The simple sum of the unemployment rate and the (y/y) inflation rate:

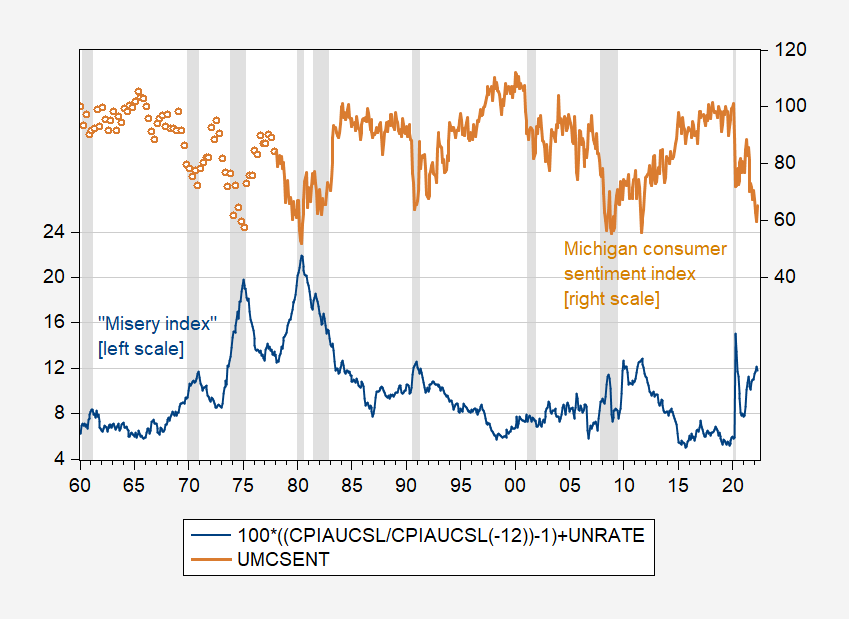

Figure 1: “Misery index” as sum of inflation and unemployment rate, in % (blue, left scale), and University of Michigan Consumer Sentiment index (brown, right scale). NBER defined recession dates shaded gray. Source: BLS via FRED, Cleveland Fed, U.Mich., NBER, and author’s calculations.

There’s no particular reason to give equal weight to inflation and unemployment; rather Arthur Okun suggested this particular composite (which he called a “discomfort index”) as a way of conveying an idea in a simple way (see Cohen, et al. 2014 for history). Jimmy Carter subsequently cited this measure as an index of “economic misery”.

How is this related to measures of how people actually describe their discomfort? One popular measure of economic satisfaction is the University of Michigan Index of Consumer Sentiment (shown as the brown line in Figure 1). This index is clearly inversely related to the misery index:

UMCSENT = 161.36 – 2.99MISERY – 0.022TIMETREND

Adj-R2 = 0.55, SER = 8.405, DW = 0.23, Nobs = 604. Bold denotes significance at 10% msl, using HAC robust standard errors.

There is no particular reason why one should weight unemployment and inflation equally.

UMCSENT = 161.00 – 2.58INFLATION – 3.86UNRATE – 0.020TIMETREND

Adj-R2 = 0.57, SER = 8.221, DW = 0.25, Nobs = 604. Bold denotes significance at 10% msl, using HAC robust standard errors.

While the INFLATION and UNRATE coefficients do not look particularly different, a Wald test rejects equality at very high levels of significance.

Several interesting aspects to the relationship between the misery index and consumer sentiment.

First, the relationship is not stable; Bai-Perron least squares break point tests indicate three breaks over the graphed period.

Second, relatedly, importance of unemployment and inflation change over time, both in terms of the slope coefficients, and in terms of standardized beta coefficients. In the latest two years, inflation looms larger.

As an aside, both the Michigan consumer sentiment index (in levels) and the misery index are lousy predictors of recession 12 months ahead (over the 1986-2022 period).

The unemployment rate, by itself, is a decent indicator of recession one or maybe two quarters ahead.

https://fred.stlouisfed.org/graph/?g=Qlxl

Inflation is a lagging indicator of activity, which messes up the misery index as a predictor.

I’m just tickled Menzie got a Jimmy Carter reference in. The only thing that would top that is a David Lee Roth reference. But this blog isn’t Utopia, I mean…….

You know Jimmy Carter, a big believer in Christian prayer, is now 97 years old, and outlived his VP (age wise) by 4 years. Just saying….. I actually probably liked Walter Mondale more, but I’m a bleeding heart liberal, what do you expect?? I feel they both got short shrift from the American voting public, but, wut awe ye gonna do??

macroduc,

Unemployment rate more of a coincident indicator, or even a slightly lagging one. That is what one sees looking at the link you provided. Anyway, it is not a leading indicator and has never been considered one.

I just checked, and the standard list of leading economic indicators is the stock merket, manufacturing activity, inventories, retail sales, building permits, housing market, and new business startups, with many also adding shape of yield curve. Unemployment rate is traditionally considered to be a lagging indicator.

No mention of OIL? Princeton Steve is going to be all upset with your list.

@ Macroduck

I kinda like to go back to this one when things get somewhat confusing (which I don’t know about you, but I feel the indicators are very confusing right now). Philly Fed have different time frames, I thought this one was applicable.

https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/ads/ads_2000.pdf?la=en&hash=DE96682384E789AF546ADA2BB91DC5AE

A reader asked about green hydrogen”:

https://news.cgtn.com/news/2021-04-21/Is-hydrogen-the-future-of-energy–ZDqKYp9kM8/index.html

April 21, 2021

Is hydrogen the future of energy?

By Djoomart Otorbaev

If humanity continues to emit carbon dioxide at its current level, then the average temperature on Earth will rise by 1.5 degrees Celsius between 2030 and 2052. With this threat in mind at the 2019 UN Climate Summit, 77 countries pledged to achieve zero carbon emissions by 2050. Scaling up the use of green hydrogen will be critical to achieving this ambitious goal.

To classify hydrogen by production technology and feedstock, chemists use a color scale. “Gray” hydrogen is obtained by conversion of methane, “brown” hydrogen – from coal. “Green” hydrogen is produced by splitting water into hydrogen and oxygen molecules, a process called “electrolysis of water”, and “yellow” by electrolysis but using nuclear energy. “Blue” hydrogen is made from natural gas. According to the International Renewable Energy Agency (IRENA), 95 percent of the world’s hydrogen production is currently gray.

Experts believe that in the future, hydrogen will become the undisputed leader among renewable energy sources. Indeed, when using traditional sources of green energy, such as solar or wind, power is generated unevenly, it cannot be accumulated, and their infrastructure occupies significant land plots. Hydrogen is free from such disadvantages. The energy generated in green hydrogen production does not emit any pollutants. Users can store hydrogen for a long time and in large quantities.

Experts believe that hydrogen will replace oil as the primary fuel in various spheres of life. According to Goldman Sachs, green hydrogen could supply up to 25 percent of the world’s energy needs by 2050 and become a $10 trillion market by that time. However, to achieve this goal, green hydrogen will have to be produced at prices comparable to the cost of current energy carriers.

Encouragingly, the cost of producing hydrogen has now plummeted. According to the U.S. Department of Energy, the cost of hydrogen production will drop from $6 per kg in 2015 to $2 per kg by 2025. Recent analysis has shown that a $2 per kg production rate will be the tipping point that will make green hydrogen competitive in many industries, including transportation, steel and fertilizer production, power generation, and more.

Data from the International Energy Agency showed that global production of low-carbon hydrogen increased from 0.04 million tons in 2010 to 0.36 million tons in 2019. Production will reach 1.45 million tons in 2023 due to the opening of new hydrogen plants around the world. Bloomberg predicts that by 2025 the market for hydrogen production will reach $700 billion.

The advanced countries are stepping up their investments in the development of hydrogen energy. Last July, Saudi Arabia, backed by U.S. gas giant Air Products and Chemicals and their ACWA Power, started to construct the world’s largest green power plant. The $5 billion project will produce 650 tons of green hydrogen daily. The European Union has recently allocated $500 billion in investments in hydrogen production.

Russia aims to capture 20 percent of the global hydrogen market by 2030, said Pavel Sorokin, deputy head of the Ministry of Energy, on April 12. “We believe that the export of green hydrogen from Russia in 2035 can be from 1 million to 2 million tons in the “low” scenario, up to 7 million tons – with more active development [of demand for hydrogen in the world]”, he said.

As stated in the draft Concept for the development of hydrogen energy, by 2050, Russia intends to earn up to $100 billion a year from the export of environmentally friendly types of hydrogen, supplying to the world market from up to 33.4 million tons of hydrogen. The Russian government’s plans for green energy production are linked to the fact that the European Union plans to introduce a special tax on imports of energy carriers with a large carbon footprint. This tax could cost Russian exporters 33.3 billion euro tax bill between 2025-2030.

China leads the world in hydrogen production with an annual output of 22 million tons, about one-third of the world’s output, enough to cover one-tenth of its vast energy needs. However, most of China’s production is associated with fossil fuel-fired gray hydrogen.

The country is stepping up substantial additional investments in green hydrogen energy, guided by the government’s policy to develop the hydrogen industry, which was identified in the country’s 14th Five-Year Plan for 2021-2025 as one of six future priority industries. The China Hydrogen Alliance predicts that China’s hydrogen energy investment will reach 1 trillion yuan by 2025.

By 2030, China’s demand for hydrogen will reach 35 million tons, at least 5 percent of the country’s total energy consumption….

Djoomart Otorbaev is the former Prime Minister of the Kyrgyz Republic and a distinguished professor of the Belt and Road School of Beijing Normal University.

If you are referring to the previous exchange between baffling and me, the problem I was highlighting is that the hydrogen project in question employed the label “green”, but was pretty obviously relying on natural gas as a feedstock. Greenwashing is a big problem in hydrogen energy, and very dangerous.

Hydrogen made from natural gas is “blue hydrogen.” Green hydrogen is produced with the electrolysis of water, which takes electricity. The problem with green hydrogen production will be the electricity cost for the electrolysis. About 70% of the current cost of green hydrogen production in China is for the necessary electricity.

If you’ve read this blog awhile, you’ll know I’m a HUGE David Letterman fan. I almost sent him a snail-mail as a child asking him if he’d be my adopted stepdad (joke). But seriously he kept me going, and his sister wrote this article. So I thought I’d pass it on to the blog, and encourage everyone to read it to the end.

https://www.tampabay.com/opinion/2022/05/26/id-like-to-introduce-gov-desantis-to-my-nonbinary-child-column/

I’m middle aged, I’m older and I grew up with certain notions, “traditional values” and I won’t lie~~~some of this stuff, it makes me uncomfortable and it makes me feel awkward. But in the end analysis I have to say, if other people are pursuing a life that makes themselves happy, How does that hurt me, if these people choose a path that makes them happy?? And the answer that always comes back to me inside my own head is “I’ll be damned…… I can’t think of anything about them living their life how they want that hurts me”.

It is a simple index indeed. Underweighting unemployment and overweighting inflation.

Brian Deese gets the fact that the oil market is global. I guess this is why even the Cable News clowns rely on him and not utter idiots like Bruce Hall:

https://www.msn.com/en-us/money/news/oil-industry-does-not-need-anything-more-from-biden-admin-to-ramp-up-production-white-house-economist/vi-AAYdJps?bk=1&ocid=msedgntp&cvid=7d16a0dfe3c346dd87138e52c2753b8e

Poor little Princeton Stevie – he cannot even get on Fox and Friends these days!

“White House economist”…. Well, no bias there.

If God himself said something nice about the economy – you would call him Satan. But hey – it is your job to lie for Trump and we would not want you to be fired.

https://news.cgtn.com/news/2022-06-09/China-s-foreign-trade-rises-8-3-in-first-5-months-of-2022-1aICSAA5z1u/index.html

June 9, 2022

China’s exports surge to double-digit pace in May, beat forecast

China’s exports rebounded and grew at a double-digit pace in May, shattering expectations and adding to signs that China’s economy is recovering from COVID-19 outbreaks as factories restarted and logistics snags eased in Shanghai, customs data showed on Thursday.

The country’s exports rose 16.9 percent in May year on year in dollar terms, accelerating from April’s 3.9 percent increase, according to the General Administration of Customs (GAC). It was the fastest growth since this January and beat Reuters’ forecast of an 8 percent gain.

https://news.cgtn.com/news/2022-06-09/China-s-foreign-trade-rises-8-3-in-first-5-months-of-2022-1aICSAA5z1u/img/74586b1749e74d4f86512407d5300471/74586b1749e74d4f86512407d5300471.jpeg

The dollar-denominated imports also expanded for the first time in three months, rising 4.1 percent in May from a year ago. It compared with flat growth in April, and was above Reuters’ expectation of a 2 percent increase.

https://news.cgtn.com/news/2022-06-09/China-s-foreign-trade-rises-8-3-in-first-5-months-of-2022-1aICSAA5z1u/img/cbd48509b9a746beba83a7fac1c90c61/cbd48509b9a746beba83a7fac1c90c61.jpeg

Foreign trade value increased 11.1 percent to $537.74 billion last month, with exports jumping to $308.25 billion, and imports growing to $229.49 billion, according to GAC. The country posted a trade surplus of $78.76 billion in May, versus a $51.12 billion surplus in April.

The Shanghai port, which was running at severely reduced capacity in April, has also been handling more cargo since last month, with official data showing that daily container throughput at the world’s biggest port is back to 95.3 percent of the normal level in late May.

China will introduce targeted measures to boost foreign trade, including improving port operations, lowering shipping costs, organizing online trade fairs to help foreign trade firms secure orders and offering export tax rebates, Vice Commerce Minister Wang Shouwen said Wednesday….

It was assumed back then that the utility of the “misery” index would be a political one, not particularly an economic one.

So the question would be: does the higher the number suggest a rejection of the party in power via elections?

I was going to say, my big “take away” of the graph and numbers above, and I do think Menzie is trying to semi-tether this to politics, or rather simply he is observing that they are indeed tethered, that this does NOT bode well for American politics as the American voter has shown very poor judgement any time they are required to “read between the lines” or digest more than one “moving part”.

The Michigan Index indicates that we are already in an oil shock recession.

No it does not. The Michigan index does not attribute changes to a particular factor such as high oil prices. Chalk this up as another episode of Princeton Steve writing words he does not understand.

https://fred.stlouisfed.org/series/UMCSENT/

Hey – the Michigan consumer sentiment index fell below 60 back in September 2011. Now I do not remember the 2011 recession – do you? Maybe the chief economist for Fox and Friends Princeton Steve can write us an analysis of the 2011 recession and how this was caused by things like “suppression” and oil shocks. It would be interesting to read as we all need a good laugh.

BTW – could someone tell the chief economist for Fox and Friends it is not called the “Michigan index”.

Steven,

Not as long as actual consumption remains high, which so far it is doing, despite some declines in a few sectors.

https://english.news.cn/20220609/3162b4214cc0441aa7abefb812b86535/c.html

June 9, 2022

Tesla’s Shanghai factory resumes full production

SHANGHAI — U.S. carmaker Tesla’s Shanghai Gigafactory has returned to full production capacity. Over 40,000 vehicles have rolled off the production line since it resumed production on April 19, according to the company.

Affected by the latest COVID-19 resurgence in Shanghai, the Shanghai Gigafactory once suspended production for over 20 days.

The Gigafactory now implements a two-shift working schedule after resuming production on April 19 with about 8,000 employees back to work under the “closed-loop” production model, namely employees live and work in isolation.

According to the China Passenger Car Association, in the first five months of this year, Tesla delivered 215,851 vehicles, up over 50 percent year on year. In May alone, the wholesale volume of Tesla reached 32,165 vehicles, including 22,340 vehicles exported to Europe, Australia, Japan and other markets….

Kevin Drum makes an argument that inflation is coming down:

https://jabberwocking.com/inflationary-pressure-seems-to-be-easing/#comments

Now I went to the comment section to see all the hype and lies from Bruce “the sky is falling because Biden is old” Hall but not a word from this MAGA troll. What’s up? Oh Kevin bans trolls. Check out the comments as many are quite interesting – unlike the serial garbage from our Usual Suspects.

core inflation month on month annualized and a trend line?

if we look m on m why not smooth it w/ a 4 month moving average?

i lived, as an adult, through the 70’s.

in feb 73 we cut our losses in vietnam!

how and when do we cut the losses in ukraine?

the ’20’s is making the 70’s look like the good old days……

good for jimmy carter’s place in history

Good for Kevin Drum. I seem to remember you waxing poetic about temporary inflation about a year ago. Yeah, that worked out well. Meanwhile, the national average for regular gasoline reached $4.97 today (6/9). Let’s define “core inflation” as anything that has an inflation rate below 3%. Nothing to see here, folks.

“I seem to remember you waxing poetic about temporary inflation about a year ago.”

Then you need to take your meds. I am not a poet and only you take wax when you get COVID19, Hey Bruce – came up with some better lies as the ones you are touting are getting really BORING.

Ryan D. Kelly is hoping to be the GOP nominee for the governor of Bruce Hall’s state but it seems he is up on charges for trying to overthrow the Federal government on 1/6/2001:

https://www.metrotimes.com/news/fbi-arrests-gop-michigan-gubernatorial-candidate-ryan-kelly-searches-his-home-30269057

Yea there are other Republicans running but all of them may have committed crimes on behalf of Trump’s attempt to steal the 2020 election.

I guess this explains why Bruce Hall has gone total bananas. These Republicans are all corrupt and Michigan will likely still have a Democratic governor even after the election. Poor Bruce – what is a racist MAGA hat clown to do with such an incompetent party!

I see that the San Francisco DA was recalled. Even Californians can take just so much progressivism in their streets.

Gee – policy differences versus downright treason. I would think even someone as stupid as you would see the difference but maybe not.

Evidence on the effectiveness of assault weapons ban:

https://theconversation.com/did-the-assault-weapons-ban-of-1994-bring-down-mass-shootings-heres-what-the-data-tells-us-184430

Yes mass shooting deaths were lower in the 1994 to 2004 period where this ban was in effect. Yes mass shooting deaths went up quite dramatically after the 2004 sunset of this law. Of course we know Bruce Hall and his pet pit bull (CoRev) are going off barking why this evidence should be ignored. After all – Bruce Hall is incapable of protecting his chickens from raccoons unless he can fire off hundreds of bullets in a couple of minutes. MAGA

Looks like the Obama years were not too good in that regard, eh?

Now then, how many mass shootings were among black and Latino gang members in major cities? How many used AR-15s? How many used pistols of various calibers?

You’re like the doctor whose patient comes in for skin cancer treatments and the doctor focuses on toenail fungus.

https://ucr.fbi.gov/crime-in-the-u.s/2019/crime-in-the-u.s.-2019/topic-pages/tables/table-43

https://www.brookings.edu/blog/social-mobility-memos/2015/12/15/guns-and-race-the-different-worlds-of-black-and-white-americans/

https://www.nber.org/digest/jan03/what-reduced-crime-new-york-city

Yea Obama wanted to have gun safety laws but your buddies at the NRA have Republicans bought and paid for. But I see you are still playing the race card there. I guess your mother picked up your KKK outfit from the cleaners today.

Oh my – a study about NYC from 2003. Gee Brucie – I guess you did not know we further reduced crime from 2003 to 2019. Then of course Trump made sure COVID19 would just take off.

https://news.cgtn.com/news/2022-06-09/Chinese-mainland-records-70-new-confirmed-COVID-19-cases-1aIuNnaXoqI/index.html

June 9, 2022

Chinese mainland records 70 new confirmed COVID-19 cases

The Chinese mainland recorded 70 confirmed COVID-19 cases on Wednesday, with 53 linked to local transmissions and 17 from overseas, data from the National Health Commission showed on Thursday.

A total of 170 asymptomatic cases were also recorded on Wednesday, and 3,505 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 224,535, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-06-09/Chinese-mainland-records-70-new-confirmed-COVID-19-cases-1aIuNnaXoqI/img/caa9c9c4379c49869ceb5b00cccaf7b8/caa9c9c4379c49869ceb5b00cccaf7b8.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-06-09/Chinese-mainland-records-70-new-confirmed-COVID-19-cases-1aIuNnaXoqI/img/2486a711d03d4789bcb41c57d8bfa24d/2486a711d03d4789bcb41c57d8bfa24d.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-06-09/Chinese-mainland-records-70-new-confirmed-COVID-19-cases-1aIuNnaXoqI/img/5c646467d9cd4d09bc814555e73a4358/5c646467d9cd4d09bc814555e73a4358.jpeg

https://www.worldometers.info/coronavirus/

June 8, 2022

Coronavirus

United States

Cases ( 86,988,671)

Deaths ( 1,035,031)

Deaths per million ( 3,092)

China

Cases ( 224,465)

Deaths ( 5,226)

Deaths per million ( 4)

I am aware these numbers don’t always “sync up”. But am I wrong to think it’s strange the China’s export numbers are starting to rise pretty strongly at the same time America’s import numbers are starting to drop??

https://www.freightwaves.com/news/us-import-demand-drops-off-a-cliff?s

The personal savings rate in America is also an interesting number right now,~~which I imagine might be hurting Biden more than the actual inflation. It is amazing to me personally, how tolerant Americans can be on extortionately high prices, but when they see that bank account number dropping the steam FINALLY starts coming out of their ears.