Why is no mystery:

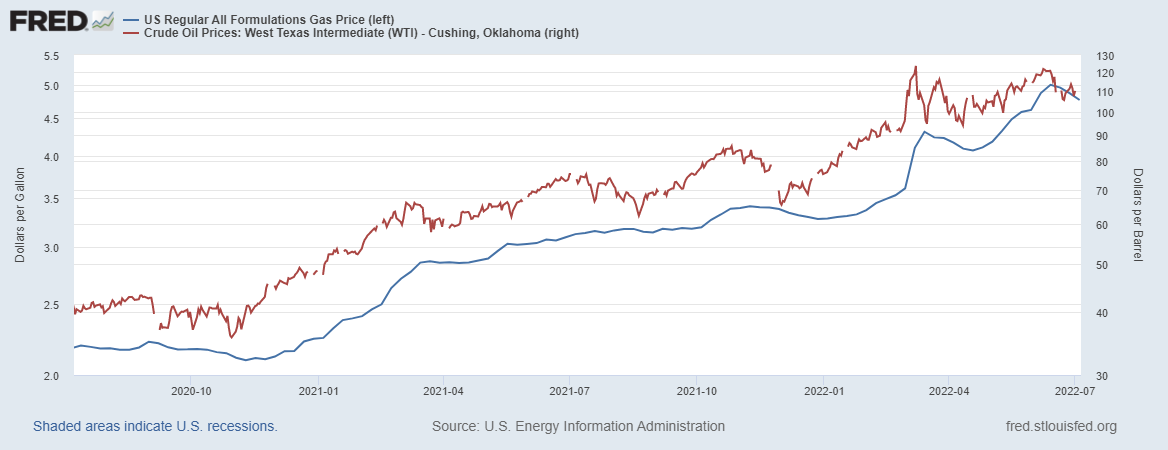

Source: FRED.

The gasoline prices are through week ending 7/4. Gasbuddy.com indicates prices have fallen to $4.66 today, from about $4.79 on 7/4, and peak of $5.03 on 6/14.

Source: gasbuddy.com, accessed 7/10/22.

Gasoline has a 3.75% weight in the CPI (see here), but the percentage variation in gasoline prices are enormous, so can account for substantial shares of headline CPI inflation.

Futures as of four days ago were signaling continued decline, and this is true today, albeit with a slightly higher level (about 17 cents for December 2022 contract).

You know this works. When gasoline prices were rising – CoRev and Bruce Hall would scream it is the end of the world all due to Biden being President. But now that gasoline prices are falling, they are screaming this is due to the Biden recession. Never mind we are not in a recession. They have to attack Biden no matter what.

pgl,

I think Bruce Hall is somewhat mote intelligent than out pathetic CoRev, although he had me wondering with his recent “Dr. Faucistein” wisecrack, something I, as someone who has just tested positive for Covid, find pretty out of line.

In any case, our dear CoRev did on another thread here actually declare that things are “getting worse” even when it was specifically pointed out to him that gasoline prices were declining. But, we know how he is. When caught saying something silly he changes the subject by moving goal posts.

CoRev is incredibly stupid but no – Bruce Hall is the dumbest troll ever.

pgl,

It is coming back to me that Bruce was one who pushed full bore Covid quackery when Trump was in, notbably hydroxychloroquaned, or whatever that horse medicine eas. This makes his recent wisecrack about “Dr. Faucistein” even more inappropriate.

I shall grant that Trump did encourage by funding and deregulation development of vaccines against Covid. Otherwise, his policies were mostly terrible, with Biden’s far superior, althoiugh not many seem to be giving Biden much credit on this matter.

Barkley just can not comment without moving the goal posts. ” CoRev did on another thread here actually declare that things are “getting worse” even when it was specifically pointed out to him that gasoline prices were declining. ” Things = gasoline? Really??

Moreover, Barkley since you put in quotes your claim of what I said, show us the comment.

I’ll wait.

No., CoRev,, I am NOT going to play some dumb game to go chase down the exact wording of what you said so you cam play games with goal posts over “things” versus “gasoline prices.” etc. I commented on it at immediately the time you did it several threads ago, noting how completely ridiculous it was of you to make such an obviously off-the-wall comment.

You can wait until the goal posts start moving towards you,. Heck, you still look waaaay dumber to me than Bruce Hall, despite his being seriously wackadoodle gonzo about pandemic stuff. Heck, for that matter, you can wait until somebody actually does give you an award for your work on the Apollo program.

CoRev writes a LOT of intellectual garbage. And when called on it – he typically plays the deny, deny, deny game. Of course that is what one expects from a weasel.

Barkley, thank you for admitting to be a liar

You are accusing someone of moving the goal posts? Snicker!

Barking Bierka – the Disgusting NYC Jerk, no. I’m calling him a liar. There is a difference. Snicker! 🙂

CoRev

July 12, 2022 at 4:12 pm

Barkley, thank you for admitting to be a liar

Look in the mirror CoRev – you are the only liar here. Is this all you got? Cheap insults that a 3 year old might make?

CoRev,

I did not admit to being a liar. You said it and I called you out on it when you did. All I am doing is not playing your game of going digging around to find it to get your exact wording. So, go eff yourself, because indeed you are a worthless liar, not me.

demand destruction is a benign event.

price decline as inventory draw continues?

someone see demand fading.

fallen to $3.66 today, from about $3.79 on 7/4

I think you meant $4.66 and $4.79.

Yes!

An aspect of the relation of basic energy prices to fuel prices, which Paul Krugman just wrote about is the “rockets and feathers” character of increases and decreases in price. Gasoline and diesel prices rocket up with the price of oil and drop like feathers as oil prices ease and fall. Consumers are at a continual disadvantage. I would like to have an administration that sought to lessen the rockets and feathers effect. Chinese regulators look to lessen the effect, with what I consider considerable success.

https://www.nber.org/papers/w4138

August, 1992

Do Gasoline Prices Respond Asymmetrically to Crude Oil Price Changes?

By Severin Borenstein & A. Colin Cameron

Our empirical investigation confirms the common belief that retail gasoline prices react more quickly to increases in crude oil prices than to decreases. Nearly all of the response to a crude oil price increase shows up in the pump price within 4 weeks, while decreases are passed along gradually over 8 weeks. The asymmetry could indicate market power of some producers or distributors, or it could result from inventory adjustment costs. By analyzing price transmission at different points in the distribution chain we investigate these theories. We find that some asymmetry occurs at the level of the competitive spot market for gasoline, perhaps reflecting inventory costs. Wholesale gasoline prices, however, exhibit no asymmetry in responding to crude oil price changes, indicating that refiners who set wholesale prices are not the source of the asymmetry. The most significant asymmetry appears in the response of retail prices to wholesale price changes. We argue that this probably reflects short run market power among retail gasoline sellers.

https://www.nytimes.com/2022/07/08/opinion/inflation-oil-biden-monopoly.html

July 8, 2022

Wonking Out: Rockets, feathers and prices at the pump

By Paul Krugman

One of the sad paradoxes of politics is that few economic indicators matter more for public opinion — for voters’ evaluation of the government in power — than energy prices, especially the price of gasoline. This isn’t just a U.S. phenomenon: Inflation driven by soaring energy prices has undermined the popularity of leaders across the Western world.

Why do I call this a sad paradox? …

The same pattern could be seen with lumber prices. But when I expressed the thought that slowly declining retail prices reflected some market power amongst wholesalers or retailers, pgl hysterically jumped in to ridicule the idea and defend those who were profiteering…the usual garbage from pgl.

A year ago many, including Jay Powell, thought that falling lumber prices were proof of the transitory nature of inflation. How wrong they were! Well, lumber prices are finally down…somewhat…but they are still double what they were in 2018! Far be it for any mainstream economists to see any inflation there! Accountability is best left to be applied to fields not dominated by a “professional” class!

“pgl hysterically jumped in”

Seriously dude – you never grew up. Did you?

“Rockets and Feathers”: The same pattern could be seen with lumber prices….

Lumber prices would never fall? Dude – check out the recent data:

https://tradingeconomics.com/commodity/lumber

Maybe you knew prices have declined but the lying troll in you could not tell us.

“Well, lumber prices are finally down…somewhat…but they are still double what they were in 2018!”

A decline from 1500 to 660 is not somewhat. And it seems that they are only 1x were they were in 2018 not 2x.

I would say you LIED we all know you are as incompetent as it gets when it comes to analyzing current data.

The same “rockets and feathers” pattern could be seen with lumber prices.

[ This is well worth discussing further. Do continue when possible. ]

ltr,

Not really worth discussing further because it looks to be false.

ltr is usually quite good about presenting data. I hope she realizes JohnH totally sucks at presenting current reliable data. So when he makes a claim – it is not be trusted. Is JohnH just lazy or is he a blatant liar? Either way – I do not care.

Good to see gas prices declining for July, however, June energy inflation could be about 5.5% for the month.

The Econoday CPI consensus forecast for June is 1.1% with a range of 0.9% to 1.3%.

The Bloomberg CPI consensus forecast for June is 1.1%.

My FWIW forecast is below. The weights are from May 2022.

https://www.bls.gov/web/cpi.supp.toc.htm See Table 1

Food***********0.811% x 13.421= 0.109

Energy **********5.540% x 8.255 = 0.457

Excl food & eng.**= .499% x 78.324 = 0.391

Total rounded = 1.0%

.1 increase.

I resent these posts on gasoline prices because Moses inevitably comments about how he just filled up his car for 50 cents less than the national average. I suspect he has a black market source—probably the Corey-Trevor Convenients Store. You Midwesterners should elect state legislators that jack up your gas taxes to rational levels instead of sopping up Federal handouts for the debacle that is the ethanol cartel.

Given that most Americans measure inflation by the price of gas and cheeseburgers this news should be good. However, as Josh Barro pointed out, we can expect to see Republican propaganda about the struggles of gas station owners who are trying to manage with this price collapse.

Oh come on. Moses uses gasbuddy in a nonpartisan way to save a few bucks. As opposed to Bruce Hall who abuses gasbuddy to push the MAGA agenda.

Hey I got a great deal on chicken this weekend. Sue me!

$4.07 Sunday afternoon. 10% ethanol if you must know. I wish I was smart enough to have a “black market source”. If I had a black market source for my gasoline I would feel like Morty Seinfeld when Jerry told him he got “The Wizard” for “a deal”.

Interesting headlines out of China. I hope the public protests continue and increase in numbers and in vociferousness. Realistically, I doubt that they will.

https://www.theguardian.com/world/2022/jul/11/china-violent-clashes-at-protest-over-frozen-rural-bank-accounts

Kind of disappointed in Michael Pettis’s amorally neutral comments. Though in fairness, I can’t say if I was residing inside the country or had assets there I would act much differently. I’d like to think I’d raise holy hell, but really I’m not convinced I’m that courageous a person. Maybe if Americans observed more stories about regular mousy Chinese citizens being robbed of their life savings, we’d see less of stories like this:

https://www.yahoo.com/news/one-small-step-democracy-live-114112181.html

NATIONAL AVERAGE GAS PRICES

Regular Mid-Grade Premium Diesel E85

Current Avg. $4.678 $5.118 $5.415 $5.642 $3.997

Yesterday Avg. $4.684 $5.127 $5.425 $5.650 $4.006

Week Ago Avg. $4.807 $5.228 $5.528 $5.735 $4.066

Month Ago Avg. $5.004 $5.371 $5.666 $5.765 $4.325

Year Ago Avg. $3.144 $3.491 $3.764 $3.263 $2.650

https://gasprices.aaa.com (July 11, 2022)

No doubt prices have fallen from the high a month ago, but is that sufficient to avoid further economic pain? The housing component of the GDP will be a big suppressor for awhile as that market softens considerably. And while food price inflation may well supplant gasoline/energy prices as consumers’ main issue… even if gasoline and food are not in the core CPI… wheat futures have also declined from the high of a month ago because US farmers have switched some of their land to that crop and Russia appears to be moving toward a record crop this year.

https://www.foodnavigator-usa.com/Article/2022/07/07/price-rises-in-key-grocery-categories-far-exceeding-general-inflation-rate-nielseniq

The hike in rates is dampening overall US activity. Existing home sales fell for the third month in a row in April according to the National Association of Realtors. And the Mortgage Bankers Association (MBA) has reduced its annual projection of new mortgage origination by 35% to $2.5 trillion.

https://www.privatebank.citibank.com/insights/us-real-estate-market

The point is even if the rate of inflation abates somewhat, the absolute level of prices compared to a year or even 6-months ago has created economic pain that does not appear to be going away quickly.

WTF? Barkley just said you were not as stupid as CoRev. And there you go proving you are the dumbest troll ever. Keep it up!

“the absolute level of prices compared to a year or even 6-months ago has created economic pain that does not appear to be going away quickly.”

So if we do not have deflation, people are worse off? I guess you never got the fact that inflation also means nominal incomes for certain people are rising.

Yes Bruce no relationship to Robert Hall is the dumbest troll ever. CoRev is not even close./

It seems Bruce Hall once again failed to read one of his links – the Food Navigator story about food prices have risen. I did noting how Tyson Foods is saying a major reason food prices are up is that demand for food is up. As in the strong economy.

Now I get Bruce’s sole mission in life is claiming that Biden has ruined the economy. But it seems that aggregate demand is strong and the labor market is doing quite well. Of course a MAGA hat wearing moron like Bruce Hall would call a strong labor market evidence that Biden is a failure.

Existing home sales averaged less than that precovid. That misses you eh???

A run on banks in China. Classic brutal response from Chinese authorities.

https://us.cnn.com/2022/07/10/china/china-henan-bank-depositors-protest-mic-intl-hnk/index.html

How about just giving them 10% of their deposits every month, while things are being sorted out?

The US had bank runs during the Hoover years. Correct me if I’m wrong but the US never used martial law on depositors back then.

https://www.reuters.com/article/us-usa-occupy-may1/dozens-arrested-during-may-day-protests-across-u-s-idUSBRE8400UV20120502

https://www.dailymail.co.uk/news/article-2062560/Now-THATS-bank-job-Dozens-arrested-sit-Occupy-San-Francisco-Bank-America-branch.html

Not really that different tactics. Only the guys in the white shirts might not have been locals. The local police in China mostly just watched in this particular incident. Or maybe they were plain-clothed locals to stop a mob rush of local dept offices?? It’s hard to tell. PSB can be very bullying, to put it nicely. If you look at NYC Occupy protests, the police bullying and creating false rumors about Occupy protesters were local police long since “bought and paid for” by NYC TBTF banks. I used to have a TON of links on it but it was on another computer. Not industrious enough to hunt them back down, but there was tons of journalism on it at the time of Occupy.

Also had bank runs during Roosevelt years.

“After a month-long run on American banks, Franklin Delano Roosevelt proclaimed a Bank Holiday, beginning March 6, 1933, that shut down the banking system. When the banks reopened on March 13, depositors stood in line to return their hoarded cash. ”

Bank holiday instead of martial law.

https://www.newyorkfed.org/research/epr/09v15n1/0907silb.html

Franklin Roosevelt was elected in November of 1932 and was inaugurated on March 4, 1933, so in office only a couple days before stopping the bank runs with the bank holiday.

Exactly. When Obama first entered the White House, he needed to act more like FDR in my view.

This is an interesting article. Thanks.

This article attributes the success of the Bank Holiday and the remarkable turnaround in the public’s confidence to the Emergency Banking Act, passed by Congress on March 9, 1933. Roosevelt used the emergency currency provisions of the Act to encourage the Federal Reserve to create de facto 100 percent deposit insurance in the reopened banks. The contemporary press confirms that the public recognized the implicit guarantee and, as a result, believed that the reopened banks would be safe, as the President explained in his first Fireside Chat on March 12, 1933. Americans responded by returning more than half of their hoarded cash to the banks within two weeks and by bidding up stock prices by the largest ever one-day percentage price increase on March 15—the first trading day after the Bank Holiday ended. The study concludes that the Bank Holiday and the Emergency Banking Act of 1933 reestablished the integrity of the U.S. payments system and demonstrated the power of credible regime-shifting policies.

Turning around the damage Hoover allowed to happen took bold steps and a little time.

That English-language banner may have incited violence by the authorities. Clever tactic, as long as you can live with the consequences. ltr, any thoughts?

Deposit insurance and a decent system of inter-bank lending would prevent this problem in most cases.

I think ltr is down at Bō Dūn Kè Bank seeing if they’ll give him a free pen.

Not arguing with that last statement in a general kind of way. But insurance companies generally don’t pay out to sectors well-known for fraud and corruption. It’s a trust issue. In a country where people remember their own relatives turning them in to authorities, trust is a concept that doesn’t work very well.

https://www.npr.org/sections/parallels/2014/01/23/265228870/chinese-red-guards-apologize-reopening-a-dark-chapter

https://www.upi.com/Archives/1984/03/13/Dengs-son-injured-in-cultural-Revolution/9931448002000/

Mostly in America these are more idle threats:

https://www.salon.com/2022/07/11/lauren-boebert-reported-to-fbi-for-tweeting-terminate-this-presidency_partner/

I mean you can argue American mobsters collect on property insurance all the time, but it’s just different in China. It’s not something they could introduce any time in the next 10 years and have ANY kind of systemic validity. It would just be forced on people like car insurance is here. If China ever instituted deposit insurance they’d all be like “Yeah I got it, because the government automatically takes it out of my account.”

Micheal Pettis told NPR the money was put into wealth management accounts, uninsured, instead of insured deposits. Not clear that savers were aware that their money was in wealth management accounts.

Quasi-official thugs beat saverd while the police watched, a common practice when the government wants to quell legitimate protest.

One of the reasons to have a firewall between banks and investment businesses. The customers will better understand what they are doing with their money. Not that there will not be any cases of people being swindled, but you have to make it more difficult.

@ Ivan

Very well stated. Which is why the Volcker Rule exists. Of course the TBTF bankers, the “masters of the universe” are indeed NOT “masters of the universe” but 2-legged walking frauds and swindlers who sit down on and crap in a toilet most days, the same as you and me. As they are only interested in risking other people’s money</b" on "innovative" financial instruments, rather than their own money. As the TBTF bankers patently know they are not “masters of the universe” or they would invest their own damned money in the “innovative” instruments, rather than taking your money when they win, and Uncle Sam’s Money (again your money used for socialism payments to banks) when they lose. TBTF bankers are only masters of semantics, which FOX “news”, CNBC “news”, National Review etc repeat for them like well-trained and leashed poodles. Which is how you get douches like Andrew Ross Sorkin with “exclusive access” to bank executives for bestselling books that soft=pedal the bank executives’/”masters of the universe” felony crimes.

https://www.msn.com/en-us/news/world/ukrainian-teen-says-russian-captors-made-him-clean-prison-torture-room/ar-AAZs6zY?ocid=msedgdhp&pc=U531&cvid=57158b261741473fb8c2eb48cda10785

Vlad Buriak, 16, sits next to his father Oleh as they speak with CBS News’ Holly Williams in Zaporizhzhia, Ukraine.

I wonder if Putin’s various poodles (JohnH, CoRev, Bruce Hall, etc.) bothered to watch this at all. If they did and if they still continue to blame Biden and not Putin for these incredibly inhumane acts, then Barkley’s call for them to burn in hell is not misplaced.

https://www.desmoinesregister.com/story/money/business/2022/07/11/john-deere-des-moines-works-employee-sues-over-racist-jokes-threats/10017269002/

John Deere sued by Des Moines Works employee who says he was subjected to racist jokes, threats

A veteran Iowa employee recently sued Deere & Co., alleging that co-workers and supervisors subjected him to racist jokes and threats for years.

Johnnie Ray Hogan III, who has worked at John Deere Des Moines Works in Ankeny since 2010, said many employees called him “the angry black man” and refused to associate with him once he complained about how they treated him, according to a lawsuit filed in Polk County District Court in late June. He also alleged that his managers scrutinized his work more. Hogan, 40, of Pleasant Hill, is suing the company for harassment and discrimination on the basis of race, as well as retaliation.

“John Deere has allowed a culture of racism to flourish and thrive within the Des Moines Works facility,” his attorney, Roxanne Conlin, wrote in the complaint. “… Johnnie Hogan has been insulted, harassed, belittled, humiliated, and excluded all because he is a black male.” … According to the lawsuit, a co-worker gave Hogan the nickname “the angry black man” in 2019. The name stuck, with other co-workers and supervisors allegedly using it during meetings. In December of that year, according to the lawsuit, Hogan’s supervisor in the shipping department called him into her office and showed him a picture of a biracial baby. She allegedly asked him, “Which one of your cousins or homies got ahold of my baby?” During a lunch break in January 2020, according to the lawsuit, three co-workers joked about Hogan eating fried chicken, a racist trope about Black people. When Hogan told one co-worker that he had worked in the cotton department, the co-worker allegedly said, “It’s good you and your ancestors have something in common,” an apparent allusion to U.S. slaves picking cotton in the 1800s. In March 2020, according to the lawsuit, a co-worker asked Hogan to teach him how to make cornbread because his wife “really likes black people cornbread.” Hogan said that he told a civil rights liaison about his co-workers’ racist comments in November 2020. But, according to the lawsuit, “nothing happened as a result.” A month later, Hogan’s team leader allegedly threatened him, saying he “needed to be chained to a dock.” That same day, according to the lawsuit, a co-worker told Hogan that no one would be able to find him if someone threw him into a box filled with black machine parts. In January 2021, according to the lawsuit, a supervisor and some co-workers began to call Hogan “boy.” Some supervisors and co-workers allegedly called him a racial slur around that time.

Seven years ago one would have thought that this hate filled garbage had no place in corporate America. But then came Trump and blatant racism was given a green light. MAGA?

https://www.businessinsider.com/durbin-clarence-thomas-impeachment-unrealistic-scotus-january-6-ginni-2022-7

Sen. Dick Durbin in a Sunday interview said that calls by some Democratic lawmakers to impeach Associate Justice Clarence Thomas were unrealistic. During an interview on “Fox News Sunday,” the Illinois Democrat — who chairs the Senate Judiciary Committee — told anchor Mike Emanuel that the jurist should “show good judgment” and recuse himself from cases involving the Capitol riot on January 6, 2021. But he stated that the removal of Thomas, who has sat on the bench since 1991, is very unlikely to happen. “I don’t think it’s realistic,” Durbin said. “I can tell you, there is, in my mind, a clear conflict of interest when it comes to Justice Thomas and issues related to the January 6 insurrection.”

I like Durbin but this strikes me as absurd. After all they impeached President Clinton over an affair. Thomas’s wife conspired to commit treason and when a case was brought before the Supremes to obtain relevant information – Justice Thomas declined to recuse himself and voted to impeded the investigation.

Oh well he has not cheated on that [edited MDC] wife of his since the Anita Hill affair.

Clarence Thomas did lie to the Judiciary Committee during his confirmation hearing. As you might recall, Anita Hill mentioned several porno films that Clarence Thomas would always talk about whenever he was around her. He denied ever seeing or renting any of those films. A few months after he was confirmed some industrious journalists when around to all of the video rental stores in the DC area and found that he had in fact rented all of the films that Anita Hill mentioned. So Thomas committed outright perjury.

2slugs claims: ” some industrious journalists” MAY BE something other than misinformation.

Other than Russia, Russia, Russia, the latest “industrious journalists” story may be the 10 YO Ohio girl who needed to be moved to Indiana for an abortion after being raped. Other industrious journalists are finding too many holes in that story to be considered valid journalism and medical practice. Even WaPo is having doubts over the stories veracity. If pursued charges could be filed against the Drs. and journalist.

Are you really saying Clarence Thomas never sexually harassed Dr. Hill? If so you are as repugnant as the dude in the office that sexually harasses every person in a skirt. Come on CoRev – we get you are dumb, racist, and a blatant liar. But someone who defends sexual harassment? Seriously?

https://www.salon.com/2010/10/27/anita_hill_clarence_thomas/

https://greensboro.com/book-alleges-thomas-frequented-porn-flicks/article_7682daae-1518-5492-8a59-3a0ac08ad401.html

http://www.cnn.com/2010/US/10/25/scotus.thomas.mcewen/index.html

https://nypost.com/2016/04/17/clarence-thomas-had-threesomes-loved-drinking-ex-girlfriend/

It’s kind of difficult to tell if these women are taking up for his defense or annihilating him. One seems to imply he was a much better person when drunk all the time (possibly true, but not really a “ringing endorsement”). And goes on to say he became abusive to his own son after sobriety. That his personality/actions regressed after becoming regularly sober.

The other one admits to an adulterous sexual affair, during 4 years of marriage to his first wife. Also at the very least was a heavy drinker (drunk?? she doesn’t seem to go with that label). BOTH women say he used porn very commonly. When two separate women, both of them in “long-term relationships” with a man, describe him in VERY similar ways, one of them still seemingly enamored with the man while admitting his vices, what are we to surmise?? CoRev??

CoRev,

The only people who say “Russia, Russia, Russia” and think they are impressing a reader or listener that they are proving something are Donald Trump. various people at Fox News, and fools who believe them, I remind you that Trump found lying over 30,000 times in his presidency.

It was not just the Mueller Report, but the less publicized but much more extensive Senate Intelligence Committee report on the matter, not to mention that a rather large number of Trump associates were actually found guilty of lying to the FBI about their various dealings with the Ruissians. “Russia, Russia, Russia” was not remotely a hoax, and the fact that you are spouting this stuff with Trump-supporting Putin engaging in unjustified invasion of Uktaine where war criminal slaughter of civilans is ongoing is truly astounding, although maybe not given how incredibly stupid and untruthful you are.

I am curious though, are you so deluded you actually believe Trump lies on this matter? I hope you are aware that over 70% of the Steele dossier has been verfird, even though people like Hannity think that combining “Russia, Russia, Russia” witht “discedited Steele dossier” somehow proves something.

But then I just saw a letter to my local paper where somebody claimed that if somebody thinks that Biden got more votes than did Obama, they “must have rocks in their head.” What do you have in your head, CoRev, maybe holes left from where some old goal posts used to be stuck that you moved elsewhere to an unknown location?

BTW, CoRev, that SEnate Intel Comm was chaired by a GOP, Sen Burr of NC.

2slugs claims: ” some industrious journalists” MAY BE something other than misinformation. Show us the article, please.

A transcript of a Nina Totenberg NPR radio program said this: “… According to sources who’ve seen the FBI report, nothing in it contradicted Hill’s story except nominee Thomas, who denied any harassment.

… Last night the White House, responding to inquiries from NPR, issued a statement saying that it had been informed by the Senate Judiciary Committee on September 23 about the allegation against Thomas and that the president had directed the FBI to conduct an investigation. Two days later, the White House reviewed the report and, quote, `determined that the allegation was unfounded,’ close quote.” https://jwa.org/media/transcript-of-nina-totenbergs-npr-report-on-anita-hills-charges-of-sexual-harassment-by-0

Way to totally misrepresent what her reporting said! Try this:

“On the other hand, women have increasingly said that men don’t take charges of sexual harassment terribly seriously, and the United States Senate is almost all male.:

It seems even today you are one of those makes who do not take sexual harassment seriously. Which in plain English means you are a pig.

One of the old stratagems on that, which honestly I find distasteful, but……. is to ask “what if it was your Mom, sister, daughter, who was being raped??” Said question always makes me grimace in disgust. I think the question can be like a blast of cold water into the face (or maybe more like someone puked on your new shoes). But the deal is the person has to have some form of empathy first. Empathy has to be some part of your character make-up before such questions are effective. But ask yourself, how many women who support donald trump and his anti-women policies have empathy for women who are raped?? His comments about “grabbing them by the….” his comment about Megan Kelly and blood. My theory is, there are just as many women “pigs” as men.

You know who donald trump surged with after openly admitting to sexually molesting women like it was a fun vapes habit?? Women and Hispanics:

https://www.politico.com/news/2021/06/30/new-trump-poll-women-hispanic-voters-497199

” …… but Trump won white women by a larger spread (7 points) than he won them in 2016 (2 points).”

……..

“Trump ‘had about a 10-point gain from 2016 to 2020 in the share of Hispanic voters who supported him,’ said Ruth Igielnik, a senior researcher at Pew.”

Barkley, relevance of your last 2 comments? Maybe relevant to the voices in your head?

CoRev,

You are the worthless disgusting and now clearly immoral a-hole who talks about “Russia, Russia,Russia.”

This is now a matter of deep morality. You are supporting evil on the level of Hitler, when you shoot your mouth off like that. You create a goal post you can not move. You are supporting profound evil, and I shall denounce you to the gates of hell, you disgusting nauseating evil scumbag if you do not clean up your act at least around here on this matter.

Got it?

CoRev Once again you are trying to move the goal posts by pretending I was saying something that I never actually said. My comment about Clarence Thomas was strictly about Thomas’ claim (i.e., lie) that he never viewed or rented the porno films that Anita Hill mentioned in her testimony. Clarence Thomas flatly denied it under oath. Some months afterwards some reporters decided to fact check his claim, so they went to many of the video rental places in the DC area. And they found that he had in fact rented those movies. There was a paper trail. This is an open and shut case. Clarence Thomas lied under oath with respect to this part of his testimony. You can believe or disbelieve his testimony regarding the rest of the Anita Hill/Clarence Thomas exchange, but when it comes to the porno movie charge he clearly lied. There is no ambiguity about that. He lied under oath. Full stop.

2slugs claims: “This is an open and shut case. “, but provides ZERO evidence.

I even asked nicley: “2slugs claims: ” some industrious journalists” MAY BE something other than misinformation. Show us the article, please.”

Get thee to the nearest Vomitorium, CoRev. You have completely lost it.

CoRev Here’s your proof: https://www.salon.com/2010/10/27/anita_hill_clarence_thomas/

In November ’94, three years after Thomas was confirmed, Wall Street Journal reporters Jill Abramson and Jane Mayer released a book, “Strange Justice,” which brought new information about the Thomas/Hill confrontation to light. As a Washington Post article described it:

“Strange Justice” uses statements from Thomas’s friends and associates to undermine Thomas’s testimony that he never talked dirty with Hill. The authors, after interviewing acquaintances as far back as his college years at Holy Cross, report that he often recounted sexually explicit films in lurid detail. Kaye Savage, a former colleague, reports that the walls of his bachelor apartment were covered with Playboy nude centerfolds. The owner of a video store near the EEOC said Thomas was a regular customer for pornographic movies.</b?"

At his confirmation hearings, Thomas had specifically denied ever engaging in workplace discussions about pornography. Joe Biden, who had chaired the Judiciary Committee hearings, told Abramson and Mayer:

"I could have brought in the pornography stuff. I could have decimated [Thomas] with that. I could have raised it with more legitimacy than what the Republicans were doing. But it would have been impossible at that point to further postpone the hearings for more investigation into his patterns of behavior … and it would have been wrong."

BTW, it turns out that the 10 year girl who was raped did in fact go to Indiana for an abortion. Her story was confirmed by the Ohio prosecutors handling the case. You lose again.

2slugs thank you and Moses for the reference.

As for the 10 year old, what a sad commentary for it to be used for politics.

https://news.cgtn.com/news/2022-07-11/China-s-June-auto-sale-up-23-8–1bA8n6LVSsU/index.html

July 11, 2022

China’s June auto sale up 23.8%

China’s auto sales regained strong momentum in June, boosted by the waning COVID-19 outbreaks and strong policy stimulus, industrial data showed Monday.

A total of 2.5 million units of cars were sold in June, up 23.8 percent from one year earlier, data from the China Association of Automobile Manufacturers showed.

Sales of passenger vehicles soared by 41.2 percent year on year to 2.22 million units, data showed.

The sales of new energy vehicles jumped to 596,000 units in June, up 130 percent year on year. The sales of electric vehicles grew by 120 percent compared with the same period of last year….

http://english.news.cn/20220711/7cfe0d3095c9447faa45f2ae8ec9b20d/c.html

July 11, 2022

China’s auto exports surge in June

BEIJING — China’s auto exports sustained their growth momentum last month, hitting a record high and soaring 57.4 percent year on year, industry data showed on Monday.

In June, auto companies exported a total of 249,000 vehicles, climbing 1.8 percent from a month earlier, according to the China Association of Automobile Manufacturers.

Some 198,000 passenger cars were exported last month, jumping 65.6 percent from the previous year, and exports of commercial vehicles stood at 51,000 units, an increase of 32.4 percent, the association said.

In the first half, China’s auto exports rose 47.1 percent year on year to nearly 1.22 million units.

New energy vehicles have become a bright spot of China’s auto exports, with some Chinese brands entering the markets of developed countries such as many in Europe, with growing global recognition and increasing competitiveness, the association noted.

Exports of new energy vehicles came in at 202,000 units in the first six months, skyrocketing 130 percent.

pgl had asked what I meant by a buyers’ strike in real estate. From CR today:

Read these builder comments from around the country. Sales have declined sharply in June.

Some homebuilder comments courtesy of Rick Palacios Jr., Director of Research at John Burns Real Estate Consulting (a must follow for housing on twitter!):

#Atlanta builder: “Someone turned out the lights on our sales in June!”

#Austin builder: “Sales have fallen off a cliff. We’re selling 1/3 of what we sold in March and April. Trades are more willing to negotiate pricing since market has adjusted significantly past 60 days.”

#Birmingham builder: “Sales have fallen 75% the last two months in a further out community.”

#Boise builder: “Sales have slowed tremendously. Builders are dropping prices and halting new starts. Seeing prices drop on labor due to slowing of home starts. Expecting 15% to 20% reduction in most costs.”

That’s what I meant.

https://www.calculatedriskblog.com/2022/07/homebuilder-comments-in-june-someone.html

So you have stopped reading the insights from Bill McBride preferring to read the comments section. Go figure!

It’s in Bill’s text. Click through and educate yourself.

Bill? Like you insult Dr. Hamilton with “Jim”. Show some effing respect.

Bill used to run my rig count graphs on Fridays, for example, here:

https://www.calculatedriskblog.com/2018/11/oil-rigs-increased.html

Steven Kopits

July 12, 2022 at 8:10 am

He used to? Do you mean he decided not to infest his blog after he read some of your other BS statements? I can he finally figured out that you only think you are THE EXPERT ON EVERYTHING. You are not – not even close.

But do continue your disgusting parade of self promotion.

@ Kopits

So, Mr. McBride finally got smart and switched over to Baker Hughes’ rig count instead of inferior grade data??

I use the Baker Hughes data.

I think Bill decided he wanted to stick closer to macro and real estate. But ask him.

Steven Kopits

July 12, 2022 at 10:44 am

I use the Baker Hughes data.

But Stevie said it was his data. His data taken from Baker Hughes? Gee Stevie – your claim it was your data was another lie. Baker Hughes should sue you.

pgl (and Moses also),

This is one of those times I shall defend Steven. I believe him that he has met Jim Hamilton at some conferences. I think that does give him the right to call the guy “Jim,” who is not a pompous or stuffy guy, even if for many of you he has become a sort of distant and forbidding figure. He is an easy-going nice guy.

Also, unlike Jim, whom I have known since before some of you were born, :-), I do not know Bill MacBride and only occasionally check on CR, although it is clearly a high quality blog I respect. But I would say that Steven also probably is not out of line referring to him by his first name, even if perhaps MacBride now does not think much of him (I have no idea).

Steven has been posting quite a lot of stuff here lately that has not made a lot of sense, with me giving him hard times on some of it. But giving him a hard time because you do not think he knows either Jim Hamilton or Bill MacBride well enough to refer to them by their first names is just overdoing it. This is just silly stuff.

Barkley Rosser: However, an interesting sociological exercise is to see what commenters refer to one or the other bloggers on this blog as professor, and the other by first name, when the commenter in question has met neither of the two bloggers.

@ Menzie

I have explained my reasoning before (I thought ad nauseam), if it offends you I will address you as Dr. Chinn or Professor Chinn from here on. It was never intended as any kind of dig or disrespect.

Moses Herzog: The comment wasn’t directed at you, actually. It was an observation on a previously omnipresent commenter on this blog, who no longer seems to grace us with his (nonsensical) commentary.

Moses,

I shall give you credit for recognizing there may be an issue here. This has come up before, and I have commented on it here, and I have also had private conversations with Menzie about this matter.

Frankly, I think there is not a problem for any commenter here to call the other host by his first name, even if you have never met him. Again, while he has become somewhat more withdrawn and elevated into some odd sort of place, I repeat as someone who actually does know him quite well, that Jim Hamilton is a nice guy who I have no doubt has no ptoblem whatsoever being called “Jim” by any commenter here on this blog that he in fact founded. Doing so would end the rather odd discrepancy of people somehow treating him and Menzie differently regarding how they are addressed, for which there has never been any good reason.

Of course, Baker Hughes publishes its rig data every Friday at 1 pm. Anyone can use it. So can you.

https://bakerhughesrigcount.gcs-web.com/na-rig-count?c=79687&p=irol-reportsother

Primary Vision publishes the frac spread count, usually around 4 pm on Fridays.

The public version of the count can be seen on the Primary Vision Network on YouTube.

https://www.youtube.com/watch?v=l9J4M7DgvMQ&t=74s

I also include data from the EIA DPR, PSR and STEO, with of course, my own analysis and commentary.

You can sign up for the report at info@prienga.com

Chatter like this is irrelevant. Then in July sales surged and the chatter changes. Most of that was related to a false flag interest hike of a flawed, misunderstood cpi report.

I wouldn’t be too happy about falling oil and gasoline prices, btw. This could happen for two reasons. The second one is bad.

I predicted you would say this vindicates your BS about RECESSION. Dude – you are predictably pathetic!

Imagine if you had taken the trouble to predict it in advance.

Oh yea – you are On The Record. OMG – you are such a boorish bozo.

https://www.msn.com/en-us/money/news/fed-s-bullard-us-economy-can-handle-higher-rates/vi-AAZscRW?ocid=msedgdhp&pc=U531&cvid=d543b93774154923a0f028307897d58f

James Bullard notes why he thinks US real income is still growing (yep all that Princeton Steve chirping about recession is just BS) and why he also thinks higher interest rates are a good idea.

Now he is correct that real interest rates were high during the 1983 to 1989 period of strong economic growth but I guess he left off the 1981/82 period of overly tight monetary policy.

You may think we can walk away from a collapse of the housing market. I sincerely doubt it.

It is an oil shock recession. No it is a housing crash recession. You remind me of the old SNL skit about Shimmer. It is a floor was AND a desert topping!

So, we have three different dynamics: stimulus roll-off; too easy monetary policy; and an oil shock.

We know the Federal government borrowed and spent $7 trillion over two years, creating massive excess demand. That’s clearly rolling off now and probably the primary reason for the technical recession which we most likely experienced in H1 2022.

The second issue is monetary policy, which has inflated massive bubbles in securities and real estate. Equity markets have retreated by about 20% and are now largely within historical p/e norms, assuming earnings hold up (which they probably won’t). Housing, on the other hand, remains largely at a peak, up 40% in two years, if I recall correctly. We are now beginning to see a massive correction as buyers go on strike. I think we’ll see housing down by around 20% over the next twelve months, with a few months of really spectacular declines.

The third issue is the oil shock, the provenance of which is potentially complicated. Part of it is the lack of investment during the pandemic. Part of it may be the end of the shale revolution in the US. Part of it is the Ukraine war. But part of it also has to be attributable to US (and other countries’) fiscal and monetary policies during the pandemic. In any event, the announcement of the EU oil embargo sent oil prices into oil shock levels, and I think that is an important contributing factor to taking down the global economy.

I would add that the NFIB just published its small business confidence index, which is at record lows.

The simple read on all this is that the US is about to fall splat on its face in what may prove to be a nasty, nasty recession. The housing crash, for its part, comes courtesy of the US Federal Reserve Bank.

My updated take on the matter can be found here (which, by the way, incorporates pgl’s comment on M2 and inflation after 2007).

https://www.princetonpolicy.com/ppa-blog/2022/6/21/the-pandemic-and-us-fiscal-and-monetary-policy-errors

https://assets.nfib.com/nfibcom/SBET-June-2022.pdf

Oh Lord – more of your totally misguided babbling? Maybe you should stop as NO ONE here reads your nonsense. NO ONE.

OMG “We define a depression as an economic downturn linked to a large decline in house values.”

Stevie even abuses the word suppression. BTW this moron labeled the period from 2010 to 2014 as a depression.

Yea I started to read his latest really dumb bloviating which I am afraid killed a few of my brain cells.

Everyone else – do not read his garbage as it is really, really dumb.

‘Not everyone believes the money supply and inflation are linked. In December 2021, Federal Reserve Bank chairman Jerome Powell told a House committee that the once-strong link between the money supply and inflation “ended about 40 years ago.” Powell’s beliefs rest upon the relationship of the money supply to inflation from the start of the Great Recession. From late 2007 until the start of the pandemic, M2 had risen by 60% more than GDP growth, and yet cumulative inflation over that 12 year period was only 20%. The Fed could print money with impunity, it seemed.’

NO ONE believes this last statement. Not even Powell. Stevie is lying about what the FED chair believes.

‘Standard economic theory, by contrast, attributes inflation principally to growth in the money supply. The Nobel laureate economist Milton Friedman famously said that “inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” M2 is a widely used measure of the quantity of money, and it has increased by 39% since the start of the pandemic.’

I and Barkley have told this arrogant bozo that Dr. Friedman abandoned this naive Quantity Theory of Money decades ago. So Stevie is also insulted the late great Milton Friedman. This intellectual garbage should have stopped a long time ago.

‘If Friedman were correct, we would expect prices to rise by the increase in M2 less the increase in GDP. GDP has risen by 5% since the beginning of the pandemic, and therefore we might expect prices to rise cumulatively by 34%, all other things equal.’

Stevie thinks his simplistic little equation is some sort of sophisticated means for forecasting inflation. Yes he is really THAT DUMB.

If you are asking whether we could see another depression, the answer is ‘yes’, and there are real estate guys who are now making the comparison to 2007. The question is not directly the decline in real estate values, but rather the leverage undertaken at elevated house prices. If a lot of people took out a lot of loans, yes, you could get another depression,

I would note, however, the centrality of oil in the China Depression. It was also an oil shock. Those conditions do not appear to be present for the moment. The closer comparison would be 1974 and 1979/1981, which were traditional supply shocks. The period 2008-2014 was a demand shock.

“Steven Kopits

July 12, 2022 at 10:50 am

If you are asking whether we could see another depression, the answer is ‘yes’, and there are real estate guys who are now making the comparison to 2007.”

How dumb are you? No – the Great Depression was not caused by a housing. The 2007-9 period is called the Great RECESSION. And no – I just said your claim we had a depression from 2010 to 2014 is a lie.

Dude – it might help if you stopped bloviating and actually READ what others have written.

The Great Recession was a depression. Same factors in play. Housing crash, FFR or equivalent at zero for seven years without inflation, secular stagnation, etc. The integration of China into the global economy was the proximate cause, hence, the China Depression. Anyone other than Barkley can pick it right off the graph.

The depression runs from Q1 2008 to, let’s say, Q2 2014. That’s not a peak-to-trough measure, but more peak until things start getting better measure.

So, pgl, you quote this passage:

Not everyone believes the money supply and inflation are linked. In December 2021, Federal Reserve Bank chairman Jerome Powell told a House committee that the once-strong link between the money supply and inflation “ended about 40 years ago.” Powell’s beliefs rest upon the relationship of the money supply to inflation from the start of the Great Recession. From late 2007 until the start of the pandemic, M2 had risen by 60% more than GDP growth, and yet cumulative inflation over that 12 year period was only 20%. The Fed could print money with impunity, it seemed.’

Powell’s testimony is available on YouTube, but the quote comes from the Washington Post and it’s linked in the piece.

Powell states that the once-strong link between the money supply and inflation “ended about 40 years ago.” First of all, that’s wrong. As you can see on the ‘Observed vs Predicted Cumulative Inflation’ graph linked below, observed inflation exceeded predicted inflation after 1975, 1983, and 1991. The only period where Powell is correct is after 2007. So it’s not forty years, it’s at best twenty years. So let’s start with that. But it is true after 2007, where predicted inflation to 2019 was 60% cumulatively, but only 20% was observed.

To increase M2 by 40% over two years is very much the equivalent of printing money with impunity. If you’re saying that Powell knew it would blow out inflation and did it anyway, well, he should resign. But Menzie and you and others have said that QTM is outdated and no longer applicable. Now you’re saying it is relevant after all. If it’s relevant, then why did the Fed print so much money? So which is it? Does QTM apply, or does it not?

https://www.princetonpolicy.com/ppa-blog/2022/6/21/the-pandemic-and-us-fiscal-and-monetary-policy-errors

Steven,

Sorry, but your claim to have proven quantity theory right not convincing. Also not going along with your claim that US was in a depression from 2008 to 2014, although the Great Recession was deep enough it was depression-like,

Where I do agree with you is that it does look like we are going into a major decline in the US housing market and probably related construction as well. Price-rent ratios indeed have gotten up to 2006 levels, kind of scary.

Where I think you are overdoing the downside drama of all this is that despite what some people may be telling you, I do not see leverage ratios anywhere like back then. More generally, most mortgages have been standard and solidly backed by those taking them out. There is slso not some buildup of weirdo derivatives based on flaky mortgages. In short, most of the pieces that made the housing crash of 2006 and later turn into the Great Recession do not seem to be present now.

And yet, Barkley, inflation came in hot at 9.1% in June. So now there is talk of a 1 pp rate hike coming. If my explanation is not convincing, I am sure you can provide a better one.

https://www.cnbc.com/2022/07/13/inflation-rose-9point1percent-in-june-even-more-than-expected-as-price-pressures-intensify.html

https://news.cgtn.com/news/2022-07-11/1-in-6-UK-households-face-serious-financial-difficulties–1bA5DNjj80E/index.html

July 11, 2022

1 in 6 UK households face ‘serious financial difficulties’

The number of UK households that are now in “serious financial difficulties” has increased by nearly 60 percent to 4.4 million since October, reaching an unrivaled high during the COVID-19 pandemic, a survey has found.

Among the families that have been embroiled in such financial predicament, “71 percent have reduced the quality of food they eat, 36 percent have sold or pawned possessions and 27 percent have cancelled or not renewed insurance,” according to a report released Monday by the abrdn * Financial Fairness Trust, an NGO.

A further 20 percent of all UK families are “struggling” to make ends meet, meaning more than one-third of households are either in “serious financial difficulties” or “struggling,” the NGO said.

The findings come against the backdrop of a political turmoil that has seen the resignation of Prime Minister Boris Johnson and Conservative MPs competing for the top job. In May, Johnson’s government announced an extra £15 billion ($18 billion) in cost of living support to contain the toll of the pandemic, but many are calling on the outgoing government to announce more aid before departure.

* Aberdeen ( https://www.financialfairness.org.uk/en/our-work/publications/coronavirus-financial-impact-tracker-2022 )

Can anyone call themselves “chief economist”? This Mark Fleming dude started to remind me of Princeton Steve:

https://www.msn.com/en-us/money/realestate/i-m-the-chief-economist-for-a-5-billion-real-estate-data-and-title-company-here-are-5-things-you-need-to-know-about-the-housing-market-now/ar-AAZpYlQ?ocid=anaheim-ntp-feeds&pc=U531&cvid=d320ed32399747e5ad74d67a7d9fb8d2

I never heard of this fellow and could care less about the outfit he works for. Then again as I read his babble, I start to think “at least he is not as bat$shit insane as Princeton Steve”.

Dean Baker continues to make the case that inflation will moderate:

https://cepr.net/can-we-have-a-wage-price-spiral-with-slowing-wage-growth/?emci=6a1f789f-3d01-ed11-b47a-281878b83d8a&emdi=2a8dabd3-3d01-ed11-b47a-281878b83d8a&ceid=4616197

https://fred.stlouisfed.org/series/GDI

From 2021Q1 to 2022Q1, gross domestic income (nominal) rose by 11.9%. OK – we have see prices rising by over 8% during this same period. Simple arithmetic says real income have risen by over 3% during this period. Keep this in mind when people incapable of understanding even basic economics write dumb things like this:

‘The point is even if the rate of inflation abates somewhat, the absolute level of prices compared to a year or even 6-months ago has created economic pain that does not appear to be going away quickly.’

Yea – that was Bruce Hall who thinks we must have deflation for real income to rise. He truly is THAT INCREDIBLY STUPID!

Kevin Drum has a similar message as Dean Baker:

But as you can see, wages have been running behind inflation for the past 18 months, and even nominal wage growth (shown quarterly by the cute blue arrows) has been slowing down recently. Now, this is mostly making up for the big wage spike during the pandemic. But not all of it:

https://jabberwocking.com/wages-are-moderating-no-matter-how-you-measure-them/

Well that represents the fact but Kevin makes Dean’s point thusly:

Anybody who’s worried about a wage-price spiral—or who thinks employers are serious about a worker shortage—is crazy.

Who has been worrying about high inflation persisting – Princeton Steve, CoRev, and Bruce Hall of course. As Kevin says – they are crazy.

Off topic –

After a terrible first half for developed-market financial assets, it’s no surprise to read that emerging markets funds suffered big outflows – it’s just record-keeping at this point. Still, $50 billion is a big number for this market:

https://www.ft.com/content/563d679c-a14a-42d8-bdf0-29cddfd94fc2

Yeah, but that was due to the pandemic bubble. Financial markets are essentially back to the 2013 trendline.

For all their horribleness in first half of 22, stock markets in US still above where they were when Biden took office.

https://news.cgtn.com/news/2022-07-11/Chinese-mainland-records-94-new-confirmed-COVID-19-cases-1bzBvpoz6qk/index.html

July 11, 2022

Chinese mainland records 94 new confirmed COVID-19 cases

The Chinese mainland recorded 94 confirmed COVID-19 cases on Sunday, with 46 attributed to local transmissions and 48 from overseas, data from the National Health Commission showed on Monday.

A total of 335 asymptomatic cases were also recorded on Sunday, and 3,094 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 226,704, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-07-11/Chinese-mainland-records-94-new-confirmed-COVID-19-cases-1bzBvpoz6qk/img/b1b6aa2456534246b0930c7223595312/b1b6aa2456534246b0930c7223595312.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-11/Chinese-mainland-records-94-new-confirmed-COVID-19-cases-1bzBvpoz6qk/img/012584c783c848968b4b3918a56872c1/012584c783c848968b4b3918a56872c1.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-11/Chinese-mainland-records-94-new-confirmed-COVID-19-cases-1bzBvpoz6qk/img/8a6a5215c1f846c7899832c4b17d5111/8a6a5215c1f846c7899832c4b17d5111.jpeg

https://www.worldometers.info/coronavirus/

July 10, 2022

Coronavirus

United States

Cases ( 90,338,657)

Deaths ( 1,045,792)

Deaths per million ( 3,146)

China

Cases ( 226,610)

Deaths ( 5,226)

Deaths per million ( 4)

Maybe if Americans observed more stories about regular —– Chinese citizens…

Maybe if Americans observed more stories about regular —– Chinese citizens…

Maybe if Americans observed more stories about regular —– Chinese citizens…

[ Definitive repeated conscienceless, merciless, racism. ]

https://twitter.com/CGMeifangZhang/status/1546576898494537731?cxt=HHwWhoC9ydffxfYqAAAA

Zhang Meifang张美芳 @CGMeifangZhang China government official

True warrior: When a 11-year-old taken away by the river, policemen in #Xinjiang threw themselves to block the flow. #Chinarama

https://twitter.com/i/status/1546576898494537731

3:27 PM · Jul 11, 2022

I think — is down at — — — Bank seeing if they’ll give…

I think — is down at — — — Bank seeing if they’ll give…

I think — is down at — — — Bank seeing if they’ll give…

[ Ceaseless bullying, merciless racism. ]

Considering the falsehoods and bullying directed at me by you ltr, your crying is crocodile tears.

It’s kind of confusing. I remember most of my mainland Chinese friends being able to take a metaphoric “punch” to the gut pretty well (or in this case barely a barb, mostly intended for my own humor, not like I imagined people belly laughing on the floor having read it, just maybe half a grin). ltr’s inability to roll with the punches reminds me more of America’s generation Z’s obsession with pronouns etc. than it does the resilience of the typical mainland Chinese. It seems “ltr” has been “Americanized” in the worst of ways. American boys will be getting “reassignment surgery” at age 5 any day now. Put your stopwatch at 20 seconds for Michel Martin to make the big announcement, in pretentious tones and “disbelief” 5 year old boys couldn’t change gender at age four in 1979. Then we’re all supposed to nod our head in unison like idiot robots “Oh yes, yes, of course yes, what a shame boys couldn’t get that surgery back in ’79 …… outrageous they couldn’t”.

Moses,

Sigh, talking about your mainland Chinese friends and then going on about how ltr has been “Americanized,” not to mention your continuing fantasy that she is male and all this stuff about American boys, is really over the top. It is almost certain that ltr is an American born in the USA.

@ Barkley Junior

We know neither what his gender is, nor what nation he currently resides in. Here’s the difference between idiots like you and slightly above ave intelligence people like me. I allow others to have their theories as long as they cannot be disproven on a factual basis. You take it as some kind of penetrative molestation on your soul anytime someone disagrees with you. Sounds like a YOU problem. Your beckoning grave shrieks the window is closing, see a psychiatrist soon.

Actually, Moses, I know more about ltr than you do or most here, although I am not going to say how. But, bottom line, ltr is almost certainly born in America and female.

What I do not know is her ethnic Background. Given how vigorously she has come to support the PRC and the official lines coming out of its government, observers here may not be unreasonably inclined to think that she might have at least some Han Chinese ancestry. But on this matter, I have zero actual information.

BTW, Moses, going on to somebody who has announced that he currently suffering from Covid, which I am, and which has messed up my personal life considerably, with rants about how I am supposedly facing “Your beckoning grave shrieks the window is closing” is really pretty inappropriate, although, fortunately, even if you might wish otherwise, I think I am going to survive this illness and even avoid going to the hospital, although, buster, it ain’t a lot of fun.

Oh, and the person who needs to see a shrink is the person who keeps insisting that the long and well-known “anne” of Economists View must somehow be a man. And, boy, I hope you are doing so.

I don’t pretend to know, would this slump in gasoline prices be driven by a decline in demand, or has there been an increase in supply?

@ Jacob

Stolen verbatim from the good folks at “tradingeconomics dot com”

“Brent crude futures fell below $106 per barrel on Tuesday, extending losses from the previous session, as fresh Covid-19 curbs in top importer China and mounting fears of a global economic slowdown weighed on the market. About 30 million people in China are under some form of movement restrictions as the country grapples with resurgent virus outbreaks, with a highly-contagious Omicron subvariant being detected in Shanghai. Oil prices have also been declining since mid-June on recession fears as central banks race ahead with aggressive rate hikes to combat surging inflation. Moreover, President Joe Biden is set to visit Saudi Arabia this week amid efforts to bring down energy prices. Meanwhile, persistent supply concerns kept markets on edge, as major producers are limited by capacity constraints while Russian supply remains mired in sanctions due to its invasion of Ukraine.”

tomorrow at 10:30 eia issues the week of 8 jul supply print.

last week spr was down 5.8 while commercial crude stocks were up 8.2, a net crude supply plus of 2.4 million barrels. still historic low inventory of crude, and that will hurt with a major storm in gulf which are none on the radar lately.

while crude was up gasoline and diesel were down a million barrels each. inventory also low!

refining in usa may not be able to put out much more gas and diesel no matter the crude supply.

also, from watching wti/nymex some price reaction comes from the us$ being nearly 20% up on the euro and 10 to 15% on pound and yen.

i am retiring i may get in another 600 plus mile road trip this summer…… and maybe in late sept.

i can tough out the prices.

all that said i recall other summers gasoline prices declining after early holiday gougings?

i suspect prices cause a modest bit of demand destruction over 4th of july

prices may find a level where demand cuts gasoline inventories lower.

The latest EIA data show gasoline demand down from a year ago, but that was also true during the leak in early June and during the rise toward the leak in May. Inventories are low relative to the 5-year range. Days of supply, a measure of silly relative to demand, is down from a year ago and not showing any big improvement from more decent readings.

https://www.eia.gov/petroleum/weekly/gasoline.php

On the other hand, expectations of future demand appear to have been hurt by recent evidence of slower economic growth; forward-looking markets and all that.

During the peak, not the leak.

Arabs are increasing production. IEA is worthless in that scenario. Because future transportation of the “good” oil will increase. 5 year averages aren’t that useful either considering the world was flooded with oil. It looks to me all declines have stopped since March. Nowhere for a price to go but down in the face of increased shipments.

Let’s also note Russia will now likely be China’s chief oil major.

The China virus contagion flare-ups seem to be effecting oil demand scenarios, in a heavy way. It’s almost enough to make you think Chinese manufactured vaccines are worthless isn’t it?? Of course~~~ I ~~~would never say such a thing. Maybe that was part of the subtext of Menzie’s post?? It certainly is effecting Tuesday morning markets, that’s for certain.

Anyone else going out to get gasoline in 2-3 days?? ‘Cuz I’ll tell you right now, if you got less than half a tank you’re a dumdum if you don’t.

Just filled up at the local Costco: regular @$4.369 per gallon. That’s down about $0.65 from late June which is normally the peak pricing here. We are usually impacted by the changeover to summer blends plus the tourist season which is substantial here. Unless we have the annual refinery shutdown at Marathon (south of Detroit) due to some implausible reason or another major supply disruption globally for oil, I think that there won’t be much increase until late August.

Minus the war in Eastern Europe, minus the variations in the virus contagion (not just in China, but we have to assume mostly in China), minus the uncertainty (see what I did there Menzie??) on Russian oil/natural gas sales to Europe in general, I would be very tempted to agree with you. And I have definitively stated on this blog I felt inflation (in a general way, not just energy) will be under control by late December of this year. But I think between now and late August (6 weeks) is a “long time” in the strange context we currently find ourselves in.

What happens if America decides to “donate” some of its own energy supplies to Europe in order to help fight a further invasion?? (Or Japan and South Koreas forfeit some of their supplies in their kindness to the world community)?? It’s not completely out of the question. All of those things would put a major crimp in global supply. Those lastly mentioned things would be more apt to happen this winter and on into ’23. But it’s still something to be very concerned about.

https://en.yna.co.kr/view/AEN20220428003900320

https://www.reuters.com/business/energy/japan-diverting-lng-europe-some-already-route-industry-minister-2022-02-09/

https://www.nytimes.com/2022/07/11/opinion/cryptocurrency-federal-reserve.html

July 11, 2022

Crypto Is Crashing. Where Were the Regulators?

By Paul Krugman

When the Federal Reserve speaks, it speaks in Fedspeak. A pithy turn of phrase or a striking metaphor can all too easily turn into a headline, causing big market moves and a public backlash. So dry technical language and euphemisms are usually the way to go.

Given this reality, the bluntness of a recent speech on crypto regulation by Lael Brainard, the Fed vice chair, is almost shocking.

True, Brainard didn’t go as far as Jim Chanos, the famous short-seller, who called crypto a “predatory junkyard.” But she came close. The very first heading in her remarks was, “Distinguishing Responsible Innovation From Regulatory Evasion,” and she strongly suggested that much of the crypto universe is driven by the latter. Traditional banking is regulated for a reason; crypto, in bypassing these regulations, she said, has created an environment subject to bank runs, not to mention “theft, hacks and ransom attacks” — plus “money laundering and financing of terrorism.”

Other than that, it’s all good.

The thing is, most of Brainard’s litany has been obvious for some time to independent observers. So why are we only now hearing serious calls for regulation? …

https://www.nytimes.com/2022/06/29/technology/crypto-crash-divide.html

June 29, 2022

Crypto Crash Widens a Divide: ‘Those With Money Will End Up Being Fine’

No cryptocurrency investor has been spared the pain of plunging prices. But the fallout from more than $700 billion in losses is far from even.

By David Yaffe-Bellany

https://www.msn.com/en-us/money/other/tucker-carlson-tells-fox-news-audience-that-american-education-wrecked-by-desegregated-busing/ar-AAZuU7M

On Monday, Fox News host Tucker Carlson claimed that busing for the purposes of racial desegregation “wrecked” the country’s school system, suggesting that it’s morally tantamount to a government overthrow. The pundit’s comments came just days after thousands of protesters stormed the Sri Lankan capitol building in protest of poor living conditions, leading to the impending resignation of the country’s president this Wednesday. Carlson, not a known expert in Sri Lankan politics, blamed the upheaval on liberals and environmentalism. “So we know what you’re thinking: ‘Oh, so pampered, lifestyle liberals just destroyed something else.’ They did to Sri Lanka what busing did to American education, just absolutely wrecked it and walked away like it never happened. That’s the downside. People’s lives were destroyed. It happened a lot,” Carlson said as the Fox News chyron suggested this was a result of the so-called Green New Deal, a proposal to tackle climate change that has stalled in the U.S. Congress.

The Green New Deal caused the unrest in Sri Lanka? WTF? Desegregation ruined US education? OK Tucker Carlson and his viewers are really dumb and I guess they blame their stupidity as they had to share a classroom with black children. Even Faux News should consider pulling the plug on this blatant racist.

@ Menzie, @ Macroduck

I thought the both of you would find this post interesting/ edifying(??) because it is related to both credit markets and currency. The blog post almost has more questions than it has answers. But the questions are very interesting to ponder, and the pondering of those questions might eventually provide very important answers. If you can make time enough to read it and have any thoughts it provokes, I would love to read them from either of you in this same thread:

https://www.creditslips.org/creditslips/2022/07/do-investors-really-prefer-putins-booby-trap-bonds.html

Well that’s fun!

All I can offer is sloppy speculation. Here goes –

Portfolio rules are an important driver of price adjustment. Rules supplant some part of risk analysis, even though we tell ourselves all asset prices reflect perceived risk. If the act-of-god currency clause in Russian bonds did not trgger portfolio risk rules, there is room for some mispricing. I would not, however, expect bonds with and ithout the clause to be priced identically except under odd circumstances – a very narrow set of owners, all operating under the same rules.

After the fact of invoking the clause, the perception may be that pure FX bonds are more likely to default.

This is, as I said, pretty sloppy speculation.

It has some slight similarities to the Fama Puzzle yes?? I thought if Menzie found the time he might be fascinated by it, based on the number of Fama Puzzle posts he has done.

Some phrases jump out to me: “The market does not seem to price the APC. That’s surprising for those of us who believe the markets are pretty good at pricing; not so much for those who don’t think the bond markets price new information until it become salient.”

Credit and bond markets generally have better educated investors. Yet they leave open the idea they don’t price in data until “it becomes salient”.

“between November 2021 and January 2022, when it is public information that Russia has amassed troops at the Ukrainian border and increasingly clear that something bad will happen? During this time period, western governments make it clear that they will impose significant sanctions if there is an invasion. Surely now the effect of the APC will kick in? Answer: No. Zero spread between bonds with APC and without.”

To me the above is really almost a bigger mystery than what happened to the yields after invasion breaks out. The see (at that time) almost no chance in repayment in rubles?? Seems incredibly dumb at this point.

Their “best theory” seems to be the same as yours Macroduck, that the APC bonds would at least pay, vs a complete default.

“The simple explanation is that the market realized that, given expected US and other sanctions, the Russian government was going to lose the ability to pay in dollars/euros/etc. That would block all payment on the foreign hard currency bonds. By contrast, there was at least a possibility that the Russian government would continue to pay (in rubles) both on domestic bonds and foreign APC bonds.”

I thought maybe Menzie might have thoughts on the last 3 bullet points in that blog post or Menzie might know another possibility they hadn’t listed.

https://www.nytimes.com/2022/07/12/opinion/employment-wages-recession-economy.html

July 12, 2022

The Humbug Economy

By Paul Krugman

There’s an old story about Charles Darwin, which may or may not be true but seems appropriate to our current economic moment. According to the tale, two boys glued together pieces of various insects — a centipede’s body, a butterfly’s wings, a beetle’s head and so on — then, as a gag, presented their creation to the great naturalist for identification. “Did it hum when you caught it?” he asked. When they said yes, he declared that it was a humbug.

That’s kind of where we are in the economy right now. I’m not suggesting anyone is faking the data, but the different pieces of information we have don’t seem to line up — they almost seem to come from different countries. Some data suggest a weakening economy, maybe even on the verge of recession. Some suggest an economy still going strong. Some data suggest very tight labor markets; others, not so much.

Let’s talk about the numbers, and how they don’t add up.

The number we usually use to assess where the economy is going is real gross domestic product — and according to the official estimate, real G.D.P. shrank in this year’s first quarter. We won’t have an official (advance) estimate of second-quarter G.D.P. until later this month, but “nowcasts” that try to estimate G.D.P. based on partial information — like the Atlanta Fed’s widely cited GDPNow — suggest slow growth or even an additional period of shrinkage.

In case you’re wondering, no, two quarters of declining G.D.P. won’t mean we’re officially in a recession; that determination is made by an independent committee that takes a wide variety of information into account. And given the confusing picture right now, it’s unlikely to declare a recession, at least yet.

Among other things, another widely used number — job creation — is telling quite a different story. The official estimate of growth in nonfarm employment in June came in quite strong — 372,000 jobs added — which doesn’t look at all like what you’d expect in a recession.

So do we have a conflict between data on output and data on employment? If only it were that simple. We also have alternative measures of both output and employment — and in each case these are telling different stories than the more widely cited numbers.

We usually track economic growth using gross domestic product — the total value of stuff produced. But the government creates a separate estimate of gross domestic income, the money people get from selling stuff, including additions to inventory. The basic accounting says these numbers must be the same. But they’re estimated using different data, so the estimates never agree exactly. And right now the estimates are diverging a lot: G.D.P. shows a shrinking economy, but G.D.I., well, doesn’t:

https://static01.nyt.com/images/2022/07/12/opinion/krugman120722_1/krugman120722_1-jumbo.png?quality=75&auto=webp

A shrinking economy — or maybe not….

https://www.worldometers.info/coronavirus/

July 11, 2022

Coronavirus

Germany

Cases ( 29,180,489)

Deaths ( 142,035)

Deaths per million ( 1,684)

China

Cases ( 226,811)

Deaths ( 5,226)

Deaths per million ( 4)

https://www.worldometers.info/coronavirus/

July 11, 2022

Coronavirus

France

Cases ( 32,366,941)

Deaths ( 150,179)

Deaths per million ( 2,291)

China

Cases ( 226,811)

Deaths ( 5,226)

Deaths per million ( 4)

https://www.nytimes.com/2021/12/07/world/asia/sri-lanka-organic-farming-fertilizer.html

December 7, 2021

Sri Lanka’s Plunge Into Organic Farming Brings Disaster

The economically troubled country banned chemical fertilizers without preparing farmers, prompting a surge in food prices and worries about shortages.

By Aanya Wipulasena and Mujib Mashal

RATNAPURA, Sri Lanka — This year’s crop worries M.D. Somadasa. For four decades, he has sold carrots, beans and tomatoes grown by local farmers using foreign-made chemical fertilizers and pesticides, which helped them reap bigger and richer crops from the verdant hills that ring his hometown.

Then came Sri Lanka’s sudden, and disastrous, turn toward organic farming. The government campaign, ostensibly driven by health concerns, lasted only seven months. But farmers and agriculture experts blame the policy for a sharp drop in crop yields and spiraling prices that are worsening the country’s growing economic woes and leading to fears of food shortages.