A long running debate between reader JohnH and just about anybody else on this website involves UK 2015 (1) inflation, and (2) real wages, with JohnH quoting from various documents. I thought it useful to GET THE DATA MYSELF to resolve the question. Below are three graphs, of consumer price level, year-on-year inflation, and the CPI deflated wage.

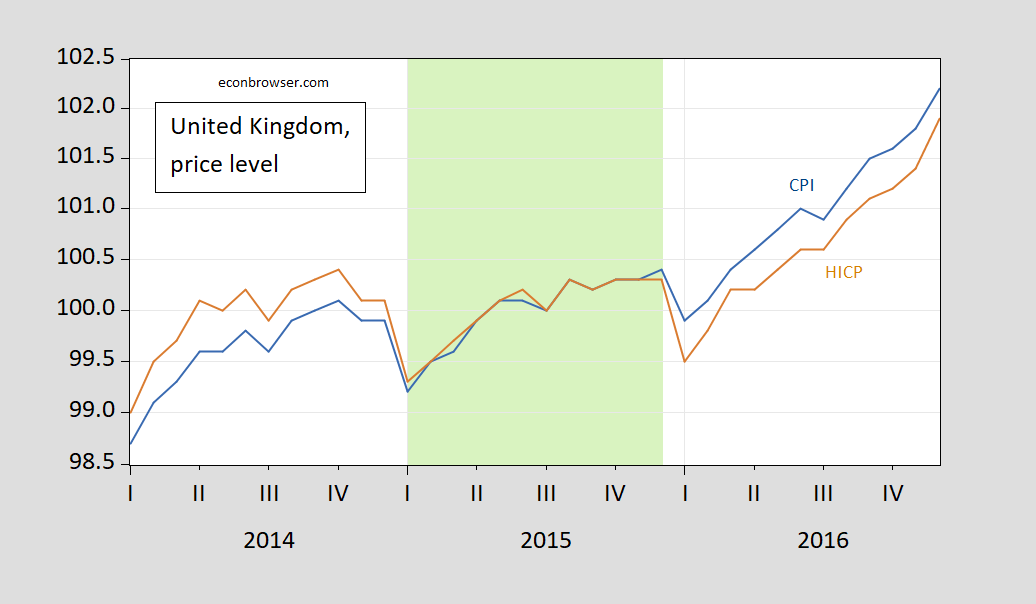

Figure 1: UK CPI (blue), HICP (tan), on log scale. Source: ONS, MEI, Eurostat via FRED. Light green shading denotes 2015M01-2015M12.

Both CPI and HICP are higher in 2015M12 than in 2014M12. One can see this same information conveyed in a different from by looking at the year-on-year values of inflation for 2015M12.

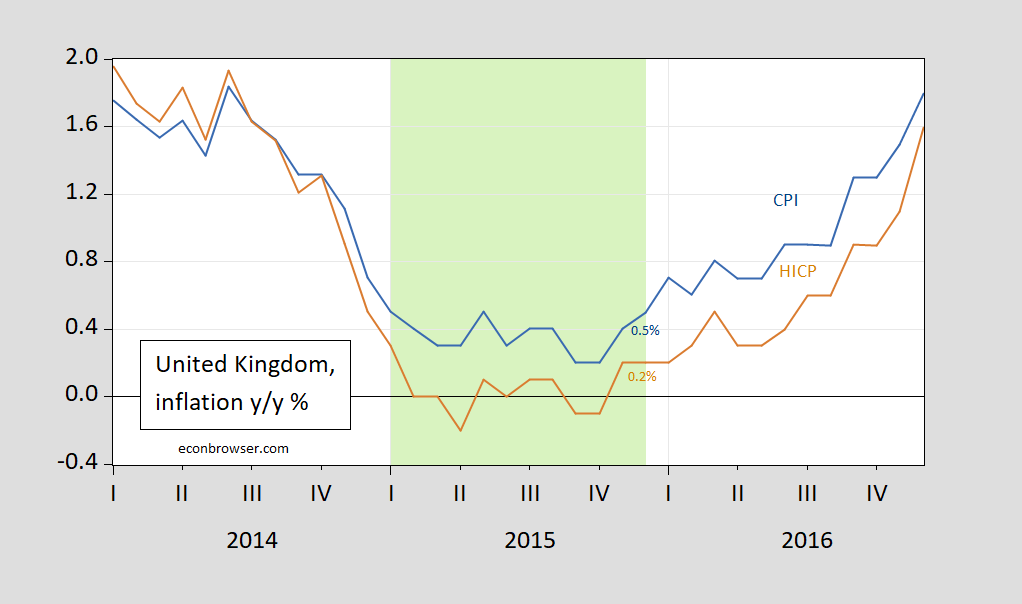

Figure 2: Year-on-year UK CPI inflation (blue), HICP inflation (tan). Source: ONS, MEI, Eurostat via FRED. Light green shading denotes 2015M01-2015M12.

Year-on-year inflation in 2015 was 0.5% (using the CPI), and 0.2% (using the HICP).

So, y/y inflation was not zero or negative in 2015, although individual months might have recorded a m/m negative reading.

What about real wages? I take the OECD’s measure of average hourly earnings in the private sector (2015=100), and

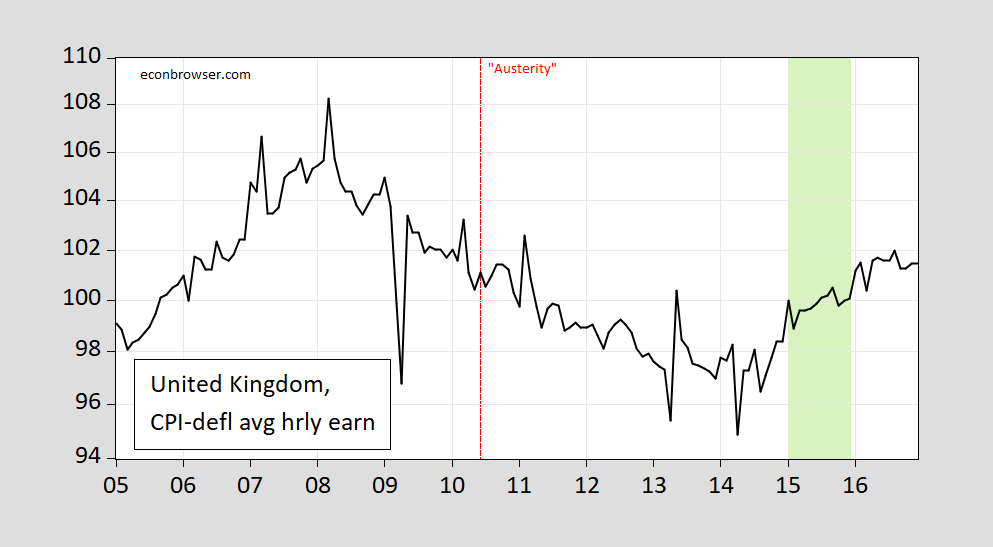

Figure 3: UK Average hourly earnings in private sector (2015=100) deflated by CPI, on log scale. Source: MEI via FRED, OECD, and author’s calculations. Light green shading denotes 2015M01-2015M12.

Average real wages rose over 2015, from 98.4 in 2014M12 to 100.1 in 2015M12, or 1.6% in log terms.

I might venture to guess that real wages rose because the output gap nearly halved going from 2014 to 2015 (according to latest IMF WEO estimates). Note that inflation was much higher in 2016 (1.8% CPI y/y), and yet real wages rose 1.3%.

While real wages did rise in 2015, ignoring the longer span of data can mean that one can take the increase out of context. Here is the real wage over a period encompassing the beginning of Cameron’s austerity measures.

Figure 4: UK Average hourly earnings in private sector (2015=100) deflated by CPI, on log scale. Source: MEI via FRED, OECD, and author’s calculations. Light green shading denotes 2015M01-2015M12. Red dashed line at June 2010 (Osborne budget speech).

By the end of 2015, real wages were down 1% relative to the announcement of specific austerity measures in June 2010,

Bottom line: Instead of endlessly quoting numbers (for e.g., year through September), look at the darned numbers themselves. You can find almost anything you need in one of the sources listed in this blogpost, “Data Source Compendium [Updated]”.

Also, for median wages, earnings, etc., that JohnH could not find before, see this post.

Addendum, 6:34PM Pacific:

Interesting that the UK’s own Office of National Statistics is not listed among the reliable statistical sources. Where do these other sources get their data from, if not ONS? (I relied on ONS data for the most part.)

Yet I have remarked in the past on discrepancies between FRED data on the UK and the UK’s own ONS. Perhaps it’s exchange rate related?

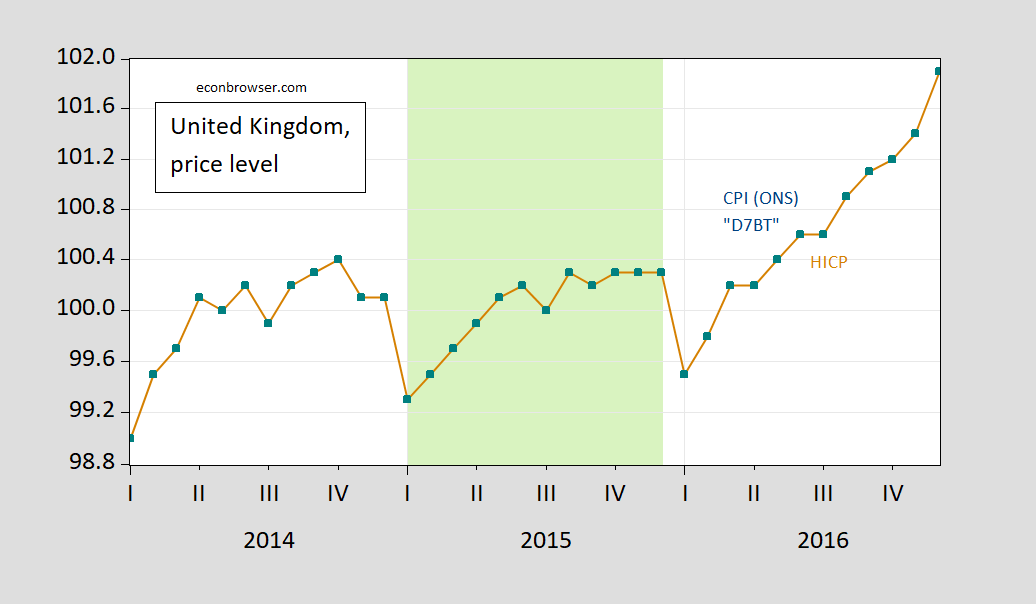

But in the legend to Figures 1 and 2, ONS is explicitly cited. But I have retrieved the ONS series from https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/consumerpriceindices

and used series D7TB in the spreadsheet, described as: “CPI INDEX 00: ALL ITEMS 2015=100”. I plot this series compared to the series listed as HICP in Figure 1. This procedure yields the following figure.

Figure 5: UK CPI all items from ONS (teal squares), HICP (tan), on log scale. Source: ONS, Eurostat via FRED. Light green shading denotes 2015M01-2015M12.

Even the not particularly astute reader will be able to tell these are exactly the same series…

“While real wages did rise in 2015, ignoring the longer span of data can mean that one can take the increase out of context. Here is the real wage over a period encompassing the beginning of Cameron’s austerity measures.”

Oh come on – now that JohnH and CoRev have moved the goal posts to the 30 yard line – we are not allowed to move them back. Seriously I have been making this point starting 10 years ago on EconomistView. But yea – JohnH wants to have an endless debate to support his total misrepresentation of what happened under Cameron.

Now if one wants to take the time – Simon Wren Lewis covered this period very ably. But could we get Johnny boy to ever read what he said?

“Note that inflation was much higher in 2016 (1.8% CPI y/y), and yet real wages rose 1.3%.”

Good point. Of course – that might be accused of moving the goal posts as well.

End and Endless Debate?

Or should that be End an Endless Debate?

pgl: Oops. Fixed now.

Uh oh, Menzie, there you go again making a regular commenter here look bad. Another regular commenter, who will remain unnamed because if he is named flies off the handle accusing other of being obsessed with him, may show up to complain yet again about this. How dare you!!!!!!! 🙂

Something tells me that even Econned is not going to defend the bizarro claim that Cameron’s fiscal austerity increased UK real wages.

Interesting that the UK’s own Office of National Statistics is not listed among the reliable statistical sources. Where do these other sources get their data from, if not ONS? (I relied on ONS data for the most part.)

Yet I have remarked in the past on discrepancies between FRED data on the UK and the UK’s own ONS. Perhaps it’s exchange rate related?

The host “might venture to guess that real wages rose because…” Isn’t the issue more important more than just a guess? In light of Smith’s statement that rising real wages in the absence of inflation runs contrary to “economists’s intuition,” shouldn’t specific instances of contrary outcomes be worth examining?

Others may disagree with me, but IMO, any time you can get real wages to rise, it’s is a good thing. And if you can do it with no inflation, even better !

Accepting and actually trying to understand what happened in the UK in 2015 and other instances Smith cites might be instructive to future public policy initiatives and, as Smith points out, to the Fed’s whole approach to setting interest rates.

“Where do these other sources get their data from, if not ONS?”

Source: ONS, via FRED, OECD, and author’s calculations.

Sheesh….

“Perhaps it’s exchange rate related?”

No.

‘”The host “might venture to guess that real wages rose because…” Isn’t the issue more important more than just a guess?’

Shoddy rhetorical gamesmanship. You’re worthless.

“You’re worthless.” That is an overestimate of JohnH’s “contributions”. Like someone from Ukraine might say Putin is worthless but in reality Putin is destroying Ukraine. And we all know how Jonny boy destroyed Mark Thoma’s blog with this garbage – and he is doing his best to do the same here.

“Interesting that the UK’s own Office of National Statistics is not listed among the reliable statistical sources.”

This is your reply – questioning Dr. Chinn on data courses. I check the ONS sources in my many corrections to your past spinning and Dr. Chinn’s presentation is consistent with their data too.

Macroduck has asked you this simple question many times – what’s your point? Oh yea – you get NOTHING right as Macroduck has often noted. NOTHING at all.

Yet I have remarked in the past on discrepancies between FRED data on the UK and the UK’s own ONS. Perhaps it’s exchange rate related?

Really? FRED notes that when it cites UK data it is in pounds not dollars. And FRED is careful to note its sources. But you never learned to read this well documented FRED data.

BTW troll – everyone here thinks higher real wages are a good thing. Our complaint with your spin is that you advocated Cameron’s fiscal austerity which lowered real wages.

Johnny boy – for your own mom’s sake – could you stop writing such incredibly embarrassing stupidity?

JohnH: HICP is identical to ONS series “CPI INDEX 00: ALL ITEMS 2015=100”, “D7BT” at spreadsheet found at:

https://www.ons.gov.uk/economy/inflationandpriceindices/datasets/consumerpriceindices

see the addendum to the post for a graphical verification.

“Get the data myself”?!?!?!?!?!?! This person is obviously a heretic to the discipline of Mosesnomix. Sick, really sick. Every adherent to Mosesnomix knows you endlessly harangue your favorite blog host to crunch the numbers for you.

All non-rubes and adherents to Mosesnomix can send your CC# to my cloud email based out of Nigeria. Remember kids, Mike Lindell and Joel Osteen will show us the light.

“I might venture to guess that real wages rose because the output gap nearly halved going from 2014 to 2015 (according to latest IMF WEO estimates). Note that inflation was much higher in 2016 (1.8% CPI y/y), and yet real wages rose 1.3%.”

This is an important point which I’m sure Simon Wren Lewis noted back in the day and I hope I made over at EV as well. Cameron’s fiscal austerity was a lot like Volcker’s crush inflation now stunt in 1982. Create a massive and perhaps prolonged output gap (Krugman’s PLOG) and once inflation finally has declined at enormous costs including declining real wages, reverse course and close the output gap. JohnH’s dishonest praise of Cameron is a lot like that slimeball 1984 Morning in America commercial where the new spin is that the rising output and the partial restoration of real wages is credited to the austerity simply because we had one good year. Of course as we all know inflation started going back up during Reagan’s 2nd term and of course in the UK in 2016.

This is fairly standard macroeconomics but of course JohnH like Cameron and Reagan has to pretend that the world does not follow the standard economic model. So they misrepresent the long-run picture with little snapshots that are designed to mislead.

Record high covid cases In China:

https://www.scmp.com/news/china/politics/article/3200527/coronavirus-china-critical-moment-beijing-cases-record-high

Related/UNrelated?? No idea, still a little data point here on China’s “RRR” being lowered.

https://www.reuters.com/markets/asia/china-will-use-timely-rrr-cuts-keep-liquidity-ample-state-media-cites-cabinet-2022-11-23/

Record high covid cases In China:

https://www.scmp.com/news/china/politics/article/3200527/coronavirus-china-critical-moment-beijing-cases-record-high

Yet I have remarked in the past on discrepancies between FRED data on the UK and the UK’s own ONS. Perhaps it’s exchange rate related?

Really? FRED notes that when it cites UK data it is in pounds not dollars. And FRED is careful to note its sources. But you never learned to read this well documented FRED data.

BTW troll – everyone here thinks higher real wages are a good thing. Our complaint with your spin is that you advocated Cameron’s fiscal austerity which lowered real wages.

Johnny boy – for your own mom’s sake – could you stop writing such incredibly embarrassing stupidity?

Our host:

‘Figure 1: UK CPI (blue), HICP (tan), on log scale. Source: ONS, Eurostat via FRED. Light green shading denotes 2015M01-2015M12.’

‘Interesting that the UK’s own Office of National Statistics is not listed among the reliable statistical sources.’ – JohnH

Our host lists the Office of National Statistics as his source but our Village Moron claims he did not.

Johnny boy never learned to READ.

Speaking of statistical discrepancies, Figure 2 (above) never shows the UK CPI dropping to zero in 2015. [Source: ONS, Eurostat via FRED.]

UK ONS data (Figure 1) shows CPI inflation varying between -0.1% to +0.1% from February 2015 – November 2015.

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/october2022

I prefer to go as close to the source as possible.

Noah Smith: “But the larger question here is: Why?? Why does inflation make wages go down? In fact, this is a major macroeconomic mystery…

This seems like an important topic for macroeconomists to research. If upward real wage rigidity exists, it changes how we should think about inflation. It would mean that inflation consistently takes income away from workers and hands it to capital owners. In addition to being unfair and reducing social welfare and making most people really mad, that will also tend to hurt economic efficiency (because it distorts the relative prices of the factors of production). So if I were a macroeconomist, this would be a topic I’d look into….

the Fed has to decide what to do about the current inflation — whether to keep raising rates, or to back off for fear of a recession. If inflation consistently reduces real wages, that biases things toward the “keep hiking rates” side of the debate. It means that a short spell of higher unemployment that brings inflation back to low levels might be the best way to raise real wages in the medium term.

That’s very contrary to typical economic intuition — usually, we think that unemployment lowers wages because it decreases labor demand. But in a world where high labor demand coexists with falling real wages, we need to start to ask ourselves whether the standard intuition is just wrong.”

https://noahpinion.substack.com/p/why-arent-wages-rising-in-a-tight

Ignoring and dismissing examples like what happened in the UK in 2015 is a convenient way of sidestepping the whole issue.

“If upward real wage rigidity exists, it changes how we should think about inflation. It would mean that inflation consistently takes income away from workers and hands it to capital owners.”

No, that’s not right. If “upward real wage rigidity” leaves labor’s share unchanged, then inflation doesn’t necessarily give income to capital owners. Setting aside the fact that we don’t have a precise definition for “upward real wage rigidity”, constant shares in an inflationary environment doesn’t take from poor Peter to pay rich Paul. If, by “rigid” you mean fixed or declining real wages, and “land” doesn’t soak up the difference, then there’d be a gain for capital. Inflation is irrelevant to that outcome, by the way.

“If inflation consistently reduces real wages, that biases things toward the “keep hiking rates” side of the debate. It means that a short spell of higher unemployment that brings inflation back to low levels might be the best way to raise real wages in the medium term.”

That has been the Fed’s story since the adoption of the dual mandate. The problem is, the persistent shift to a higher share for capital, lower for labor occurred under LOW inflation. That makes any argument that inflation is generally bad for labor relative to capital pretty shady. It is not a “stylized fact” or a “data regularity” that workers do better under low inflation. This is one of the clearest lessons from the period of low inflation. If workers lose under low inflation and u pnder high inflation, how is inflation the root cause?

It very likely is a fact that ending accelerating inflation is more costly in terms of labor income the longer you wait. It’s not clear we face accelerating inflation. It’s not clear the Fed waited so long that inflation has become imbedded.

Rising unemployment lowers nominal wages. In order for rising unemployment to increase real wages, prices have to fall more than nominal wages. Find that in the data over in any mild recession. Go on, find it. You think you have something to say? Prove it.

What we have here is a question of NAIRU, r* and the interaction between them over the medium and long term. Both NAIRU and r* are wibbly-wobbly when it comes to measuring them, but these are the underlying issues. Tell me how you think that interaction is working and how it will work over the medium and longer term.

Claiming that something is “the standard” or “typical intuition” and being met with “that’s not how I/the Fed/the articles I read view it” means that’s not THE standard intuition. It’s one intuition. And if it’s not THE standard intuition, then we don’t need to ask if the standard intuition is wrong. Only that particular intuition.

And you pretending that people who actually know something about economics are sidestepping some brilliant insight of yours, that you’ve borrowed from somebody else (Noah Smith on a bad day) is egotistical nonsense. People smarter than you correct you because you’re wrong – and you’re wong nearly all the time. Letting your nonsense go uncorrected is a disservice to anyone who comes here to learn. Keep getting economics wrong and people will keep correcting you. It’s a civic duty.

By the way, a judge just told the largest private U.S employer to stop retaliating against union organizers:

https://www.marketwatch.com/story/judge-orders-amazon-to-stop-retaliating-against-union-organizers-01669086285

That’s aoost step toward boosting wages, nominal and real.

Oh, and Johnny, any attempt you make to declare that Smith’s “typical intuition” is so by golly THE typical intuition should probably involve at least a passing mention of the Lucas critique. Waiting to hear it.

“If upward real wage rigidity exists, it changes how we should think about inflation. It would mean that inflation consistently takes income away from workers and hands it to capital owners.”

I just back and re-read Noah’s blog post and he never mentioned this stupid made up JohnH BS line about “upward real wage rigidity”. No he suggested some strange idea about upward NOMINAL wage rigidity as he lightly dismissed all the usual stories. You had this correct back under that other thread with your graph that showed nominal wages were rising – just not as fast as actual inflation (which exceeds anticipated inflation).

So JohnH just out right LIED about what Noah was trying to say. I guess saying this LIAR lied once again might be harsh as it is apparent that Jonny boy has no effing clue what any of this discussion even means.

But after literally thousands of his stupid comments lying about data he does not understand – what does this troll do? Misrepresents what his own guru said.

Get used to it. JohnH has been pulling this intellectual garbage for over a decade.

“I prefer to go as close to the source as possible.”

Questioning whether our host presented the data properly again? Dude – he did use ONS data. But hey – keep embarrassing yourself.

“This seems like an important topic for macroeconomists to research.”

They have – extensively. Just because you are too lazy to read any of this research does not give you the right to criticize those who have. And yes – it is well known that a sustained deep recession like the one Cameron gave us will allow an economy room for a short-lived growth spurt. Which of course allows right wing trolls like you to claim right wing policies help workers even though they do not.

“I prefer to go as close to the source as possible.”

THIS from the fool who reads a poorly written headline from some dope at CNBC and frets that the FED has dumped all of its Mortgage Back Securities even though a quick FRED check shows they still hold over $3.38 trillion of them.

https://fred.stlouisfed.org/series/QBPBSTASSCMRTSEC

Jonny boy – everyone here gets what a sloppy two faced troll you really are so stop pretending.

“If upward real wage rigidity exists, it changes how we should think about inflation.”

No one ever used this incredibly stupid term. I just re-read that Noah Smith piece and he was suggesting in his own weird way that we might have upward nominal wage rigidity (which sort of contradicts research data but never mind that). WHY DID YOU LIE about what he was writing? Oh wait you lie about everything else – so hey!

Look dude – you have no clue about modern labor economics, modern macroeconomics, basic data reporting, or anything else.

But you are the superstar at blatant misrepresentation. Troll on!

My view on crypto is that was something not needed and a potential source for all sorts of bad things, which is why I never commented on this weird market. Yea the FTX mess is awful and it seems some in Congress decided that this market should not even have SEC scrutiny:

https://prospect.org/power/congressmembers-tried-to-stop-secs-inquiry-into-ftx/

Congressmembers Tried to Stop the SEC’s Inquiry Into FTX

The ‘Blockchain Eight’ wrote a bipartisan letter in March attempting to chill the SEC’s information requests to crypto firms. FTX was one of those firms.

These 8 Congressmen are either financial morons or corrupt participants. Yea I have always advocated SEC scrunity of publicly traded assets especially this mess.

The CFTC, not the SEC, should regulate these commodities and the trading in them. Cryptocurrency is not an investment security as defined by Congress. A security is a vehicle which derives its value from management’s efforts in operating the project, firm, etc. A commodity is a thing and or contracts deriving value from the thing. The laws and rules regulating commodities (and commodity exchanges) differ dramatically from those which regulate securities and their exchanges. (i.e. The regulatory scheme differs between trading Chevron stock and oil for future delivery). The CFTC possesses draconian powers. The SEC is wimpy. Part of the regulatory problem in crypto is a governmental turf war. The SEC wants and lobbies for the power. The SEC’s quest for power creates legal ambiguity, an authority vacuum, and loopholes. This is a legal issue–not an economic issue. The CFTC should regulate public trading in the crypto markets. If anyone is interested, I will be glad to provide citations to U.S. Codes, CFR regs, and analogous case law.

https://fred.stlouisfed.org/graph/?g=WKJy

January 30, 2018

Real Hourly Earnings in Manufacturing for United Kingdom, 2000-20122

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=WKJS

January 30, 2018

Real Hourly Earnings in Manufacturing for United Kingdom, 2007-2022

(Indexed to 2007)

[ As important as the response to policy of general UK earnings, the response of manufacturing earnings is important. An absence of growth in manufacturing productivity since 2007 and faltering manufacturing earnings reflecting an evident lack of Conservative government concern for British manufacturing workers, along with the limits of Brexit, should indeed be worrying. ]

https://fred.stlouisfed.org/graph/?g=ocYN

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for United States and United Kingdom, 2000-2022

(Indexed to 2000)

https://fred.stlouisfed.org/graph/?g=ocZ3

January 30, 2018

Real Effective Exchange Rates based on Manufacturing Consumer Price Indexes for United States and United Kingdom, 2007-2022

(Indexed to 2007)

https://www.imf.org/en/Publications/WEO/weo-database/2022/October/weo-report?c=112,&s=NGDP_RPCH,PPPGDP,NID_NGDP,NGSD_NGDP,PCPIPCH,GGXWDG_NGDP,BCA_NGDPD,&sy=2007&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2022

United Kingdom, 2007-2022

Real GDP, percent change

Inflation rate, percent change

Investment, percent of GDP

Savings, percent of GDP

General government gross debt, percent of GDP

Current account balance, percent of GDP

[ Investment in the United Kingdom has been markedly low. ]

Off topic, of course.

BUT

Palin is now an official loser. Again.

Murkowski also re-elected

Trump burned. AGAIN!

Refill glass and raise it to these two outstanding women!

Peltola I will raise a glass to on Monday after my beer run, NOT Murkowski.

https://projects.fivethirtyeight.com/congress-trump-score/lisa-murkowski/

Pay special attention to the “not voting” and “present” votes to see how cowardly and morally vacuous this woman is. She’s a walking piece of crap, the same as Collins in Maine. I could find about a million problems here on this 538 list if I wasn’t so lazy. “Yes” on nomination of William Barr. How F’ing stupid are you?? “Two” outstanding women?? OMG. One Sir, One F’ing outstanding woman. ONE

Alaska is a tough place to live. If you believe in fantasies, you may end up dead in alaska. Probably why they are not fooled by the maga hatters quite as easily. Cheers to the broads who thumbed their nose at magaland.

PGL raised an important matter about copper pricing and a premium price that is paid to Chile by China for copper imports. China is the largest producer and consumer of copper, also China imports copper. China has a copper futures market in Shanghai and does not use the London Metal Exchange for buying imports. Rather China pays a premium for copper directly to Chile rather than paying fees to London. China saves, Chile gains:

https://www.globaltimes.cn/content/1207271.shtml

November 18, 2020

International copper futures to start trading in China

Contract helps hedge risks, increase pricing power

By Ma Jingjing

https://www.globaltimes.cn/content/1207271.shtml

November 18, 2020

International copper futures to start trading in China

Contract helps hedge risks, increase pricing power

By Ma Jingjing

________________________________

China will expand the opening-up of its commodities markets by allowing overseas investors to trade copper futures on the Shanghai International Energy Exchange of the Shanghai Futures Exchange, starting from Thursday.

Analysts said the contracts will help enterprises manage risks and give the domestic copper industry more pricing power and competitiveness on the global market.

Unlike the existing copper futures contract on the Shanghai Futures Exchange, which is intended for use by domestic traders, the international copper futures will exclude tax and customs duty, and the metal will be delivered to bonded warehouses, according to the exchange.

Meanwhile, the product being traded is copper cathode – the same as the London Metal Exchange (LME) copper futures – helping it compete with the LME.

“The launch of the copper futures will give domestic mine owners and smelters a pricing advantage,” Jiang Haihui, a senior analyst at Shanghai-based SHZQ Futures, told the Global Times on Wednesday. Because of strong pricing power of copper overseas, large domestic users have had to go overseas to negotiate prices, he said.

Volatility in global commodity prices this year has pushed up enterprises’ demand for risk management and propelled trading volume in basic metal futures in Shanghai.

In the first three quarters, trading of existing copper futures soared 44.6 percent to reach 9.74 trillion yuan ($1.49 trillion), data from the exchange showed.

China is the world’s largest producer, consumer and importer of refined copper.

According to data from the China Nonferrous Metals Industry Association (Chinania) and Chinese customs, China’s output of refined copper stood at 9.78 million tons in 2019, representing 41.24 percent of the global total, while consumption stood at 12.08 million tons, accounting for 50.72 percent. Its net imports also led the world at 3.23 million tons….

https://www.reuters.com/markets/rates-bonds/fed-minutes-may-show-debate-over-risks-aggressive-rate-hikes-2022-11-23/

Will sanity prevail?? Can you reverse a lobotomy post-surgery?? Will they make a theater film version of Homeland starring Mandy Patinkin and Claire Danes?? Will Riddler steal my fig bars while I’m in the shower?? Tune in tomorrow for “Smiley Morning VHF” sponsored by U.S. Marines’ “Camp Lejeune, Oops We Did It Again”.

If you really got the data yourself, wouldn’t you have to do surveys, and deal first hand with refusals, missing data, margins of error, etc.?

We have had enough of the stupid comments from JohnH. Your comment was even dumber. But hey – being a jerk is your mission in life.

rsm,

That is what those government agencies do who gather the data we are all using. Best to let them do it.

Girlie man Tucker Carlson goes after Pete Buttigieg:

https://news.yahoo.com/tucker-carlson-says-pete-buttigieg-060057735.html?ref=upstract.com

Fox News’ Tucker Carlson on Wednesday went after Pete Buttgieg yet again, claiming the transportation secretary “wouldn’t even admit that he was gay” until several years ago and “lied about it for reasons he has never been asked to explain.” Buttigieg, the former mayor of South Bend, Indiana, and a 2020 Democratic candidate for president, has explained. He explained in the 2015 article he wrote in the South Bend Tribune when he came out to the public. And he explained again on multiple other occasions, revealing, among other reasons, his fear that acknowledging who he was “was going to be the ultimate, career-ending professional setback.” Buttigieg joined the military in 2009, when the discriminatory “Don’t ask, don’t tell” policy ban on openly gay and lesbian service members was still in effect.

Of course girlie man would not know what is like to serve one’s nation in the military. But WTF has gotten into little Tucker? Is he afraid that someone is going to out him?

“Even the not particularly astute reader will be able to tell these are exactly the same series”

No one has ever accused JohnH of being an astute reader.

“I might venture to guess that real wages rose because the output gap nearly halved going from 2014 to 2015 (according to latest IMF WEO estimates).”

IMF WEO is very useful and rather easy to navigate. I was able to quickly pull the output gaps for the G7 for the period from 2010 to 2017.

It turns out that this gap was 3.3% when Cameron took office in 2010. It was still 2.9% 3 years later. By 2014, it still was 1.8% and fell to 1% by 2015 and to 0.5% by 2016. In other words, a slow recovery from the Great Recession. Fiscal austerity would do this when interest rates remain near zero.

Of course the US had a deeper recession and also a painfully slow recovery, which most people would attribute to the Tea Party Republicans handicapping Federal fiscal stimulus while imposing some rather drastic state fiscal restraint. But shhh – don’t tell this to fiscal austerity hawks like the friends of David Cameron and Paul Ryan.

https://news.cgtn.com/news/2022-11-23/The-false-promise-of-America-s-CHIPS-Act-1faM7sTpebS/index.html

November 23, 2022

The false promise of America’s CHIPS Act

By Anne O. Krueger

The U.S. Congress recently approved the CHIPS and Science Act, which allocates over $50 billion to strengthen the semiconductor industry in the hope of making the United States self-sufficient. And U.S. Trade Representative Katherine Tai said that President Joe Biden’s administration should be “replicating” the CHIPS Act for other industries “as the key to American competitiveness.”

Semiconductors are essential to a modern economy, and it makes sense to diversify sources. But it’s doubtful the CHIPS Act can achieve its stated goals, much less that it should be used as a model for similar support to other industries.

The law is flawed in many ways. Subsidies to support research and development account for only 21 percent of the planned expenditures, with the rest going to support physical plant construction. Yet the U.S. comparative advantage internationally is unquestionably in R&D. Building manufacturing facilities will not accelerate chip development.

“Moore’s Law” still holds: the number of transistors on an integrated circuit doubles every two years. 5G chips are now in production at advanced semiconductor fabrication plants (“fabs”), and research is well under way to develop the next generation. Each new generation of chip needs new fabs in which to produce them.

Fabs are mind-bogglingly complex, hugely expensive, and require many machines, which foreign companies often are best positioned to provide. In his book Chip War, Chris Miller of Tufts University points out that the Dutch company ASML, for example, has the technology and organization to produce extreme ultraviolet lithography machines, which are necessary to churn out the most advanced chips. One such machine requires 457,329 parts, which themselves are produced by companies in different countries.

Policymakers have termed the sorts of measures supported by the CHIPS Act “industrial policy.” But the term encompasses all sorts of policies and programs adopted to support economic, and especially industrial, activity. In the U.S., industrial policy has primarily consisted of measures that support private-sector economic activity, such as investment in R&D and transportation infrastructure. According to one recent assessment, while policymakers have been successful in supporting basic research and activities that enable more productivity across the private sector, they have done poorly in identifying and favoring individual firms and industries.

Reliance on the private sector underpins the U.S. economy’s historically high rates of innovation and productivity growth – a model that was very successful in developing the semiconductor industry. And successful efforts in other countries to catch up with the U.S. industry have entailed integrating into it, rather than replicating it. The costs of replication are too high. “A facility to fabricate the most advanced logic chips costs twice as much as an aircraft carrier,” Miller notes, “but will only be cutting-edge for a couple of years.”

Meanwhile, Miller notes, there are questions about whether the industry’s future lies in further Moore’s Law advances or in developing more specialized chips, as Intel and Google are doing.

There are other major concerns. It is estimated that establishing the plants needed to produce chips used in 2019 would require $1.2 trillion in upfront costs, then another $125 billion annually – and that of course does not include costs of R&D, innovation, and establishment of fabs for new state-of-the art-chips. There is no way that the U.S. can achieve self-sufficiency in production of chips now on the market, much less master the technological frontier by itself….

Anne O. Krueger is senior research professor of international economics at the Johns Hopkins University School of Advanced International Studies and senior fellow at the Center for International Development at Stanford University.

An interesting essay in light of the fact that this thread is noting the continuing utter confusion from JohnH. I have been trying to tell this confused little boy that companies like TSMC are contract manufacturers (fab) who do not conduct cutting edge design R&D. Good to see Krueger lending her expertise to an important debate which JohnH has never understood.

I have stayed out of the old debate about the effect of the Cameron policies, although generally found myself agreeing with Simon Wren-Lewis when I saw his comments on it. Offhand why it seems tt has reappeared as an issue now is obviously because of what has been going on more recently in many nations, including the US, where indeed we saw real wages decline as inflation accelereated, even as this decline looks to have probably ended.

Anyway, I do not know if this played much of a role during the Cameron period, but it has been noted by many, including me here, that one element in “upward sluggishness” (not “rigidity”) of nominal wages when inflation is accelerating has to do with a labor composition effect, which has its opposite number of real wages rising during a deflationary downturn, with this apparently happening over the last few years. It is the problem of those getting laid off during the downturn being predominantly low wage workers, with then them constituting a large portion of the rehiring during the inflationay upswing.

Thus a portion of the decline in real wages as inflation rose was due to the hired labor force becoming composed of more low wage workers.. Panel data would presumably correct for this effect, but the data sources being argued over here do not make such a correction.

Simon Wren-Lewis had a lot of sharp but well placed criticisms of Cameron’s policies. Of course Simon Wren-Lewis is one of the UK’s best macroeconomists. We tried back in the day to get JohnH to read what Simon Wren-Lewis was writing but it seems he choose not to.

https://english.news.cn/20221124/8e432c671b9342eaa0b2d3a2c3b97b3a/c.html

November 24, 2022

China’s high-tech hub Shenzhen holds investment promotion conference in Ireland

DUBLIN — An investment promotion conference was held here on Wednesday with an aim to enhance economic cooperation and bilateral investment between Ireland and Shenzhen, a southern Chinese coastal city and a high-tech hub.

China-Ireland economic and trade relationship has been growing steadily and two-way investment has maintained a good momentum, said Wang Jiabao, commercial counsellor of the Chinese Embassy in Ireland, who expected the 2022 Shenzhen Global Investment Promotion Conference Ireland session to inject new impetus into bilateral economic ties.

Noting that there were nearly 30 Irish companies in Shenzhen by the end of last year, Chinese representatives of the Shenzhen delegation said that Ireland’s advantages in bio-pharmacy, financial services and science and technology are highly compatible with Shenzhen’s industrial development strategy of vigorously developing advanced manufacturing and promoting the integration of advanced manufacturing and modern service industries.

Currently, there are more than 40 Chinese companies in Ireland with over 3,000 employees, and they have contributed to Ireland’s economic and social development, Paraic Hayes, director of Asia Pacific at IDA Ireland, a government agency responsible for attracting foreign direct investment into the country, told Xinhua.

Ireland looks forward to more investment from China, especially from Shenzhen, he said….

[ Importantly, while manufacturing in the United Kingdom has been faltering, manufacturing in Ireland has been strengthening. The UK is severely limiting Chinese investment, while Ireland is welcoming investment from China. ]

The decline in housing starts is as rapid now as in the housing crash, though so far not ad deep:

https://fred.stlouisfed.org/graph/?g=WN7H

The current decline started from a lower level and follows on the Covid crash, which leaves us short of new supply (setting aside the u finished overhang). Indicators of buyer interest, however, are as weak as in the 2008 period and weakened much faster:

https://en.macromicro.me/charts/1858/us-nahb-hmi-plot

No sense looking when you can’t afford to buy. There is also talk of buyers pulling oot of the market in anticipation of price and mortgage rate declines:

https://www.businessinsider.com/60000-home-purchase-contracts-were-canceled-in-october-2022-11

Cancellations are very high, despite the loss of deposits.

News of FOMC debate over the pace of rate hike is good news on this front. (Thanks, Moses.)

Pretty good article out of WSJ, discussing how “investors” in home purchases, i.e. even those with deep pockets, are sitting on the sidelines and waiting for rates to lower again. and banks such as JP Morgan are building up funds to be “ready to pounce” when the rate lowers and scoop homes up at a pretty quick rate:

https://www.wsj.com/articles/investor-home-purchases-drop-30-as-rising-rates-high-prices-cool-housing-market-11669067972

What scares me is how much banks are purchasing residential houses now. I don’t know the percentage but my guess is it is getting larger very quickly. That means single family homes owned by the same families who live in them are going to become less and less, and either banks will collude to raise housing prices or they will be turned into rental properties, or both. I see a future where it is harder and harder and harder for people to get equity in their own homes and they are, in essence forced to rent. I think large banks are thinking “Why sell them the homes/houses??~~when we can turn them into rental properties and cash flow/revenues into perpetuity”. Home ownership is going to be lost in America due to large bank “rent-seeking” Sucking up working class people’s income/productivity, with non-productive paper-shuffling and over-financialization of the American economy~~with Republicans’ full-throated endorsement.

It’s coming people, get ready.

Endless debates are usually characterized by one or more participants who have a preset narrative, that is not based on data. That person will only accept data that can be interpreted as supportive of their narrative and find excuses to reject any and all data that is not. So there is no data in the world that could change that persons opinion and debate based on facts becomes futile.

So how do you end an endless debate. You walk away and stop wasting time on it. Sure you will leave that person with a false impression – but that will be the end result anyway. You can drag a horse to the water of knowledge, but you cannot prevent it from sticking its hoofs in the ear and yelling LA-LA-LA-LA-LA.

Spend your time on productive debates.

I refer you to what mark twain said about arguing with some people