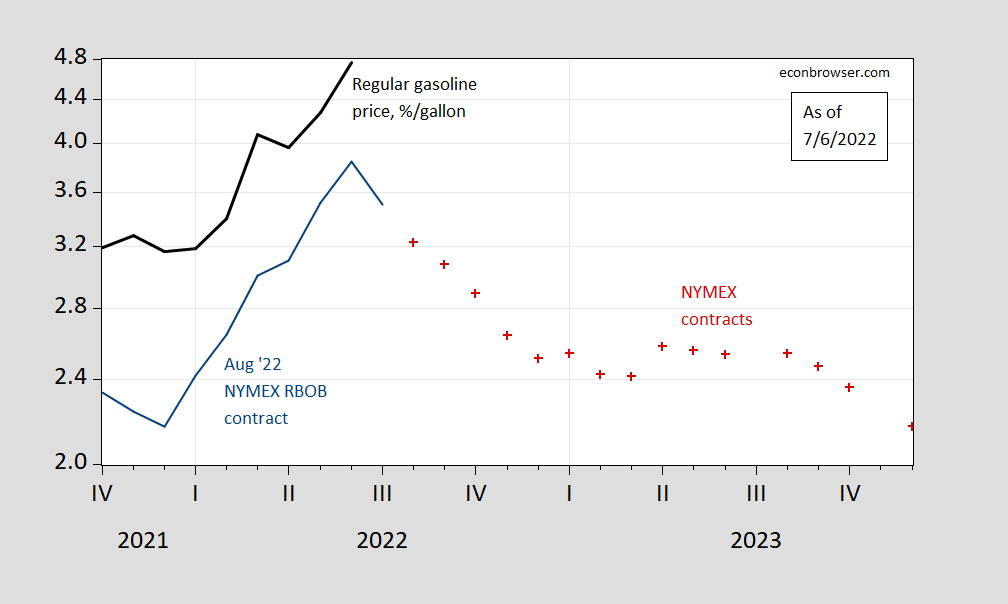

Assuming futures contract prices for gasoline are useful predictors for future gasoline prices:

Figure 1: Average regular gasoline prices (black), NYMEX RBOB August 2022 gasoline futures prices (blue), and NYMEX RBOB gasoline futures (red +), all in $/gallon, on log scale. July futures prices through 7/5. Source: EIA via FRED, INO.COM accessed 7/6, and author’s calculations.

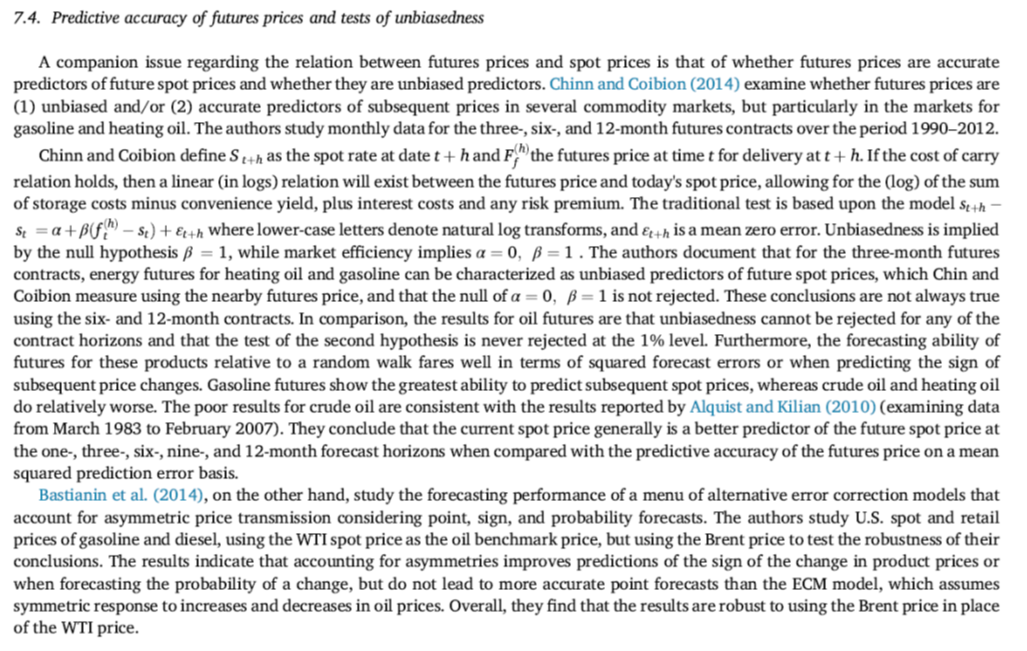

From Ederington et al. (J.Comm.Markets, 2019) [ungated version]:

More detailed discussion of futures as predictors of energy prices, see here.

Addendum:

Price of regular gasoline, through July 4th.

Are future markets suggesting gasoline prices are expected to be just over $2 a gallon by the time of the Nov. 2024 elections. Oh my if this occurs our MAGA hat wearing Usual Suspects are going to be so angry, I’m afraid they will join Proud Boys (if they have not already).

Wow Menzie, what risk could the futures prices be reflecting?

CoRev,

A far tail possible such risk, deeply unlikely, is that you have the remotest idea what you are talking about, Barking Bierka boy.

CoRev has a new cheap debating trick. I would suggest none of us take the bait.

Hey – I thought you were THE expert. Answer the question using your sophisticated economic modeling.

Incentive to store analysis suggests extremely tight markets at present. Ordinarily, this would suggest upward pressure in oil prices, and indeed, WTI is up $4+ today.

‘Gold standard’ Goldman just cuts its Q2 GDP forecast to 0.7%.

First you suggest they have no clue what they are doing and now you call them the gold standard. Your “opinions” are certainly malleable. I guess we should ask Fox and Friends to see what view they want you to portray tomorrow.

I suspect someone at Goldman Sachs is reading the ever evolving BS from Princeton Steve. GS has a strong forecast for Q2 and Stevie panned them. GS says growth will be only 0.7% in Q2 and now Stevie calls them a gold standard. Having read this – the crew at GS decides that Stevie’s recession risk BS is overblown!

https://www.msn.com/en-us/money/markets/oil-will-hit-24140-a-barrel-with-recession-risks-overplayed-goldman-sachs-says/ar-AAZm3lU

Well Stevie – at least they are not ignoring you. No – they are MOCKINIG you!

https://fred.stlouisfed.org/graph/?g=HsZn

January 30, 2020

Exports minus Imports of goods & services, 2020-2022

https://fred.stlouisfed.org/graph/?g=wtjZ

January 30, 2020

Exports minus Imports of goods & services, 2020-2022

(Indexed to 2020)

https://www.nytimes.com/2022/07/06/business/economy/fed-rate-increase-inflation.html

July 6, 2022

Fed Moves Toward Another Big Rate Increase as Inflation Lingers

As the Federal Reserve battles rapid inflation, officials are likely to stay on an aggressive path even as signs of economic cooling emerge.

By Jeanna Smialek

WASHINGTON — The Federal Reserve, determined to choke off rapid inflation before it becomes a permanent feature of the American economy, is steering toward another three-quarter-point interest rate increase later this month even as the economy shows early signs of slowing and recession fears mount.

Economic data suggest that the United States could be headed for a rough road: Consumer confidence has plummeted, the economy could post two straight quarters of negative growth, new factory orders have sagged and oil and gas commodity prices have dipped sharply lower this week as investors fear an impending downturn.

But that weakening is unlikely to dissuade central bankers. Some degree of economic slowdown would be welcome news for the Fed — which is actively trying to cool the economy — and a commitment to restoring price stability could keep officials on an aggressive policy path.

Inflation measures are running at or near the fastest pace in four decades, and the job market, while moderating somewhat, remains unusually strong, with 1.9 available jobs for every unemployed worker….

So, assuming retail gasoline prices will fall in coming weeks, what else do we know about the inflation outlook? For starters, we know the decline in the y/y core inflation rate in April and May will probably persist. There was a sharp increase in inflation in April of last year which makes raised the base for the subsequent 11 months. That increase has how fallen out:

https://fred.stlouisfed.org/graph/?g=RwaG

We are going to see another, smaller lift in October. The monhly pace of core inflation has run from a mid 3% to low 4% annualized pace so far this year, which is well above the Fed’s target. Core sticky prices are also running high relative to the Fed target:

https://fred.stlouisfed.org/series/CORESTICKM159SFRBATL#

Core sticky prices have also been unusually volatile lately, a symptom of elevated inflation. Nothing a good recession won’t fix.

The latest FOMC minutes contained this:

“Participants concurred that the economic outlook warranted moving to a restrictive stance of policy, and they recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist.”

A “restrictive stance” has, in the past, pretty much always meant a real funds rate above 0.5%. Even if Fed folk take the 5y/5y forward rate, recently fallen to 2.1%, seriously, the funds rate is still accommodative. If Fed folk take oher measures of inflation expectations seriously, the funds rate is even more accommodative, ’cause most inflation expectations measures are at 2.1% or higher. Waller and Bullard both spoke today, boh sounding like more hefty rate hikes are coming in July (Waller said 75) and September (Waller said 50).

Tens have added 7 basis points today. That’s probably thanks to Bullard and Waller, given that priced-in rate hike odds for every meeting through July of next year edged up today.

In short, Fed folk are warning us against marking down rate hike odds in response to recession fears.

I have seen that Bullard is saying US can have a “soft landing.” Yeah, I hope so, but indeed there is a danger the Fed, which was a bit slow to move against inflation will now overdo it now that they have gotten going on fighting inflatiion, which, given that probably more than half of it is supply side they are not able to do anything about that part of it.

needing more than a day to catch up bc 4th of july

eia was about an hour late posting the 1 jul petrol supply reports…..

spr -5.8 million barrels

commercial crude stock +8.2 million barrels

total us crude stock build +2.4

input to refineries about even w on w, up y on y as past few months

gasoline and distillates show small draw, large – y on y

usa net importer for 4 weeks in row now

don’t care that some crude exported!

a hurricane blows all pricing up!