I’ve only now gotten around to writing about this Trump policy proposal: “Trump trade advisers plot dollar devaluation” . I was befuddled by how they Trump brain trust was going to effectively force the weakening of the dollar: sterilized intervention, dropping interest rates in the US, or forcing foreign countries to re-peg their currencies at stronger values. They all seem to be problematic.

Sterilized intervention: There’s not much evidence that for countries with open capital markets this works, on an extended basis (see Popper, 2022 for a survey).

Dropping US interest rates: Well, if the US could drop interest rates while forcing other countries to raise their own, this would (in the absence of whatever turmoil in financial markets this might cause) depreciate the dollar. If in addition, by dropping US interest rates one could convince financial market participants that inflation would accelerate, then most standard monetary models of the exchange rate would predict dollar depreciation in the short run.

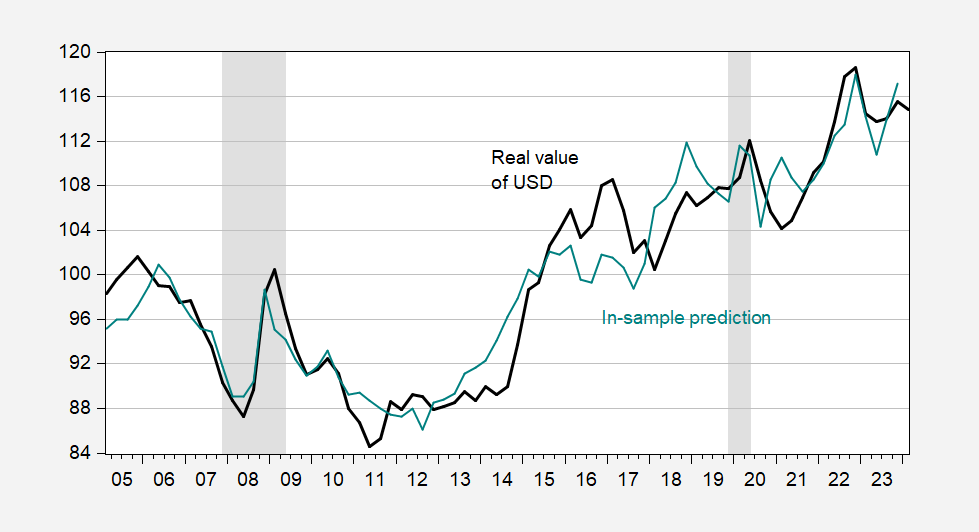

My estimates for an ad hoc model 2005-2023 yields:

r = -5.61 + 2(y-y*) + 9.6i – 9.7i* – 0.81π + 1.51π* + 0.003VIX

Adj-R2 = 0.88, SER = 0.031, DW = 0.60, N =76. Coefficients in Bold indicate significance at the 10% msl using HAC robust standard errors.

Where r is log real trade weighted dollar, y is GDP, i is the 10 year yield, π is y/y CPI inflation, and * denotes rest-of-advanced economies. The fit is shown in Figure 1:

Figure 1: Real trade weighted value of US dollar (bold black), in-sample prediction (teal). NBER defined peak-to-trough recession dates shaded gray. Source: Federal Reserve via FRED, NBER, and author’s calculations.

If this set of correlations holds up into the future, then a one percentage point reduction in the 10 year Treasury yield relative to foreign would reduce the real value of the dollar nearly 10 percent. Is this possible in practice? This is hard to say; after all, long term rates are correlated, and other advanced economies long term rates tend to comove.

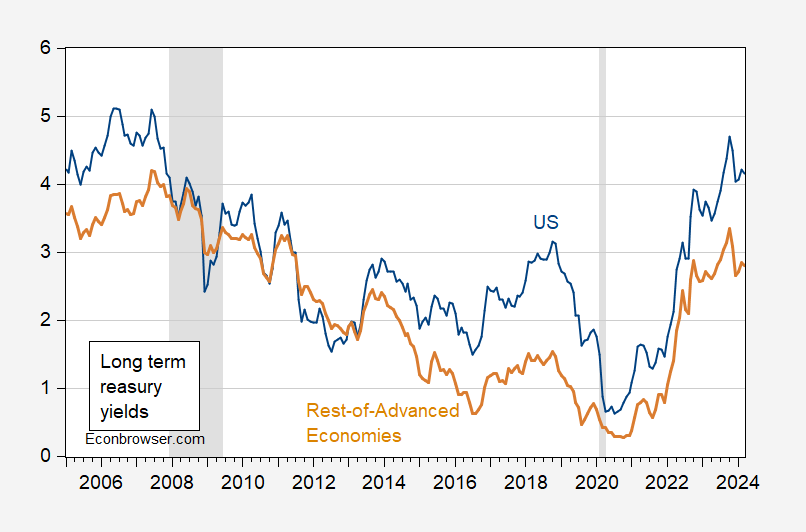

Figure 2: US Ten Year Treasury yield (blue), rest-of-advanced economy long term (5-10 years) government bond yields (tan), both in %. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury via FRED, Dallas Fed DGEI, and NBER.

In this sample period, each one percentage point change in the US Treasury yield is associated with about a 0.6 percentage point change in the rest-of-advanced economy yields.

Of course, should rates be reduced in the US, then US GDP would likely grow faster than otherwise, thereby slightly offsetting the (already diminished) interest rate effect. If the US has to exert some strong arm methods to gain the “cooperation” of other countries, presumably the VIX would rise (as it often did under Trump, particularly during the trade war). Of course, the US Treasury cannot in and of itself control the yield on Treasury bonds, in a market economy. So the compliance of the Fed would be necessary (which might be why Trump’s brain trust is thinking about how to make the Fed decision-making process more malleable).

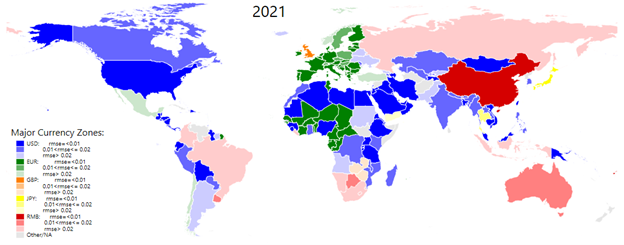

Forcing other countries to revalue: The nominal value of the US dollar is a function of policies in the countries pegging to the dollar. Ito and Kawai identify currency zones as those pegging to respective currencies. As of 2021:

Figure 3: The Evolution of the Major Currency Zones. Source: Compiled by authors from their estimations. Source: Ito (2024).

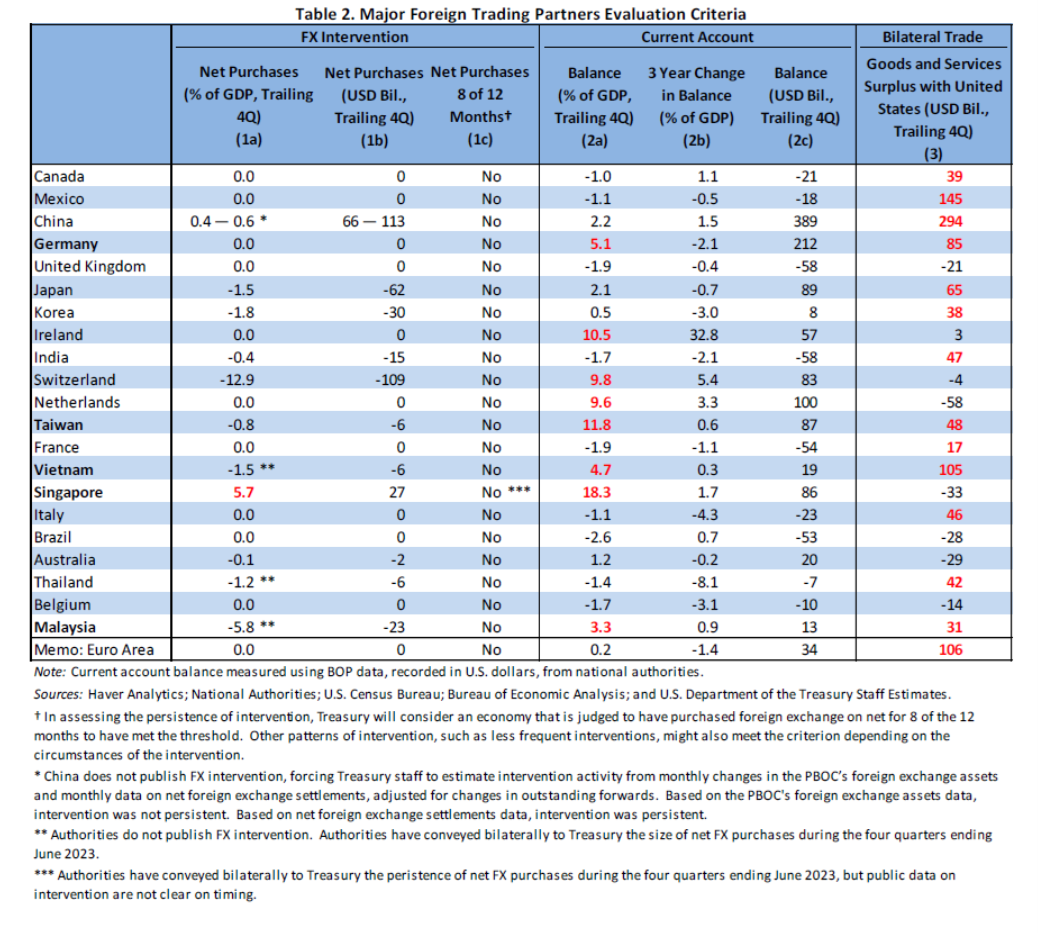

Of those countries identified as being in the dollar zone, not all peg, or quasi-peg, to the dollar. But those that do, the US could cajole into revaluing. How big of an effect? Adler, Lisack and Mano (Emerging Markets Review, 2022) find that each one percentage point of GDP reduction in FX intervention appreciates a bilateral real exchange rate by between 1.4-1.7 ppts. There is some question whether China has returned to a dollar peg as of 2024, but we can examine how feasible it is to get a big appreciation of the US dollar by examining how much intervention is going on now. The last US Treasury FX report, in November 2023, presents some statistics.

Source: US Treasury (November 2023).

Singapore is intervening substantially (as a share of GDP), but has only a 1.9% weight in the trade weighted dollar (broad US Fed). China has a bigger weight, 13.4% [1]. If China were to reduce intervention by 1 ppt of GDP (where it was estimated at 0.4-0.6 ppts by Treasury), then the RMB would appreciate by 1.4-1.7%. The direct impact on the trade weighted dollar would then be 0.23 ppts to 0.28 ppts(!). To the extent that some countries peg their currency to the yuan, then one might get a slightly bigger effect. However, in the end, it seems like a lot of work to get a small change in the value of the dollar.

More evaluation of the desirability of this policy initiative, by Rampell (WaPo), as well as Horan (National Review).

They could not devalue as the currency floats and it is the Fed not the government that sets interest rates.

That yank education system aint what it used to be

Failures of the American public education system (created by Republicans at both state and federal level) put aside for the moment, if you didn’t notice how easily the orange abomination shoved around Jerome Powell on rate decisions, you haven’t been paying very close attention.

A long run solution might be fiscal restraint as in taxing the rich a lot more. Nah Trump can’t do that

Some of the chit-chat from Trump’s wannabe advisors mentions Plaza. That is a pretty clear acknowledgement that even Trump’s ego isn’t enough, all by itself, to determine FX rates.

Now, who would need to join an FX deal to make it work? Major trading partners, which include Canada, Mexico, China, the EU and Japan. So, where do we stand against those currencies:

https://fred.stlouisfed.org/graph/?g=1nVYh

Relative to the onset of the Covid recession, MXP is a bit stronger, JPY a good bit weaker, the rest mostly little changed. Not that that matters to Trump, but it surely matters to the citizens and policymakers of those countries.

Trump’s position is that U.S. trading partners should import more, export less and surrender an increment of growth to the U.S. The U.S. is growing better, relative to either trend or potential, than any of these other countries. So they should surrender an increment of growth to us? Because a crass, deal-breaking criminal who is widely disdained and ridiculed around the world says so?

Good luck with that. Strikes me as a policy for no other reason than that presidents are supposed to have policies. No chance it can happen.

“Some of the chit-chat from Trump’s wannabe advisors mentions Plaza.”

I’d love to see who is do this chit chat and WTF they are chatting. I think they got the wrong message from the 1980’s which started with a massive $ appreciation due to Reagan’s stupid fiscal stimulus (defense spending increases and tax cuts for the rich) which triggered the tight Volcker monetary policy. And of course Trump’s fiscal stimulus was Reagan redux.

Yea – once people like Kudlow got kicked out of the White House replaced by Martin Feldstein etc. we did reverse the macroeconomic fiasco and the dollar appreciation was reversed.

Pardon me – except Mexico. Mexico has been growing well.

“Christine McDaniel has pointed out that half of U.S. imports consist of raw materials, intermediate goods, and capital goods, which go to producing final goods that Americans use or that are exported. Make no mistake, a dollar devaluation would be felt both by U.S. consumers and producers.”

Wasn’t this how the 2018 tariffs worked? BTW – it was a real surprise to see something that insightful on the pages of the National Review.

Your first graph shows the real value of the dollar may have declined during Trump’s first year but it appreciated in real terms in 2018 and 2019. So Trump as usual is just blowing smoke.