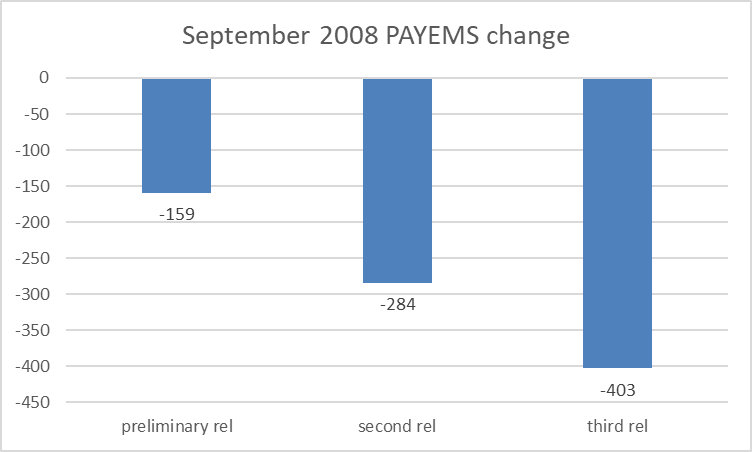

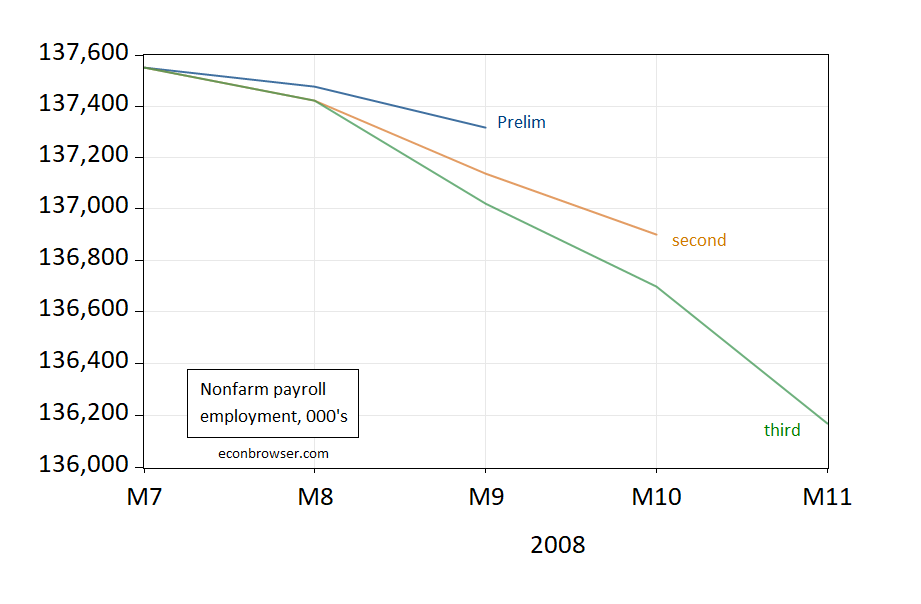

When the economy is growing in a steady manner, a missed release is not a problem. But when the economy is on a potential tipping point, the preliminary release and revisions take on a heighted importance. Example: September 2008 net job gains:

Or visualized differently:

In other words, around turning points, revisions can be of substantial interest.

Speaking of turning points, Krugman has just compared the Britain’s Railway Mania of the 1840s to today’s AI boom:

https://paulkrugman.substack.com/p/technology-bubbles-causes-and-consequences

Menzie has aldo pointed out the risks inherent in our latest technology boom:

https://econbrowser.com/archives/2025/10/scary-picture-2

https://econbrowser.com/archives/2025/09/growth-reliance-on-the-tech-spending-boom

Why stop with the UK in 1840?

The Great Depression of the 1930s involved, among other things, the end of a boom in investment in automobile production:

https://www.ebsco.com/research-starters/history/american-automobile-industry-1920s

And electification:

https://www.lifetechnology.com/blogs/life-technology-technology-news/electrification-boom-in-1920s-us-industrial-dominance

The first Great Depression, starting in 1873, was preceded by a boom in railroad construction. Jay Cooke and Company collapsed when it couldn’t arrange the sale of railroad bonds – the boom was over. Railroad construction had been the largest U.S. employer other than farming, and tens of thousands of men were suddenly without work. Iron and steel production plunged.

The recession of the early 2000s followed in the tech/Nasdaq of the 1990s. Lots of histories of that recession focus on the 9/11 attacks, but have a look at share of technology spending into Y2K and during the recession.

The Covid recession seems to have ended a smartphone investment boom, so we can’t know whether that tech boom would have ended in recession.

Not all technology boom-and-bust cycles lead to recessions. The rapid adoption of personal computers in the 1980 may have contributed to the Black Monday crash in 1987 – the drop in PC makers shares was more persistent than for the overall market – but no recession resulted.

Financial excess is a far more frequent cause of recession than the end of a technology boom, but technology booms pretty much always lead to financial excess. Krugman’s essay is behind a paywall, so I don’t know what he has to say about this connection, but the connection is clear.

I have not been concerned about an AI boom/bust until very recently. the latest investment actions by many of the AI players are pretty incestuous, with one AI firm investing in another AI firm. Pretty risky business there and seems like one firm is simply propping up the other firm. AI is the future, but I don’t think it is there yet. and the data center boom demand is a result of lots of people having free access to AI to generate a lot of garbage. that will not continue and once people start paying for the AI cost, a lot of that garbage will disappear. lots of money being made by AI scraping ad sites, etc that is not a net positive overall. right now I see a lot of inefficiencies in the AI ecosystem, and that will need to be cleaned out. I believe in the technology, but the expected profitability today does not seem realistic.

anybody seen the latest out of china on the robots and AI? ford is concerned their future is over, as Chinese autos and manufacturing seem to be taking the AI and robotics leap well ahead of us manufacturing. too bad trump is continuing his war on science and technology, while Chinese authorities are embracing it.