GDP growth in Q3 was revised up 0.1% (SAAR). Real GDI was released; taking average of GDP and GDI reveals the possibility that actual growth was faster than indicated by GDP alone. And while forecasted levels have been downwardly revised over the past months, the most recent nowcasts suggest acceleration.

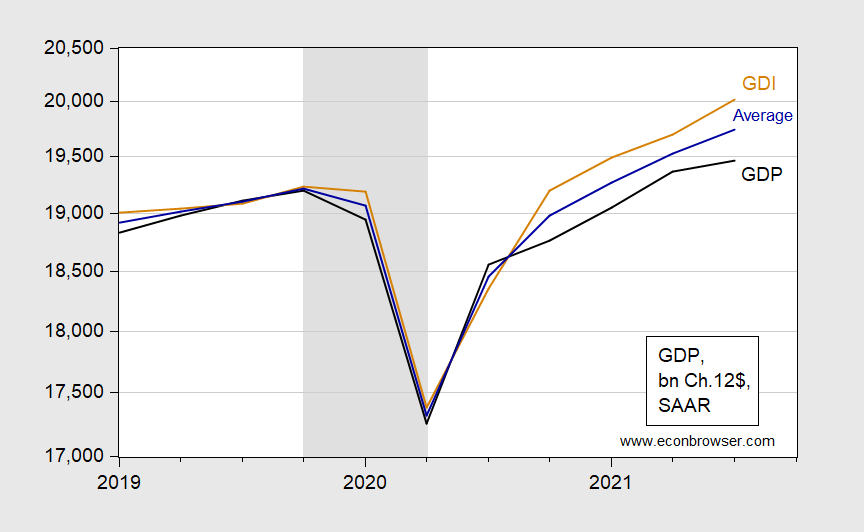

Figure 1: GDP (black), and GDI (tan), and arithmetic average (blue), all in bn. Ch2012$, SAAR. NBER defined recession dates, peak to trough, shaded gray. Source: BEA, 2021Q3 2nd release, NBER.

The growth rate of gross domestic output (the average of GDP and GDI) is 4.4% (SAAR), compared to the reported 2.1% for GDP. On a year-on-year basis, the figures were 7.0% vs. 4.9%, respectively.

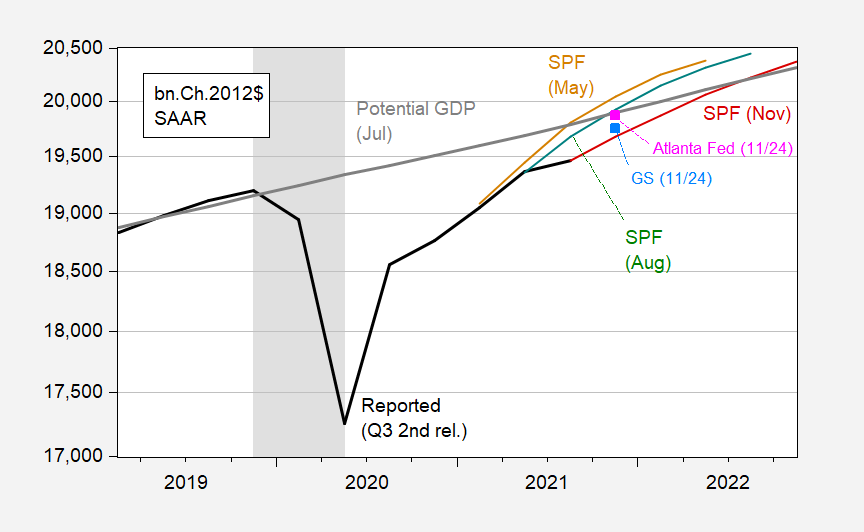

What’s the outlook for GDP as measured? Figure 2 presents median forecasts from Survey of Professional Forecasters over the past three surveys, and nowcasts as of today.

Figure 2: GDP (black), Survey of Professional Forecasters May median forecast (tan), August (green), and November (red), Atlanta Fed nowcast (pink square), Goldman Sachs tracking (light blue square). NBER defined recession dates, peak to trough, shaded gray. Source: BEA, 2021Q3 2nd release, Atlanta Fed (11/24), Goldman Sachs (11/24), NBER, and author’s calculations.

Forecasts of levels have been reduced over the last three surveys, noticeably since the August survey. That level downshift is largely driven by the low growth in 2021Q3. Interestingly, nowcasts for Q4 indicate an more substantial rebound than envisioned in the November SPF survey (responses between October 28th and November 9th). The Atlanta Fed’s nowcast indicates a 8.6% q/q SAAR growth rate in Q4.

In the near term (end-2021), the Atlanta Fed nowcast puts us where the August SPF median indicated (in terms of implied level).

In sum, it looks like in Q3, growth (and employment growth) was slowing (as some of us warned). However, growth seemingly has picked up at year’s end.

We are still below the official CBO measure of potential output but those forecasts suggest we will be this conservative measure of potential. I guess some folks might see the future as being excess demand and INFLATION but a very good case that the trajectory of potential GDP may be higher than what this CBO based graph suggests – especially given the passage of IIJA and hopefully the passage of BBB.

Oh, this is terrible news! Here we are, with a record low since 1969 of laid offs, and House GOP Leader McCarthy has informed us of the horror of a record number of “Help Wanted” ads. I was in the Post Office earlier today, and I heard an unmasked man, clearly a super expert loudly telling everybody around him in line about how there was a shortage of postage stamps because “niobody is working” in every stage of production, storage, and delivery of them, going through a long list of all the possible stages, with nobody working.

With so many people not working, obviously the economy is about to come to a disastrous crisis, even with crude oil and gasoline prices declining!!!

Good news!

Now, Chairman Powell can accelerate the taper and raise short rates 0.25% each quarter for the next seven [as he did in 2017 and 2018].

Or not. What’s your point?

Minutes Fed meeting of 23 Nov – really no insights. Fed Chair Powell had already announced that tapering would begin. All that the minutes revealed was that the FOMC members are in favor of normalizing monetary policy more quickly in view of the high inflation. This had been emphasized again by various Fed representatives themselves in speeches and interviews in recent days.

To wit.

Fed Total Assets Current $8.6 trillion – + $4.2 trillion from March 2020; 6/2008 – $0.905 trillion; 12/2008 – $2.2 trillion; 12/2012 – $2.9 trillion; 10/2014 – $4.5 trillion + 90%; 3/2020 – $4.2 trillion.

Monthly Fed Emergency Debt Securities Purchases $120 billion – $80 billion UST bonds and $40 billion MBS. Beginning mid-November 2021, $10B less USTs and $5B less MBS, then monthly declining by $15B unless something breaks. Will purchase additional $420 billion: $280 billion UST and $140 billion MBS through May 2022.

M1 – Current – September 2021 – $19.9 trillion; August 2021 M1 $19.7 trillion up 17% YoY. 9/2008 – $1.5 trillion; 9/2012 – $2.4 trillion; 9/2016 – $3.3 trillion; 9/2019 – $3.9 trillion; 5/2020 – Fed changed definition to include savings accounts which no longer had withdrawal restriction – FRED didn’t change graphs. .

Monetary Base – Current $6.4 trillion; From 11 Oct 2021 Barron’s, Federal Reserve Data Bank: Latest month Monetary Base is up on year $1.5 trillion, or 30%, to $6.3 trillion; the bulk of the increase was in FR bank deposits/reserves, up $1.3 trillion, or 45%, to $4.1 trillion. 9/2008 – $0.9 trillion; 9/2012 – $2.6 trillion; 9/2016 – $3.7 trillion; 9/2019 – $3.2 trillion; 9/2020 – $4.9 trillion; 9/2021 -$6.4 trillion.;

Fed Funds Target: 2009 to 9/2015 0% – 0.25%; 12/2015 0.25% – 0.50%; 12/2016 – 0.50% – 0.75%; [seven raises from 2017] 12/2018 2.25% – 2.50%; 12/2019 1.50% – 1.75%; 3/2020 0% – 0.25%; Current 0% – 0.25%. Expect Fed to lift 2022 or 2023.

UST 10 Yr. – 9/1981 – 15.84%; 5/1984 – 13.91%; 2/2000 – 6.42%; 12/2008 – 2.25%; 4/2013 – 1.70%; 8/2016 – 1.58%; 12/2018 – 3.24%; 3/2020 – 0.34%; Current – 1.63%;

T.Shaw: I think you mean the minutes of the November 2-3 meeting, released on November 24th, 2021.

T. Shaw only remembers dates Steve Bannon baits him into while Bannon watches and giggles from the stadium luxury boxes. T. Shaw really thinks Bannon will hold the football in place for him this time.

https://twitter.com/CWagner70/status/1463567216939618312

[ As T. Shaw falls to the ground, he openly wonders why Bannon and his orange hero were absentee at the insurrection. ]

“It was supposed to be January 6th, right?? Where is my fat orange Juliet of the Capulets??”

Here T. Shaw, since your weak pathetic loser with small hands lost the 2020 election has you feeling like you’re the type that hangs out with life’s fragile and impotent losers., I thought I’d let you go down memory lane with these pictures from infamously liberal leaning Forbes magazine:

https://www.forbes.com/sites/lisettevoytko/2020/07/21/heres-every-time-donald-trump-and-ghislaine-maxwell-have-been-photographed-together/?sh=6e9d38ec183d

Just when you were having a hard time getting into the Thanksgiving mindset. I’ve saved all of you Snowflake Republicans.

Next time try to respond with something rational, Moses.

@ T. Shaw

You can’t read calendar dates and you’re telling me to “be rational”?? This reminds me of our Virginia boy who in 30+ years as a “mathematical economist” had to be introduced to the concept of SAAR and thought the difference between 2% Native American admixture in European Americans and 4% Native American admixture in European Americans constituted a “skewed distribution”. God save us all from your and his “rationality”.

Well yea – Obama/Biden left Trump with a great economy – which of course Trump screwed up. Now if Biden gets his policy agenda past the Senate and the economy takes off, the FED should raise interest rates.

Oh did you have a different message? Too bad you are too much of a troll to articulate your “point”!

Some people aren’t happy unless they have something about which to be unhappy.

Happy Thanksgiving!

When trump was running for office, this was exactly what he called for. Why was it a problem when trumps economic solution was implemented? The lesson powell quickly learned was not to listen to trump, who is foolish.

Aren’t Real Statisticians laughing at you?

《Robustness checks involve reporting alternative specifications that test the same hypothesis. Because the problem is with the hypothesis, the problem is not addressed with robustness checks.

Are you listening, economists?》

https://statmodeling.stat.columbia.edu/2016/09/18/another-item-for-uris-comment-section/

“Are you listening, economists?”

Not to a boring troll like you. Think of the adults in a Charlie Brown cartoon. Blah, blah, blah!

I think somebody is having difficulty coping with the complexity of the real world.

No, rsm, we are laughing at you, except for realizing that this sick obsession of yours is coming from some wacko idea that somehow your brother is dead because of some sort of statistical misbehavior by economists. Sorry, bozo, it is not true. Take your insane obsession somewhere else and get over it.

Each Thanksgiving Day, I read Vermont Royster’s 1949 Wall Street Journal editorials, “The Desolate Wilderness” and “The Fair Land.”

Recommended.