Yesterday’s NYT noted “U.S. Growth and Employment Data Tell Different Stories”:

Measured by traditional yardsticks for growth, like gross domestic product, the American economy definitely looks weak. View it through the prism of hiring and employment, however, and the economy seems surprisingly strong.

“It is a real mystery how you can have nearly 300,000 new jobs created in December with the economy growing by 1 percent or less,” said Torsten Slok, chief international economist for Deutsche Bank Securities in New York. “We can’t have this discrepancy for a long period of time.”

In our 2014 J.Macro paper, Laurent Ferrara, Valérie Mignon and I asked why employment growth was so sluggish given GDP growth (post here). The current situation seems to have reversed that puzzle. Of course, we examined levels (using a nonlinear error correction model), while the current discussion is centered around growth rates. Nonetheless, this is an interesting question.

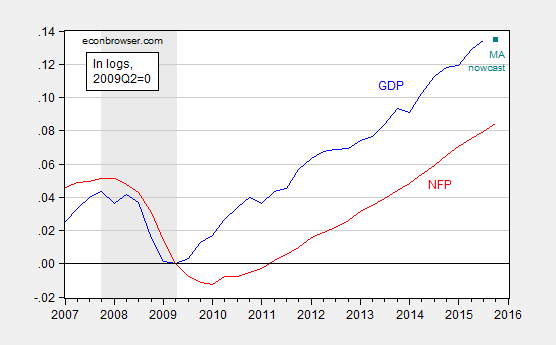

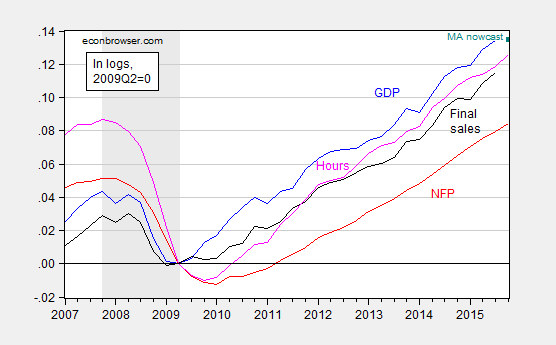

Figure 1 depicts the employment and growth trends since 2007.

Figure 1: Log real GDP (blue), and nonfarm payroll employment (red), both normalized to 2009Q2=0. 2015Q4 observation is the January 15 Macroeconomic Advisers nowcast. NBER defined recession dates shaded gray. Source: BEA, BLS via FRED, Macroeconomic Advisers, author’s calculations.

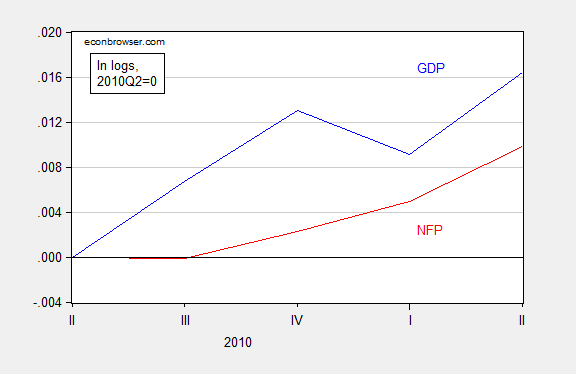

It’s hard to see how the two series’ growth rates covary over time, so I show cumulative growth for annual increments since 2009Q2, the last NBER-defined trough.

Figure 2: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2009Q2=0, 2009Q2-2010Q2. Source: BEA and BLS, and author’s calculations.

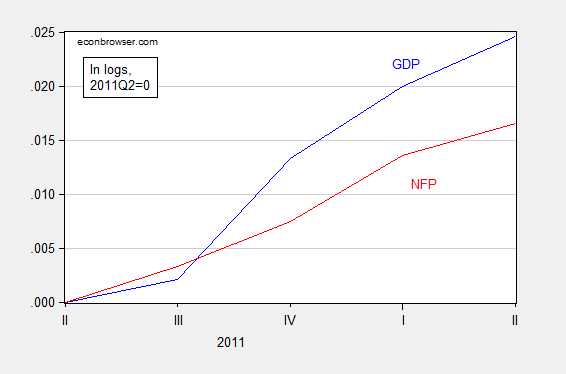

Figure 3: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2010Q2=0, 2010Q2-2011Q2. Source: BEA and BLS, and author’s calculations.

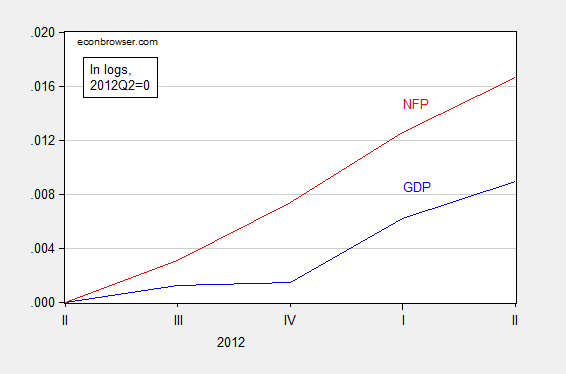

Figure 4: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2011Q2=0, 2011Q2-2012Q2. Source: BEA and BLS, and author’s calculations.

Figure 5: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2012Q2=0, 2012Q2-2013Q2. Source: BEA and BLS, and author’s calculations.

Figure 6: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2013Q2=0, 2013Q2-2014Q2. Source: BEA and BLS, and author’s calculations.

Figure 7: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2014Q2=0, 2014Q2-2015Q2. Source: BEA and BLS, and author’s calculations.

Figure 8: Log real GDP (blue) and nonfarm payroll employment (red), both normalized to 2015Q2=0, 2015Q2-2016Q2. 2015Q4 observation is the January 15 Macroeconomic Advisers nowcast. Source: BEA and BLS, and author’s calculations.

Caveat: The employment series and output series will both be benchmark-revised, so these short run correlations may very well change. For a cautionary note, see this post.

Our point estimates in Chinn, Ferrara and Mignon (2014) indicate that for an expansion regime, the short run elasticity of employment with respect to GDP is about 0.3 (sample up to 2007Q4). Figure 1 shows this correlation for the post recession sample. As Figure 5 indicates, employment outpaced GDP growth from 2012Q2-2013Q2, so the disjuncture shown in Figure 8 is not unprecedented in just the latest recovery. Nonetheless, preliminary results from our model estimated with updated data up to 2013Q4 indicates that employment in 2015Q3 is nearly 1 million above what is predicted by our nonlinear error correction model, confirming more formally the high level of employment growth relative to GDP. (More on these results to come.)

Update, 7:15pm Pacific:

Neil asks what happens if one uses hours or final sales.

Figure 9: Log real GDP (blue), and nonfarm payroll employment (red), real final sales (black), and aggregate hours worked (pink), all normalized to 2009Q2=0. 2015Q4 observation is the January 15 Macroeconomic Advisers nowcast. NBER defined recession dates shaded gray. Source: BEA, BLS via FRED, Macroeconomic Advisers, author’s calculations.

I don’t believe any big changes in interpretation arise.

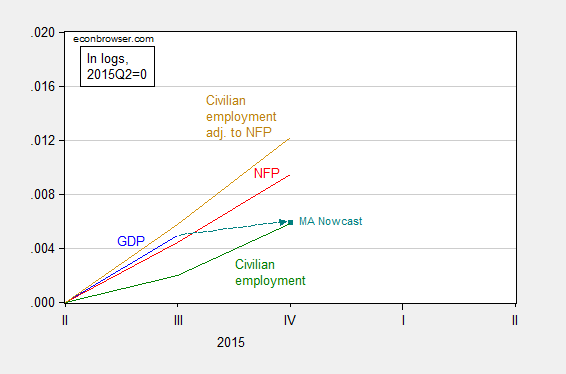

Greg Coleman asks what happens if data from the household survey are used.

Figure 10: Log real GDP (blue) and nonfarm payroll employment (red), civilian employment (green), civilian employment adjusted to nonfarm payroll concept (brown), all normalized to 2015Q2=0, 2015Q2-2016Q2. 2015Q4 observation is the January 15 Macroeconomic Advisers nowcast. Source: BEA and BLS, and author’s calculations.

I think the same basic pattern is found — acceleration of employment growth relative to GDP, relative to previous trend.

As I’ve often shared here, payroll receipts against reported wage and salary disbursements imply that employment is significantly overstated, perhaps by as much as 1% or slightly more.

Were employment to be actually growing at the reported rates for payroll and civilian employment against reported wage and salary disbursements, real GDP would typically be growing 3.25-3.5% rather than the ~1.7% 4-qtr. SAAR through Q4.

The discrepancy allows for the possibility that the US decelerated to stall speed in Q4 2014-Q1 2015 and entered recession in Q2-Q3 2015.

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-fresh-data-cheap-labor

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-updated-multiple-jobholders-boost-full-time-employment

Also, if one examines the composition of reported employment, the alleged net of payroll growth since 2011-12 is attributable to the growth in hiring of those with education of less than a high school diploma, suggesting that if employment has been growing as reported since after 2012-13, the quality of growth of employment is low, consists of multiple jobholders working a full-time and at least one part-time job or more than one part-time job, and the relative compensation is low (barely subsistence, if so, after taxes and debt service).

Moreover, these workers are less likely to qualify for unemployment compensation when they lose a full-time or part-time job because technically they remain employment, no matter the meager number of hours, and thus ineligible for benefits. This is likely contributing to the multi-decade low for initial claims, even as continued claims remain higher than would otherwise be expected with initial claims low and the labor market at official cyclical full employment.

This relatively low quality of job growth of the past 2-3 years also explains the recession-like growth of retail sales ex autos and real PCE ex household health care spending. As well, the increasing deskilling of the labor force via deindustrialization, financialization, and automation and the low quality and pay of employment that is growing contributes to the low labor share, lower productivity (by far not the primary reason, however), and the persistence of firms’ hiring managers perceptions of a lower quality of applicants.

Thus, despite the official U rate of 5%, the US labor market remains underutilized, which contributes further to the deskilling and decelerating productivity, wage gains, and growth of investment, production, and consumer spending.

BC:

The NBER recession dating committee is the official arbiter of recessions. You cannot fight them. So when in Rome do as the Romans do. The NBER does a good job of dating in my opinion. When employment, income, and GDP are positive, there is no way on God’s green earth the flow of GDP will be labeled recession. I am getting at timing here. There was no recession in 2015. The economy is not in recession now. And trajectories are such that the official date of the next recession will be April at the earliest.

Google up NBER recession dating committee and read how the committee goes about it. Pay special attention to the emphasis on economy-wide. Read carefully, including between the lines. Then applying what you already know, and using the dating committee’s remarks as a fine scalpel, you will be better able to time the recession you so correctly see coming. Very tentatively, I’d say a recession will get underway in April at the earliest and August at the latest. The latter date is by no means etched in granite. But judging by your posts you have your finger on the pulse of things and can make your own judgment. A recession is coming soon. The impulse from China and other EMs, and the devastation in the US oil patch, is now past the point of no return. I myself have moved on to: Will this be the big one? Or will the authorities kick the can down the road one final time before the globe experiences the mother of all financial crises? With real sector devastation of comparable magnitude.

JBH, I am well aware of the NBER methodology and I take your point about timing. Thanks.

I continue to maintain that employment is significantly overstated and that there is more than a 50% probability that the US economy decelerated to stall speed in early 2015 and entered recession in Q3 or Q4. I expect payrolls and real GDP to be revised lower for future benchmarks. That this will occur during an election year seems improbable, so the revised data will be an issue for the next CEO of the corporate-state.

Menzie, it may be useful to run the exercise with aggregate hours worked, not just nonfarm payrolls. You’ll likely get a similar result, but aggregate hours worked probably gives a more complete picture of the jobs market.

Neil: Done, see update.

I wonder if the disconnect makes sense given the idiosyncrasies weighing on the GDP tracking figures. After all, we are going through a meaningful inventory correction at the moment. Energy capex continues to weigh on growth. Both of these stories should prove temporary. Aggregate hours tends to be a more stable measure of activity than GDP nowcast-type models.

Neil: Done, see update.

What if you use employment from the CPS?

Greg Coleman: Same patter arises; see update.

Menzie,

This sounds like a lagging problem. GDP growth is related to employment through productivity, and investments in new productive equipment may not be that great, or that easy to analyze. If a company builds a new steel mill, and advertises for workers, the line of job seekers will be around the block the next day, and the relationship should be relatively contemporaneous if the company has sales of the newly produced steel. If the company changes the PCs in the office to tablets, the productivity effect will be much more diffuse and harder to measure. Might the patterns in non-financial corporate investment, towards computerization, and increased non-financial corporate liquidity be linked to this pattern?

Julian

Julian Silk: In our nonlinear ECM, we account for lagging effects by including a dynamic structure which changes depending on expansion/contraction regimes. I think the relative increase in employment vs. GDP growth persists after accounting for these dynamics.

In some blogs and articles I read the last two years, I have read suggestions (see Simon Wren-Lewis posts for example) that it may be that the fall in real wages in the both the U.S. and U.K., particularly trade weighted comparisons with China, SE Asia, and Latin America, that has caused the decline both in productivity growth and high employment despite low GDP growth in both countries. Why would firms invest in equipment, training, and efficiency when labor is cheap and easily added or replaceable? Better to use the increase profits for buy backs and dividends from the CEO perspective to keep their positions and boost their own income.

I’m wondering how data revision plays into this analysis of the latest comovements of output and employment. My understanding is that employment-based measures play a much more important role in early estimates of GDP growth, but that this weight diminishes as output figures are revised as more solid evidence arrives. That means that the post-2008 comovements you’re looking at (which are mostly based on fully revised data) might not be the same as those typical of “just released” estimates.

Do we see much the same results if we replace the usual GDP series with initial-estimates in Figures 1-6?

Jan P.A.M. Jacobs and I have a forthcoming paper (http://dx.doi.org/10.1016/j.jmacro.2015.11.004) where we look at data revision in various measures of productivity growth (including GDP/Employment) and we find surprisingly large effects. However, we didn’t directly examine the implications for forecasting GDP conditional on employment.

Just curious.

SvN: I agree this would be an interesting comparison. I don’t have the realtime data handy; I’d have to go through ALFRED to download the correct vintages. Also using different vintages complicates estimation of error correction models since levels change (see last benchmark) introducing breaks. But in principle one could pretty easily do this for at least growth rates.

Employment historically has been a lagging indicator.

To the extent the Fed pays attention to the 5 year, 5 year forward inflation expectation, it’s not looking so well-anchored anymore.

http://tinyurl.com/jktv6dv

Ray Dalio of Bridgewater was on CNBC this morning speaking from Davos noting that the Federal Reserve made a huge mistake in raising rates in December and that the FOMC is further erring in not caring much what the markets think.

These words may end up echoing that other Fisher’s comments (back in 1929) – Dr. Stanley Fischer speaking on CNBC on January 6, 2016:

“We watch what the market thinks, but we can’t be led by what the market thinks,” Fischer told CNBC’s “Squawk Box.” He added that market expectations of the number of future rate hikes are “too low.” According to the December median predictions from central bankers, the Fed may increase rates four more times this year.

PS: The Chinese are selling something like $50-$100 billion in reserves monthly in defending the Yuan, and the Saudis are selling about $10 billion per month because of deficits resulting from low oil prices. The Fed believes in “stocks” and the markets care about “flows” and the flow is negative QE ugly.

I focus on the hours worked data in the employment report.

Since the recession bottom the trend growth for hours worked has been for a 0,2% monthly increase. This is significantly lower than the growth of either payroll or household employment growth. I believe this reflect the very low quality of jobs being created that is also reflected in the weak growth of average hourly earnings.

I think the employment data is causing people to overestimate how strong the economy is, while the hours work is much more consistent with all the other data and the weak productivity reports.

Remember, except for the Bush recovery of the early 2000s this is by far the weakest we have seen employment growth in any cycle. I suspect the problem is much more one of perception. For the first couple of yeas of this cycle we believed the employment reports were very weak, but over time we have gotten accustomed to the weak numbers and now we look at employment growth as strong even though employment growth is still around some 2%, where it has been since 2011. So for almost exactly the same number of jobs being created five years ago we called it weak but now call it strong.

Look at the y/y change in both payroll and household data , it is some 2% and is actually slowing in 2015 compared to 2014.. I just fail to understand why anyone would think employment this cycle is strong by historical standards.

You aren’t adjusting for demo. Post-war recession were generally fast recoveries, but employment would flatten out considerably by the cycle peak.

Interesting, We share your ‘problem’ downunder