GDP is only one measure of income. Following up on Jim’s post on GDP (and housing), here are others.

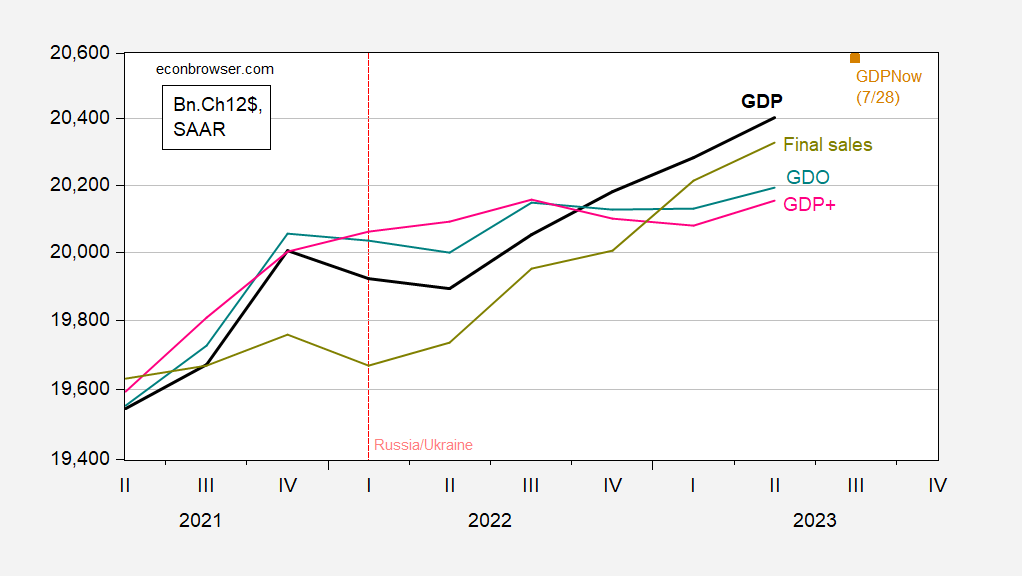

Fiugre 1: GDP (bold black), GDPNow as of 7/28 (tan square), GDO (teal), GDP+ (red), final sales (chartreuse), all in bn.Ch.2012$ SAAR. GDO assumes net operating surplus drops $100 bn SAAR in Q2. GDP+ level GDP+ growth rates iterated on 2019Q4 GDP. Source: BEA 2023Q2 advance, Atlanta Fed, Philadelphia Fed (7/28), and author’s calculations.

GDI is not available for 2023Q2, but all but one major component of GDI (net profit) is reported. Assuming net profit falls by $100 billion (SAAR) in Q2, I estimate Q2 GDO in Figure 1.

While 2022Q4-23Q1 saw GDO and GDP+ decline, both have increased in Q2, as have final sales.

Paging “New Deal Democrat”. Paging “New Deal Democrat”. Some of your medical colleagues say your diagnosis of “blood in the patient’s stool” is incorrect, and that it is only some cranberries. Please update.

“GDI is not available for 2023Q2, but all but one major component of GDI (net profit) is reported. Assuming net profit falls by $100 billion (SAAR) in Q2”

Not sure why one would assume profits by this amount but maybe you were trying to get JohnH all emotional again. After all he wants us to simultaneously believe GDI is falling my more than you suggest while profits are soaring. Yea – there is an inherent contradiction in the babble JohnH spews but what’s new?

If profits fall by $100 billion, they would still record the fifth highest margin ever, well above the 11% margins that were common only five years ago…all of which supports my observations about the persistence of obscene profitability.

However, there are indications that corporate profiteering has shifted from raising prices in excess of cost increases to just maintaining prices while input costs decrease. As a result, the hit on profitability may not be that much.

“Companies Aren’t Eager to Cut Their Prices as Costs Fall…’Rockets and feathers’ is economists’ name for how prices change in some less-than-competitive markets. When companies’ input costs go up for some reason, the prices they charge their customers go up like a rocket. When their input costs go back down, their prices fall, but ever so slowly, like a feather. The example most of us can relate to is the retail price of gasoline.” [It also happened with lumber prices two years ago.]

At least in the feather scenario, retail prices do go down. What’s worse for consumers is when companies simply don’t cut their prices in response to lower costs, and enjoy higher profit margins as a result. There are signs of that beginning to happen now in the U.S. market, at least in some segments.’

https://www.nytimes.com/2023/07/26/opinion/inflation-greedflation-prices-profits.html

Fat cats getter fatter…what could make pgl happier?

Your observations? Johnny, who cares?

And don’t you thing “observation” is a highfalutin word for the way you carry on? Hyperventilation seems more accurate.

Oh, and Johhny? Johnny, Menzie made a working assumption about Q2 profits. His working assumption is not evidence in favor if anything, certainly not of your hyperventilation. It is crazy dishonest to claim an assumption as evidence for your views. Facts are evidence. Assumptions are not.

The people at the NYTimes rely on for his little stories are not exactly being honest with him. That PepsiCo fiasco was bad enough but if Jonny boy thinks Sherwin-Williams has been great over the past one or so, maybe he should check out how its stock price fell off its 2021 perch:

https://finance.yahoo.com/quote/SHW

Let’s fact it – Jonny boy is incapable of the most basic research.

Ducky is sure intent on solidifying his bona fides with his Wall Street buddies by attacking anyone who thinks that dramatically increased profits margins are anything stupendous! 1%, rah, rah, rah!

This is all you got? Damn – you are pathetic even for a mentally retarded troll.

My stalker finally found something from the NYTimes that has decided not to go after PepsiCo. But it links to that stupid May 30 discussion where (as I have pointed out many times) that lied to little Jonny boy. And alas – little Jonny boy is so incompetent he can’t check Pepsico’s financials for himself.

Since Jonny boy keeps evading this, let me repeat my critique of how the NYTimes has misled little Jonny boy:

pgl

July 30, 2023 at 4:12 am

From Jonny boy’s favorite little article:

‘PepsiCo, which makes Gatorade sports drinks, Lay’s potato chips and Quaker Oats, reported this month that its second-quarter revenue grew 10 percent and its profit doubled, to $2.7 billion, compared with the same time last year.’

Maybe the moron who writes Jonny boy’s favorite fluff should let little Jonny boy know two key things: (1) he is referencing net income and not operating profits; and (2) 2022QII net income included a large deduction for the impairment of intangibles.

Yes Jonny boy is relying on a turkey who flunked basic accounting as little Jonny boy does not know how to read financial filings for himself.

BTW – this was only a single quarter. If one looks at the first 6 months of 2022, one would see its operating profits were $7.344 billion while operating profits for the first 6 months of 2023 were only $6.288 billion. Whoops! A little challenge for Jonny boy. Try to figure out how this could be. We’ll wait!

pgl gets so emotionally unhinged when someone provides reasons why profit margins might not take as much of a hit in 2Q23 as they did in the previous quarter!

Did he forget his meds this morning?

You are the one who gets all whiney when the facts undermine your incessant stupidity. I would ask you to learn how to do basic research but we all know you are too stooopid to do so.

Jonny boy’s latest relies on some vague reporting of the profit margin for Sherwin-Williams. Of course Jonny boy once again fails to do his own research but Macrotrends makes this so easy:

https://www.macrotrends.net/stocks/charts/SHW/sherwin-williams/profit-margins

Yep over the last couple of quarters, the profit margin increased from a profit margin that was well below its reporting for early 2021. So let me get this straight. When inflation was rising, the profit margin for Sherwin-Williams fell but now it is rising just as inflation is subsiding.

Come on Jonny boy – it might have helped if you checked the data. But you didn’t. And your latest example runs against your story.

BTW Peter Coy (NYTimes) used “income before income taxes” for Sherwin-Williams but used income after taxes for PepsiCo. Like I have said before Peter Coy’s accounting skills are pathetic.

He should be using operating profits which does not deduct interest expenses for this issue. Something called the Modigliani-Miller proposition. He should also take care to back out nonrecurring expenses such as goodwill impairment.

But it seems Peter Coy is a reporter who is not very good at basic accounting. And of course little Jonny boy has no clue what I just said as little Jonny boy is even more stupid and incapable of going to http://www.sec.gov to check the data for himself.

Peter Coy is a guy, who continually writes at a junior high essay level, but gets treated like he the second coming of Ted Sorensen or Clark Clifford, on the sole reason he makes Mike Bloomberg’s weenie tingle.

pgl: Profits have been declining by about $100bn per quarter (SAAR) last two quarters.

Thanks for the update. Of course this contradicts the silliness JohnH keeps peddling.

pgl is so unhinged. Apparently he totally missed Samuel Rines point: “Profit margins grew, as an article in The Times this year showed. Now, though, he said, they could grow even more. He’s coined another term: “price and margin.” Some key input costs have fallen, and customers aren’t agitating for lower prices because they’ve become inured to paying more. “The next year is going to be a completely different level. The interaction of price increases and input cost deflation is powerful,” he wrote in a follow-up email.

True, a business could try to grab market share by slashing prices, but few chief executives are willing to play that game. “Businesses will be much more resistant to lowering their prices based on two to three months of declining costs” because they think the decline might be temporary, Rines said. “They’re afraid they’re going to get whiplashed.” https://www.nytimes.com/2023/07/26/opinion/inflation-greedflation-prices-profits.html

If Rines is right then 2Q23 profit margins will remain near record levels and GDI might not continue to decline, perhaps even taking the economy out of limbo or, if you prefer, the box that Shrödinger’s cat is in.

Of course, if you want to look at it mechanically, with the performance of past quarters determining future ones, then GDI might continue to decline…leaving the economy in limbo.

You are still hyping an article written by Peter Coy after it has been made clear that Coy’s little examples (PepsiCo and Sherwin-Williams) are not what you think they are? Coy has lied to you about their accounting and Jonny boy is too stupid to check the financials for himself.

Yea – you are DUMB. Kind on reminding us how DUMB you are.

National income: Corporate profits before tax (without IVA and CCAdj)

https://fred.stlouisfed.org/series/A053RC1Q027SBEA

Is this your measure of profits? It is certainly more reliable than the fluff we keep seeing from JohnH.

Yes – profits did rise a lot from the pandemic to 2022Q2 but you are right, they have declined a bit since then.

pgl: Use line 9 of Table 1.10 of NIPA.

Table 1.10. Gross Domestic Income by Type of Income

As of 2022Q2, net profits had increased to $6,194.6 billion.

As of 2023Q1, net profits were $5,942.1 billion.

Not exactly what JohnH has been peddling. But wait for it – Jonny boy will accuse the Deep State of manipulating the numbers.

Sometimes I’m a little slow but FRED has this data:

https://fred.stlouisfed.org/series/GDINOS

Gross Domestic Income: Net Operating Surplus

This series peaked in 2022QII but has dropped considerably since.

“Not exactly what JohnH has been peddling.” For once pgl is right.

I was using referring to profits margins, not to aggregate profits…though I doubt pgl knows the difference.

JohnH

July 30, 2023 at 12:03 pm

Another incredibly lame reply from someone who has yet to calculate operating profits relative to sales properly.

Let’s see – sales rising and profits falling. And Jonny boy thinks the margin rose? Yea – he is indeed that STUPID.

Wait – you said net profits (as in profits after taxes):

https://fred.stlouisfed.org/series/CP/

Corporate Profits After Tax (without IVA and CCAdj)

https://fred.stlouisfed.org/series/A261RX1Q020SBEA

I’m pretty slow sometimes (it kills me to admit it, but there it is), but I found this otherwise should be easy number to find, by comparing your tan line in a prior post with the FRED line.

[ looks down at my shoes wondering why I couldn’t figure this out in a straight out way ]

2024q1 is no problem. It’s q2 that has to be estimated.

And yes – we are still waiting for 2023QII profits to be reported. Maybe when this comes out, a new post that focused on the share of net income to GDI would qualify a few things.

Understood. I guess I was mainly looking at your 200 billion divided 2~~by last two quarters number, where you had got it. This is not a complaint, more confessing/showing my stupidity, was, I wasn’t sure where you had got the profit numbers.

Another economist I read off and on says that the GDI numbers, or the GDI number averaged with the GDP number hints that the GDP number doesn’t make the economy as robust as it appears. He says this average of the two numbers shows 0.4% decline in 4th quarter and 0.1% rise in first quarter. He also showed a graph of the Index of Coincident Indicators put out by the Conference Board, which as you might have guessed (you probably check it regular anyway) shows the rate of economic activity staying at a very steady/”slow” rise, which seems to “agree” with the average of the two GDP/GDI numbers.

Thanks for the reply. : )

I have no guess on the Q2 number, I assume it comes out late August?? I think this is an extremely interesting question, and would be fun to posit some guesses on, though have no courage to give my “armchair wannabe economist” attempt at this moment.

Off topic, devaluation-

The Institute of International Finance is reportedly touting the virtues of devaluation as a spur to growth for heavily indebted nations:

https://www.finance.yahoo.com/amphtml/news/currency-devaluations-touted-iif-aid-205056249.html

…and with respect to China, which is heavily indebted mostly to itself, so probably a different thing:

https://www.scmp.com/comment/opinion/article/3229121/could-china-go-nuclear-and-devalue-its-currency-boost-ailing-recovery

Given the recent decline in the renmimbi, this view may seem somewhat belated, and with the IIF text behind a paywall, I don’t know what it actually says, but in comparison to the devaluation that China engineered between the mid-80s and mid-90s, recent renmimbi decline is quite modest:

https://fred.stlouisfed.org/series/DEXCHUS

Presumably (curse all paywalls), IIF is suggesting something big.

China has low inflation, relative to the average for the OECD:

https://fred.stlouisfed.org/graph/?g=17reT

That makes China a logical candidate for devaluation. However, devaluation is an anti-consumer policy choice. If China is serious about shifting toward increased reliance on domestic consumption, devaluation is the wrong tool. Devaluation would essentially be a choice to stick with investment and exports as the main drivers of growth. Devaluation would amount to rearranging the economy so that once-familiar policy tools can be made to work again.

Devaluation implies an increase in reserves. That would put downward pressure on rest-of-the-world interest rates to accompany downward pressure on ROW prices.

Maybe Ducky should consider the US as a candidate for devaluation–its external debt is about 100% of GDP whereas China’s is only about 14%.

Of course, that won’t happen…devaluation of the dollar would make it much more expensive for DOD to maintain and supply hundreds of military bases around the world…

Where did you get those bogus numbers? Oh wait – you have no idea what the basic concept even is. Never mind.

Try Net Foreign Assets – dumbass:

https://corporatefinanceinstitute.com/resources/economics/net-foreign-assets-nfa/#SnippetTab

Yes it is well known that the US has a lot more foreign liabilities than foreign assets. China has a lot more foreign assets than it has foreign liabilities. Of course there is this puzzle. The US has positive net foreign income position while China has negative net foreign income.

Now if you actually paid attention to the economic discussions from our host (which of course you are too stupid to do so) you would have known this has been true for a generation. But I bet you have no effing clue how this could be.

The US puzzle is known as the infamous Dark Matter controversy. Now I get you have no effing clue what this even is. But I have posted blog posts on what I dubbed China’s Dark Anti-Matter. Pretty basic finance which means it is WAY over Jonny boy’s excuse for a brain.

links: https://www.ceicdata.com/en/indicator/china/external-debt–of-nominal-gdp

https://www.ceicdata.com/en/indicator/united-states/external-debt–of-nominal-gdp

United States External Debt: % of GDP

2003 – 2022 | YEARLY | % | CEIC DATA

United States External Debt accounted for 96.4 % of the country’s Nominal GDP in 2022, compared with the ratio of 100.2 % in the previous year.

US External Debt: % of Nominal GDP data is updated yearly, available from Dec 2003 to Dec 2022.

The data reached an all-time high of 101.4 % in Dec 2020 and a record low of 60.6 % in Dec 2003.

Why would anyone pay attention to a series that looked at only debt owned to foreigners but did not look at foreign assets owned by US citizens. Jonny boy comes up with another incredibly misleading series.

pgl recommends looking at NIIP. So he would probably recommend investing in Argentina, whose NIIP looks pretty good. https://www.ceicdata.com/en/argentina/bpm6-international-investment-position-annual/ar-iip-net-international-investment-position

Does pgl have any clue as to what he’s talking about?

Are you really this STOOPID? I guess so. But wait – BEA reports on Argentina? Seriously dude – this is why even the little kiddies do not discuss real issues with you.

Argentina has a positive NIIP. China has a positive NIIP.

But wait – Argentina and China both have negative net income from abroad.

But Jonny boy thinks Argentina is awful and China is great.

Of course Jonny boy cannot be bothered to check the data. Even if he did – this troll has no effing clue what any of this even means.

Eh, that is a vicious paywall, nevermind. Sorry.

@ Macroduck

If you wanna get a good rest before Monday morning I get it, but if you can answer this before midnight Sunday (tonight) it would be great. Do you know the date of the IIF story/publication you’re wanting to read behind the….. ???

Kevin Drum notes that Trump’s legal issues are the full employment act for lawyers:

https://jabberwocking.com/trump-is-spending-1-5-million-per-week-in-legal-fees/

Spending $40 million in six months is impressive. That’s a run rate of $1.5 million per week. No wonder they need that $60 million back. Still, at least Trump doesn’t have to pay any of it himself. Instead he’s using money his donors thought was going to his reelection effort

It *is* going to his re-election effort. Imagine what would happen if he was acquitted! Is there any way the entire right wouldn’t rally around him and massively get out the vote to put him back in office? Even Chris Christie would probably fall in line!

NO disrespect to you personally, but why does the phrase “Even Chris Christie” make me want to giggle for an extended period of time??

Why do Americans in general, only have a memory that stretches back about 2 months??~~if even that?? Is municipal water that defiled now??

Almost everyone I know in New Jersey would tell you Christie was a horrible governor. And as far as corruption – BridgeGate is all that needs to be said.

I’m glad I brightened up your day!

Analysis of events and their impact on political polls indicates that the half-life of an event’s impact on polling averages is, indeed, slightly less than two months…

Don’t usually watch this show, but some lady had a pretty good line to end “Meet the Press”. She said “You know the one Republican who never attacks Joe Biden on his age??……. Mitch McConnell”

I wanted to contribute something on this GDI/GDP stuff, but I’m still working on getting my thoughts discombobulated, so it will have to wait for later in the day. Nothing monumental to be sure, but still wanted to put my nickel in the jar.

I bet Mitch goes light on Feinstein as well. When is her term over? We know Mitch has another 2.5 years to go.

At one time Feinstein was an extremely extremely sharp lady, and, at that time, had my respect in those regards. But I do think senile or not senile, the woman treasures her power, and also I think she has a streak of paranoia inside of her. Ever try to steal an old lady’s throw blanket in the dead of winter?? I figure that’s about the way it’s going to go with her trying to get her to resign her Senate seat. And everyone agrees (but won’t say in public setting) the woman should have gracefully resigned months ago—maybe a year+ ago.

She has another 1.5 years to go. And yea – Mitch has another 3.5 years ago (not 2.5).

This is it; she’s not seeking re-election in 2024, so we have less than a year and a half to go.

The field of Democrats who might run for her seat next year should be interesting. In the meantime,

God speed to her staff for making sure she can serve for the next year and a half.

@ pgl

Your chance to rub elbows with the big boys:

https://secure.actblue.com/donate/abs-website?express_lane=true&amount=25&refcode=AU_ABS_website

It’ll be your penance for past sins when you donated to Andrew C.

: ) It’s just a friendly ribbing. Hey, I liked (past tense) Tulsi Gabbard, now I have to hide my face at the 7-11.