(7/1 – with update including credit spread augmented specification.) Estimated probit over 1986M01-2018M06 period (assuming no recession as of 2019M06):

Prob(recessiont+12=1) = -0.323 – 0.869Spreadt

McFadden R2 0.295, observations = 390, bold denotes significance at 5% msl. Spread in percentage points.

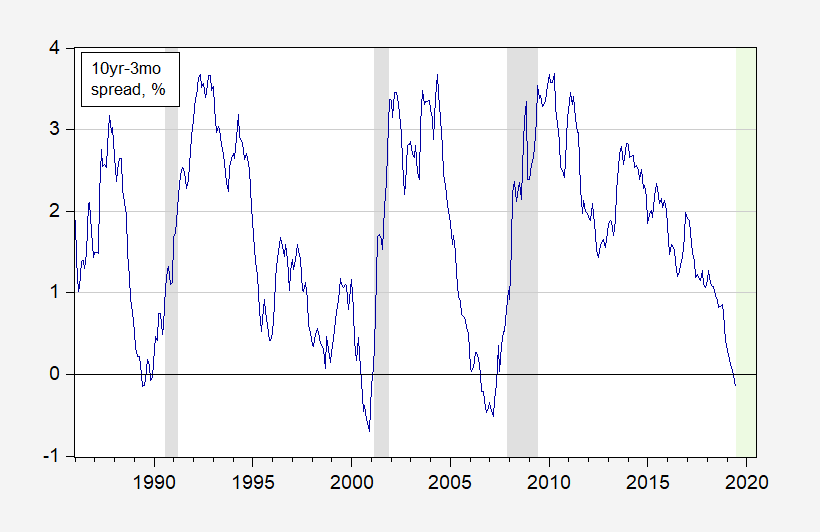

Current spread and current recession dates in Figure 1 (green denotes out-of-sample data).

Figure 1: Ten year minus three month Treasury spread, % (constant maturity) (dark blue). NBER defined recession dates shaded gray. Source: Federal Reserve Board via FRED, NBER, and author’s calculations.

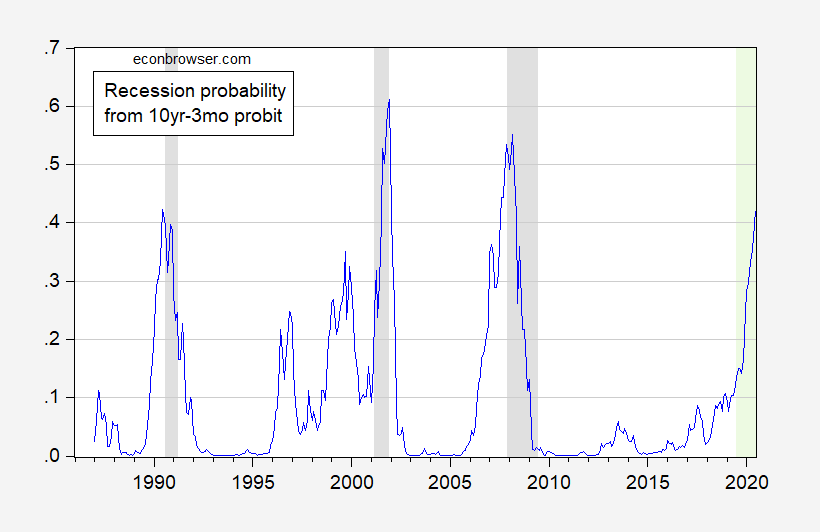

Using the data to forecast out-of-sample yield implied probability of recession equal to 42% in 2020M06.

Figure 2: Probability of recession for indicated month. NBER defined recession dates shaded gray. Light green denotes out-of-sample. Source: NBER, author’s calculations.

Jim pointed out a month ago that the term premium is likely much smaller currently than in past episodes, so that the historical correlation which I am relying on may be misleading. At the same time, I’m not relying on any credit spreads, which of late have been rising.

For a comparison of different spread model estimates — going through May only — see this post. (A good recent survey and evaluation of competing spreada models is provided by David Miller in FEDS Notes.)

Addendum:

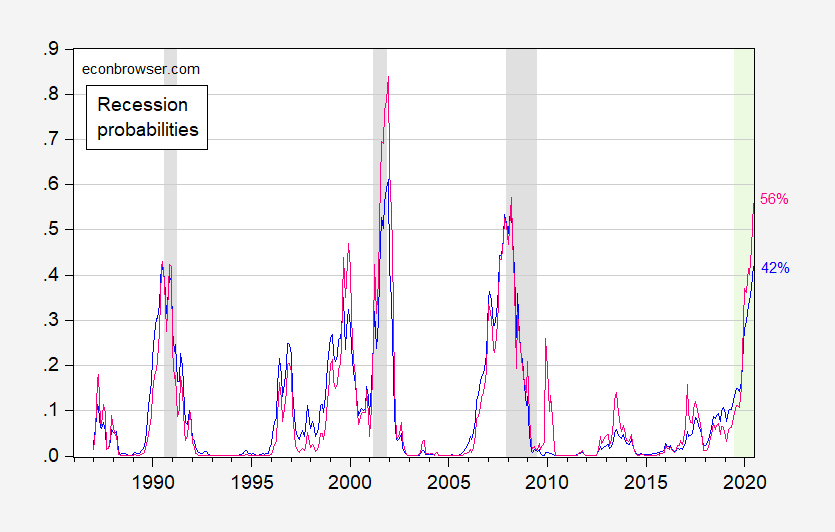

Probabilities, augmented with credit spread:

Figure 3: Probability of recession for indicated month, using 10yr-3mo spread (blue), and 10yr-3mo spread augmented with BAA-10yr spread (red). NBER defined recession dates shaded gray. Light green denotes out-of-sample. Source: NBER, author’s calculations.

Update, 7/2: For more, on growth rates, see IMF.b

The FRB- San Francisco found that the unadjusted term spread is a better predictor of recessions than one adjusted for the term premium.

https://www.frbsf.org/economic-research/publications/economic-letter/2018/august/information-in-yield-curve-about-future-recessions/

Also, that the 10yr-3mo is the most accurate predictor.

Also, see the same here

https://www.frbsf.org/economic-research/publications/economic-letter/2018/march/economic-forecasts-with-yield-curve/

Bro, you need to change that 42 to a 51+ %. I think my prediction time only lasts until July 31 2020, and I don’t like being wrong dude.

Damned darned Puh-hud dudes. Thinks he’s better than me because he would never marry his cousin, believes in inoculations for children, reads the directions on pill bottles, flushes the public toilet with the sole of his shoe, and only drinks craft beers. Me and CoRev gonna wreck him.

I knew it!!!!! My challenge to Prof Chinn would make him change the numbers above 51%. He knew we would wreck him. CoRev and I win again!!!!

The only person who truly understands CoRev and my recession models is Charlie Sheen, our adopted godfather, Daddy Sheen explains the base concepts here:

https://youtu.be/h5aSa4tmVNM?t=32

You need to remember, donald trump has other things than just the economy to worry about Menzie:

https://external-preview.redd.it/6-MUdIdXQEIUhQbkJIMQ0avwR2N7wU8Leic-x6E1G-8.jpg?auto=webp&s=6b616f589fa1f2d4616e2f6e6f8b86ea664dfa29

https://talkingpointsmemo.com/news/cartoonist-fired-drawing-trump-indifferent-reaction-drowned-migrant-family

“Canadian media company Brunswick News Inc. ended its contract with freelance cartoonist Michael de Adder over the weekend after his drawing of President Donald Trump and the Salvadoran migrant family that drowned near the southern border went viral.”

Time to boycott Brunswick News.

Going to the movie theater tomorrow (actually it would be today). It’s quite rare for me to go to the theater to watch a film. I would say TOPS 3 times per year. Going to see this film. I hope it doesn’t bring me bad karma, cause me to be struck down by lighting, or worse, mean I’m headed to Hell. Only the SJWs can tell me for certain.

https://i.redd.it/h520u3m6vyz21.jpg

Folks, I have to contribute to the MAGA economy somehow!!! And buying 5,000 lbs of groceries at WinCo for roughly $200 is not gonna do it folks. Plus I got a papaya from Mexico at 88cents per pound, which counts as 5 MAGA cardinal sins and 1/4 use of a condom, so I have to give indulgences, or so the Catholics tell me. And they would never lie.

Watched the film. As good or better than I thought it would be. I give it a very strong 7 on a 1-to-10 scale. It won’t be in theater much longer (except possibly discount theaters) because it’s not selling tickets—so if you wanna see it in the theater you gotta move fast. It has one of the best “shoot-em up” action scenes I have ever seen in my life (and I have seen a bunch). The scene is much more engaging on a big screen. If you’re on the fence about this one, get your butt out to the theater and watch it.

Sasha Luss is the REAL DEAL. This little Russian lady CAN act and held her end of the bargain with Helen Mirren.

Hello 2slugbaits,

I got the same answer as 2slugbaits => 39%

My work:

Use csv format in all steps, so I can easily see the numbers in the text file and easily use the probit function in R.

1) Downloaded the period of record for the 10 year minus 3 month from FRED in csv format

https://fred.stlouisfed.org/series/T10Y3M

2) Manually remove the missing records from the csv file.

3) use the libreoffice pivot table function to get monthly averages. Use monthly avgs per Professor Chinn. Save monthly avgs as csv.

4) Download the recession dates per 2slugbaits.

5) Create training set using 01/1985 to 06/2019. (I manually shifted the 12 month window using a block copy in the csv text file.) I know there are ways to do this with R commands, but I want to see the numbers.

6) Create test set using 07/2019 to 06/2020. (I manually shifted the 12 month window using a block copy in the csv text file.)

7) Create my probit model in R on the training set:

mymodel = glm(recess ~ avgspread, data=train, family=binomial(link=”probit”))

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.3951 0.1503 -2.629 0.00857 **

avgspread -0.8298 0.1312 -6.322 2.58e-10 ***

8) Predict recession probability on the test set:

testpredict = predict(mymodel, newdata=test, type=”response”)

For 06/2020 I got

0.3918860

Cheers,

Frank

Ooops,

I replied to the wrong message. I was supposed to reply to 2slugbaits below.

I went back and checked my work, again. I counted the years in the spread graph. I used the wrong starting year.

Correctly started my training set in 1987.

1) changed the training set to start in 1987.

The result was almost identical with to starting in 1986:

Coefficients:

Estimate Std. Error z value Pr(>|z|)

(Intercept) -0.3966 0.1505 -2.636 0.0084 **

avgspread -0.8259 0.1321 -6.252 4.06e-10 ***

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

For 06/2020 I got

0.3911078 |z|)

(Intercept) -0.2839 0.1497 -1.897 0.0578 .

avgspread -0.8956 0.1357 -6.600 4.11e-11 ***

—

Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

For 06/2020 I got

0.4389469

Using 1986 instead of 1987 as the starting year for my training set made very little difference.

Using the recession dates per AS (and the correct starting year 1987) did make a difference.

Cheers,

Frank

So in working your probit model I learned something new. I pulled the NBER recession dates from FRED https://fred.stlouisfed.org/series/USREC and noticed that the first “1” value indicating a recession was always one month later than the peak month shown in the NBER narrative. For example, if you go to the NBER business cycle dating page it shows Dec 2007 – Jun 2009 as the peak-to-trough dates; but when you look at the FRED binary data it shows Jan 2008 – Jun 2009. It’s the same way with the other recessions. My first reaction was that FRED must have made some kind of downloading error, but when I checked the binary file from NBER it showed the same thing. So apparently NBER begins the recession as the first full month following the peak; however, they don’t apply the same logic to the trough. Learn something new every day.

BTW, my probit model was very close to your results. I came up with a 39% recession probability and the coefficients were slightly different. But close enough that it could be due to maximum likelihood iterations.

2slugbaits: I use the convention you use — didn’t download the FRED recession dates. I guess I should try your approach; could explain the difference.

That’s VERY interesting. Wonder how many people have noticed that?? I am assuming there must be some. It would only produce a small variation in the end result right?? But assuming you’re right, 3% is still noteworthy, especially when you’re getting to that 50% which may be the difference between a “yes, we will have a recession” call and a “no we won’t”.

Good spot/catch there.

Last I heard, current estimate is 100% that the Fed lowers interest rate next meeting. Any guess if this will reduce credit spread worry? And while speculation is rife, perhaps the question that this whole credit spread problem is simply the outcome that the FED was wrong, or at least too early, with their aggressive interest rise should be entertained.

Ed

You didn’t think cowardly donald fired Yellen for no reason, did you?? Jerome is going to be a good little boy. We want to know, if in this “young love”, if donald gives Jerome some flowers will Jerome give out on every date after that?? At this point it looks like Jerome will need the day after pill very soon.

https://youtu.be/6jDcWAWRRHo?t=52

Why not just regress output growth on the spread and lags then use actual residuals to figure out probability statements about out-of-sample growth. Probably you have used NBER dates for recessions. NBER dating is a mysterious process. As you may have guessed, I an not keen on censoring continuous data. (Rant)

The period from 2010 to 2018 certainly does not look like a change in term premium is holding down spreads.

The historical chart indicates that while the probability of a recession in 2020Q2 might be 42%, the probability of a recession some time in the next two years is quite a bit higher. The 10yr-3mo is batting 1000 on that for the past 35 years. It’s the timing which is less clear. Given the not-too-bad situation of most economic indicators, I’d expect a recession, but towards the later end of the range.

I am puzzled why the Fed is so resistant to lowering rates. A stubborn inflationhawk Fed is another common feature predicting recessions, if not as well as the 10yr-3mo spread.

2slugs,

I notice that you used the FRED series USREC, there is another series USRECM, peak to trough. Not certain if this helps. Comparing the two series, there is some difference.

AS You’re right. It looks like the USRECM has the usual start date. I wonder why they decided to have two different versions.

I used the FRED data series: USRECM and t10y3m (end of month derived from the daily data). This showed a constant of -0.346 and a coefficient of t10y3m of -0.835, and a McFadden R-squared of 0.284. The resultant probability of recession is 40%. Close but perhaps no cigar.

By the way I am using monthly average interest rate data.

Using FRED data: USRECM and t10y3m (average), I show C=-0.284 and the coefficient of the spread at -0.896. A McFadden R-squared of 0.306 and a probability of recession of 44%. Again, close but no cigar.

One more thought. Since there is only one independent variable in addition to the constant, a useful scatter chart can be made with the interest rate spread on the x-axis and the probability of recession on the y-axis. This allows for an easy visual estimate of the probability of recession given the interest rate spread and given the probit regression model output used to create the chart.

“At the same time, I’m not relying on any credit spreads, which of late have been rising.”

Like Bernanke – I tend to follow credit spreads. But are they currently high? Looking at June 27, 2019, this measure “Moody’s Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity” is reported at 2.31%. Actually that may be misleading as the Moody’s Baa yield is for 20-year bonds, which was 4.32% on June 27, 2019. While the 10-year government bond yield was 2.01%, the 20-year government bond yield was 2.31%. So this credit spread is actually only 2.01%. A tad high but not that alarming.

Regarding these models, the threshold for a recession signal varies depending on the calculation method employed.

According to my particular one, we’ve reached the first month (June, 2019) of a 100% recession probability.

From this 100% reading, the average length of time until recession start is 12 months, in a range of 17 months to 6 months.

Your mileage will, of course, vary.:)

Sebastian

To both you and Ed Hanson, declaring that something that has not happened yet is “100% certain” unless it is something like “the sun will rise tomorrow” is just plain deluded.

You’re right, it is kind of annoying on some levels, yet I think we can assume someone saying this is not pro trump. These comments are best ignored as they are self-evident to be what they are. As much as I loath this cliche, Sebastian’s comments fall under the “it is what is is” category. If someone says “the sky is red” we need not necessarily refute it.

Bark

Your statement has truth, but does not apply. I said expectations are at 100%, not certainty of rate reduction.

The rest of the post was an invitation to speculate if the rate reduction happens.

Ed

Ed,

You did not say “expectations.” YOu said “current estimate” without specifying who is the source of this “estmate.” I am unaware of anybody saying that, although certainly the probability is high.

Moses,

This has nothing to do with who is or is not pro-Trump. I know Ed is, but I am not at all clear on Sebastien’s view. This is just me being my anally epistemological self. It is another one of those annoying things I have published on in refereed journals with citations, pompous me. I would not have bothered if it had been just one person, but when it got to be two chiming in with this rank nonsense about 100%, I had to step in and correct them.

BTW, Ed, “100%” is exactly the same thing as “certainty.”

Putin: “Western Style Liberalism is obsolete”.

Trump: I agree!

http://nymag.com/intelligencer/2019/06/trump-thinks-western-style-liberalism-is-about-california.html

‘Russian strongman Vladimir Putin elucidated his oft-stated belief that Western-style liberalism has failed, leaving Putin-style authoritarianism as the only alternative. “The liberal idea presupposes that nothing needs to be done. The migrants can kill, plunder, and rape with impunity because their rights as migrants must be protected,” Putin said. “The liberal idea has become obsolete.”’

If Trump understood what Putin meant here – his agreement is treason. Of course the press is claiming Trump is so incredibly stupid that he misunderstood what Putin meant.

Either way – Trump is a complete disaster as President of our nation. Traitor or just stupid as hell? Who cares. Get him out of office – NOW!

“Western style liberalism”…… Putin may be saying what Gandhi said about western civilization….. “They say that when Mahatma Gandhi was asked what he thought of Western civilization, he replied that he thought it might be a good idea.”

The past 70 odd years western as practiced has not been ‘sellable’. or moral.

We may be able to talk our way into a recession, but the economy is remarkably sound and showing moderate growth.

• low interest rates>

• high employment

• rising wages

• low inflation

• fair productivity improvements

https://www.bls.gov/eag/eag.us.htm

Thank you Kevin Hassett. BTW – is the DOW at 36000 yet?

Is the DOW at 15000 yet?

Ah Bruce – I never predicted the DOW would be this low right now. Your BOY predicted the DOW would it 36000 by sometime around 2002. How did that work out? Oh wait – why am I asking the clueless wonder?!

https://fredblog.stlouisfed.org/2018/10/the-data-behind-the-fear-of-yield-curve-inversions/

“…If the yield curve were to continue its downward trend from its previous high in December 2013, the yield curve would invert in August 2019 (using the 10-year and 1-year yields). Historically, this would predict a recession sometime in 2020…”

Evidently some sharp cookies over there at FRED.:)

Sebastian

Predicting a recession is difficult:

• https://www.marketwatch.com/story/next-recession-will-hit-during-trumps-first-two-years-2017-05-01

• https://www.pbs.org/newshour/economy/get-ready-economic-recession-coming-2017

• https://www.cnbc.com/2017/04/10/theres-more-than-60-chance-of-a-global-recession-within-the-next-18-months-economist-says.html

• https://www.huffpost.com/entry/the-coming-recession-of-2017_b_5797688

So, maybe the recession will occur in _______ give or take 3 or 4 years.

Another spiffy comment from the peanut gallery! Why not the age old joke – why do economists forecast? Come on Bruce – you don’t know the punch line? OK – to make the weather man look good!

Oh wait – you and CoRev will take this to be a comment on climate change! Snicker!

Now now, pgl, CoRev has made it abundantly clear that he is a super expert on the difference between weather and climate, so he will certainly not get confused about this, not him. After all, he is probably 85 years old given that he was at the highest expert level of the US space program from its very beginning.

Oh, pgl, you can do better than “spiffy”. You’re just upset that the previous past predictions of a Trump recession didn’t happen.

I can appreciate the difficulty in being precise when dealing with incomplete data/estimates and unpredictable events. Predicting the orbit of the moon is far simpler. It’s not unreasonable to expect an economic pause after a decade of growth. But you seem to take umbrage if I point out that current conditions are not all that bad. I’m guess that if this were a Democratic Party administration you’d be singing the praises of:

• low interest rates

• high employment

• rising wages

• low inflation

• fair productivity improvements

Keep predicting bad news; it’s bound to happen eventually. Even Obama had a couple of bad years (’15-’16).

“You’re just upset that the previous past predictions of a Trump recession didn’t happen.”

That is a lie and a rather pathetic one. No – I want continued economic growth. Find me one – just one – post or comment from me that suggests otherwise. You can”t. But you can whine and lie a lot. It is what you do.

“Even Obama had a couple of bad years (’15-’16).”

Ah yes – the Obama recession. Damn Bruce – hasn’t Trump made you Head Troll yet!

Bruce Hall declared the last 2 years under as Obama as bad years. Gee – BLS disagrees as it notes the employment to population ratio increased from 59.3% to 60.2%:

https://fred.stlouisfed.org/series/EMRATIO

Gee Bruce – is BLS lying? Seriously? Trump should make you Head Troll!

Bruce Hall: Fair productivity improvements? For some informed analysis, see: https://www.frbsf.org/economic-research/publications/economic-letter/2019/june/is-slow-still-new-normal-for-GDP-growth/

I am still wondering about the effect of the oil-price-moderating effects of fracking. And why your co-host has not said anything about this phenomenon. (Or did I miss it?)

Fracking is relevant when oil prices top $75/barrel. It seems that has not been the case since 2014!

https://fred.stlouisfed.org/series/DCOILWTICO

Here is commentary suggesting that the Federal Reserve can forestall a recession again by means of large-scale asset purchases . Maybe it tries to keep animal spirits alive until there is more room to cut rates, given that the average rate cut cycle is ~4%.

You make an excellent point that I had seen mentioned in a WSJ from a few weeks back and had semi-forgotten. This could maybe help the FedRes stall the rate change another quarter?? Enough to create enough fog to cover the appearance of kowtowing to donald trump. Of course the large scale asset purchases are STILL kowtowing to donald trump, but this method takes that kowtowing off the public address system or off the bullhorn.

Jerome is smart enough to know this may be his best political play to make here—large asset purchases made “on the low down”.

* “on the down low”

So, if there is indeed a recession mid-2020, do I get a cookie for blundering into prophesy? The signals still look confused, but they point sideways at best. If there is no recession, it still won’t feel like boom times.

But it creates limit pricing for OPEC. And the extra capacity, once created, can allow continued production at much lower cost than would be needed to develop new capacity…..and U.S. oil imports have remained suppressed.

Unfortunately, a lot of signs imply that the US economy has been overheating in the past year. A tax stimulus applied (potentially) at the peak of the business cycle will of course produce records in terms of low unemployment, extraordinary growth, stock rally etc… Couple this with huge deficits when economic growth is at an all time high and you have your typical overheating caused by fiscal policy. Hopefully I am mistaken, the only indicator that does not feet into this story is the inflation (which could be due a shift inflation expectations caused by a prolonged period of low inflation). If not, one can expect a harsh landing and a strong revision of the estimates of the output gap for the past year.

I don’t expect too harsh a landing. There’s no bubble to burst, or at least not one I’m aware of for now. The pro-cyclical policy was dumb, and it will have a negative effect. That doesn’t mean we are going to get a repeat of 1873, 1929, or 2009. It won’t be as deep or as long, and it won’t double dip like it did in the early 1980s. But, here it comes.

Excuse my English. I do not expect a crisis similar to the great depression or the financial crisis. But a recession following an overheating seems likely. I think that we are on the same page.

Off-topic

I wanted to put this in a more current thread in hopes more people would see it. My understanding is, it is Border Patrol staff that is manning the Fort Sill Children’s Death Camp. If it is “ICE” or some other, I am happy to be corrected on that (preferably with a link for verification of the fact). If Border Patrol Staff are manning the Fort Sill Children’s Death Camp, people should be VERY scared:

https://twitter.com/CBP/status/1145885534302199814

Walter Schaub’s point in the comment thread is very perceptive and astute in my opinion.

https://twitter.com/waltshaub/status/1145897975257939970

These vultures on the vulnerable are amongst us folks, and they are thick in the population. They go silent and off radar when guys like President Obama are running things, they come out in large termite hives when creatures like donald trump and Hitler are running the gameshow.

https://www.propublica.org/article/secret-border-patrol-facebook-group-agents-joke-about-migrant-deaths-post-sexist-memes

I know that the post noting how silly CoRev’s modeling out employment growth was as it assumed an unchanged trend is a bit dated but here is FRBSF Economic Letter paper that makes my point:

https://www.frbsf.org/economic-research/publications/economic-letter/2019/june/is-slow-still-new-normal-for-gdp-growth/

“Estimates suggest the new normal pace for U.S. GDP growth remains between 1½% and 1¾%, noticeably slower than the typical pace since World War II. The slowdown stems mainly from demographic trends that have slowed labor force growth, about which there is relatively little uncertainty. A larger challenge is productivity. Achieving GDP growth consistently above 1¾% will require much faster productivity growth than the United States has typically experienced since the 1970s.”

Little uncertainty with respect to “demographic trends that have slowed labor force growth”! I wonder if CoRev even know what this means!