Ad hoc time series analysis.

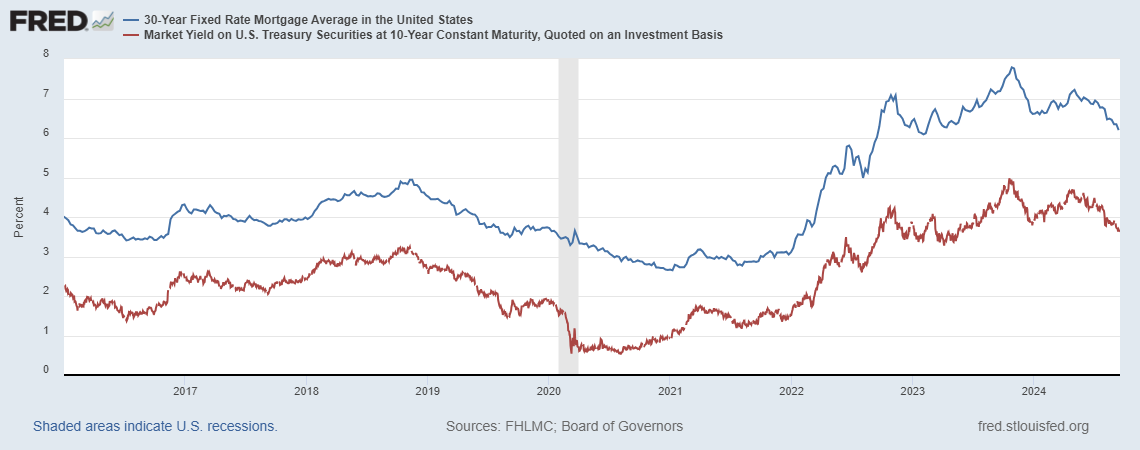

The 30 year mortgage rate and 10 year Treasury constant maturity yield comove over the past 8 years. A Johansen maximum likelihood test (constant in cointegrating equation, in VAR, 4 lags of differences) rejects the no cointegration null using the Trace statistic (also only 1 cointegrating vector, so both series might be stationary) over the 1986-2024M08 period.

The null hypothesis of (1 -1) cointegrating vector is not rejected (point estimates (1 -1.02).

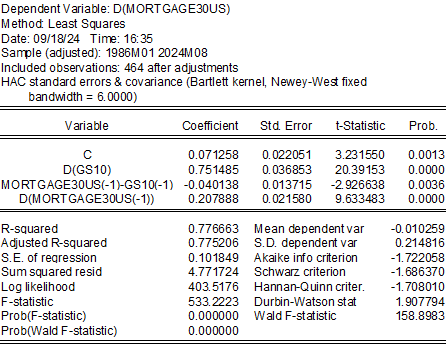

Using a single equation error correction model (imposing homogeneity) yields:

These estimates indicate mortgage rates are about 7 ppts above 10 year Treasurys. A one percentage point reduction in the 10 year yield results in a 0.75 percentage point reduction in mortgage rates upon impact (here, in month). Deviations from equilibrium have a half live of about 4.5 years.

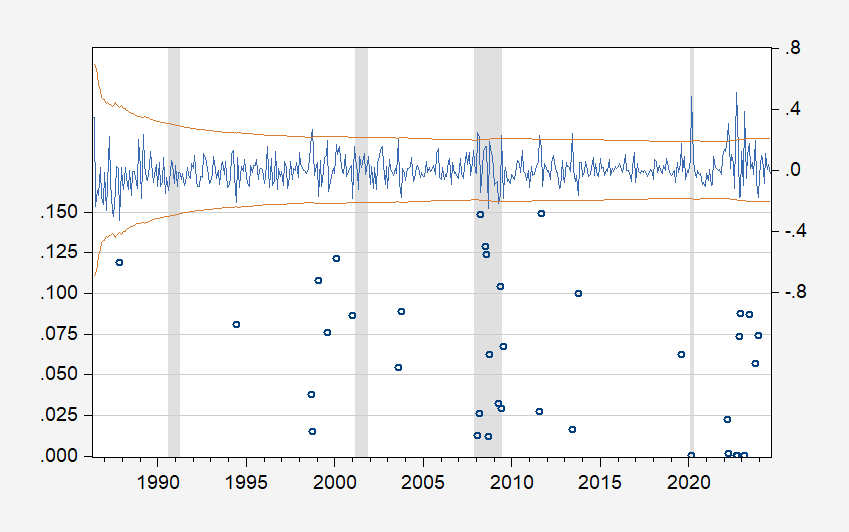

The relationship is subject to structural breaks, as indicated by recursive one-step ahead Chow tests, particularly around September 2022.

Figure 1: Probability for recursive Chow one-step ahead test for no break (left scale), recursive residuals (right scale). NBER defined peak-to-trough recession dates shaded gray.

If 100 bps reduction in the Fed funds rate (currently the talk for end-of-year) results in about 30 bps reduction in the ten year, this implies about 23 bps reduction in mortgage rates by year’s end (ballpark!).

Off topic but timely since Trump is touting the benefits of his proposed tariff system. After all Trump says tariffs lower the price of imported food.

It seems someone at the Heritage Foundation in 2019 had a very different view!

Do No Harm: Tariffs and Quotas Hurt the Homeland

https://www.heritage.org/trade/report/do-no-harm-tariffs-and-quotas-hurt-the-homeland

Trade policy has been at the forefront of the Trump Administration’s agenda primarily to help the domestic manufacturing sector. To achieve its goals, the Administration has used its authority to impose new trade barriers—namely tariffs—on a wide variety of goods imported from multiple trading partners. Although the Administration believes tariffs are a good negotiating tactic, implementing these barriers is dangerous because tariffs detract from the value U.S. businesses create, thus creating a risk of harming the domestic economy. Many businesses have requested tariff relief, and some are pressuring the Administration to consider replacing tariffs with quotas, which are potentially more harmful than tariffs. Unlike tariffs and quotas, free trade allows Americans to access more goods of differing qualities at different prices.

Well it seems the MAGA morons following little JD are dumber than he is:

https://x.com/Acyn/status/1836490587006210471?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1836490587006210471%7Ctwgr%5Ee3cfe199c6c74e0a8d8f8e37011d4ce426950108%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.thedailybeast.com%2Fmaga-fans-at-jd-vance-rally-boo-rate-cut-that-will-alleviate-inflation

They all boo’d the interest rate cut while JD gave a really dumb reply to the reporter’s question. Does this clown even know what the FED did today?

No. Or Vance would have done better with his “harvest:” app thing-ie, He’s pretty much as dumb as our man Kopits, who thought he could win a municipal election because everyone else was absentee.

Two things –

We have to assume mortgage rates already price in some of today’s rate cut.

The likelihood that recent mortgages will refinance as rates fall shortens duration of MBS. Mortgages during the period of high rates are very likely hedged against, and priced off of, Treasuries of shorter duration than ten year notes.

This is one of those posts where I wonder if Prof Chinn is asking a semi-rhetorical question. He is pretty sharp and must have some students working at investment banks etc,. He’s careful not to say where markets are going (a difficult undertaking) And yet……

https://x.com/Acyn/status/1836490587006210471?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1836490587006210471%7Ctwgr%5Ee3cfe199c6c74e0a8d8f8e37011d4ce426950108%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.thedailybeast.com%2Fmaga-fans-at-jd-vance-rally-boo-rate-cut-that-will-alleviate-inflation

Time for Trump to sell some stock?

Those who have followed the turkey known as Trump Media probably know all of what Kevin Drum offers here but the way Kevin mocks those who hold this turkey is classic!

Keeping with the idea that long, fixed-rate mortgages (15 and 30-year mortgages) have priced off of Treasuries of shorter duration than 10-year notes during the period of high rates, here’s a picture of yields on 2s, 5s and 10s so far this year:

https://fred.stlouisfed.org/graph/?g=1tTX0

Lots of action in 2s and 5s. If it is the case that MBS hedging has been against Treasuries with maturities shorter than 10s, maybe yield-curve dis-inversion (de-inversion?) means a good bit of the decline in mortgage rates has already taken place? Maybe, but it doesn’t look like based on the 30-year mortgage/10-year Treasury spread:

https://fred.stlouisfed.org/graph/?g=1tU2c

The 30/10 spread is still about 1% wider now than prior to the Covid mess. So maybe take whatever is going to happen to 10-year note yields and subtract 1% more for 30-year mortgages.

This is a bit wishful, I suppose, compared to Menzie’s estimate. Staring at mortgage spreads, I just say “here’s an extra 100 basis point decline in mortgage rates” when spreads may not return to their pre-Covid state.

Off topic – the VA has stopped using cats and dogs in medical research:

https://thehill.com/opinion/congress-blog/4885346-va-ends-animal-research/

Something about a shortage in Ohio…I guess…

Funny, hahahaha. I’m driniing now and kinda in that dark spot. I needed that laugh so much, thanks pal

The not so funny thing about it is that PETA animal rights activists have taken over the VA animal research regulatory office in DC, and systematically has travelled around the country to find excuses for shutting down animal research facilities at VA hospitals.

Some of that research is into diseases that are also investigated by National Institute of Health. But it is difficult and can take decades to duplicate and rebuild a strong research group in a specific area, at other institutions. Some research is fairly uniquely pursued by VA in areas such as post traumatic stress disorder (PTSD) or blast injuries. Shutting down the pipelines of new treatments developed in animal models means that progress in clinical treatments will come to a dead stop in a couple of years time. I think our Veterans deserves better.

Even worse – some of the best medical doctors are those who want to discover basic mechanics of diseases, so they can develop new and better treatments. That kind of progress is not possible without studies in animal models. So those most imaginative and thoughtful doctors will be driven away from the VA when the “bedside-to-bench-to-bedside” pipeline is broken.

I didn’t intend to make any humor out of anything that hurts America’s military veterans. I think you know that. But I want to make it clear to the general reader. I view combat veterans as the best humans on Earth, not “suckers” as some orange man said.

I know that Moses. Just wanted to bring out the back story. The absurd level of hostility to animal research could end up handing all future biomedical research progress to China.

When does the media start touting that Bidenomics worked and produced an economic recovery and lasting economic growth from the worst Trump healthcare response to a pandemic in modern history and 10% unemployment from the Trump/GOP recession? And it was done in the face of the highest interest rates in decades. Now that grocery prices are down – can we talk to some people that put savings in CDs paying unprecedented 5% interest? I recall my parents talking about getting a 5% CD back in the late 70s? (I don’t know – I was little kid and remember it had something to do with my hero – Jimmy Carter.)

Also can JD Vance take a look at reality – “Overdose deaths in Ohio are down 31 percent” rather than make up xenophobic/racist smears targeting some people – https://www.npr.org/2024/09/18/nx-s1-5107417/overdose-fatal-fentanyl-death-opioid

Also for today – the do-nothing/obstruction House GOP – their only achievement was spending millions of tax payer $ to have staffers do a B.S. three-year investigation of a private citizen’s Russian hacked laptop to find dirt on Biden (nothing there GOP – hey Comer – Putin trolled you) – is once again – doing Trump’s bidding and threatening to shut down the U.S. government – even Senator Leghorn/Foghorn/GOP party gravedigger says – now boys – ya’ll know that’s politically beyond stupid – https://digbysblog.net/2024/09/18/trumps-campaign-message-burn-the-place-down/

30-Year Fixed Rate Mortgage Average

https://fred.stlouisfed.org/series/MORTGAGE30US/index.php

Declined from 6.2% last week to 6.09% now.

https://finance.yahoo.com/quote/DJT/

Trump Media stock below $15 a share.

I know Prof Chinn won’t put this song up on the blog. If He LISTENS to it, I’m ok with that, Just listen and REMEMBER when we could listen the these songs, I’m gonna sneak on my MOm’s back porch today Menzie, drinking 4% beer in the sun, THats a low point beer Menzie,n wondering where MY America went??”??

Will P&P update us with the FFR forecast?

P&P? I guess you never learned to speak English.

Presumably this paper:

https://ideas.repec.org/a/bla/ecinqu/v45y2007i4p834-853.html

Thanks for the link.

David H Papell & Ruxandra Prodan, 2007. “Restricted Structural Change And The Unit Root Hypothesis,” Economic Inquiry, Western Economic Association International

P&P perhaps but it would have been nice had little Stevie said he was referring to Papell and Prodan. Now I’m not sure why this 2007 paper has anything to do with his cryptic comment. But I’m not holding my breath for Stevie to articulate what on earth he meant.

pgl: I think Mr. Kopits wanted another post as in this last one in the series.

Steven Kopits: Should now be P&P-B.

Well I missed that. Congratulations to Ruxandra!

@ Kopits First intelligent thing you have said on any blog in MONTHS.

I was thinking about it just now, watching the “Outlaws”~~Willie, Waylon, Kris, and Cash and drinking beer, The congratulations belong to her husband, actually (both?? You men folk know what I mean)

Our host told us you likely were referring to this post:

Guest Contribution: “The Federal Funds Rate: FOMC Projections, Policy Rule Prescriptions, and Futures Market Probabilities from the June 2024 Meeting”

Today, we present a guest post written by David Papell and Ruxandra Prodan-Boul, Professor of Economics at the University of Houston and Economics Lecturer at Stanford University.

Now you could have told us that this was what your very vague comment was referencing. Now if I’m reading their discussion correctly, the FED was behind the curve and still are.

5-Year Breakeven Inflation Rate

https://fred.stlouisfed.org/series/T5YIE/

I provide this for two reasons. The obvious reason is that this is a measure of expected inflation which it seems has been less than 2 percent of late.

I also heard Kentucky’s junior senator and serial moron (Rand Paul) proposed his “six penny” plan to balance the budget. If it sounds like one of Bruce Hall’s many pathetic comments, you are already on the right track. Rand the moron thinks we should cut nominal spending by 6% each and every year which means 8% real cuts for 2025, another 8% real cut for 2026, etc. Let’s see – a 40% reduction in defense spending. Think that is a good idea? How about a 40% cut in Medicare and Medicaid as well as Social Security?

Look putting an infantile title on something this draconian is not a serious proposal. It is stupid and incredibly insulting. But hey – we are talking about Rand Paul.

When Janet Yellen speaks, everyone should listen:

‘Americans Will End Up Paying the Tariffs’

https://www.msn.com/en-us/money/markets/americans-will-end-up-paying-the-tariffs/ar-AA1qRoF3?ocid=msedgdhp&pc=U531&cvid=1611e210ccd543fa9a292d9726a2eba9&ei=45

“When we spoke two years ago, what I said was, I believed that there was a path to bring inflation down in the context of a strong job market,” she said, referring to her previous appearance at the festival, in 2022. “And if the Fed and the administration’s policies could succeed in accomplishing that, we’d call that a soft landing. And I believe that’s exactly what we’re seeing in the economy.”

Without commenting on specific proposals by the Republican presidential nominee, Donald Trump, Yellen also argued that sweeping tariffs on foreign goods and the mass deportation of undocumented migrant workers—two ideas that Trump has insisted would be priorities of a second White House term—could significantly disrupt the economy and reverse progress in reducing inflation.

“I think it would be devastating to simply remove” that many undocumented workers from the economy, Yellen said, predicting that it would revive inflation. And although Trump has argued that foreign countries would pay the cost of the sweeping tariffs he says he will impose as president, Yellen echoed almost all mainstream economists when she said: “Americans, if we have tariffs, will end up paying the tariffs and seeing higher prices for goods that they purchase.”

S&P500 up 1.7% today. One stock did not fare so well:

https://finance.yahoo.com/quote/DJT/

Trump Media & Technology Group Corp. (DJT)

Closed at $14.70 a share.

Off topic – California’s legislature has passed a law regulating political disinformation:

https://talkingpointsmemo.com/news/newsom-takes-significant-stab-at-reining-in-social-media-disinfo-prompting-ire-from-musk

Governor Newsom is credited by TPM for the bill, but that shows a lesser of understanding how a bill becomes a law than Schoolhouse Rock offered as far back as ’96.

Elon Musk is trying ever so hard to pretend the massive dishonesty in our political (and business) culture is just people being funny, but he’s massively dishonest.

It is instructive that Democrats are fighting back against disinformation, while Republicans embrace it; their own lies, the lies of crazies and white supremacists, Russian lies – all are welcomed.

On its face, this bill only regulates what happens In California, but we know how this works. The cost of mediating content for California is just about exactly the same as doing so for the entire country, a huge step toward cleaning up content throughout the U.S.

Republican states can, of course, legislate against the truth. I expect some will. Supreme Court, here we come.

“On Tuesday and Wednesday, Musk took to social media to mock the new California laws over several posts, suggesting they were violations of the First Amendment and would “make parody illegal.” The laws contain exemptions for parody, but one of the three requires parodies to feature a disclaimer in the run-up to an election.”

Shorter Musk – I’m rich so eff you asking me not to lie like a rug. Parody is legal if one admits it is parody. But of course billionaries are above all of this. MAGA!

Water rights have always been a big deal in California (remember the movie China Town?) and the drought made them a huge deal. Trump has a solution but it turns out that his solution is stupid as it gets. Surprise?

Donald Trump claims B.C.’s ‘very large faucet’ could help California’s water woes

https://www.msn.com/en-ca/news/politics/donald-trump-claims-bc-s-very-large-faucet-could-help-california-s-water-woes/ar-AA1qJmvu?ocid=BingNewsSerp

Werner Antweiler with the University of British Columbia Sauder School of Business said Trump’s idea is actually not a new one. “The idea seems to be in the heads of people that Canada has all this wonderful water,” he said. “Can we not just get it down to where we need it, where we have drought conditions, as in California? But of course, the business logic is that it’s all way too expensive to do so, and there’s just no realistic business model for that.” Antweiler said there is a treaty that exists between B.C. and the U.S., which is called the Columbia River Treaty.

“That actually regulates how much water is flowing across the border and what it’s going to be used for,” he added. “In fact, we’ve actually had less water because of climate change that’s going south. And so there has to be some adjustments made. But also the water is used for hydro dams. It’s used for maintaining the fisheries in the Columbia River all the way to the coast, all the way through Oregon primarily. And so there is just no spare water here, frankly, shipping it anywhere.”

Yea – Trump is one stupid man.