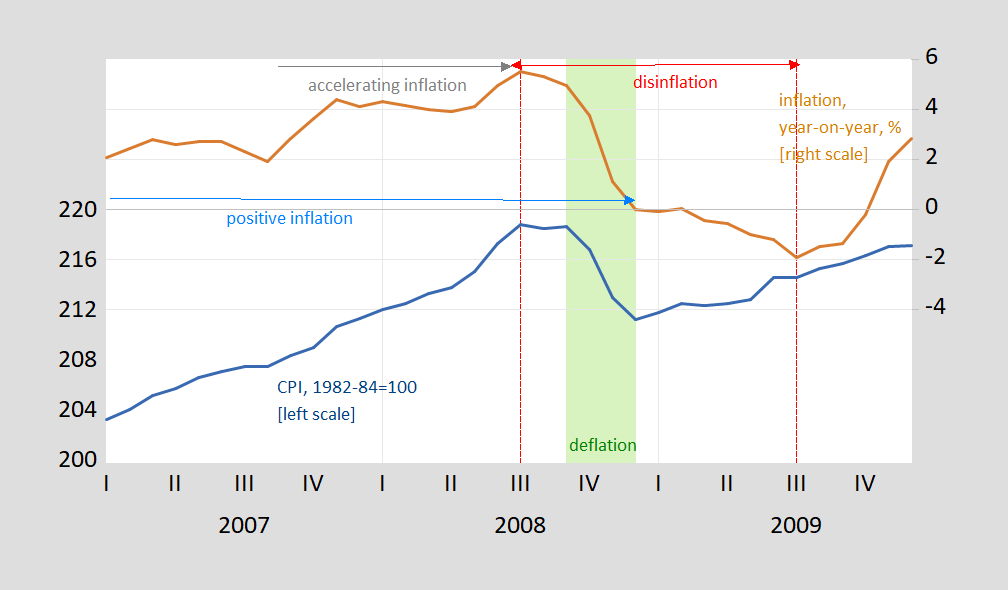

Yesterday, a discussion on Marketplace (w/Justin Ho) about how these terms fit together. In order to explain, consider a broad price index (e.g., CPI). Then one can illustrate these concepts graphically:

Figure 1: CPI, 1982-84=100 (blue, left scale), year-on-year inflation rate of CPI, % (brown, right scale). Green shading denotes deflation red arrow denotes disinflationary period, sky blue arrow denotes positive inflation, gray arrow denotes accelerating inflation period. Source: BLS and author’s calculations.

In particular, you can have disinflation with positive inflation, and you can have deflation with positive inflation. Obviously, there’s some judgment involved (do you use year-on-year or quarter-on-quarter inflation, or even month-on-month, and when you get to shorter horizons, do you call a one month decline in inflation a “disinflation” or not).

“Heh — that’s really not the way it works,” said Tim Duy, economics professor at the University of Oregon. “Inflation is really the rate of change in the price level. So inflation slowing just means that prices are not rising as quickly as they were last month,” he said.

Tim used to do guest blog post at Mark Thoma’s EconomistView. Alas this excellent blog ceased to post new materials.

I think some of his stuff gets posted at his brokerage or firm, but if I remember right it’s hit and miss on what of Duy’s writings they will share.

The brokerage firm University of Oregon.

I know similar to Barkley you enjoy talking out of your nether regions most the time. All it takes is a 30 second search:

https://www.sghmacro.com/team_member/tim-duy/

You know Menzie also picks up a “private” paycheck from time to time. Strange how the market has a hunger for people with brains. That begs the question, how do you make ends meet Econned???

https://www.sghmacro.com/team_member/tim-duy/

https://www.washingtonexaminer.com/news/john-eastman-suggested-pennsylvania-throw-out-absentee-ballots-to-give-trump-lead-email-shows?msclkid=2642862bd16611ecbc378549b5f89248

So we all know Biden got more votes than Trump in Pennsylvania during the 2020 election. Well John Eastman came up with his own little magical way for the final vote count to favor Trump – just throw out a bunch of the legally casted ballots.

Hey – this is even more corrupt than how Russia does it!

“just throw out a bunch of the ballots legally casted by black voters”

There, I fixed it for you.

Thanks as that is precisely right!

“casted”?? These are the type English errors I never had to teach my Chinese students to unlearn, as they weren’t raised by the American clods who keep passing them on. If I was getting nit-picky (which I would have if you were one of my prior students) I would also tell you that you should capitalize the word Black—you don’t use lower case when you type “European American”, or “Asian”, do you?? Think real hard now Biffy.

As I say, I know where buffoons such as yourself learn them though.

https://www.hollywoodreporter.com/news/politics-news/is-casted-a-word-mike-pence-deletes-incorrect-tweet-election-day-945392/

Which is why I strongly admonished my students to ignore and stay away from reading or listening to George “W” Bush speeches (it’s a common convention in China for students to study American Presidents’ speeches thinking, incorrectly, that it is “ideal” English).

Which is why “Fool me once, I can’t get fooled again, because it’s subliminiminal” <<—- words once spoken by a dyslexic Republican President.

Um, I am not sure that “positive inflation” and “deflation” are compatible. I think “deflation” is the same as “negative Inflation.” “Inflation” is the rate of price increase, although it is sometimes thought to mean “positive inflation” as in a positive rate of price increase and hence the opposite of “deflation.” I have never seen the term “positive inflation” refer to an increase in the rate of inflation, that is the opposite of “disinflation,” a decline in the rate of inflation.

However, I must admit that I do not know if there is a term or what it is for a rising rate of inflation. In any case, I repeat that I have never seen the term “positive inflation” used for that. What I think I have usually seen is a longer phrase, like “rising rate of inflation.”

Barkley Rosser: IF one used monthly data and monthly rates of change, negative inflation and deflation would match up exactly. But if one does monthly horizons, then one could get deflation one month, next month inflation, next month deflation, next month inflation, etc. So I used year-on-year, which gives this disjuncture. But we use the term “inflation” as a broad, sustained increase in general price level. That’s why I said it’s a kind of judgment call on inflation.

If we were working in continuous time, we’d get even clearer linking.

Menzie,

I get that, and your point is valid. The problem I am raising, and maybe I misread and misunderstood your meaning, is definitional. It is what does the term “positive inflation” mean. On thinking about it I think the shortest and clearest way to denote an increase in the rate of inflation is to call it “acccelerating inflation,” which one does see.

I fully grant that there may be confusion about what to call something when one is combining different lengths of time periods during which there may be different rates of inflation, including even some with deflation. Hopefully we are on the same page her, and perhaps I misread or more likely misinterpreted what you meant. I certainly grant that one can have a short period of deflation coinciding with a longer period it is embedded over which there is “positive inflation,” meaning a positive rate of price increase, but not necessarily a rising rate of price increase.

Terminology can be slightly confusing when you try to discuss a decreasing rate of increasing or an increasing rate of decreasing. Here’s an example of how this was framed:

The moves came in the wake of the Labor Department’s April Consumer Price Index (CPI), which offered an update on price increases across the U.S. economy. While the report showed some deceleration in inflation compared to March, the rate of price increases came in well above many economists’ estimates.

It reminds me of the age old way the government announces its budgets, to wit: “Final budget numbers show a decrease for next year.” That means the final budget year-over-year increase was less than the draft version.

Terminology can be slightly confusing? Anyone with a grade school education gets this but then again you struggle with preK reading so hey.

The exchanges where someone who is operating at a lower level than the average person on the blog thinks they are saying something amazingly deep are often the most entertaining. Tomorrow Barkley “explains” to Menzie why the sky is blue.

Moses,

If you wish to suggest that I am “someone who is operating at a lower level..” be my guest. However, there has been a lot of misuse of these terms in public discourse, and in Menzie’s presentation it looked like there was an outright misstatement, which was not clarified in his presentation. He said that one can have “deflation” and “positive inflation” simultaneously, but it turns out that this only holds if one is not using those terms for the same measures for the same time periods. It took my raising the issue for him to clarify that point, that there can be deflation for one month while there is positive inflation over the quarter in which the month is contained.

One can also have this oddity if one is looking at different measures for the same time period. So there might be deflation on the CPI for a quarter while the core inflation measure has positive inflation for that same time period.

Here is what is impossible, having deflation and positive inflation for the same time period for the same period for the reason that these terms mean completely opposite things, with deflation being negative inflation, just the opposite of positive inflation.

So, was realizing that Menzie’s presentation was confusing and needed clarification something below the level of “the average person on the blog”? I suspect you were roo effing stupid and ignoratn to even realize there was a problem.

Highly entertaining. Very few people have the entertainment value you do Barkley. Similar to you, Kopits is very dumb, but I can’t imagine veins popping out of his neck like I can you when I point out his vapidness to him, so he just falls slightly short of the level of amusement you provide. Barkley, any thoughts you want to share on Kharkiv today?? Your past thoughts were so prescient:

My comment on Kharkiv back in February:

I got this off of a blog report on CNN:

“Of particular concern, the US warned, is the major northeastern city of Kharkiv, according to the senior Ukrainian official and a Western official familiar with the intelligence. The Ukrainian foreign minister said on Tuesday there were no plans to evacuate the city.”

Barkley Rosser’s reply directly related to Kharkiv:

“According to a long story in today’s WaPo, people there are pretty calm, although according to you they should be running around freaking out. It may be that they are all a bunch of fools. But in fact I suspect another element of this is that because the city is dominated by ethnic Russians, they figure that life will go back to normal if they get conquered. But all accounts they do not support Putin or an invasion. But if it happens, they will move on.”

https://econbrowser.com/archives/2022/02/predictions-oil-prices-and-recoveries-and-recessions#comment-268846

One presumes, since Barkley Rosser is our resident “expert on Russia” this is what Barkley Rosser envisioned in his mind when he stated “If war invasion happens, Kharkiv will move on”

https://www.rferl.org/a/kharkiv-russia-shelling-ukraine-destruction/31827487.html

Obviously, the “ethnic Russians” (as Barkley refers to them) of Kharkiv are having a cheerfully good time.

Moses,

You seem to think you are proving something by repeating my report of what was going on in Kharkiv when the invasion started, but it was accurate. I am glad that Kharkiv has not been conquered, and that it looks like the Russians have given up on doing so and seem to be pulling back from it.

Do you want to remind us of how you ridiculed me for saying the US should not move its embassy out of Kyiv to Lviv? You were right that US intel was right that Putin would do a total invasion of Ukraine, but I was right that they would have a tough time taking Kyiv and that the US should show its support for the Zelenskyy government by keeping its embassy open there as most nations did. We are now reopening the embassy.

So, US intel was right that Putin would totally invade, but wrong that Kyiv would fall within three days, much less at all. In both cases, you sided with US intel against President Zelenskyy, while I sided with President Zelendkyy. And you want to kieep bragging about this?

BTW, it remains a fact that if the Russians had taken Kharkiv, they would have found it much easier to rule than if they had taken over Kyiv, much less Lviv, the point I accurately made. Of course, you were with the groups predicting that we would see them take ovet Kyiv, and presumably also Kharkiv, but you were wrong, so, fortunately, we did not have to see that particular comparison in reality.

You really need to stop posting stuff that reminds people that you did not know what you were talking about on a lot of this, and still do not.

Moses,

I am going to emphasize in fact how treasonable what I posted was, which you reposted in capitalized letters, as you like to do when you get too excited about things.

So, I accurately noted that indeed “by all accounts they (residents of Kharkiv) do not support Putin or the invasion,” which indeed seems to have been proven true. You want to claim I was somehow foolish for noting that?

I also note, since it was not reminded of here, that this post by me came in real time. I was also posting on what was going on in Kyiv at the same time, where missile attacks were happening. People were freaking out and leaving the streets. There was a sharply different reaction between what people were doing in Kyiv, freaking out immediately, and in Kharkiv, where they were initially behaving calmly and normally, although that would not continue. I think my speculation regarding why we saw those different behaviors in real time, as I accurately posted on them, is not completely ridiculous.

Do you not realize how ignorant and stupid you are revealing yourself to be with this sort of repetition, Moses, not to mention just obsessively sick?

This is a followup on what I just posted here.

So I googled “positive inflation” and what I got was what I just posted “a positive rate of price increases.” There is no link that suggests that the term “positive inflation” refers to the second derivative of the price level rather than the first derivative, which is given by “the inflation rate,” which when negative is “deflation.”

I am with you Barkes. Deflation is falling prices. not rising prices. Forget about M/M changes. Just look at ANNUAL rates

Inflation is the first derivative of the price level, which can be a positive number or at times negative (deflation).

Now you are stressing out how to describe the 2nd derivative of the price level, that is whether inflation is “accelerating” (positive 2nd derivative) or declining aka disinflation (positive 1st derivative but negative 2nd derivative).

Yea I get I’m being a calculus nerd here but remember we sometimes have to deal with Village Idiots who write “Terminology can be slightly confusing” (aka the Uber Village Idiot Bruce Hall)!

Maybe I was being too harsh. Do you think Barkley might try to structure his undergraduate dissertation around this??

I’m sure the graduate classes in economics at James Madison University requires the students to know basic calculus as EVERY graduate program does so. In fact he is pretty decent with things like nonlinear economic dynamics and other higher order math for whatever that is worth.

But in Bruce Hall’s case, he is still struggling with 2 plus 2. Consider Bruce’s new bozo definition of inflation. I mean no one is THAT stupid except for Brucie.

pgl,

As it is, my Wikipedia entry describes me as being a “mathematical economist” right up front, although I never make such a claim in my cv (“economic theory” and “complexity economics” I claim, both of which are pretty mathy). Of course, we know that Wikipedia is a seriously unreliable source.

https://www.nytimes.com/2022/05/10/us/baby-formula-shortage.html

May 10, 2022

A Baby Formula Shortage Leaves Desperate Parents Searching for Food

Some parents are driving hours at a time in search of supplies. Others are watering down formula or rationing it, hoping for an end to the shortage.

By Edgar Sandoval, Amanda Morris and Madeleine Ngo

SAN ANTONIO — Maricella Marquez looked at the last can of baby formula in her kitchen on Tuesday and handed her 3-year-old daughter, who suffers from a rare allergic esophageal disorder, a smaller-than-usual portion of the special nutrition she needs to stay healthy.

Ms. Marquez has been calling suppliers all over Texas, asking about any new shipments. “Right now they are out of it, completely,” she said. “I’m desperate.”

Ms. Marquez lives outside San Antonio, a city that has seen the nation’s highest rate of formula shortages — 56 percent of normal supplies were out of stock as of Tuesday, according to the retail software company Datasembly — amid a nationwide supply crunch that has left parents scrambling to feed their children.

The shortage has been a challenge for families across the country, but it is especially palpable at grocery stores and food banks in San Antonio, a Latino-majority city in South Texas where many mothers lack health insurance and work at low-wage jobs that give them little opportunity to breastfeed. Across the city, baby food aisles are nearly empty and nonprofit agencies are working overtime to get their hands on new supplies….

[ Such a problem strikes me as an intolerable supply weakness for any country, let alone the most developed of countries. What is happening here is especially important. ]

“Such a problem strikes me as an intolerable supply weakness for any country”

Excuse me but where is your evidence that baby formula is always plentiful in the PRC? It isn’t.

“America BAD, China GOOD”

Interesting choice of topic for a Chinese man to bring up:

https://qz.com/1323471/ten-years-after-chinas-melamine-laced-infant-milk-tragedy-deep-distrust-remains/

I’ve shared the story of how I have personally watched Chinese people stare at large bags of rice for 10 minutes straight (not the rice display, individual bags of rice for 10 minutes) in local Chinese supermarkets, so I’ll spare readers for today.

Nearly any negative number you want to mention in China is intentionally under-estimated or uncounted. The number often quoted about the infant milk scandal in China was roughly 300,000 sick babies. This from a country that will tell people they have 5%+ GDP in an economic downturn. So you guess how that one went.

Ah, another example of you, Moses, showing off both how stupid you are and how sick you are regarding the female gender that you keep insisting ltr is a man. Just what was it that your mother did to you that you are so messed up?

I keep having flashbacks of loud snoring emanating from my parents’ room.

Excuse me? That’s not from a government-approved news source. I demand a retraction.

You give us the sensationalist propped up version of the problem but fail to copy-paste the explanation (let alone discuss the potential solutions already being implemented).

“The shortage became acute with a recall of a defective brand this year after at least four babies were hospitalized with bacterial infection and at least two babies died. But the recall has been exacerbated by relentless supply-chain woes and labor shortages. The Datasembly research found that the national out-of-stock rate for baby formula reached 43 percent for the week ending Sunday, up 10 percent from last month’s average”

So nationwide we went from 33% to 43% out of stock rates in a month. Always a problem if you need a highly specialized formula – but not a disaster for the majority of parents who just use another brand. As with toilet paper shortages in the first months of Covid; when people get scared they drive hoarding shortages that are hard to solve. At least this President is taking concrete measures to solve the problem, rather than leaving people to shit in their pants.

IF one used monthly data and monthly rates of change, negative inflation and deflation would match up exactly. But if one does monthly horizons, then one could get deflation one month, next month inflation, next month deflation, next month inflation, etc. So I used year-on-year, which gives this disjuncture. But we use the term “inflation” as a broad, sustained increase in general price level. That’s why I said it’s a kind of judgment call on inflation.

— Menzie Chinn

China’s consumer price index, yearly and monthly:

https://news.cgtn.com/news/2022-05-11/China-s-consumer-price-index-rises-2-1-in-April-19Wp6imCfsc/img/a3224024031d4cefa9abbc2f96301fc2/a3224024031d4cefa9abbc2f96301fc2.jpeg

China’s producer price index, yearly and monthly:

https://news.cgtn.com/news/2022-05-11/China-s-consumer-price-index-rises-2-1-in-April-19Wp6imCfsc/img/edbd21f94d854d6aa44f4609dc7c527c/edbd21f94d854d6aa44f4609dc7c527c.jpeg

What is up in the US is the inflation rate is volatile. OK – you are suggesting the REPORTED inflation rates in China are low and stable. But I guess your political masters will not let you admit that the PRC reporting of inflation rates is not exactly reliable data on market prices.

OK – you are suggesting the REPORTED inflation rates in —– are low and stable. But I guess your political masters….

[ The graphs simply reflect explanatory remarks by Menzie Chinn, but inveterate prejudice evidently makes even a graphic illustration intolerable. ]

https://www.wsj.com/articles/china-remains-an-outlier-in-a-world-of-surging-inflation-11652018400

May 8, 2022

China Remains an Outlier in a World of Surging Inflation

Consumer prices in the world’s second-largest economy have held relatively steady, but China’s experience will be hard to replicate elsewhere

By Stella Yifan Xie

https://english.news.cn/20220511/85d696c9c2124d28b011dcdb977d5a02/c.html

May 11, 2022

China’s consumer prices see mild uptick, factory inflation narrows

BEIJING — China’s inflation has remained at an overall moderate and controllable level, with consumer prices seeing a mild uptick in April and factory prices facing cost pressure, official data showed on Wednesday.

The consumer price index (CPI), the main gauge of inflation, rose 2.1 percent year on year in April, and went up 0.4 percent from the previous month, according to the National Bureau of Statistics (NBS).

The rise was partly due to the domestic resurgence of COVID-19 and the continuous rise of bulk commodity prices across the globe, noted Dong Lijuan, a senior statistician with the NBS.

Food prices went up 0.9 percent from the previous month, driving up the monthly consumer inflation by about 0.17 percentage points.

Specifically, the price of pork, a staple meat in China, increased 1.5 percent month-on-month in April, compared with a 9.3 percent decrease in March. Hog production has gradually tempered and stockpiling of pork to replenish state reserves is in progress, Dong said.

Pork prices still registered a year-on-year drop of 33.3 percent, narrowing by 8.1 percentage points from the previous month.

Non-food prices rose 2.2 percent from a year earlier, the same growth recorded the previous month. The prices of gasoline, diesel and liquified petroleum gas went up by 29 percent, 31.7 percent and 26.9 percent year on year, respectively.

The core CPI, which excludes food and energy prices, gained 0.9 percent year on year in April, down 0.2 percentage points from the previous month….

https://fred.stlouisfed.org/graph/?g=Gb0g

January 30, 2018

Consumer Prices for China, United States, India, Japan and Germany, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=OULh

January 30, 2018

Consumer Prices for China, Indonesia, Brazil, France and United Kingdom, 2017-2022

(Percent change)

[ China records and releases data on “means of production” prices every 10 days, allowing for specific and quick responses to problematic price changes. ]

Utterly, completely and wildly off-topic, but Holy Rise-of-the-Machines, Batman:

https://www.quantamagazine.org/machine-scientists-distill-the-laws-of-physics-from-raw-data-20220510/

Point-and-click science is here!

Meh. That’s precisely the sort of thing you’d think machine learning would be good at: extremely regular patterns. Purely predictive regressions are enough.

Now try that on humans!

https://news.cgtn.com/news/2022-05-10/Chinese-mainland-records-357-new-confirmed-COVID-19-cases-19UHHP1dSaQ/index.html

May 10, 2022

Chinese mainland records 357 new confirmed COVID-19 cases

The Chinese mainland recorded 357 new confirmed COVID-19 cases on Monday, with 349 linked to local transmissions and eight from overseas, data from the National Health Commission showed on Tuesday.

A total of 3,118 new asymptomatic cases were also recorded on Monday, and 87,294 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now number 220,397, with the total death toll from COVID-19 at 5,191.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-05-10/Chinese-mainland-records-357-new-confirmed-COVID-19-cases-19UHHP1dSaQ/img/a7a99ee463e44f849ea89c58a3022f6d/a7a99ee463e44f849ea89c58a3022f6d.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-05-10/Chinese-mainland-records-357-new-confirmed-COVID-19-cases-19UHHP1dSaQ/img/27cd74dfef394049b2d6360e350490a0/27cd74dfef394049b2d6360e350490a0.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-05-10/Chinese-mainland-records-357-new-confirmed-COVID-19-cases-19UHHP1dSaQ/img/e5a40f11f6d84e9fbe1fc602c059d3b5/e5a40f11f6d84e9fbe1fc602c059d3b5.jpeg

https://www.worldometers.info/coronavirus/

May 10, 2022

Coronavirus

United States

Cases ( 83,778,760)

Deaths ( 1,025,104)

Deaths per million ( 3,064)

China

Cases ( 220,397)

Deaths ( 5,191)

Deaths per million ( 4)

It might be clearer to use the mathematical terms, price level, first derivative, and second derivative.

First and second derivatives of the price level may be both positive or both negative or one positive and the other negative.

Inflation, I think, refers to a positive first derivative.

Inflation typically refers to increasing prices, and deflation to decreasing prices. But inflation may refer to either.

In the same way, physicists refer to acceleration and deceleration, but sometimes acceleration refers to both.

This way you can refer to all combinations without ambiguity.

Inflation is positive, 4%, but less than it was last month, when it was 6%, sounds like disinflation to me. But not deflation, which I think would be inflation of -3%.

The cases for negative inflation increasing or decreasing I leave as exercises for the commentariat to this great blog.

Perhaps the professionals here will correct my ideas.

Bernard,

It might be, but only to people who know what first and second derivatives are, which is not the general reading public. As it is, confusion has arisen because of the careless use of some of these terms in much public discussion, and unfortunately for those unable to figure these things out, telling it to them using calculus terms will probably not enlighten them much.

Ivan: “The Datasembly research found that the national out-of-stock rate for baby formula reached 43 percent for the week ending Sunday, up 10 percent from last month’s average”

43% out of stock means 43% of the multitude of brands, sizes and formulations down an entire aisle of the grocery are out of stock. It also means that 57% of brands, sizes and formulations are in stock.

It may be upsetting to not have your favorite brand on hand but substituting Simulac vs Enfamil vs Gerber vs liquid vs powder is not exactly a humanitarian crisis. Of course there may be some rare babies with special nutritional needs but these could be accommodated by other supplements in coordination with a doctor. No babies are starving because of formula shortages.

This is just another Republican firestorm amplified by a compliant media.