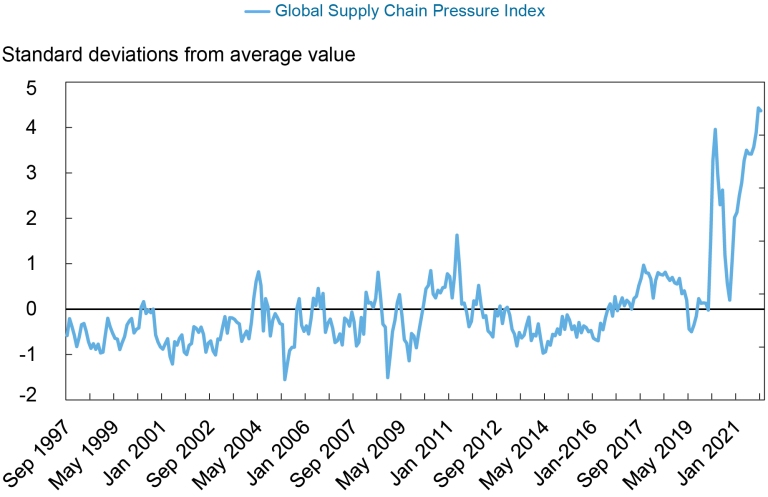

From the NY Fed, a new measure (Benigno, di Giovanni, Groen and Noble):

From the post:

[W]e propose a new gauge, the Global Supply Chain Pressure Index (GSCPI), which integrates a number of commonly used metrics with an aim to provide a more comprehensive summary of potential disruptions affecting global supply chains.

The index itself:

To estimate our GSCPI measure, we thus have available a data set of twenty-seven variables: the three country-specific supply chain variables for each of the economies in our sample (the euro area, China, Japan, South Korea, Taiwan, the U.K., and the U.S.), the two global shipping rates, and the four price indices summarizing airfreight costs between the U.S., Asia, and Europe. All these variables are corrected for demand effects to the greatest possible extent, as described previously. This data set is made up of monthly time series of uneven length: the advanced economies’ supply chain variables all start in 1997, for Japan they start in 2001 and for the other Asian economies 2004, the Harpex index starts in 2001, the BDI goes back to 1985 and the BLS airfreight price indices go back to 2005 on a monthly frequency and are quarterly from 2005 to 1997. Our aim is to estimate a common, or “global,” component from these time series. To be able to do that while also dealing with data gaps, we follow Stock and Watson (2002) and extract this common component for the 1997-2021 period through a principal component analysis while simultaneously filling the data gaps using this estimated common component.

The authors conclude that the pressures are extraordinarily high right now, but seem to moderating in the last observation.

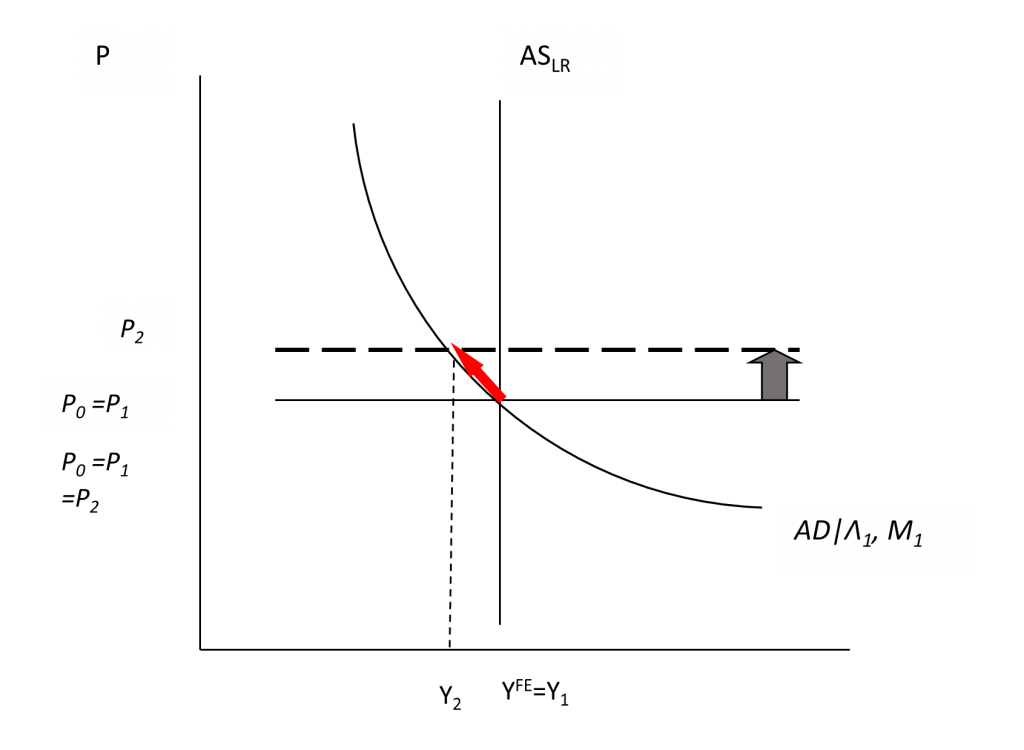

For a graphical depiction of why supply chain pressures matter, see this post, Figure 3 – cost push shock.

Figure 3: Cost-push shock.

Their blog post has a graph of what appears to be the annual change in the Baltic Dry Index but it also like to the BDI website which graphs the level over time some 1985:

https://www.balticexchange.com/en/data-services/market-information0/dry-services.html

Note the spike during the height of the commodity boom, which dwarfs where the BDI is now.

I’m glad that you showed the P-V chart. But sad that the explanations seem needed. (And they are, see people debating things all the time on the Net and confusing how the shift of one curve affects movement of the intersection on the other.)

But as a businessperson, this is the sort of econ that affects us and that we pay attention to and think about. Not Dept Labor Statistics or money velocity. 😉

Anonymous: Not sure I understand your point. Certainly calculation of potential GDP/natural output relies on DoL data…

Let me help you Menzie with the translation “As a businessperson” = “Be impressed. Be very very impressed, I am God”

Firms are understandably interested in the econ that is related to behavior of firms (micro). This is not to say that macro is not useful for those that set policy (which is not firms). And they don’t really think about GDP (unless you are a monstrosity with a corporate economist, and even then…he needs to be a raconteur to connect with the real businesspeeps).

General managers and marketers and manufacturing heads think about future demand and supply projections for their specific product. Coal, oil, shipping, polyorgochemicalX, RVs, etc. What the outlook is for pricing/margins. And if things are promising enough to get capex approved by the powers that be.

Yeah, we can tell you are a very “sophisticated businessperson”. After all, why would the macro picture ever effect the micro picture of demand for firms’ products?? Especially products like oil and coal that are so disconnected from the macro picture. Good point.

You don’t care to share what product your business sells do you?? I have a feeling this is going to be a laugh riot, so I’m dying to know.

Peaktrader, is that you, did you come home again?? The prodigal son has returned home to Econbrowser!!!! We kept your booger collection right where you left it under the nightstand by your bed, and Mom kept all of your participation award certificates. You want your Cap’n Crunch served in bed on the tray, correct??

“Firms are understandably interested in the econ that is related to behavior of firms (micro).”

Dude – read the blog post as well as its links. Lots of lots of data related to the behavior of firms. Unless you are telling me that shipping costs do not matter in your business.

I didn’t say shipping (or P-V diagrams) were not interesting. My point was that they are.

The Harpex Index tracks the cost of container shipment:

https://www.harperpetersen.com/harpex

It escalated quite dramatically since January 2000 but the good news is that has started coming down a wee bit.

Brent is sticking its nose over $80 (time of post submission):

https://www.cmegroup.com/markets/energy/crude-oil/brent-crude-oil-last-day.quotes.html

This is not going to help with the gasoline prices just dropped posts. 😉

Frackers need to get buzy! No more slacking. It’s a new year. Order moar rigs! No excuses. (As Heisenberg said, “figure it out”.)

https://twitter.com/MOAR_Drilling/status/1449200951580151812

Menzie,

Any indication of which specific sectors are especially driving this apparently large increase in supply chaim problems? We have certainly seen various reports of some improvement in some parts of all this, such as times to get things off boats and onto trucks in LA, not to mention the decline in gasoline prices that went on for awhile, although that may now cease with crude going up. I know there is still a chip shortage, which may not have improved, and I have seen some reports of the lumber shortage worsening. Is there anything else out there, or is this sort of an across-the-board worsening?

BTW, it seems like some other things we take for granted are just falling apart. So I am in Harrisonburg, VA where the latest winter storm caused power outages where I am, although they did not hit me. But there was this horrendous traffic jam on I 81 that involved Senator Tim Kaine (D-VA) stuck for 26.5 hours, along with a lot of other people. I mean, OK, it was a foot of snow, but they have had that much and more there many times, not to mention far more than that around the country. But this has got to be one of the worst such jams ever anywhere, and I do not get how it got so bad.

Was there a geostationary orbit weather satellite report for the area, for immediacy and precision? Why was the road open when the storm struck, so that plowing was problematic?

I do not know, ltr.

Was there a geostationary orbit weather satellite report for the area, for immediacy and precision? Why was the road open when the storm struck, so that plowing was problematic?

[ These are only meant to be the beginning of analytical questions to be asked about the severe logistics problem in the wake of the Virginia snowstorm. ]

ltr,

Nobody is saying anything about positions of satellites, and I think they are irrelevant anyway.

Here is what is in a long front page story in WaPo, for which this is a local story, even as it is a national one as well.

Gov. Northam, leaving office on Jan. 15, is trying to defend the VDOT’s handling of things, but many are highly criticial. It seems that in general they are pretty competent, but whether they could have done better or not, this situation really got out of control.

There was a forecast of 2 inches. It ended up being 12. Many said “why did they not pretreat the roads?” It started out as rain that turned to ice and sleet and then to snow. Any pretreatment would have been washed off by the rain. This looks like the biggie, along with the snow being far more than forecast.

I 95 is one of the busiest highways in the nation, the main east coast north-south corridor. Problems got going when multiple tractor traliers jacknifed and blocked the road. There were also lots of trees falling onto the highway as well as side roads,, with these causing power outages as well, due to the snow being wet and heavy. Tractor trailers were even blocking entrances and exits. Things then just began to pile up, with it taking more than 24 hours to clear it all off, and even now people are being advised basically to avoid it.

The one thing that it looks like VDOT could have and should have done but did not was to close access to the highway sooner than they did. But even if they had done that, it looks that i still would have been a major mess. Apparently there was something like this in the Washington area 11 years ago, but not this bad.

The center of the problems was a hilly section of I 05 near Fredericksburg between Richmond and DC, where the tractor trailer jacknifings really got going. At its peak a 48 mile stretch of the road was “a parking lot” with the emergency lanes also blocked. The north end of it all was basically at the Beltway around Washington.

I’m in the area. We knew it was going to be 8+ inches a few hours before the start of the snow. So, it’s not like 2 became 12.

I find it hard to believe they couldn’t do anything as the precipitation was coming down. Usually you see trucks starting to roll a bit preemptively, even if the plowing and treating hasn’t started yet. Plus 95 has enough traffic to take a while to cool down. But I’m not an expert on the weather or the salting, sanding, plowing scheduling. Probably just bad luck. And I doubt the governor did something irresponsible.

@ ltr

Let’s put it this way, freedom of travel in Virginia is much better than in Xian right now.

https://www.washingtonpost.com/world/2022/01/05/china-covid-xian-lockdown-miscarriage/

Good luck with those garbage pills you guys use that can’t even solve menstrual cramps. I could tell you a “heroic” story related to this, but it would just bore everyone here.

Solve the pain from menstrual cramps I should have said, just to be clear. English is my first language you know. Honest it is.

As I understand it, rain was falling on the road, and therefore the road surface could not be salted, as the salt would be washed away. Apparently the rain froze on the unsalted road. In essence, under these conditions, everything becomes an ice-skating rink in short order. We had this in Baltimore on Christmas Day perhaps thirty years ago, if memory serves. You really can’t even walk on it without falling. In any event, this time the ice was followed by a good amount of snow and that shut down everything.

My sense is that you need very specific circumstances to achieve these conditions: rain falling on ground below freezing, with temperatures dropping through the process. If the temperature is just a bit warmer, the rain doesn’t freeze and runs off the road as water; if just a bit colder, the precipitation falls as snow and you can still drive, if slowly. But at just the right temperature, the rain will fall and freeze on the ground and you can neither walk nor drive on the surface. You can appreciate why this might be a hard to forecast. It’s really a knife’s edge event.

https://fred.stlouisfed.org/graph/?g=KvER

January 4, 2018

Real Average Hourly Earnings of All Private Workers * and Quits Rate, 2020-2021

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=KvU6

January 4, 2018

Quits Rate, 2007-2021

High quit rates predominantly in accommodation and food services, and retail trade. Most other areas not hit anywhere as hard.

https://www.bls.gov/news.release/jolts.t04.htm

Since these are sectors where COVID reduced demand, could it be that workers “quit” in response to lack of hours? If so, hysteria about the Great Resignation would be overblown.

You’re mistaken. Other than in government employment, the quit rate has reached record high levels across sectors. The quit rate is higher now in leisure and hospitality than other sectors, but that’s pretty much always the case. The fact that some sectors’ rates are higher than others’ doesn’t mean only a few are facing abnormally high quits.

https://fredblog.stlouisfed.org/2019/01/which-workers-quit-more/?utm_source=series_page&utm_medium=related_content&utm_term=related_resources&utm_campaign=fredblog

You’ve gotta stop thinking you understand stuff after a superficial glance at it.

Workers quit jobs for lots of reasons. Sometimes it is a better job but this time it may be crappy pay, crappy benefits, and a total lack of attention to the safety of the workers. To be honest – we will not know the whole story for a while but I bet there will be some really good research that comes from this difficult period.

Unfortunately, the media narrative calls it the Great Resignation and suggests that workers are making out like bandits. Companies are using it as an excuse to increase prices.

Yet the data provided by ltr shows that real average hourly earnings in Nov 2021 are $.01above what they were in March 2020. Wow! Humongous pay raises!

https://www.bls.gov/opub/ted/2021/real-average-hourly-earnings-down-1-9-percent-from-november-2020-to-november-2021.htm

The media narrative about wage increases is total BS…and Democrats are likely to be in big trouble…as I predicted would happen if real wages started to drop into Trump era levels.

Macroduck: what don’t you understand about the word ‘predominantly?’ As I said, other sectors not hit nearly as hard. Nothing that I wrote suggested that other sectors were not affected

Learn to read.

Macroduck is willing to admit that we are still trying to figure out what labor markets will eventually look like. He offers some real insights but unlike you does not pretend to be a know it all. So you should learn to read as in this:

“You’ve gotta stop thinking you understand stuff after a superficial glance at it”.

I read just fine: “Most other areas not hit anywhere as hard.”

It is remarkable that you have selective memory even regarding your own claims.

You are simply wrong about the data and not honest enough to admi it.

And heck let’s test “predominantly” against facts:

https://fred.stlouisfed.org/graph/?g=KAxM

Nope, Johnny is wrong on all counts! Quits are higher and have increased more outside of leisure, hospitality and retail than in those sectors combined. Jeez, what are the odds you could make qn assertion that wrong, just at random? It’s almost like you’re trying to be wrong!

Did I leave out the link proving Johnny’s “predominantly” is wrong? If so:

https://fred.stlouisfed.org/graph/?g=KAxM

If not, no need to post this.

https://fred.stlouisfed.org/graph/?g=Kw6r

January 4, 2018

Quits Rate for Total Nonfarm and Health Care & Social Assistance, 2017-2021

Guess she didn’t have the preggers excuse. Too bad…….

https://www.yahoo.com/news/california-deputy-da-fought-vaccine-131753710.html

“Ernby’s husband, Mattias Ernby, appeared to confirm his wife had not been vaccinated in response to a Facebook user who claimed she had died of blood clots after getting vaccinated.

‘She was NOT vaccinated. That was the problem,’ ” Mattias Ernby wrote.

Maybe the QAnons will tell us she was attacked by martians. Perhaps she was killed because she knew JFK Junior was still alive?? We’ll never know. Perhaps Bruce Hall or one of our resident QAnon experts here will update us.

If supply chains are just payment chains in reverse, shouldn’t we be looking at financial flows, not quaint old supply-and-demand curve fables?

Now that is a really dumb comment even for you. Payments can easily occur electronically. Goods require ships. Try looking at shipping rates. DUH!

I think he’s trying to make reference to over-financialization of the economy. Which is a legit problem, but he’s not expressing it very well.

Perhaps the economy is over-financialized but he has consistently been harping Menzie with comments that real factors cannot matter. At least he has toned down his confidence interval rants.

BTW – a financial sector constraint on the real economy often turns up in high market interest rates. As in the spike in credit spreads during the Great Recession. We did have a very short lived spike back in March 2020 but now interest rates and credit spreads are quite low. I’m sure Menzie has in mind a nice retort using market prices for the financial sector v. shipping rates.

Looks like Sarah Bloom Raskin may be returning to the Fed. Biden’s folks think she should be easy to confirm. Warren likes her.

Seems like a solid choice at first glance.

It’s interesting. Guess we will see if it catches on as a frequently used metric.

One methodological question I have is if it shows results in real dollars. (Not clear to me if the container rates are nominal or real, for instance). They probably did it right, but just missed where they discussed it.

I guess I’m also interested in long meta-trends. Maybe more so than the topical Covid recent spike. Like I would figure we’ve gotten better/cheaper at shipping things (bigger ships) since 100 years ago. And distribution systems (e.g. “Walmart effect” have supposedly improved over time. Although perhaps this is partially impacted by growing use of longer supply chains (as transport becomes faster or at least cheaper, can go further to get cheaper parts). Probably some way to isolate for desired variable.

I suspect these indices measured nominal costs. Of course when nominal costs rise by a factor of 4 real costs also shoot up. Think 4.0/1.068.

https://news.cgtn.com/news/2022-01-05/Chinese-mainland-records-91-confirmed-COVID-19-cases-16zeB3ivuz6/index.html

January 5, 2022

Chinese mainland reports 91 new COVID-19 cases

The Chinese mainland recorded 91 confirmed COVID-19 cases on Tuesday, with 41 linked to local transmissions and 50 from overseas, data from the National Health Commission showed on Wednesday.

A total of 71 new asymptomatic cases were also recorded, and 632 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 102,932, with the death toll remaining unchanged at 4,636 since January last year.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-01-05/Chinese-mainland-records-91-confirmed-COVID-19-cases-16zeB3ivuz6/img/d5b6109ac7f0435f999d58feb86d106a/d5b6109ac7f0435f999d58feb86d106a.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-01-05/Chinese-mainland-records-91-confirmed-COVID-19-cases-16zeB3ivuz6/img/2394f536d5bd4b1bb6881cf280cbfce3/2394f536d5bd4b1bb6881cf280cbfce3.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-01-05/Chinese-mainland-records-91-confirmed-COVID-19-cases-16zeB3ivuz6/img/ee36a1f1f1714d67b15e413dfe815327/ee36a1f1f1714d67b15e413dfe815327.jpeg

https://www.worldometers.info/coronavirus/

January 4, 2022

Coronavirus

United States

Cases ( 58,040,720)

Deaths ( 851,439)

Deaths per million ( 2,550)

China

Cases ( 102,841)

Deaths ( 4,636)

Deaths per million ( 3)

http://www.xinhuanet.com/english/20220103/66c0743f10f240cdbcbe989bf45e444d/c.html

January 3, 2022

Nearly 2.85 bln COVID-19 vaccine doses administered on Chinese mainland

BEIJING — Nearly 2.85 billion COVID-19 vaccine doses had been administered on the Chinese mainland as of Sunday, data from the National Health Commission showed Monday.

[ More than 1.2 billion or 85% of the residents on the Chinese mainland have been fully inoculated. ]

https://news.cgtn.com/news/2022-01-05/Turkey-s-risky-inflation-experiment-16yluHJsZ68/index.html

January 5, 2022

Turkey’s risky inflation experiment

By Şebnem Kalemli-Özcan

Monetary policy in most economies today is anchored by an explicit inflation target, because targeting price stability has served both developed countries and emerging markets well. Until pandemic-related disruptions to supply chains and labor markets began fueling rapid price growth, inflation was well below target in major economies, and, sooner or later, the question of what to do in such situations will return.

Twentieth-century American economist Irving Fisher had an answer. Economic orthodoxy dictates that central bankers should increase nominal interest rates when inflation exceeds policymakers’ target. After all, raising interest rates reduces borrowing and spending, cooling the economy and curbing inflation.

Fisher, however, argued that when inflation is too low, central banks should raise their targets for nominal interest rates. He maintained that there is a positive correlation between nominal interest rates and inflation. This relationship, known as the Fisher effect, can be seen in economic data. Modern macroeconomists interpret the causality as going from inflation to nominal interest rates.

Turkey is the first country to put Fisher’s theory to the test – but with a crucial twist. Turkish officials believe that high interest rates cause inflation, so they claim that there is causation in the other direction. Lowering interest rates, the Turkish authorities say, should reduce inflation. After all, as Fisher argued, the nominal interest rate is the sum of the real interest rate and future inflation. If the real interest rate is constant, then the only long-term effect of decreasing the nominal interest rate will be lower inflation because any effect on the real interest rate from lowering the nominal interest rate will disappear in the long run.

But in the short run, such monetary neutrality is absent, so a drop in the nominal interest rate also decreases the real interest rate. And that hurts both domestic and foreign savers, which is a major problem for a country like Turkey, which runs a persistent current-account deficit to finance its economic growth.

With the real interest rate currently negative, the neo-Fisherian experiment will make Turkey’s inflation problem worse. A country that needs both domestic and foreign savings to finance rapid growth cannot offer those savers negative returns….

Şebnem Kalemli-Özcan is professor of economics at the University of Maryland, College Park.

https://fred.stlouisfed.org/graph/?g=JpfL

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 2000-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=JpfT

August 4, 2014

Real per capita Gross Domestic Product for China, India, Brazil, Turkey and South Africa, 2000-2020

(Indexed to 2000)

“Turkish officials believe that high interest rates cause inflation, so they claim that there is causation in the other direction. Lowering interest rates, the Turkish authorities say, should reduce inflation.”

Some may call this neo-Fisherian but something tells me Irving Fisher is rolling in his grave.

https://fred.stlouisfed.org/graph/?g=EQVi

January 30, 2018

Consumer Prices for China, India, Brazil, Turkey and South Africa, 2017-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=n8V8

January 15, 2018

Real Broad Effective Exchange Rate for China, India, Brazil, Turkey and South Africa, 2007-2021

(Indexed to 2007)

Sic semper tyrannis. Erdogan is going down.

Of greater interest to your employer should be events in Kazakhstan:

Kazakhstan riots: Protesters seize airport, government resigns

Though the unrest was triggered by the [gas] price rise, there were signs of broader political demands in a country still under the shadow of three decades of one-man rule.

These sorts of protests often occur in the context of high oil prices, eg, the Arab Spring of 2011. I think I count four or five events that could take down Xi. High gasoline or other energy prices are one of them. Count on that too, by 2026.

https://www.jpost.com/international/article-691596

Turkey has a high inflation problem and you actually believe this will take down Xi? Hey big boy – who don’t you lead a Far East version of the Bay of Pigs. I’m sure the PRC is shaking in its boots over the prospect of General Koptis leading a military invasion – not.

Unclear what is up in Kazakhstan, but looks more important for Russia than China. Another color revolution Putin so opposed to, and here just as he has all those troops on the Ukraine border and making demands.

I note that in the last few days Finland has publicly raised the issue of joining NATO because of Putin’s threats against Ukraine. Putin seems not quite to have realized how much backlash his unjustified aggression against Ukraine would bring.

Putin overplayed his hand, to be sure. Putin can only move with some confidence if China has his back. But the risk of that is that China may want a few time zones from Russia as compensation. Structurally, Russia should be a NATO ally, not opponent. The territorial risk to Russia is from China, not NATO.

Steven,

Apparently China is saying a big fat zero about both Kazakhstan and Uktaine. The group sending troops in to Kazakhstan is Russia’s answer to NATO, the CSTO, ot “Warsaw Pact lite,” which consists of only six nations: Russia, Armenia, Belarus, Kazakhstan, Kyrgyzxtan, and Tahikistan, all of whom reportedly have sent troops in to Kazakhstan to get the foreign terrorists under control. Funny how NATO has never sent troops into one of its members to overcome an internal uprising.

The Kazakhstan situation is much more complicated than is being portrayed in the US media. I shall almost certainly hold off on giving some of thise unreported details until things settle down a bit more, with there indeed being a lot of contradictory rumors flying around the Russian language sources.

One tidbit I shall throw out is that an important aspect of China’s murky role involves the BRI, with one of its centerpieces being a rail line across Kazakhstan that is supposed to be the most important direct link between China and Rurope. There have apparently been a series of problems about this rail line, not widely reported. These tange from it not making much money due to poor supporting facilities to what it should be shipping, with this getting tangled up in the LNG matter, whose prices were the trigger of this uprising. Supposedly this is part of where the weird rumors of British involvement come in as somehow they have been tangled up in all this. Yes, the Russian sources ultimately blame it on the CIA, James Bond working for Felix LIghter, or whatever. But the factual basis here may be that the Americans have been much more out of the action (although involved in oil production in western Kazakhstan),and it being Brtitish hands who really know their way around Central Asia, maybe a legacy of Lawrence if not Rudyard Kipling, going Great Game and all that.

According to my wife sources in Russia say that Putin is spinning the developments in Kazakhstan as being a “British plot.” Really. Who knows, with those meanie Brits in Almaty and Finland threatening to join NATO, well, probably he needs to go ahead and invade Ukraine just to show who is boss around there, gosh darn it!

https://www.stlouisfed.org/publications/regional-economist/july-2016/neo-fisherism-a-radical-idea-or-the-most-obvious-solution-to-the-low-inflation-problem#:~:text=The%20key%20Neo-Fisherian%20principle%20is%20that%20central%20banks,typically%20believe%20that%20cutting%20interest%20rates%20increases%20inflation.

Stephen Williamson tried to explain the neo-Fisherian idea back in 2016. This view is certainly unconventional. Even if there were merit in this idea, Turkey is not exactly following what Williamson is describing here.

Erdogan is taking a Fischerian view of monetary policy, that rate cuts will decrease inflation. Not working so far, is it?

And that was a substantive comment, btw.

Wow – you are my Gilligan. Call me the Professor.

You should have stuck with the first comment. Reverse causality in the equation is actually an interesting question and relevant to the issue of depression v suppression.

So, more on presentation. As I eyeball Fig. 1, the average is set too high. It appears the authors took the average from the entire period, including anomalous times. When setting an average, I prefer to use periods when I presume the data was near normal, in this case, 1997-2019. This would have the effect of dropping the average to about -0.5. This would more clearly show the impact of the Trump tax cuts and also suggest some sort of event in the 2010-2012 range. This once again highlights the need to understand the narratives implicit in the data. If you are just doing reflexive statistical analysis, your presentation may not properly reflect the underlying phenomena.

Steven Kopits: You should really read the underlying description of the index before commenting. The authors are trying to isolate the supply side factors, so they are trying to purge the measure of demand side factors. Personally knowing 2 of the 4 authors – and understanding what they are trying to get at in their index — I really don’t think they’re doing any sort of “reflexive” analysis at all.

Well, maybe I don’t quite understand their intent. If I drop the post-2019 period, then the typical standard deviation from the average is negative, to eyeball it. Statistically, I don’t see how that could happen. If events are IID, shouldn’t the standard deviations be symmetrical around the mean? Now, you could have a standard deviation that’s negative from a given target, eg, you always shoot low. But if you were shooting at the side of a barn, you’d expect the bullet holes to be distributed approximately evenly around the mean.

So: Cover the part of the graph from 2017 on with your hand. Now look at the graph. The standard deviations are overwhelmingly below the average (as designated by 0). I believe the authors have included the post 2017 (or if you prefer, the post 2019) data in the calculation of the average. While this may be correct statistically, it is wrong fundamentally, if I understand what they have done here.

To illustrate: Imagine you tracked a person you knew had the flu for ten days, of which for seven his temp was 98.6 and on three days it was 103 deg F. Then you would say that his average temperature was 99.9 deg F (by which we are implying ‘normal’ temp, aren’t we?) and doing the standard deviations from there. This is correct in terms of statistics but misleading. His average temp should be calculated during his healthy days, and then the sick days should be compared to the healthy mean, although you could include all the data in the standard deviation calculation.

I’m prepared to debate it.

This is actually an interesting point to debate, in my opinion.

As for Figure 3: Showing supply as fixed is misleading, because there is normally spare capacity. As long as spare capacity > 0 , we would expect a normal upward sloping supply curve. When spare capacity is consumed, supply does in fact become fixed and the curve will be vertical. However, even here, we have to be careful to note the binding constraint.

In the case of shipping to the US west coast, the capacity of the ports is more binding than the capacity of the vessels. How do we know? Because we have a backlog of vessels waiting to unload. Therefore, the cost of unloading and the implicit supply curve of the port is related to the the capacity constraints of shipping. That is, if the port is congested, the shipper can still store the goods on the vessel until the port clears. However, if the vessels fill up as floating warehouses, in effect, both shipping and port rates could theoretically go through the rood, assuming such rates are set in a spot market.

Steven Kopits: You really don’t understand the concept of “potential GDP” in the (utterly) conventional aggregate demand-aggregate supply framework, do you? What you have in mind is full employment in e.g., Friedman’s “plucking model”. I suggest you do some reading (or start with this blogpost, motivated by your earlier comments).

You’re suggesting Fig. 3 is the aggregate economy, not a specific supply chain? Well, okay, but they I would seriously take exception to the notion that aggregate supply is in any meaningful way fixed. The graph you’re showing is typical of fixed assets like power plants or port facilities, hence Enron-like price spikes. At the aggregate economy level, I think that’s wildly misleading. There is no such limit for labor, for example. Pay people enough, and they’ll work 100 hours per week, so the slope remains upward sloping, not vertical.

Steven Kopits: Did you take a macro course when you doing your Master’s? If not, I highly recommend reading pretty much any macro textbook on the market: Mankiw, Blanchard, Hubbard & O’Brien. Question: can a given worker work more than 168 hours per week?

We’re working 168 hours per week? Really? On what planet? You’re arguing that supply is fixed because Americans can’t work more at any price? That’s nonsense, Menzie.

It is, however, true, that ports have been at capacity and that radiates out towards shipping rates both in terms of trade volumes and parked ships being used as container warehouses as they wait to be unloaded. That’s where the cost push is coming from, and that in turn is coming right from US fiscal and monetary policy.

I think his reply that basically says workers CAN work say 20 hours a day 7 days a week envisions a return to slavery. Maybe he is taking Gerald Friedman’s macroeconomic course!

And I am saying that labor will have a normal upward sloping demand curve to multiples of current labor levels. It does not become a vertical line in any scenario which we might contemplate and therefore the proposed model (Fig 3) is not relevant for purposes of the current discussion at any economy-wide level.

It is however relevant for purposes of ships and ports, as well as for power plants. Because spare capacity is often small in fixed, but more or less, stable systems, a large demand shock can blow through spare capacity and cause a price spike. That’s correct and I agree with the assertion. However, supply will not be a vertical line below the exhaustion of spare capacity. Below that level, it should exhibit a normal upward slope. So it’s normally upward sloping to the exhaustion of spare capacity and then vertical thereafter. That’s the whole story of the Enron saga.

Anyone who writes this really does not understand basic macroeconomics:

“Steven Kopits

January 6, 2022 at 11:26 am

And I am saying that labor will have a normal upward sloping demand curve to multiples of current labor levels. ”

Upward sloping demand curve? I guess he still does not understand the distinction between supply curves v. demand curves. DUH. Yes a lot of macroeconomic models accept the concept that the labor SUPPLY curve is responsive to changes in REAL wage rates. But only money illusion models makes this claim for equiproportinate changes in nominal wages and the general price level.

Now WTF does “multiples of current labor levels” even mean. Steve has no clue but he thought it sounded smart. It isn’t smart but to someone who has no idea what basic terms even me – he must be so proud of himself.

“Pay people enough, and they’ll work 100 hours per week, so the slope remains upward sloping, not vertical.”

the current job market indicates that is not the case.

And finally, I would take exception to the notion of ‘cost push’ in this case. Cost push is the direct result of unanticipated excess demand. So the question is the cause of the excess demand, not the fixed capacity of shipping and infrastructure.

Steven Kopits: I struggle to find any conventional description of “cost push” as the result of unanticipated excess demand. Please provide some sort of documentation.

Did Stephen Moore and Judy Shelton write their Principle of Macroeconomics? That must the text Steve has been reading!

No substance here. I liked your other comment better. Actually added some value to the discussion.

You of all people should not lecture others over “substance”.

I am sorry that I have to.

“Cost push is the direct result of unanticipated excess demand.”

My Lord – where on earth did you learn macroeconomics? Oh yea from the hosts of Fox and Friends. Never mind.

To have a vertical supply line, you have to have a firmly fixed supply base which cannot be increased through short term price movements. That’s pretty rare and almost inevitably involves large, fixed assets like power plants, ships, ports or at times aircraft. These price spikes occur either when there is an unexpected outage, for example, last year’s ice storms in Texas, or when there is unanticipated excess demand.

Neither ports in the US nor shipping anywhere has seen supply collapse (with a notable exception of automobiles, which has seen a supply collapse). No one has been torpedoing tankers in the Pacific, nor is fuel in short supply. There is a record amount of goods being shipped to the California ports, as I understand it. So where does that ‘push’ come from? Well, it’s coming from excess demand, substantially (4-5 stand dev to judge from the graph) above normal. And where is that coming from? Well, it’s either fiscal or monetary policy, or both, no? There is no sui generis cost push from either shippers or the ports.

Steven Kopits: Aggregate supply/potential GDP is not the same as a micro “supply curve”, nor is it simply the average of all the micro “supply curves”. Please, please, please read a textbook before commenting further.

Yeah, except in real life Y2 is above Y1. The ports are operating at 20% above normal, not below it.

Well a 4 fold increase in the relative price of shipping will do that. DUH!

You’re arguing that raising prices will increase volumes? You really are a fan of Fischer.

The problem with this line of reasoning is that Y2 is below Y1 on Fig. 3 above. You’re making the case the Y2 is above Y1, which is in fact the case, but not what’s shown on the graph. Menzie is illustrating that a loss of capacity could lead to a price spike. That’s absolutely true in an industry with a strictly fixed capacity, and a good description of the power market in Texas during last winter’s ice storm.

And that would be reasonable if the west coast ports were processing fewer containers than normal, except as we discussed a few weeks back, the ports are processing about 20% more containers than normal. So Y2 is above Y1, to the extent we are treating Y as a proxy for the west coast ports.

I guess you never got the distinction between general inflation v. relative price changes. A basic macro concept which completely eludes you. Which is why 99% of your comments are completely devoid of “substance”.

This is inflation, not a relative price change.

Steven Kopits: I’m sorry, I missed what “this” is. Which price level index are you talking about here? Not shipping costs I hope.

Your little “theory” is based on the microeconomic effects of relative price changes. Gee Steve – you are now arguing with yourself. I guess you are the dog chasing its own tail.

I guess we need to go back to the beginning and unpack all the stupidity in this:

“To have a vertical supply line, you have to have a firmly fixed supply base which cannot be increased through short term price movements. That’s pretty rare and almost inevitably involves large, fixed assets like power plants, ships, ports or at times aircraft. These price spikes occur either when there is an unexpected outage, for example, last year’s ice storms in Texas, or when there is unanticipated excess demand.”

You are talking about a microeconomic foundation and changes in relative prices even if you are too stupid to know this. But OK one sector expands when its relative price goes up from an increase in aggregate demand. Where do these economic resources to satisfy the increase in demand come from. From other sectors. You are doing are doing partial equilibrium but good macro requires a general equilibrium perspective. Of course you likely have no idea what that is.

You also assume here perfectly competitive markets. Yea we get do have no clue that the real world has sorts of market failures including monopoly power and even monopsony power. Come on dude – try taking a freshman course in basic economics before writing any more of your usual BS.

I mean the situation with the ports and shipping is an inflationary, not relative price, effect. Yes.

If CPI were not increasing and wages were not increasing, then we could say that we are seeing relative prices changes. We see these all the time wrt, for example, oil. However, both prices and wages are rising rapidly.

In this case, we have an inflationary impulse from the US government in the form of a 12.6% deficit on a 3% output gap and suppression of interest rates during a suppression, not a recession. These will blow out asset prices, which they have, and then translate into inflation in consumption categories over time. It is fair to say that this sort of inflation may not show up at the same time in all the same places. Thus, when we are speaking of major infrastructure like ports, where capacity is close to actual throughput, then a general inflationary surge can appear there as a bottleneck, with inflation accentuated there compared to aggregate CPI for a period of time.

Put another way, if you’re going to put a huge fiscal and monetary stimulus through the system, you can blow up your critical path infrastructure in the process. The Biden stimulus (let me not entirely allow Trump off the hook here) led to the bottlenecks at the ports. Yes, that is what I am asserting and that’s a takeaway point for your macro class. The ports bottleneck is a man-made crisis.

“Steven Kopits

January 6, 2022 at 11:46 am

I mean the situation with the ports and shipping is an inflationary, not relative price, effect. Yes.”

Just wow. Nominal shipping costs have gone up by 300%. I guess you believe all other prices have risen by 300% even though BLS says this is less than 7%. Look dude – I’m sorry your bagel costs more but if you think the relative price of shipping has not increased – you are dumber than even I give you credit for. Please stop writing words you do not understand and buy a damn dictionary. If you can’t afford one – I’ll pay for it. GEESH!

“If CPI were not increasing and wages were not increasing, then we could say that we are seeing relative prices changes. We see these all the time wrt, for example, oil. However, both prices and wages are rising rapidly.”

So Princeton Steve can see relative price changes only if the inflation is zero? Dumbest troll EVER!

Pointless comments.

Those relative prices changes are due entirely to the oversized stimulus from the White House and Fed. Government policy blew up the ports and sent rates up sharply. Without the stimulus or egregiously low interest rates, the ports would be functioning normally without price spikes. Absolutely.

Steven Kopits

January 7, 2022 at 12:05 pm

Pointless comments.

Followed by more of the incredibly pointless stupidity you excel in. You know – talking to a dead tree would be more useful than going back and forth with your insane garbage. Just go away and stop wasting everyone’s time.

That’s true. Still nothing but rants from you.

Wannabe dictator endorses actual dictator Viktor Orban:

https://www.msnbc.com/rachel-maddow-show/why-trump-s-endorsement-hungary-s-viktor-orban-matters-n1286848

Wait a second – Orban rules Hungary which Princeton Steve claims is his homeland. Stevie pooh has often demanded that our host call for Xi to be removed as China’s leader. But I have never seen Stevie pooh calling for Orban’s removal from power. Now if he has – I stand correct. If not – Stevie pooh is the ultimate hypocrit.

I probably favor Marki-Zay. Orban, as I have said, is probably the most talented politician in Europe, and his policies are generally well regarded in Hungary, where I visited a couple of months ago. Having said that, it appears that Orban et al have stolen truly vast sums of money, mostly from the EU, and that a certain gangsterism has developed there. Hungary has also become a hotbed of Russian intrigue, and it looks like the Chinese are in play there, too. The country needs a change.

I figured you would have nice things to say about Hungary’s version of Trump. I even bet you are celebrating 1/6 with the Oath Keepers.

Orban is a whole different class from Trump.

And yet you cannot condemn either one of them!

I don’t like Trump or his demeanor. And I wasn’t crazy about many of his policies. On the other hand, compared to Biden, Trump’s economic policies were superior, crime was lower and the border was far more secure. I supported Hillary and Biden. In 2024, unless the Dems pony up Manchin, I will either vote Republican or sit it out. I am no fan of this version of the Democrats. The majority of voters aren’t either. My model shows them at ninety year lows for House seats come next November. Indeed, I think a reasonable read of developments speaks to the destruction of the Democratic Party as we have known it.

Steven Kopits: A massive tax cut at full employment and a trade war (partly waged against our allies, i.e., Section 232 actions) which sent policy uncertainty to record levels is your idea of a superior economic policies.

As for Orban, as I have said, he is perhaps the most talented politician in Europe and he continues to enjoy wide support in Hungary. In fact, his support is so solid that the candidate from the opposition is also a conservative. I agree with many of Orban’s policies, but in truth, GDP / capita is no higher than it was in 2008 and Budapest looks like a dump, worse than when I was last there 16 years ago. The population is thoroughly beaten down, the worst since the end of the communist period, in my estimation. So, not all is golden in Hungary, but that does not mean that everything is bad, either. It is an incredibly seductive place, very easy to feel at home there, even for non-Hungarians. A lot of the ex-pats of old are drifting back, unable to stay away.

Back in the day, I worked on a project with Gyurcsany, the former socialist prime minister and the de factor leader of the opposition today. He’s a really smart guy, very sharp, but the Socialists screwed up when they were last in power. I also know the Free Democrats, a relative of mine having been minister of infrastructure for them and a former girlfriend, an MP. Both rock solid, incorruptible. I also know the son of the first prime of Hungary elected after the fall of communism, a conservative and the embodiment of decency; and the son of the last communist era prime minister worked for me at Deloitte. Very, very smart. Some of these folks have sharper elbows than others, but I feel privileged to know all of them. I don’t hate any of them, including Orban.

If you’re trying to frame this in terms of good-vs-evil, you’re missing the point. It’s more a matter of which imperfections you’re willing to tolerate. I don’t love Orban or hate Gyurcsany. I think pretty highly of both of them, but neither of them are saints, and you wouldn’t want to leave your EU funding lying around too long unattended near either of them. They both know which side of the toast is buttered and how to take away yours, if it comes to that. Or to share the toast, if it comes to that. Not angels, but not demons, either.

Hungary’s problems stem from the structure of governance, not the personalities involved. If Gyucsany came back, you’d just get a different flavor of the corruption and venality we see there now. The longer in power, the greater the corruption and cronyism. What is needed, as I have been saying for seventeen years now, is to align the principal with the agent by linking pay to performance. If pay is linked to outcomes, you can get the outcomes you want. If pay is linked to power, then power will be the product of the system. That simple. Who runs the show is a secondary issue, from my perspective. While the rules of the game remain the same, the outcomes will tend to be similar. It’s the rules we need to fix.

I think you’ll find in my comments, Menzie, that I was not crazy about either of those policies. But at least the ports weren’t clogged and inflation was reasonable. So, sure, I agree that I was not a fan of many of Trump’s policies, but by comparison with Biden, Trump’s beginning to look like a genius.

Of greater interest to your employer…

Of greater interest to your employer…

Of greater interest to your employer…

[ This is precisely the way in which the writer chooses to threaten people. The point is to threaten by race or ethnicity, so that a person who is, for instance, Jewish must denounce other Jews to be found acceptable. A profound way of intimidation, perfected in the Inquisition. Denounce the Jewish people and convert or be condemned, but even after conversion the convert is always suspect.

Of greater interest to your employer…

Of greater interest to your employer…

Of greater interest to your employer…

[ I was fortunate enough to have read through “The Grand Inquisitor,” from the Brothers Karamazov, * with a sublime teacher. The class was moved twice to a larger hall, as listeners came.

Try the translation by David Magarshack. ]

Touched a nerve, have we?

“I strongly encourage you once again to post in no uncertain terms calling for democracy in —–.

—– Needs Democracy Now!

Let’s see you post on that.”

[ “The Grand Inquisitor” was stunning to read. Say the words that will set you free, at the expense of an entire people. There is however no freedom to ever be gained from such words. ]

https://fred.stlouisfed.org/graph/?g=KxEE

August 4, 2014

Real per capita Gross Domestic Product for Germany, France, Turkey and China, 2000-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=KxEH

August 4, 2014

Real per capita Gross Domestic Product for Germany, France, Turkey and China, 2000-2020

(Indexed to 2000)

Some supply chain issues links:

Food…

• https://www.thepigsite.com/news/2022/01/purdue-dashboard-reveals-weaknesses-in-us-food-supply-chain

..

Home furnishings (will they lower prices when supply chain issues ease?)

• https://thehill.com/regulation/business/587844-ikea-boosts-prices-blames-supply-chain-troubles

Probably the worst impact for consumers during COVID…

• https://www.wbrc.com/2022/01/01/supply-chain-issues-limiting-liquor-availability-sales/

From the people who actually move the stuff…

• https://www.freightwaves.com/news/fearless-supply-chain-predictions-heres-what-will-happen-in-2022

• https://www.benzinga.com/markets/commodities/22/01/24860197/new-year-same-supply-chain-mess

And the COVID wild card…

• https://www.msn.com/en-us/news/politics/hong-kong-airline-suspends-cargo-flights-amid-covid-19-protocols-warns-of-supply-chain-issue/ar-AASjp78

Did Kelly Anne compile this weird list for you? The Pig Site and Purdue? OK. IKEA – like any real person shops there. Now the 3rd link may be of interest but your “source” does not get why this is happening:

‘Bourbon, cognac, and champagne have been particularly hard for Dee’s package to get in the store and management now believes the issue could be hurting the bottom line.’

Not cause by COVID supply chain disruptions as everyone on the fine wine sector knows making champagne requires time and the harvest for the grapes had been low for a the last several years. I guess Dee’ package believes in your stupid Just in Time Inventory approach which plagues the car sector. Oh wait Bruce Hall denies he ever advocated this stupid inventory policy even though he did many times.

Wow – Bruce Hall has a new job as spokesperson for Cathay Pacific, which is a massive airline multinational based in Hong Kong. They sort of had been buying up the competition so their profits margins were quite sweet before COVID. So let’s not fell too sorry for them especially since upper management caved into the Xi government on the issue of Hong Kong protestors:

https://www.reuters.com/article/us-hongkong-protests-cathay-pacific-idUSKCN1V413C