevance (to anything other than dogma) is absurd. On the other hand, maybe your implication is that central banks don’t matter at all.”

So, is it your implication that central banks & $policy don’t matter at all?

Thanks again.

rtd: No, not my point. Policy matters. Lots of things matter — external demand, balance sheets, so forth. But one can still look at data, before embarking upon a comprehensive econometric analysis.

Indeed, look at the data. However, you were guilty of more than simply looking at the data in the initial blog post. If, after your “comprehensive econometric analysis”, you posted your analysis, that would be a different matter. However, you decided not to do that and instead your approach was to only “look at data” and then post (in a public forum) a disingenuous analysis which seemed to me & others to imply causal factors of employment growth.

At least we agree that lots of things matter, as I stated numerous times in the previous blog post. It’s too bad you didn’t care to mention such a caveat in your initial blog posting (or others).

rtd: I’ve never mentioned other things matter in any previous post? I referred you to this post just a few comments ago. In fact, I think some people would say I’ve mentioned conditioning ad nauseum. Apparently, you’re the only one who has the impression that I’ve never made the caveat before.

Menzie,

As Move On stated earlier, “Get over it”.

Your blog post was subjective, dogmatic, and sloppy for anyone who is a professional economist. I hope you don’t spend your entire night combing through each and every word that I type so you can continue your ill-fated attempt to save face. The fact remains that you didn’t even allude to conditioning in your initial blog post and took it further with a not-so-thinly-veiled partisan & disingenuous ‘analysis’ of employment growth littered with implied causal suggestions.

BTW, the link you reference mentions “Proper Citations”. Why don’t you follow that advice and properly cite my quotes instead of cherry-picking and omitting as you see fit.

rtd: Thanks for your comments.

I have added a Figure 2 to the post to highlight are agreement on the existence of “jobless recoveries”.

I used hyperlinks to your comments provide “proper citations”. I think that is accepted practice in weblogging.

I find it hilarious that despite me explicitly (and purposefully) using the wording “virtually” you go out of your way in making an issue of this while simultaneously ignoring your omission of conditioning from your initial post. It’s convenient when you’re the owner of the blog (also to edit a post for your convenience yet not edit the quotes you cherry-picked despite my asking kindly) but such is life for us commentators. Talk about playing tennis without the net.

Menzie,

Even without considering policy differences and other factors, you seem to have posted data that does not contradict what rtd said. rtd just said that it was virtually guaranteed that employment rises after a trough. He didn’t say that it must begin to rise right at the point when a business cycle dating committee dates a trough though.

In the data you posted, the first recession ends in the Eurozone in June of 2009, the second quarter of 2009. The rate of job loss began to slow starting with the third quarter of 2009 and turned positive in the fourth quarter of 2010. The rate of increase increased until the second quarter of 2011. Unfortunately, the second recession began in July 2011, the third quarter. Employment growth became progressively more negative with the recession ending in February 2013, the first quarter of 2013. The rate of decline of employment growth slowed again during the incipient expansion until employment growth turned positive in the first quarter of 2014 and has been growing since.

You’re doing it again and it’s becoming quite a habit. You’re trying to change the plain meaning of what rtd actually said by offering up implausible escape lines. These are the tricks of dishonest used car salesmen.

CUSTOMER: Did you ever turn back the mileage on the odometer?

USED CAR SALESMAN: No.

CUSTOMER: Then why is the odometer reading lower today than when I looked at this car last week?

USED CAR SALESMAN: You asked if I turned back the mileage. I never said one of my mechanics didn’t do it.

Or how about this:

REPORTER: Did you deflate any footballs?

TOM BRADY: No.

REPORTER: Then why were 11 of 12 NE Patriot balls underinflated at halftime?

TOM BRADY: You asked if I underinflated any balls. I never said that my equipment manager didn’t underinflate the balls for me.

You get the picture. You casual attitude towards straight talk explains your obvious sympathy with for many Wall St. sharks. Two peas in a pod, as it were.

Here is what the NFL’s Rule Book actually says, Slugs

“Rule 2 The Ball – Section 1

BALL DIMENSIONS

The Ball must be a “Wilson,” hand selected, bearing the signature of the Commissioner of the League, Roger Goodell.

The ball shall be made up of an inflated (12 1/2 to 13 1/2 pounds) urethane bladder enclosed in a pebble grained, leather case (natural tan color) without corrugations of any kind. It shall have the form of a prolate spheroid and the size and weight shall be: long axis, 11 to 11 1/4 inches; long circumference, 28 to 28 1/2 inches; short circumference, 21 to 21 1/4 inches; weight, 14 to 15 ounces.

The Referee shall be the sole judge as to whether all balls offered for play comply with these specifications. A pump is to be furnished by the home club, and the balls shall remain under the supervision of the Referee until they are delivered to the ball attendant just prior to the start of the game.”

Implications:

1. There is no obligation on the part of the team to deliver a ball which meets specifications.

2. The ref alone determines whether these specifications have been met. If the team hands the ref a beagle, and he determines that it meets the specifications, then it can be used for play.

3. The balls are under the supervision of the refs. That means the refs, not the home team, are responsible for ball security. If someone tampers with the balls during this period, the refs are negligent.

4. The balls are to be delivered only to the ball attendant, and only prior to the start of the game. Thus, the only opportunity to modify the balls is the start of the game by the attendant. Hence the elevated level of interest ball boy’s 90 second rest stop. It took nine days to figure this out?

Bottom line:

Ref Walt Anderson approved the 11 lb balls that the Patriots played with.

Menzie, I think this is important. The core issue we’ve been going back & forth over is also illustrated beautifully in your recent blog post: https://econbrowser.com/archives/2015/01/hottest-on-record

How can you, as an individual with quantitative expertise likely greater than 99% of the public, post such an article? Just as with the ‘Private Employment under Obama and Bush’ post, where you never directly come out and say “this is proof Obama > Bush2 because, yeah, jobz!!!”, you never directly come out and say “this is proof of global warming”. However, (and in all honesty I don’t like to make such assumptions) despite never directly making either claim, both are the initial and obvious implications of each respective post. As I stated clearly, I have no preference of Obama or Bush (or Reagan as another commentator queried with regards to “presidential recoveries” – whatever they are) and my gripe isn’t about my preference towards Bush2 – because I don’t have that preference, or lack of preference quite frankly. On the other hand, with the ‘Hottest on Record’ post, I am both in support of and believer in the claims made by NOAA, NWS, National Climate Assessment, etc….. with regards to global warming and the likely impact humans have had on the issue. However, the issue remains that your post implies that 2014 being the hottest on record is proof of global warming. This is extremely sloppy and totally disingenuous. Again, I know that you did not state this explicitly within the post itself (just as you never stated “Obama > Bush2 because, yeah, jobz!!!”) but it is the message that I (and many others) received. As a man who likely has forgotten more statistics & math than I will ever know, you should know, akin to the “Private Employment under Obama and Bush” post, how disingenuous the implication of the ‘Hottest on Record’ post truly was. Moreover, akin to the ‘Private Employment under Obama and Bush’ post, the ‘Hottest on Record’ post reeked of partisan dogma. Quite simply, this is far too often your M.O. However, as someone who is a professional economist, academic, and expert in analytical work, it is extremely sad that you take advantage of this successful public form to push your agenda(s) via disingenuous, sophomoric, subjective, and dogmatic speech. Again, your co-blogger isn’t guilty of this (that I can ever recall) and you should follow his upstanding lead. I know you’re an adult and what I say will likely mean nothing to you, and I’m okay with that. What I’m not okay with is people taking advantage of the pervasive innumeracy & economic illiteracy of the public and I will, as I’m able, call people out on it. But, i digress.

I’m sure you’ll nitpick my comments again, so:

Maybe I shouldn’t have said “However, the issue remains that your post implies that 2014 being the hottest on record is proof of global warming.” Rather, “However, the issue remains that your post implies that 2014 being the hottest on record is support of global warming.”

Actually, i don’t care, either one of the above is fine with me.

And please don’t reply with an argument along the lines of “well, obviously the planet is warmer if it’s the warmest year. By definition, if the most recent year was the warmest on record, the planet has warmed even if global warming in the traditional sense is false. So, my post is true blahblahblahblah, Obama is the greatest” or something of the sort – you know that I’m referencing the warming trend & the larger issue that “a single data point, a trend isn’t.”

Who ya gonna believe? rtd or Menzie’s lying graphs????

I wonder what causes these “jobless recoveries” with U or L shaped economic recoveries?

In the late 1970s, interest rates and inflation were high. So,, there was more saving and less spending.

And, Carter was a fiscal conservative.

When Reagan came in, there was a “wall-of-money” to flow into the economy.

Moreover, with the shift in demographics (i.e. the Baby-Boomers starting to enter “prime-age”), there was a V-shaped economic recovery.

There’s a wall-of-money today (e.g. $4 trillion of cash held by non-financial corporations and excess reserves in the banking system) that hasn’t flowed into the economy,

I think, one problem is when government pays people not to work, or pays people too much not to work, they won’t work.

For example, many laid-off workers, who had a $15 an hour job, may discover the only jobs available pay only $10 or $12 an hour. So, they stay on (extended and overextended) unemployment benefits.

Also, many students, who expected a much higher paying job after they graduated, became disappointed, and wouldn’t accept a low-paying job.

Perhaps, generally, when people receive more government benefits, because they earn less income, a $10 or $12 an hour full-time job may not be worth the opportunity cost.

“I think, one problem is when government pays people not to work, or pays people too much not to work, they won’t work.”

It is good to hear from someone who has boots on the ground so to speak and has lived comfortably on unemployment/welfare.

Would you rather work full time for $3,000 a month or receive $2,000 a month for not working?

You’ll have plenty of time to work under-the-table without the need to pay taxes when receiving “free” government benefits.

I live somewhat uncomfortably, because I work so much and pay so much in taxes.

I lived very comfortably in college for a while when I wasn’t working full-time and attending school full-time, i.e. when I decided to live on student loans, grants, and scholarships, along with working part-time whenever I felt like it (e.g. buying goods at a merchandise mart in Denver, sometimes by the dozen, selling at the flea market in Boulder, where people have money, and making $100 profit, after all expenses, in less than four hours).

Another point:

Your Update, 9pm Pacific addendum shows 21 months from NBER trough to employment trough. This is supposedly evidence my comment was erroneous. However, the conversation was about presidential terms, employment, and timing of business cycles. Unless you’re William Henry Harrison, James Garfield, or Zachary Taylor, it’s virtually guaranteed that if your administration begins in the middle of a recession, you will see an upward trend in employment growth. Again Menzie is omitting important conditional variables.

rtd: For goodness sake, it’s an exact quote, as hyperlinked. Go to the link. Read what you wrote.

No Menzie, you need to go reread my very first comment. For convenience I will repost it here so that you won’t cherrypick portions of the comment as you see fit:

“menzie, I can’t help but feel you are taking advantage of (some of) your readers with (constant) partisan posts such as this. Wether it is intentional or not, the ‘ceteris paribus’ implication in such graphs are misleading at worst and disingenuous at best. Someone with your credentials should know better than to compare job growth between theses two (or possibly any) administrations, unless there is an agenda. With one beginning near the trough of one of the worst economic downturns in modern history, it was virtually guaranteed an upward trend with the other administration experiencing the exact opposite – implying causation or relevance (to anything other than dogma) is absurd. On the other hand, maybe your implication is that central banks don’t matter at all.”

Please clearly elucidate exactly how it is that this quote isn’t explicit with regards to administrations, business cycles, and employment growth. I can’t wait to hear year reply.

rtd: No, why do I have to go to your first statement? I was responding to your second, un-caveated, statement — unless that comment is “no longer operational”.

You sir, are ridiculous.

Does this sound vaguely familiar?:

“I’ve never mentioned other things matter in any previous post? I referred you to this post just a few comments ago. In fact, I think some people would say I’ve mentioned conditioning ad nauseum. Apparently, you’re the only one who has the impression that I’ve never made the caveat before.”

At least I am asking you to reference my initial comments to your post and not referring you to different posts all together. You’re making yourself look worse & worse with each reply, Menize. You simply can’t have it one way. Again, tennis without the net.

rtd: The difference is that I have a body of posts with my name ascribed to it. You make a couple comments and I’m supposed to parse them?

But thanks, your comments have inspired me to do an entire post (forthcoming in the coming week) on your assertion, to quote verbatim: “Yes, it is virtually guaranteed that after a nation’s business cycle trough, that same nation’s employment growth will display an upward trend.”

Menzie, you don’t have to parse my statements. This was my very first comment to your blog post. It’s there clear as day. The quote you’re so hung up over was a response to another’s comment in reply to my initial comment. Face it, your initial post was partisan, subjective, and completely disingenuous.

It’s too bad that your humiliation won’t allow you to address the real problem or “inspired [you] to do an entire post (forthcoming in the coming week) on [my] assertion, to quote verbatim”:

“With one beginning near the trough of one of the worst economic downturns in modern history, it was virtually guaranteed an upward trend with the other administration experiencing the exact opposite – implying causation or relevance (to anything other than dogma) is absurd. On the other hand, maybe your implication is that central banks don’t matter at all.”

Please stop acting immature, put up the tennis net, and let’s play the game in a serious fashion.

Menzie, your problem is you assume everyone will weigh the evidence equally. Being open to accepting evidence that contradicts ones beliefs is a rare quality among those believe in an ideology.

I absolutely love Menzie baiting these innumerate ideologues. I have a learned a lot from behavioral economics over the last ten years, and the power of motivated “reasoning” on the internets is exceeded only by the pr*n. rtd is a *classic*, much appreciated. I always enjoy Rick Stryker’s posts too.

Russell,

I’m glad you enjoy reading my comments. I hope you will join me in working to persuade Menzie to support Scott Walker in 2016.

Rick – thanks for proving my point!

Robert,

I fail to see how my comment above proves your point.

I think it’s important to clarify European business cycle dating.

Business cycles are officially determined the CEPR, ie, the CEPR makes the official call as to whether a recession has ended in Europe. Their latest release, dated June 2014, states this:

“The Committee observed that since early 2013 the euro area has witnessed a prolonged episode of extremely weak growth in economic activity: Euro area GDP has risen by less than 1% from 2013Q1 to 2014Q1 and labour markets have shown little change over that period. Had the improvement in economic activity been more significant, it is likely that the Committee would have declared a trough in the euro area business cycle in early 2013, most likely in 2013Q1. The lack of evidence of sustained improvement of economic activity in the euro area does, however, preclude calling an end to the recession that started after 2011Q3. Rather, consistent with the concerns expressed by the Committee at its October 2013 meeting, the euro area may be experiencing since early 2013 a prolonged pause in the recession that started after 2011Q3.

“The decision of the Committee not to call an end the recession that started after 2011Q3 in spite of several quarters of positive (but weak) economic developments in the euro area illustrates that its identification of peaks and troughs does not follow a mechanical two-quarter rule for GDP (see FAQ).The Committee indeed assesses both the length and the strength of improvements in economic activity to document the sustained growth that it requires to call the end of a recession.”

The CEPR has not called an end to the European recession. They are the ones who count.

http://www.cepr.org/content/euro-area-business-cycle-dating-committee

As for the OECD.

OECD recession indicators suggest an end to the European recession in March 2013.

http://research.stlouisfed.org/fred2/series/4BIGEURORECM

However, I am unable to find any evidence that the OECD has stated that the European recession has ended, Instead, we see this, from November 2014:

“A bigger worry for the Paris-based think-tank [OECD] is the euro area, which it said “may have fallen into a persistent stagnation trap”. “The euro area is at risk of deflation if growth stagnates or if inflation expectations fall further,” it said.

“The OECD today reiterated its call for the ECB to embark on quantitative easing in the euro zone.

“We are far from being on the road to a healthy recovery. There is a growing risk of stagnation in the euro zone…”

The OECD has not endorsed the notion of an end to the recession in Europe, but rather indicated on-going stagnation with downside risks, and endorsed ECB QE, something we would not expect for an economy literally two years into recovery, as Menzie suggests above.

The call that the European recession ended in March 2013 would, I think, be considered a minority and controversial viewpoint at present, endorsed by neither the OECD nor the CEPR, who is formally charged with making these determinations.

rtd, you feel menzie should be careful regarding how he states things on his blog because he holds a greater position to sway public opinion. fine-that is the essence of your argument. now i will explicitly call out fox news. they consistently produce partisan economic hacks who try to sway public opinion on the performance of the economy.

point blank, are fox news and those partisan economists and commentators in the wrong and should they stop immediately?

Great point! You could add many other “news” organizations to that as well.

There is a bit of difference with ‘news’ organizations who are in the business of selling the story and a professional economist who is expected to objective & non-dogmatic. Also, as stated previously, it isn’t just Menzie who is guilty. However, there are others (Jim Hamilton, and most (non-social) scientists) who don’t feel the need to do this.

rtd, i could add other organizations. but i am quite interested in hearing you particularly identify fox news in this regard. we can discuss the others later. by your assertions, fox news should not be taken seriously, correct?

“There is a bit of difference with ‘news’ organizations who are in the business of selling the story and a professional economist who is expected to objective & non-dogmatic. ”

a news organization with responsibility defined in the us constitution, such as freedom of the press, should be held differently than a private citizen commenting to the public. you are correct they are different, but mistaken by who should be held to a higher standard.

Also, and again, I don’t think it is laudable to be disingenuous, the freedom of press allows for such ‘reporting’. I think your idea of the definition for freedom of press per the constitution needs revision.

Baffling,

I suppose you are now willing to make a similar statement criticizing MSNBC now for its partisan reporting?

rick, i have not watched msnbc in years. but you could comment on fox news? or defend them, your choice. they were the topic.

Baffles,

I figured you’d duck the question.

It should come as no surprise that my favorite tv news network is Fox.

rick, if i don’t watch a network do you really want me to comment on the content of that network? not ducking any question, just giving you a straight answer. i do, however see a little of faux news, and it is no surprise you watch such gibberish. i suppose you disagree with rtd on the content of faux news?

Our sentiments exactly! Menzie is as legit a scholar as Bill O’Reilly and Sean Hannitty.

Well said.

Patrick R. Sullivan: I am still waiting to hear you admit you were in error regarding depth of the downturn in Canada vs. US during the Great Depression. As you recall, you stated unequivocally:

And this statement is wrong.

menzie hosts an econoblog and must deal with looney folks every now and then. he also produces very serious economic papers which are highly respected in the field of economics. oreilly and hannity produce comic books for faux news readers. they have not produced anything of substance in years-if ever. you cannot even compare those fools to prof chinn.

I should add that I’m not saying Menzie isn’t a top-notch scholar with regards to his academic pursuits – his cv speaks for itself. This is however, unequivocally, arena-dependent.

FoxNews is probably, to me, the worst offender of all the larger ‘news’ agencies.

I disagree with “mistaken by who should be held to a higher standard”. I feel Menzie and others, as experts in a field, should be held to the highest standards. FoxNews is a business trying to gain readers. I’m not advocating they continue their approach of not being truthful at all times, but I do feel experts in a field should be held to the highest standard in their respective field.

Because you are “quite interested in hearing you particularly identify fox news in this regard”, I would be happy to point out that one of the best examples of FoxNews in this regard was their ‘reporting’ of a piece on federal liabilities by Dr. Hamilton. It was as extreme display of poor reporting as you could imagine.

I forgot to add a link for reference. Here’s Hamilton’s response to FoxNews:

https://econbrowser.com/archives/2013/08/california_econ

Also, if you weren’t following, go back to Hamilton’s initial piece & then the FoxNews piece. It baffles me that Hamilton would ever have to clarify anything he writes. IMO, he is the clearest writer of anyone in the econ blogosphere (not to mention objective & nonpartisan) & it illustrates the questionable approach of FoxNews in this regard perfectly.

This was buried at the end of the last post, so I’ll put it here as well:

Measured by the employment to population ratio, the US is dead last in the OECD in the post-recessionary (Obama) period compared to the pre-recessionary (Bush) period.

For example, for selected countries, employment to population ratios pre recession, post recession, and percentage point change:

US: 72 (Bush era); 65 (Obama era); change -7 pp

Germany: 65, 73, +8 pp

Italy: 58. 56. -2 pp

France: 64, 64, unchanged

UK: 74, 74, unchanged

Switzerland: 78, 79, +1

The employment ratio has fallen much farther in the US since the recession (ie, under the Obama administration) than in any other OECD country, by a substantial margin. We have, in effect, switched places with Germany, which has raised the employment ratio even during the recession–and with significantly lower GDP growth than the US. Even France and Italy performed better compared to pre-recessionary times. The US, which used to be on par with the UK, is now on par with France.

US performance is awful, absolutely dreadful–and for reasons which we have debated here over the years. Updating labor market policies should be a priority for any administration, and a key campaign issue for Republicans.

http://www.prienga.com/blog/2014/10/31/employment-to-population-ratio-detail

Steven Kopits is hilarious. He still can’t read a simple line graph, even one that he generates. I’m not going to vouch for the accuracy of his graph, but just taking as presented, it shows that the Bush era started at around 73.5 and ended around 68.5, a loss of about 5 points.

Then he says that the Obama era is 65, when his own graph clearly shows it never even gets down to 66 and ends today at about 67.5.

What is up with this inability to read even the simplest line chart — even one that he creates himself?

In 2008, the employment ratio was 71, most recent is around 67.5, fine. However, under Bush, it averaged around 72, and has averaged around 65 under Obama. The ratio is down 3.5 pp in the more favorable case. Either way, still the worst relative performance in the OECD.

I did not, however, state that all of it was Obama’s fault. Disability rates, for example, have been creeping for more than a decade. Some factors should be fading, eg, massive run up in student loans and resulting collapse of young adult employment ratios. And reduced unemployment insurance should encourage people to get back to work. I think an expansion of welfare / SNAP benefits is still an issue, though I haven’t looked in detail. So. some of these factors are being reversed organically, some as a matter of policy, and some are riding longer trends which the Obama administration either exacerbated or did nothing to reverse.

It would be a mistake to consider my views of Bush as entirely supportive and Obama as completely unconstructive. Notwithstanding, the US performs very, very poorly in a cross country comparison, and we need to continue to tighten employment policies to encourage more people back into the work force.

Joseph,

You continue to be the nattering nabob of nitpicking. Is Steven’s essential point unchanged?

NBER study shows ending unemployment insurance reduces unemployment.

To those of us who think this is not a surprise. If you pay someone for not working they will not work. It simply proves the classical economists who say, “you can have all the unemployment you are willing to pay for.”

the same researchers also found ending unemployment benefits drives down wages. are we trying to help the workers or the owners?

Baffling,

Yes, I do disagree with rtd about Fox news. I think it’s the best news organization out there. The others are very biased to the left and often make significant mistakes. Every news organization does make mistakes of course, and Fox is no exception, but the others are much worse.

rick, so you don’t believe that faux news is very biased to the conservative viewpoint? actually it is a little bit of an exaggeration to call them a news organization, since they don’t do much reporting anymore. but we can keep our definition of news organization rather liberal and include them for discussion sake.

Baffles,

I think Fox has a conservative point of view, yes. I don’t really believe in objective news though. You can’t really get away from having a point of view in news. You have to decide what is and isn’t worth reporting for example.

rick, you mean a very conservative point of view. and if you do not strive for objective news, then you begin to mix up opinion with fact. very common trait of faux news viewers.

Consider Full-Time Employment. When questions about jobs and economic well being come up, St Louis Fed data series LNS12500000. Employed: Usually Work Full Time is my go-to statistic.

The current number of those employed full-time is 119,934,000. The high water mark for Full-Time employment in America was all the way back in November 2007 when there were 121,875,000 Americans employed full-time. So we still are 1,941,000 full-time jobs short of where we were over 7 years ago.