Given we’re unlikely to get a CPI release for October…

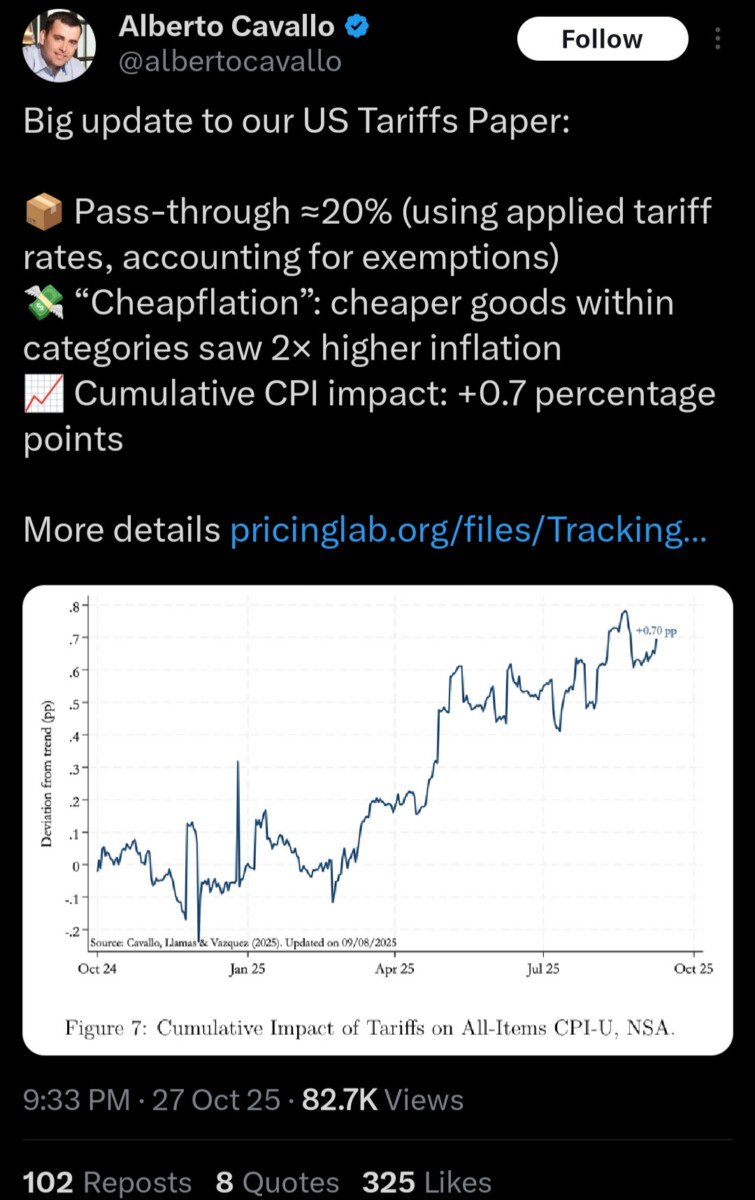

Cavallo estimates CPI is 0.7 ppts higher than w/o tariffs…

Source: Bluesky.

Impact of tariffs as read through consumer prices for tariffed goods:

Source: PricingLab, data through October 12, accessed 10/29/2025.

The FOMC has cut the funds rate by 25 basis points and announced the end of quantitative tightening as of December 1. Pretty much as expected. No Summary of Economic Projections this time.

Ten-year yield off 2 basis points from yesterday – negligible. More interesting is that money market pricing implies lower odds of another cut in December that was the case yesterday or a month ago. The modal priced-in estimate for the June, 2026 FOMC meeting outcome is now 75 bps lower than today’s rate, compared to 100 bps lower yesterday. The change in the modal estimate didn’t take much change in price.

The DXY index rallied in response to the policy announcement. I’d guess that’s because of the end of quantitative tightening, but that’s just a guess.

Since Sep 2025 QT negligible at $14 B n roughly $6.6T.

still have not reduced mortgage rates in a meaningful way. trump promised mortgage rate reductions. so far, failure. and the trump shutdown continues to be problematic for much of the country in various ways. but trump does not care, he is gallivanting across the globe collecting crowns. and the house is still on vacation during the shutdown, ie republicans have chosen not to work during the shutdown. nice optics.

A similar result appears in the Fed manufacturing and services reports from the five regions that do so: increases in both prices paid for materials and prices received for end products are widespread, but with prices paid far outstripping prices received.

Here are the relevant numbers for the NY and Philadelphia Feds, but Richmond, Kansas City, and Dallas are similar:

https://fred.stlouisfed.org/graph/?g=1NuYE

I’ve also included the quarterly change in corporate profits excluding inventories (black) to show the (unsurprising) resulting effect.

The blow to the lower income consumer, including access to health insurance, food, housing and in some states SNAP benefits will register.

Macroduck: “The FOMC has … announced the end of quantitative tightening as of December 1.”

Speaking of quantitative tightening, this seems up your alley. How is it that bank reserves were in the tens of billions up until 2008 but now when bank reserves are over $3 trillion the the Fed is worried about liquidity and needs to pause tightening? Something unobvious must be going on.

The Fed has adopted an “abundant reserves” policy framework. The idea is that fluctuations in, for instance, Treasury’s account at the Fed, should have negligible impact on rates. Turns out this definition of “abundant” means something like the level of reserves in place now. As the economy grows, the Fed will probably need to increase reserves proportionally.