As promised by Donald Trump?

“We’re going to have prices down- I think you’re going to see some pretty drastic price reductions.”

Associated Press, Trump holds a press conference at Mar-a-Lago, YouTube (January 7, 2025).

And here’s the data we have.

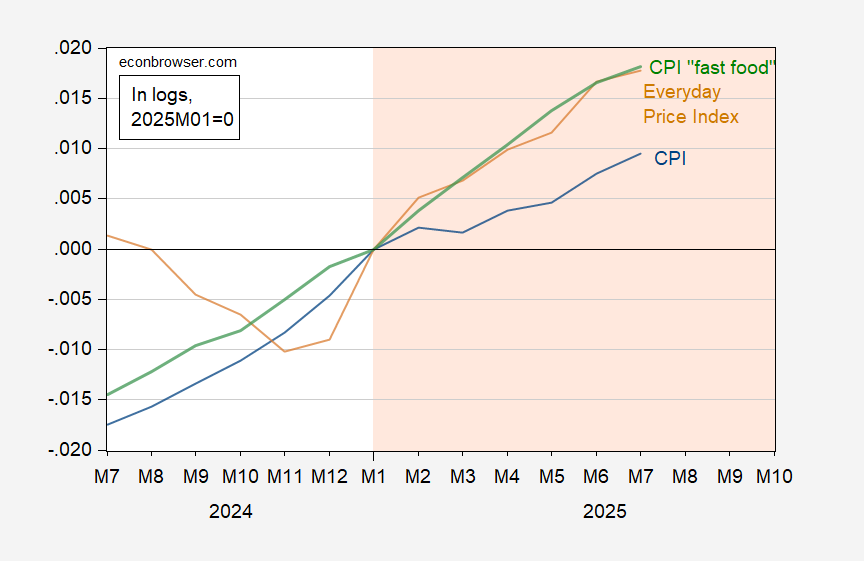

Figure 1: CPI (blue), Everyday Price Index (tan), and CPI-limited service restaurants (green), all in logs, 2025M01=0. CPI-limited services restaurants seasonally adjusted by author using X-13 in logs. Source: BLS, American Institute for Economic Research, and author’s calculations.

Chinny you are so biased.

Antoni will do it. no-one knows recessions like this man

Macroduck linked to several sources about electrical/utility costs the other day – “Household electric bills are up 10 percent nationally since Trump took office, and are poised to spike even further. Republicans’ budget bill took a “sledgehammer” to clean energy sources, fueling an energy crisis of skyrocketing utility bills just as demand for energy surges from data centers. A new report from Climate Power details how Trump’s Republican Rate Hike is saddling Americans with higher energy costs, a weaker electric grid, and job losses.” https://climatepower.us/wp-content/uploads/2025/08/EMBARGOED-Energy-Crisis-Fact-Sheet-RES-2025_08.pdf

Also at the end of year, employer provided health insurance rates will spike due to the Republican’s budget bill.

I keep reading in the business press that consumer spending is holding up – but I believe that by the end of year we will be seeing several headwinds against consumer spending: higher costs for goods (tariffs), student loan repayments, Federal job loses, higher utility costs, higher costs for services (such as caregiving, construction workers lost to deportations).

Looking back we can see that the Biden admin had carefully targeted policies in renewable energy, research, etc. that had the economy growing – and the Republicans wrecked all that to give tax cuts to the 1%.

so we will have a little experiment coming up. another 0.5% rate cut. after a couple of months, look at the 2-10 yield spread, and the change in the 2 and 10 year yields. if a fed rate cut increases the yield curve and those 2 and 10’s increase in yield, which very likely may happen, then we know the market is expecting inflation and the cuts were foolish. it won’t take too long to make this determination. if those longer terms yields drop, different story. but during the last round of cuts, we saw very little change overall in the mortgage rates. so i am not confident that another round of rate cuts will help with mortgages-one of trump’s stated goals. in fact, it is very possible that if he is wrong then a rate cut will result in higher mortgages for homeowners. if that happens, the fed will be extremely far behind the curve, and require a recession to cool inflation. the risk profile is asymmetric going forward. holding rates steady will not cause much of a problem if we are wrong. decreasing rates will cause a huge problem if we are wrong.

Here’s a look at the 30-year mortgage/Treasury 10-year spread:

https://fred.stlouisfed.org/graph/?g=1LEzw

Notice that the spread is wider than the historic average. As I understand it, that’s not so much because of perceived default risk as what mortgage folk call “convexivity”. That’s jargon for the odds of refinancing. Recent-vintage mortgages are assumed to have high odds of refinancing, so a premium is built in.

I should note that refi assumption also creates a duration mismatch between 30-year mortgages and Treasury 10s, so some mortgage hedging – and pricing – is done with shorter maturity Treasury notes. That makes the conventional 30/10 spread somewhat misleading as a guide to the risk premium on mortgages.

All of which is to say, there’s going to be some repricing of mortgages should the Fed cut rates, but not entirely based on the Treasury curve. The refi assumption is a prety big deal. If, as you suggest, a higher inflation premium limits the downside for long Treasury yields, will mortgage brokers decide that refi risk isn’t as high as they thought? Dunno. If they don’t, then the refi premium stays in. If refi risk is seen to be reduced, that would help offset some of the new inflation premium for mortgages.

There could be a mini-bonanza for new homeowners through refinancing if mortgage rates drop; just “mini” because home sales in this cycle were not all that strong. Mortgage refis are one of the mechanisms by which monetary policy works. If, as you suggest, mortgage rates don’t fall much, that will limit the effectiveness of any rate cuts.

nice note on the convexivity idea. that idea of a premium vaguely entered my mind, but i really don’t know the mechanics of the idea.

i think it is very interesting that a rate cut could very realistically result in higher mortgage rates. the last round of cuts has not pushed mortgages down in any meaningful way, other than a short dip in september. i interpret that to mean that inflation is a concern for the 10 year, which also has not dropped in response to the rate cuts beyond the september dip. if you drop it another half percent, and mortgages and 10 years hold relatively firm, after any knee jerk reactions, then it means you made a mistake. and how would the fed respond to that? and how would trump respond to no drop in the 10 year? demand a bigger rate cut, and risk even more inflation?

the rational folks at the fed want to hold for a reason.

donnie buys over $100 million in bonds. then pressures the financial regulators to lower yields. this increases the values of those bonds. coincidence? and now you now why he is so adamant about dropping interest rates. the most conflicted, transactional president. ever.

Off topic – Ethnic cleansing of Palestine:

https://www.middleeasteye.net/news/libya-senior-official-secret-talks-israel-resettle-palestinians-gaza

I can’t vouch for the accuracy of this report, but NBC has it too, presumably from different sources:

https://www.nbcnews.com/politics/national-security/trump-administration-working-plan-move-1-million-palestinians-libya-rcna207224

The gist is that Israel has discussed resettling Gazans (NBC says up to 1 million of them) in Libya with Libya’s National Security Advisor. The Advisor is also a relative of Libya’s PM. The U.S. would sweeten the deal with the release of $30 billion to Libya.

i am not a defender of hamas. but what Netanyahu has done to gaza is criminal. the death and destruction of the civilians is on par with the actions by putin in his wars. i don’t have a solution for the middle east. but i know what is happening now is not a solution.

I thought the NBC article really laid out the logistical difficulties quite well. Not something that I expect the Trump administration to pay any attention to, except perhaps for Rubio. Plus, of course, ethnic cleansing as something that only Israel and Trump actually want really mitigates against this happening.

Speaking of inflation, here’s a thought, in the form of a list, about food supply:

– Drought and flooding have both become more frequent and widespread.

– Climate change in general, causing current crops and farming practices to be inappropriate for local conditions.

– Soil depletion in the midwest.

– Tariffs.

– Labor shortage due to anti-immigrant policies.

– Over 60% of U.S. commercial beehives died out over the past year, very high by historical standards.

The combined threat is obviously the sort of issue government is well suited to address because of structural barriers to private adaptation and because of the risk of market failure to provide appropriate price signals.

Glad our government is making a big push to address this list of problems.

It depends. Some prices up, some down.

Energy prices are down which is good.

https://fred.stlouisfed.org/series/GASREGW/

https://www.usatoday.com/story/money/2025/08/12/why-gas-prices-down-steady-inflation/85627851007/

The screwworm that hit the beef industry is bad.

https://www.nytimes.com/2025/07/28/us/politics/screwworm-beef-prices.html (another “benefit” of imports like the emerald ash borer, Asian flying carp, Zebra mussels, etc. that cost billions of dollars).

Now that the avian flu epidemic has somewhat subsided, poultry and egg prices are down.

https://www.yahoo.com/news/articles/national-egg-prices-hit-one-132856501.html

So, do we cherry pick bad or cherry pick good?

And that is why we use an index of goods. You’ve been gone for a while bruce, but still just as stoooopid as before.

https://fred.stlouisfed.org/series/CUSR0000SEHF01

Consumer Price Index for All Urban Consumers: Electricity in U.S. City Average

Krugman covered this. Brucie pretended it to not be there. Gee Brucie – how’s your electricity bill? I hear lying 24/7 drives it up.

James, sorry I missed your comment earlier. Electric bill only slightly up from 2024. I’m guessing that has more to do with the warmer summer than anything else.

You shouldn’t confuse local and national changes. Our area is served by nuclear power, but you can elect to have your bill <b?attributed to “alternative energy” for about 10% more because the provider serves a wide area and has solar and wind arrays and they are hoping they have enough virtue signaling customers to give their profit a boost.

I guess Brucie couldn’t mention electricity prices. See Krugman today on how Trump’s MAGA moronic policies have driven them up.

BTW Brucie – even gasoline prices are higher today than they were at the beginning of the year. So once again – Bruce is too stupid to lie coherently.

Now James (and I don’t stoop to juvenile nicknames), surely you understand that gasoline prices typically increase significantly from January to July for two reasons:

1) there are more miles driven during the summer travel season

2) refineries are forced by the EPA to produce many different summer blends which drives up production costs and selling prices

This year, the increase was quite minimal. You need to look at yr/yr prices.

Are you a non-driver?

The analysis on prices is really important because while political promises sound good, the actual numbers often tell a different story. CPI trends and everyday price indexes give a clearer picture of whether costs are actually stabilizing or continuing to rise in sectors like food, housing, and services.

This is where business and technology updates also play a big role innovations in supply chains, digital payments, and automation are some of the real factors that can help bring costs down over time, beyond just policy announcements.

For readers who want to keep track of both the economic side and the technology shaping these changes, you can explore https://siozinis.com/ a platform focused on delivering the latest in business news and technology insights. http://cellulogia.com/

Should we cherry-pick prices, as you have done? No, we look at various broad aggregates of prices, which you have avoided doing. After all, inflation is a general rise in prices.

CPI, core CPI, median CPI and sticky-price CPI are all rising faster now than at the end of 2024. No cherry-picking. Inflation is accelerating. And even you knew that, but decided to pretend there’s some question about it. How very honest of you.

Speaking of honesty, your own link says that screwworms are not in the U.S.:

“Now, a potentially bigger threat is approaching, migrating north from South America, where screwworm is endemic. It has been detected as close as 370 miles from Texas’ border…”

Not in the U.S. and not a threat due to imports, but rather due to migration. So you lied twice about the same link! Same old Brucie.

About 15% of the beef consumed in the U.S. is imported, and just about all of the imports face tariffs of between 15% and 50%. Beef prices are up because of the felon-in-chief’s policies, not because of screwworm.

Avian flu is seasonal, abating in summer. Instead of comparing summer prices to cooler months, which is what you had to have been doing to claim a decline, you should compare to year-ago prices. Poultry prices are up 4.5% from a year ago and egg prices are up 3.6%.

So pretty much your entire argument is based on lies and deception. So nice of you to join in.

https://paulkrugman.substack.com/p/kilowatt-madness

Something from Krugman that blows to shreds all of brucie’s lies and stupidity.

James, are you the reincarnation of “pgl”?

“Poultry prices are up 4.5% from a year ago and egg prices are up 3.6%.”

Bruce, that is the definition of inflation.

Agreed, however one must look at the backstory.

https://www.thepoultrysite.com/news/2025/04/tight-supply-avian-influenza-push-us-egg-prices-higher

The same type of problem occurred for beef prices.

https://www.nytimes.com/2025/07/28/us/politics/screwworm-beef-prices.html

Those are not a result of policies, although the screwworm is an “import”.

Bringing prices down remains a major challenge as rising utility costs, healthcare premiums, and tariffs continue to impact consumers. While some sectors show stability, overall consumer spending faces pressure. For the latest insights on Technology News and Business Updates, visit myreadignamga.com and explore our detailed coverage on Bringing Prices Down: How’s It Going?.