Two of the methodologies discussed in the post on recent nowcasting developments provide insights into the state of the economy.

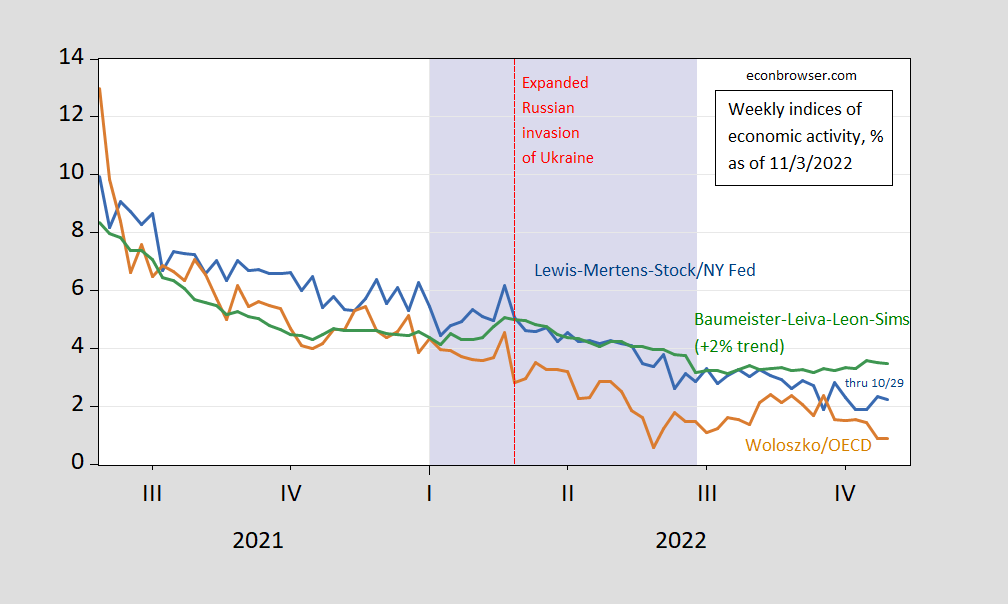

Figure 1: Lewis-Mertens-Stock (NY Fed) Weekly Economic Index (blue), Woloszko (OECD) Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green). Lilac shading denotes a hypothetical 2022H1 recession. Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The WEI has been fallen relative to five weeks ago, to 2.2% from 2.8% for the week ending 9/24. While the Weekly Tracker as fallen, the WECI has trended sidewise. The Weekly Tracker continues to indicate lower growth than the WEI, unsurprisingly, given the large differences in methodologies. The WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales). The Weekly Tracker — at 0.9% — is a “big data” approach that uses Google Trends and machine learning to track GDP.

The WEI reading for the week ending 10/29 of 2.2% is interpretable as a y/y quarter growth of 2.2% if the 2.2% reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 0.9% is interpretable as a y/y growth rate of 0.9% for year ending 10/29. The Baumeister et al. reading of 1.5% is interpreted as a 1.5% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 3.5% growth rate for the year ending 10/29.

Since these are year-on-year growth rates, it’s possible we were in a recession in H1 as one observer asserted a week ago, but it (still) seems unlikely.

GDPNow for Q4 as of 11/1 is 2.6% q/q SAAR.

Since these are year-on-year growth rates, it’s possible we were in a recession in H1…

[ Essentially, then, a full employment with declining productivity recession; with the declining productivity especially in manufacturing striking me as quite worrisome. After all manufacturing productivity is lower now than in 2011, which a prominent economist dismissed by saying that “Moore’s Law has not been repealed.” What then is happening? ]

https://fred.stlouisfed.org/graph/?g=lSwT

January 4, 2018

Manufacturing and Nonfarm Business Productivity, * 2000-2022

* Output per hour of all persons

(Percent change)

https://fred.stlouisfed.org/graph/?g=lSwU

January 4, 2018

Manufacturing and Nonfarm Business Productivity, * 2000-2022

* Output per hour of all persons

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=lSy9

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2022

* Output per hour of all persons

(Percent change)

https://fred.stlouisfed.org/graph/?g=lSyd

January 30, 2018

Manufacturing and Nonfarm Business Productivity, * 1988-2022

* Output per hour of all persons

(Indexed to 1988)

Wouldn’t proper error bars stretch from -5% to +7%?

rsm: No. Look at the documentation. If you can read. OECD Weekly Tracker has spreadsheets with prediction intervals.

https://www.bls.gov/news.release/empsit.nr0.htm

THE EMPLOYMENT SITUATION — OCTOBER 2022

Total nonfarm payroll employment increased by 261,000 in October, and the unemployment rate rose to 3.7 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred in health care, professional and technical services, and manufacturing.

The rise in the unemployment was due to the decline in employment as reported by the household survey.

https://www.msn.com/en-us/news/us/house-republicans-release-1-000-page-report-alleging-politicization-in-the-fbi-doj/ar-AA13JG3J?ocid=msedgdhp&pc=U531&cvid=a10cf69735904de88ab4a794e1b3db38

The House Republicans have decided to trash the FBI and the Department of Justice. Yes – the House Republicans want to make it easier for Mob Boss Donald Trump to undermine law and order.

Only 261,000 jobs? Will this cursed recession never end??!!??

Alas the household survey suggested employment fell. But see Dr. Chinn’s new post.

“Since these are year-on-year growth rates, it’s possible we were in a recession in H1…”

https://fred.stlouisfed.org/graph/?g=VxM7

January 30, 2020

Real Gross Domestic Product and Real Potential Gross Domestic Product, 2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=VxR4

January 30, 2020

Real Gross Domestic Product and Real Potential Gross Domestic Product, 2020

(Indexed to 2020)

https://www.nytimes.com/2022/11/04/business/economy/federal-reserve-inflation-expectations.html

November 4, 2022

Workers Expect Fast Inflation Next Year. Could That Make It a Reality?

The Federal Reserve chair is eyeing near-term inflation expectations, which might shape wages — and help keep prices rising rapidly.

By Jeanna Smialek

Amitis Oskoui, a consultant who works mostly with nonprofits and philanthropies, has not had a wage increase since inflation began to noticeably eat away at her paycheck early this year. What she has had are job offers.

Ms. Oskoui, 36, has tried to leverage those prospects to argue for a raise as the rising cost of food, child care and life in general in Orange County, Calif., has cut into her family budget.

“Generally, in the past, it was taboo to say: I need it to survive, and I know what I’m worth on the market,” she said. “In this environment, I think it’s more acceptable. Inflation is so front of mind, and it’s a big part of the public conversation about the economy.”

That logic, reasonable at an individual level, is making the Federal Reserve nervous as it echoes across America.

When employees successfully push for raises to cover their cost of living, companies face higher wage bills. To offset those expenses, firms may lift prices, creating a cycle in which fast inflation today begets fast — and maybe even faster — inflation tomorrow.

So far, Fed officials do not think that wage growth has been a primary driver of America’s rapid inflation, Jerome H. Powell, the Fed chair, said on Wednesday.

Fresh data out on Friday showed that average hourly earnings climbed 4.7 percent over the past year. That is far faster than the 3 percent pace that prevailed before the pandemic, and is so quick that it could make it difficult for inflation to fully fade. Plus, policymakers remain anxious that today’s pressures could yet turn into a spiral in which wages and prices chase each other higher….

https://fred.stlouisfed.org/graph/?g=IBTh

January 4, 2020

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change)

https://fred.stlouisfed.org/graph/?g=Qe7j

January 4, 2020

Real Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=EvBg

January 4, 2018

Average Hourly Earnings of All Employees in Manufacturing, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=KH4x

January 4, 2018

Real Average Hourly Earnings of All Employees in Manufacturing, 2017-2022

(Indexed to 2017)

Funny, Marketwatch’s headline says the job gain is still too strong for the Fed, while NPR says the slowing in job growth reported for October is what the Fed is aiming at. No good reporting the news. Gotta do the “we know stuff” thing.

Did Marketwatch hire Princeton Steve or what?

BOTH 5-star comments, I LOVE YOU TWO GUYS

Zero Substance, 100% “content” more useless “content” more paying village idiots/functionally illiterate.

Did you invest money into Trump’s idea of taking Truth Social public? If so, Trump has managed to steal your investment:

https://tyt.com/stories/7015be31e708f973a/4c45850e7c43937a8

In a call with investors, Patrick Orlando, the chairman and CEO of the struggling shell company announced that DWAC was going to reconvene on Nov. 22. It was an ominous sign that Digital World had failed to receive authorization from 65% of shareholders to continue the company’s existence, despite months of trying. Under the terms of DWAC’s incorporation, the company was supposed to merge with a private firm within one year’s time or dissolve and reimburse its investors at a rate of about $10 per share.

Liquidation appears more likely to be DWAC’s fate as Trump himself appears increasingly uninterested in the company (or its stockholders) as it has struggled to defend itself from a criminal investigation that executives engaged in prohibited insider trading and a separate inquiry from the Securities and Exchange Commission about allegations of illegal contact between DWAC officers and the leadership of Trump Media and Technology Group (TMTG).

The disgraced ex-president hasn’t said a word to his supporters to encourage those who own the stock to prolong DWAC’s existence. New documents released by William Wilkerson, a former TMTG executive, indicate that Trump has been exploring merging with other right-wing technology companies instead, including Rumble, a video hosting platform which recently completed a merger similar to the one that DWAC and TMTG have been attempting. Another potential target listed was Parler, another Twitter clone which the antisemitic rapper formerly known as Kanye West has talked publicly about purchasing in order to build more safe spaces for far-right discourse.

As DWAC has struggled to avoid dissolution, Orlando has tried in vain to enlist Trump to help. Should the company end up liquidating, it will mean massive losses for many of Trump’s most ardent supporters who purchased the stock at prices in excess of $90 per share.

https://www.msn.com/en-us/video/news/anderson-cooper-rips-kari-lake-for-joking-about-pelosi-attack-%E2%80%98when-did-we-become-like-this%E2%80%99/vi-AA13G4ij?t=13&category=foryou

Kari Lake makes a tasteless joke about the attack on Paul Pelosi and then tries to blame it on CNN’s creative editing. Kari Lake is a liar.

“Complexity deserves clarity”, no matter what WSJ says, I have the copyright on that phrase.