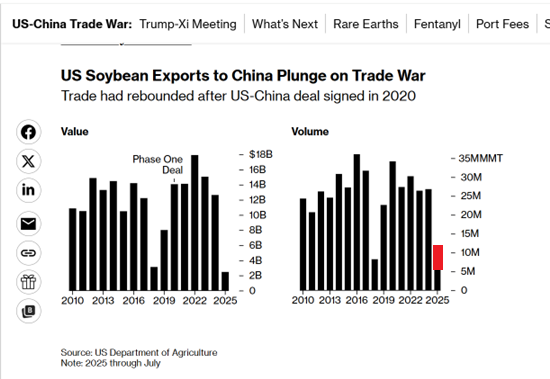

Per Bloomberg. Hmm. Commitment to 12 mn metric tons (MMT) “this year” (calendar, market?).

Figure 1: Figures up to pre-meeting, black bars; red bar, commitment assuming 12 MMT pertains to CY2025. Source: Bloomberg.

Source: Barchart.

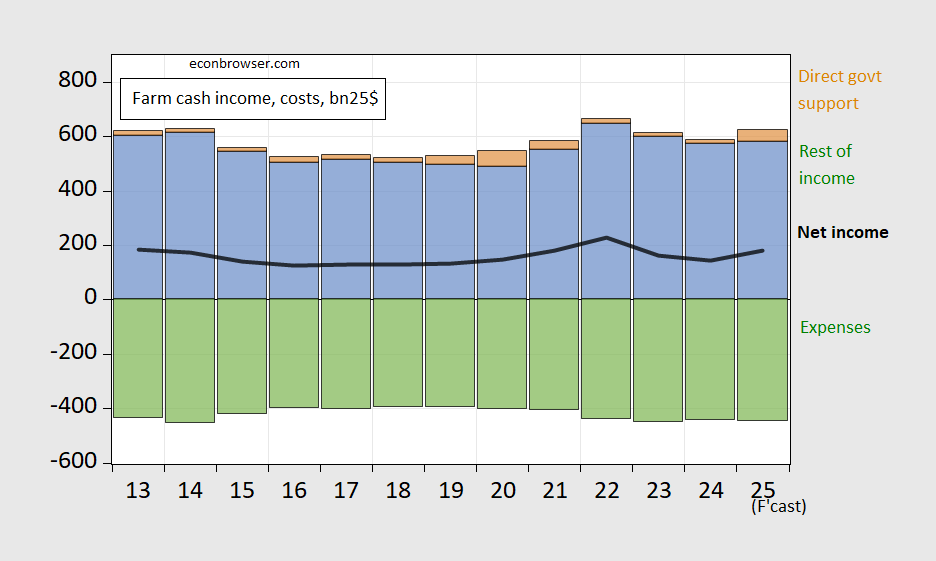

Say net farm income rises by about $3 bn. That does not appreciably change the outlook for net farm income, as shown here (discussed here):

Figure 2: Farm net cash income (bold black line), government support (tan bar), rest of income (blue bar), expenses (green bar), all in bn2025$. 2025 figure is ERS estimate. Source: ERS USDA (Sept 2025).

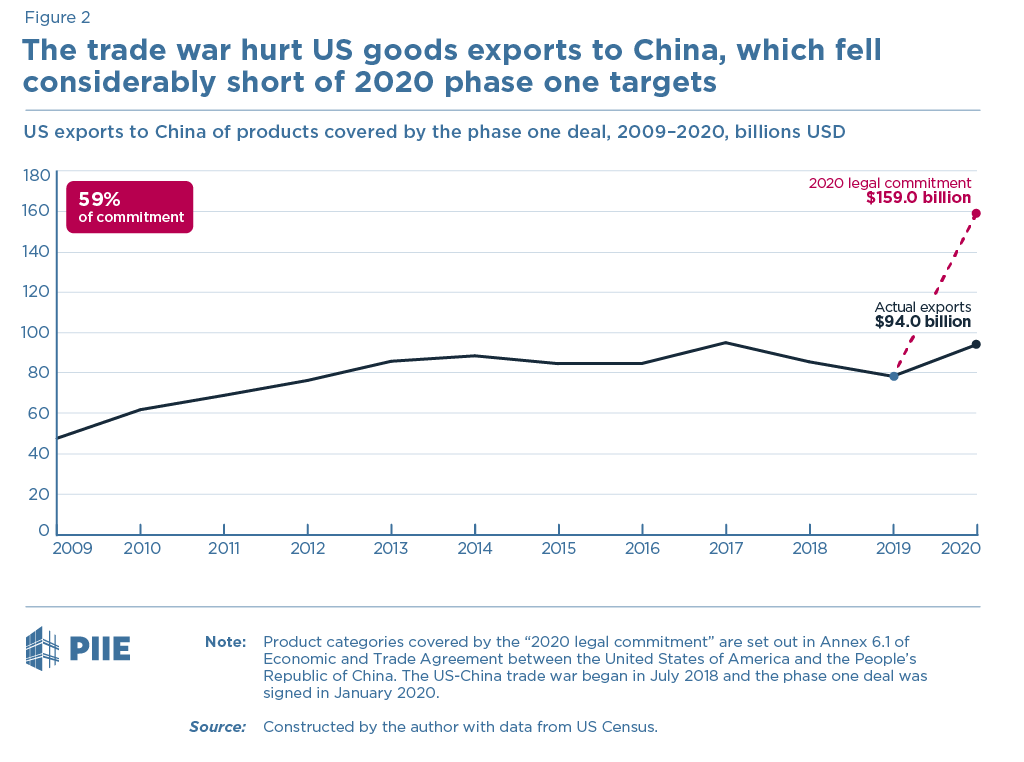

I will say, given the record of compliance of the Chinese in purchases during Trump’s “Phase 1” of the US-China deal, I am not sanguine.

Source: Bown/PIIE.

Estimates of potential Chinese demand in the December-May period, just prior to the Autocrat Bilateral, ran around 8 million tons, 5 million of that in December and January:

https://www.desmoinesregister.com/story/money/agriculture/2025/10/29/chinese-purchase-of-us-soybeans-is-first-of-season/86972865007/

Just prior to the meeting, China’s COFCO commodity purchaser put in an order for 180,000 tons as a lubricant for the talks, pretty standard Chinese negotiating. Tiny relative to China’s usual purchases and

Promises are one thing, storage space and throughput, quite another. That 12 million ton figure really only makes sense spread through Q1 2026, ahead of Brazilian deliveries, and China probsbly probably doesn’t need that much. Brazil’s harvest starts in February, the U.S. in September, and China is unlikely to screw Brazil to please us. If China is going to return to a normal pattern of purchases, that would be in the 23-35 million ton range, mostly in Q3 and Q4 next year.

Between China’s physical capacity to absorb beans, the calendar, relations with Brazil and the normal pattern of U.S. sales to China, that 12 million tons looks like a made-up number. It doesn’t fit any particular bit of reality.

trump got fleeced in his deal with china. fleeced big time. after these negotiations, on average, china has gotten more and the usa has gotten less. while trump may claim victory, when reading the ledger it is clear the usa is the loser in these negotiations. my guess is there is a trump tower sweetener in there somewhere…