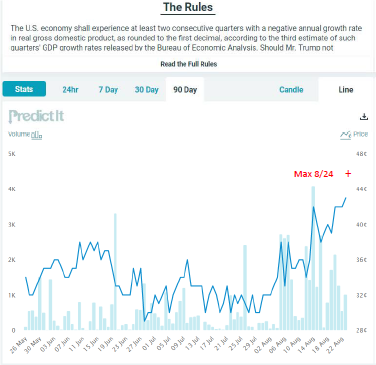

Hit that value earlier today, before dropping to 42% (recession in Trump’s first term, that is)

Source: PredictIt, accessed 8/24/2019 2pm Pacific.

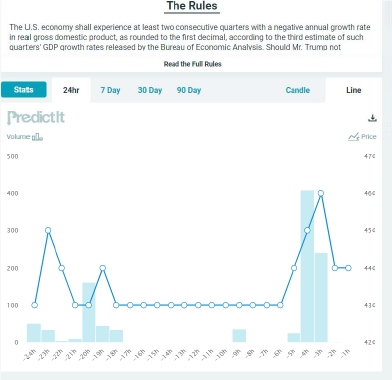

Detail:

Source: PredictIt, accessed 8/24/2019 2:15pm Pacific.

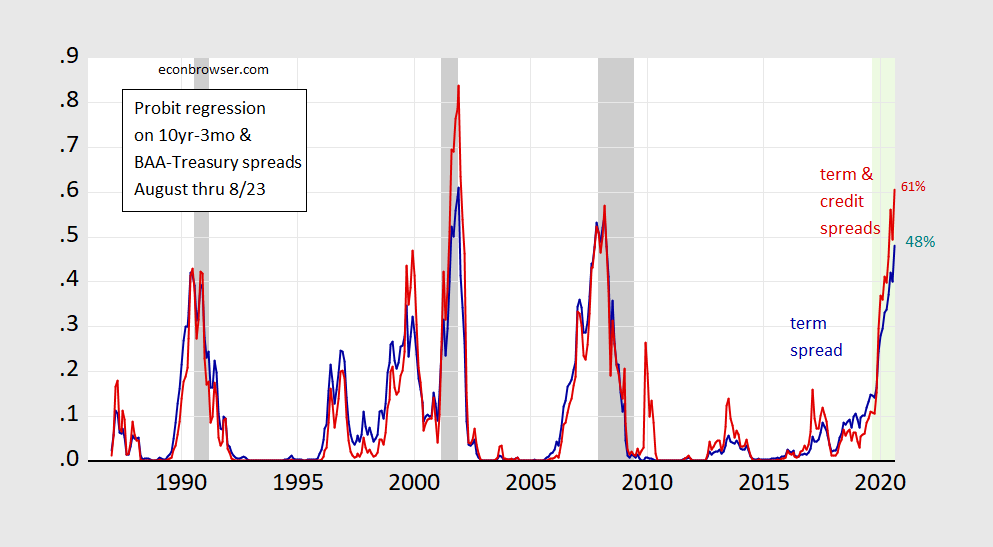

My estimates of recession probability, using plain vanilla term spread model, and augmented with a credit spread, estimated over the 1986-2019M08 period (assuming the rest of August is like what transpired through August 23):

Figure 1: 12 month ahead probability from probit regression on 10yr-3mo spread, (blue), and same augmented with BAA-Treasury 10yr spread. NBER defined recession dates shaded gray. Forecast period shaded light green. Source. NBER and author’s calculations.

A NY Fed staff report from 2014 presents a six month recession forecast model linked here https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr691.pdf

The six month model includes “the annual return on the S&P500 stock market index”, in addition to the GAP (GS10-TB3ms) and a six month lag in the gap. I approximated the latest S&P 500 return from 8/31/2018 to 8/23/2019, so the probability will vary a bit depending upon the next market week.

If I followed the model properly, it looks like the probability of a recession within six months is about 47% using data through 8/23/2019.

@ AS

Interesting. Does Eviews allow you to present things in graph form?? I 100% believe your assertions, but would still think it fascinating to see it in a visual form. But I admire your for crunching the numbers and it’s one more validation of a high chance here of a recession. I still believe the chances are about 75% donald trump backs off on the December implementation of the tariffs. I’m not there yet as far as “predicting” he won’t, but am only saying I lean strongly to him not at this moment.

Hi Moses,

EViews does allow the presentation of data in graphic form. Professor Chinn, uses EViews. The graph/chart above is an EViews output.

The six month chart looks pretty good. However, there is a false positive in 1966. The McFadden R-squared is 0.41. There are 672 included observations. Except for the constant, the regressors are very significant beyond 0.01.

An interesting Econbrowser entry that I just found is from 2/5/2008. A guest contributor, Michael Dueker presented his forecast of the upcoming recession using the US business cycle and a “Qual Var” model. He wrote an article on the Qual Var in the January 2005 Journal of Business & Economic Statistics, now available online, for those who have access.

His Econbrowser is titled, “Predicting Recession”. I can’t seem to connect to that posting, so I can’t provide a link. I was able to access the entry earlier today.

Here is the link to the Dueker entry.

https://econbrowser.com/archives/2008/02/predicting_rece

Here is a link to Dueker’s Journal article on Qual Vars https://amstat.tandfonline.com/doi/abs/10.1198/073500104000000613#.XWNSwHdFxAh

He wrote an earlier article on the same topic at the St. Louis Fed

Here is the link https://pdfs.semanticscholar.org/3bc8/f39979fb95427cc9f6ed764b9752bf08dec5.pdf

Any experts out there who want to show us how to create a Qual Var model for EViews?

From what I can determine, the Qual Var model combines a VAR and Probit (any further comments are beyond my pay grade).

2Slugs maybe you could help us.

I’ll be surprised if 2slugs doesn’t have a couple thoughts here. He’s usually moderate in his comment volume, but this type intellectual question is more apt to tease him out of the bushes. He may be busy crunching the Qual Var numbers as I eat a Carl’s Jr cookie staring at the computer monitor vacantly. The British say “Horses for courses”……

@ AS

Thank you

You are welcome!

The good news is that everyone is anticipating a recession and therefore we may avoid it by taking countermeasures now.

The worst recessions are the ones that policy makers don’t see coming.

Paul Mathis wrote: “The good news is that everyone is anticipating a recession and therefore we may avoid it by taking countermeasures now. The good news is that everyone is anticipating a recession and therefore we may avoid it by taking countermeasures now.”

That is the trouble is it not? Some anticipate every recession and many more do not anticipate every recession.

In this particular case, it is likely too late for general fiscal and monetary stimulus to offset the coming, anticipated recession. Moreover, even in an optimistic scenario it would appear that the marginal productivity of active, discrete counter-cyclical policy at this point would converge on zero.

Now if “countermeasures” means doing a complete 180 turn on trade policy, then any recession that materialized would like be shallow and short-lived.

Kudlow tries to explain Trump’s ever changing “thoughts” on the trade war. He said tariffs might be raised or did he say tariffs would be raised even more? Babble, babble, babble. Look Kudlow exceled at this shifty babbling when he wrote on monetary policy for the National Review. If it were Tuesday, the FED was lowering interest rates too much. But by Thursday, he’d be bashing the FED for not lowering interest rates enough.

https://talkingpointsmemo.com/news/white-house-clean-up-trump-second-thoughts-trade-war-china

Trump abuses the Twitter for economic statements. Me thinks Kudlow is still abusing cocaine!