In Governor Brownback’s re-election campaign, he committed to 25,000 new jobs per year in his next term. This is reminiscent of Governor Walker’s August 2013 promise to create 250,000 new private sector jobs over the four years of his first term, by January 2015. How are things going?

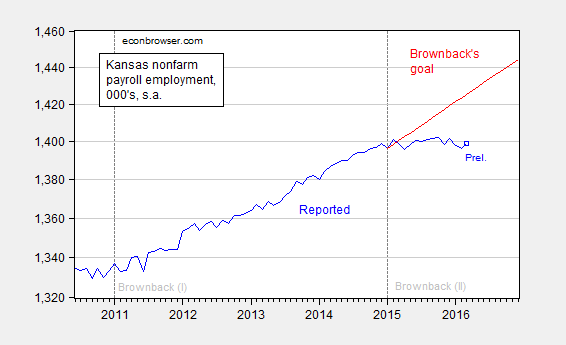

Figure 1: Kansas nonfarm payroll employment (blue), and Governor Brownback’s goal, assuming linear growth. Log scale. Source: BLS and author’s calculations.

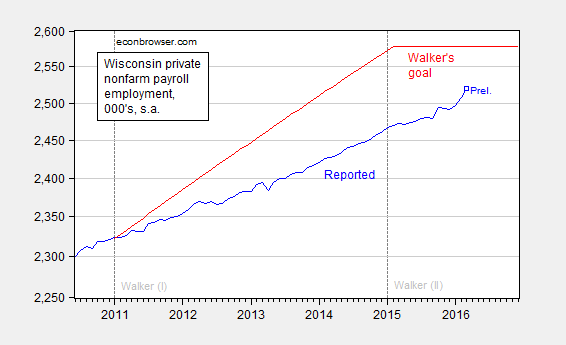

Figure 2: Wisconsin private nonfarm payroll employment (blue), and Governor Brownback’s goal, assuming linear growth. Log scale. Source: BLS and author’s calculations.

Since net employment growth in Kansas is essentially zero, Kansas is short by 26.7 thousand relative to trend. Despite the fact that I’ve allowed for extra time for Governor Walker’s promise, Wisconsin remains 58.1 thousand short.

For more on Kansas, see [1] and [2]. For more on Wisconsin, see [3].

Wow, the low hanging fruit that is a Republican governor….

Dear Dr. Chinn,

Thank you for your work.

I’ve noticed lately, that, here in Wisconsin, several state legislators are touting “largest job growth in any 12-month period since 2004” as vindication of their policies.

For reference: “A strong start to 2016 for job growth in Wisconsin continued with the state adding 13,100 private-sector jobs in March, according to preliminary, seasonally adjusted estimates.”

http://host.madison.com/ct/business/preliminary-estimates-show-wisconsin-with-best-three-month-stretch-of/article_6cb84f02-aa95-53e8-b124-f348f2b6f102.html

If you are assuming that economic for the average person is the goal of the GOP then you are incorrect . The policies are for the well off and are working as designed.

Both Walker and Brownback have always lied about their real agendas–cutting taxes for the 1%, while cutting spending and payrolls in education and all other public sector jobs. They were always about downsizing their governments, which should have made them unelectable for anything but Dog Catcher.

“They were always about downsizing their governments”

Well, you’re either going to have to downsize the government, or scale back public sector wages and benefits if you are to ever grow the private sector again – but then again the momentum in Wisconsin (and the US, and truly the entire Global Economy) is against any positive and long term growth in the private sector ever happening again. It is over.

During the end game, the only solution to a waste-based industrial economy and the government it supports is to establish a progressive guaranteed monthly income for citizens which must be spent or lost during the month – only to be reloaded for the next month, with continual adjustments made for inflation.

Cripes – the FED might as well begin bailing out Wisconsin’s failing Municipal governments by buying their debt, forgiving the interest and burying the principal, so at least the game of extend and pretend can continue. The public sector only exists to transfer wealth from the private sector to themselves. Why should government workers pay income taxes when that money was already taken from productive individuals via confiscatory taxes levied against actual productive enterprises? They can’t finance themselves – although to listen to them whine, they certainly believe they do. Get over yourself.

“Dog Catcher” At least the Dog Catcher performs a useful function for those involved in the private sector.

tim,

“Well, you’re either going to have to downsize the government, or scale back public sector wages and benefits if you are to ever grow the private sector again”

the public sector is not what is holding back growth. in reality, too many in the private sector have an unrealistic view of risk/reward in the modern world. businesses can invest and expand today on the cheap, but they will not be rewarded until further down the road when the economy heats up. interest rates are extremely low today. however, most in the private sector are unwilling to deal with another year or so of slow growth, so they do not expand today on the cheap. they will wait and expand tomorrow at a more costly rate. too many people in management/ownership positions are still dreaming of the easy days of 2003-2006 with easy profit margins. that world does not exist today, but their management style thinks otherwise. put your capital to work cheaply today and be rewarded tomorrow. in todays business climate, you actually have to work to make your capital profitable. it is very possible, but not if one holds a rentier attitude.