On imported steel, that is

From Politico today:

STEEL REPORT COULD COME NEXT WEEK: Commerce Secretary Wilbur Ross is expected as early as next week to give President Donald Trump a menu of options for restricting steel imports, senators said after a closed-door meeting with the Cabinet official Thursday afternoon.

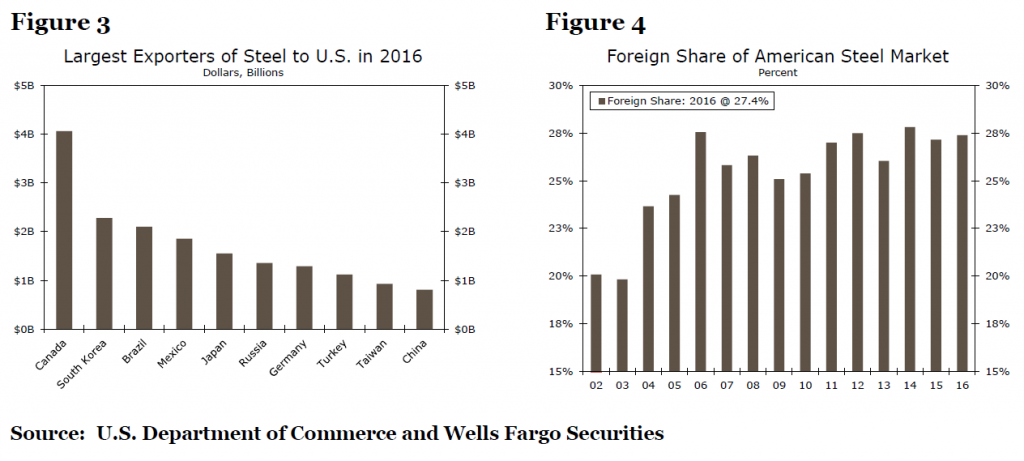

The avowed basis for these restrictions would be for national security (technically Section 232, described in this post). Apparently China is in the cross-hairs. This is interesting because imports of steel from China have decreased, and now rank behind countries like, for instance Russia.

Source: Wells Fargo.

Some people will say that it’s okay to raise taxes on foreigners. But anybody who has a grasp of elementary economics will recognize that the incidence depends on the size of the domestic market relative to the rest of the world. If the domestic market is small, then some of the incidence will fall on domestic consumers, broadly defined to include downstream steel-using firms.

Jay Bryson at Wells Fargo has documented the sectoral impact.

Direct and Indirect Price Effects of Tariffs

A tariff on foreign-produced steel, should the administration decide to levy one, would raise its price to American purchasers. If the tariff were confined to China only, its effect on the overall steel industry likely would not be that impactful given China’s small share at present of the overall American steel market.However, a tariff levied on all foreign producers of steel would be more impactful. With roughly 30 percent of the market experiencing a tariff-induced price hike, American producers of steel could feel emboldened to raise prices as well.

So, which downstream industries would be most affected by higher steel prices, should they transpire? The detailed input-output tables for the U.S. economy show that the following notable industries have high degrees of exposure to steel inputs: fabricated metal products (#332), electrical equipment, appliances and components (#335), machinery (#333), transportation equipment (#336), and furniture and related products (#337). Prices charged by these industries could also rise and/or profit margins could be squeezed. ….

These industries, some of which would seem to be important to national defense, would experience a deterioration in their effective rate of protection.

If indeed the administration proceeds with implementing restrictions against China by way of Section 232, it should also do so against Russia. I must confess, I do not believe this administration will impose sanctions against Russian-sourced imports. Just call it a hunch.

It’s been reported, China exports cheap steel to countries and then those countries export that steel to the U.S. at higher prices, but low enough to be competitive with U.S. steel producers.

And, it’s been reported, China produces half of the world’s steel – more than the U.S., the E.U., Russia, and Japan combined.

It may be better for the U.S. to impose a small tariff, e.g. 10%, and allow China to directly export to the U.S..

Looking at this from a German point of view, 1 billion is just 0.07% of our exports ….

But the US has plenty of opportunity to alienate

– neighbors, like Canada, Mexico, Brazil

– Allies like Canada, South Korea, Japan, Turkey

There are far more Americans who work at jobs that consume steel than there are those that produce steel. This is true of all commodities. Raising tariffs on industrial inputs makes America uncompetitive. Those subsidies paid to Chinese steelmakers end up in the pockets of American steel consumers and their workers, unless America chooses to raise tariffs to ‘defend’ ourselves from China’s generosity

The communists keep the masses employed to avoid a rebellion. So, they subsidize with low standards. What you believe is a free market can lead to a steel shock, like an oil shock, and create risk in national security.

“The communists keep the masses employed to avoid a rebellion. So, they subsidize with low standards. What you believe is a free market can lead to a steel shock, like an oil shock, and create risk in national security.” -Peaktrader

Hilarious. Absolutely hilarious.

Then PT, you might be on to something here. Perhaps the social contract in the USA is so weak, so fragile, that the dual mandate of the US central bank is absolutely necessary in order to avoid modern civil war. As you know PT, the US central bank is the only rich western central bank with a dual mandate; all the others have gone to a single mandate.

Capitalism allows the creation of almost unlimited value, which doesn’t happen under socialism or communism.

So, a country can have enormous wealth.

And, you can praise the Fed later for facilitating low unemployment and low inflation.

Actually if used correctly, communist ideology can be useful