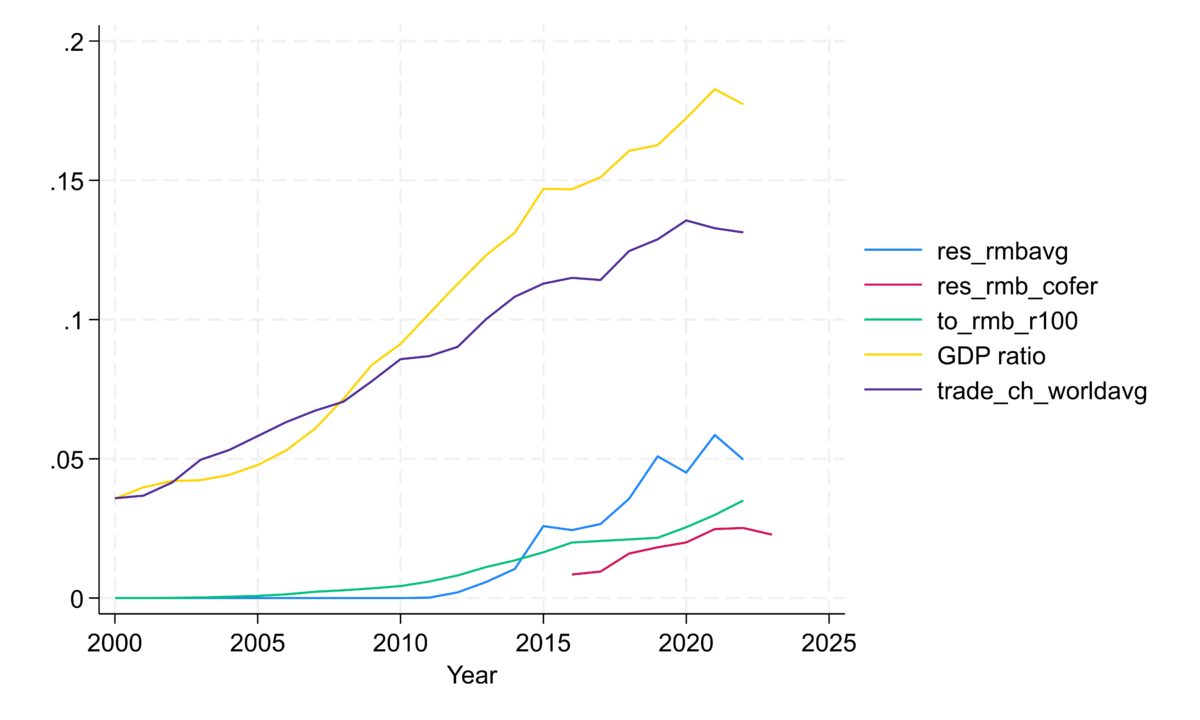

Here’s a picture of the RMB’s role as a reserve and vehicle currency, from an ongoing project with Jeffrey Frankel and Hiro Ito, where we examine the determinants of individual central bank reserve holdings.

Figure 1: Simple average of holdings of RMBs among central banks reporting RMB holdings in Ito-McCauley database (blue), average holdings of RMBs among central banks reporting holdings to IMF (red), turnover of RMBs (out of 1) (green), share of GDP in world GDP (yellow), simple average of trade share with China (purple). Turnover is linearly interpolated between BIS triennial surveys. 2023 COFER holdings for first three quarters. Source: Ito-McCauley database, COFER, BIS, author’s calculations.

Note that COFER share holdings in RMB is lower than simple average of RMB holdings which means that in general it’s smaller central banks holding more RMBs. Further note that RMB holdings have seemingly stalled out in 2023.

Off topic, the border and the budget –

Politico reports an immigration deal may be in the offing:

https://www.politico.com/news/2024/01/07/top-gop-negotiator-border-deal-00134185

This is a deal among Senate negotiators – the Senate was always going to reach a deal. There are reports that some GOP House members (some Senate, too) want to use immigration as an excuse to shut down the government when the current spending deal runs out:

https://thehill.com/homenews/senate/4387973-shutdown-risk-grows-with-gops-border-fury/

Johnson says that won’t happen, but he can only make that stick if he relies on Democratic votes.

This is certainly another case where (just like abortion) GOP needs the issue more than passage of their solutions. Biden need to be able to say that the GOP twisted his arm so he had to give in. Excessive numbers of asylum seekers is not in the interest of Biden or the democrats. A compromise that keep asylum seekers on the other side of the border should be easy to accept. Setting it up such that it includes help for Ukraine and Israel, will make it very hard for the GOP to reject a grand deal without paying a big political price – if the border is an existential crisis then they cannot block border legislation because its paired with something many conservative GOP members actually also support. There will likely be substantial GOP and Democrat votes against the final deal in the house, but it will pass – and easily pass in the Senate.

One thing that you can be sure of is that Trump is going to have a field day with Democrats’ inability to craft a coherent economic message.

First, he’ll play Reagan–“are you better off than you were before the pandemic?” Short answer: “No.” (And he would be right.)

https://fred.stlouisfed.org/series/MEHOINUSA672N/

Democrats have spent months making the counter argument–real wages are up. And liberal, mainstream economists will say Democrats are right. And they would be…real average hourly wages have risen by 0.07% since 4 years ago…less than $.25 per hour in today’s dollars. Big whoop! Trump could have lots of fun with that! Democrats think that’s a real pay raise!?!

Second, Trump will talk about how, being a successful businessman, he knows how to make the economy grow, as he claims to have done before the pandemic set in.

Third, Trump will call for the usual Republican prescriptions–tax cuts. At that point Democrats stable of economists, who have done nothing to lay the groundwork with the public, will rise up and cry. “There is no evidence!” And they will provide no economic case for raising taxes on the wealthy, even though this is their ticket.

Robert Waldman (AngryBear) notes: “From time to time I argue that the optimal strategy for Democrats is good old egalitarian populism: soak the rich and spread it out thin. I note the polls which have, for 3 decades now, shown that a majority of US adults think that upper income people and corporations pay less than their fair share in taxes and the fact that Bill Clinton, Obama, and Biden were elected promising to raise taxes on the rich and cut taxes on everyone else.

I suppose I should address two important questions. FIrst why don’t all Democrats do this? In particular, why didn’t Mondale, Dukakis, Gore, Kerry, or Hillary Clinton do this (note the perfect 100% pattern of fitting which Democrats get elected) ? Second, given the importance of the issue and the fact that all Republicans did when they had power was cut taxes on the rich and on corporations, why do Republicans ever win elections.

I will get to these questions, but first I want to take a stroll down memory lane. First I remember a day in 1992 when I was watching the commentary on a Clinton Bush Sr debate. They had the focus group dials so that viewers could indicate agreement and disagreement. They had 3 groups: Clinton supporters, Bush supporters, and undecided voters. Clinton said of the Reagan years “only rich people got tax cuts”. The three groups (on average) each dialed in agreement. Then the calm TV commentators noted that it was unusual for supporters of one candidate to vigorously agree with the other candidate (I think it may have been more unique than unusual). The memory remains vivid.” https://angrybearblog.com/2023/10/how-i-learned-to-soak-the-rich

And what about those liberal, mainstream economists. How do they propose to make the case about potential macroeconomic benefits to taxing the wealthy? I asked that question a couple days ago and got nothing but the usual grousing, snarking, misrepresentation, and dodging the question…and no constructive commentary.

It seems that nothing has changed in the decade since Steve Roth wrote: “It comes to mind as I ponder the rather grudging and tepid suggestions that you hear here and there these days — that excessive inequality might actually be a drag on economic growth and prosperity. There are some full-throated assertions of this belief out there, but in the mainstream economics community they are rare and in general quite decidedly mealy-mouthed…

The general failure to question the “more inequality is good for growth” mantra has deep roots, even among progressive economists. Viz, this from Paul Krugman back in December, 2008…

For those who prefer to look at pesky things like facts, the empirical data bears this out: at least in prosperous countries, greater wealth equality correlates with greater long-term prosperity.” Steve has been refining his argument ever since that was written.

https://angrybearblog.com/2012/10/gdp-prosperity-wealth-effect-and

As for this blog, the most recent discussion of this issue is already two years old, which is a testament to how little interest there has been in preparing for the inevitable onslaught of Trump’s tax cut mantra. Talk about being asleep at the wheel!

JohnH: Hey, I think I’m a mainstream economist. I was against the TCJA, against the 2001 and 2003 tax cuts (all documented on this blog, not that you seem to recall what I write). I’m for getting rid of carried interest deduction. I’m for the global corporate tax rate. So who exactly have you polled in your characterization of mainstream economists? Remember, mainstream is not the same as Wall Street economists.

“So who exactly have you polled in your characterization of mainstream economists?”

Well Art Laffer is not mainstream but little Jonny boy actually defends him as if Laffer were a progressive. Yea – he is indeed THAT STUPID.

OK…so you were against tax cuts 20 years ago…that’s not the point, Where are the contemporary pieces that directly counter Republican nonsense that tax cuts promote growth? Where are the pieces that show that tax increases actually promote growth? Apart from a few lonely warriors like Steve Roth, they are not to be found in any current public debate.

It seems standard procedure to refer to pieces that were written years ago, if not decades ago and then claim that they are somehow evidence of efforts to counter Republican BS in this election cycle. Wall Street economists are quite active, “liberal” economists seem to be asleep at the wheel.

JohnH: I think the Tax Cuts and Jobs Act of 2017 was only a 6 years ago. April 2021 was not 20 years ago.

he’ll play Reagan–“are you better off than you were before the pandemic?”

Damn – my mentally retarded stalker must have missed my mocking of this dumba$$ statement. Five years not four years? I said it the time only a MAGA moron would fall for this garbage and guess you did? MAGA moron JohnH! Take a bow!

Given the current mood of the voters…bolstered by actual evidence from the household survey…I expect that a whole lot of voters, who on average have seen their average real wages increase by $.25 over the past four years, will be susceptible to Trump’s arguments…and not to Democratic efforts to hype the fact that average real wages have actually increased, but omitting the triviality of the amount.

“they will provide no economic case for raising taxes on the wealthy”

I guess you have been living under a rock for the past 50 years and this case has been made many times. OK – little Jonny boy is too stupid to know this so little Jonny boy claims it has never been made. Dude – you are a total moron which is the only reason you actually think your latest rant makes any sense.

I remember what Steve Roth wrote over at my former blog. Maybe you might notice I was always in favor of increasing taxes on the rich even as you resort to total misrepresentations of what had been said over at Mark Thoma’s blog. But hey – I have become accustomed your pathetic lying so hey.

I also read the comments under Steve’s post. Your comment? Nada. Then again Angrybear has always insisted on adult conversations to you were never invited.

Speaking of Clinton – he did raise taxes on the rich in 1993. Of course little Jonny boy is too stupid to remember. Of course little Jonny boy is also too stupid to realize that things like Social Security are funded by payroll taxes. Come on Jonny – find us the research where taxing employment is more progressive than taxing consumption. This should be fun!

pgl claims that he “was always in favor of increasing taxes on the rich,” but he was also in favor of a regressive VAT to fund social services. His support for VAT had no conditions attached, such as being a progressive consumption tax. He just talks out of both sides of his mouth.

Also, the Robert Reich article that I cited a few days ago specifically mentions the Clinton tax hikes as evidence that raising taxes on the wealthy is good for economic growth…but there are few economists apart from Stiglitz who will touch that point with a 10′ pole.

JohnH: Hmm. I think I’ve written a gazillion times that since multipliers for spending are typically bigger than multipliers for tax cuts — both in Keynesian theory and empirics — then tax increases coupled by spending increases would be stimulative (and certainly tax decreases coupled with spending decreases would be contractionary).

You are obviously not reading this blog before commenting.

The Omnibus Budget Reconciliation Act of 1993, which the top federal income tax rate from 31% to 39.6% and increased the corporate income tax rate. Republicans predicted this would lead to a recession. It didn’t. Zero Republicans voted for it but the Democrats got it passed.

Now one would think every person with an IQ above the single digits would remember this. But not JohnH. Yea – Jonny boy is THAT DAMN DUMB!

BTW Jonny boy alludes to some failure of Paul Krugman ala December 2008. Funny thing – lying little Jonny boy failed to note anything Krugman wrote back then. Which of course is not surprising as Jonny boy’s job is to lie about everything and everybody.

Actually, pgl, if you had thought this through and not had your standard knee jerk reaction, you would have noticed that Steve Roth specifically referred to Krugman’s lack of support for taxing the wealthy to promote economic growth and provided a link to a quote from Krugman.

I know certain people mock Forbes, but this is an interesting story. We’ll have to see how things play out economically for China as it becomes more aggressive with its neighbors and more closely aligned with Russia.

https://www.forbes.com/sites/miltonezrati/2023/12/29/chinas-deflation-another-tell-of-serious-economic-trouble/?sh=3cc047d640f6

For those folks who would mock Forbes:

https://www.cnn.com/2023/12/27/economy/china-economy-challenges-2024-intl-hnk/index.html

Bruce Hall is one confused dude. No Brucie – we do not mock Forbes even if we mock people like Tim Worstall who writes stuff almost as dumb as your comments. This is a good article:

https://www.forbes.com/sites/miltonezrati/2023/12/29/chinas-deflation-another-tell-of-serious-economic-trouble/

China’s Deflation: Another ‘Tell’ Of Serious Economic Trouble

Americans, stressed as they are by inflation, might welcome news that prices are falling, as they are in China. Deflation, however, is seldom good economic news, and it certainly is not for China.

Oh wait – little Brucie boy has been cheering on deflation for the US economy. Hey Brucie – read own link. You might learn something.