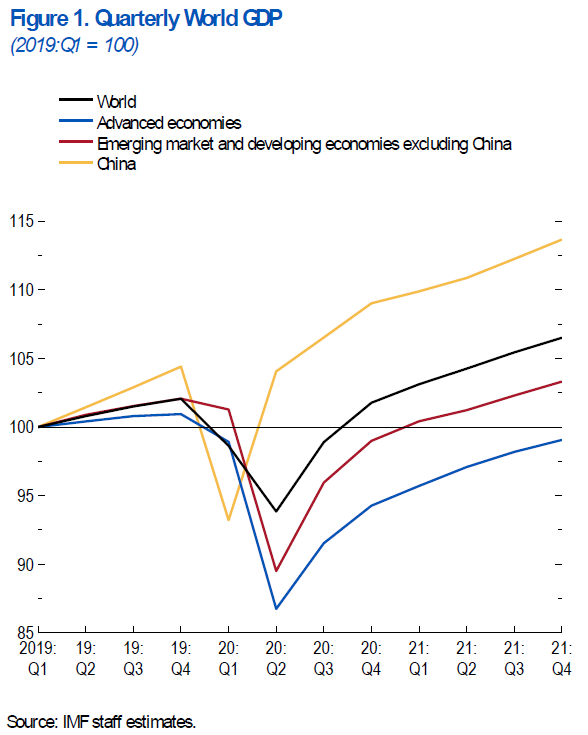

Today, the IMF released an extensive update to its April forecast, incorporating substantial downward revisions to forecasted growth.

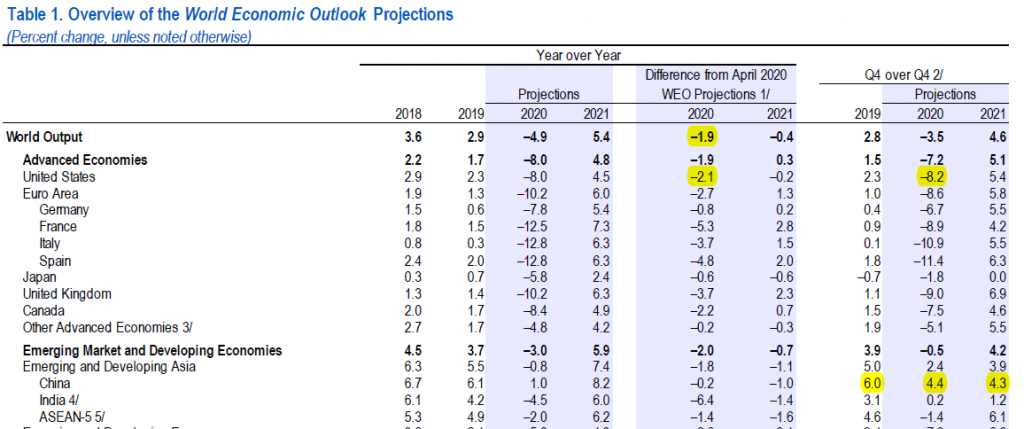

Inspection of the table presenting forecasts and revisions is enlightening.

Notice the US forecast for 2020 has been revised down by 2.1 percentage points on a year-on-year basis, reflecting a variety of things, of which I imagine the incredibly botched response to the pandemic is a major part. It is interesting that Q4/Q4 growth for 2020 is projected to be -8.2%, lower than -6.2% implied by the WSJ June survey mean responses.

Regarding China, the 4.4% 2020 Q4/Q4 growth doesn’t seem that much lower than the 6% recorded in 2019. However, one must recall this rate is being sustained by massive fiscal, quasi-fiscal, and monetary policies. Both public and private debt levels are rising rapidly.

From the WEO:

Uncertainty. Similarly to the April 2020 WEO projections, there is pervasive uncertainty around this forecast. The forecast depends on the depth of the contraction in the second quarter of 2020 (for which complete data are not yet available) as well as the magnitude and persistence of the adverse shock. These elements, in turn, depend on several uncertain factors, including

• The length of the pandemic and required lockdowns

• Voluntary social distancing, which will affect spending

• Displaced workers’ ability to secure employment, possibly in different sectors

• Scarring from firm closures and unemployed workers exiting the workforce, which may make it more difficult for activity to bounce back once the pandemic fades

• The impact of changes to strengthen workplace safety—such as staggered work shifts, enhanced hygiene and cleaning between shifts, new workplace practices relating to proximity of personnel on production lines—which incur business costs

• Global supply chain reconfigurations that affect productivity as companies try to enhance their resilience to supply disruptions• The extent of cross-border spillovers from weaker external demand as well as funding shortfalls

• Eventual resolution of the current disconnect between asset valuations and prospects for economic activity (as highlighted in the June 2020 GFSR Update)

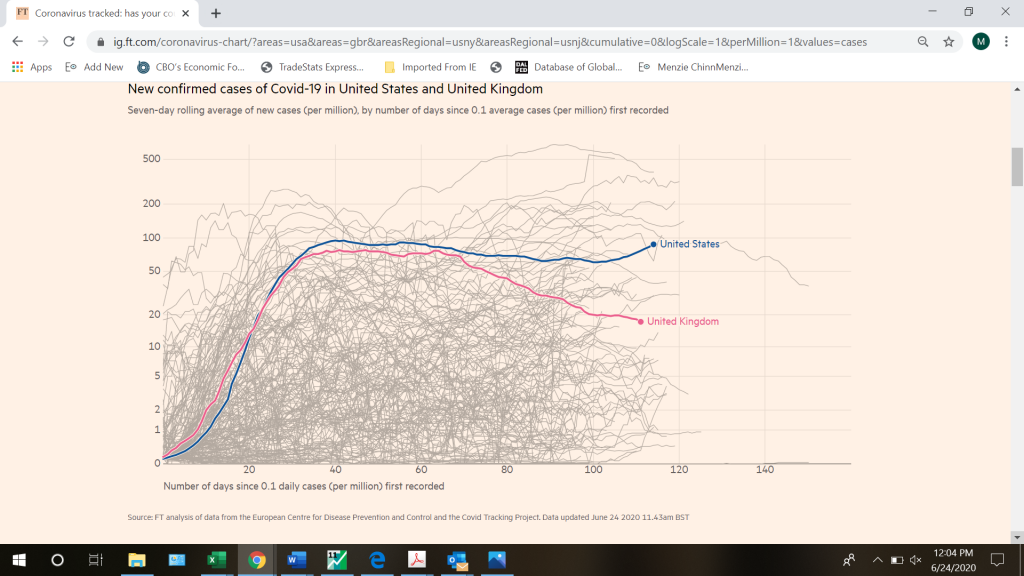

Regarding the length of the pandemic, it’s clear that the Trump attempt to just plow through in reopening is likely to increase uncertainty and end in sadness.

That looks too optimistic. That’s all I have to say.

The forecasted performance for those “advanced economies” looks like they are going backwards. Of course with “leaders” like Donald J. Trump, I’m not surprised.

I appreciate that those making this report note the ongoing levels of high uncertainty regarding data, if not models involved in this.

Regarding the US, I think we are seeing this swinging back and forth. So we had exaggerated models of how sharp decline in the US for the second quarter would be, which do not seem to have been supported strongly by some of the data coming out, such as that of unforecast increases in employment in May, not to mention the 17.7% increase in retail sales in May. But now we have the reemergence and spread of the pandemic in the US really taking off, with widespread reports of businesses shutting down due to it, even as some governments continue with further official reopenings. In any case, this recent apparent burst of growth in the US may seems likely to slow down again and possibly reverse.

I do not feel suffiiciently on top of the data to comment on what is happening in many parts of the world. I see Europe being forecast to have a larger annual decline than the US. This may be justified by the sharp drop due to the massive shutdown they has somewhat leading the US. But in most of Europe now, aside frmo a few nations, the virus is way more under control than in the US, so their reopenings look a lot more solid than those in the US, with them more likely to have sustaqined economic recoveries as the year peoceeds than the US, which is in much more danger of a W, or at least a V that flattens out into a square root sign or whatever. But, even with that, I guess they could still end up at the end of the year with lower net growth than the US.

I also note a super caveat, this matter of global carbon emissions. I have gone searching for an update on the May 20 Springer Nature article that showed global carbon emissions declining 17% from Jan. 1 to April 7, but then turning around and beginning to increase, if only gradually. Again, for the umpteenth time, that looks like a sign of positive aggregate GDP growth. But I do not know if that has continued or not, and even if it is continuing it may be that it is so slow that by the end of 2020 the rate of carbon emissions may still have not recovered from the 17% decline experienced in the first quarter of the year. But I note this as a sign thatt the IMF’sa projection of negative global growtrh for the second quarter may prove to be as inaccurate as the widepsread forecasts in the US of declining employment in May.

Once again, I just don’t see the policy value in these unconditional forecasts. What we really need are sector-by-sector conditionally based forecasts. For example, what’s the economic effect of reducing the hospitality sector by X% or the meat processing sector by Y%? The econometricians out there should be working on models that try to capture the elasticity of the change in COVID-19 infections with respect to various policy responses.

Oh, I see from the post before this one that what I called a “square root” pattern, following somebody here, is now being called a “reverse radical,” which there does seem some evidence for in the US, and which is apparently being forecast by 73% of US economists now.

@ Barkley Junior

I promised myself I would not come back to comment, but it’s just too much. You never fail to contradict yourself, do you?? Not only contradict, but saying the polar opposite.

https://econbrowser.com/archives/2020/05/who-is-predicting-a-v-shaped-recovery#comment-236771

You belittle someone for calling it a square root, then claim it was what you had said, after someone comes up with much better terminology. This is almost as funny as you pushing a V recovery in at least two post-recession comments. Just keep throwing them out there, and enough people will be sleeping to where you’ll have all your bases covered when we finally know the answer.

https://fivethirtyeight.com/features/what-economists-fear-most-during-this-recovery/

Moses,

Welcome back. I am changing my mind as new data appears, Moses, and also changing terminology as it changes in the usage of others. To quote the late J.M. Keynes (roughly) “When the facts change, I change my opinion. What do you do?”

So, sorry, Moses, y9u score no points whatsoever for pointing out my various changes of opinion on all this. Most of this is very much up in the air, and if you want to be helpful rather than just pointlessly pissy, i suggest you try to offer some constructive remarks on what is happening. YOu are actuallly capable of doing so. It will be too bad if you just degenerate back to your vacuous personalistic diatribes and silly links.

“In economies with declining infection rates, the slower recovery path in the updated forecast reflects persistent social distancing into the second half of 2020; greater scarring (damage to supply potential) from the larger-than-anticipated hit to activity during the lockdown in the first and second quarters of 2020; and a hit to productivity as surviving businesses ramp up necessary workplace safety and hygiene practices. For economies struggling to control infection rates, a lengthier lockdown will inflict an additional toll on activity. ”

I fear that this text will end up as grist for rightwing propaganda.

I appreciate knowing some of the assumptions behind the forecasts, but I think the assumptions offered may misrepresent some of what we know about reduced demand. At least some research (reported here, maybe?) finds that personal choices have had a larger impact on demand than government shutdown orders. The WEO text assumes it is the shutdown orders that are to blame. More grist for bad-faith politicos.

The text mentions alternative scenarios. Given the high uncertainty involved in economic forecasts right now, alternatives would be good to have. Contrasting “back to work prematurely” with “back to work belatedly” and with the baseline probably wouldn’t prevent Trump from misusing the WEO text, but it could matter to more serious thinkers.

Oops. There is a box offering alternative scenarios. My bad. Good for the IMF.

so we have idiots like rick stryker and bruce hall arguing against lockdowns because it impacted the treatment of other medical conditions. well now in houston, texas CHILDRENS hospital will now begin treating ADULT covid patients because the other medical center hospitals have filled up with……covid patients. so the dishonorable rick and bruce cried about locking out noncovid patients and encouraged a state reopening that……is locking out noncovid patients to deal with the resulting exponential spread of the coronavirus. hey dick stryker, did you see that outcome in your econometric pandemic modeling? what a worthless piece of crap. bruce and dick have no problem pushing their propaganda that results in illness and death as long as private bone spurs can get re-elected.

So how will COVID-19 affect next year’s health insurance premiums? Some insurance companies in hard hit states could take a real beating this year and may have to raise rates next year to recover losses. But if you live in a state that has not seen a spike in hospitalizations because of a stricter lockdown that suspended elective procedures, then hospitals and doctors will take a hit this year but insurance companies will enjoy a windfall. What happens to next year’s negotiated rates?

I wonder if Rick Stryker, Jr bought Obamacare health insurance or if he decided to go the free rider route. He could bankrupt dear old dad if he finds himself in a COVID ICU for a couple of months without insurance.

“So how will COVID-19 affect next year’s health insurance premiums?”

early on i was under the impression the government would pick up the costs for covid patents. is this still the case, or has that cost now moved onto the insurance companies? spending weeks in the icu is expensive.

rick stryker jr disavowed his old man months ago. he realized the old man was a selfish prick who only cared about himself, kind of like bunker boy. jr realized dear old dad would hang him out to dry financially if he got into a predicament. last i heard, jr was writing a tell all book on how his family helped to create the decrepit old man we occasionally see troll this blog. sr is still working on his econometric pandemic models, trying to show how the recent exponential growth we have seen in texas and florida are simply a result of increased maga testing, and not really a threat to those states. the full icu beds are simply a liberal conspiracy to unseat dear leader trump. my guess is dick is hunkering down with bunker boy under the white house as we speak.

The WEO’s identified “scarring” (persistent damage to supply-side resources) and financial stress as big concerns for growth as the immediate effects of the pandemic lift. The text also note that extraordinary central bank efforts have done a great deal to limit financial stress. So yay for the Fed and, more recently, more reluctantly, the ECB.

We have learned a great deal in recent decades about financial shock, and the benefits of that knowledge are showing. We’ll see with time whether central bank action, on top of macroprudential regulation, has served to prevent financial disintermediation from being a major channel for transmission of economic harm this time.

The real-side shock this time is huge. There has been a big reduction in supply-side capacity and turmoil for incomes. The policy response to those problems is in flux. The WEO urges, again, that automatic stabilizers be put in place to a greater extent than is now the case. Bless the IMF on this one, but the politicians we have in the U.S. are the wrong politicians. Maybe Andrew Yang will run again.

For now, there is a large idiosyncratic element to policy response. Some novelty in response is inevitable, but automatic stabilizers would reduce uncertainty.

Economic policy is not the only area in which great certainty is possible. We have an idiosyncratic pandemic response – whatever feels good to the politician in charge. “To hell with science” seems a poor choice when we are ultimately relying on science to save our butts.

Durable goods orders for US (FRED series DGORDER) was reported at +15.8% for May 2020 compared to Econoday consensus of 10.0%.

New Claims for Unemployment Insurance (FRED series ICSA)was reported today for week of June 20 at 1,480K compared Econoday consensus of 1,380K.

Some great news and some disappointing news.

Tension mounts, will Barkley be right on 2020Q2 GDP or will the virus vanquish 2020Q2 GDP?

AS: As of today, Atlanta Fed GDPNow is -46.6%, IHS-Markit (nee Macroeconomic Advisers) at -39.1%.

Thanks for that, I think. I had not checked the latest GDP updates.

I was beginning to think we could see a -19% 2020-06-20 17 GDP.

Meant

2020 Q2 gdp auto fill made an entry.

Wow, Menzie, that is well beyond doubling down. Guess we shall see in not too long.

well the quarter is not over yet. this week i have seen houston traffic cut in half due to the massive growth in covid infections. the final week of june will probably be back in the gutter for about a quarter of the nations population. this is going to be a hit to 2nd quarter gdp.

baffling,

Well, Houston seems to be one of the hardest hit places in the entire country with the resurgence of cases, with hospitals apparently running out of ICU capacity and bars and other outlets being reclosed. Looks like a place where we might expect lower traffic.

Professor Chinn,

As of today, NY Fed GDPNowcasting is -16.3%.

Incredible spread from Atlanta Fed GDPNow.

I guess I should not feel too bad forecasting as of last night a 2020Q2 GDP of -13.0%.

The NY WEI has consistently improved for many weeks and as of Thursday was at -7.69.

WEI, today’s PCE results for May and DGORDER results for May perhaps give some hope for optimism.

Maybe Barkley will be correct.

I think you are a very sharp cookie “AS”. Don’t jump on the U.S.S. Barkley Ship of Fools. You’re much better than that. I wish not to include you by inference when I crucify the bastard on his 2nd Quarter call. Jump off the ship before you drown with the nutjob “O-6”. We’ll just call you a temporary stowaway, OK??

Hi Moses,

As I recall, Barkley was the first and perhaps the only economist to say that we may have a positive 2020Q2 GDP, so I was trying to give credit to his comments which are far different from what the average of the forecasts by the various NowCasts . As we all know “it is difficult to make forecasts, especially about the future.”

Given the preponderance of the eminence of the various NowCasts, I don’t think I would put any money on my forecast, just having some fun. I do have an earlier forecast at -37%, but I am hoping for the optimistic model.

Well, today it was reported that consumption rose 8,6% in May after declining 12.6% in April (r9 something like that). Would not take all that much growth in June for consumption to be rising on net for second quarter, and as I have noted it is far from obvious we are having major declines in investment or exports to drag it down, although local governments and those doing business with them do seem to be declining, and layoffs are clearly still happening, if at a gradually declining rate.

I do not know whether US GDP growth for second quarter will be positive or negative, but as of now it looks to be a close call, and those forecasting double digit declines for second quarter look to me to be whistling past a lot of data going the other way. My suspicion is they are using models whose parameters have simply become unglued from reality, but in organizations it is often hard to overcome group inertia to recognize that what one is using has become severely flawed (or maybe that is understood by many, but no agreement on how to fix it).

Barkley,

I notice that nominal May Advance Retail Sales for Food Services and Drinking Places(FRED series: RSFSDP) increased from $29,992M in April to $38,627M in May, or about 29%. The food and service sales give some doubt to PCE for services.

PCE for services (FRED series: PCES) increased from 8,280.9B in April to 8,728.0B in May, or about 5.4%.

If this rebound in RSFSDP continued through June, then I think that total nominal PCE could be up about 7.8% in June.

Nominal PCE for nondurable goods (FRED series: PCEND) increased from $2,702.1B in April to 2,910.7B in May or about 7.7%. I think there is a chance of an increase to $3,210.4 for June, or 10.3%.

Nominal PCE for durable goods (FRED series: PCEDG) increased from $1,18532B in April to 1,523.9B in May or an increase of about 29%. I think there is a chance for PCEDG to increase to about 1,576 in June, or about 10%.

Sum it all up an I am cheering for an increase in nominal total PCE from 13,163B in April to $14,186 for June, or about a 7.8% increase as mentioned above.

If my calculations are correct, then the change in nominal PCE from 2020Q1 to 2020Q2 would be about -$1,411B, from $14,583B to $13,172B or about -10%.

I think the nominal percent change would be roughly the same in constant dollars. Hard to see how we get a positive 2020Q2 GDP change.

Can anyone tell me how much of the federal incentive spending for 2020Q2 will be counted in GDP? I have not read that chapter in the book yet.