There is so much chaff floating around about the roles of Fannie and Freddie and of the Community Reinvestment Act in the current crisis, despite the best efforts of economists like Jim Hamilton [0] [1], Mark Thoma and Janet Yellen, that it seems worthwhile to once again go through some of the arguments that have been forwarded.

From David Goldstein and Kevin G. Hall, “Private sector loans, not Fannie or Freddie, triggered crisis”:

Federal Reserve Board data show that:

- More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions.

- Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

- Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that’s being lambasted by conservative critics.

The article continues:

What’s more, only commercial banks and thrifts must follow CRA rules. The investment banks don’t, nor did the now-bankrupt non-bank lenders such as New Century Financial Corp. and Ameriquest that underwrote most of the subprime loans.

These private non-bank lenders enjoyed a regulatory gap, allowing them to be regulated by 50 different state banking supervisors instead of the federal government. And mortgage brokers, who also weren’t subject to federal regulation or the CRA, originated most of the subprime loans.

In a speech last March, Janet Yellen, the president of the Federal Reserve Bank of San Francisco, debunked the notion that the push for affordable housing created today’s problems.

“Most of the loans made by depository institutions examined under the CRA have not been higher-priced loans,” she said. “The CRA has increased the volume of responsible lending to low- and moderate-income households.”

In a book on the sub-prime lending collapse published in June 2007, the late Federal Reserve Governor Ed Gramlich wrote that only one-third of all CRA loans had interest rates high enough to be considered sub-prime and that to the pleasant surprise of commercial banks there were low default rates. Banks that participated in CRA lending had found, he wrote, “that this new lending is good business.”

One point the article does not touch on is why the states did not regulate more rigorously the banks most involved in subprime lending. The answer is, in part, explained by this item (which I’ve cited in the past) from the NYT:

The Fed was hardly alone in not pressing to clean up the mortgage industry. When states like Georgia and North Carolina started to pass tougher laws against abusive lending practices, the Office of the Comptroller of the Currency successfully prohibited them from investigating local subsidiaries of nationally chartered banks.

What about the charge that Fannie and Freddie “made” the market so that all these subprime loans could be securitized? There’s a grain of truth in there, but I think keeping in mind which loans are going bad is useful, when reading this excerpt.

This much is true. In an effort to promote affordable home ownership for minorities and rural whites, the Department of Housing and Urban Development set targets for Fannie and Freddie in 1992 to purchase low-income loans for sale into the secondary market that eventually reached this number: 52 percent of loans given to low-to moderate-income families.

To be sure, encouraging lower-income Americans to become homeowners gave unsophisticated borrowers and unscrupulous lenders and mortgage brokers more chances to turn dreams of homeownership in nightmares.

But these loans, and those to low- and moderate-income families represent a small portion of overall lending. And at the height of the housing boom in 2005 and 2006, Republicans and their party’s standard bearer, President Bush, didn’t criticize any sort of lending, frequently boasting that they were presiding over the highest-ever rates of U.S. homeownership.

Between 2004 and 2006, when subprime lending was exploding, Fannie and Freddie went from holding a high of 48 percent of the subprime loans that were sold into the secondary market to holding about 24 percent, according to data from Inside Mortgage Finance, a specialty publication. One reason is that Fannie and Freddie were subject to tougher standards than many of the unregulated players in the private sector who weakened lending standards, most of whom have gone bankrupt or are now in deep trouble.

During those same explosive three years, private investment banks — not Fannie and Freddie — dominated the mortgage loans that were packaged and sold into the secondary mortgage market. In 2005 and 2006, the private sector securitized almost two thirds of all U.S. mortgages, supplanting Fannie and Freddie, according to a number of specialty publications that track this data. [Emphasis added — mdc]

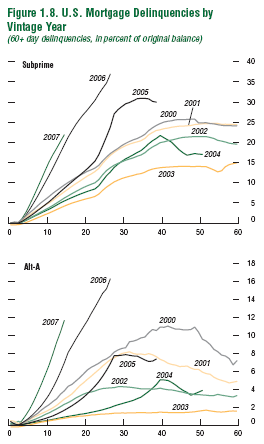

Now, again, consider which subprime loans, in the graph below, went bad…

Figure 1.8 from IMF, Global Financial Stability Report, Oct. 2008.

Notice that the delinquency rate is highest in the years after Fannie and Freddie are constrained in terms of their subprime holdings. So, more regulation of F&F was a good thing, I’ll say, with the benefit of hindsight.

Now, there are more sophisticated, game-theoretic based arguments. In particular, Jim has observed that the mere existence of GSEs with substantial portfolios of MBS’s meant that the government — by insuring Fannie and Freddie — would implicitly insure the private firms as they expanded their operations, supplanting F&F’s market share:

what forces caused the explosion of private participation in a much more reckless replication of the GSE game? A year ago, I suggested one possible answer– private institutions reasoned that, because the GSEs had developed such a huge stake in real estate prices, and because they were surely too big to fail, the Federal Reserve would be forced to adopt a sufficiently inflationary policy so as to keep the GSEs solvent, which would ensure that the historical assumptions about real estate prices and default rates on which the models used to price these instruments were based would not prove to be too far off.

This is by far the most intelligent and plausible interpretations of how F&F could have contributed in a significant way to the current housing crisis (as separate from the overall crisis, which would have been triggered by some other market given the mixture of securitization, credit default swaps and high leverage [2]). In fact, Mike Dooley and I have made similar arguments about the expansion of contingent liabilities, in the run-up to the East Asian crises [3]. The challenge here is how to test this hypothesis against others; we need to measure the implicit insurance that these private firms felt they had directlyfrom the Fed’s intent keep the monetary policy sufficiently expansionary to keep housing prices going up, separate from the insurance committed directly by the Treasury to prevent individual banks from going under. (By the way, this is a separate issue from whether F&F made sense economically in their circa 2006 form; see the analysis by Frame and White. I tend to think the answer is no.)

Interestingly, one of the corollaries of this argument is that it would be hard to disentangle the balance of blame of F&F and the “Greenspan put”.

One question I do (or will) have is the following: if the credit card or auto loan securitized markets blow up [4], who are the equivalents to the GSE’s?

I think all of this leads to a more nuanced view of the role of CRA and the two GSE’s in the crisis. If I had to identify the central factors, I wouldn’t point to F&F alone, or CRA alone (if at all). Rather, I’d look to (i) monetary policy (including whether it was lax, and the implications of the “Greenspan put”), (ii) what drove down the returns at the long end of the maturity spectrum (“the conundrum”) thus inducing the desperate search for yield, (iii) securitization in the absence of countervailing regulation and (iv) the development of a completely non-transparent and unregulated over-the-counter credit default swap market.

Technorati Tags: recession, Community Reinvestment Act,

Fannie Mae, Freddie Mac,

and subprime.

I believe this analysis overlooks the fact that rampant foreclosures referred to in Obama’s ’07 “warning” letter seeking borrower relief started the downward spiral of housing prices. A great portion of the intital foreclosures were F&F held or guaranteed loans, because their debtors were least able to cope with the increased cost of ARMs. Investment banks were leveraged 20-30 to 1 but Freddie was leveraged 68-1. F&F initiated the bubble burst, but many private institutions were involved, and all were over leveraged.

Al Fata: Let me get this straight, and you on the record: Are you imputing causality to Obama’s “warning” letter? In other words, had he not written the letter, then your argument is that there would have been no collapse in housing prices?

Let’s stop the bold.

Ah, that’s better.

“because the GSEs had developed such a huge stake in real estate prices, and because they were surely too big to fail, the Federal Reserve would be forced to adopt a sufficiently inflationary policy so as to keep the GSEs solvent, which would ensure that the historical assumptions about real estate prices and default rates on which the models used to price these instruments were based would not prove to be too far off. ”

I agree that this is by far the most plausible explanation for sole GSE blame. But I still don’t buy it. Surely everyone knew the GSEs would be bailed out by the government assuming their debts, rather than by inflationary policies that would save the rest of the industry. Perhaps by assuming those debts, there would be some fiscal consequences, but I find it a stretch that this would lead to any inflationary consequences that would bail out the industry.

The most obvious responses:

If Fannie and Freddie kept better than average standards, why did they require nationalization?

Also please respond to this:

When do you believe the housing bubble ended? I’ll buy almost any argument for the start date, but the end date is clearly 2005. That is where Case Schiller and others see the price peak. Housing sales volume were already down by David Lareah’s data which was not pessimistic.

So if the fundamental problem is an asset bubble, and the asset was at peak inflation in 2005, and the GSE’s held 48% of subprime in 2004, you can not let them off the hook.

The private companies willingly and aggressively _followed_ the GSEs to that cliff. Relative horizontal velocity after the ground ended is not important if absolute vertical velocity dominates landing criteria.

KevinM: The 10 city Case-Shiller index (as graphed in this post) max is at 2006M06. OFHEO seasonally adjusted purchase only index max is at 2007M04 data here. I will allow the readers to make their own judgments regarding the definitiveness of the bubble-end-date with that data; I’ll work with levels and you can work with first derivatives.

KevinM: With regard to your first question: Undercapitalization.

The arguement that FM going from 48% in 2004 to “just” 24% in 2006 is not pursuasive.

24% is still a huge(!) portion of the market and no doubt the single greatest purchase for any signle entity. FM was still driving this market.

Looking back, I think the commercial banks saw that FM was making money on these loans – lots of money – and they wanted in. What the didn’t understand was that is was only FM’s GSE status that let them have access to the cheap capital that made such risky lending possible.

The Republicans claim they were trying to regulate FM, but the truth is they wanted to push FM aside so their backers could eat at the trough. What they didn’t know was that the slop was poisoned.

I think the better question is if FM was not buying 50% of the subprime paper in 2004 and 24% in 2006 (not to mention all the purchases prior to 2004), would the commercial subprime market have existed to any major extent?

I would have to say no.

It is hard to imagine just private banks driving this market to anything near the size it reached without FM leading the charge.

Yes, once the private entities got there they acted like drunken pigs, but it took the government to give birth to the unstable market in the first place.

This seems to suggest that the marginal effect of these programs is proportional to their absolute contributions.

For example, the part about Fannie and Freddie suggests that since the their fraction of the bad stuff was small the total impact was small. But their marginal contribution could have been large even if their portion of the total it was small.

Similarly, the quotes from Ed Gramlich suggest that the CRA had a small impact on the subprime because it was just a small part of their program. But it could have had a large impact on the amount of subprime borrowing even though their contribution was small. It is hard to know what the marginal effect was.

It seems we need to keep an eye out for natural experiments to see the true marginal effects.

Finally, “undercapitalization” is not enough information. My understanding is that FM had to keep a 3% reserve while banks were required to keep a 4% reserve.

That was one of the complaints that the private sector made about unfair competition with FM, and can be seen in that famous youtube/c-span video.

Is it you contention that if only FM had kept a 4% reserve they would have remained solvent? That is a hard one to believe.

If not, then it seems the undercapitalization excuse is not legitimate.

When private lenders make bad loans, they destroy themselves. When Fannie and Freddie make bad loans, they destroy the US government balance sheet.

Daveg, I believe you are dead wrong.

There was tremendous demand for subprime ABS in the non-GSE private sector. This demand came from hedge funds, overseas banks (as we know know) and pension/mutual funds.

But even that private demand did not account for the compression of spreads in subprime, nor its profitability for issuers. We can lay the blame for that on the combination of CDO’s and CDS. CDO’s accounted for the true marginal demand for subprime ABS — just ask any Wall Street professional involved in subprime. Further, the ballooning notional in CDS of CDO’s is what really compressed subprime spreads and led to the explosion of lending.

Bottom line: in a yield-starved environment with little perceived volatility, there was more than enough demand away from Fannie and Freddie to cause the subprime crisis.

A recent NY Times article had this to say about Fannie and Freddie.

link

This is Mozilo, CEO of Countrywide meeting with Mudd, CEO of Fannie Mae.

Mr. Mozilo, who did not return telephone calls seeking comment, told Mr. Mudd that Countrywide had other options. For example, Wall Street had recently jumped into the market for risky mortgages. Firms like Bear Stearns, Lehman Brothers and Goldman Sachs had started bundling home loans and selling them to investors — bypassing Fannie and dealing with Countrywide directly.

“You’re becoming irrelevant,” Mr. Mozilo told Mr. Mudd, according to two people with knowledge of the meeting who requested anonymity because the talks were confidential. In the previous year, Fannie had already lost 56 percent of its loan-reselling business to Wall Street and other competitors.

“You need us more than we need you,” Mr. Mozilo said, “and if you don’t take these loans, you’ll find you can lose much more.”

Then Mr. Mozilo offered everyone a breath mint.

Sounds a lot like the tail wagging the dog.

“In other words, had he not written the letter, then your argument is that there would have been no collapse in housing prices?”

….. I read the comment as simply noting “rampant foreclosures,” those mentioned in Obama’s letter.

One question – did these loans issued by the private companies get bought from them by Fannie and Freddie and packaged into cmo’s? If so – then without fannie and freddie these companies would never have been able to issue as much toxic paper.

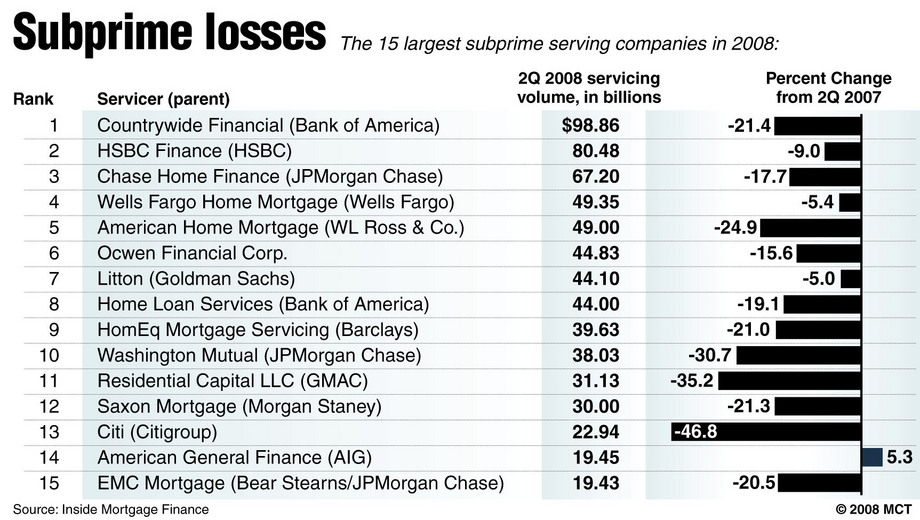

I don’t understand the point of the graph depicting who has the largest sub-prime servicing portfolio. Servicing the loan does not mean you have any exposure to the performance of the underlying.

Menzie wrote:

Interestingly, one of the corollaries of this argument is that it would be hard to disentangle the balance of blame of F&F and the “Greenspan put”.

Why try to disentangle then. They were both to blame as you indicate later. One reinforced the other.

I think all of this leads to a more nuanced view of the role of CRA and the two GSE’s in the crisis. If I had to identify the central factors, I wouldn’t point to F&F alone, or CRA alone (if at all). Rather, I’d look to (i) monetary policy (including whether it was lax, and the implications of the “Greenspan put”), (ii) what drove down the returns at the long end of the maturity spectrum (“the conundrum”) thus inducing the desperate search for yield, (iii) securitization in the absence of countervailing regulation

The Office of Federal Housing Enterprise Oversight (OFHEO) was an agency with a $66 million budget specifically tasked with Fannie and Freddie oversight. There was no absence of regulation. The regulation was influenced by politics to issue reports and pay salaries with no real oversight.

and (iv) the development of a completely non-transparent and unregulated over-the-counter credit default swap market.

Most of this would have never been necessary if the government had not attempted to alter the mortgage market. It was over 20 years of government intervention weakening lending standards that led us the edge of the cliff. Now we seem to be arguing about who pushed who over.

If you want a name how about Charles Schumer whose attack against Indymac was the catalyst that precipitated the whole mess.

Or Barney Frank who still believes that the solution is to increase low income mortgages.

There was tremendous demand for subprime ABS in the non-GSE private sector. … We can lay the blame for that on the combination of CDO’s and CDS. CDO’s accounted for the true marginal demand for subprime ABS

Do you contend that if the private banks not entered this market that fannie mae would still be solvent?

Even by the graph presented here some 15-25% of 2000-2004 subprime loans went bad at 40 months.

Yes, the 2005-2007 loans are much worse, but those prior years are not pretty either.

Also note that the graph here shows fannie mae stepping on the gas from 2004 forward.

You still have the corpse of fannie mae to explain, which has not been done. If fannie mae was not the cause they why did they go down so fast and so hard.

The flippant answer of “undercapitalization” is not sufficient.

We need to recognize that defaults of fixed prime and subprime loans stayed about the same as a percentage. Where the greatest problem was in with both prime and subprime variable mortgages. It is obvious that these mortgages were taken out by people who had no intention of living in their homes for very long. The lowering of down payments was a huge reason these loans exploded. Down payments were reduced when the risk was removed from mortgage companies and inflation was determined to be perpetual.

Menzie,

This is the Case Schiller CSX sampled this month every year since 1988.

Oct-88 76.9

Oct-89 82.44

Oct-90 80.84

Oct-91 78.68

Oct-92 77.45

Oct-93 76.22

Oct-94 77.5

Oct-95 77.26

Oct-96 78.36

Oct-97 81.83

Oct-98 89.8

Oct-99 98.48

Oct-00 111.75

Oct-01 123.46

Oct-02 140.12

Oct-03 157.71

Oct-04 188.65

Oct-05 219.07

Oct-06 224.74

Sep-07 212.65

Notice that between 2001 and 2005 it went up 77%.

From 2005 to 2006 it moved less than 3%.

RE sales volume was already down.

“I’ll work with levels and you can work with first derivatives.”

Very disappointing. I’d hoped for better.

Name: I have no idea why the numbers you’ve posted tell me anything different from the graph shown in this post, which I cited in my rejoinder to KevinM.

Then of course, there’s this report by the St. Louis Federal Reserve Bank before the crisis, that doesn’t even mention Fannie, Freddie or the CRA in its history of subprime mortgage lending:

In other words, it was 80s era banking deregulation (not all of which was Regan’s, I might add), the profit seeking activities of private entities, (and, notably, subprime origination exploded at the blow off stage of the bubble due in part to the flattening of the yield curve and the insatiable demand from the highly levered financial markets for yield), and the lack of appropriate state and federal regulations as to lending standards, credit rating agencies, and- especially- capital adequacy of the the critical class of ‘insurance’ providers, that created the subprime component of this mamoth financial debacle.

Perhaps if the Fed would switch from writing white papers to making snazzy You Tube videos the truth might have a chance to get its boots on before these types of lies circled the world a few hundred times…

Menzie-

This is a repackaged story, but it did contain this sidesplitter:

“Between 2004 and 2006, when subprime lending was exploding, Fannie and Freddie went from holding a high of 48 percent of the subprime loans that were sold into the secondary market to holding about 24 percent, according to data from Inside Mortgage Finance, a specialty publication. One reason is that Fannie and Freddie were subject to tougher standards than many of the unregulated players in the private sector who weakened lending standards, most of whom have gone bankrupt or are now in deep trouble.”

Those “tougher” standards worked like a charm, didn’t they?

What’s with all this pseudo-intellectual babble? Subprime loans, isn’t that an oxymoron? If someone was greedy and impatient enough to take out a 105% loan on a home, they deserve to lose that home. If a financial institution was shortsighted enough to agree to such a loan, they deserve to be taken over by the feds.

I pay CASH for my houses, my cars, my vacations, my clothes, etc. Remember CASH? If you pay CASH for what you want and do not buy anything for which you canNOT pay cash, there’s no problem. So the stock market is fluctuating? Well, so what? If you don’t invest (i.e. ‘gamble’) in the stock market, you don’t need to worry about what’s going on with the market.

Rich Berger: The proper controlled experiement is to allow for differential standards, holding constant the capital/asset ratio. Barring that, I concur it is difficult indeed to discern the net impact of countervailing effects.

Violet Weed: Despite some grumblings about the workings of the financial system, I bet the opinion that the stock market performs no function in a modern capitalist economy is one rarely held.

Menzie,

“I bet the opinion that the stock market performs no function in a modern capitalist economy is one rarely held.”

The problem is that the current crisis calls into question the fundamental principles of that “modern capitalist economy.” It has shown that the Fed, the Vatican of capitalism, doesn’t understand what capitalism does any better than the average Joe.

And for the average worker in a capitalist economy, in wiping out 50% of his retirement assets and in reverting to the market levels of more than a decade ago, the crisis has shown the standard assumption that “if you hold stocks for more than 5 years, you should be OK,” to be chillingly bad advice from clueless people.

I think it is naive to believe that more regulation will fix it without thinking of fundamentally changing the systems we have. It seems to me that it is the absence of transparency–the absence of any knowledge about the true cost of goods and services–that allows pricing power, and a similar lack of transparency in credit markets led to this massive crisis. Any thoughts on what can be done about that?

Can we agree that if at least 5% down was required on home loans this crisis would not have happened?

If we can agree to this it would seem to say that loose lending standards played a huge role in this mess.

And were did we get the push for loose lending standards?

daveg: I think synergy is the key word. We might be having a different crisis — auto loans, credit cards, emerging market debt — without lax standards for home loans. Leverage, lax government regulation, undercapitalization all seem important. So, to me, it’s not as simple as you put it. Once again, see the Mizen piece.

I will agree with that.

Here is how I view it. Fannie mae and the associated federal “home ownership” programs including the CRA and the Fed’s over the top attempt to show discrimination in lending (combined with justice department enforcement) created the groundwork for the problem.

That was the seed.

But this group alone only caused a 400 million dollar, a problem on the scale of a S&L crisis.

The less than responsible private sector, however, including the CDSs, turned that 400 million dollar problem into a 4 trillion dollar global crisis.

And crazy government spending on things like Iraq did not help either.

I suggest that the effort to pin this crisis on one government policy or another is futile. This crisis built over several decades with numerous factors layer on top of each other to produce an asset bubble.

IMO, the main factor was the fact that nationally, home prices appreciated in nominal terms for every year post WWII or possibly since the depression. As a result, ALL risk models and data sets failed to account for the possibility that home prices could decline materially. Given the assumption of ever increasing prices, it was inevitable that the capital markets would find ways to leverage that implied guaranteed return until prices rose to a level that guaranteed a negative future return. Any asset that carries a universal belief of ever increasing prices will eventually get bought up to unsustainable prices. Its no different that the arguments that stock prices always outperform over any ten year period (i.e. there should be no equity risk permium) leading to stock prices that guranteed losses over a ten year period.

In this case, virtually everyone bought into the story. You local real estate agent assured you that owning a house was always a ticket to wealth in the long run, your mortgage broker assured you that you would be able to take on any level of debt because you could always sell, your appraiser (and mortgage lenders) consistently relied on 3 month comparative value estimates and ignored price to income levels or price to construction cost levels. (Might be a good idea for a bank to restrict lending criteria in an area when price to income levels are one standard deviation above the mean, no?) All your neighbors consistently cheered when house prices went higher despite the fact that higher home prices don’t benefit anyone except sellers who exit the market and home builders/land bankers. At any given time, the vast majority of people would like to buy more house than they already have, so why not cheer for lower prices today? Its delusional to want higher prices unless you are about to check out of the housing market entirely.

The government got behind this whole line of thought. IMO, its a mistake for the government to get involved in home ownership at all. Certainly, using government incentives and legislation to lower interest rates does not make housing more affordable, it just makes prices go up. Despite this crisis, there is an OVERSUPPLY of houses. This should eventually lead to lower housing costs in the medium term, although the composition of who owns and who rents will change massively. There are currently more houses to live in than ever before and record vacancies by far. People will have better housing options than ever before but they may have to rent. So what?

Hopefully, we will learn that the goverment should get out of the housing business. This will make it far more likely that house prices will remain in an affordable range for all people who actually have the capacity to own a building.

Menzie,

Thank you for your continuing contributions on the housing bubble and the ensuing financial crisis. As a former loan officer, I found the delinquency rates by year interesting. From what I have read, underwriting standards declined, but so did economic conditions. Has anybody estimated a default rate for 2000-2004 given economic conditions of 2005-2006?

If I had to identify the central factors, I wouldn’t point to F&F alone, or CRA alone (if at all). Rather, I’d look to (i) monetary policy (including whether it was lax, and the implications of the “Greenspan put”), (ii) what drove down the returns at the long end of the maturity spectrum (“the conundrum”) thus inducing the desperate search for yield, (iii) securitization in the absence of countervailing regulation and (iv) the development of a completely non-transparent and unregulated over-the-counter credit default swap market.

A big part of (ii) is Asian countries excecuting their mercantalist economic policies. They’re desperately looking for ways to reinvest their trade dollars so that their currencies don’t appreciate and make their export oriented economies’ less competitive.

If the Chinese are reinvesting their trade dollars in 10 year T-bills, and that drives down the yield on T-bills, and mortgage rates are calculated as the T-bill rate plus, then that can explain a lot of the bubble.

It’s amazing to me how economists like to theorize six ways to Sunday on exactly how Greenspan should have gotten right from a policy standpoint or what % of the problem is attributed to Fannie/Freddie.

Most of the comments here are just parsing partial blame and I agree 100% with Violet Weed.

We had 2 asset-based bubbles in the last 10 years, one in tech stocks and one in housing

1. Tech stock bubble. You can only margin yourself 50% in stocks. When the bubble burst, people got closed out of their accounts by brokers or still had at least some equity left.

2. Housing Bubble. If the fed/gov’t required you to put down a minimum 20% equity (cash), no matter how much add’l debt you took on, the risks of you/someone being totally wiped out or abusing the lending system (NINJA loans) would have been dramatically reduced.

Who gives a s*** about Greenspan’s interest rate policy. Is the entire market really going to depend on him getting it exactly right? What is common sense allocation of capital in a lending practice?

Violet Weed’s comment on here is the one that makes the most sense, even more than Menzie’s original posting.

“They were the ones who screamed REDLINING! and sent banks scurrying for cover in low-income neighborhoods, where they have been forced to lower long-held industry standards for judging creditworthiness to make the subprime loans.

If they dont comply, they are threatened with stiff penalties under the Community Reinvestment Act, or CRA, a law that forces banks to make home loans to people with poor credit risks.

No fewer than four federal banking regulatory agencies are responsible for enforcing the law. They subject lenders to racial litmus tests and issue regular report cards, the industrys dreaded CRA rating.

The more branches that lenders put in poor neighborhoods, and the more loans they make there, the better their rating. Those lenders with low ratings can not only be fined, but also blocked from mergers and other business transactions needed to expand.

The regulation grew to monstrous proportions during the Clinton administration, obsessed as it was with multiculturalism. Amendments to the CRA in the mid-1990s dramatically raised the amount of home loans to otherwise unqualified low-income borrowers.

The revisions also allowed for the first time the securitization o0f CRA-regulated loans containing subprime mortgages. The changes came as radical housing rights groups led by ACORN lobbied for such loans. ACORN at the time was represented by a young public interest lawyer in Chicago by the name of Barack Obama.

HUD, in turn, pressured Fannie Mae and Freddie Mac to purchase more subprime mortgages, and Fannie and Frededie, in turn, donated to the campaigns of leading Democrats like Barney Frank and Pelosi who throttled investigations into fraud at the agencies.” Investor’s Business Daily

flow5: Did you actually read the post and the linked article? Please cite numbers or at least some URL to source (is that an article or oped in the IBD?) if you are going to make these assertions, so we can cross-validate.

Of course you’re right Menzie. Even though nobody knows who you are and what your qualifications are. I mean it couldn’t be the fault of poor people. They just wanted their piece of the pie. Why does the “rich” guy who works hard for his money deserve a house more than the “poor” guy loafing around? I can’t wait ’till Obama gets in office. He’ll make everything better for poor people by taking the rich man’s money!!!

I just read Menzie’s vita (http://www.nber.org/vitae/vita614.pdf). I wish it were mine. By the way, I don’t always agree with Menzie’s conclusions, but I enjoy reading his ideas. They are clear and well presented.

Brooks Wilson: You might find this paper helpful.

Brooks Wilson: Thanks for the words of support. Like you, I’d like to think that we can keep the level of discourse at one where we are debating ideas and concepts, rather than engaging in critiques of qualifications.

Daggah: If you were to look at the main page of this weblog, you’d notice there are links at the top right hand corner in a light blue colored box, labeled “Authors”. Both authors’ webpages incorporate links to complete cv’s (both dated October 2008). While it may be true that nobody knows who I am and what my qualifications are, you could have easily apprised yourself of my credentials, with a minimum of research, since you are so concerned. I list there all my professional affiliations and consulting/visiting positions.

I look forward to your response, hopefully based upon some chain of logic, or some statistical analysis.

Hi,

Looks like everyone has a prime suspect, just that they are all different. And each depends on the political views of the

accuser.

Socialists say it proves that Capitalism is a failure.

Some blame GREED. Greedy home buyers who wanted more house than they could afford, or greedy lenders who pushed loans on

those they knew could not make the payments and then sold the toxic debt to others.

Some blame Alan Greenspan for keeping interest rates “too low”. So the way to get out of the current mess is to—lower

the interest rate.

Libertarians blame government intervention in the housing market by pushing loans to those who didn’t have good credit.

But, since mortgage backed securities play a large role, I haven’t seen any data on just what kind of houses are in default.

On TV, the stories seem to feature either very inexpensive looking houses in poor neighborhoods–the kind that would have likely been “red lined” when that was legal. Or else they show new pricy looking houses in wealthy looking suburbs. They interview either families trying to stay in their house, or else people unable to sell a house that they do not appear to actually be living in.

Would it help to understand the cause (and how to avoid a repeat), if there were more information on just what kind of houses are in default? How many were taking advantage of low introductory rates and no down payment, to quickly turn over houses that were rapidly appreciating? Is there any data on the fraction of foreclosed houses that were owner occupied?

We need to know who is at fault here. If greedy banks, the $700 Billion should go those banks to reward their CEO’s with big bonuses. But if it was greedy home buyers, the money should be used to pay off the mortgage on their too big houses so they can resell at a big profit 🙂

You said that most sub-prime loans were not subject to the CRA, but what about the default rates? Aren’t defaults the issue rather than loans? And if there were few defaults during the first several years of the “balloon loans”, isn’t that likely because the higher interest rate didn’t kick in for several years?

And maybe higher gasoline prices played a role? Remember the advice to “drive until you can afford the mortgage” when buying a house? Did a lot of expensive houses in distant suburbs become less desirable when gas hit $4 a gallon?

In case you missed it, here is a short movie by two comedians, made in 2007, that explains the current crisis.

http://www.brasschecktv.com/page/187.html

IMO, the main factor was the fact that nationally, home prices appreciated in nominal terms for every year post WWII or possibly since the depression. As a result, ALL risk models and data sets failed to account for the possibility that home prices could decline materially.

Oh come on, what an astounding level of American navel-gazing. ALL the models? There’s an abundance of examples from other parts of the world that can be factored into risk models. Many institutions did follow credible models, but you rarely hear about them because they don’t make headlines.

The sad part is that when any realist shorted a mortgage bond, the debt doubled because the financial wizards would use it as an opportunity to create a CDO. Shorting can act as a market mechanism for reining in excesses but here it was completely sidestepped, or rather, a stepping stone for more excesses.

I enjoyed reading ALL the above comments. Two conclusions. 1) Fannie Mae was up to its neck, at various times, as a willing partner in this event. 2) The posts that explain that this event had many “causes” or contributing events are best. Certainly common beliefs played a role. Beliefs about the necessity to escape from governmental control played a role. Beliefs that poor people were being excluded from home ownership played a role.

Neither political party is blameless.

I liked Guymillie’s post (10/24/08 – 8:13 AM because he spread the blame around but I do not agree that the government should give up and get out. Mistakes were made because we are all human. We go forward by correcting mistakes and trying to prevent new ones, not by giving up.

Joseph (10/21/08 – 10:16) provides a like to a NYTimes article which goes into detail on the role of Fannie Mae with explanation that what Fannie did was in response to pressure from others – plus the benefits to the managers.

Go back to the Joseph article and click on “link” at the top of his post.

The role of incorrect use of interest rate manipulation has only superficially been explored. The whole notion of using interest rates to react to inflation is rather interesting in its unusual truck sized flaws.

Raising interest rates simply transfers more wealth fom the middle and lower incomes to the wealthy. It is wealthy people who loan money and poorer people who borrow money. Why is transfering more money directly from poorer people to wealthier people considered to be anti-inflationary? How very convenient for the wealthy!!

There can hardly be a more inflationary influence than high interest rates! High interest rates effect everything that is bought, sold, manufactured, shipped or imported. The cost of this effects every cost but is disproportionally felt by the middle and lower income classes.

When one examines all cases and all countries there does not seem to be a correlation between low interest rates and calamatous insanity among borrowers which always precipitates economic bubbles.

If low interest rates do mean that house prices rise that only means that the owner of the property enjoys the benefit of ownership rather than the ownership benefit being subsumed by the lender.

The toxic mortgages were less than 50% comprised of new home purchase mortgages, most were some kind of refinance.

The role of one-way trade agreements and how they have emptied out factories in North America and transfered well paying jobs to slave wage economies; leaving American workers with grossly reduced incomes which caused them not to qualify for normal mortgages at renewal time which led them in desperation to go for trick mortgages in the hope that some miraculous intervention of the invisible hand which so richly rewards the wealthy, would intervene to provide a living wage job before the mortgages tricked over to much higher rates!

The right agenda ideologues would prefer to forget that most of the troubled mortgages are renewals not new purchases. Workers who have been downsized and outsourced and now have a minimum wage job to replace their middle income job that was exported; homeowners who can no longer entertain the notion of home ownership which was sold to them as their part of the American dream, struggled on with the only hope they had to retain home ownership – trick mortgages.

The right agenda ideologues just cannot refrain from blaming the victims as the wealthy get financial bail outs and former middle class homeowners just get poor and dispossessed.

Those who are interested in the current mess should remember two things.

First, the wealthy never did so well or had such an economic advantage over lower income groups than during the ‘depression’. Second, that the only way the wealthy know they have sucked up all the money possible is when there are only two economic classes – rich and poor. To this end the wealthy and their ideological minions have never ceased in economic warfare with the middle class. The job exporting, economy busting, misnomered free trade agreements are the reason that so many American workers can no longer afford their homes. Free trade is the last and most powerful weapon used by the wealthy to transform the economic middle classes to poor. As governments also depend largely on income taxes on workers for most of their income; and as governments are the only actors capable of forcing the wealthy and their corporate fronts to be environmentally protective, pay living wages and give workers safe workplaces; unemploying well paid workers does two good things for the wealthy. First it forces American workers to compete on the basis of wages with slave wage rate economies and second unemploying middleclass workers deprives government of resources so that the government must borrow from the wealthy just to survive thereby becoming totally dependent upon the wealthy and impotent to oppose their agendas or to help middle incomes earners by levelling the playing field.

Unfortunately and obviously to any non-ideologue, is the corollory that the suddenly impoverished previously middle income workers will now no longer qualify for mortgages throwing the housing market and financial markets eventually into utter chaos!

The complete greed of the right agenda ideologues blinded them to the fact that their ‘coup d’grace’ on the middle class and the government would also destroy the financial system and probably world currencies and stock markets along the way!

What most people do not comprehend is that morality has three positions.

Moral: we know what it is and do it.

Immoral: we know what it is and don’t do it. Amoral: we never consider morality as a mitigating factor before making any decision.

There can hardly be a more true definition of amorality than someone whose only consideration before action is dollars.

There is not a single human or social value that can be usefully described by dollars. Therefore in equations where only dollars can be considered the answers are always amoral!

OK Mike. I feel your pain.

However, academic dicing of “what happened, really” is useful too.

With that in mind, on Dec. 24th on CSpan, I watched a panel of Harvard professors discuss (along with some Congressmen) our economic woes today. One particular panelist, a Harvard Law professor, focused in on a particular item that I had never before considered: Prepayment penalties on mortgages.

Apparently, mortgages with prepayment clauses received, on average, a 60 basis point lower ARP!!

Why? Because they were less likely to be flipped.

Additionally, the 60 basis point higher ARP paid for by non-prepayment penalty mortgages, allowed for a large profit making opportunity via securitization. This professor asserted that this factor played an important role in securitization and bubble creation.

I’d never heard that before.

Sometimes the devil’s in the details.

Sorry. APR, not ARP.