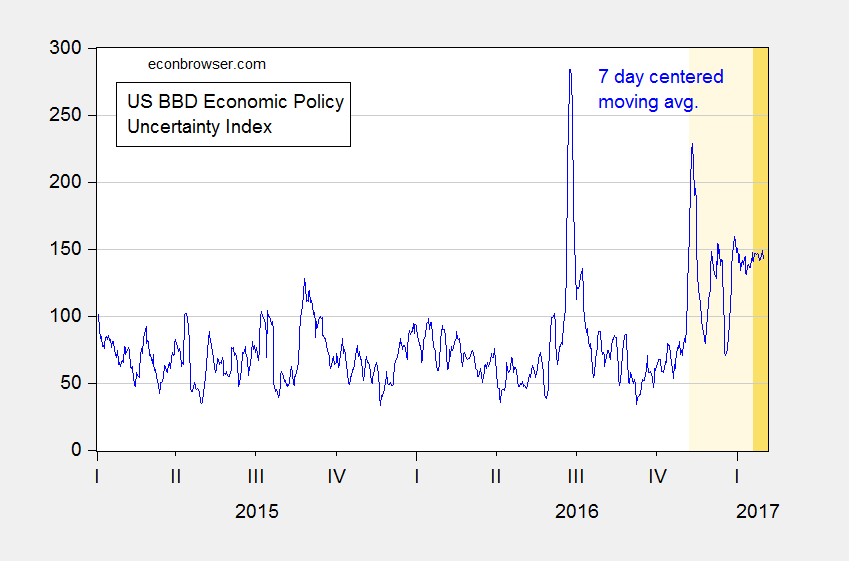

Economic policy uncertainty as measured by the Baker, Bloom, Davis news-based index is definitely higher than pre-election.

Here is the daily data, since the beginning of 2015:

Figure 1: 7 day centered moving average of Economic Policy Uncertainty Index (news-based), as of 4 February 2017. Light orange period denotes period after the presidential election; orange denotes period since inauguration. Source: BBD accessed 4 November 2017, and author’s calculations.

The impact of the election, and subsequent statements and actions, has heightened uncertainty both in the US and abroad (the global index does include Australia).

Figure 2: Monthly Economic Policy Uncertainty Index (news-based) for US (blue), global (red), as of 4 February 2017. Light orange period denotes period after the presidential election. Source: BBD, accessed 4 November 2017.

Current levels of US Economic policy uncertainty as measured by the index is certainly not unprecedented. Clashes over the debt ceiling and the government closure, as well as the Wall Street meltdown of 2008 clearly vie for top billing. However, the global index is, interestingly, at very high levels for a somewhat sustained (i.e., more than a couple months) period.

I have been taking the EPU as literally an indicator of uncertainty [1] [2] [3] [4]. In a recent post, Jim has offered an alternative interpretation:

Here to me then is the most natural interpretation of the Economic Policy Uncertainty Index. At times there is a dramatic exogenous event that increases the probability that something bad will happen to the economy. Congress and the President talk about taking some kind of action in response, though nobody is sure what that response is going to be. It likewise is much less clear what course the Federal Reserve will take in response to the events. Sometimes something bad indeed does happen in the wake of those events, just as everyone feared, and despite whatever policy did or did not do. Even if we have a pure and exact measure of the object of interest– uncertainty about economic policy– it is not valid to conclude that policy uncertainty per se was the cause of the subsequent poor economic performance.

That interpretation of what the BBD index is telling us leads to — in my mind — a less sanguine outlook on prospects for the US and global macroeconomy.

Yet, optimism surged, since the election, reflected in consumer sentiment and the stock market.

http://news.medill.northwestern.edu/chicago/consumer-sentiment-highest-since-2004/

Chart:

http://marketrealist.com/2017/01/rising-us-consumer-sentiment-index-means-economy/

The rise in the stock market is almost exclusively financial stocks. Wall Street expects Trump to unleash them from Dodd-Frank and go back to their old ways that brought us the Great Recession.

That’s not true. And, you can thank economically illiterate politician lawyers, like Dodd and Frank, for creating a housing market that went from one extreme to the other over the past 20 years.

Too Big Not To Fail

The Economist

Feb 18th 2012

“…demands for fees and paperwork with which Dodd-Frank will blanket a vast segment of America’s economy…the massive cost and complexity of its regulations…The law that set up America’s banking system in 1864 ran to 29 pages; the Federal Reserve Act of 1913 went to 32 pages; the Banking Act that transformed American finance after the Wall Street Crash, commonly known as the Glass-Steagall act, spread out to 37 pages. Dodd-Frank is 848 pages long…Like the Hydra of Greek myth, Dodd-Frank can grow new heads as needed…For the same reasons that bankers are worried, lawyers are rubbing their hands… litigation is just beginning…Another product of Dodd-Frank is a plethora of new government powers and agencies with authority over areas of the American financial system and economy…power to regulate more intrusively and to make arbitrary or capricious rulings.”

“for creating a housing market that went from one extreme to the other over the past 20 years.”

false. but i expect that from a hack who was part of the financial crisis problem. why take the blame as a financial professional, when you can take the populist approach and blame government. face it peak, it was financial types like yourself that created the problems in the housing market. time to grow up and accept responsibility for your actions.

Baffling, you need to take responsibility for supporting the policies that created the boom/bust in housing. People like you are dangerous – like weapons of mass destruction. Michael Bloomberg, a social liberal, who know’s something about data, finance, politics, and the media, also disagrees with you:

“I hear your complaints,” Bloomberg said. “Some of them are totally unfounded. It was not the banks that created the mortgage crisis. It was, plain and simple, Congress who forced everybody to go and give mortgages to people who were on the cusp.

Now, I’m not saying I’m sure that was terrible policy, because a lot of those people who got homes still have them and they wouldn’t have gotten them without that.

But they were the ones who pushed Fannie and Freddie to make a bunch of loans that were imprudent, if you will. They were the ones that pushed the banks to loan to everybody. And now we want to go vilify the banks because it’s one target, it’s easy to blame them and Congress certainly isn’t going to blame themselves.”

Michael Bloomberg is an American businessman and politician who was Mayor of New York City. With a net worth of $45 billion. He is the founder of Bloomberg L.P., a financial data-services firm.

peak, you have quoted that piece a thousand times on this site. bloomberg may be rich, but he is incorrect in this statement. i like bloomberg, but he is wrong. fannie and freddie chased the banks down the rabbit hole-they did not lead the charge.

my guess is you were one of the guys pushing those mortgages. and to rid your guilty conscience, you grasp at anything that absolves you of your behavior during the runup to the financial crisis.

there are no credible economists who agree with your assessment of the cause of the financial crisis.

PeakTrader Michael Bloomberg is rich, which is probably as good a reason as any why no one should listen to him. This BS story about how Congress forced bankers into making bad loans to bad people is a crock. It’s been studied to death and every reputable (read not “Heritage”) study has found it to be just another banker inspired urban myth. Try reading some actual academic studies on the issue.

Baffling, obviously, you’re dishonest, because I’ve shown there are credible economists, including academic economists, who agree with me. You remain in complete denial after I’ve shown you a mountain of evidence, including the data. You’re like a religious fanatic or a global warming alarmist. Absolutely nothing can make you consider government had something to do with it. To you, it’s the entire banking industry and free market’s fault, including Dodd-Frank and the subsequent depression in the economy and housing market.

2slugbaits, I’ve already shown studies by academic economists. Even Krugman wanted to replace the Nasdaq bubble with a housing bubble. And, Bloomberg is likely a credible source. Get in the real world.

Also, I may add, almost all the academic economists not only failed to predict the housing bust, they believed it would never happen.

peak, show me a credible economist who agrees with your assessment. you have shown nothing, other than your “alternative facts”. there is a reason you have shown nothing. your assessment of the financial crisis is incorrect. as i have stated repeatedly, the fact you were one of the participants in the financial crisis has forced you to find scapegoats rather than accept blame.

i just find it fascinating that you can continue to blatantly lie about the financial crisis in an attempt to further your ideology. it seems to not bother you one bit. you are smart enough to know what you are stating is false. and yet you persist. i find that rather disturbing. you can repeat a lie a million times, but it will not become truth. it just gets repeated in your echo chamber.

Baffling, don’t play games. I’ve shown you all the evidence you asked for before. You pretend you haven’t seen any of it. What a joke. I dug up a another credible economist that supports my statement.

Economist who predicted the financial crisis:

Ann Pettifor, director of Policy Research in Macroeconomics (PRIME)

“In the book, Pettifor blames the US Federal Reserve, politicians and mainstream economists for endorsing a framework to support unsustainably high levels of borrowing and consumption under the guise of propping up the economy. Continuing the theme in her most recent writing, Pettifor attacks the “small elite that controls the global finance sector” and suggests government bailouts protecting speculative private wealth holders mean “we are no longer dealing with anything resembling a free market system”.”

PeakTrader: You do know that neither Pettifor nor Smith (heads of PRIME) have advanced degrees in economics…

Menzie Chinn, how about John B Taylor of the Taylor Rule:

“He finds that the crisis was primarily caused by flawed macroeconomic policies from the U.S. government and other governments. Particularly, he focuses on the Federal Reserve which, under Alan Greenspan, a personal friend of Taylor, created “monetary excesses” in which interest rates were kept too low for too long, which then directly led to the housing boom in his opinion. He also believes that Freddie Mac and Fannie Mae spurred on the boom and that the crisis was misdiagnosed as a liquidity rather than a credit risk problem. He wrote that, “government actions and interventions, not any inherent failure or instability of the private economy, caused, prolonged, and worsened the crisis.””

Afflicted with heightened cognitive dissonance, we hear the bell toll. It disequilibrates the mind.

Stored conceit discharges through the paths of power transforming the energy of the self into potent common flux. When resolved through discontinuity, dissipation entropy begets causality. The outcome holds non-fraudulent coupled promise for those who remain engaged.

This potential force can be captured, stored and applied to form coherent structures.

Regardless of the source, power flowing through the structure evokes convection that separates the elements into domains. When domains recombine, new physical forms emerge from the synthesis, not from the argument of design.

Exist, observe, become and be gone. Now that you see it…. NOW YOU ORGANIZE

I went to one of the local anti-Trump protests last week. It was inspiring seeing the vigorous push back to Trumpism.

Now I’m by my mailbox anxiously awaiting that sweet check from George Soros that Trump spokesman Sean Spicer said I will get. I just hope it’s cash and not one of those crummy gift cards.

Republicans believe that stuff. Dumber than dirt.

I guess you missed the ad that Washington CAN! put on Craigslist a few days ago. They are paying $15-20 per hour plus benefits to “Fight the Trump Agenda.” Not surprisingly, here is one of the groups providing the funding.

Washington CAN! was surprisingly indiscreet and this ad was pulled by Craigslist after an outcry. That’s not a problem as many jobs are not advertised and are word of mouth any way. Joseph, I would imagine if you ask around you’ll find that you have many opportunities to supplement your income.

Ha, ha, ha. Stryker strikes again with his conspiracy theories. First it was Obamacare costing $100,000 per person. Then it was defending Trump’s wall across Canada. Then it was terrorist ninjas riding jet-ski’s across lake Erie to invade American. And recently jumping to defend Trump’s lies about the size of the crowd at his inauguration.

The latest is that George Soros is paying millions of people around the world to go out into the streets to protest.

Stryker swallows them whole. He must spend all day clicking on Breitbart and listening to Hannity on Fox to keep up with the latest Trump conspiracy.

Washington Citizen Action Network is a long time citizen’s advocate organization. It’s been around for over 15 years. They are hiring a few people to work the phones for their canvassing activities. Stryker turns it into a conspiracy, echoing Sean Spicer.

Trump is so insecure, he has to invent conspiracies to explain why he is so unpopular. George Soros is paying protesters. Spicer and Conway repeat them. Hannity and Breitbart repeat them. And then Stryker.

As Garry Kasparo said “Obvious lies serve a purpose for an administration. They watch who challenges them and who loyally repeats them. The people must watch, too.”

We are watching.

PeakTrader Blaming the CRA for the behavior of bankers is ridiculous. It’s a banker’s version of telling the police that its the woman’s fault if she’s raped. Stop me before I lend again!!! No one forced these bankers to engage in dodgy lending. No one forced the ratings agencies to fudge the numbers. And it’s not the borrower’s responsibility to determine his or her credit worthiness. That’s what bankers are supposed to do. It’s what justifies their paychecks. It’s also bad economics to suggest that risky loans are a bad thing. Risky loans are only bad if the risk is mispriced…and who’s fault is that?

You clearly didn’t understand Krugman’s comment about bubbles.

2slugbaits, when politician lawyers in Washington want you to make more loans, including minority loans, it would be suicide to tell them: “No, because it would be irresponsible.”

PeakTrader,

You are wasting your time with Menzie, 2slugs, and Baffles, but they cannot deny that there is serious and credible evidence for the points you have made.

I’d mention the book “Fragile By Design: The Political Origins of Banking Crises and Scarce Credit” published by the Princeton University Press by Charles Calomiris and Steven Haber. Calomiris is an eminent banking economist and professor at Columbia University while Haber is a political science professor at Stanford. The book lays out in detail how incentives provided by Congress laid the groundwork for the most recent financial crisis.

I’d also mention the book “Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacles of Mortgage Finance,” also published by Princeton University Press and authored by four NYU business school professors. This book emphasizes the role of the GSEs in the financial crisis.

of course we are going to disagree, rick stryker. you have advocated the use of lies in order to achieve your desired outcome. it is ok for trump to lie in public, in your opinion. i don’t subscribe to such behavior. rick stryker is ok with it.

How do you reconcile the low levels of volatility in the market with high levels of policy uncertainty? Which indicator do you think matters more for real activity? Most measures of financial stress since the election have eased.

Neil: Don’t know why VIX has been so quiet, but here is a paper on news EPU. VIX/VXO seems to have less predictive power.

Because Obama’s legacy will be inevitable, a television personality with some skill in persuasion. Is it Trump’s future legacy to give us someone more in line with a Berny Sanders or Elizabeth Warren?

And don’t you just love a good index of something so measurable as uncertainty?